2-12 End of Day: Corn Recovers, Soybeans Continue Lower Wednesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 490.25 | 6.25 |

| JUL ’25 | 507.25 | 6 |

| DEC ’25 | 473.5 | 3.25 |

| Soybeans | ||

| MAR ’25 | 1027.75 | -15.75 |

| JUL ’25 | 1062 | -14 |

| NOV ’25 | 1044 | -11.5 |

| Chicago Wheat | ||

| MAR ’25 | 574.25 | -2.75 |

| JUL ’25 | 598.75 | -3 |

| JUL ’26 | 645.5 | -2.75 |

| K.C. Wheat | ||

| MAR ’25 | 591.5 | -1.25 |

| JUL ’25 | 611.25 | -1 |

| JUL ’26 | 645.5 | -0.75 |

| Mpls Wheat | ||

| MAR ’25 | 614.75 | -3.5 |

| JUL ’25 | 639.5 | -3.5 |

| SEP ’25 | 650.5 | -3 |

| S&P 500 | ||

| MAR ’25 | 6074.25 | -18 |

| Crude Oil | ||

| APR ’25 | 71.21 | -1.87 |

| Gold | ||

| APR ’25 | 2920.7 | -11.9 |

Grain Market Highlights

- Corn: Corn futures rebounded today, recovering some of yesterday’s losses despite weakness in other grains. New crop contracts pushed to fresh highs for 2025.

- Soybeans: Extended their decline on Wednesday, dropping by double digits. Ongoing harvest pressure in Brazil, along with weaker soybean prices in both Brazil and China, weighed on the market.

- Wheat: Found support from stronger corn futures, helping prices stabilize and close near unchanged on the day.

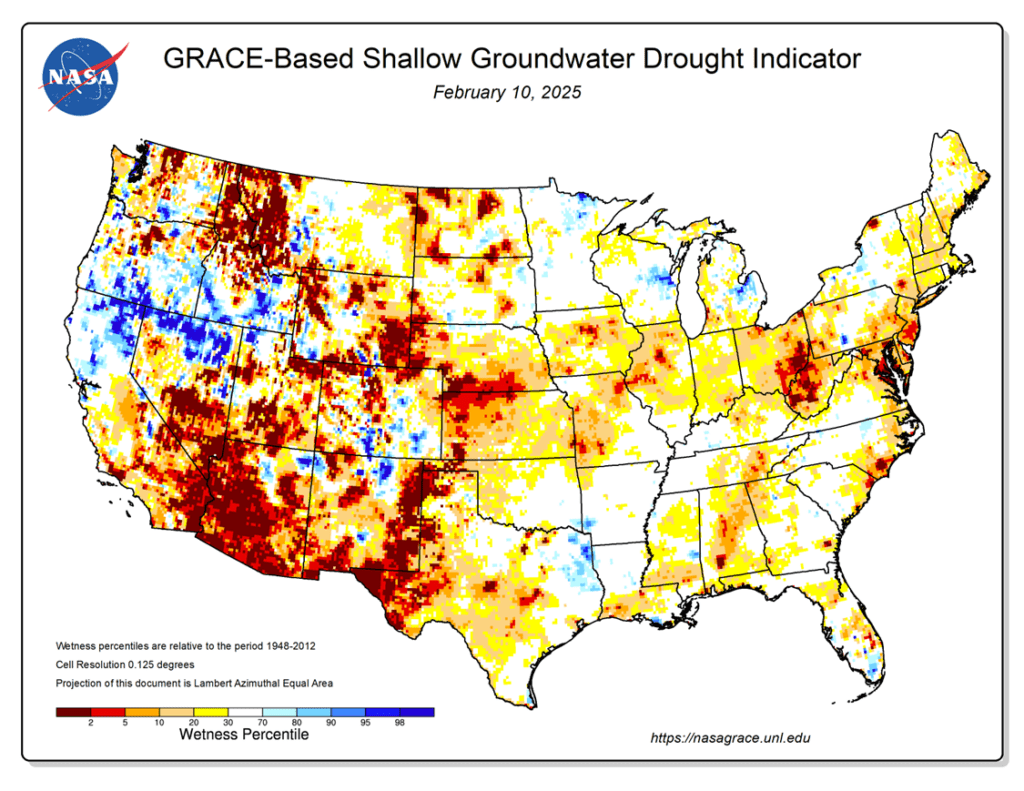

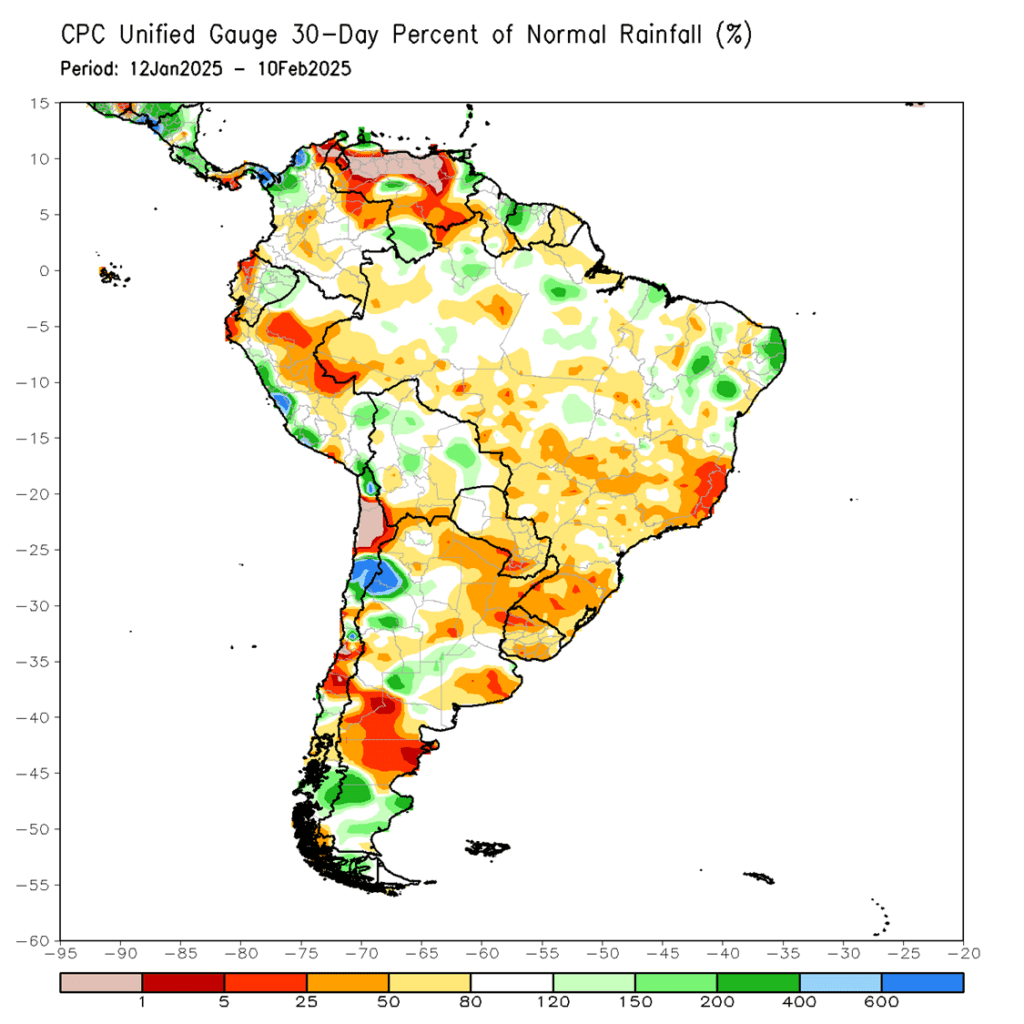

- To see the updated GRACE-Based shallow groundwater drought indictor for the U.S. as well as the 30-day percent of normal rainfall for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

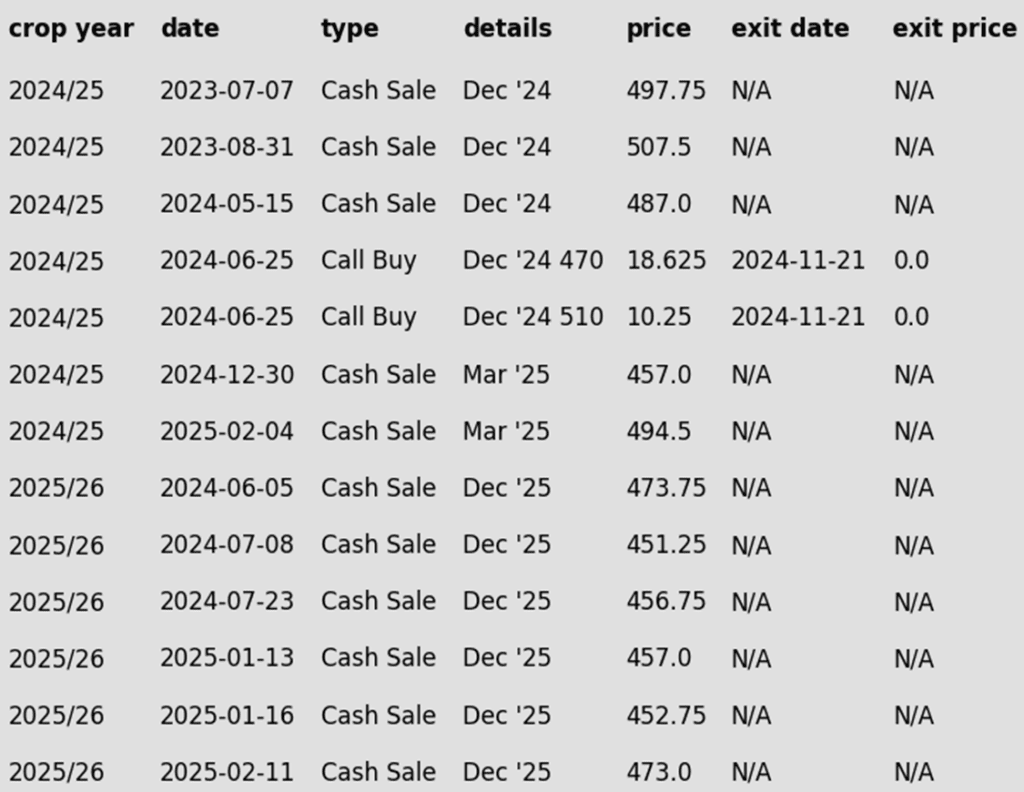

2024 Crop:

- Last Sales Recommendation: Grain Market Insider last recommended a sale for the 2024 crop on February 4 at 494.50.

- Strong Resistance at 498.50: Since January 29, the March ‘25 contract has attempted to break the 500 level seven times, but each effort has fallen short, with intraday highs ranging from 496.50 to 498.50. A decisive break above 498.50 could pave the way for a run toward the May 1996 high of 513.50.

- Strategy: No Plan B for now—Grain Market Insider recently recommended a sale within the current range, so the focus remains on giving March ‘25 a shot at clearing 498.50. If it breaks through, the next upside target would be 512, just below the 1996 high of 513.50.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 corn crop at the current price level.

- Major Resistance at 479: December ‘25 faces strong resistance at 479. A decisive close above this level could signal broader upside potential as we move into the spring planting window.

- Potential Call Option Strategy: If prices break through 479, stay tuned for a possible call option recommendation. This strategy would hedge against existing sales while positioning you for upside exposure in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–3 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures found support on Wednesday as buyers stepped back in, erasing most of Tuesday’s losses despite overall grain market weakness. Strong demand continues to underpin prices.

- The corn market was disappointed in the lack of changes on Tuesday USDA Supply/demand report, but traders may have stepped into the corn market on the belief that the USDA will need to reduce carryout in future reports as both export and ethanol demand have remained strong.

- The USDA announced a flash corn export sales on Wednesday morning. USDA stated that unknown destinations purchased 130,320 mt (5.1 mb) of corn for the current marketing year.

- On Thursday morning, the USDA will release weekly corn export sales totals. Expectations for the week ending Feb 6, the new exports sales range from 800,000 – 1.7 MMT. Last week’s sales totaled 1.477 MMt as U.S. corn export demand has remained supportive.

- Weekly ethanol production fell to 1.082 million bpd in the week ending February 7. This was down from 1.112 million bpd the previous week. Corn used in the production of ethanol was estimated at 104.3 million bushels for the week. The current pace is still trending ahead of the target set by the USDA for the marketing year.

Corn Bulls in Control, Eyeing Key Resistance

The corn market’s post-harvest rally remains intact, driven by strong fund buying and robust demand. Solid support holds at 475, with additional footing near the breakout zone around 450. On the upside, prices are pressing against the 500 mark — a critical resistance level that could dictate the next move. With buyers still engaged, all eyes are on whether momentum can propel corn beyond this key threshold.

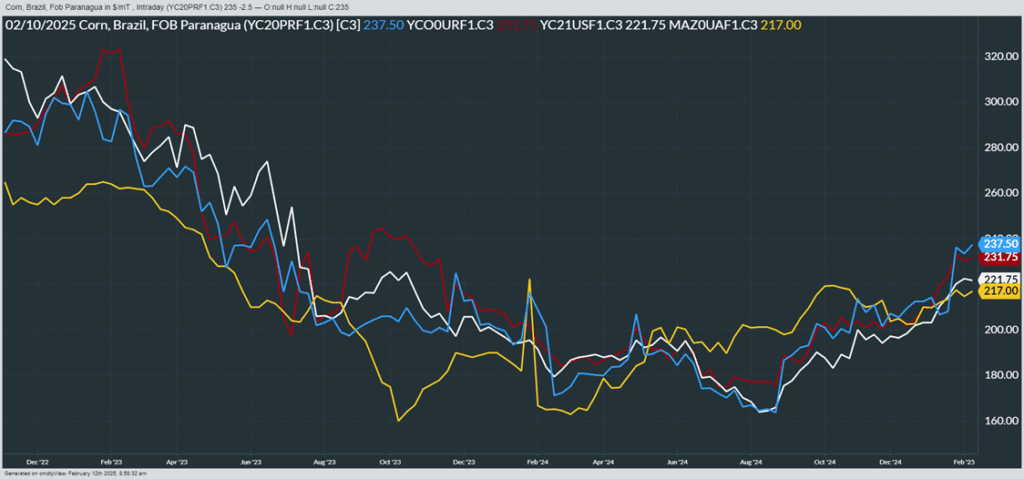

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine (Yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Break of 1039: The March ‘25 contract closed below 1039 for the first time since January 17, setting a new monthly low by breaking the February 3 low of 1031.75. This marks the first lower low since the market bottomed on December 19, interrupting the previous pattern of higher highs and higher lows that led to the February 5 high of 1079.75.

- Possible Trend Change: The break below 1031.75 could indicate a potential trend shift, but confirmation would require additional downside follow-through in the coming sessions.

2025 Crop:

- Recent Recommendation: Grain Market Insider recently advised selling the first portion of your 2025 soybean crop and purchasing call options. For full details, see the recommendations summary table below.

- Current Recommendation: Hold off on any additional actions for now. With recent recommendations in place, Grain Market Insider is comfortable waiting for higher price levels, especially given how early it is in the year.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

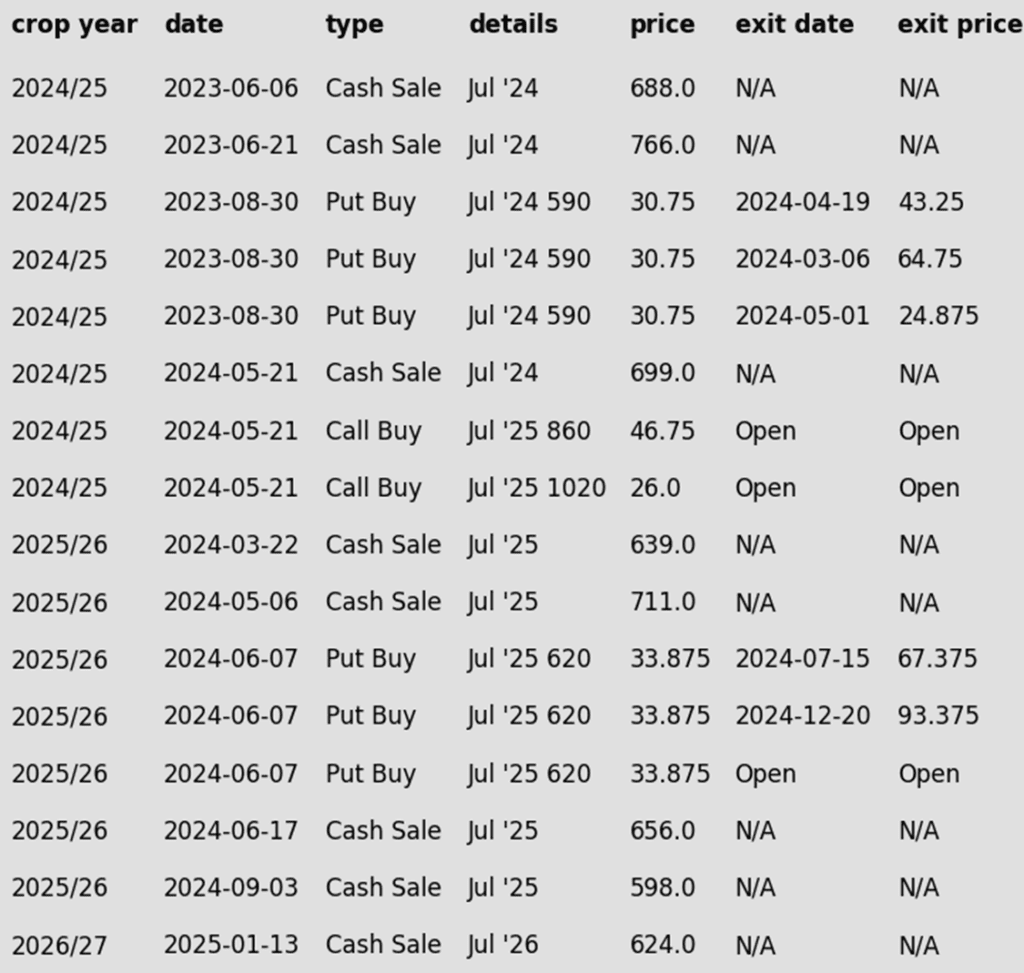

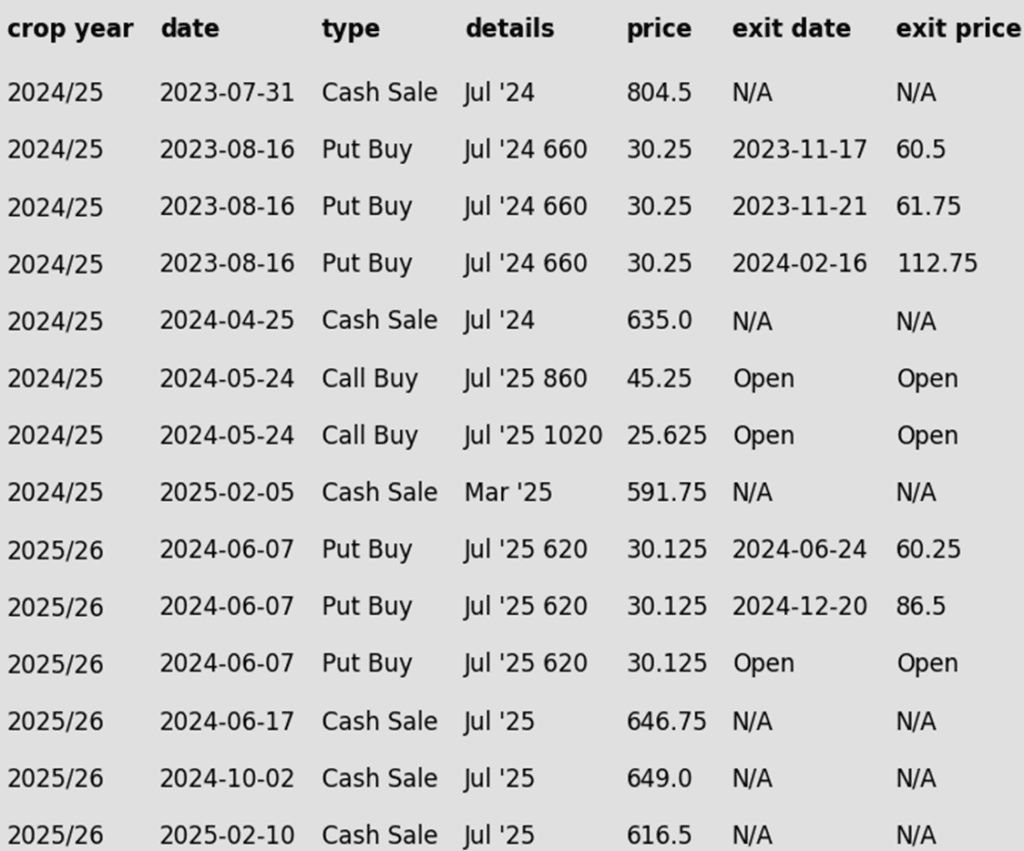

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans extended their losses for a second consecutive session following Tuesday’s WASDE report, which left U.S. carryout unchanged despite trade expectations for a decline. Pressure continues from Brazil’s ongoing harvest and signs of a peak in soybean prices on China’s Dalian exchange. Both soybean meal and oil closed lower.

- Private exporters reported a sale of 120,000 metric tons of soybeans to unknown destinations for the 2024/2025 marketing year this morning. However, U.S. export sales have begun to slow as Brazil’s export season gains momentum.

- In China, soybean futures on the Dalian exchange may be topping out. In addition, Brazilian soybeans are 80 cents cheaper per bushel compared to the US. China has primarily been a buy of Brazilian and Argentinian soybeans.

- Weather in Argentina has improved with rain falling and more in the forecast. While the USDA reduced their estimates for Argentinian soybean production yesterday, a large crop is still expected, and Argentinian soybean meal prices have reached their lowest levels since Covid.

Soybeans Attempting to Breakout

Front-month soybean futures have repeatedly tested but failed to clear resistance at the 200-day moving average in recent weeks — a stubborn ceiling that has limited upside momentum for over 18 months. A decisive close above this level would be a strong signal for potential further upside. Support is expected to be near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

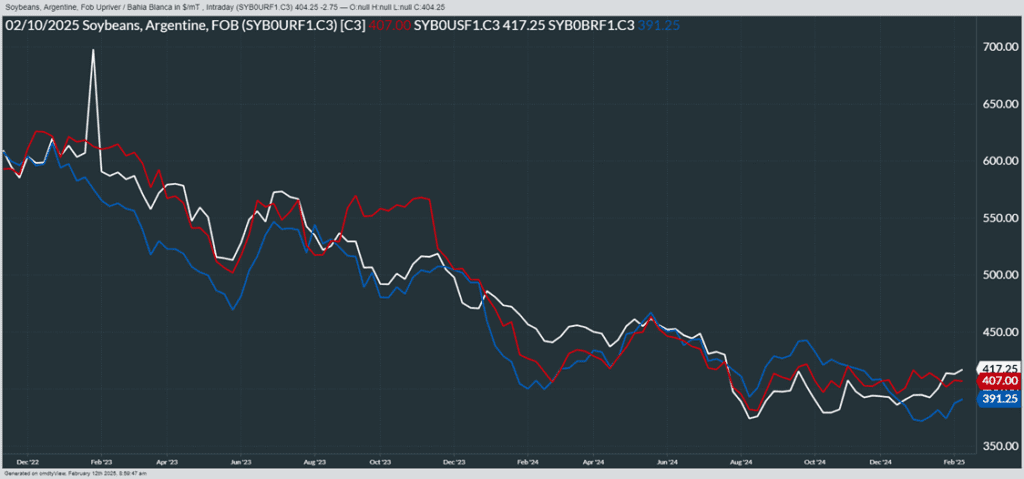

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures fluctuated throughout the session but ultimately closed with small losses, pressured by weaker soybean prices, easing winterkill concerns, and reports of potential Ukraine-Russia peace negotiations. A sharp decline in Matif wheat futures also failed to offer support to U.S. prices.

- The snowstorm moving across the central US should provide snow cover to help insulate much of the winter wheat crop before the upcoming frigid temperatures. This has reduced the concern on traders’ minds of damage to the winter wheat crop. Furthermore, the Black Sea region is expected to receive good snow cover to help protect their wheat too.

- News outlets have reported that President Trump had a phone call today with Putin, in which they discussed the Ukraine war among other topics. Reportedly, Putin has agreed to begin negotiations to end the war. And though Ukraine has already been highly successful in shipping grain in the face of logistics issues, this still may be perceived as negative to prices.

- According to the European Commission, EU soft wheat exports as of February 9 have reached just 13 mmt since the season began on July 1. This represents a 36% drop from the 20.4 mmt shipped for the same timeframe last year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- No Change: The 680-705 range for March ‘25 remains the next potential target for a sale.

- Uptrend Intact: Despite a four-day pullback, the March ‘25 contract continues to hold a pattern of higher highs and higher lows.

2025 Crop:

- No Change: The next target range for a sale remains 690–715 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stuck in Neutral – For Now

Chicago wheat continues to tread familiar ground, locked in a tight range between 530 and 577. The market is searching for a spark, and a breakout above the 577–586 resistance zone could open the door for a push toward 617. On the flip side, if support at 536 cracks, sellers may take control, driving prices down toward the 521–514 support zone. For now, wheat remains in wait-and-see mode, poised for its next big move.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRW wheat crop.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 HRW wheat crop.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

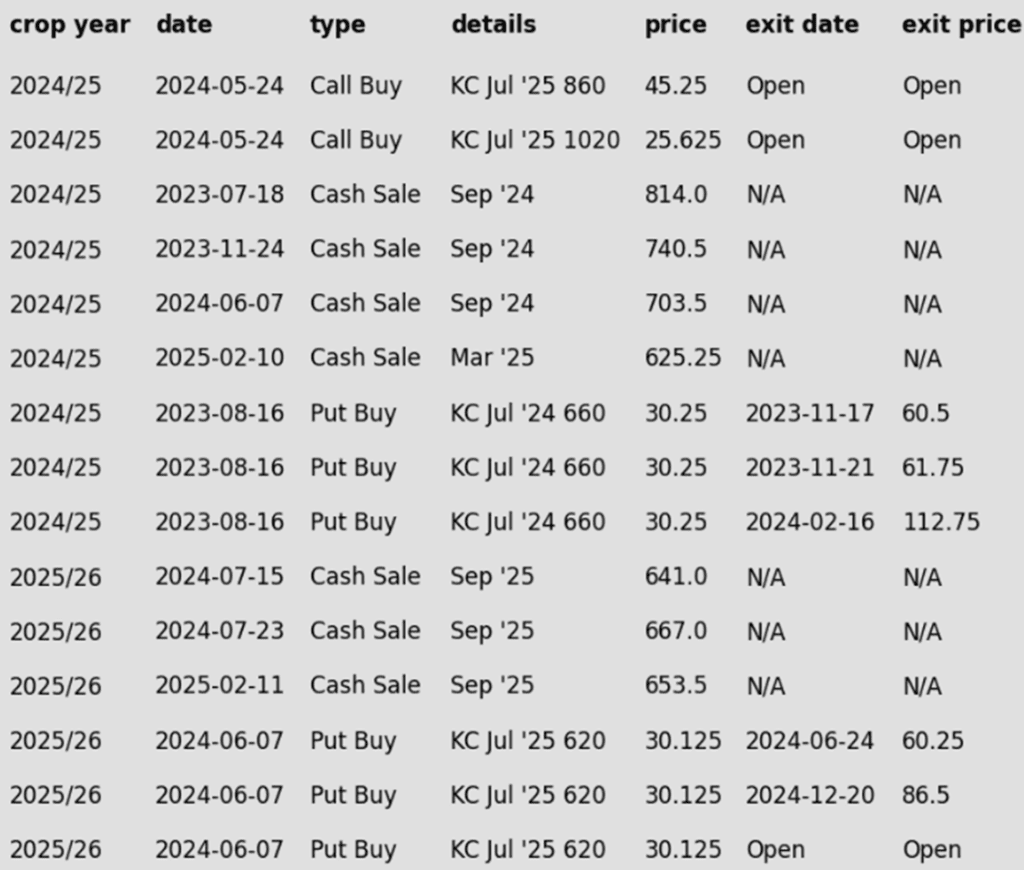

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Attempts to Break Out

Kansas City wheat futures kicked off February on a strong note, closing above the 200-day moving average and testing multi-month highs near 620. A decisive close above the October peak of 623 could open the door for a rally toward the 700 level. On the downside, initial support lies near the 200-day moving average, with stronger support around 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

Active

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRS wheat crop.

- Latest Sales Rec: This is the first sale recommendation that Grain Market Insider has made for the 2024 Minneapolis wheat crop since June 7 of last year.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 HRS wheat crop.

- Stalling Momentum: The September ’25 contract has struggled to maintain its upward momentum, facing strong resistance around 660 for the past four sessions. With the price up about 8% from the January 3 low of 605, Grain Market Insider recommends selling another portion of your 2025 new crop Minneapolis wheat today. This marks the first recommendation for the 2025 crop since July 23 of last year.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout: Rally or False Start?

After months of treading water, spring wheat finally found its spark in late January, surging beyond its previous range and signaling a potential breakout. The next big test lies at the 200-day moving average near 625, a level that could either fuel further momentum or stand as a stubborn ceiling. However, any near-term weakness or a close back below 613 could snuff out the rally, pulling prices back into their familiar rangebound pattern.

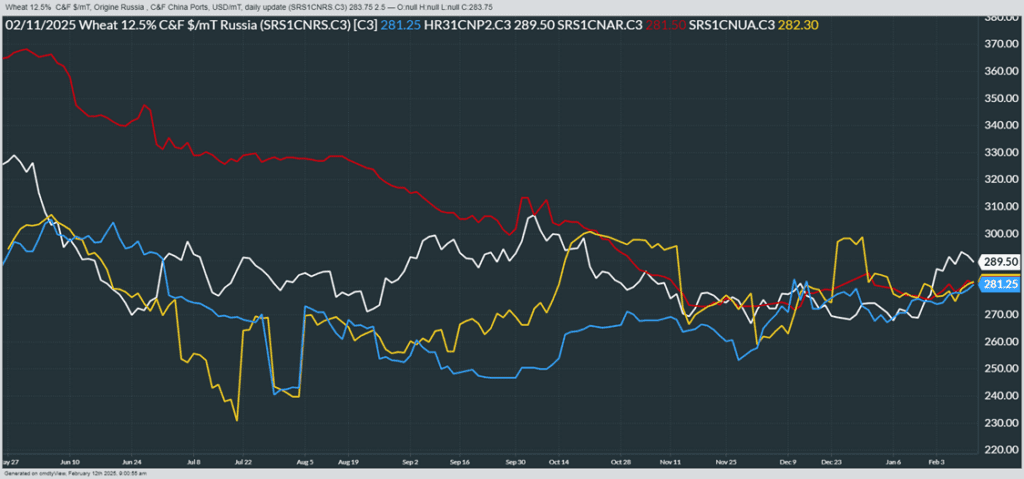

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather