2-11 End of Day: WASDE Sparks Grain Market Correction

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 484 | -7.5 |

| JUL ’25 | 501.25 | -6.25 |

| DEC ’25 | 470.25 | -1 |

| Soybeans | ||

| MAR ’25 | 1043.5 | -6 |

| JUL ’25 | 1076 | -4.5 |

| NOV ’25 | 1055.5 | -2 |

| Chicago Wheat | ||

| MAR ’25 | 577 | -2.5 |

| JUL ’25 | 601.75 | -2.75 |

| JUL ’26 | 648.25 | -4.5 |

| K.C. Wheat | ||

| MAR ’25 | 592.75 | -4 |

| JUL ’25 | 612.25 | -4.25 |

| JUL ’26 | 646.25 | -8 |

| Mpls Wheat | ||

| MAR ’25 | 618.25 | -7 |

| JUL ’25 | 643 | -4.75 |

| SEP ’25 | 653.5 | -4.5 |

| S&P 500 | ||

| MAR ’25 | 6096 | 7.25 |

| Crude Oil | ||

| APR ’25 | 73.06 | 1.05 |

| Gold | ||

| APR ’25 | 2929 | -5.4 |

Grain Market Highlights

- Corn: Long liquidation pressured corn futures lower after the USDA’s WASDE report left the U.S. corn balance sheet unchanged from last month.

- Soybeans: Improving weather in Argentina and a neutral WASDE report pushed soybean futures lower on Tuesday. Soybean meal slipped back below the $300 mark, while soybean oil managed to end slightly higher.

- Wheat: A slight reduction in wheat ending stocks in today’s WASDE report wasn’t enough to spark a rally, as declining corn and soybean prices added additional pressure to the market.

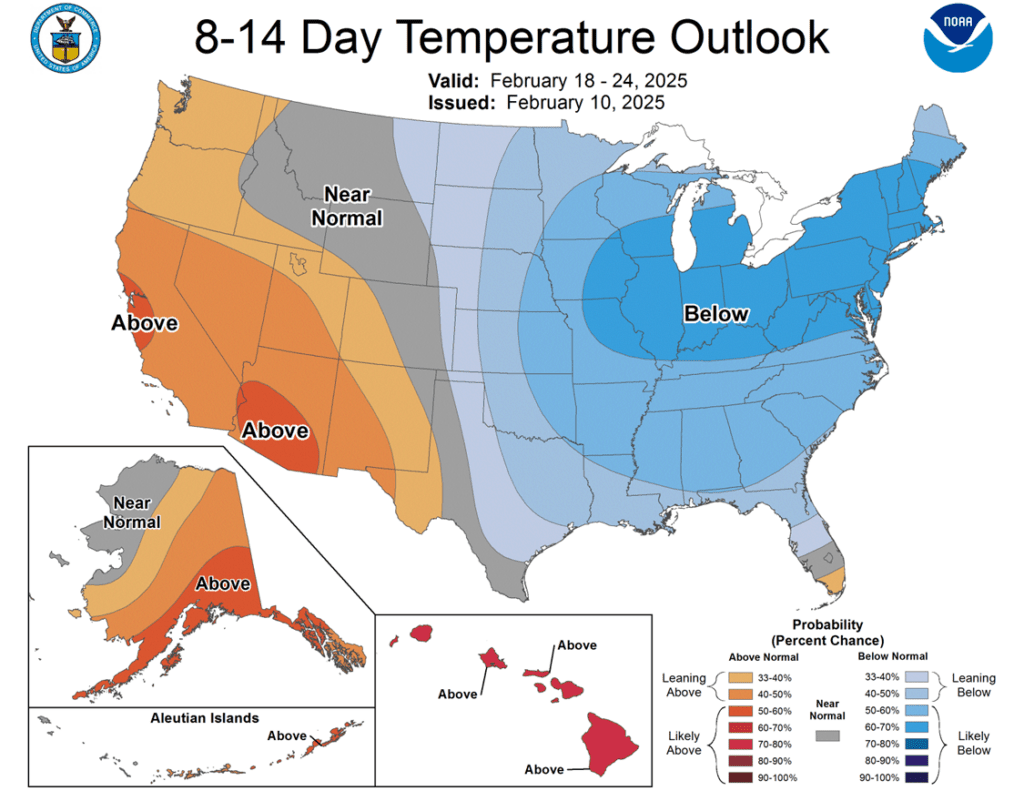

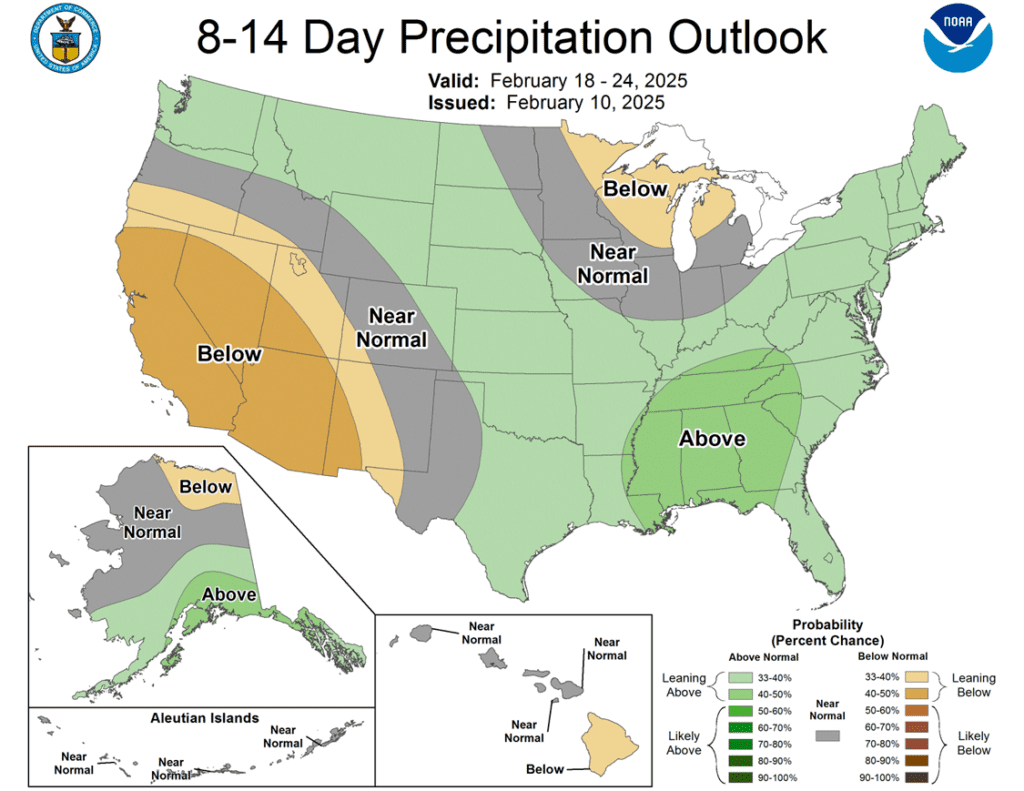

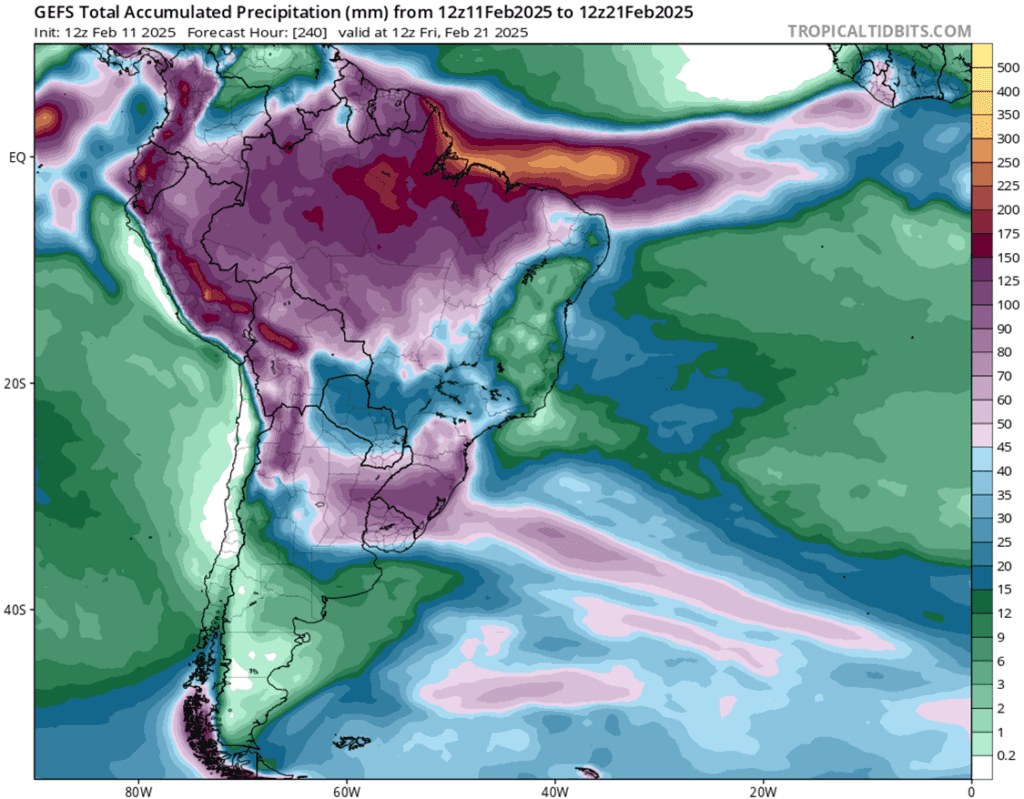

- To see the updated 10-day GEFS total accumulated precipitation forecast for South America as well as the 8–14-day U.S. temperature and precipitation outlooks, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

New Alert

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 corn crop.

- Sales Target Range: With the March ‘25 contract facing continued resistance at the lower end of the 495 – 515 target range, Grain Market Insider recommended making a sale on Tuesday. The upper end of the target range at 515 remains a key level to watch. If March ‘25 corn can close over the recent high of 498.50, Grain Market Insider will consider the 515 area as another potential sales target.

- Resistance Levels: Key resistance on the front-month continuous chart remains between the recent high of 498.50 and the May 1996 high of 513.50.

2025 Crop:

- NEW ACTION: Grain Market Insider recommends selling a portion of your 2025 corn crop today.

- Target Range Hit: The December ’25 contract tested the 473–479 target range today, reaching an intraday high of 474. Although it couldn’t sustain those gains, the session still closed at 470.25, marking the second-highest close since the rally began on November 29 from a low of 428. With prices now up nearly 10% from that low, Grain Market Insider recommends selling another portion of your 2025 new crop corn today.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A strong close above this level could open the door to broader upside potential as we head into the spring planting window.

- Buying Call Options: If prices break through 479, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge against existing sales and get you repositioned to the topside in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–3 weeks.

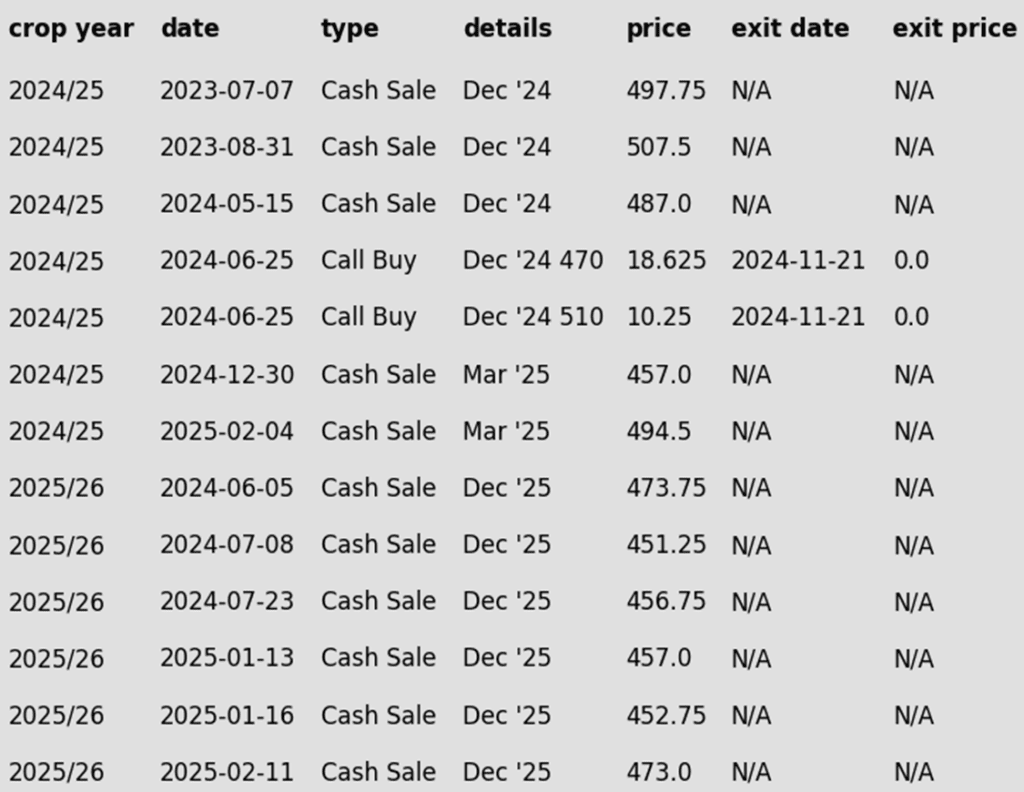

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

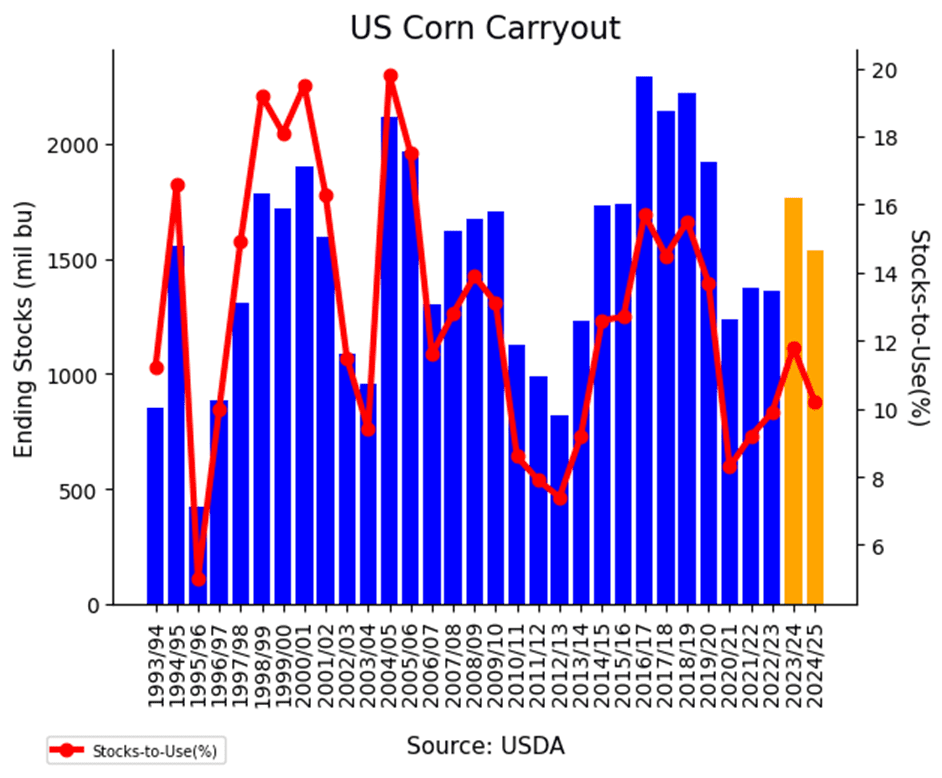

- The front end of the corn market came under strong selling pressure as the USDA WASDE report failed to make any changes to the U.S. corn balance sheet. The weak technical close and selling momentum into the end of the session could leave the corn market open to additional selling pressure going into tomorrow’s session.

- The USDA kept 2024/25 corn ending stocks at 1.540 billion bushels, while analysts had expected a 15 mb reduction due to strong demand. The higher-than-anticipated carryout led to long liquidation.

- The USDA lowered forecasted production for Argentina by 1 MMT and Brazil by 1 MMT reflecting the difficult start to the growing season in some regions. However, February weather conditions in both regions have improved.

- The cash market has seen soft basis action, which could be an indicator that corn supplies are in the pipeline and front-end demand could be cooling. The corn market is moving toward a key pricing window as the March contract nears First notice day at the end of February.

Corn Bulls in Control, Eyeing Key Resistance

The corn market’s post-harvest rally remains intact, driven by strong fund buying and robust demand. Solid support holds at 475, with additional footing near the breakout zone around 450. On the upside, prices are pressing against the 500 mark — a critical resistance level that could dictate the next move. With buyers still engaged, all eyes are on whether momentum can propel corn beyond this key threshold.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

Active

Enter(Buy) NOV ’25 Calls:

1100 @ ~ 55c & 1180 @ ~ 32c

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Recent Sales Recommendations: Grain Market Insider recommended selling portions of your 2024 soybean crop on January 14 at 1047.50 and again on January 22 at 1056.00, both against the March ‘25 contract. The average of these two sales is 1051.75, which is 2-½ cents above today’s March ‘25 closing price. If you missed either of the January sales recommendations, now is still a good time to catch up, as the March ‘25 contract remains within that price range. Additionally, with a USDA WASDE report set for release tomorrow, securing a sale ahead of time could be wise—especially if the USDA reports numbers that put pressure on the soybean market.

- Off Highs: The March ‘25 contract finished last week up nearly 8 cents, but 30 cents off the high of 1079.75.

- Resistance: The March ‘25 contract was again unable to secure a weekly close above the start of the resistance band at 1060 last week. The last time the front-month contract closed above this level on a weekly continuous chart was the week of September 23 last year.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying November ‘25 1100 soybean calls and November ‘25 1180 soybean calls in equal quantities with a total net spend of approximately 88 cents plus commission and fees. Buying these call options will reopen the topside on the sales recommendation made two weeks ago. Also, buying two strikes provides the option to leg out of the lower strike once it covers the cost of the upper strike.

- Grain Market Insider recently recommended selling the first portion of your 2025 soybean crop on January 29 at 1063.50 vs November ‘25.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

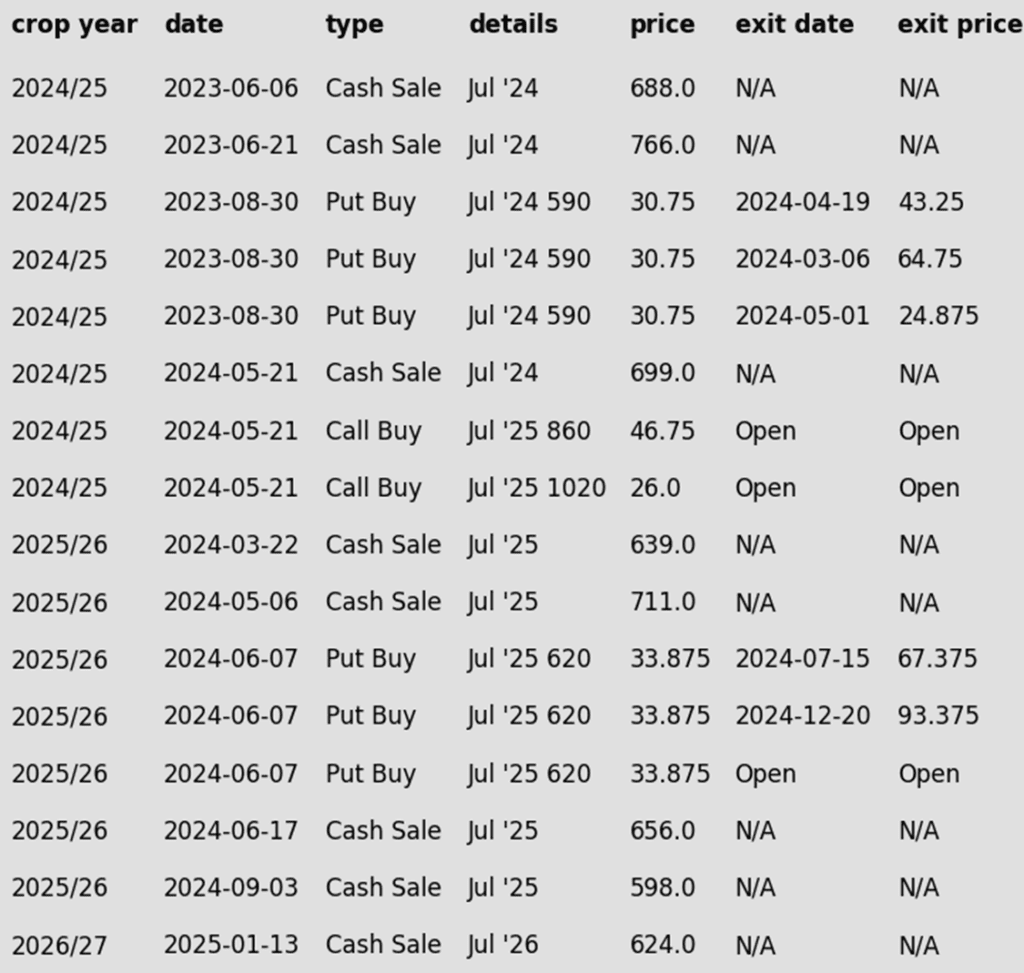

To date, Grain Market Insider has issued the following soybean recommendations:

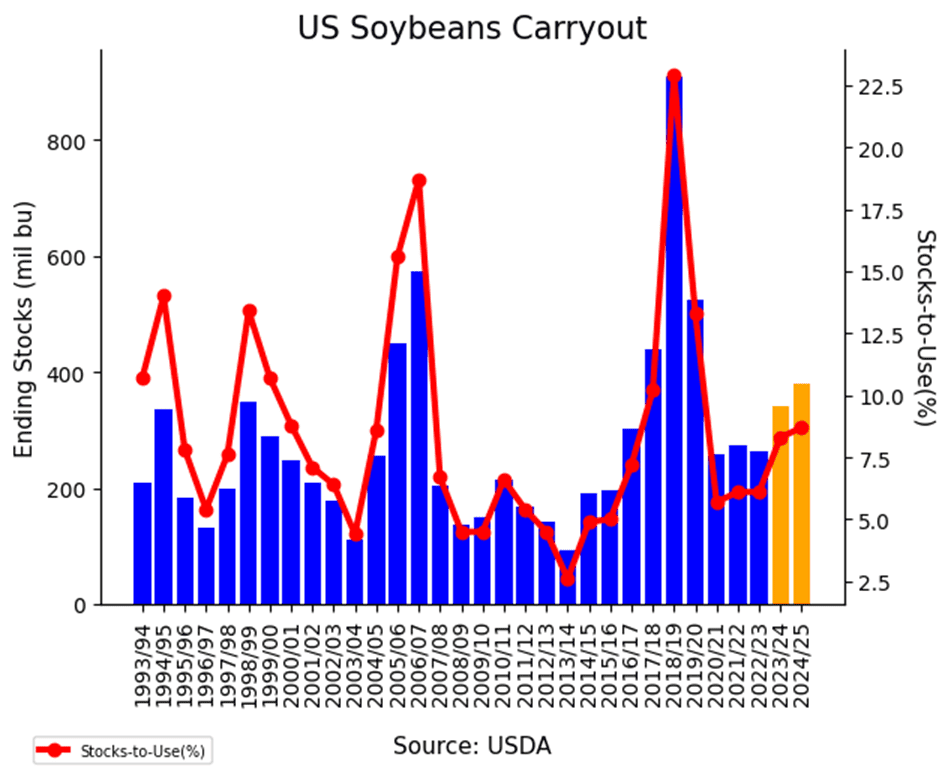

Market Notes: Soybeans

- Soybeans ended lower after a neutral WASDE report failed to provide the bullish support traders were hoping for. Prices were up earlier in the day but retreated as the report offered no surprises. Soybean meal led the decline on improving Argentinian weather, while soybean oil found support from rising crude oil prices.

- The WASDE report held U.S. ending stocks steady at 380 mb, despite market expectations for a slight reduction. Global soybean ending stocks dropped to 124.3 mmt from 128.4 mmt, in line with forecasts.

- Regarding South America, the USDA did make some changes to South American production. In Argentina, soybean production was lowered by 3 mmt from last month to 49.0 mmt. This was expected given the recent dry spell in the country. In Brazil, soybean production estimates were left unchanged at 169 mmt, but some analysts have estimates closer to 171 mmt.

- Brazil is reportedly 15% done with its 24/25 soybean harvest as of February 6. Prices in the country have been firm as strong export demand has kept supply limited.

Soybeans Attempting to Breakout

Front-month soybean futures have repeatedly tested but failed to clear resistance at the 200-day moving average in recent weeks — a stubborn ceiling that has limited upside momentum for over 18 months. A decisive close above this level would be a strong signal for potential further upside. Support is expected to be near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all three classes, as a relatively uneventful WASDE report failed to generate much buying interest despite being mildly supportive. The broader weakness in corn and soybeans likely added pressure to the wheat complex by the session’s end.

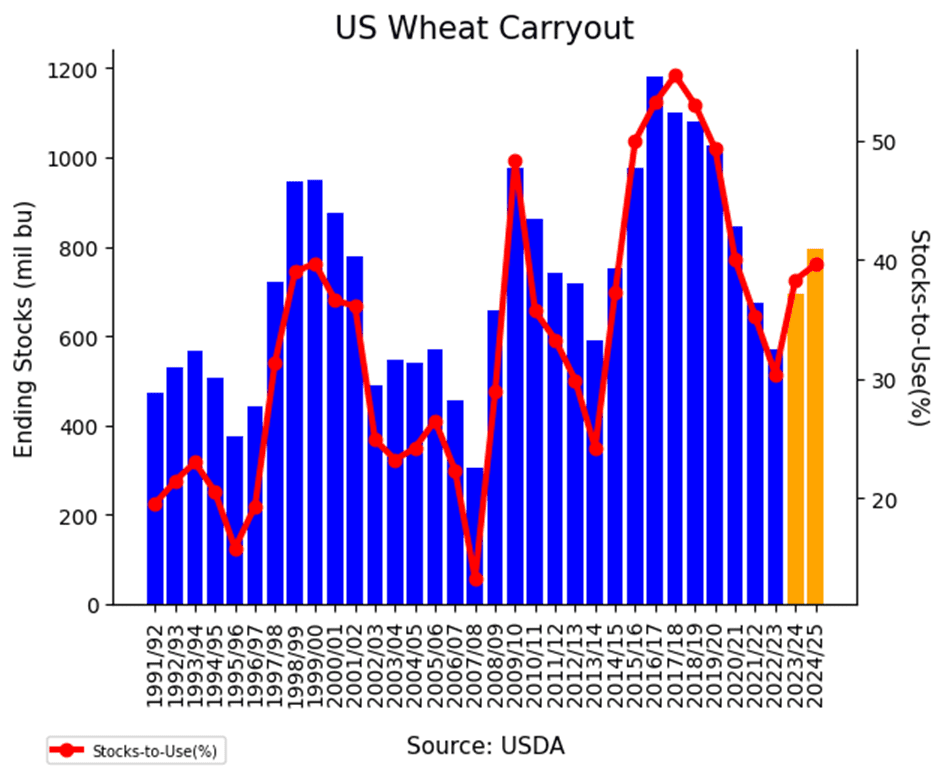

- The report lowered U.S. 2024/25 wheat ending stocks by 4 mb to 794 mb, while traders had expected a slight increase to 800 mb. Global wheat carryout also declined from 258.8 mmt to 257.6 mmt, contrary to trade expectations for a steady figure.

- US wheat exports were unchanged at 850 mb, with imports also holding steady at 130 mb. Australian wheat production was untouched at 32 mmt, but Argentina’s did increase by 0.2 mmt to 17.7 mmt. Meanwhile, Russian and Ukrainian exports were both dropped by 0.5 mmt, to 45.5 mmt and 15.5 mmt respectively.

- Brazilian wheat prices remain firm amid limited supplies. January wheat imports totaled 716,900 mt, marking the highest monthly volume since April 2020 and the largest January total since 2008.

- According to the French farm ministry, their estimate of soft winter wheat plantings has increased. For the 2025 harvest, the forecast was raised from 4.51 million hectares in December, to 4.57 million hectares as of Tuesday. Furthermore, this new estimate is 10% above 2024 and 0.4% above the five-year average.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 680-705 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in SRW supports 680–705 as a realistic and achievable target. In the last three instances where the Funds held a similar net short position and were forced to cover, the front-month contract rallied approximately 140 cents, 90 cents, and 170 cents.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June, providing ample time for potential upside.

2025 Crop:

- No Change: The next target range for a sale remains 690–715 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

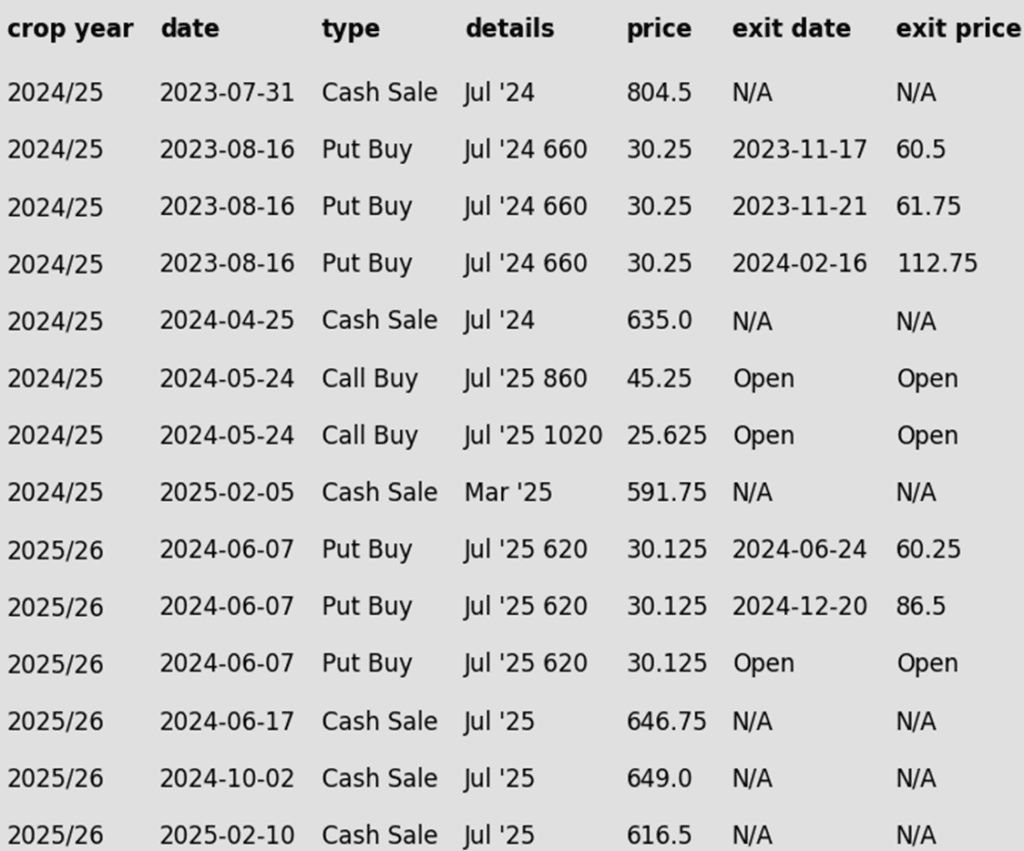

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stuck in Neutral – For Now

Chicago wheat continues to tread familiar ground, locked in a tight range between 530 and 577. The market is searching for a spark, and a breakout above the 577–586 resistance zone could open the door for a push toward 617. On the flip side, if support at 536 cracks, sellers may take control, driving prices down toward the 521–514 support zone. For now, wheat remains in wait-and-see mode, poised for its next big move.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRW wheat crop.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 HRW wheat crop.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

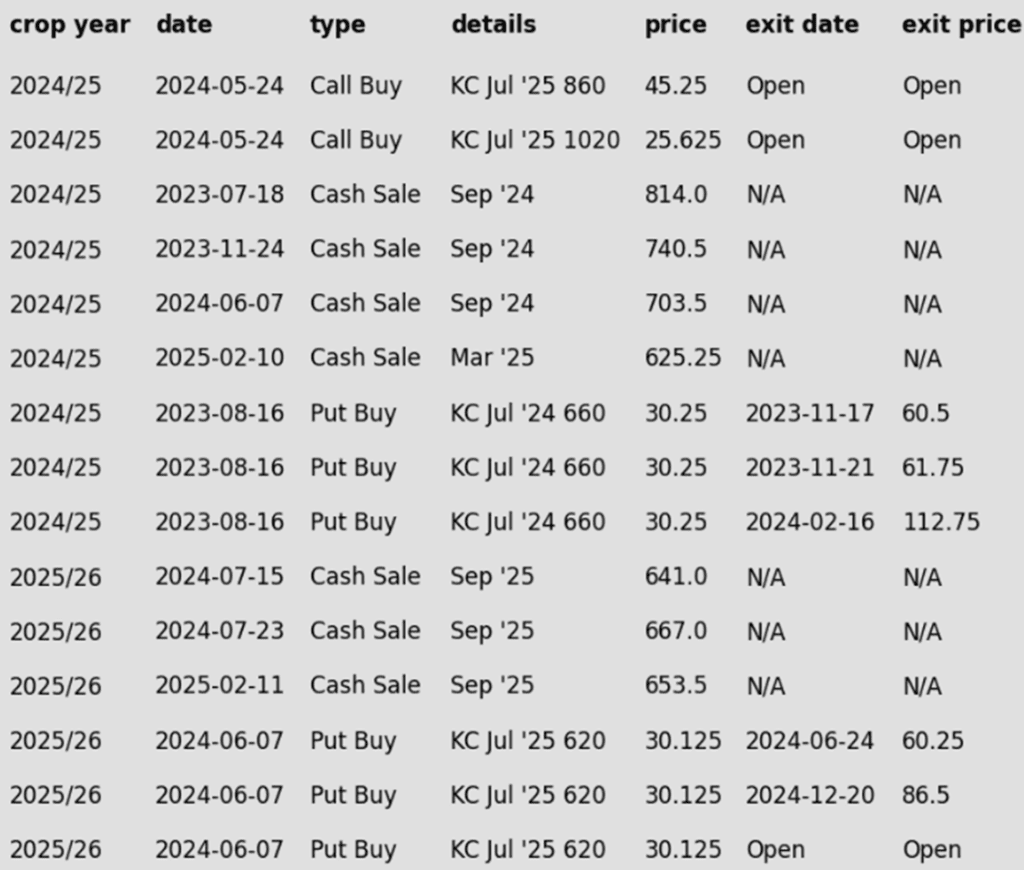

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Attempts to Break Out

Kansas City wheat futures kicked off February on a strong note, closing above the 200-day moving average and testing multi-month highs near 620. A decisive close above the October peak of 623 could open the door for a rally toward the 700 level. On the downside, initial support lies near the 200-day moving average, with stronger support around 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

New Alert

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRS wheat crop.

- Latest Sales Rec: This is the first sale recommendation that Grain Market Insider has made for the 2024 Minneapolis wheat crop since June 7 of last year.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends selling a portion of your 2025 HRS wheat crop today.

- Stalling Momentum: The September ’25 contract has struggled to maintain its upward momentum, facing strong resistance around 660 for the past four sessions. With the price up about 8% from the January 3 low of 605, Grain Market Insider recommends selling another portion of your 2025 new crop Minneapolis wheat today. This marks the first recommendation for the 2025 crop since July 23 of last year.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout: Rally or False Start?

After months of treading water, spring wheat finally found its spark in late January, surging beyond its previous range and signaling a potential breakout. The next big test lies at the 200-day moving average near 625, a level that could either fuel further momentum or stand as a stubborn ceiling. However, any near-term weakness or a close back below 613 could snuff out the rally, pulling prices back into their familiar rangebound pattern.

Other Charts / Weather

South America 10-day GEFS Total Accumulated Precipitation, in millimeters, courtesy of Tropical Tidbits.