2-07 End of Day: Grains Finished the Week Lower Across the Board

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 487.5 | -7.75 |

| JUL ’25 | 504.5 | -6.25 |

| DEC ’25 | 466 | -3.75 |

| Soybeans | ||

| MAR ’25 | 1049.5 | -11 |

| JUL ’25 | 1081 | -9 |

| NOV ’25 | 1057.5 | -8.5 |

| Chicago Wheat | ||

| MAR ’25 | 582.75 | -5 |

| JUL ’25 | 606.25 | -3.75 |

| JUL ’26 | 652.75 | -3 |

| K.C. Wheat | ||

| MAR ’25 | 604.25 | -3.25 |

| JUL ’25 | 623 | -2 |

| JUL ’26 | 658.25 | 2 |

| Mpls Wheat | ||

| MAR ’25 | 627.75 | -0.75 |

| JUL ’25 | 648.75 | 0 |

| SEP ’25 | 659.5 | -0.75 |

| S&P 500 | ||

| MAR ’25 | 6056 | -50 |

| Crude Oil | ||

| APR ’25 | 70.74 | 0.37 |

| Gold | ||

| APR ’25 | 2885.9 | 9.2 |

Grain Market Highlights

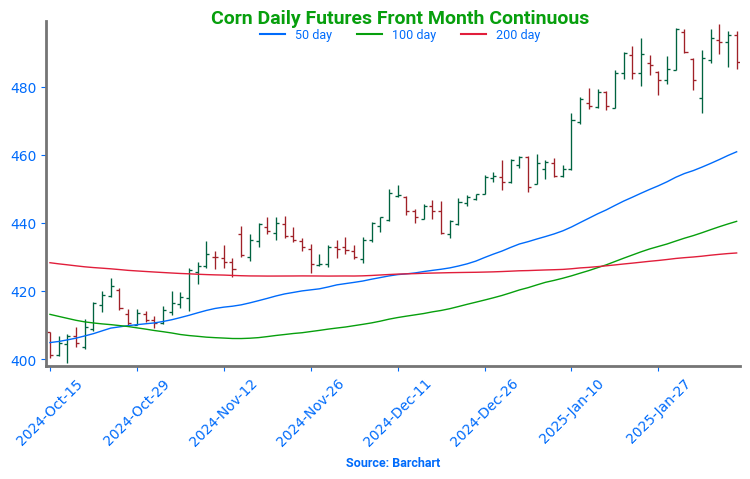

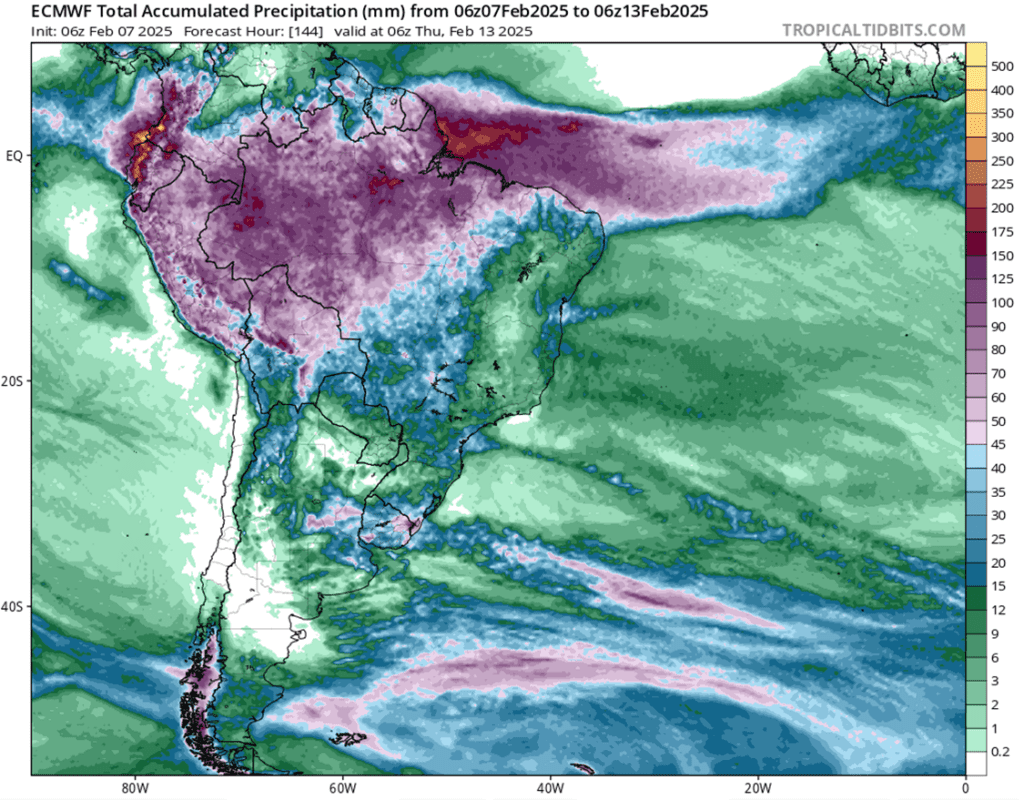

- Corn: Corn prices closed lower today, pressured by favorable weather conditions in South America, which provided the crops with much-needed relief.

- Soybeans: Soybean prices ended the day lower, pressured by a stronger dollar and improved weather conditions in Argentina following recent rains.

- Wheat: Wheat prices closed lower today, weighed down by declines in the corn and soybean markets, along with added pressure from a stronger US dollar.

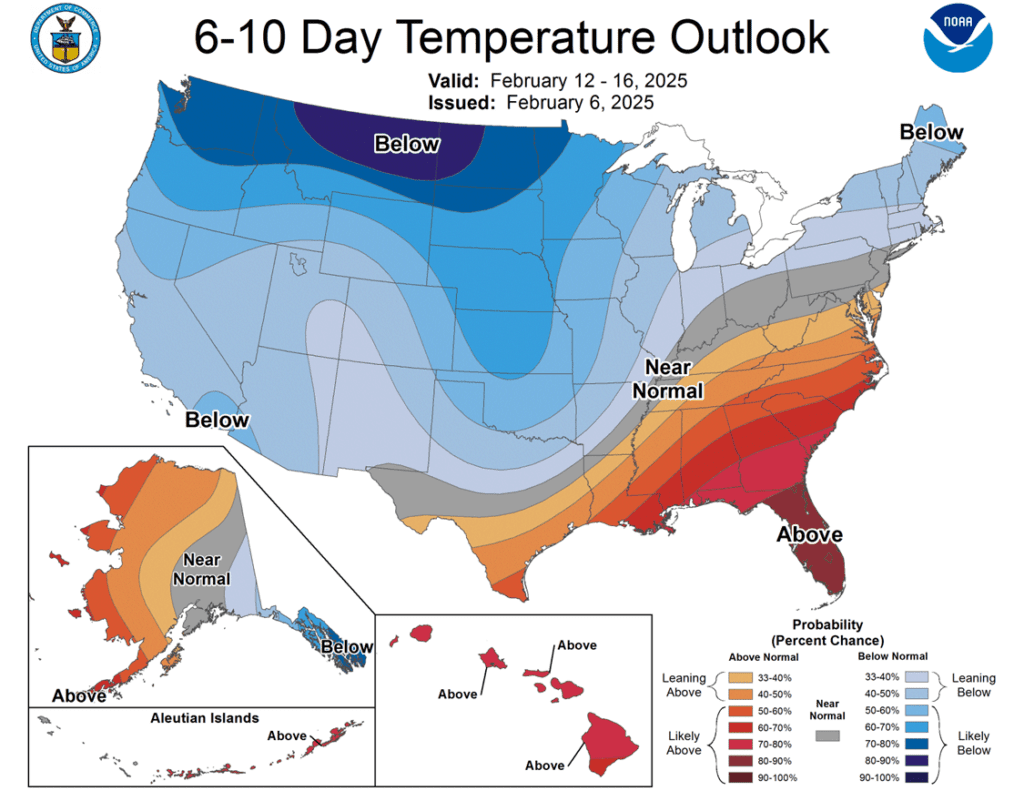

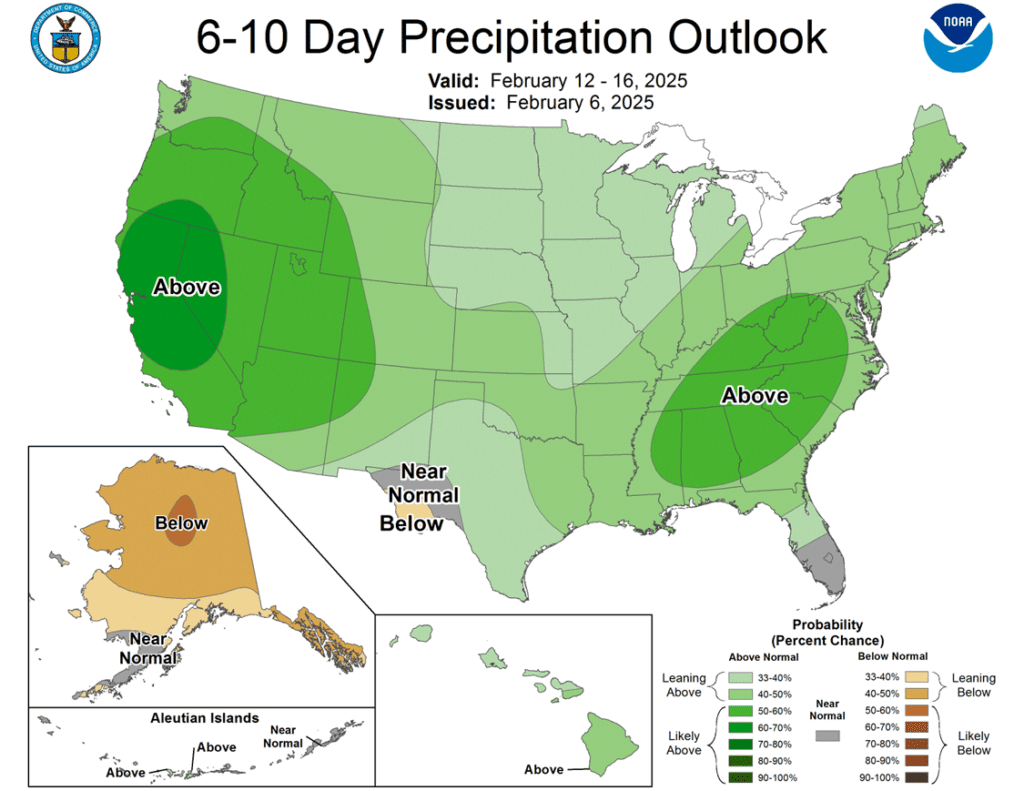

- To see the updated 10-day GEFS total accumulated precipitation for South America as well as the 6–10-day temperature and precipitation outlooks for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

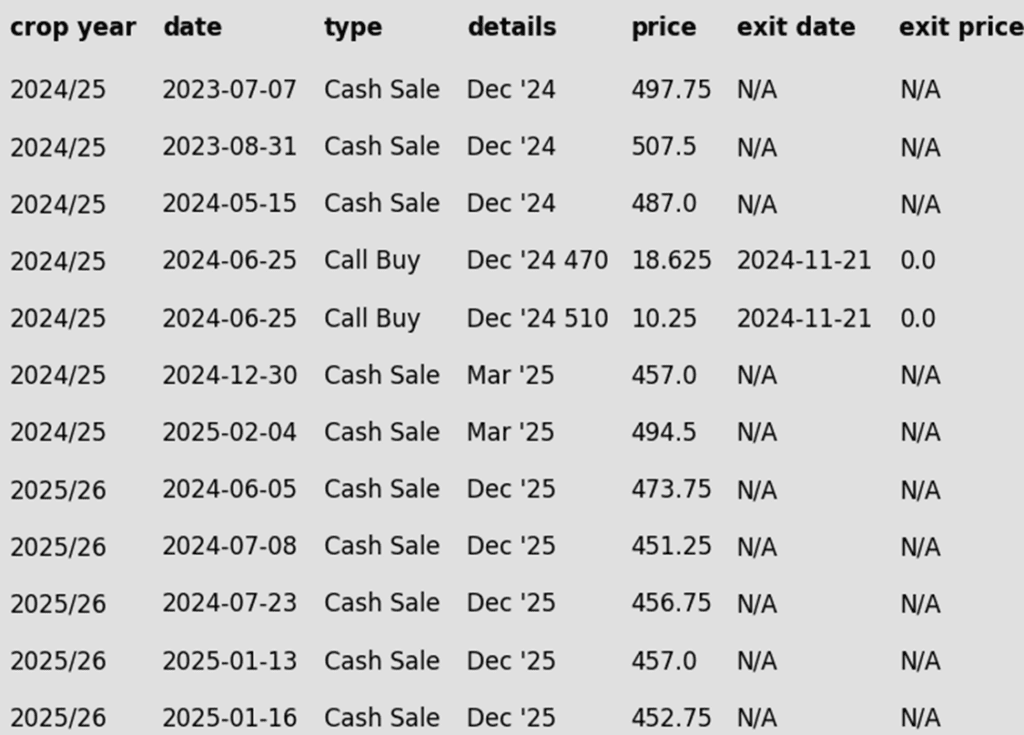

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 corn crop.

- Sales Target Range: With the March ‘25 contract facing continued resistance at the lower end of the 495 – 515 target range, Grain Market Insider recommended making a sale on Tuesday. The upper end of the target range at 515 remains a key level to watch. If March ‘25 corn can close over the recent high of 498.50, Grain Market Insider will consider the 515 area as another potential sales target.

- Resistance Levels: Key resistance on the front-month continuous chart remains between the recent high of 498.50 and the May 1996 high of 513.50.

2025 Crop:

- Be Ready: Stay alert for a sales recommendation in the 473–479 range vs December ‘25.

- Downside Support: Key support for the December ‘25 contract remains at 453.75 — an important level to watch in the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A strong close above this level could open the door to broader upside potential as we head into the spring planting window.

- Buying Call Options: If prices break through 479, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge against existing sales and get you repositioned to the topside in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 2–4 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn prices finished 4-7 cents lower heading into the weekend on pressure from rain in South America and weakness in the wheat complex.

- President Trump’s USTR nominee, Jamieson Greer, made comments yesterday that he favors a strong dollar policy, which cooled buying interest overnight and into Friday’s session.

- If an agreement can be reached with Mexico before the implementation of tariffs, we could see Mexico start to buy even more corn in 2025 compared to the record 25.3 mmt they purchased in 2024.

- Much of the Northern Midwest is seeing drought conditions and was highlighted by yesterday’s drought monitor. Drought conditions were 4% worse than last week to 46%. This compares to the 27% of the corn area in the US seeing drought conditions the same week last year.

- The Mato Grosso region of Brazil continues to push forward with planting their second crop. Corn planting is now seen at 23% complete, up 6% from last week, but still below the 5-year average of 33% done by this time.

Corn Rally Holding Strong as Buyers Stay Engaged

The corn market’s uptrend has been firing on all cylinders since harvest, fueled by eager fund buying and solid demand. Support is firmly in place at 475, with an extra layer of reinforcement near the breakout zone around 450. On the upside, prices are knocking on the door of 500, a key resistance level that could determine the next leg of this rally. For now, the bulls remain in control, but the market is watching closely to see if momentum can push corn through the next hurdle.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

Active

Enter(Buy) NOV ’25 Calls:

1100 @ ~ 55c & 1180 @ ~ 32c

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

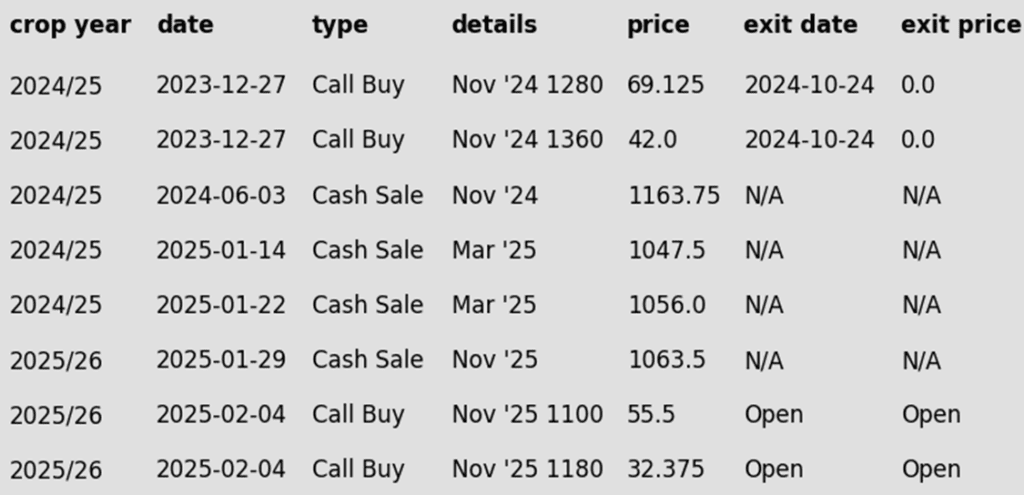

2024 Crop:

- Recent Sales Recommendation: Grain Market Insider advised selling another portion of your 2024 soybean crop last week.

- Off Highs: The March ‘25 contract finished the week up nearly 8 cents, but 30 cents off this week’s high of 1079.75.

- Resistance: The March ‘25 contract was again unable to secure a weekly close above the start of the resistance band at 1060 this week. The last time the front-month contract closed above this level on a weekly continuous chart was the week of September 23 last year.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying November ‘25 1100 soybean calls and November ‘25 1180 soybean calls in equal quantities with a total net spend of approximately 88 cents plus commission and fees. The November ‘25 contract closed over 1071 resistance on Tuesday, which opens the door of opportunity for a continued move higher. Buying these call options will reopen the topside on the sales recommendation made last week. Also, buying two strikes provides the option to leg out of the lower strike once it covers the cost of the upper strike.

- Grain Market Insider recently recommended selling the first portion of your 2025 soybean crop.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean prices ended the day lower, though they have remained relatively rangebound in recent weeks, with the March contract trading between $10.75 and $10.40. The stronger dollar likely weighed on the entire grain complex, and funds may have taken profits ahead of the weekend. While soybean meal closed lower, soybean oil ended the day higher.

- Estimates for Tuesday’s WASDE report suggest U.S. soybean ending stocks will decrease by 3 mb to 378 mb, while a potential increase in export demand is also expected. Global ending stocks are projected to remain unchanged or slightly lower.

- In South America, Argentinian soybean production was last estimated at 52 mmt but may slip due to recent dry weather. The Brazilian soybean crop is estimated at 170 mmt. Safras has pegged production higher at 174.88 mmt, but the recent harvest delays may have cut that number slightly.

- Argentinian weather has improved recently with rains, but the dry stretch damaged the soy crop, and good to excellent ratings have fallen to just 17% while poor to very poor conditions have increased to 32%.

Soybeans Attempting to Breakout

Front-month soybean futures struggled to break above resistance at the 200-day moving average in January, a level that has capped gains for over 18 months. However, early February price action has shown enough strength to close above this key level, signaling potential for further upside. Support is expected near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

Wheat

Market Notes: Wheat

- Wheat closed with small to modest losses, pressured by lower corn and soybean futures. Additionally, a higher US Dollar added to pressure. All three March wheat contracts are considered technically overbought and may also be due for a correction to the downside.

- According to Stats Canada, December wheat stocks came in at 24.48 mmt, which was above both the expected 23 mmt, and last year’s 20.68 mmt figure.

- The average WASDE pre-report estimate for US 24/25 wheat ending stocks is projected at 800 mb, which would be up 2 mb from the January report and well above the 696 mb from the 23/24 season. Global wheat carryout is expected to show a slight decrease to 258.7 mmt from 258.8 mmt in January.

- The Russian ag ministry has increased the wheat export tax by 1% to 3984.20 Rubles/mt through February 18. In related news, the Russian wheat export quota is expected to begin on February 15.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

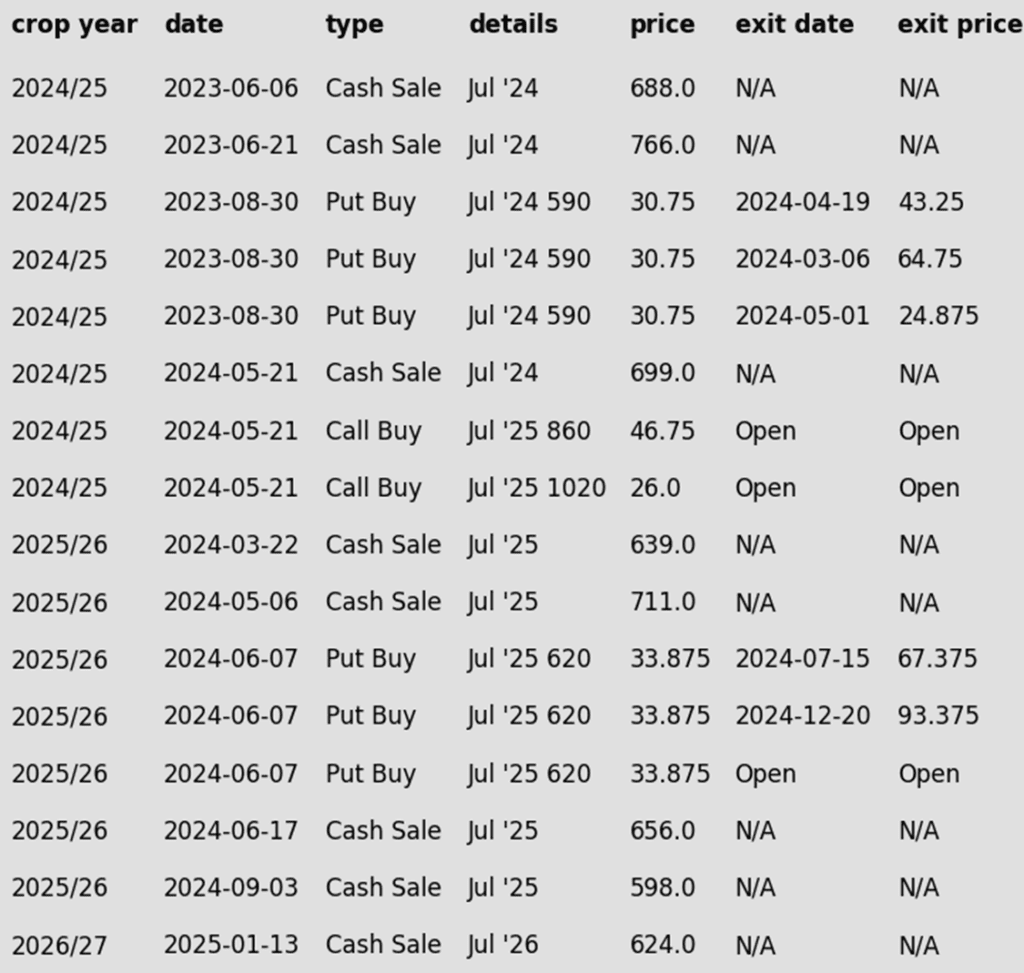

2024 Crop:

- Sales Target Range: The target range remains 680-705 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in SRW supports 680–705 as a realistic and achievable target. In the last three instances where the Funds held a similar net short position and were forced to cover, the front-month contract rallied approximately 140 cents, 90 cents, and 170 cents.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June, providing ample time for potential upside.

2025 Crop:

- No Change: The next target range for a sale remains 690–715 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

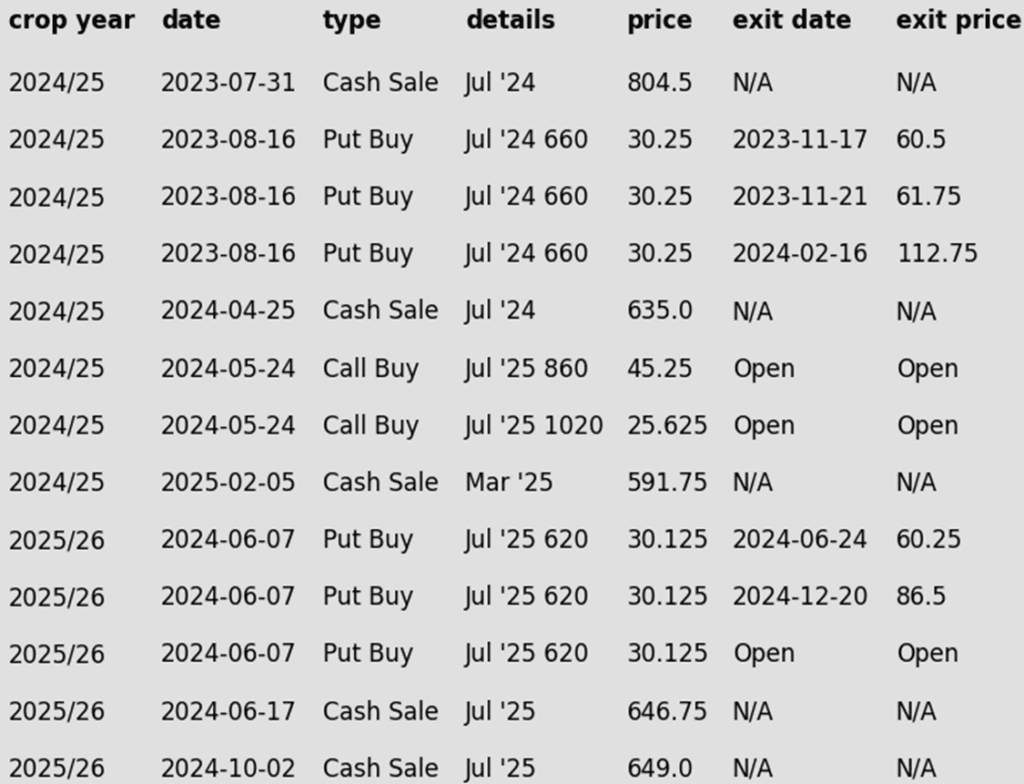

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stuck in Neutral – For Now

Chicago wheat continues to tread familiar ground, locked in a tight range between 530 and 577. The market is searching for a spark, and a breakout above the 577–586 resistance zone could open the door for a push toward 617. On the flip side, if support at 536 cracks, sellers may take control, driving prices down toward the 521–514 support zone. For now, wheat remains in wait-and-see mode, poised for its next big move.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRW wheat crop.

- Weekly Gain: The March ’25 contract closed the week 25 cents higher, making it a solid opportunity for a sale. If the market continues its upward momentum, the next target range is 650–700.

- Short Covering Potential: The massive net short position of the Funds in HRW reinforces 650–700 as a realistic and achievable target. Historically, when the Funds held a net short position exceeding 40,000 contracts and were forced to cover, the front-month contract rallied approximately 100 cents, 100 cents, 160 cents, and 70 cents in the last four instances.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June, providing ample time for potential upside.

2025 Crop:

- No Change: The target range to make an additional sale for your 2025 HRW wheat crop remains 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Shows Signs of Life

KC wheat has traded between 536 and 583 since November, with the early February rally above the 200-day moving average a test of the October highs near 620 looks likely, support should appear at the top end of the recent range near 580.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Continue to hold. Grain Market Insider continues to recommend holding off on additional sales for the 2024 HRS wheat crop. The March ’25 contract has gained approximately 44 cents over the past three weeks, supporting a wait-and-see approach going into next week.

- Short Covering Potential: The Funds’ massive net short position in HRS continues to provide upside potential. The last time they held a short position of this size and were forced to cover, the front-month contract rallied about 110 cents.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June.

2025 Crop:

- No Change: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

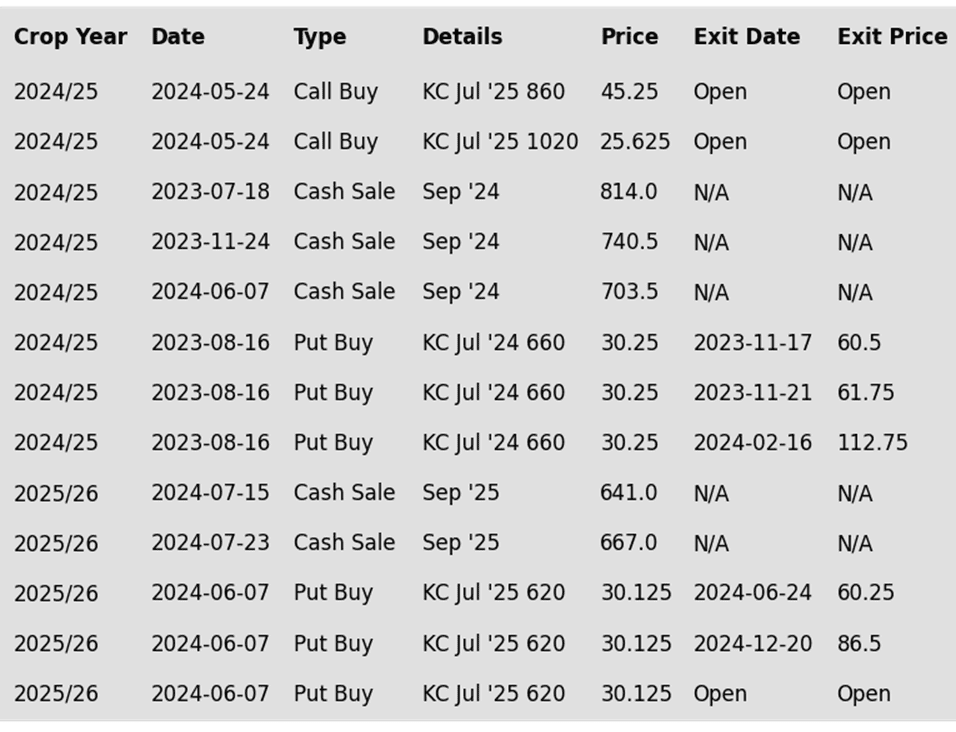

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout: Rally or False Start?

After months of treading water, spring wheat finally found its spark in late January, surging beyond its previous range and signaling a potential breakout. The next big test lies at the 200-day moving average near 625, a level that could either fuel further momentum or stand as a stubborn ceiling. However, any near-term weakness or a close back below 613 could snuff out the rally, pulling prices back into their familiar rangebound pattern.

Other Charts / Weather

Above: South America 10-day GEFS Total Accumulated Precipitation, in millimeters, courtesy of Tropical Tidbits.

Above: US temperature and precipitation forecast courtesy of NOAA, Weather Prediction Center.