2-06 End of Day: A Strong Wheat Market Drives Corn and Soybeans Higher

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 495.25 | 2 |

| JUL ’25 | 510.75 | 3.25 |

| DEC ’25 | 469.75 | 1.25 |

| Soybeans | ||

| MAR ’25 | 1060.5 | 3.5 |

| JUL ’25 | 1090 | 3.25 |

| NOV ’25 | 1066 | 3.5 |

| Chicago Wheat | ||

| MAR ’25 | 587.75 | 15.5 |

| JUL ’25 | 610 | 13.25 |

| JUL ’26 | 655.75 | 9.25 |

| K.C. Wheat | ||

| MAR ’25 | 607.5 | 15.75 |

| JUL ’25 | 625 | 14.25 |

| JUL ’26 | 656.25 | 9.5 |

| Mpls Wheat | ||

| MAR ’25 | 628.5 | 10 |

| JUL ’25 | 648.75 | 10.25 |

| SEP ’25 | 660.25 | 10.5 |

| S&P 500 | ||

| MAR ’25 | 6077.25 | -9.25 |

| Crude Oil | ||

| APR ’25 | 70.23 | -0.51 |

| Gold | ||

| APR ’25 | 2875.8 | -17.2 |

Grain Market Highlights

- Corn: Corn closed higher today, supported by strong demand and buying strength in the wheat market.

- Beans: After a choppy trading day, soybeans ended higher, supported by strength in the wheat market and the ongoing harvest in Brazil.

- Wheat: Wheat continues higher at close on all three markets driven by another cold snap anticipated in the Northern Great Plains.

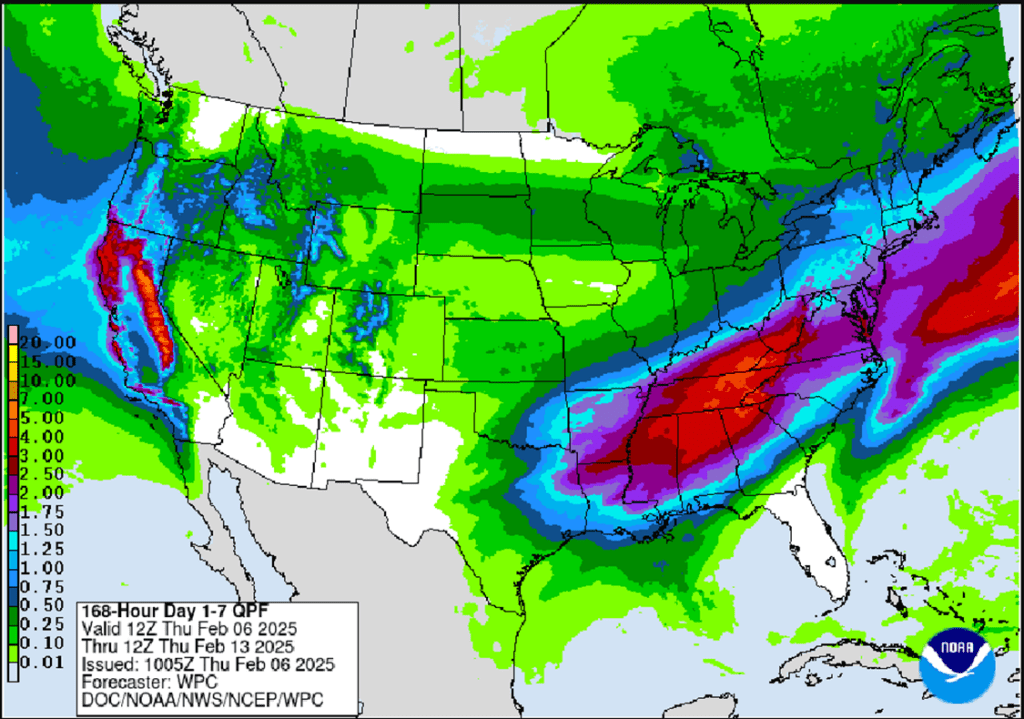

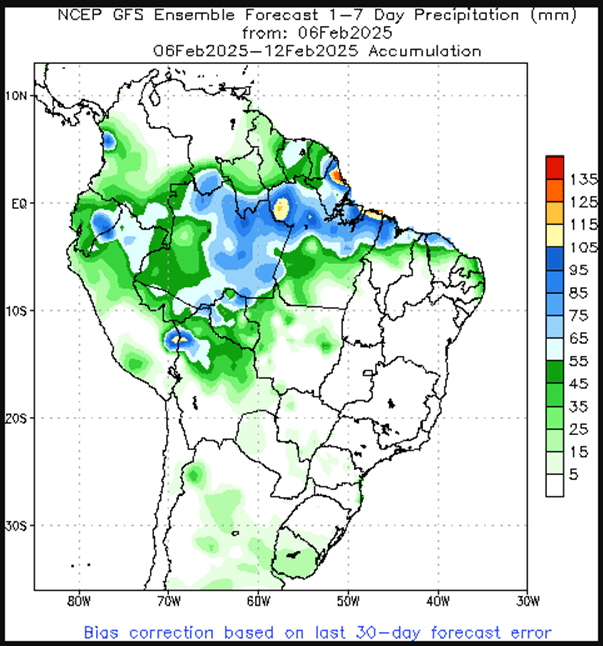

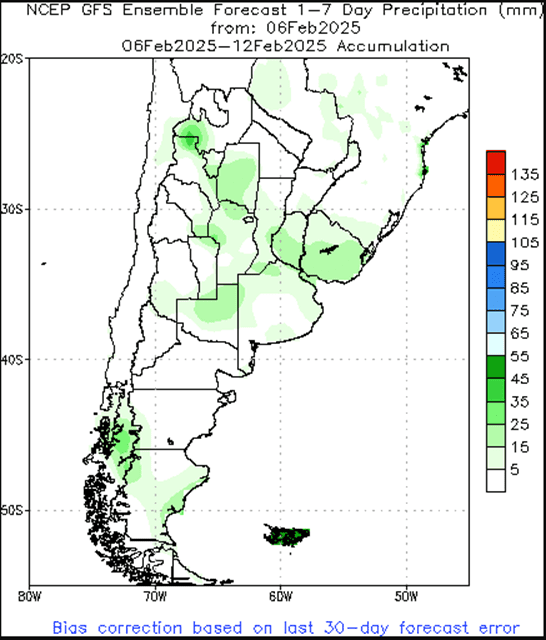

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 corn crop.

- Sales Target Range: With the March ‘25 contract facing continued resistance at the lower end of the 495 – 515 target range, Grain Market Insider recommended making a sale on Tuesday. The upper end of the target range at 515 remains a key level to watch. If March ‘25 corn can break through this resistance, Grain Market Insider will consider it as another potential sales target.

- Resistance Levels: Key resistance on the front-month continuous chart remains between the September 2021 low of 497.50 and the May 1996 high of 513.50 — historical levels that could challenge further upside.

2025 Crop:

- Be Ready: The December ‘25 contract just closed at a new high in the current uptrend. Stay alert for a sales recommendation in the 473–479 range.

- Downside Support: Key support for the December ‘25 contract remains at 453.75—an important level to watch in the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A strong close above this level could open the door to broader upside potential as we head into the spring planting window.

- Buying Call Options: If prices break through 479, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge against existing sales and get you repositioned to the topside in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 2–4 weeks.

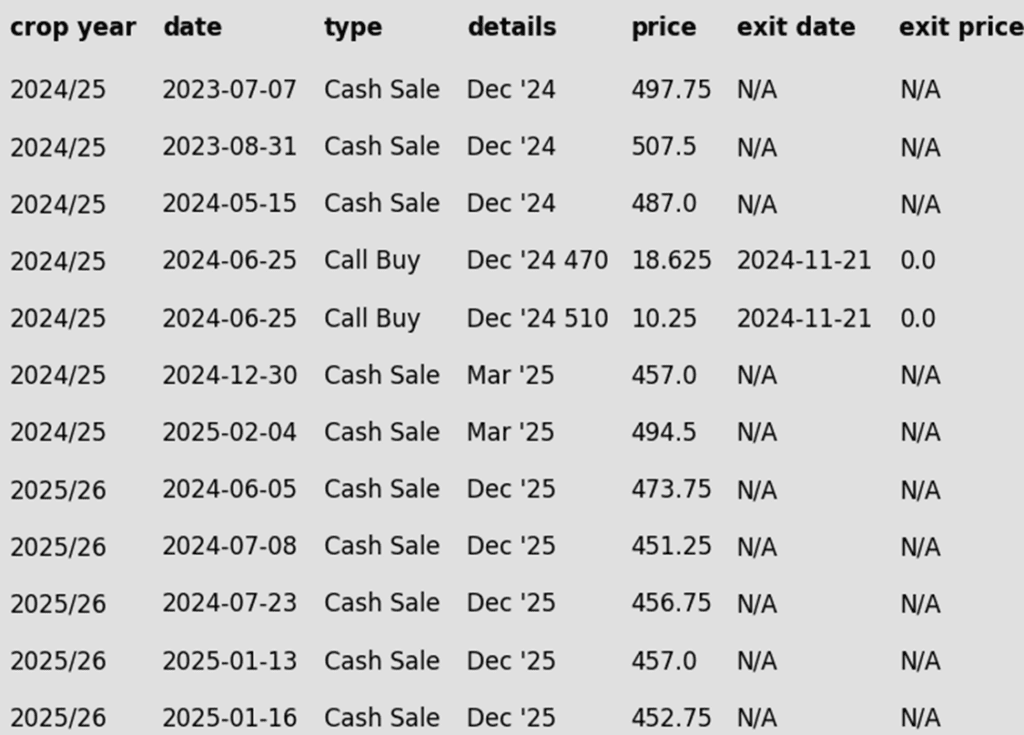

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures pulled off session lows to finish slightly higher, supported by good demand tone and buying strength in the wheat market. The March futures have been consolidating just under the 500 level.

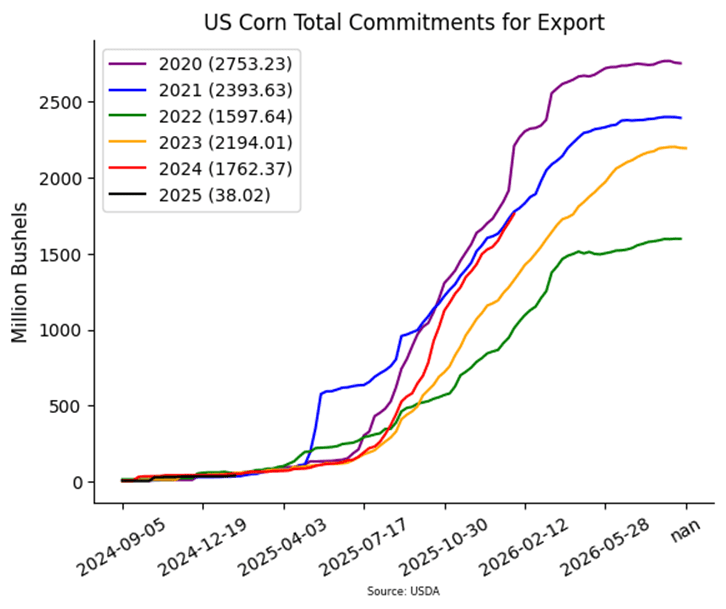

- Weekly corn export sales were announced on Thursday morning. The USDA released that new corn sales for the week ending January 30 totaled 1.477 MMT (58.2 mb). This was toward the top end of analyst expectations. Year-over-year, total corn sales are running 28% better than the last marketing year.

- Argentina’s corn crop conditions slipped this week to 25% good, down 3% from last week, and 28% poor, also down 3% from last week. The corn market is still anticipating some production losses with the Argentina corn crop.

- Mexico announced that they have officially dropped restrictions on GMO corn inputs. Previously, the GMO import ban was a concern with possible limitations for imports of U.S. corn, if the ban was enacted.

Corn Rally Holding Strong as Buyers Stay Engaged

The corn market’s uptrend has been firing on all cylinders since harvest, fueled by eager fund buying and solid demand. Support is firmly in place at 475, with an extra layer of reinforcement near the breakout zone around 450. On the upside, prices are knocking on the door of 500, a key resistance level that could determine the next leg of this rally. For now, the bulls remain in control, but the market is watching closely to see if momentum can push corn through the next hurdle.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

Active

Enter(Buy) NOV ’25 Calls:

1100 @ ~ 55c & 1180 @ ~ 32c

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Recent Sales Recommendation: Grain Market Insider advised selling another portion of your 2024 soybean crop last week.

- Down Week: Last week, the March ‘25 contract snapped a five-week winning streak, posting its first weekly loss since December 16. It closed the week down nearly 14 cents.

- Resistance: The March ‘25 contract has yet to secure a weekly close above the start of the resistance band at 1060. The last time the front-month contract closed above this level on a weekly continuous chart was the week of September 23 last year.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying November ‘25 1100 soybean calls and November ‘25 1180 soybean calls in equal quantities with a total net spend of approximately 88 cents plus commission and fees. The November ‘25 contract closed over 1071 resistance on Tuesday, which opens the door of opportunity for a continued move higher. Buying these call options will reopen the topside on the sales recommendation made last week. Also, buying two strikes provides the option to leg out of the lower strike once it covers the cost of the upper strike.

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling the first portion of your 2025 soybean crop. Now remains a good time to get the first new crop sale on the books and use today’s call option recommendation to re-own this sale right away.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

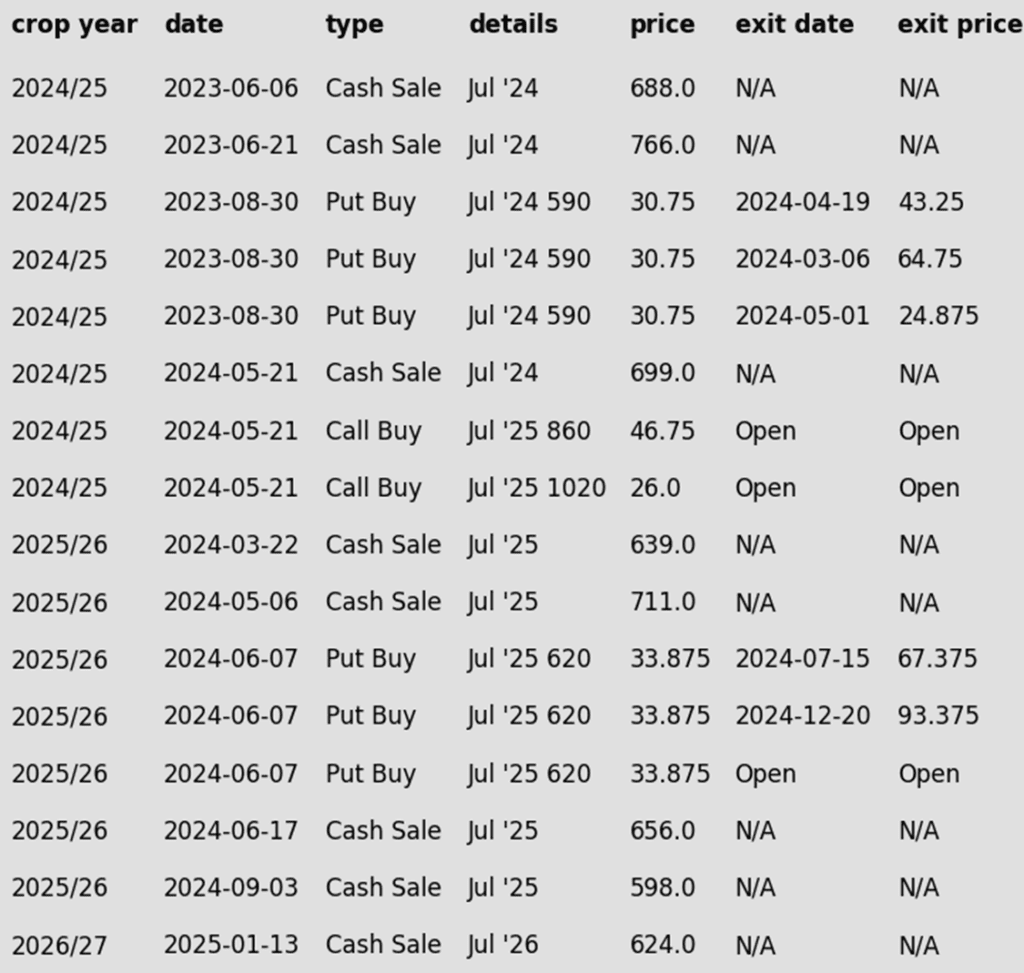

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans traded either side of unchanged today but ultimately closed higher with support from a very strong wheat market. Export sales were disappointing, and harvest progress continues in Brazil despite the wet conditions. Soybean meal ended the day lower while soybean oil was slightly higher.

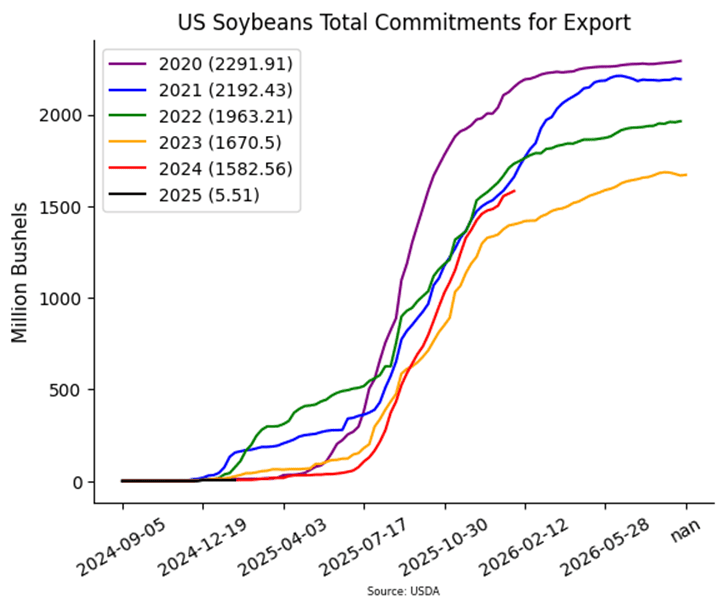

- Today’s export sales report saw soybean sales come in towards the lower end of trade estimates. The USDA reported an increase of 14.2 million bushels of soybean sales in 24/25 and none for 25/26. Last week’s export shipments of 43.8 mb were above the 19.9 mb needed each week to meet the USDA’s estimates.

- Primary destinations last week for soybean export sales were to China, the Netherlands, and Egypt. With tariffs recently placed on Chinese goods and the potential for more to come, it is possible that Chinese demand will slow down in favor of South American soybeans.

- In Brazil, harvest progress continues despite the wet weather, and expectations for a large crop remain intact. Some fields in Mato Grosso are reporting yields around 62.5 bpa. While progress has been made, transportation bottlenecks are emerging as major highways remain congested with trucks hauling beans.

Soybeans Attempting to Breakout

Front-month soybean futures struggled to break above resistance at the 200-day moving average in January, a level that has capped gains for over 18 months. However, early February price action has shown enough strength to close above this key level, signaling potential for further upside. Support is expected near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

Wheat

Market Notes: Wheat

- All three wheat markets closed higher, holding above the 100-day moving average, driven by cold temperatures moving into the northern Great Plains of the U.S. and ongoing fund short covering.

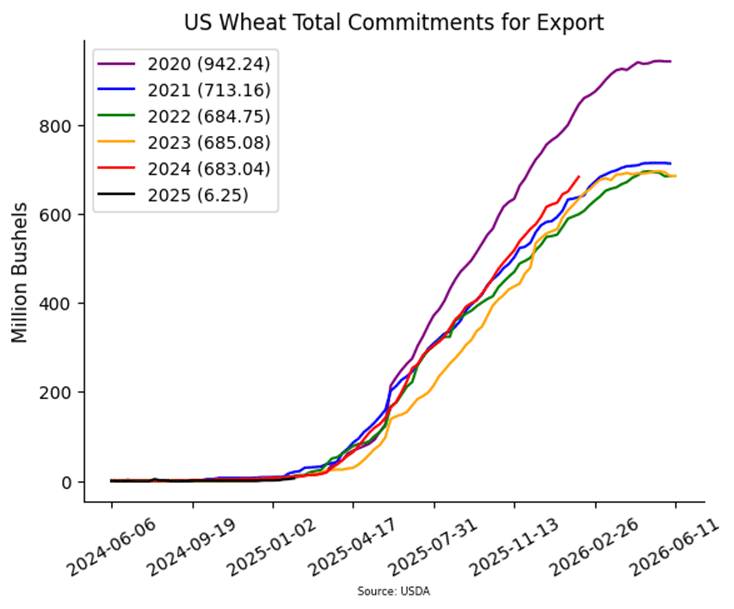

- Weekly wheat exports came in at 18 mb, which was in line with expectations, with old crop commitments at 683 mb up 8% from YA vs the USDA forecast of up 20%.

- The Black Sea regions in Russia and Ukraine are expected to experience a drop in temperatures starting next week, following an unusually warm winter. Given the less-than-ideal establishment of last fall’s crop in these areas, the need for snow cover has become critical. Snow cover is essential to protect winter crops from damage and ensure their survival during this cold spell.

- The U.S. drought monitor shows increasing dry conditions in the Northern half of the Great Plains and dry conditions coming back in the southern half as well.

- Market concerns continue to weigh heavily on prices as traders closely monitor U.S.-China relations, with ongoing tariff negotiations maintaining tensions over the potential for a trade war.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 680-705 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in SRW suggests that 680-705 is a realistic and reachable target zone. In the last three instances when the Funds held a similar net short position and were forced to cover, the front-month contract rallied approximately 140 cents, 90 cents, and 170 cents.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

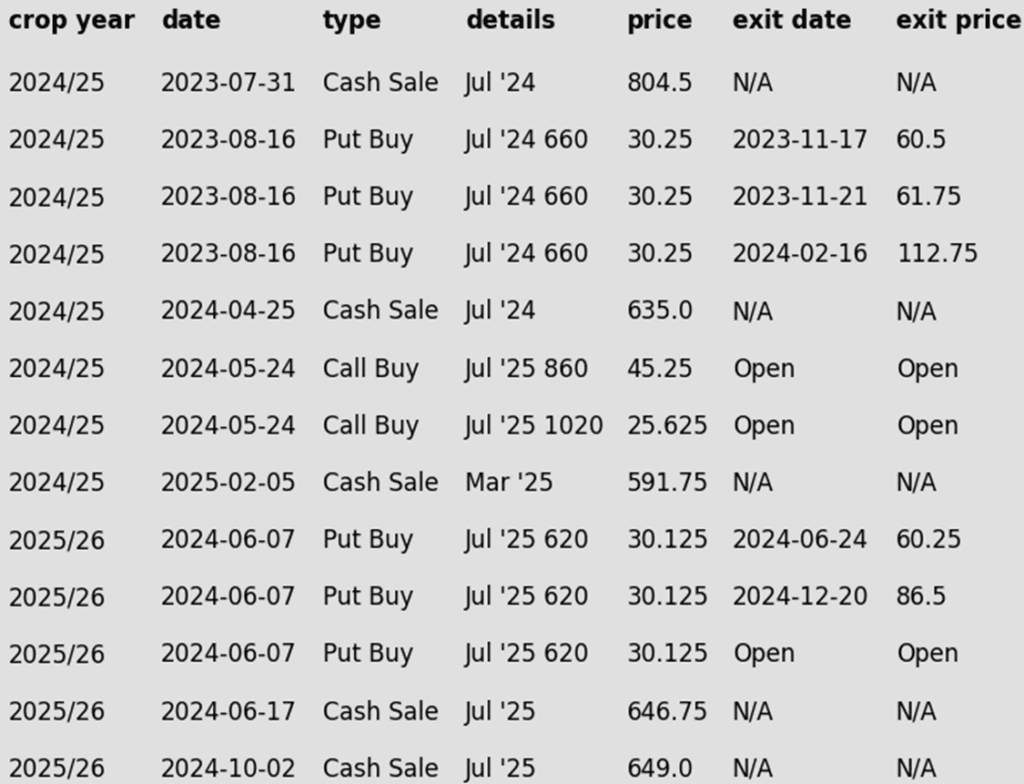

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stuck in Neutral – For Now

Chicago wheat continues to tread familiar ground, locked in a tight range between 530 and 577. The market is searching for a spark, and a breakout above the 577–586 resistance zone could open the door for a push toward 617. On the flip side, if support at 536 cracks, sellers may take control, driving prices down toward the 521–514 support zone. For now, wheat remains in wait-and-see mode, poised for its next big move.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRW wheat crop.

- Next Sales Target Range: Buyers regained control today, pushing the March ‘25 contract above the 600 pivot level and surpassing yesterday’s bearish reversal high of 603.25. The next target zone is 650–700.

- Short Covering Potential: The massive net short position of the Funds in HRW supports 650-700 as a realistic and reachable target zone. Historically, when the Funds held a net short position exceeding 40,000 contracts and were forced to cover, the front-month contract rallied approximately 100 cents, 100 cents, 160 cents, and 70 cents in the last four instances.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

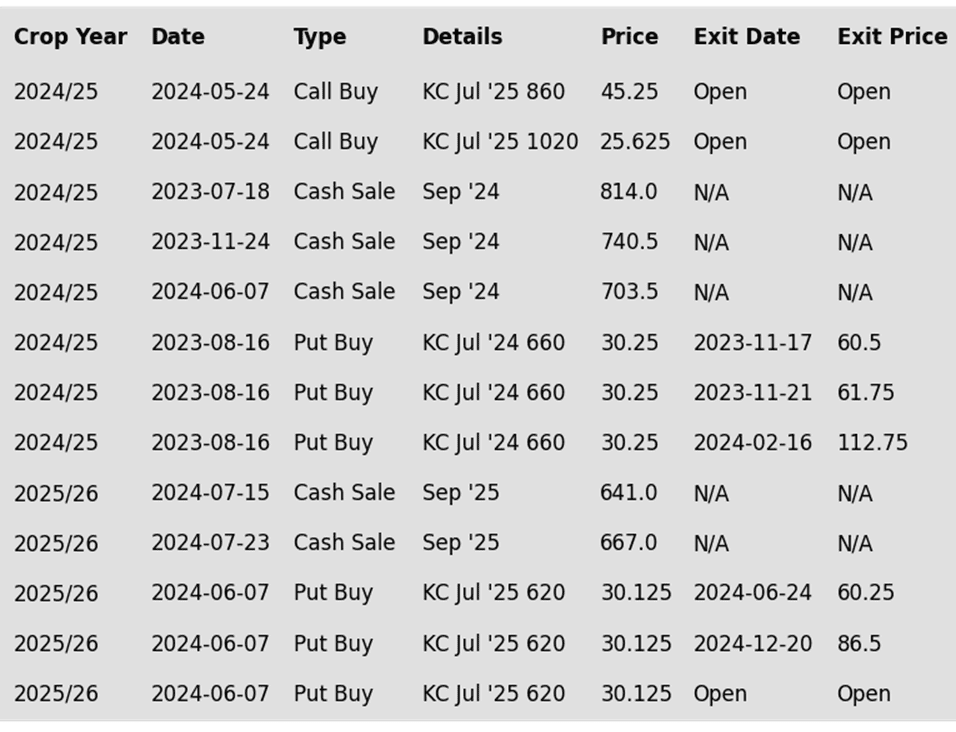

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Shows Signs of Life

KC wheat has traded between 536 and 583 since November, with the early February rally above the 200-day moving average a test of the October highs near 620 looks likely, support should appear at the top end of the recent range near 580.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- No Official Target Range: Over the past couple of trading days, the March ‘25 contract has pushed into the previously mentioned potential target range of 610-635. Unless market conditions shift, Grain Market Insider plans to take a more opportunistic approach and aim for a target beyond 635.

- Short Covering Potential: The Funds’ massive net short position in HRS continues to provide upside potential. The last time they held a short position of this size and were forced to cover, the front-month contract rallied about 110 cents.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout: Rally or False Start?

After months of treading water, spring wheat finally found its spark in late January, surging beyond its previous range and signaling a potential breakout. The next big test lies at the 200-day moving average near 625, a level that could either fuel further momentum or stand as a stubborn ceiling. However, any near-term weakness or a close back below 613 could snuff out the rally, pulling prices back into their familiar rangebound pattern.

Other Charts / Weather

Above: U.S. 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above two: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.