2-04 End of Day: Grains Continue March Higher

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 494.5 | 5.75 |

| JUL ’25 | 506.75 | 3.25 |

| DEC ’25 | 468 | 2.75 |

| Soybeans | ||

| MAR ’25 | 1075 | 16.75 |

| JUL ’25 | 1100.75 | 13.75 |

| NOV ’25 | 1073.5 | 10.25 |

| Chicago Wheat | ||

| MAR ’25 | 577 | 10.25 |

| JUL ’25 | 599.25 | 9 |

| JUL ’26 | 646.75 | 6 |

| K.C. Wheat | ||

| MAR ’25 | 594.75 | 9 |

| JUL ’25 | 613.25 | 8.75 |

| JUL ’26 | 649.5 | 3.75 |

| Mpls Wheat | ||

| MAR ’25 | 621.75 | 5.25 |

| JUL ’25 | 640.5 | 6.5 |

| SEP ’25 | 650 | 6.5 |

| S&P 500 | ||

| MAR ’25 | 6064.5 | 42.25 |

| Crude Oil | ||

| APR ’25 | 71.95 | -0.44 |

| Gold | ||

| APR ’25 | 2872.7 | 15.6 |

Grain Market Highlights

- Corn: With concerns over tariffs on Mexico and Canada delayed, traders shifted their focus to strong demand, driving buying in corn futures on Tuesday.

- Beans: News that China did not retaliate against U.S. tariffs by placing tariffs on soybeans spurred buying across the soybean complex. This momentum helped March futures close above significant resistance, signaling renewed strength in the market.

- Wheat: Futures joined the rally higher in corn and soybeans as front month KC wheat futures closed above significant upside resistance, the 200-day moving average.

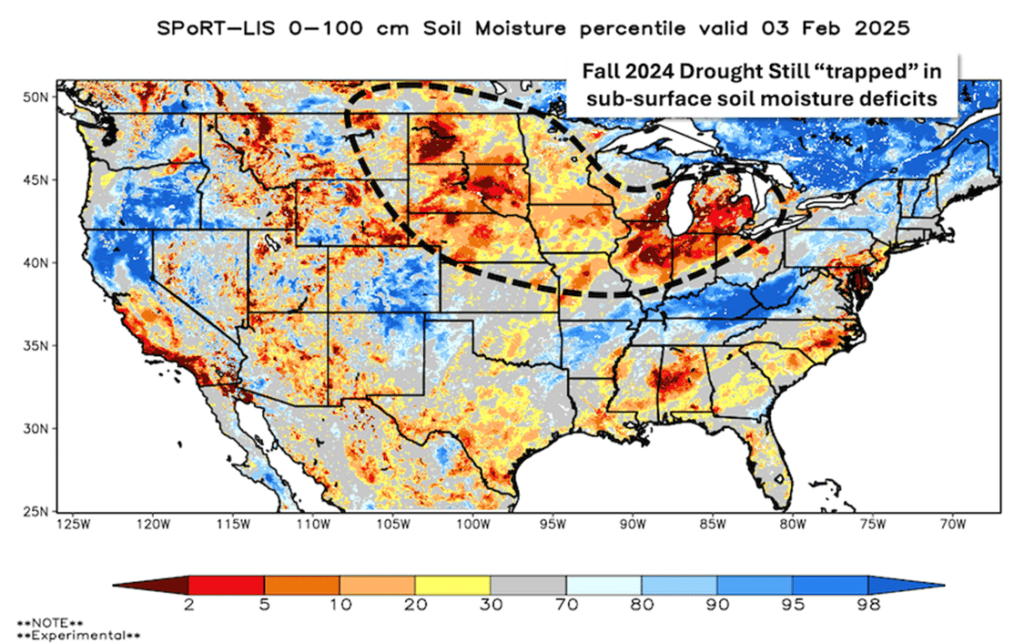

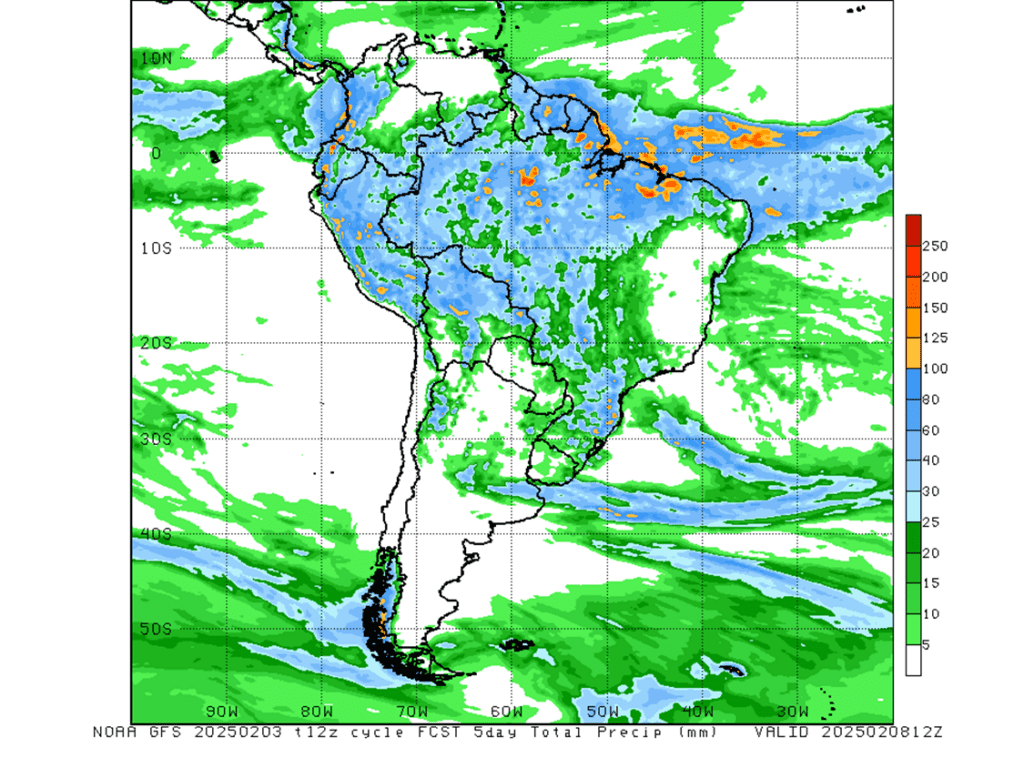

- To see the updated 5-day precipitation forecast for South America as well as the soil moisture percentile map for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- NEW ACTION – Grain Market Insider recommends selling a portion of your 2024 corn crop today.

- Sales Target Range: With the March ‘25 contract facing continued resistance at the lower end of the 495 – 515 target range, Grain Market Insider recommends making a sale today to capitalize on this week’s rebound. The upper end of the target range at 515 remains a key level to watch. If March ‘25 corn can break through this resistance, Grain Market Insider will consider it as another potential sales target.

- Resistance Levels: Key resistance on the front-month continuous chart stands between the September 2021 low of 497.50 and the May 1996 high of 513.50 — historical levels that could challenge further upside.

2025 Crop:

- Hold Recommendation: Grain Market Insider previously recommended making a couple of sales for the 2025 crop in mid-January. For now, the advice is to hold steady as we watch for a move toward 479, which could trigger the next sales recommendation.

- Downside Support: Key support for December ‘25 contracts sits at 453.75 — an important level to watch in the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A strong close above this level could open the door to broader upside potential as we head into the spring planting window.

- Buying Call Options: If prices break through 479, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge against existing sales and get you repositioned to the topside in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 2–4 weeks.

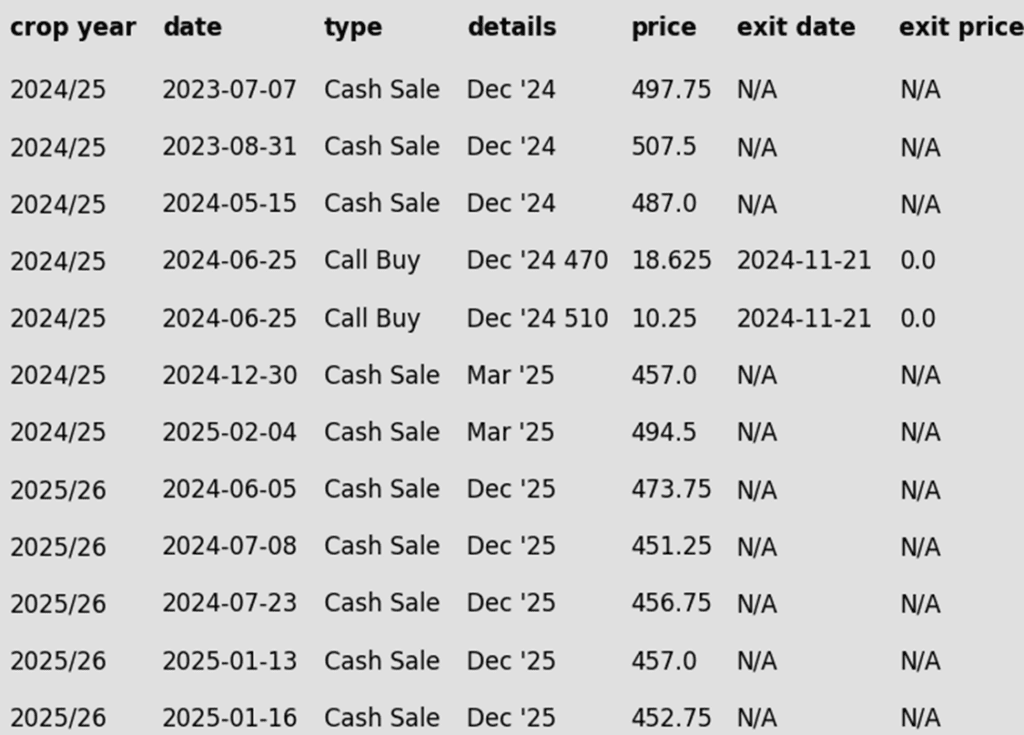

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Buyers stayed active in the corn market as traders put prospects of tariffs on the back burner and focused on the strong demand tone for U.S. corn. Buying in both the soybean and wheat markets helped support corn futures on Tuesday.

- The front end of the corn market is pushing back toward the $5.00 resistance level, a price barrier that has capped March futures in recent trading.

- The USDA announced a flash export sale of 132,000 metric tons (5.2 million bushels) of U.S. corn to South Korea for the current marketing year, further reinforcing demand strength.

- Traders are closely monitoring Brazil’s delayed planting pace for its key second corn crop. A slow planting pace could extend the U.S. export window into early summer and expose Brazil’s crop to less favorable weather conditions, potentially limiting production.

Corn Uptrend Well Supported

Fund buying and strong demand have sustained the corn market’s uptrend since harvest. Initial support is at 475, with additional support near the breakout area around 450. Overhead resistance is now just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

New Alert

Enter(Buy) NOV ’25 Calls:

1100 @ ~ 55c & 1180 @ ~ 32c

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Recent Sales Recommendation: Grain Market Insider advised selling another portion of your 2024 soybean crop last week.

- Down Week: Last week, the March ‘25 contract snapped a five-week winning streak, posting its first weekly loss since December 16. It closed the week down nearly 14 cents.

- Resistance: The March ‘25 contract has yet to secure a weekly close above the start of the resistance band at 1060. The last time the front-month contract closed above this level on a weekly continuous chart was the week of September 23 last year.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends buying November ‘25 1100 soybean calls and November ‘25 1180 soybean calls in equal quantities with a total net spend of approximately 88 cents plus commission and fees. The November ‘25 contract closed over 1071 resistance today, which opens the door of opportunity for a continued move higher. Buying these call options will reopen the topside on the sales recommendation made last week. Also, buying two strikes provides the option to leg out of the lower strike once it covers the cost of the upper strike.

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling the first portion of your 2025 soybean crop. Now remains a good time to get the first new crop sale on the books and use today’s call option recommendation to reown this sale right away.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

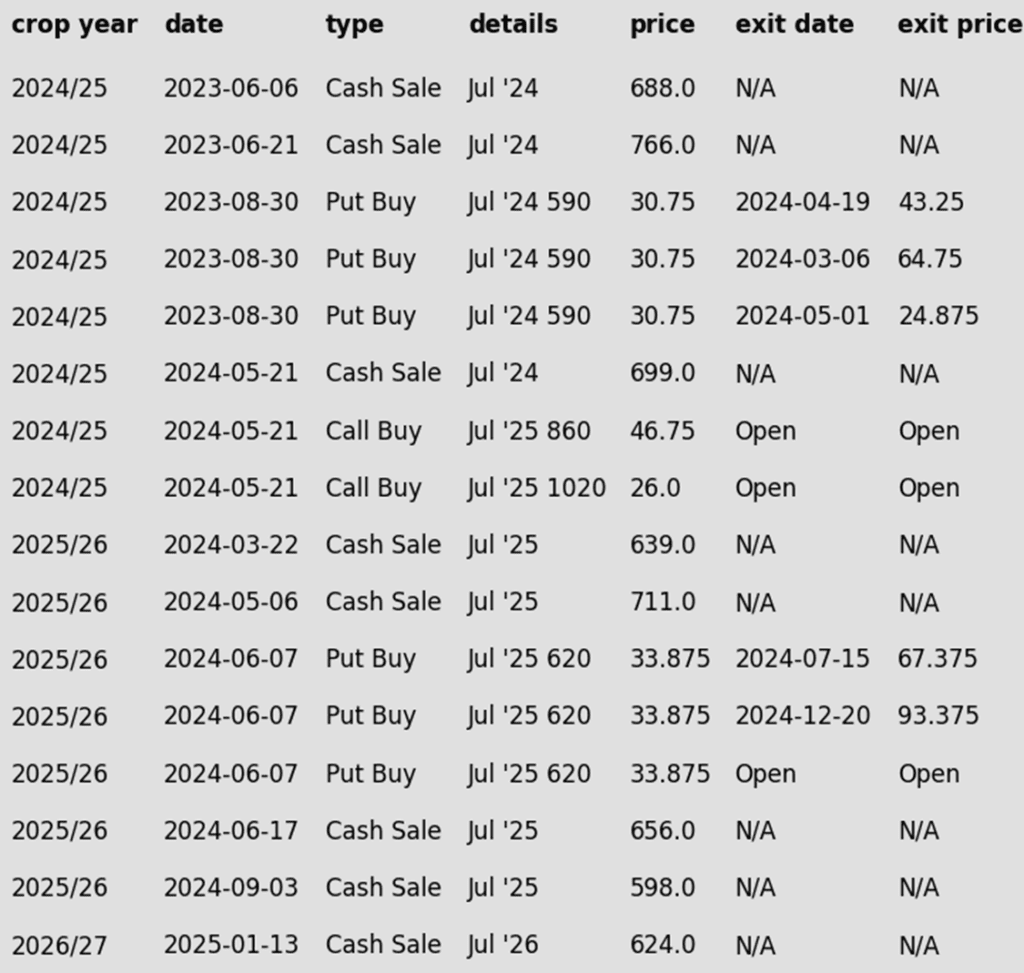

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly higher with the March contract closing above the 200-day moving average for the first time since December 2023. Higher soybean meal was the primary driver for soybeans today while soybean oil was slightly lower along with crude oil. The higher meal prices likely point to dry weather in Argentina and logistics issues in Brazil.

- Grain markets have been volatile since tariffs were implemented and in some cases postponed yesterday, but China’s tariff of 10% was held in place. The bullish part of this news was that though China did retaliate placing tariffs on some U.S. goods, soybeans were not included.

- In Brazil, despite the wet conditions that are delaying harvest, a large crop is still expected. A portion of harvest is completed, but there have been serious problems within the country concerning transportation with many main highways backed up with trucks carrying beans.

- Yesterday, the USDA released its Fats and Oils report which saw the December soybean crush at 217.7 million bushels which was another monthly record for soybean crush. Crush margins remain firm which points to another strong crush number in January.

Soybeans Attempting to Breakout

Front-month soybean futures struggled to break above resistance at the 200-day moving average in January, a level that has capped gains for over 18 months. However, early February price action has shown enough strength to close above this key level, signaling potential for further upside. Support is expected near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

Wheat

Market Notes: Wheat

- All three wheat classes posted gains today, supported by strength in corn and soybeans, as well as a significant drop in the U.S. dollar. Winter wheat crop ratings, released yesterday, showed improvement in Kansas, the top-producing state, while conditions declined in Nebraska, Illinois, Oklahoma, and Colorado.

- European Union soft wheat exports have reached 12.5 mmt as of February 2. That is down 37% year over year. Furthermore, the European Commission has kept EU total grain production steady at 255.8 mmt for 24/25, with wheat accounting for 111.9 mmt of that total.

- According to SovEcon, Russia’s 24/25 wheat exports are anticipated at 42.8 mmt, below the USDA estimate of 46 mmt. However, they raised the 25/26 export estimate from 36.4 to 38.3 mmt. In related news, they have also said that domestic Russian wheat prices so far in 2025 have climbed 9% to $158/mt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 680-705 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in SRW suggests that 680-705 is a realistic and reachable target zone. In the last three instances when the Funds held a similar net short position and were forced to cover, the front-month contract rallied approximately 140 cents, 90 cents, and 170 cents.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

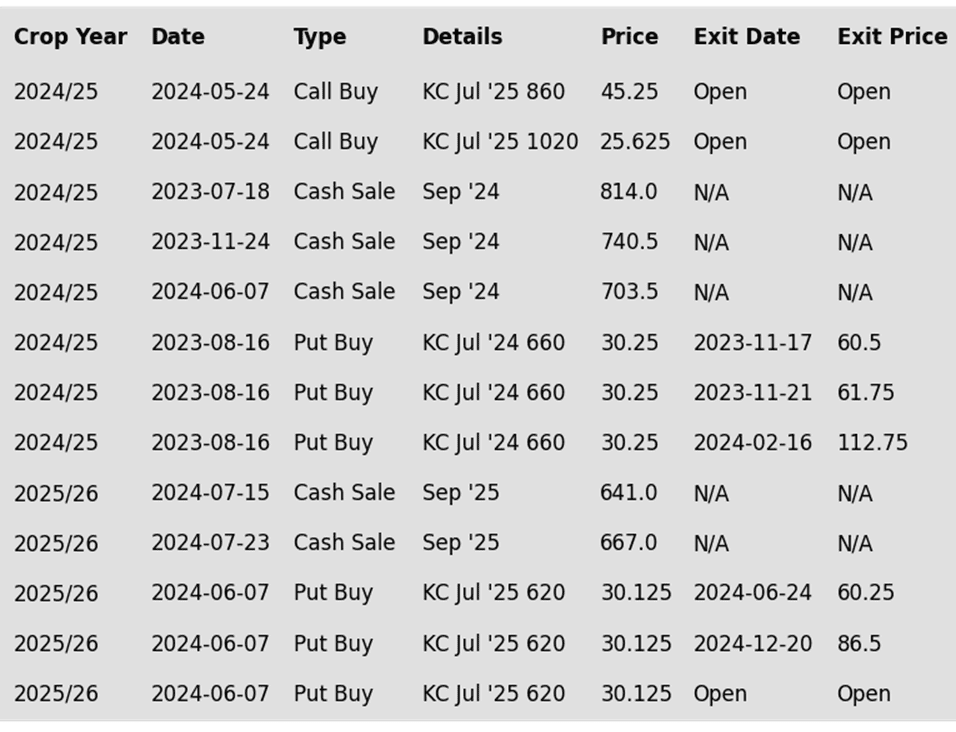

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stays Rangebound

Front-month Chicago wheat remains confined between 530 and 577. A breakout above the 577–586 resistance zone could prompt a retest of 617, while a close below 536 may lead to a decline toward the 521–514 support range.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 650-700 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in HRW supports 650-700 as a realistic and reachable target zone. Historically, when the Funds held a net short position exceeding 40,000 contracts and were forced to cover, the front-month contract rallied approximately 100 cents, 100 cents, 160 cents, and 70 cents in the last four instances.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Shows Signs of Life

KC wheat has traded between 536 and 583 since November, with the early February rally above the 200-day moving average a test of the October highs near 620 looks likely, support should appear at the top end of the recent range near 580.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- No Official Target Range: Over the past couple of trading days, the March ‘25 contract has pushed into the previously mentioned potential target range of 610-635. Unless market conditions shift, Grain Market Insider plans to take a more opportunistic approach and aim for a target beyond 635.

- Short Covering Potential: The Funds’ massive net short position in HRS continues to provide upside potential. The last time they held a short position of this size and were forced to cover, the front-month contract rallied about 110 cents.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Holds Range

After months of rangebound trade, spring wheat staged a late-January rally, breaking above its previous range. Overhead resistance lies at the 200-day moving average near 625. Near-term weakness or a close back below 613 would negate the potential breakout and likely see a resumption of rangebound trade.

Other Charts / Weather

Above: South America 5-day precipitation forecast, courtesy of the Climate Prediction Center.