2-03 End of Day: Corn and Soybeans End Higher in Volatile Monday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 488.75 | 6.75 |

| JUL ’25 | 503.5 | 6.75 |

| DEC ’25 | 465.25 | 5 |

| Soybeans | ||

| MAR ’25 | 1058.25 | 16.25 |

| JUL ’25 | 1087 | 14.75 |

| NOV ’25 | 1063.25 | 12.25 |

| Chicago Wheat | ||

| MAR ’25 | 566.75 | 7.25 |

| JUL ’25 | 590.25 | 6 |

| JUL ’26 | 640.75 | 2.25 |

| K.C. Wheat | ||

| MAR ’25 | 585.75 | 6.5 |

| JUL ’25 | 604.5 | 6 |

| JUL ’26 | 645.75 | 6 |

| Mpls Wheat | ||

| MAR ’25 | 616.5 | 1 |

| JUL ’25 | 634 | 2 |

| SEP ’25 | 643.5 | 2 |

| S&P 500 | ||

| MAR ’25 | 6048 | -19.25 |

| Crude Oil | ||

| APR ’25 | 72.37 | 0.39 |

| Gold | ||

| APR ’25 | 2858.2 | 23.2 |

Grain Market Highlights

- Corn: Futures reversed from overnight lows today following the announcement that tariffs between the U.S. and Mexico would be delayed for 30 days.

- Beans: Rallied sharply on Monday on strong export inspections as futures closed back near recent upside resistance at the 200-day moving average.

- Wheat: Wheat was the weakest performer in the grain markets on Monday, posting minimal gains as the U.S. Dollar Index notched its fifth consecutive session higher.

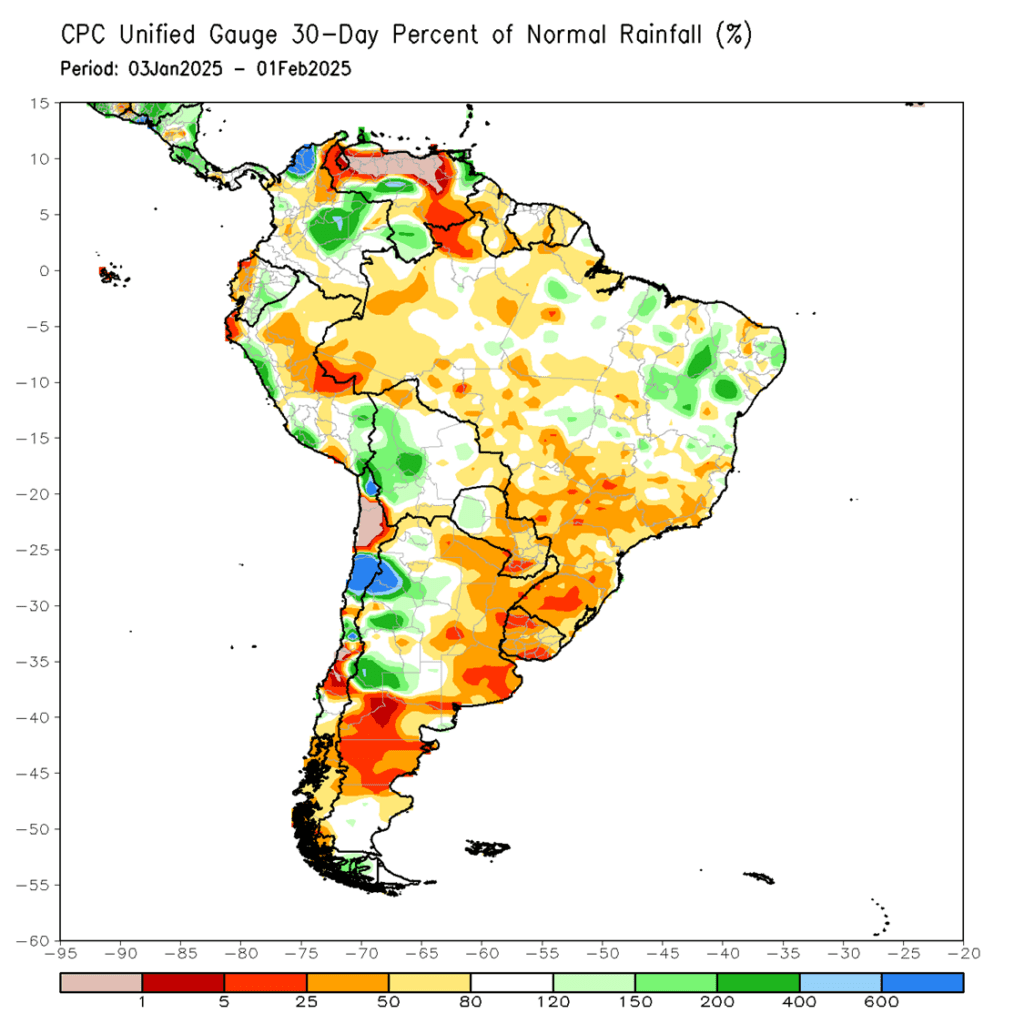

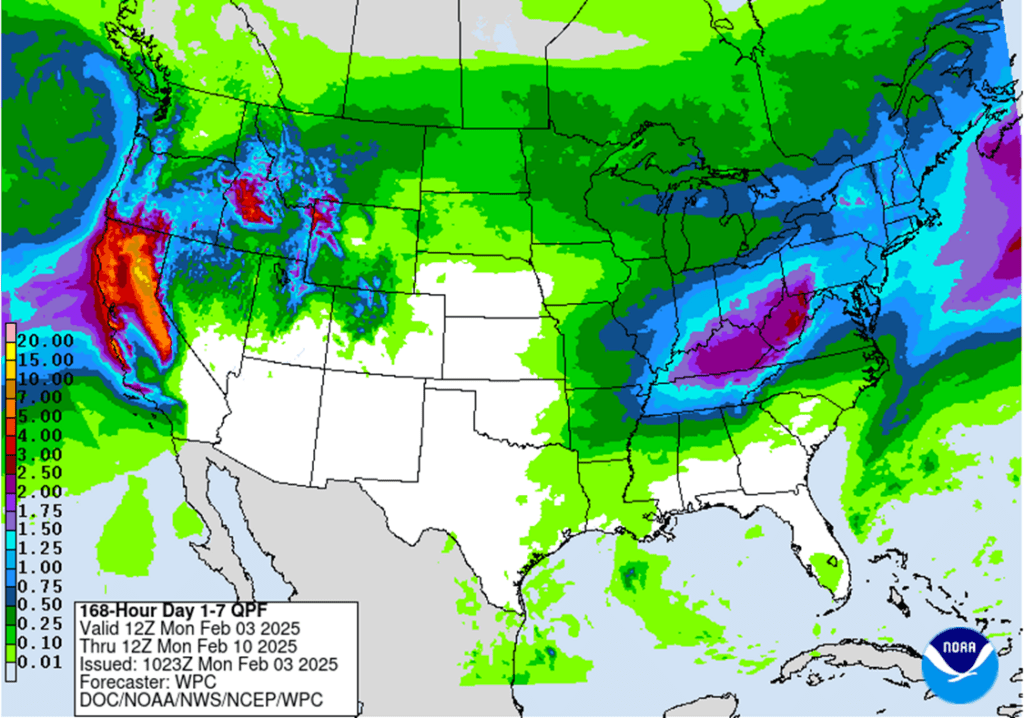

- To see the updated 30-day percent of normal rainfall map for South America as well as the 7-day U.S. precipitation forecast scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

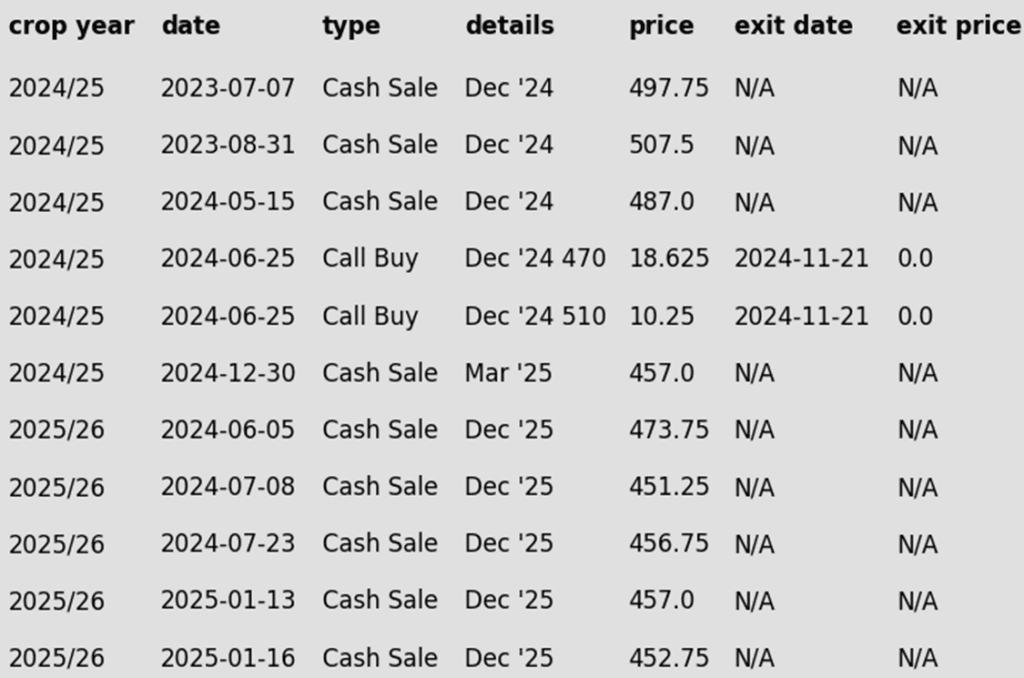

2024 Crop:

- Sales Target Range: Grain Market Insider is continuing to target towards the top end of the 495 – 515 range vs March ‘25 to recommend making the next sale.

- Down Week: March ‘25 fell a net of 4-½ cents last week and posted its first down week since the week of December 30th.

- Resistance Levels: Key resistance on the front-month continuous chart stands between the September 2021 low of 497.50 and the May 1996 high of 513.50 — historical levels that could challenge further upside.

2025 Crop:

- Hold Recommendation: Grain Market Insider previously recommended making a couple of sales for the 2025 crop in mid-January. For now, the advice is to hold steady as we watch for a move toward 479, which could trigger the next sales recommendation.

- Downside Support: Key support for December ‘25 contracts sits at 453.75 — an important level to watch in the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A strong close above this level could open the door to broader upside potential as we head into the spring planting window.

- Buying Call Options: If prices break through 479, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge against existing sales and get you repositioned to the topside in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 2–4 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn ended the day higher after very volatile trade which saw prices sharply lower overnight before rallying following breaking news that the tariffs on Mexico would be postponed for 30 days. March corn filled both the gap left from last night’s trade along with the gap left on Friday at $4.90.

- Weekly inspections reached 49.3 million bushels, bringing the 2024/25 total to 856 million bushels, which is 33% ahead of last year. Inspections are outpacing the USDA’s estimated export pace of 2.450 billion bushels, which would reflect a 7% year-over-year increase.

- Argentina is forecasted to receive improved rainfall between Tuesday and Thursday, with as much as four inches possible over the next 10 days. This contributed to early session weakness in the corn market.

- Brazil has experienced heavy rains, delaying safrinha crop planting. As of last week, only 6% of the crop was planted, compared to 29% last year.

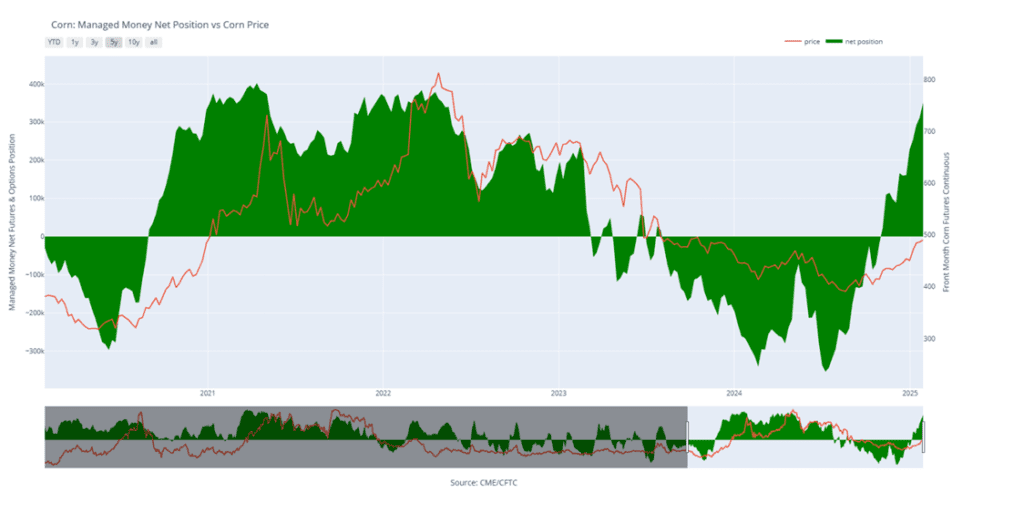

- Friday’s CFTC report saw funds as buyers of corn as of January 28 by 39,043 contracts which increased their net long position to 350,721 contracts. Funds are now just 50,000 contracts shy from a record large net long position, and it may not take much bearish news to incentivize profit taking.

Corn Uptrend Well Supported

Fund buying and strong demand have sustained the corn market’s uptrend since harvest. Initial support is at 475, with additional support near the breakout area around 450. Overhead resistance is now just below 500.

Above: Corn Managed Money Funds net position as of Tuesday, January 28. Net position in Green versus price in Red. Managers net bought 39,043 contracts between January 21 – January 28, bringing their total position to a net long 350,721 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

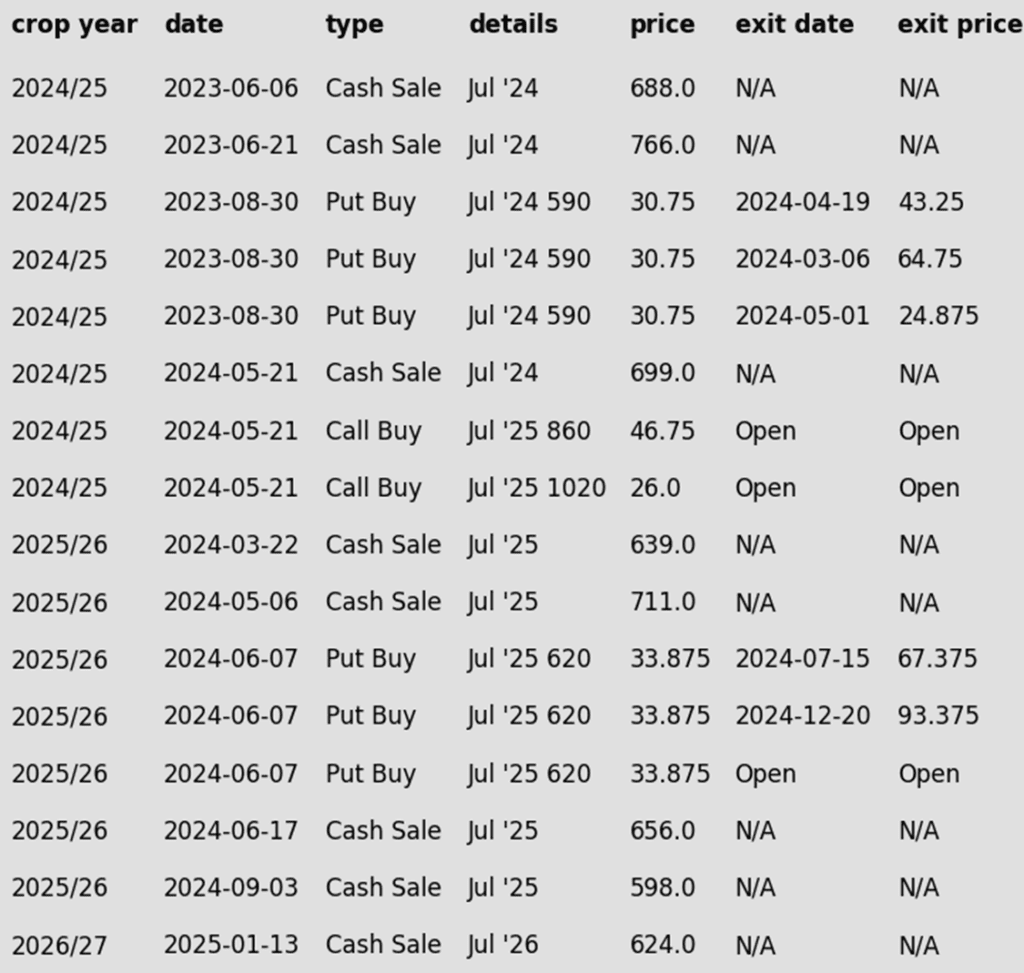

2024 Crop:

- Recent Sales Recommendation: Grain Market Insider advised selling another portion of your 2024 soybean crop last week.

- Down Week: Last week, the March ‘25 contract snapped a five-week winning streak, posting its first weekly loss since December 16. It closed the week down nearly 14 cents.

- Resistance: The March ‘25 contract has yet to secure a weekly close above the start of the resistance band at 1060. The last time the front-month contract closed above this level on a weekly continuous chart was the week of September 23 last year.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling the first portion of your 2025 soybean crop.

- First Sale Recommendation: Grain Market Insider recommended initiating 2025 soybean sales last week on Wednesday, as the November ‘25 contract closed at a fresh high of 1063.50, and as the spread between the March ‘25 and November ‘25 contracts flipped from an inversion to a carry. With this spread trending bearish and significant resistance looming near 1070, now looks like a good time to start locking in new crop sales. Especially as Grain Market Insider is prepared to quickly recommend reowning this sale with call options if needed.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher after a volatile session driven by shifting tariff news. Early in the session, soybean meal traded lower while soybean oil found support from tariffs on Canadian oil. However, once the Mexico tariffs were postponed, soybean meal rebounded, contributing to the broader soybean rally.

- Weekly soybean export inspections totaled 37.2 million bushels for the week ending January 30. Year-to-date, 2024/25 inspections have reached 1.252 billion bushels, up 16% from last year. The USDA projects soybean exports for 2024/25 to rise 8% from the previous year.

- Brazil’s 24/25 soybean harvest is reportedly 7.6% complete as of January 31 which compares to a pace of 15.7% the previous year and the 5-year average of 11.8% at this time. Rainfall has continued to fall throughout the country which could delay harvest further.

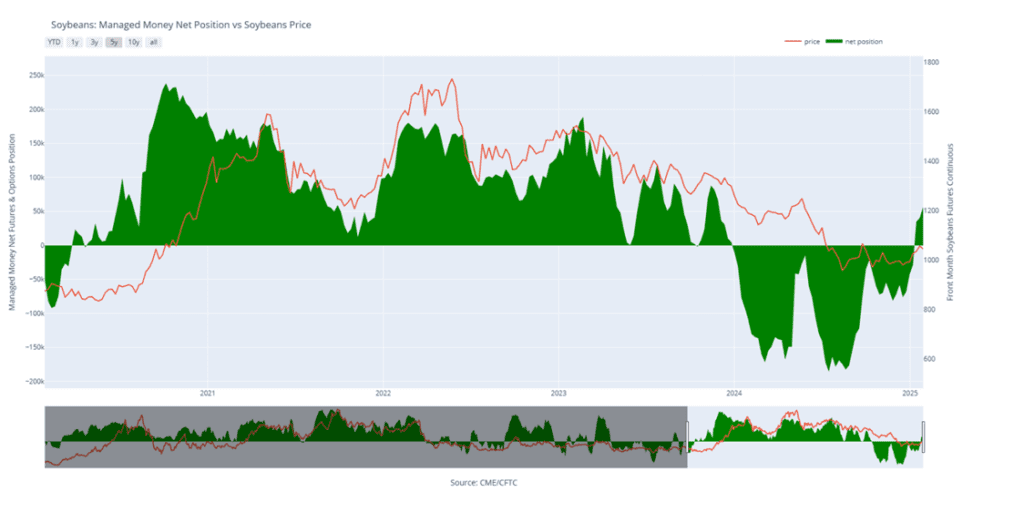

- Friday’s CFTC report showed funds as net buyers of soybeans as of January 28, adding 16,166 contracts and increasing their net long position to 56,496 contracts.

Soybeans Face Long-Term Resistance

Front-month soybeans hit resistance at the 200-day moving average in January, a level capping gains for over 18 months. Support is expected near 1000 on a pullback. Initial resistance lies at the 200-day and recent highs around 1060. A weekly close above 1060 could pave the way for a test of the 1100 level.

Above: Soybean Managed Money Funds net position as of Tuesday, January 28. Net position in Green versus price in Red. Money Managers net bought 16,166 contracts between January 21 – January 28, bringing their total position to a net long 56,496 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed higher across all three classes today. The suspension of Mexico tariffs for one month provided a boost to grain markets after early session weakness. Additional support came from a retreat in the U.S. dollar off-session highs and strength in Matif wheat futures, where the May contract broke above resistance at the 200-day moving average.

- Weekly wheat inspections at 9.3 mb bring the 24/25 inspections total to 515 mb, which is up 24% from last year. Inspections are running ahead of the USDA’s estimated pace, with exports for 24/25 estimated at 850 mb, up 20% from last year.

- According to IKAR, Russian wheat export values finished last week at $239/mt which is up $2.50 from the week prior. Additionally, SovEcon reports that Russian grain exports totaled 660,000 mt last week, with wheat accounting for 590,000 mt of that total.

- Australia’s government estimated the wheat crop at 31.9 mmt in December. However, new analyst estimates suggest that the 24/25 crop could be about 2 mmt larger. In an analyst poll by Reuters, estimates now range between 32 and 35.5 mmt. This increase may be in large part due to yields in Western Australia exceeding expectations.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 680-705 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in SRW suggests that 680-705 is a realistic and reachable target zone. In the last three instances when the Funds held a similar net short position and were forced to cover, the front-month contract rallied approximately 140 cents, 90 cents, and 170 cents.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

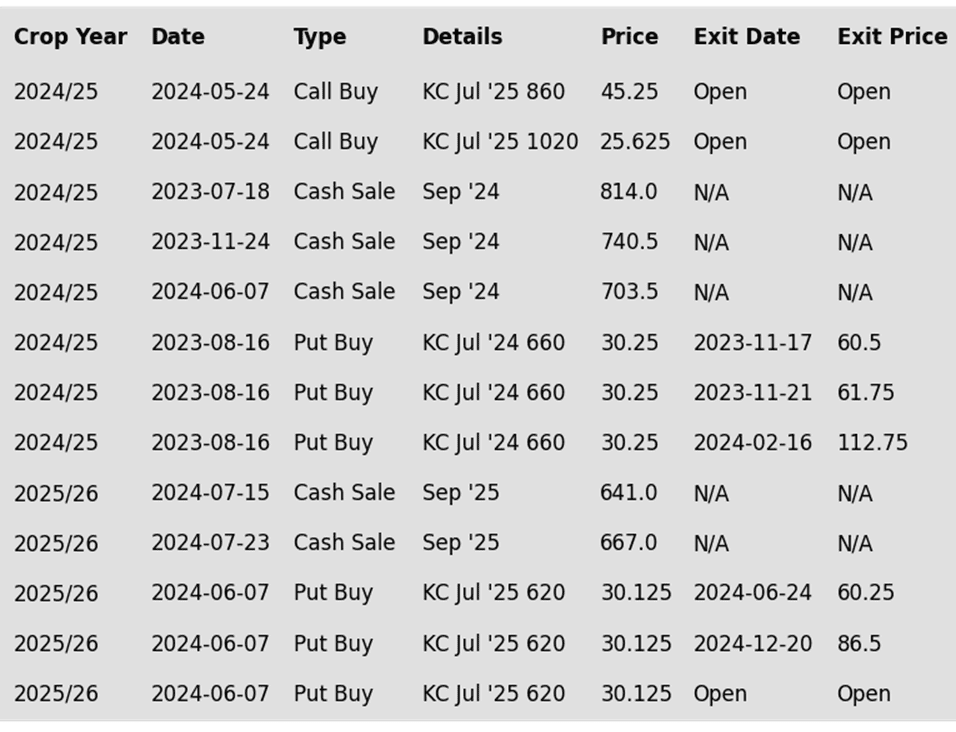

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

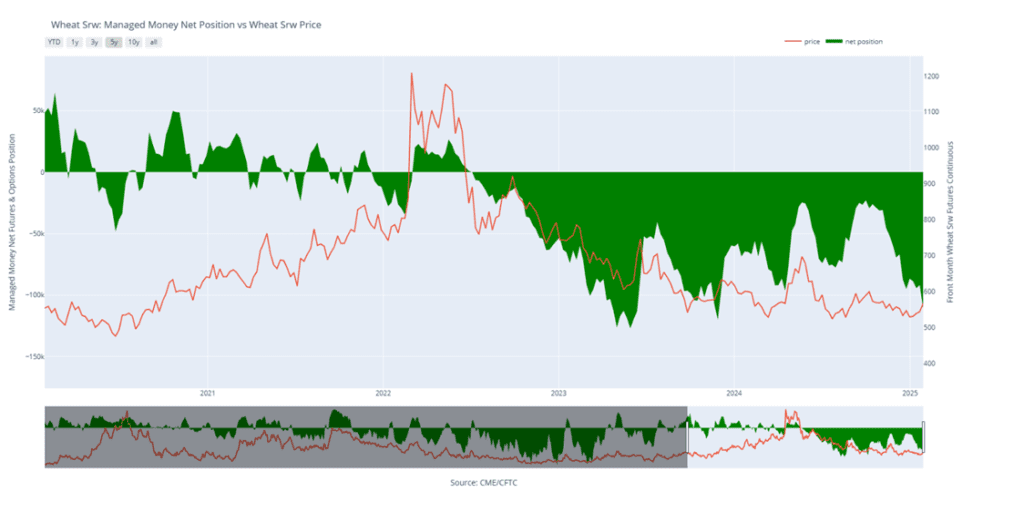

Chicago Wheat Stays Rangebound

Front-month Chicago wheat remains confined between 530 and 577. A breakout above the 577–586 resistance zone could prompt a retest of 617, while a close below 536 may lead to a decline toward the 521–514 support range.

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, January 28. Net position in Green versus price in Red. Money Managers net sold 18,990 contracts between January 21 – January 28, bringing their total position to a net short 110,782 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range remains 650-700 vs March ‘25 to make the next sale.

- Short Covering Potential: The massive net short position of the Funds in HRW supports 650-700 as a realistic and reachable target zone. Historically, when the Funds held a net short position exceeding 40,000 contracts and were forced to cover, the front-month contract rallied approximately 100 cents, 100 cents, 160 cents, and 70 cents in the last four instances.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

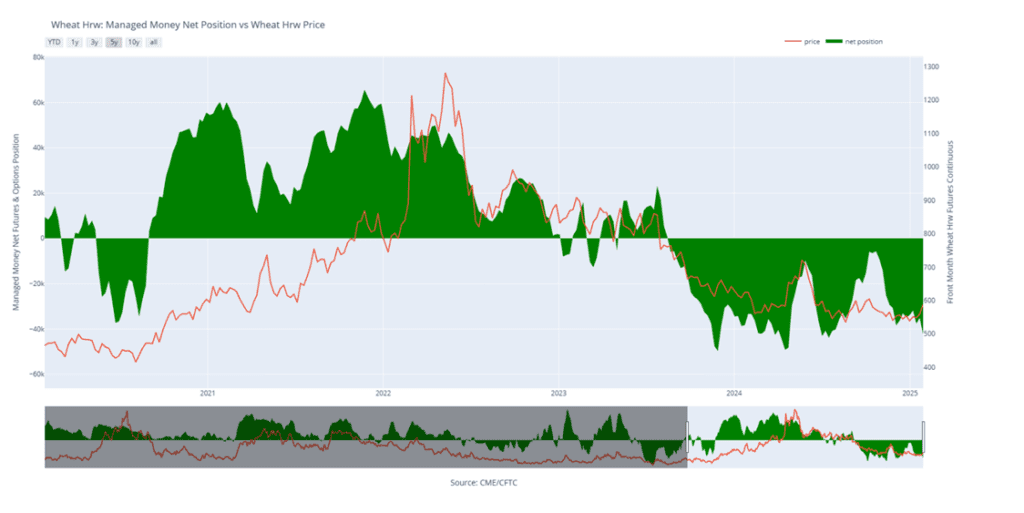

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Maintains Range

KC wheat has traded between 536 and 583 since November, with initial resistance near the 100-day moving average at 568. A close above 583 could pave the way for a move toward 600, while a close below 536 risks a decline to 525.

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, January 28. Net position in Green versus price in Red. Money Managers net sold 7,225 contracts between January 21 – January 28, bringing their total position to a net short 42,386 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- No Official Target Range: Over the past couple of trading days, the March ‘25 contract has pushed into the previously mentioned potential target range of 610-635. Unless market conditions shift, Grain Market Insider plans to take a more opportunistic approach and aim for a target beyond 635.

- Short Covering Potential: The Funds’ massive net short position in HRS continues to provide upside potential. The last time they held a short position of this size and were forced to cover, the front-month contract rallied about 110 cents.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

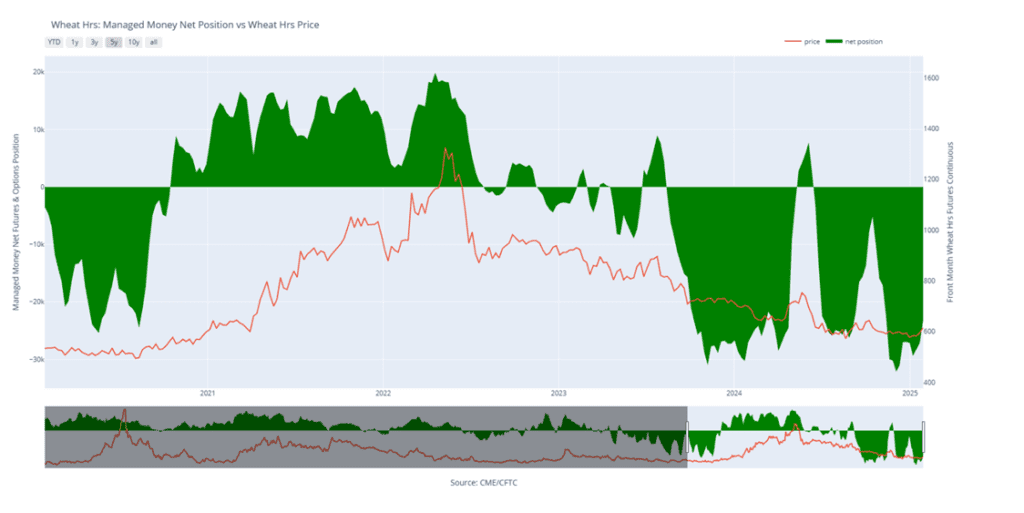

Minneapolis Wheat Holds Range

After months of rangebound trade, spring wheat staged a late-January rally, breaking above its previous range. Overhead resistance lies at the 200-day moving average near 625. Near-term weakness or a close back below 613 would negate the potential breakout and likely see a resumption of rangebound trade.

Above: Minneapolis Wheat Managed Money Funds net position as of Tuesday, January 28. Net position in Green versus price in Red. Money Managers net bought 3,922 contracts between January 21 – January 28, bringing their total position to a net short 23,242 contracts.

Other Charts / Weather

Above: South America 30-day precipitation, percent of normal, courtesy of the Climate Prediction Center.

Above: U.S. 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.