12-3 End of Day: Beans and Wheat Close Firm, While Corn Slips

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 432.25 | -0.25 |

| JUL ’25 | 440.75 | -1.25 |

| DEC ’25 | 430.75 | -1 |

| Soybeans | ||

| JAN ’25 | 991.75 | 6.5 |

| MAR ’25 | 997.25 | 6.25 |

| NOV ’25 | 1006.25 | 0.75 |

| Chicago Wheat | ||

| MAR ’25 | 547.5 | 0.25 |

| MAY ’25 | 556.5 | 0.75 |

| JUL ’25 | 562 | 0.25 |

| K.C. Wheat | ||

| MAR ’25 | 541.75 | 1.25 |

| MAY ’25 | 549.5 | 1.75 |

| JUL ’25 | 556.75 | 1.25 |

| Mpls Wheat | ||

| MAR ’25 | 590 | 2.25 |

| JUL ’25 | 606.5 | 2.25 |

| SEP ’25 | 615.75 | 2.5 |

| S&P 500 | ||

| MAR ’25 | 6130.75 | 1 |

| Crude Oil | ||

| FEB ’25 | 69.6 | 1.76 |

| Gold | ||

| FEB ’25 | 2663.9 | 5.4 |

Grain Market Highlights

- The corn market settled near the low end of its 5-cent range (March) with minor losses, struggling to gain upward traction due to improved South American crop prospects and a lack of 45Z guidance.

- Soybeans rallied on reports of record crush totals that were posted for the month of October. The strong demand news lent support to the front month soybean contracts while deferreds lagged.

- Soybean oil rallied on record October crush numbers, which left bean oil stocks below estimates and last month’s levels, indicating strong demand. Meal also closed higher, supported by a drier Argentina forecast.

- Wheat settled mostly higher with small gains across the board, led by Minneapolis. Carryover strength from higher Matif wheat was tempered by projections of a large Australian wheat crop potentially exceeding last year’s.

- To see the updated US and South American precipitation forecasts, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We are now in the window when seasonal opportunities tend to improve and we anticipate posting target ranges for new sales soon, but they could be as late as early spring.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

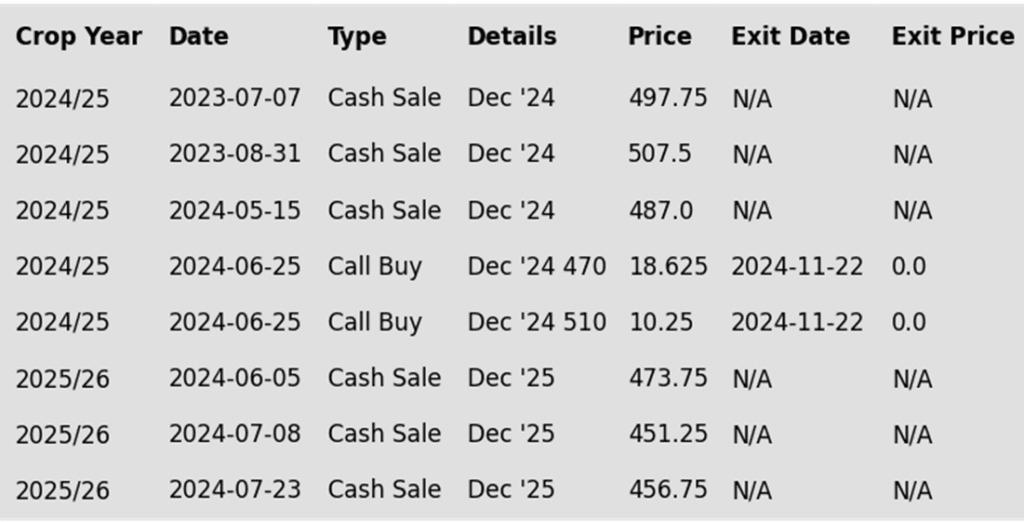

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market finished soft on Tuesday as prices failed to hold early session gains. The lack of direction on biofuel tax credits and increased South American corn production estimates limited market strength.

- Reuters reported that the Biden administration will not finalize clean fuel tax credit guidance, known as the 45Z policy, before his term ends. The uncertainty of this key biofuels initiative’s likely kept pressure on the corn market.

- South American weather conditions remain highly favorable for soybeans and corn in Brazil and Argentina. Independent analysts suggest an additional 200–250 mb of combined South American production could be possible next crop year if conditions persist.

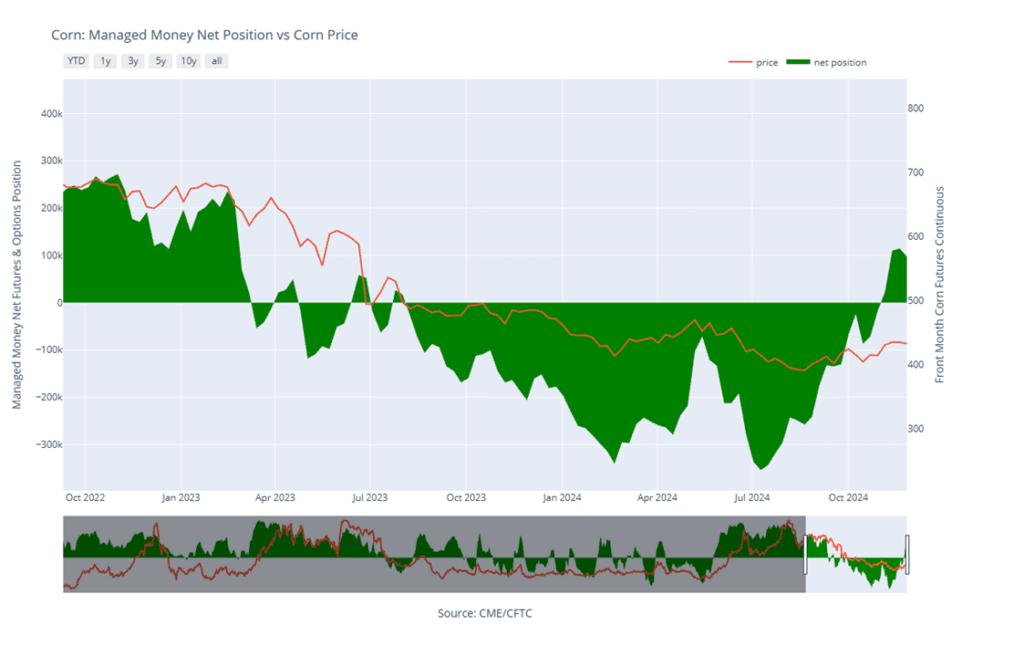

- Managed Money has reduced its recent net long position on the Commitment of Trader’s report. As of Nov. 26, managed funds were net long 97,442 contracts of corn, a reduction of 17,186 contracts.

The corn market has, so far, held support near the 425 area and the 200-day moving average (ma), and could potentially retest the 442 area with the possibility of trading towards 465. If prices break through and close below the 50-day moving average (ma), near 422, they run the risk falling further and testing more major support near the 410 area and 100-day ma.

Corn Managed Money Funds net position as of Tuesday, Nov. 26. Net position in Green versus price in Red. Managers net sold 17,186 contracts between Nov. 20 – 26, bringing their total position to a net long 97,442 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- This is the period when seasonal opportunities typically improve, and we plan to post target ranges for new sales soon, though it could be as late as early spring.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

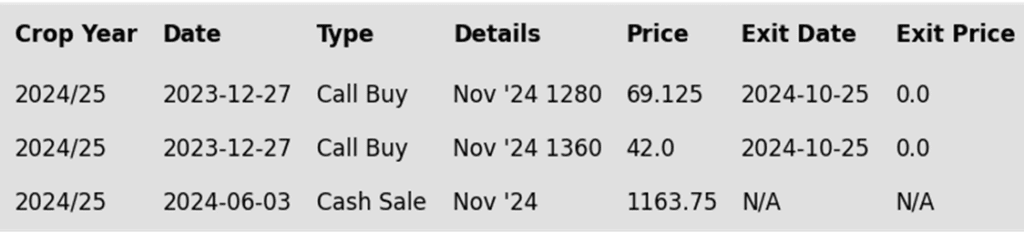

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher, recovering all of yesterday’s losses and more, with front-month contracts leading gains. Soybean meal and oil also ended higher, with oil leading.

- Brazilian production estimates remain lofty, with Celeres at 170.8 mmt, StoneX at 170 mmt, and AgroConsult at 172.2 mmt. Exports are expected to rise by 4 mmt, supported by favorable weather conditions.

- The USDA Fats and Oils report showed a record October soybean crush of 216 million bushels, exceeding trade estimates. High crush levels have pressured soybean meal prices due to excess supply, while lower-than-expected bean oil stocks signal strong demand.

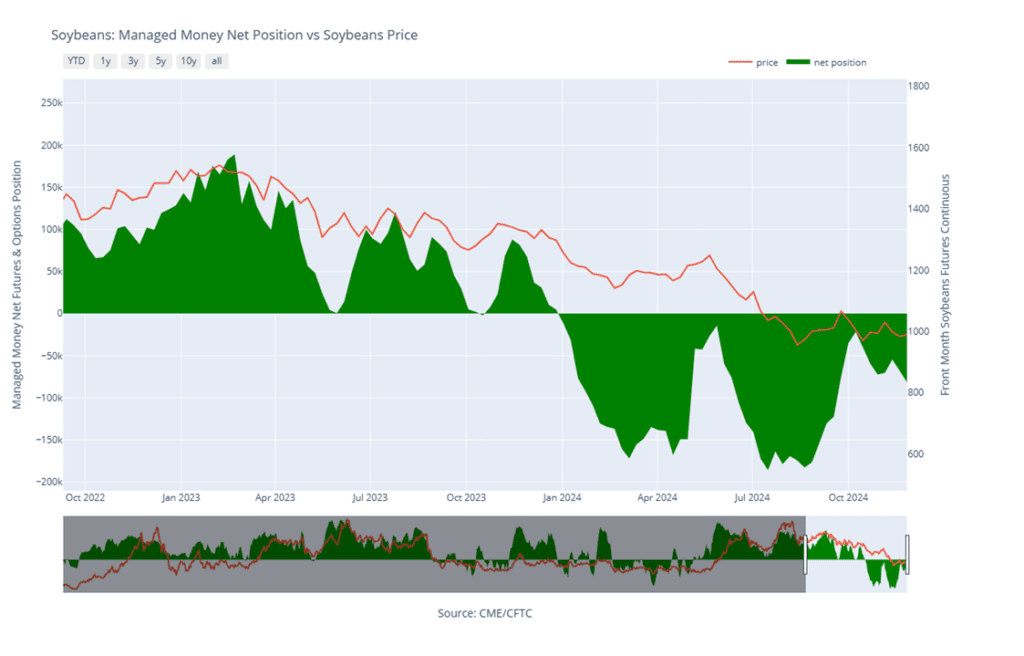

- Yesterday’s CFTC report showed funds as of Nov. 26 as net sellers of 13,771 soybean contracts, increasing their net short position to 81,472 contracts. Historically, funds shift to buying soybeans in December through year-end.

The soybean market continues to trend sideways just above 975 support. Should the market close below there, it could be at risk of sliding toward the 940 support area near the August low. Conversely, if prices gain traction and rally, they could resistance near the 50-day moving average and 1013 before retesting 1045.

Soybean Managed Money Funds net position as of Tuesday, Nov. 26. Net position in Green versus price in Red. Money Managers net sold 13,771 contracts between Nov. 20 – 26, bringing their total position to a net short 81,472 contracts.

Wheat

Market Notes: Wheat

- Wheat closed mostly higher across the three classes, though early strength faded by session’s end. Gains from higher Paris milling wheat were limited by projections that Australia’s crop could exceed last year’s by 5–6 mmt.

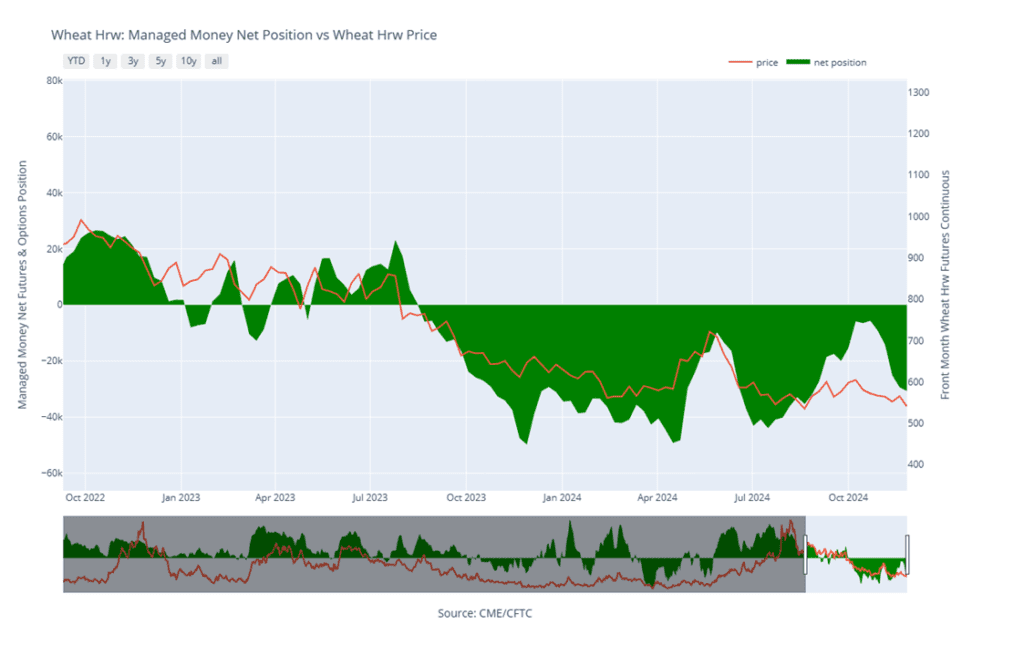

- According to the CFTC’s Commitments of Traders report, as of Nov. 26 managed funds sold nearly 7,600 Chicago wheat contracts, and 1,300 KC wheat contracts, increasing their total net short position to a four-month high of 120,000 contracts.

- India’s Meteorological Department forecasts a warmer-than-average winter, which could threaten wheat yields. December–February temperatures are expected to be above normal, impacting the winter wheat crop that thrives in cooler conditions.

- Australia’s wheat production is projected to rise 23% to 31.9 mmt in the fiscal year ending June 2025, according to the Australian Bureau of Agricultural and Resource Economics. This would be 20% above the 10-year average, driven by production increases of 75% in New South Wales and 40% in Western Australia, its largest growing regions.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

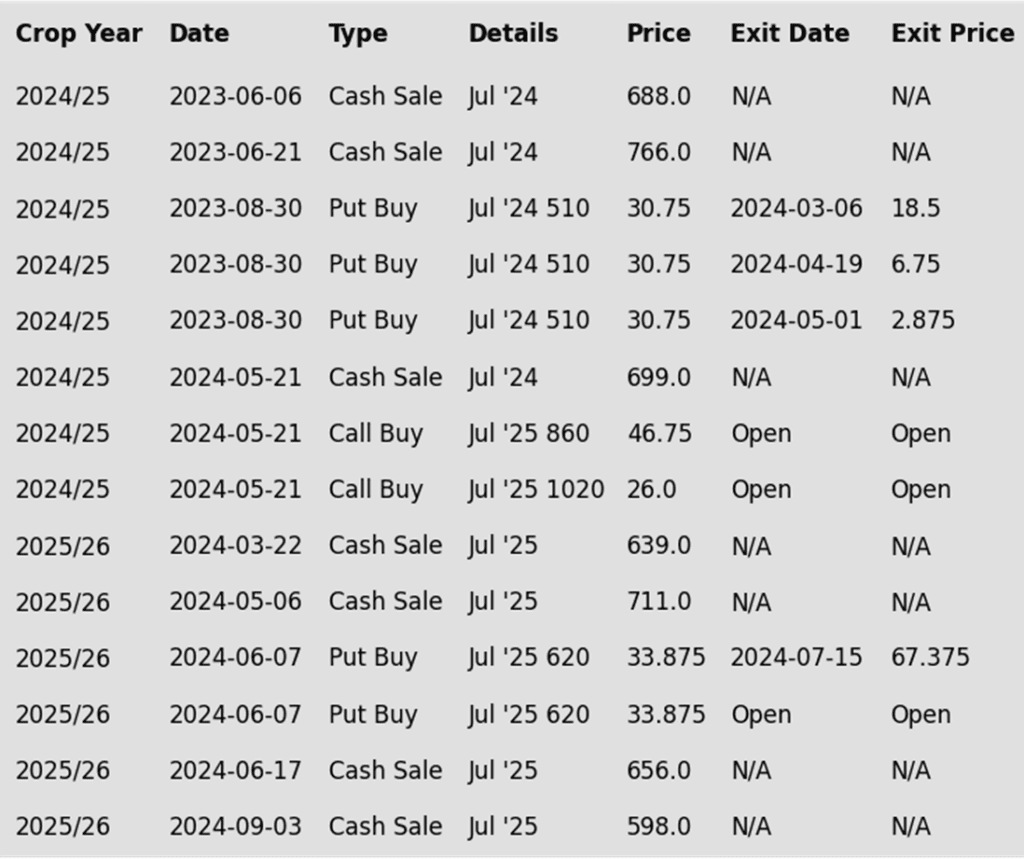

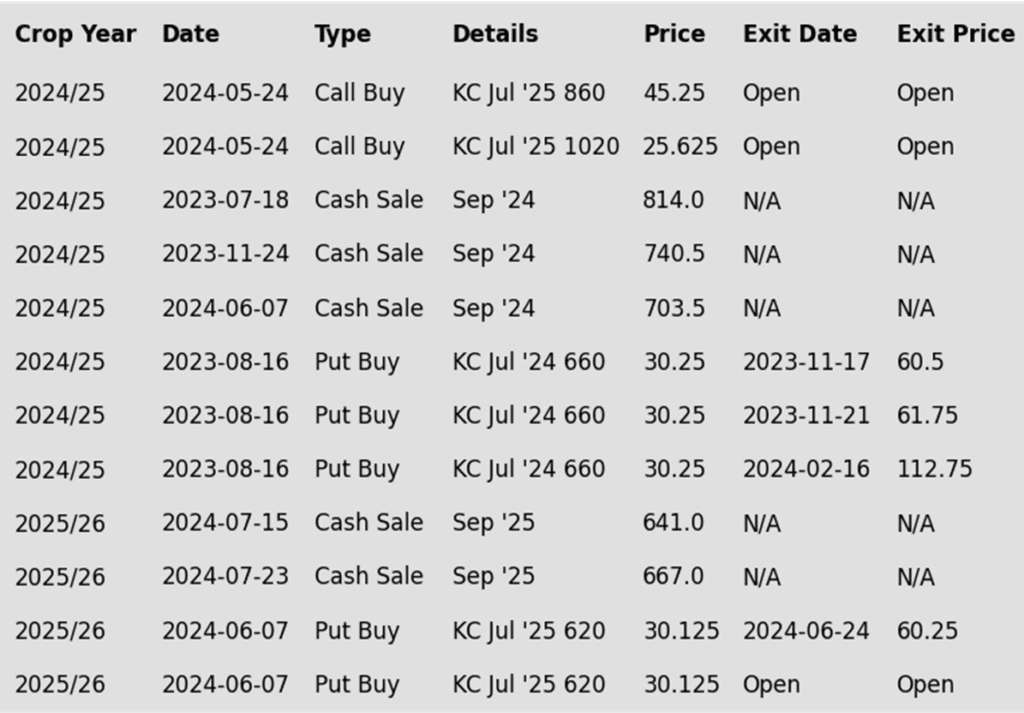

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Front month Chicago wheat remains in a broad trading range between 536 down below and 586 up top. If the market can trade through the 50 and 200-day moving averages and close above 586 it could be poised to retest the 617 area. Whereas a close below 536 could put the market at risk of trading to the 521 – 514 support area.

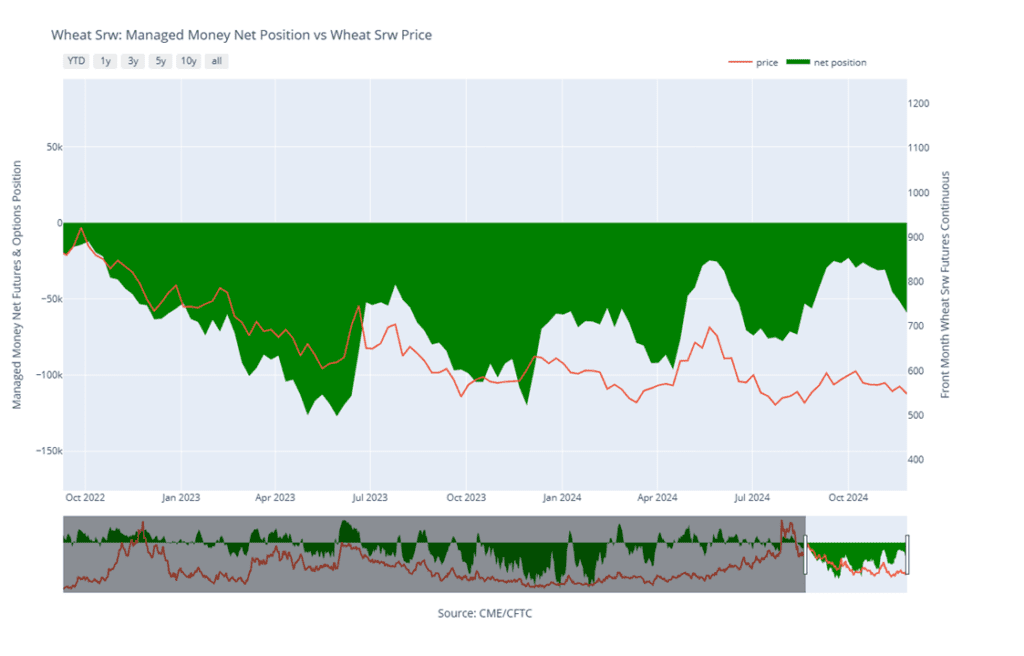

Chicago Wheat Managed Money Funds’ net position as of Tuesday, Nov. 26. Net position in Green versus price in Red. Money Managers net sold 7,572 contracts between Nov. 20 – 26, bringing their total position to a net short 59,118 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

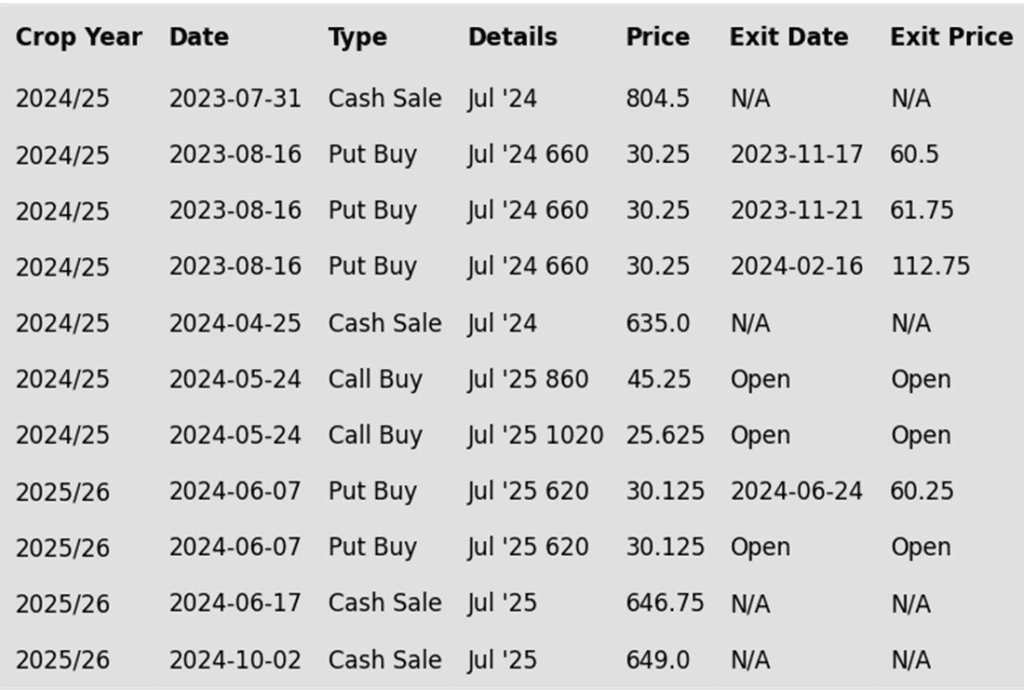

To date, Grain Market Insider has issued the following KC recommendations:

Since failing to trade above the 50-day moving average (ma), March KC wheat has trended lower and is testing the bottom of the 536 – 577 range. A close below this level could put the market at risk of testing the August low of 527 ¼. Should a bullish catalyst emerge to push prices higher, they could encounter resistance near 567 before re-testing 577.

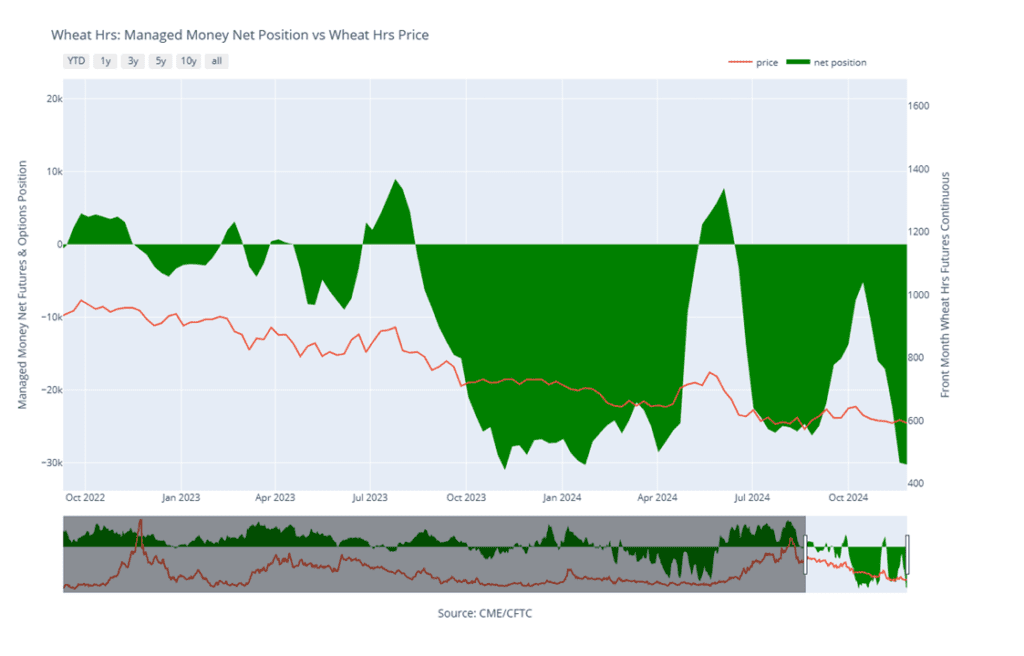

KC Wheat Managed Money Funds’ net position as of Tuesday, Nov. 26. Net position in Green versus price in Red. Money Managers net sold 1,286 contracts between Nov. 20 – 26, bringing their total position to a net short 30,661 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept. ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Since rolling to the March contract, front month Minneapolis wheat has been capped by resistance near the 50-day moving average around 613. A close above this point could put the market on track to test the October highs near 655, with potential resistance around the 200-day moving average. Should prices slide below 584 they could then be at risk of retesting the 563 area.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, Nov. 26. Net position in Green versus price in Red. Money Managers net sold 225 contracts between Nov. 20 – 26, bringing their total position to a net short 30,227 contracts.

Other Charts / Weather

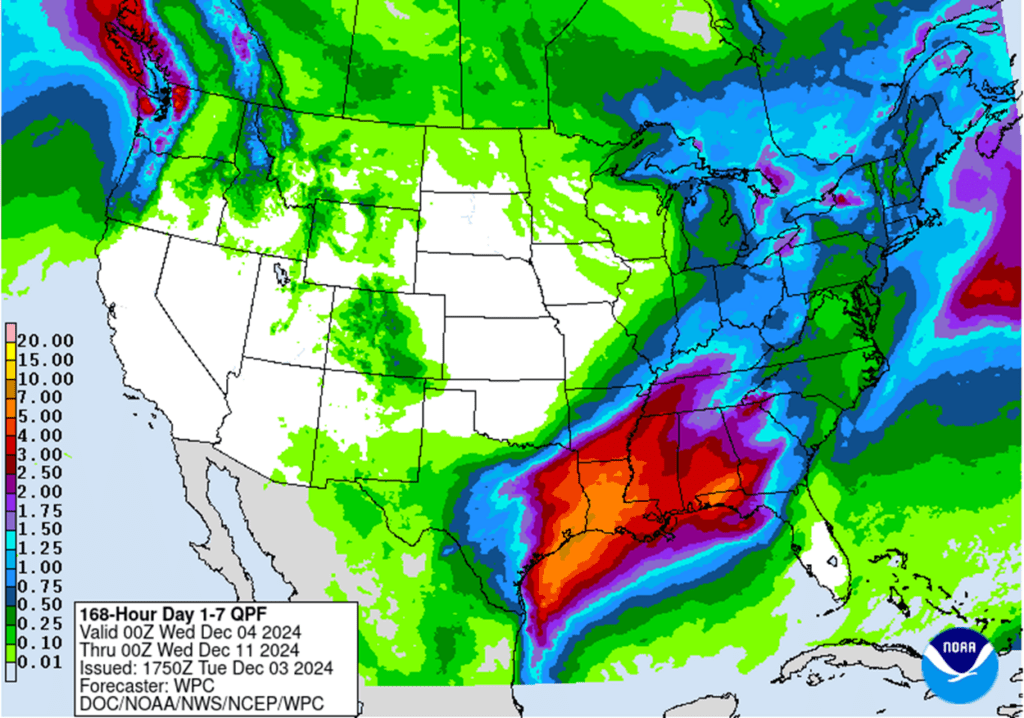

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

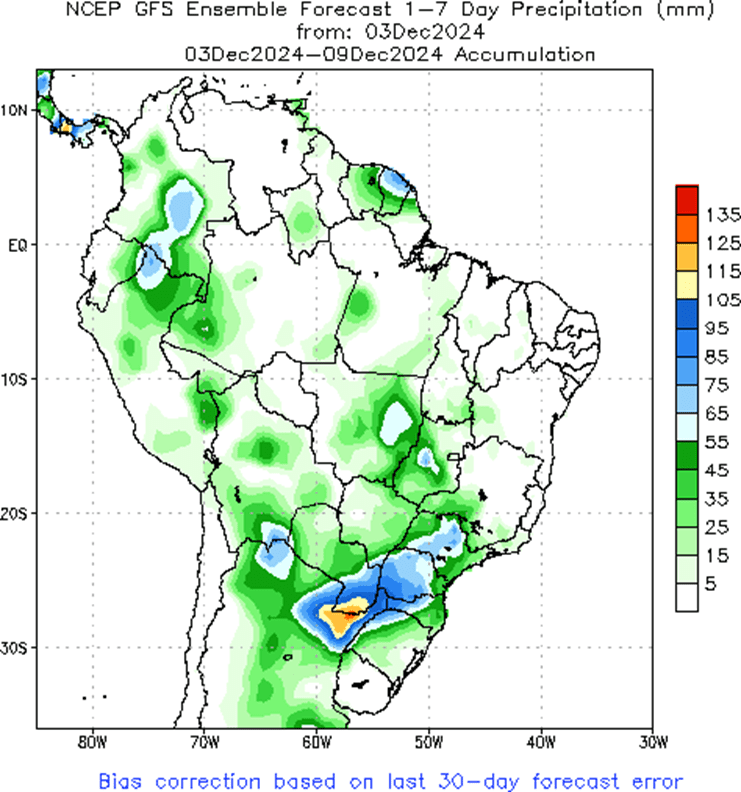

Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

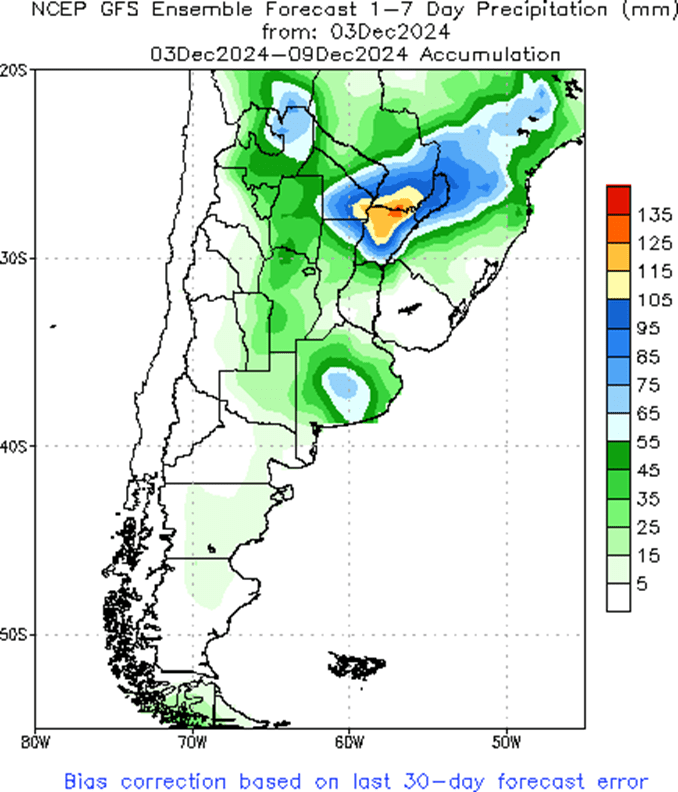

Argentina 7-day total accumulated precipitation courtesy of the National Weather Service, Climate Prediction Center.