12-26 End of Day: Markets Close Higher Following the Holiday

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 453.75 | 5.25 |

| JUL ’25 | 463.75 | 6.5 |

| DEC ’25 | 441.75 | 4.5 |

| Soybeans | ||

| JAN ’25 | 988 | 12.75 |

| MAR ’25 | 997.25 | 16 |

| NOV ’25 | 1009.5 | 15.5 |

| Chicago Wheat | ||

| MAR ’25 | 541 | 6.25 |

| MAY ’25 | 552 | 6.75 |

| JUL ’25 | 559.5 | 7 |

| K.C. Wheat | ||

| MAR ’25 | 551.5 | 7.75 |

| MAY ’25 | 559.5 | 7.75 |

| JUL ’25 | 568.25 | 8 |

| Mpls Wheat | ||

| MAR ’25 | 594 | 4.5 |

| JUL ’25 | 609.75 | 4.75 |

| SEP ’25 | 619 | 4.75 |

| S&P 500 | ||

| MAR ’25 | 6091 | -7 |

| Crude Oil | ||

| FEB ’25 | 69.64 | -0.46 |

| Gold | ||

| FEB ’25 | 2653.2 | 17.7 |

Grain Market Highlights

- Corn finished the day with moderate gains supported by strong rally in soybean and soybean meal markets.

- Higher soybean meal and low volume trade following the Christmas holiday lead gains in the soybean market.

- It was a solid day of gains in all three US wheat classes driven by the sharply higher soybean futures. The day of gains is also likely due to a drier than anticipated 10-day weather outlook in Argentina.

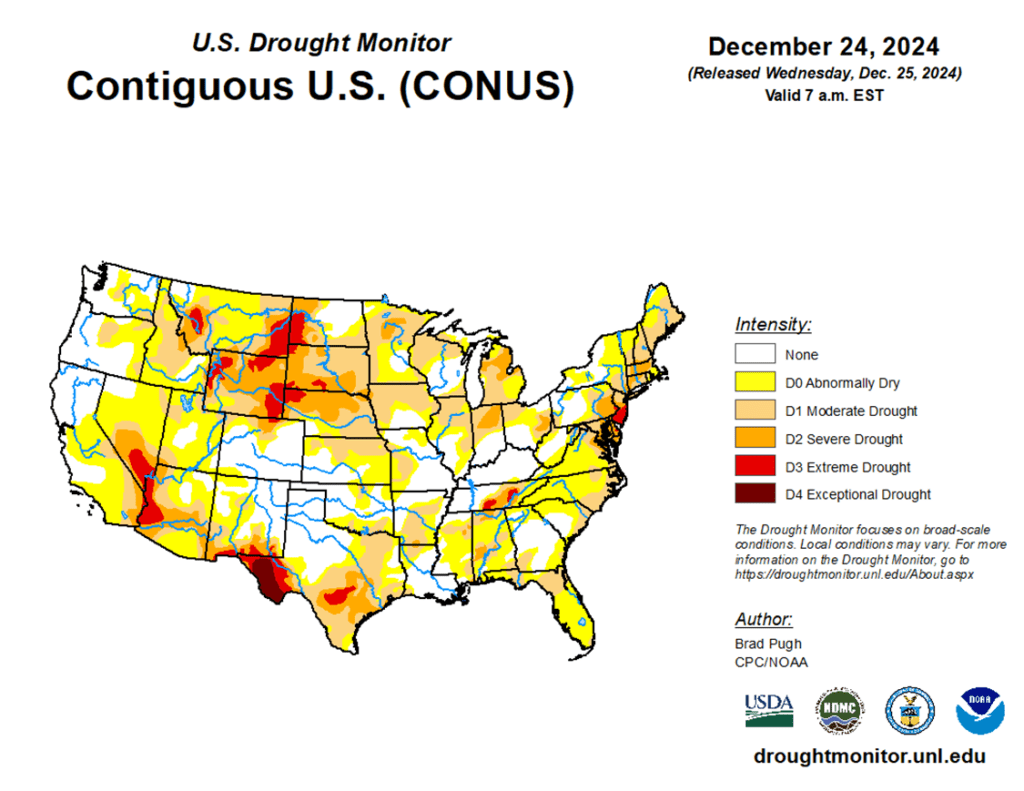

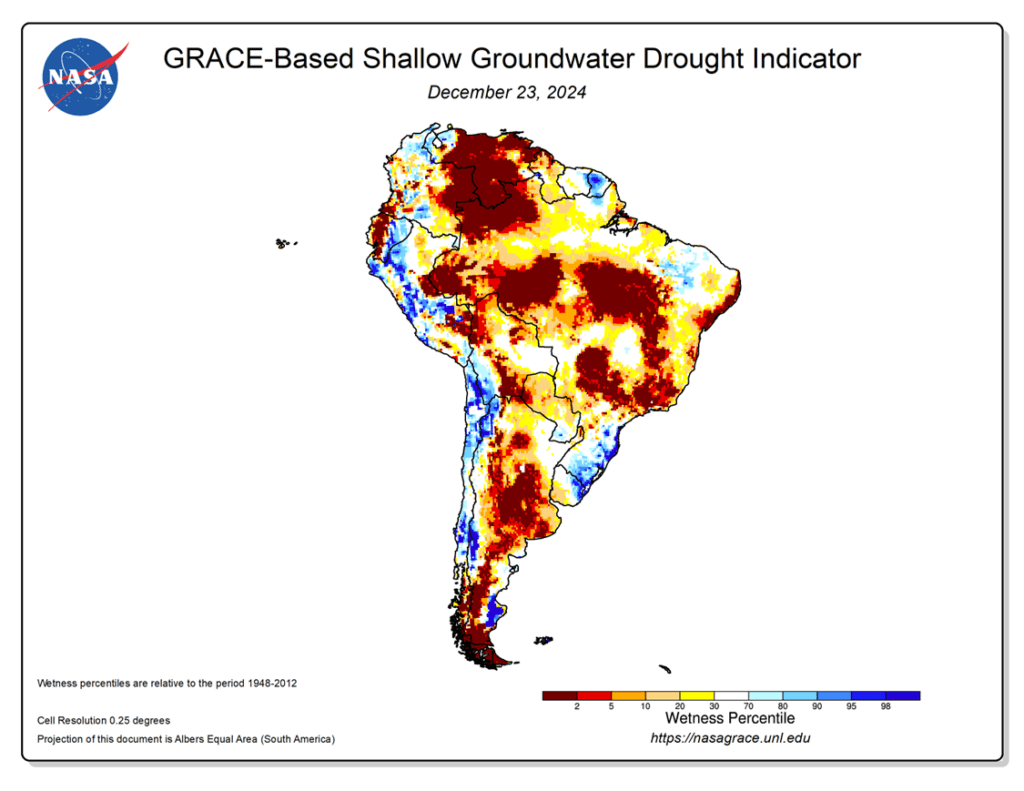

- To see the updated US Drought Monitor as well as the South American GRACE-Based Root Zone Soil Moisture Drought Indicator courtesy of NASA, University of Nebraska-Lincoln scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

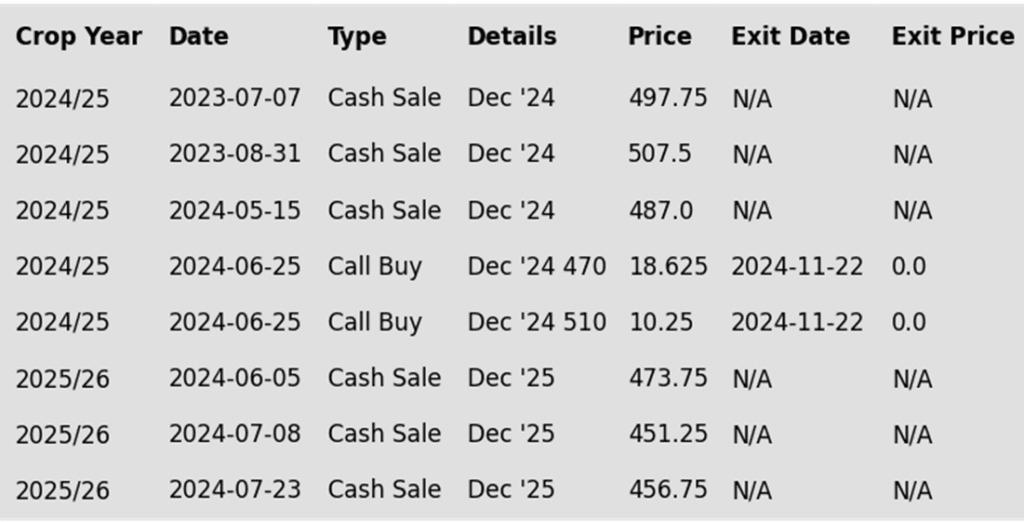

Corn Action Plan Summary

2024 Crop:

- If you did not act on the prior sales recommendations and/or need to move bushels for cash flow, Grain Market Insider issued a catch-up recommendation on December 11 near the 450 area (Mar ‘25).

- Over the past three months, the corn market has repeatedly tested resistance just above current levels. With post-harvest basis improvements, cash corn prices in many areas are now nearing their highest levels since June. Target the 455 to 460 versus March ‘25 area to make additional sales against your 2024 crop.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Strong buying moved into the grain markets on Thursday, fueled by a strong rally in soybean and soybean meal markets. That buying strength supported the corn market as futures finished with moderate gains. March corn posted its highest daily close since June 27.

- Drier than normal forecasts for Argentina have triggered short covering in the soybean and meal markets, adding some weather premium into the market. Corn futures are watching Argentina weather as well as the Argentina corn crop is finishing planting and could be limited with a drier forecast.

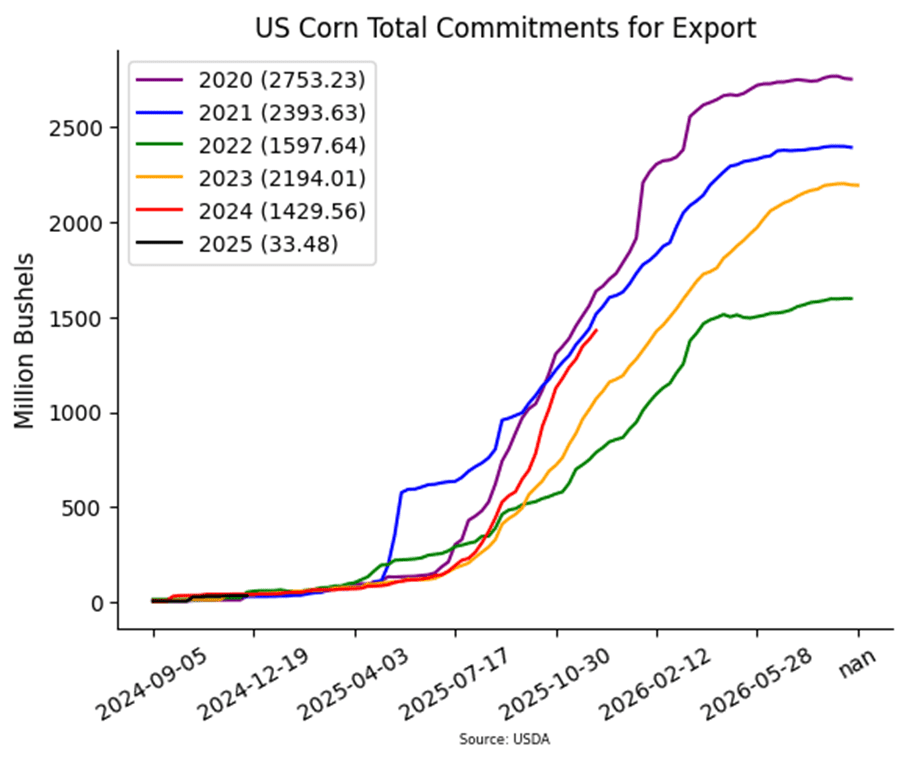

- USDA will release weekly export sales on Friday morning. Expectations for new sales to range from 1.0 MMT –1.6 MMT for the week ending Dec 19. Last week, export sales were 1.17 MMT as the pace remains strong.

- The demand in the corn market will be a key driver in price. Export demand and ethanol usage are still ahead of USDA pace, and U.S. corn is still the largest player in the corn export market through spring with limited global export supplies.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 436, with additional support near 425. Initial overhead resistance comes in near 451 with additional resistance near 465.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1100 – 1110 area versus Jan ‘24 to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

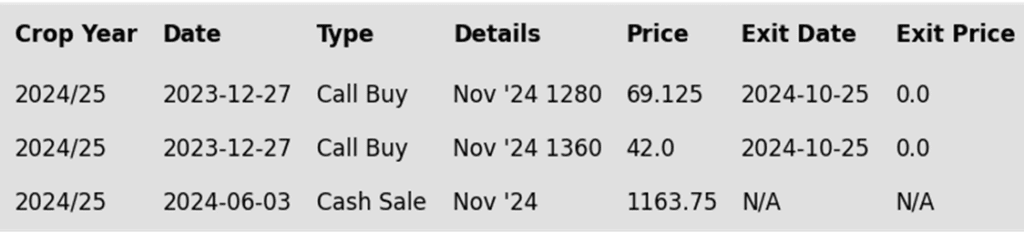

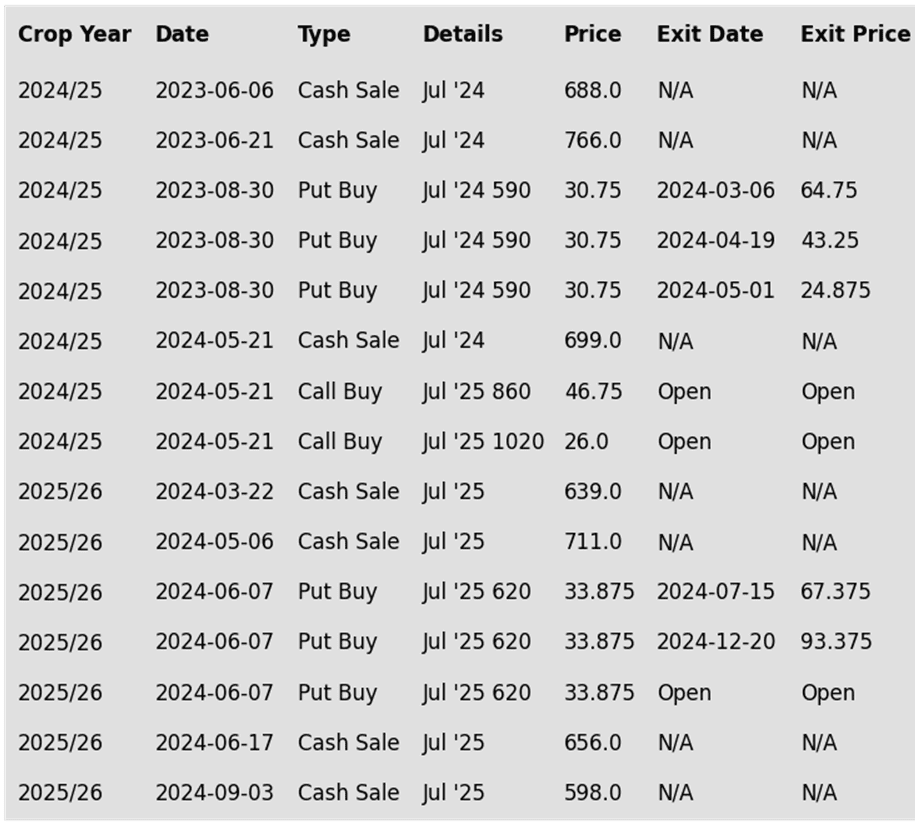

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly higher following the Christmas holiday and were driven by sharply higher soybean meal and low volume trade. March soybeans have now rallied 50 cents from their contract low on December 19. Soybean oil closed lower today.

- There was little news and less volume for soybeans to trade today, but the dominating factor seemed to be the new slightly drier forecast for Argentina over the next 10 days. This is not likely to affect production much but could be temporarily supporting meal prices.

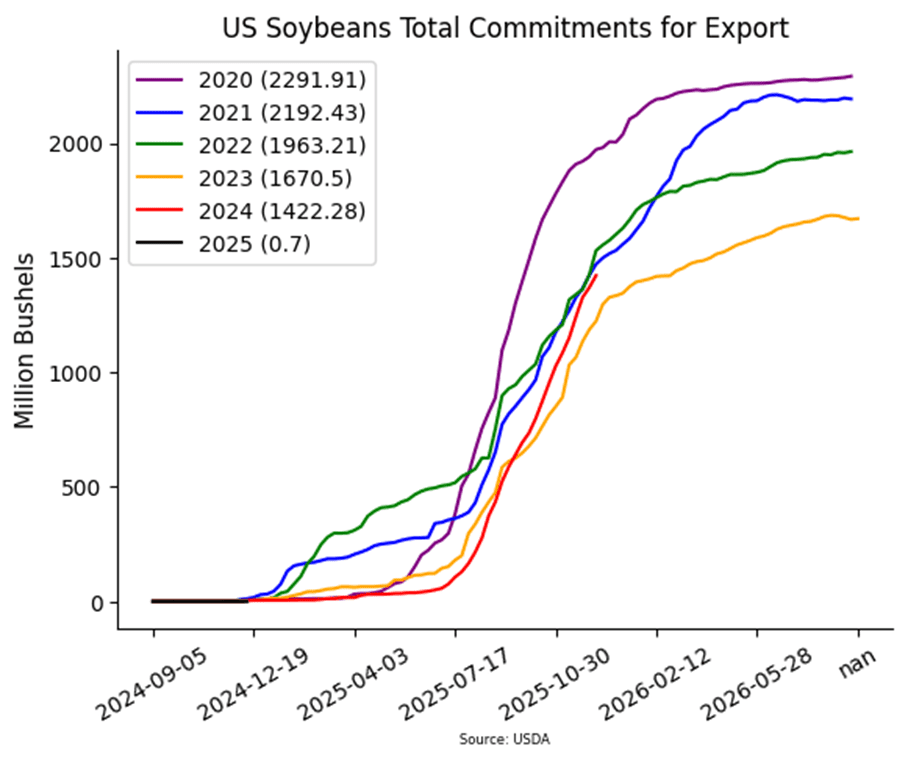

- CONAB has reported that Brazil is expected to export 105.5 mmt of soybeans in the 24/25 season. Through November of this year, the country’s soybean exports total 96.8 mmt, which is down 46% from the previous period.

- Funds hold a large net short position in soybeans and may be buying a portion back before the end of the year. Additionally, soybeans have been closely following moves in the Brazilian real which was higher today and therefore supportive.

Above: The recent break in prices found initial support between 950 and 945. Initial overhead resistance lies just above the market near 985 with additional resistance between 990 and 1004.

Wheat

Market Notes: Wheat

- All three US wheat classes saw solid gains today, driven primarily by spillover support from sharply higher soybean futures. This itself was likely due to a gap higher in meal after Argentina’s 10-day weather outlook turned drier. Additionally, lighter trade volume surrounding the holidays may be leading to increased volatility.

- The US Dollar Index continued to consolidate today but remains at an elevated level. If it sets back, that may give wheat some room to rally. But from a technical perspective, it is forming a bullish pennant chart formation. If this pattern is accurate, it could mean that the Dollar is due for a breakout to the upside, which would likely lead to weakness in the wheat market.

- Data out of Russia indicates that their 2024 wheat crop reached 82 mmt. It was also said that frost damage in the spring and drought in the summer led to a 30% decline in production for Russia’s largest growing area. Finally, their government is estimating 25/26 wheat exports at 36.4 mmt, compared to the USDA estimate of 47 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit Half JUL ’25 620 Puts ~ 93c

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of your remaining open July ’25 620 Chicago wheat puts at approximately 93 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 16% from its October high of 656.25, this is an attractive risk/reward point to exit half of the remaining July ’25 620 Chicago Wheat put options as we approach the winter dormancy period.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit Half JUL ’25 KC 620 Puts ~ 86c

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

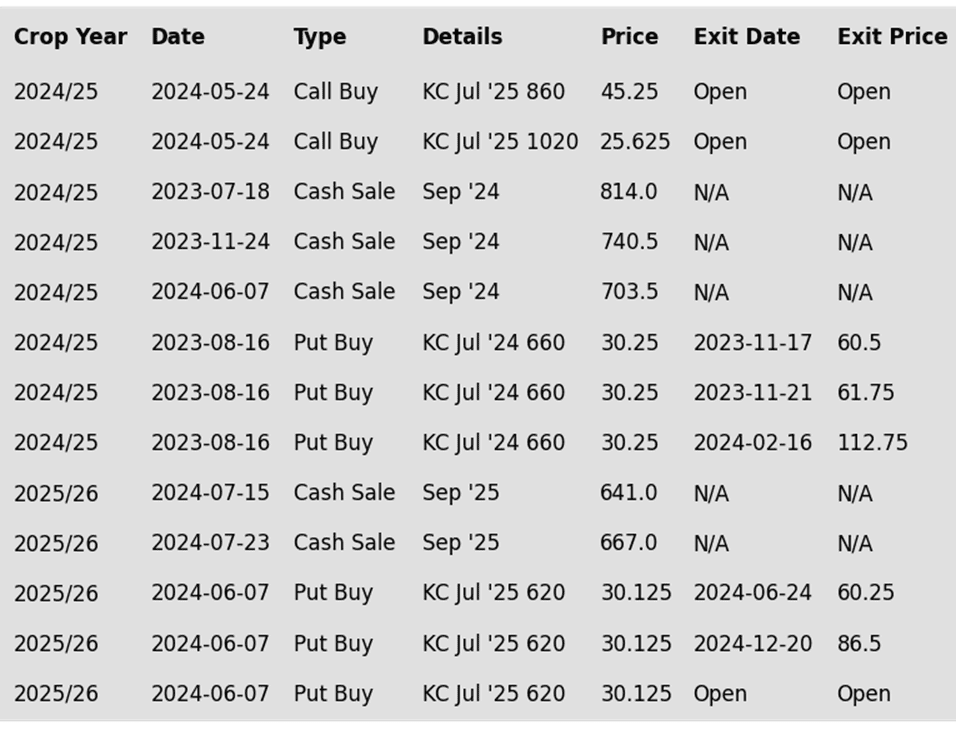

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 20- and 50-day moving averages around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit Half JUL ’25 KC 620 Puts ~ 86c

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather