12-20 End of Day: Corn and Soybeans Continue to Rebound for the Second Consecutive Day.

MERRY CHRISTMAS FROM ALL OF US AT TOTAL FARM MARKETING!

TUESDAY, DECEMBER 24: The CME closes at 12:15 p.m. (CT), and Total Farm Marketing offices close at 1:00 p.m. (CT). There will be no End of Day Grain Market Insider

WEDNESDAY, DECEMBER 25: The CME and Total Farm Marketing offices are closed.

WEDNESDAY, DECEMBER 25: The CME and Total Farm Marketing offices are closed.

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 446.25 | 5.5 |

| JUL ’25 | 454.5 | 5.25 |

| DEC ’25 | 437.75 | 3 |

| Soybeans | ||

| JAN ’25 | 974.5 | 11.5 |

| MAR ’25 | 979.25 | 12.75 |

| NOV ’25 | 987.25 | 10.5 |

| Chicago Wheat | ||

| MAR ’25 | 533 | 0 |

| MAY ’25 | 542.75 | -0.75 |

| JUL ’25 | 550.25 | -0.75 |

| K.C. Wheat | ||

| MAR ’25 | 544.75 | 1.5 |

| MAY ’25 | 552.5 | 1.5 |

| JUL ’25 | 560.75 | 1.75 |

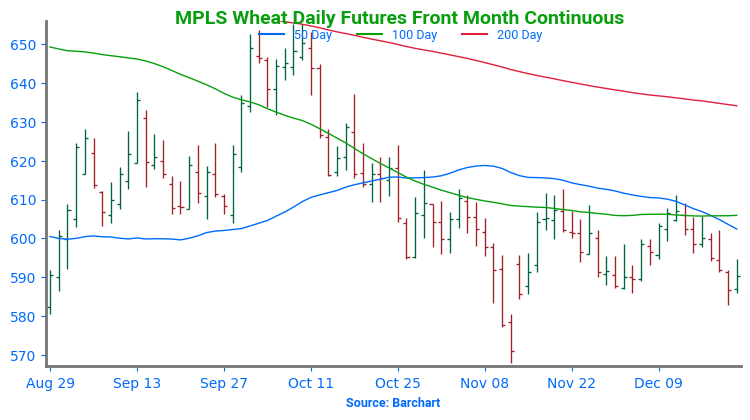

| Mpls Wheat | ||

| MAR ’25 | 590.25 | 3.5 |

| JUL ’25 | 606 | 3 |

| SEP ’25 | 615 | 2 |

| S&P 500 | ||

| MAR ’25 | 6032 | 98 |

| Crude Oil | ||

| FEB ’25 | 69.43 | 0.05 |

| Gold | ||

| FEB ’25 | 2647.3 | 39.2 |

Grain Market Highlights

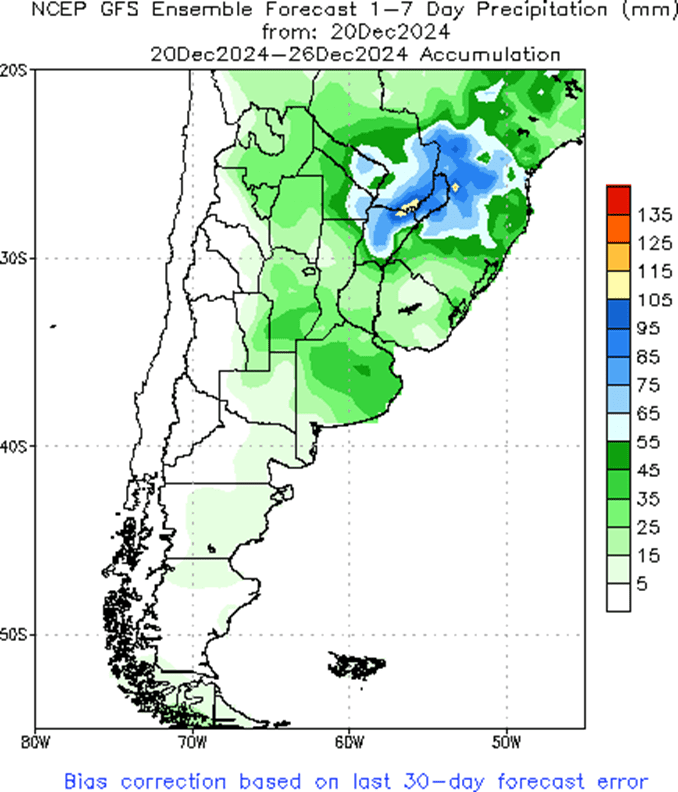

- Corn benefited from the strength of the soybean market, rising for the second consecutive session. A drier forecast in Argentina could potentially limit corn production, providing a further boost to the corn market.

- Soybeans rose today for the second consecutive session, driven primarily by higher soybean meal prices, although soybean oil ended lower.

- Wheat markets closed mixed today, with Chicago wheat finishing lower, while Kansas City and Minneapolis wheat saw modest gains. A lower close in Matif wheat failed to provide support for the overall wheat market.

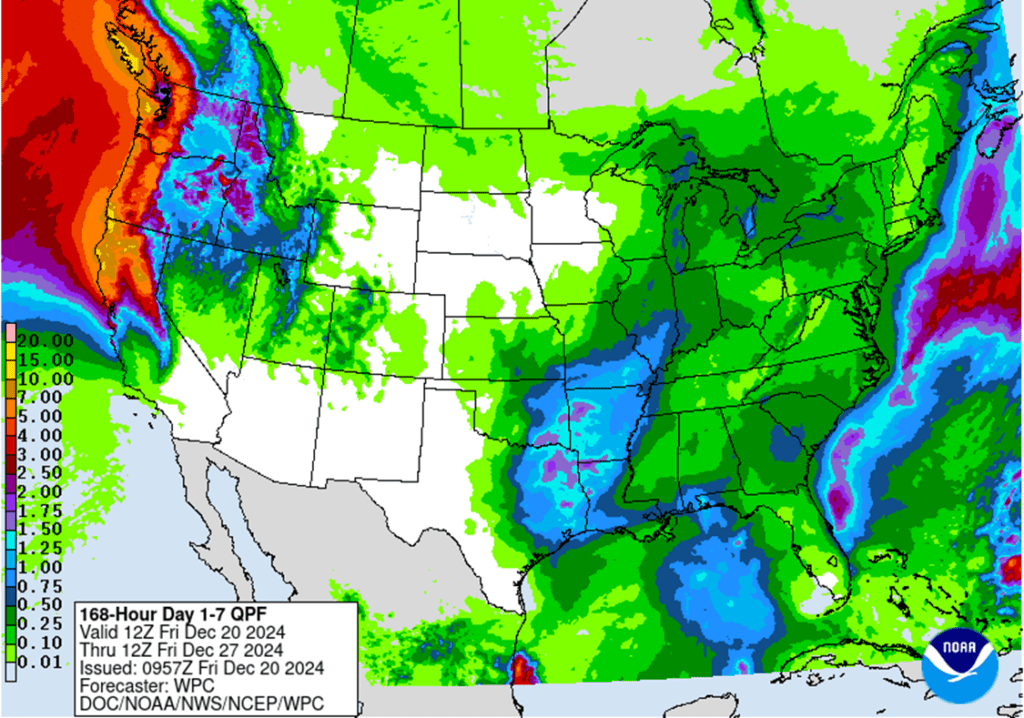

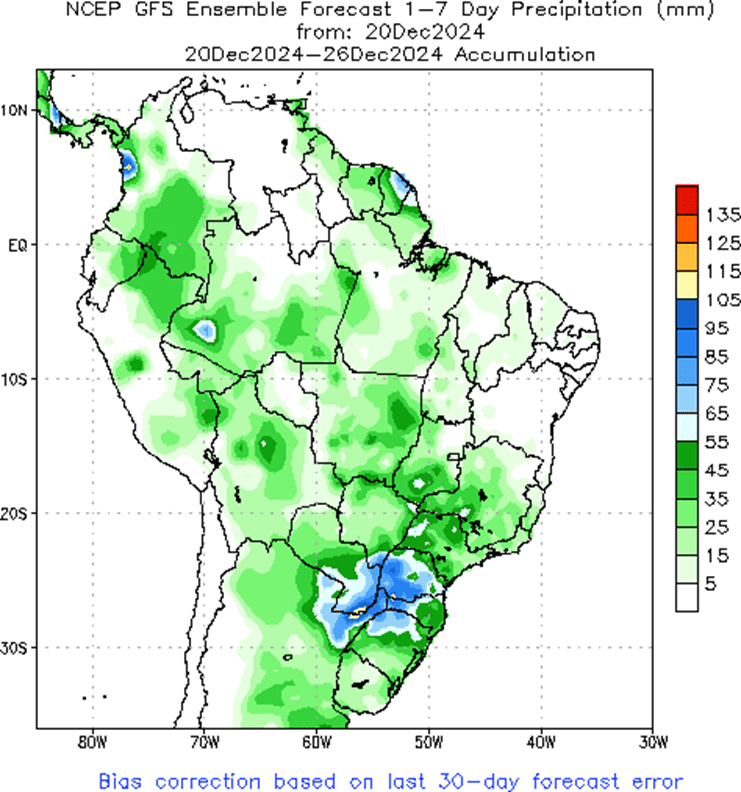

- To see the updated U.S. and South American precipitation forecasts, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you did not act on the prior sales recommendations and/or need to move bushels for cash flow, Grain Market Insider issued a catch-up recommendation on December 11, with the next catch-up target at 455 (Mar ‘25).

- If you have followed all prior sales recommendations and are comfortable with cash flow until spring, Grain Market Insider advises holding steady for now.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

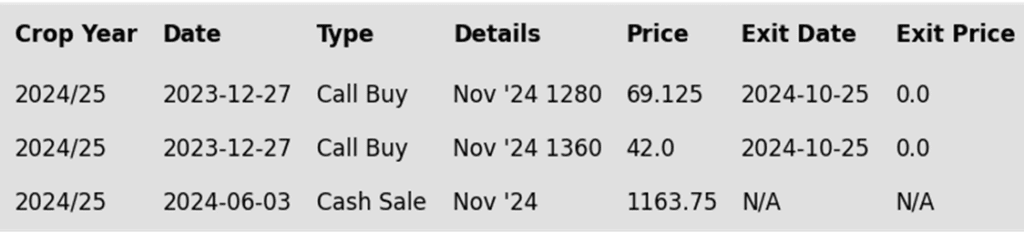

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

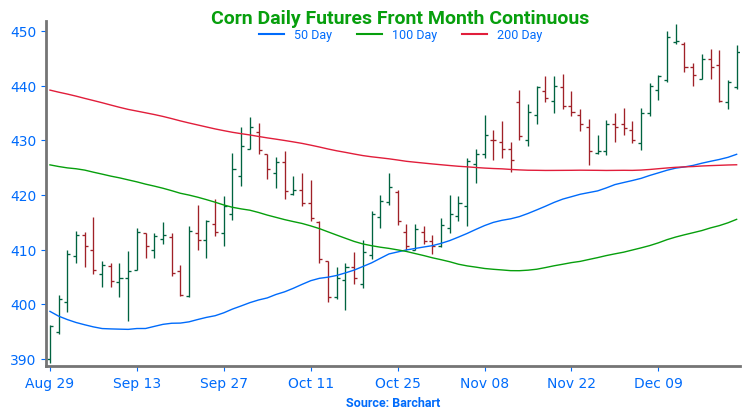

- The corn market finished the week higher as the market used strength in the soybean market to trend higher for the second consecutive session. For the week, March corn futures finished 4 ¼ cents higher as prices are trading range bound in an overall direction.

- Forecast for a possible trending drier forecast in Argentina help pull the soybean meal market higher, supporting soybeans. A drier forecast could limit corn production, so the corn market moved in sympathy.

- USDA reported a flash export sale of corn this morning. Columbia bought 150,000 MT (5.9 mb) of corn for the current marketing year.

- With the Christmas holiday approaching next week, the market could turn choppy on thin or lighter trade volumes. The corn market will be open for a short trading session on Tuesday and closed on Wednesday next week in the Christmas Holiday trading hours.

Above: The breach of 442 support puts the market at risk of declining toward the 425 level, with potential trendline support near 432. If a bullish trigger emerges, prices could initially find support near 442 and again near 450.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1100 – 1110 area versus Jan ‘24 to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

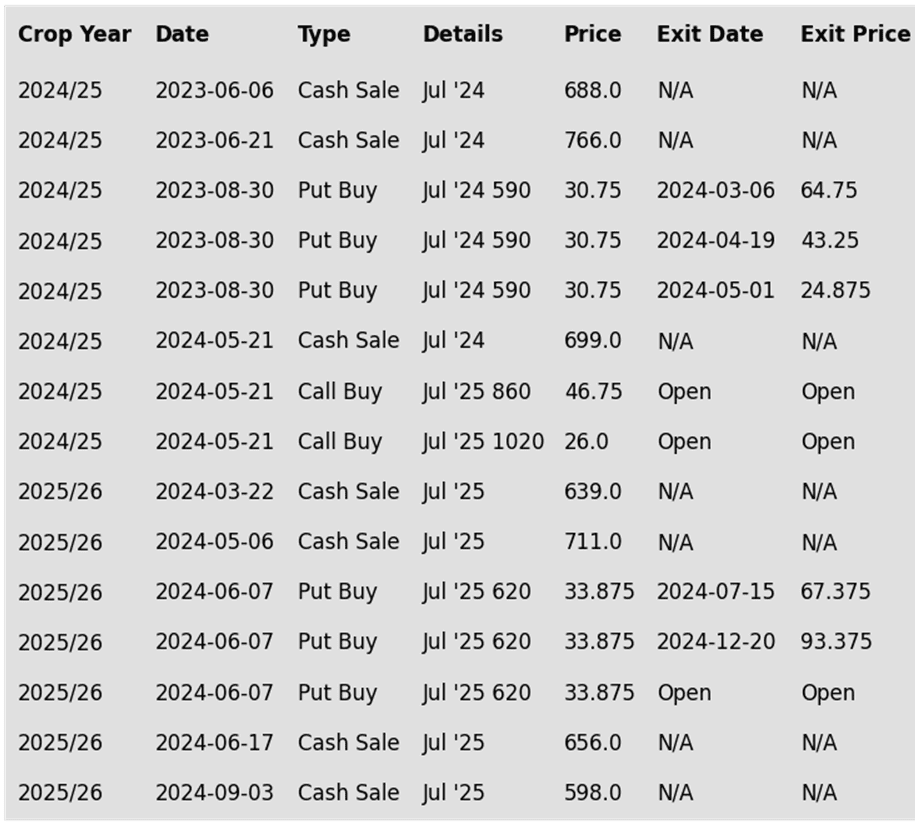

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher for the second consecutive day and have now taken back all but two cents of Wednesday’s sell-off. Soybean meal clearly led soybeans higher today with a gain of 3.66% in the January contract or $10.40. Soybean oil ended the day lower.

- Soybean oil continued to sell off today and posted large losses for the week as the expiration date for the 40B tax credit looms at the end of the year. The Biden administration has not yet approved the subsequent 45Z tax credit that would be in effect next year, and this has trade concerned.

- China is seemingly loading up on US soybeans before potential tariffs take effect in the Trump administration. Sinograin has bought 500,000 tons of US soybeans for delivery in March-April as they reportedly prefer the quality of US soybeans. There are concerns that export demand may slide next year if tariffs are implemented.

- For the week, January soybeans lost 13-3/4 cents at $9.74-1/2 while November 25 soybeans lost 19 cents at $9.87-1/4. January soybean meal gained $8.30 on the week to $294.50 and January soybean oil lost 3.13 cents to 39.48 cents.

Above: The recent close below 975 support puts the market at risk of testing the August low of 940 on the front-month chart. If prices rebound, overhead resistance could emerge near 975, followed by additional resistance between 995 and 1000.

Wheat

Market Notes: Wheat

- After trading both sides of neutral, Chicago wheat closed slightly lower, while Kansas City and Minneapolis futures posted small gains. The sharp decline in the US Dollar Index alleviated some pressure on the wheat market, but a lower close for Matif wheat provided no support.

- Globally, weather in the northern hemisphere remains generally favorable for the wheat crop. While there is speculation about smaller Russian exports and potential quality concerns in European wheat, the larger harvests expected in Australia and Argentina are likely to offset these factors.

- According to the Buenos Aires Grain Exchange, as of December 19, Argentina’s wheat harvest is 76.1% complete, up from 63.9% the previous week. The production estimate remains unchanged at 18.6 mmt, compared to last year’s crop of 15.1 mmt.

- In a statement from the German Federal Statistics Office, farmers have planted approximately 4.8 million hectares of winter grain, reflecting a 5.6% increase year-over-year. Of this total, winter wheat accounts for 2.8 million hectares, marking a 12% year-over-year rise.

- The second vessel carrying wheat from Russia to Egypt has reportedly departed port. Egypt purchased 430,000 mt of wheat from Russia in September, but the shipments were delayed until recently. This vessel is said to be carrying 54,000 mt of wheat.

- According to the European Commission, the 2024/25 EU grain production estimate is now 255.8 mmt, down from 256.9 mmt in the November forecast. The soft wheat crop saw a decline from 112.3 mmt to 111.9 mmt for the same period.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit Half JUL ’25 620 Puts ~ 93c

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recommends liquidating half of your remaining open July ’25 620 Chicago wheat puts at approximately 93 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 16% from its October high of 656.25, this is an attractive risk/reward point to exit half of the remaining July ’25 620 Chicago Wheat put options as we approach the winter dormancy period.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

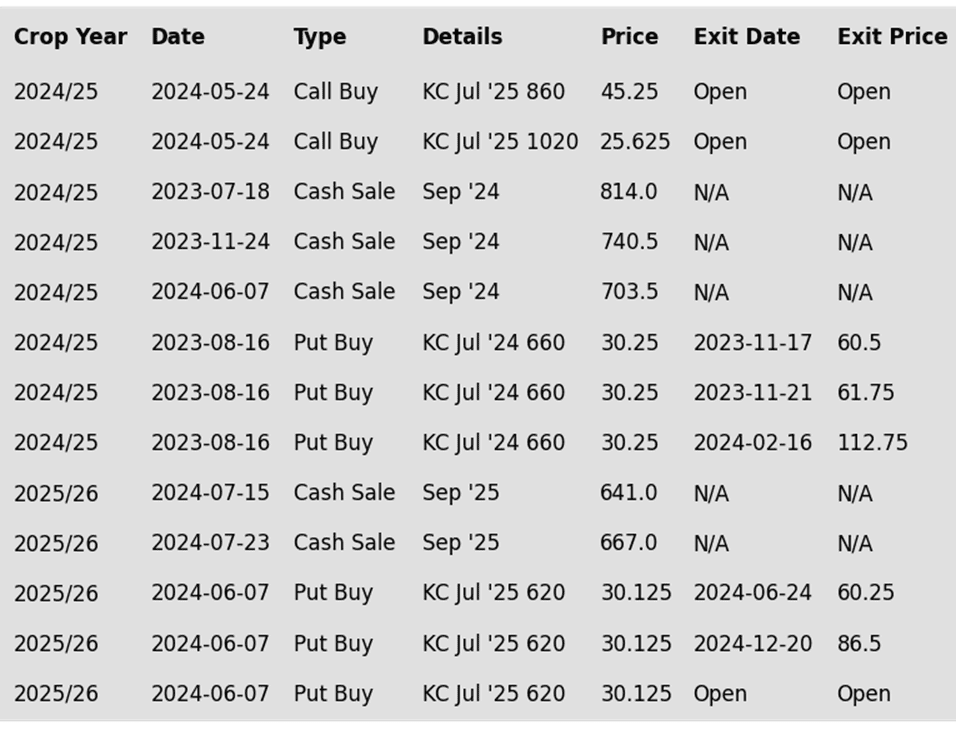

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit Half JUL ’25 KC 620 Puts ~ 86c

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recommends liquidating half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 20- and 50-day moving averages around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit Half JUL ’25 KC 620 Puts ~ 86c

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recommends liquidating half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil, N. Argentina 1 week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.

Argentina one-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.