12-2 End of Day: Grain Markets Close Mixed on Monday

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 432.5 | -0.5 |

| JUL ’25 | 442 | -0.25 |

| DEC ’25 | 431.75 | 0.25 |

| Soybeans | ||

| JAN ’25 | 985.25 | -4.25 |

| MAR ’25 | 991 | -5 |

| NOV ’25 | 1005.5 | -5.25 |

| Chicago Wheat | ||

| MAR ’25 | 547.25 | -0.75 |

| MAY ’25 | 555.75 | -1.25 |

| JUL ’25 | 561.75 | -2 |

| K.C. Wheat | ||

| MAR ’25 | 540.5 | -0.25 |

| MAY ’25 | 547.75 | -0.75 |

| JUL ’25 | 555.5 | -0.5 |

| Mpls Wheat | ||

| MAR ’25 | 587.75 | -4 |

| JUL ’25 | 604.25 | -3.5 |

| SEP ’25 | 613.25 | -4 |

| S&P 500 | ||

| MAR ’25 | 6130.25 | 11.25 |

| Crude Oil | ||

| FEB ’25 | 67.85 | 0.13 |

| Gold | ||

| FEB ’25 | 2661.9 | -19.1 |

Grain Market Highlights

- The corn market closed fractionally mixed, near the middle of its modest 5 ¼ cent range, after a quiet day of two-sided trade. Light buying supported the December contract, with few deliveries reported.

- Soybeans settled lower, largely due to expectations of a large South American crop, despite a flash sale to China. However, the market rebounded from session lows to close mid-range.

- Both soybean meal and oil ended the day lower, likely contributing to the soft close in soybeans. While bean oil mostly consolidated within last week’s range, meal found buying interest near support.

- The wheat complex closed mostly lower across all three classes after a day of two-sided trade. Prices fluctuated around unchanged, caught between higher Matif wheat and a surge in the US dollar.

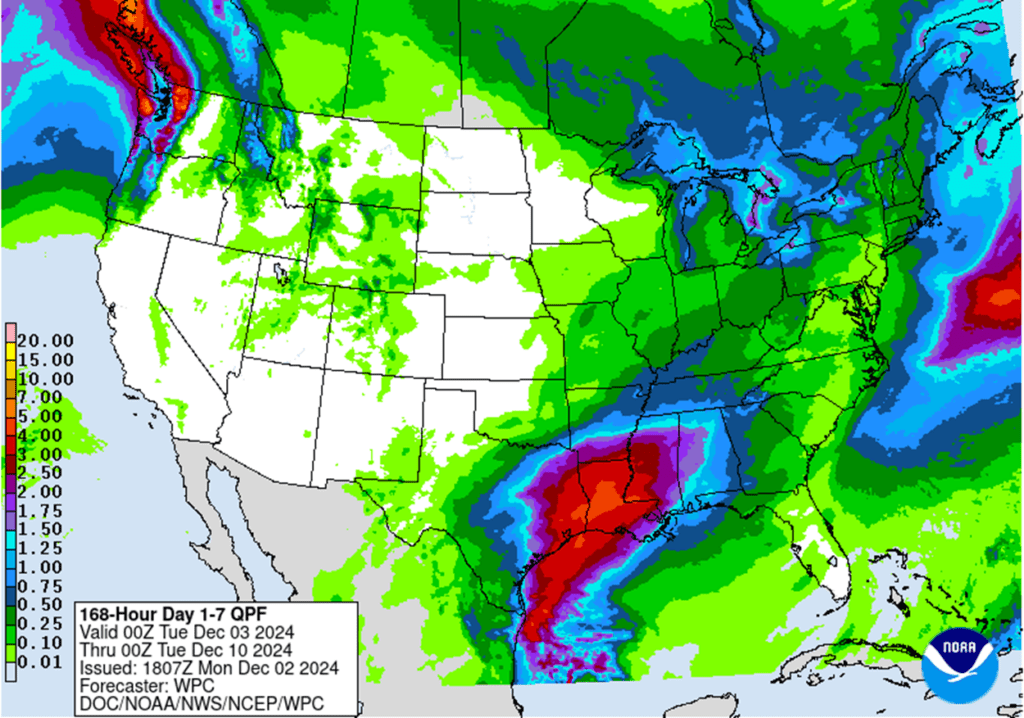

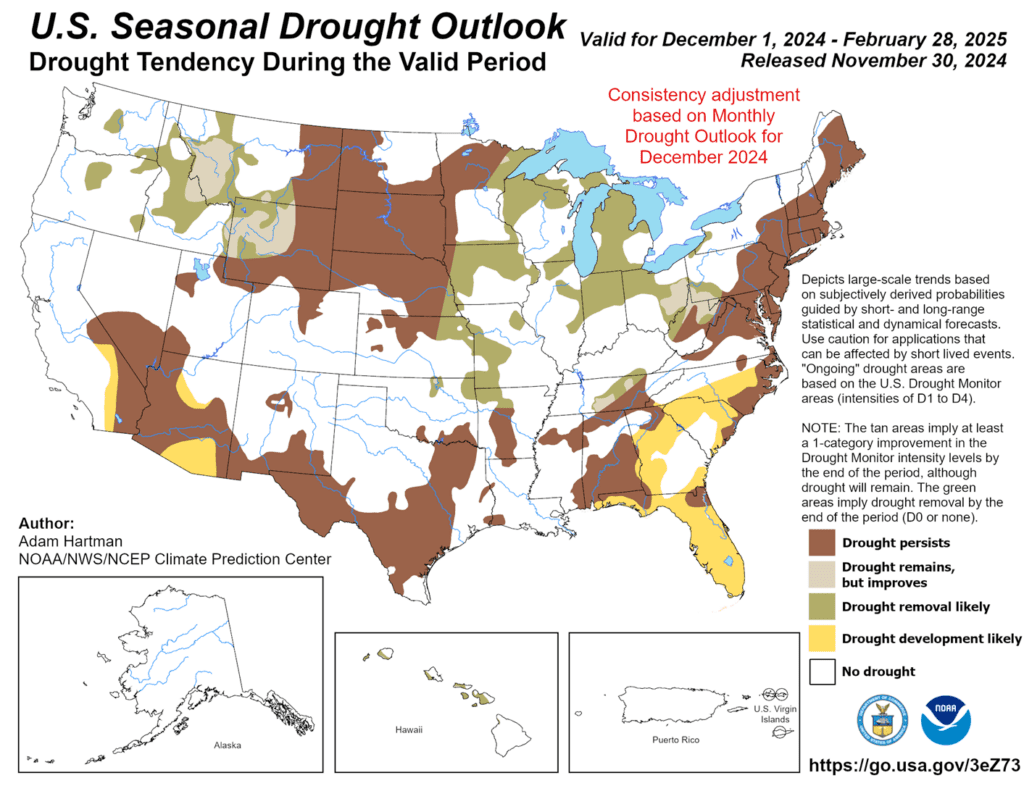

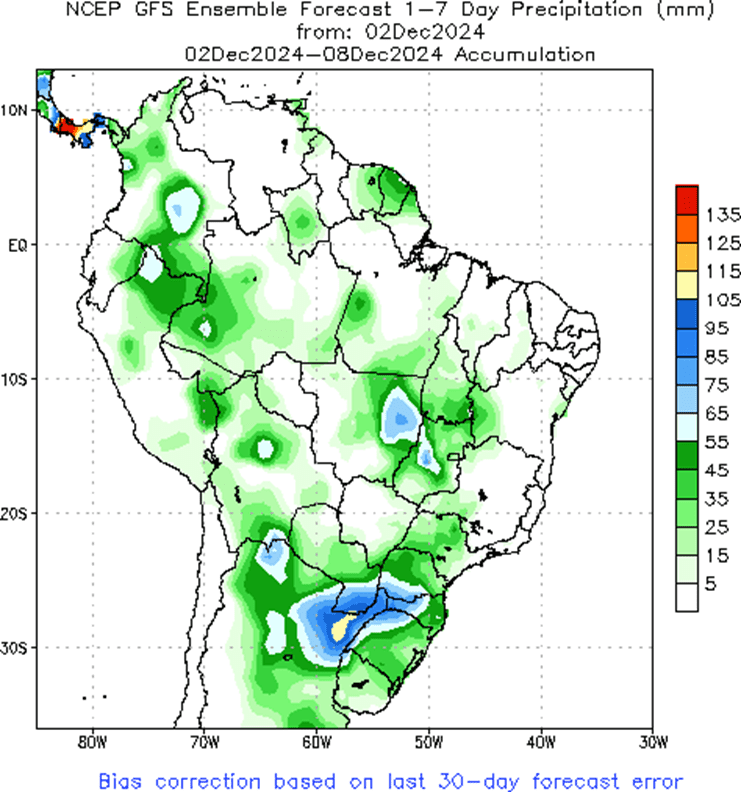

- To see the updated US and South American Seven Day precipitation forecasts and the US Seasonal Drought Outlook, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We are now in the window when seasonal opportunities tend to improve and we anticipate posting target ranges for new sales soon, but they could be as late as early spring.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

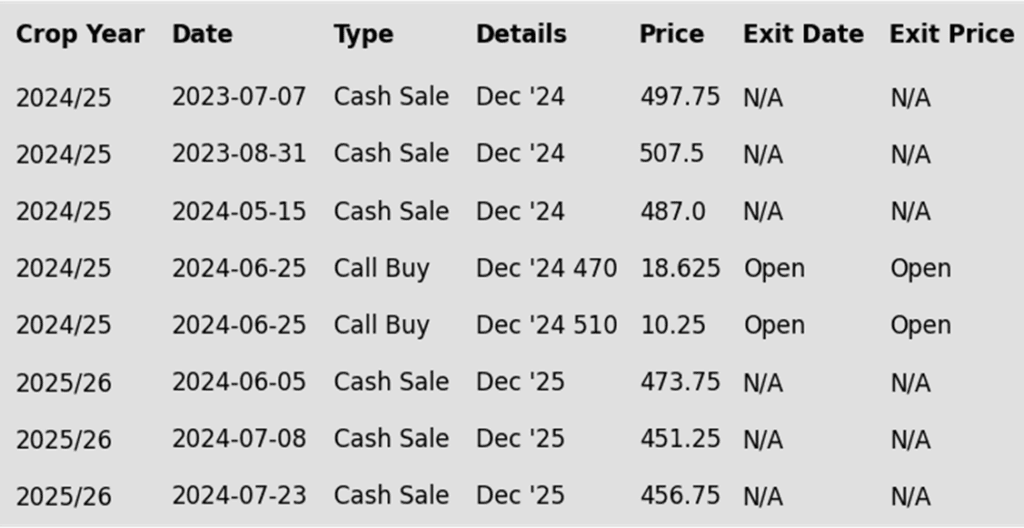

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market opened the month of December with quiet, mixed trade. Light buying supported the December contract that is in delivery, while the most active March futures traded within a narrow 5 ¼ cent range.

- The December contract entered delivery with 222 contracts delivered, a relatively small number that likely helped support prices.

- USDA weekly corn inspections totaled 36.8 mb, bringing cumulative inspections 31% above last year. The key shipping window for corn still lies ahead during the March–May time frame.

- Brazil’s crop planting remains ahead of schedule, with soybeans 91% planted and the first corn crop 94% complete. Timely soybean planting keeps producers on track for the Safrinha corn crop, hitting the optimal weather windows for development.

The corn market has, so far, held support near the 425 area and the 200-day moving average (ma), and could potentially retest the 442 area with the possibility of trading towards 465. If prices break through and close below the 50-day moving average (ma), near 422, they run the risk falling further and testing more major support near the 410 area and 100-day ma.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- This is the period when seasonal opportunities typically improve, and we plan to post target ranges for new sales soon, though it could be as late as early spring.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower but recovered from their lowest prices earlier in the day that saw the January contract down to 977 ½. There was a flash sale reported this morning, but the trade seemed more focused on the excellent growing conditions in Brazil. Both soybean meal and oil ended the day lower as well.

- The USDA reported that 134,000 mt of soybeans were sold to China for the 24/25 marketing year. There have been multiple sales of soybeans throughout the past few weeks indicating good demand, but analysts are also expecting record production out Brazil on top of the large US crop.

- Soybean inspections were strong for the week ending Thursday, November 28, totaling 76.7 mb, bringing 24/25 inspections to 801 mb, up 16% from last year. The USDA projects exports at 1.825 bb, a 7% increase year-over-year.

- Brazil’s soybean crop is in excellent condition, with Agroconsult projecting a record 172.2 million bushels. AgRural estimates 91% of the crop has been planted.

January soybeans continue to drift and test the 975 support area. A close below there could put the market at risk of receding to the 940 support area around the August low. Should the 975 area hold turning prices back higher, they may find resistance between the 50-day moving average and 1014, before retesting the 1045 area.

Wheat

Market Notes: Wheat

- After a day of two-sided trade, wheat closed mostly lower in all three US classes. Gains from higher Matif wheat futures were limited by a surge in the US Dollar Index, driven by concerns over a potential collapse of the French economy.

- Weekly wheat export inspections reached 10.9 mb, bringing 24/25 totals to 404 mb, up 32% from last year. Inspections exceed the USDA’s projected pace, with total exports forecast at 825 mb, a 17% year-over-year increase.

- Russian officials approved an 11 mmt wheat export quota for mid-February through June, down from 29 mmt last year. The smaller quota reflects a reduced crop and record early-season exports.

- China recently approved Argentine wheat imports, with potential sales marking the first since the 1990s. Argentina is on track for a large harvest, including a 3.9 mmt wheat crop in Buenos Aires province (up 18% year-over-year) and a total wheat crop of 17.5 mmt, up from 15.9 mmt last year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

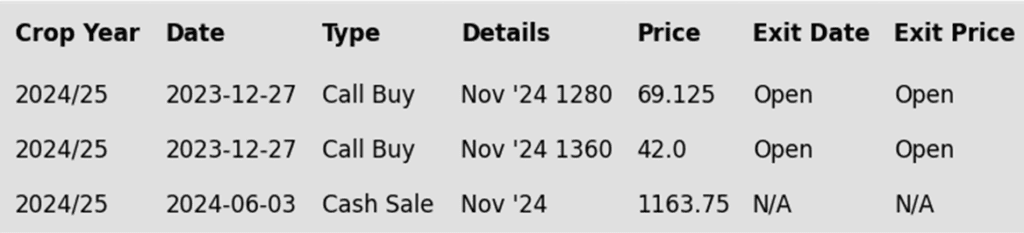

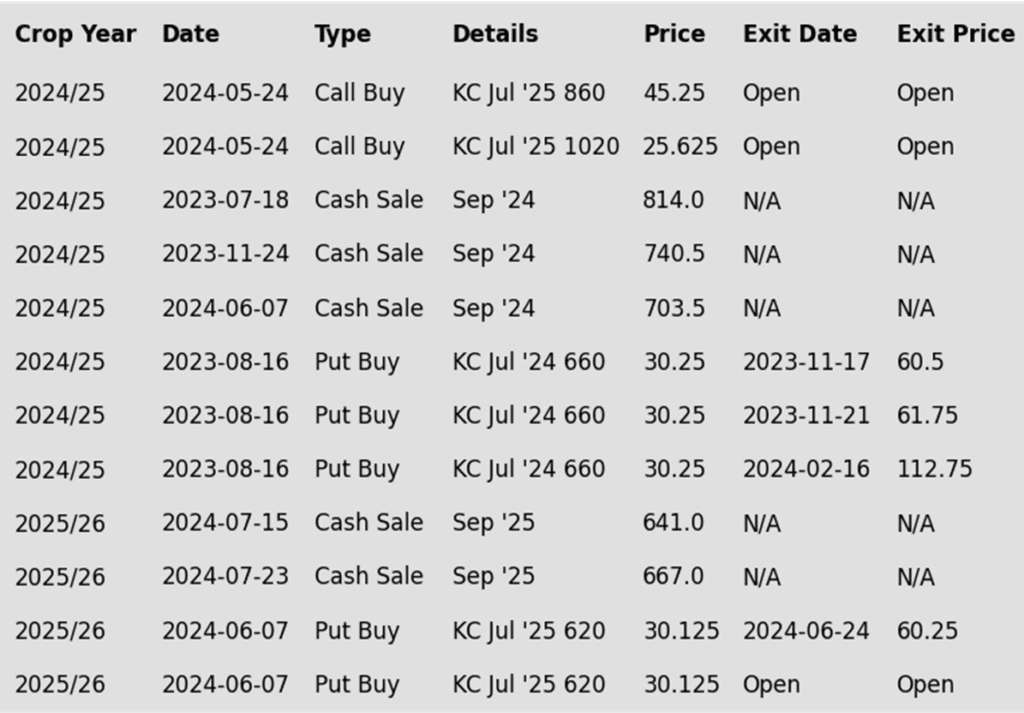

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Front month Chicago wheat remains in a broad trading range between 536 down below and 586 up top. If the market can trade through the 50 and 200-day moving averages and close above 586 it could be poised to retest the 617 area. Whereas a close below 536 could put the market at risk of trading to the 521 – 514 support area.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

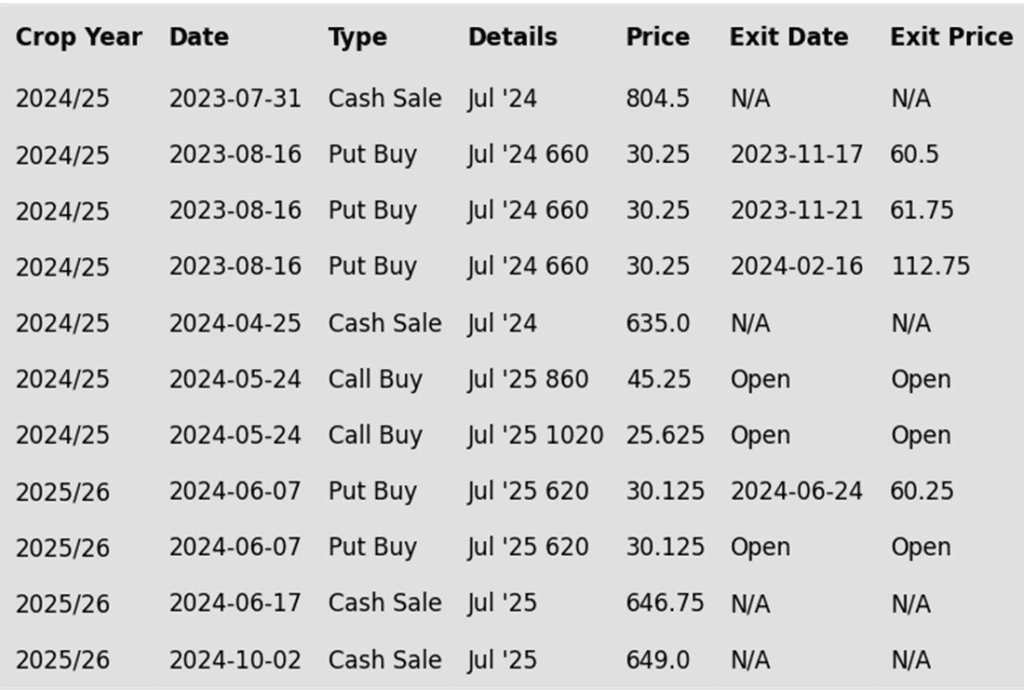

To date, Grain Market Insider has issued the following KC recommendations:

Since failing to trade above the 50-day moving average (ma), March KC wheat has trended lower and is testing the bottom of the 536 – 577 range. A close below this level could put the market at risk of testing the August low of 527 ¼. Should a bullish catalyst emerges to push prices higher, they could encounter resistance near 567 before re-testing 577.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept. ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

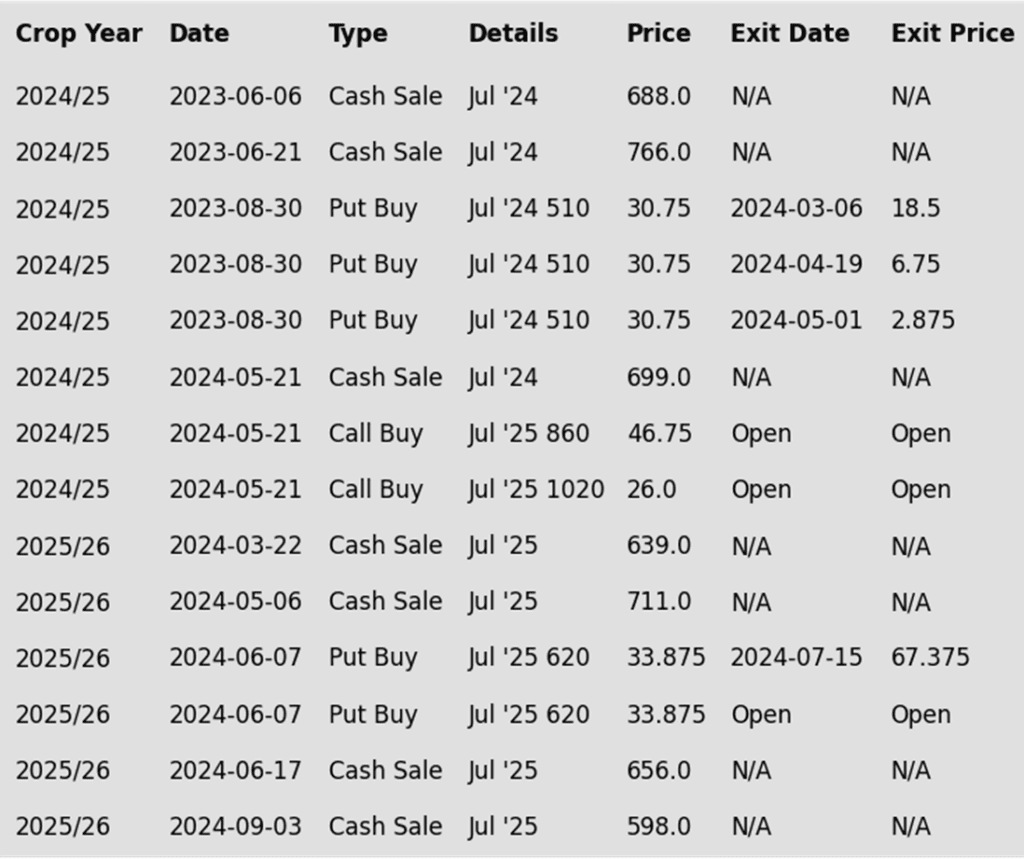

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Since rolling to the March contract, front month Minneapolis wheat has been capped by resistance near the 50-day moving average around 613. A close above this point could put the market on track to test the October highs near 655, with potential resistance around the 200-day moving average. Should prices slide below 584 they could then be at risk of retesting the 563 area.

Other Charts / Weather

Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.