12-18 End of Day: Sharply Lower Soybeans Weigh on Markets

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 437.25 | -6.25 |

| JUL ’25 | 447.25 | -6 |

| DEC ’25 | 433 | -5.5 |

| Soybeans | ||

| JAN ’25 | 951.75 | -25 |

| MAR ’25 | 953.25 | -25.5 |

| NOV ’25 | 965.75 | -23 |

| Chicago Wheat | ||

| MAR ’25 | 541.25 | -3.75 |

| MAY ’25 | 551.75 | -2.75 |

| JUL ’25 | 559 | -2.25 |

| K.C. Wheat | ||

| MAR ’25 | 548.75 | -3.75 |

| MAY ’25 | 556.75 | -3.5 |

| JUL ’25 | 564.75 | -3.5 |

| Mpls Wheat | ||

| MAR ’25 | 592 | -3 |

| JUL ’25 | 607.5 | -3 |

| SEP ’25 | 617.25 | -3 |

| S&P 500 | ||

| MAR ’25 | 6089 | -38.25 |

| Crude Oil | ||

| FEB ’25 | 70.01 | 0.36 |

| Gold | ||

| FEB ’25 | 2638.1 | -23.9 |

Grain Market Highlights

- Big losses in the bean market and the expiration of a key biofuel tax credit kept sellers active in the corn market, pushing prices below key support from recent consolidation.

- Sharply lower prices in both products weighed on the soybean market, which hit fresh contract lows for the second consecutive day. Expiring biofuel tax credits and a weak Brazilian currency contributed to the negativity.

- Weakness in the corn and soybean markets spilled over to the wheat complex, which reversed earlier gains to close lower across the board and near session lows.

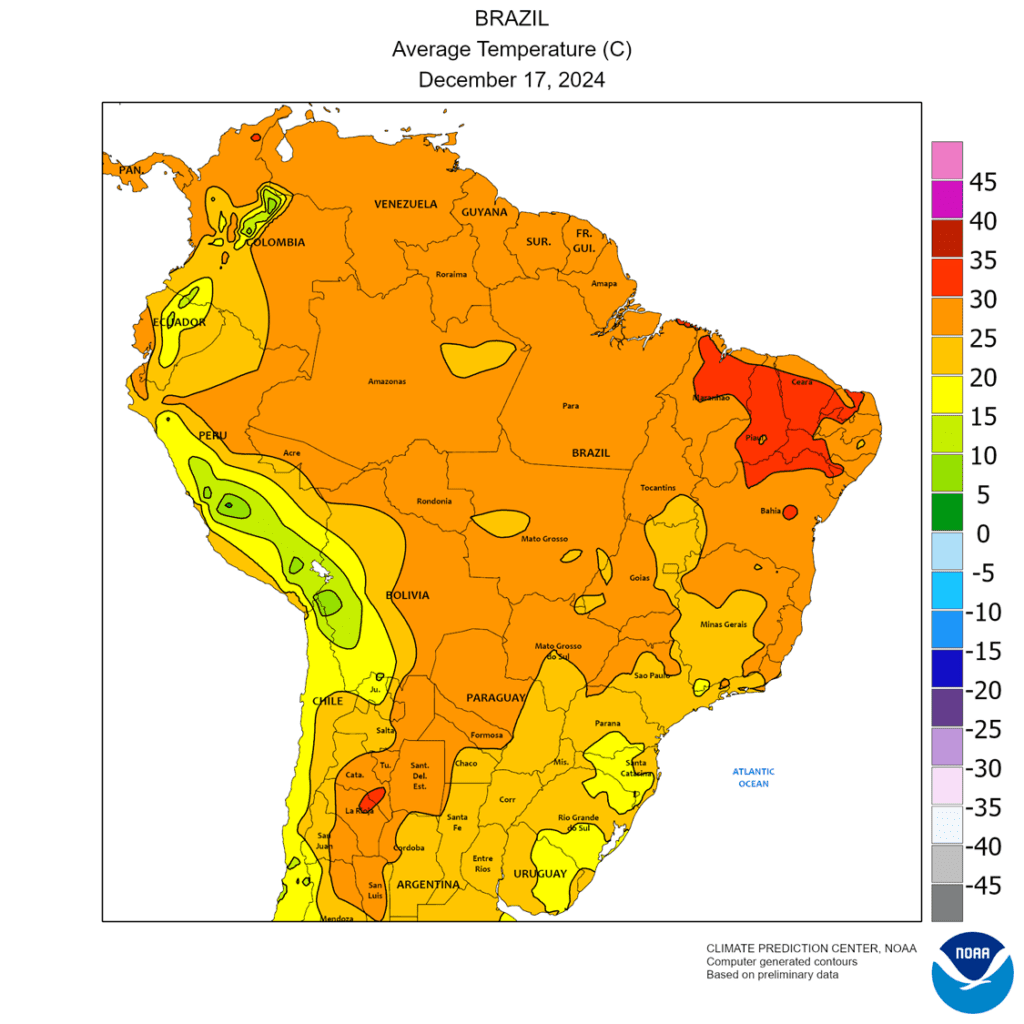

- To see updated US and South American weather outlooks, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

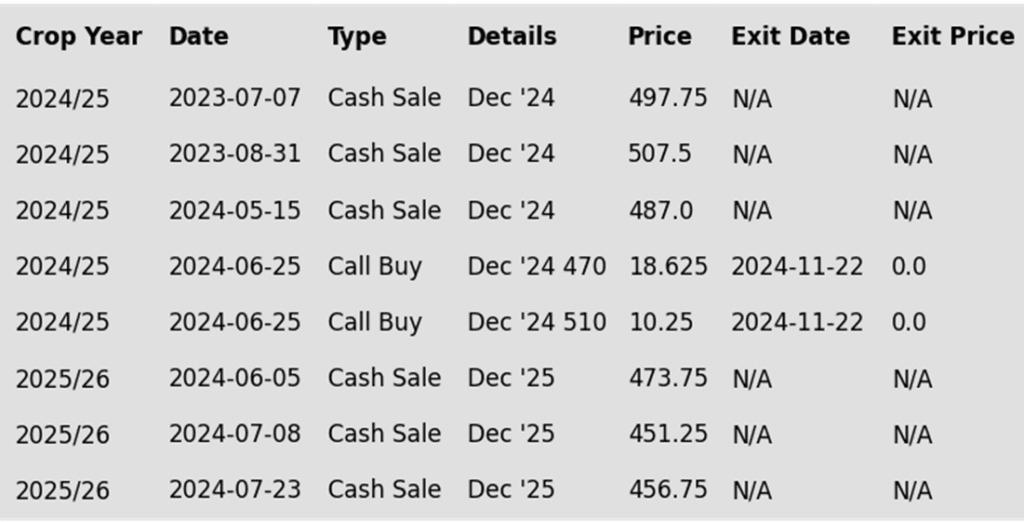

Corn Action Plan Summary

2024 Crop:

- Grain Market Insider sees an opportunity to make catch-up sales on a portion of your 2024 corn crop. The corn market is trading around the 450 area in the March ’24 contract. If you missed previous sales recommendations, this level offers a good opportunity to catch up on sales, especially with potential heavy resistance just overhead near the 200-day moving average. Additionally, making a sale now could help meet any capital needs for your operation.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Selling pressure across the grain markets, led by strong selling in the soybean market, weighed on corn futures, resulting in moderate losses on the day.

- Concerns over the expiration of tax credits for biofuels pressured grain markets for the second consecutive day. The 40B tax credit, which supports the sustainable aviation fuel (SAF) program, is set to expire at the end of the year. With no plan for extension into 2025, the lack of clarity has triggered selling across the grain markets.

- The Brazilian real continues to lose value against the US dollar, reaching new historical lows again on Wednesday. The weaker currency gives Brazilian grain exports a significant price advantage over US offerings.

- Weekly ethanol production remains strong, rising to 1,103K barrels per day for the week ending Dec. 13, up from 1,078K bpd the prior week. Corn usage for ethanol was estimated at 107.3 mb, higher than the previous week but below last year’s levels. Corn use for ethanol remains ahead of USDA targets for the marketing year.

- Weekly export sales will be announced Thursday morning. Last week’s sales fell below expectations, disappointing the market. New sales are expected to range between 800,000 and 1.6 mmt, with traders looking for direction in corn exports.

Above: The breach of 442 support puts the market at risk of declining toward the 425 level, with potential trendline support near 432. If a bullish trigger emerges, prices could initially find support near 442 and again near 450.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

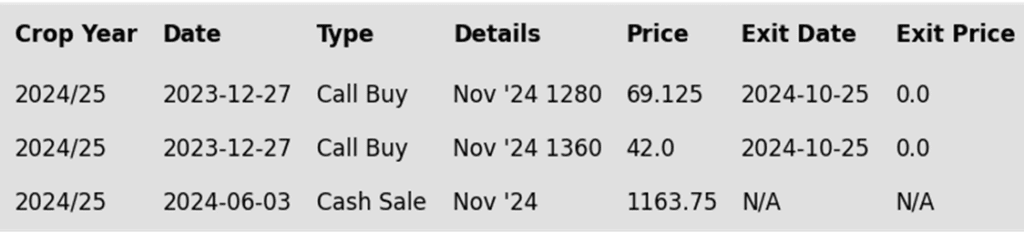

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1100 – 1110 area versus Jan ‘24 to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

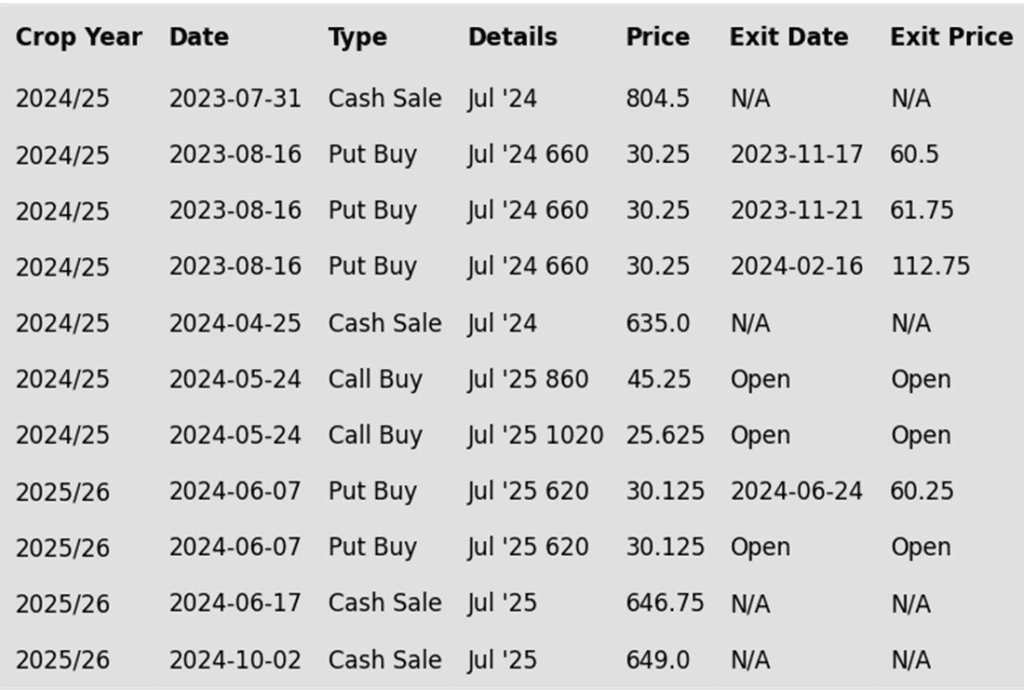

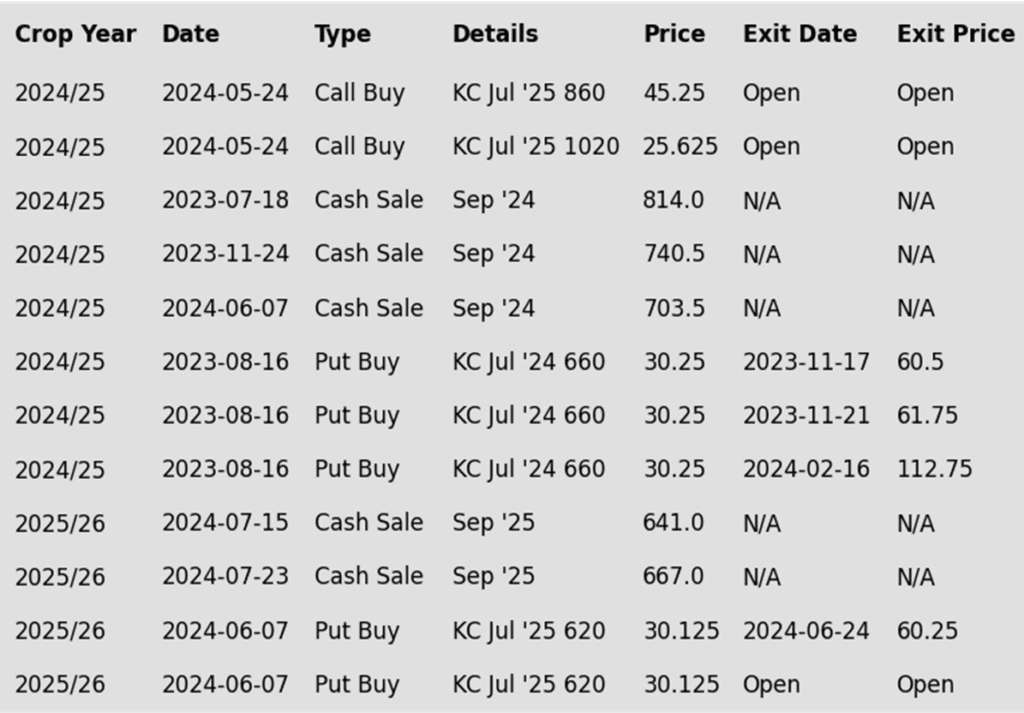

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply lower for the fourth consecutive day, hitting new contract lows. Both soybean oil and meal also declined, with soybean oil posting larger losses recently. A flash sale reported this morning was largely dismissed by traders.

- The devaluation of the Brazilian real relative to the rising US dollar has made US soybeans less competitive. However, the larger bearish news today may stem from concerns about the expiration of the 40B tax credit at the end of the year, which could impact renewable diesel and, consequently, soybean oil.

- The 40B tax credit will expire at year-end, and although the Biden administration was expected to implement the 45Z tax credit for 2025, this has not yet occurred. The uncertainty surrounding biofuels and sustainable aviation fuel has led traders to sell aggressively.

- This morning, the USDA reported a flash sale of 120,000 metric tons of soybean cake and meal for delivery to Colombia during the 24/25 marketing year.

Above: The recent close below 975 support puts the market at risk of testing the August low of 940 on the front-month chart. If prices rebound, overhead resistance could emerge near 975, followed by additional resistance between 995 and 1000.

Wheat

Market Notes: Wheat

- Wheat posted losses again, fueled by lower corn prices and sharply lower soybeans in another risk-off session. The Fed’s decision to cut interest rates by 25 basis points has caused the U.S. Dollar Index to rise sharply, which may add pressure on wheat in the coming days.

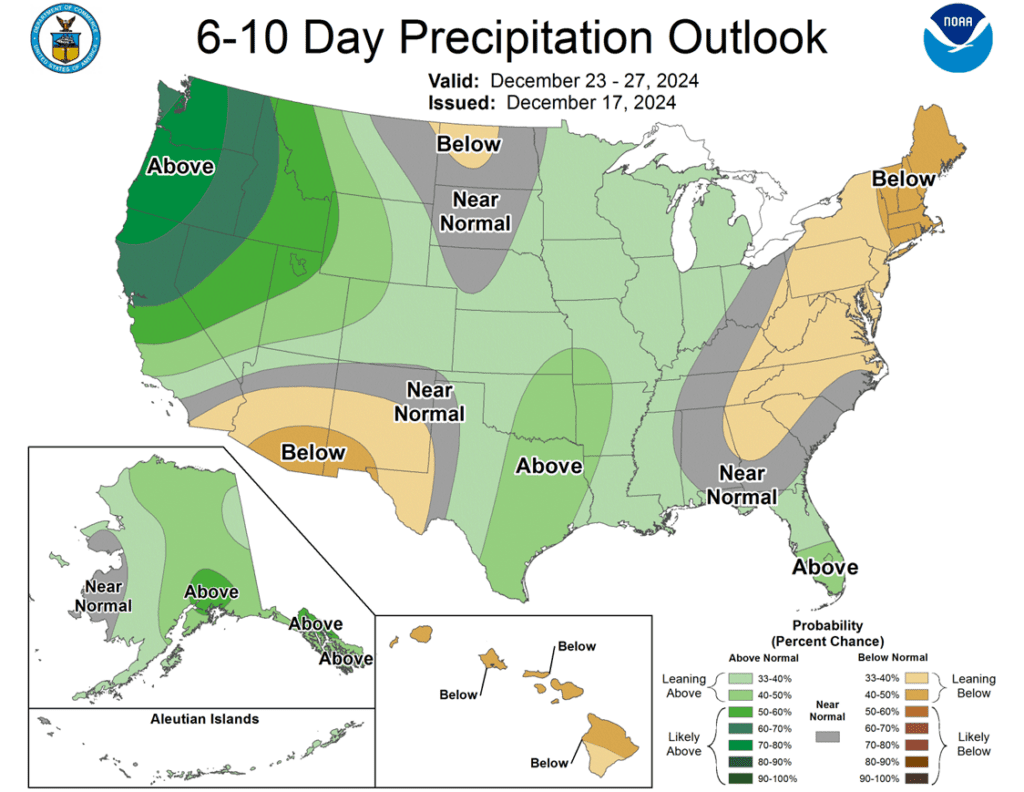

- Despite scattered showers in southern Australia, the weather pattern looks drier as the year-end approaches. This should aid in their remaining wheat harvest.

- Chinese customs data shows November wheat imports at just 70,000 metric tons, down 89.9% year-on-year. Year-to-date imports have also declined 4.1% to 11.02 million metric tons.

- Egypt is preparing to receive the first shipment of their 430,000 metric ton purchase of Russian wheat from September, which was delayed from its original October schedule for unknown reasons. The vessel is said to be carrying 63,000 metric tons of wheat.

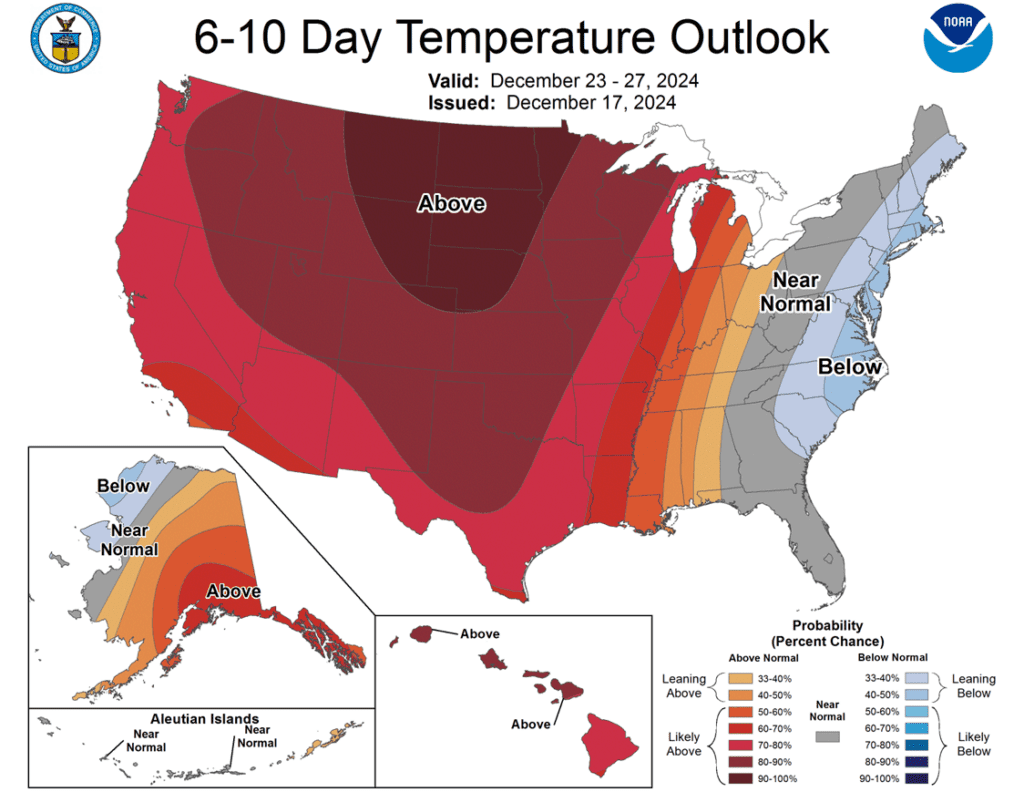

- Weather models indicate above-normal temperatures in European Russia through December, but thick snow cover should protect dormant wheat from damage, despite a potential cold snap approaching.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

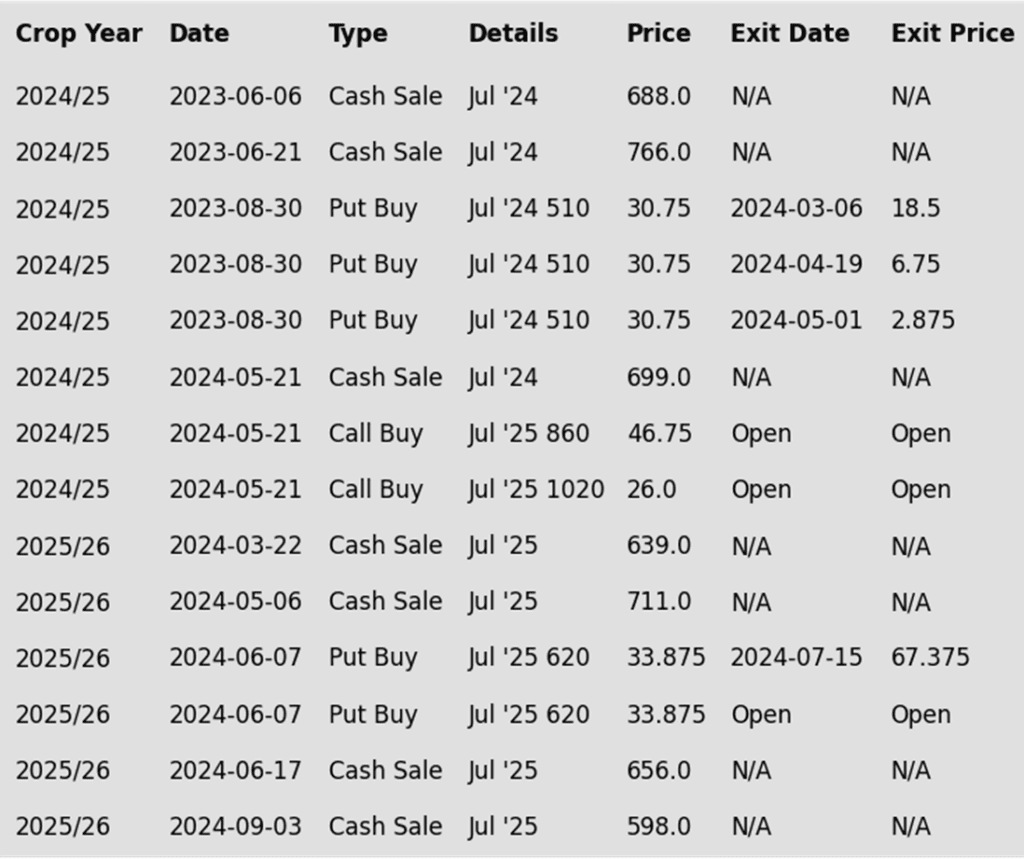

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 20- and 50-day moving averages around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

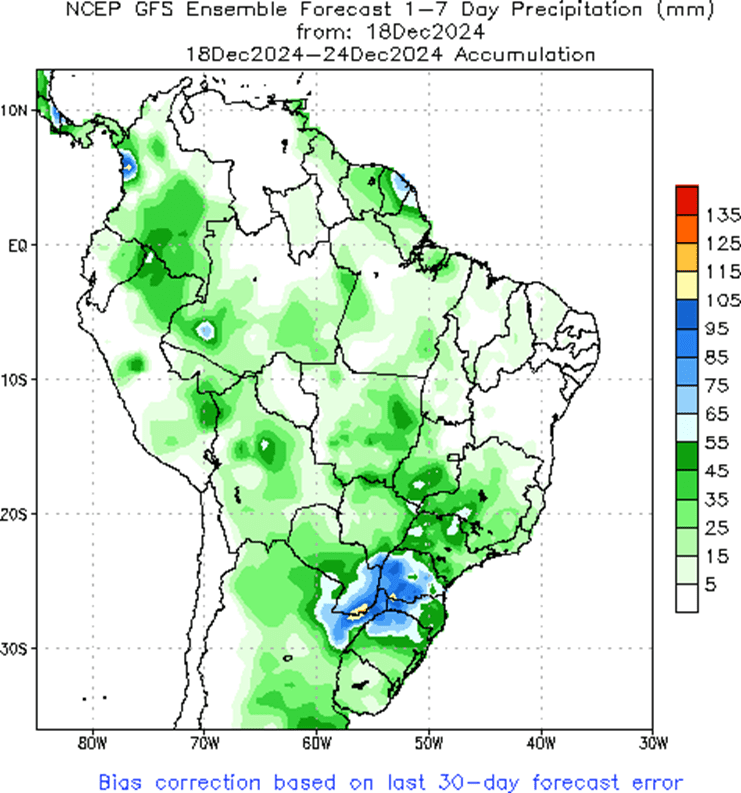

Above: Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.