12-10 End of Day: Markets Close Higher Following USDA Report

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 449 | 7.25 |

| JUL ’25 | 457.25 | 6.75 |

| DEC ’25 | 441.75 | 2.5 |

| Soybeans | ||

| JAN ’25 | 994.75 | 4.75 |

| MAR ’25 | 1000.25 | 4.75 |

| NOV ’25 | 1009.75 | 5 |

| Chicago Wheat | ||

| MAR ’25 | 561.75 | 3 |

| MAY ’25 | 570.5 | 3.25 |

| JUL ’25 | 577 | 3.75 |

| K.C. Wheat | ||

| MAR ’25 | 565.75 | 7 |

| MAY ’25 | 573 | 6.75 |

| JUL ’25 | 580.75 | 6.75 |

| Mpls Wheat | ||

| MAR ’25 | 606.5 | 3.25 |

| JUL ’25 | 621.5 | 3.25 |

| SEP ’25 | 630 | 3.25 |

| S&P 500 | ||

| MAR ’25 | 6123.5 | -9.75 |

| Crude Oil | ||

| FEB ’25 | 68.23 | 0.14 |

| Gold | ||

| FEB ’25 | 2718.2 | 32.4 |

Grain Market Highlights

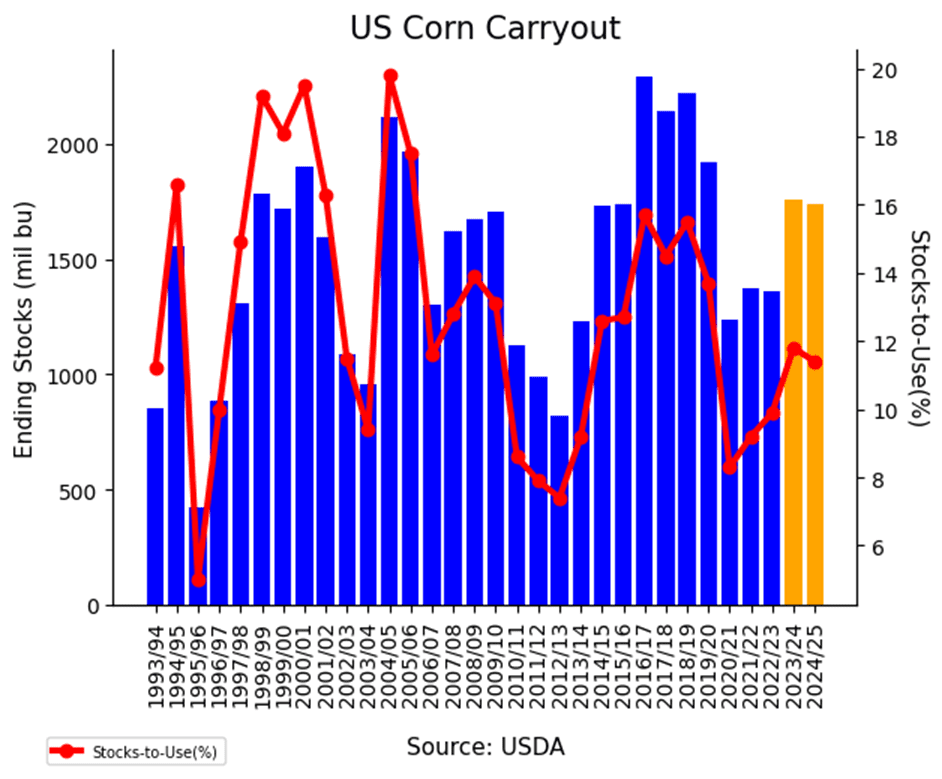

- Bullish US corn ending stocks, which came in well below expectations in today’s USDA report, drove the corn market higher for the fourth consecutive day.

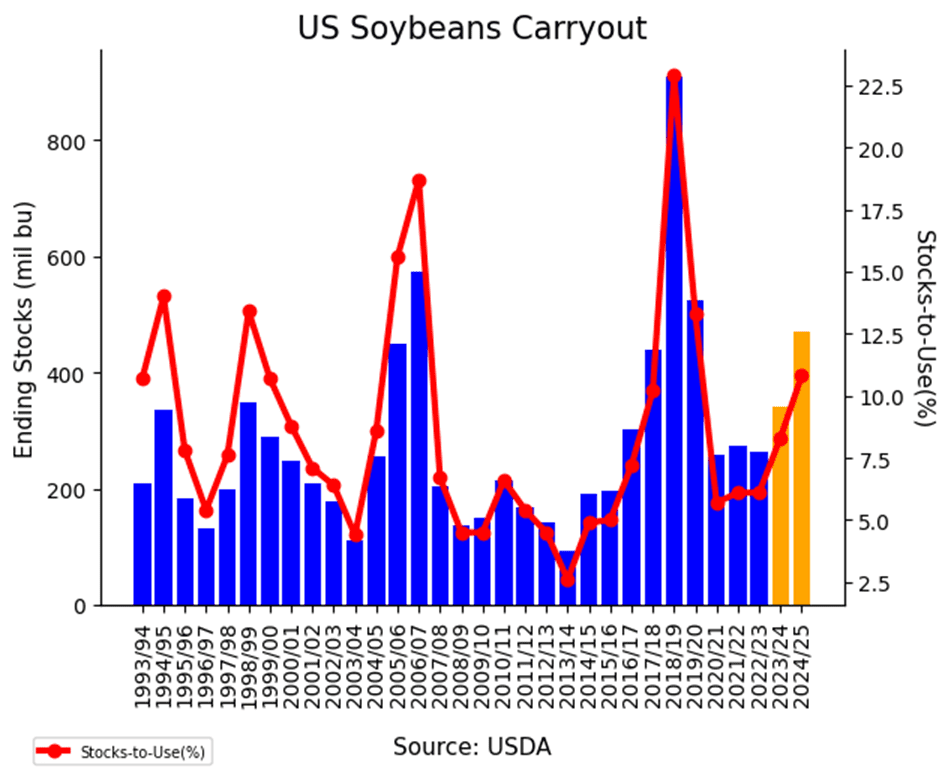

- Soybeans gained support from a higher corn market and settled higher on the day, with the USDA making no significant changes to the soybean balance sheet.

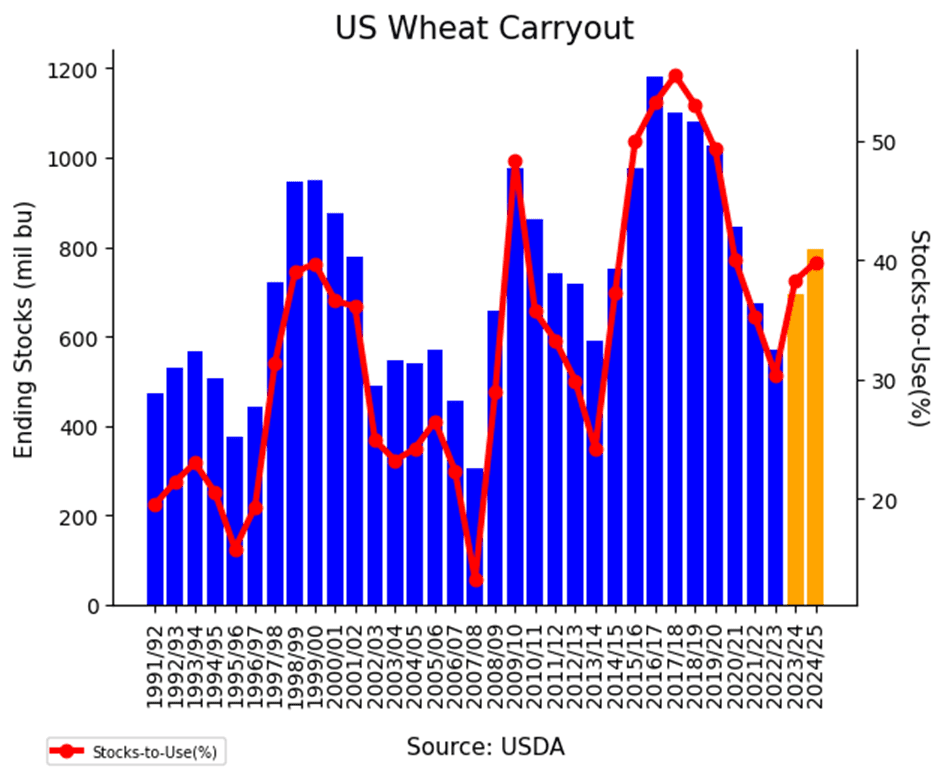

- US wheat ending stocks were unexpectedly reduced by 20 mb in today’s WASDE report, boosting the wheat market to close higher, led by gains in the KC contracts.

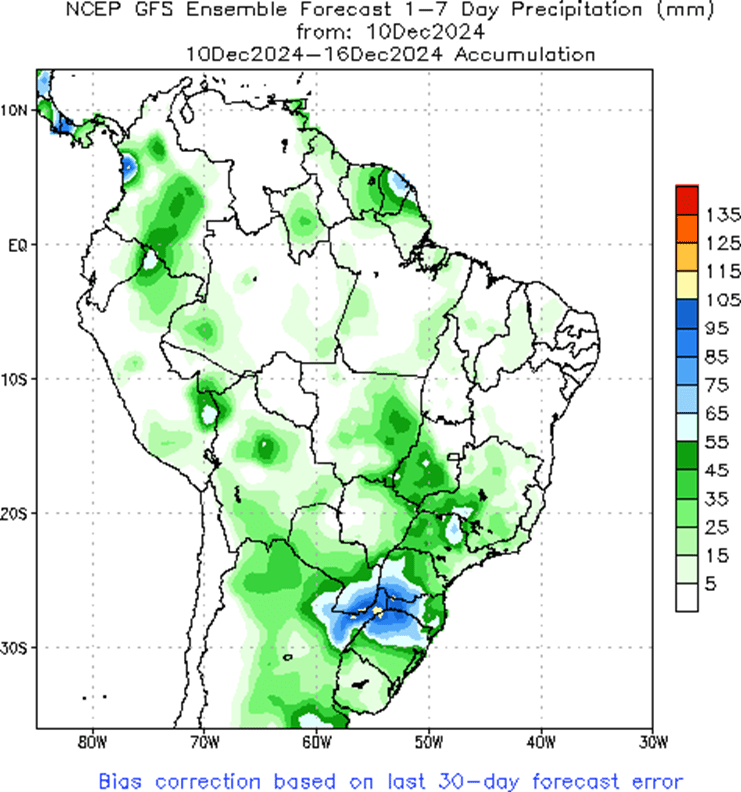

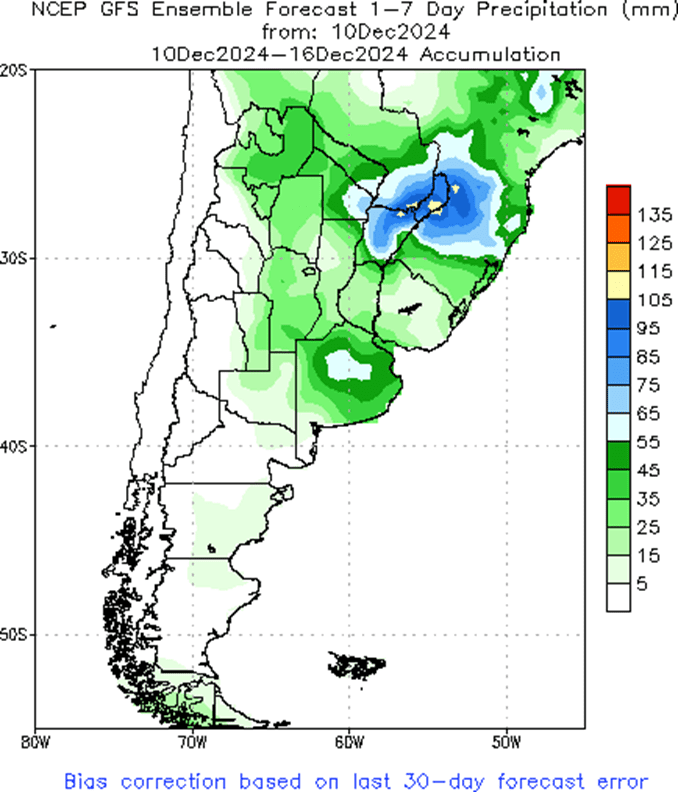

- To see the updated South American precipitation forecasts, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

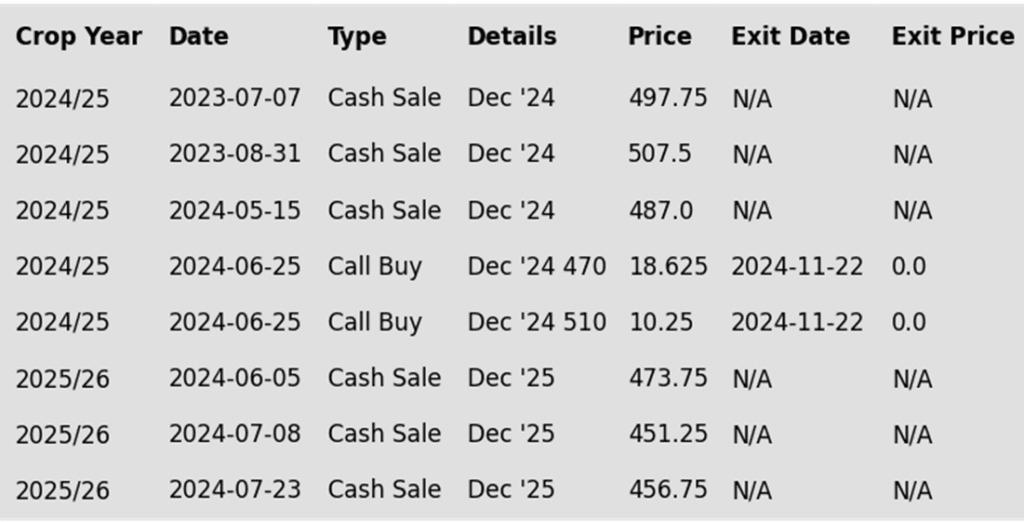

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We are now in the window when seasonal opportunities tend to improve and we anticipate posting target ranges for new sales soon, but they could be as late as early spring.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- As we enter the time of year when seasonal opportunities tend to improve, we will begin posting target ranges for additional sales, though this may not happen until late winter or early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market got a shot in the arm and closed higher for the fourth consecutive day, supported by much lower-than-expected US ending stocks in today’s USDA report.

- The USDA shocked the market by cutting US 24/25 corn carryout by 200 mb to 1.738 bb in today’s WASDE report. Exports were raised by 150 mb, while corn used for ethanol increased by 50 mb.

- The lower carryout number brings 24/25 corn ending stocks below last year’s level, which can be supportive this early in the marketing year.

- While Brazil and Argentina corn production estimates remained unchanged, global corn stocks fell well below expectations to 296.4 mmt due to higher use and lower US supplies.

Above: Front-month corn broke through 442 resistance and could be on its way to testing the 465 June high. If prices happen to retreat, initial support may be found near 442 with additional near 50-day moving average, around 425.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

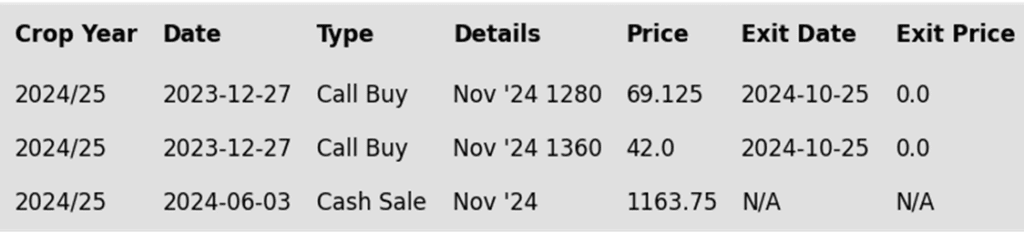

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1100 – 1110 area versus Jan ‘24 to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher after a largely uneventful WASDE report, likely supported by bullish corn data. Soybean meal also rose, while soybean oil ended lower.

- The USDA report left soybean production, yield, and ending stocks unchanged at 470 mb. Brazilian production remained at 169.0 mb, while Argentina’s was revised up to 52.0 mb from 51.0 mb.

- CONAB reported Brazilian soybean planting at 94% complete, up 4% from last week, with favorable weather supporting the crop.

- China imported 7.15 mmt of soybeans in November, down 10% from last year and below expectations of 8 mmt. Rumors surfaced of China canceling 4–6 December cargoes from the PNW.

Above: The soybean market continues to drift sideways, with support at 975 and resistance in the 1007–1013 range. A close below 975 could trigger a slide toward 940, while a close above 1013 may set up a retest of 1045.

Wheat

Market Notes: Wheat

- Wheat posted gains across all categories, supported by a favorable WASDE report, despite strength in the US Dollar Index.

- The USDA lowered US 24/25 wheat carryout to 795 mb from 815 mb, exceeding expectations, while world ending stocks for 23/24 and 24/25 were slightly raised. US wheat exports were increased by 25 mb to 850 mb.

- Global wheat production was reduced from 794.73 mmt to 792.95 mmt. Brazil’s production fell to 8.1 mmt, while Argentina and Australia remained steady at 17.5 mmt and 32.0 mmt, respectively. Russian exports dropped 1 mmt to 47.0 mmt, while Ukraine’s rose 0.5 mmt to 16.5 mmt.

- Egypt’s grain purchasing system has shifted to military control, replacing GASC. As a key wheat supplier, Russia is monitoring potential impacts on its exports.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

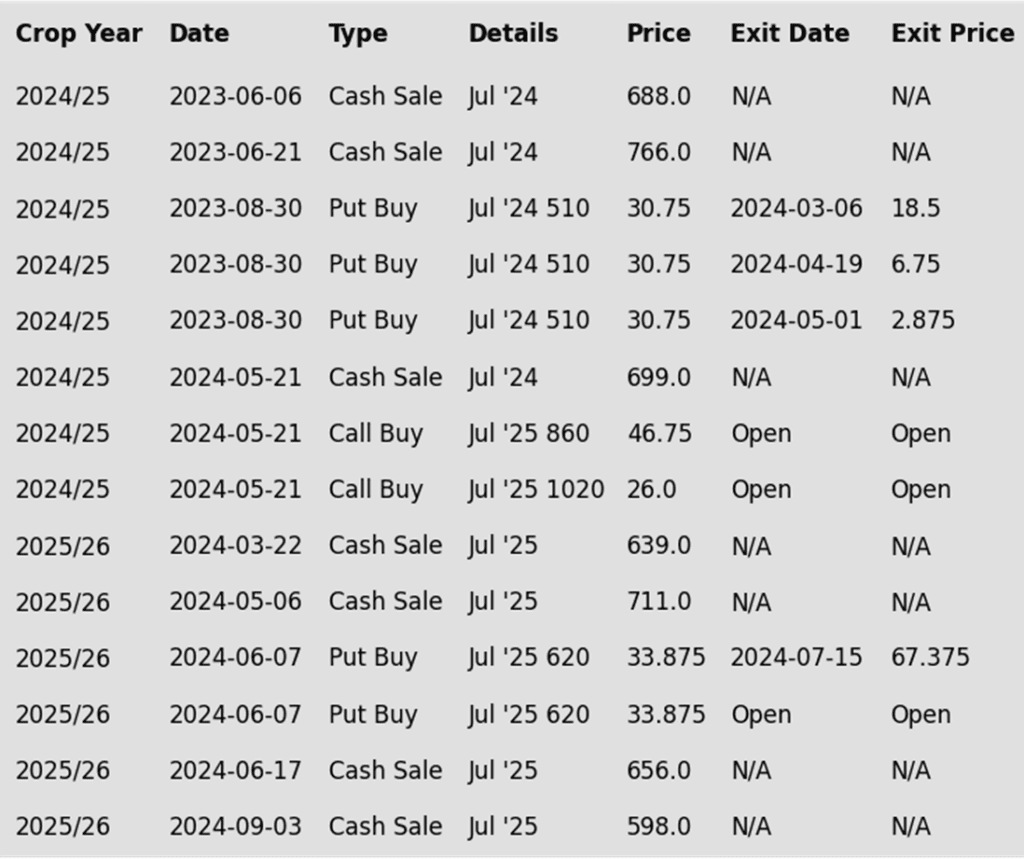

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

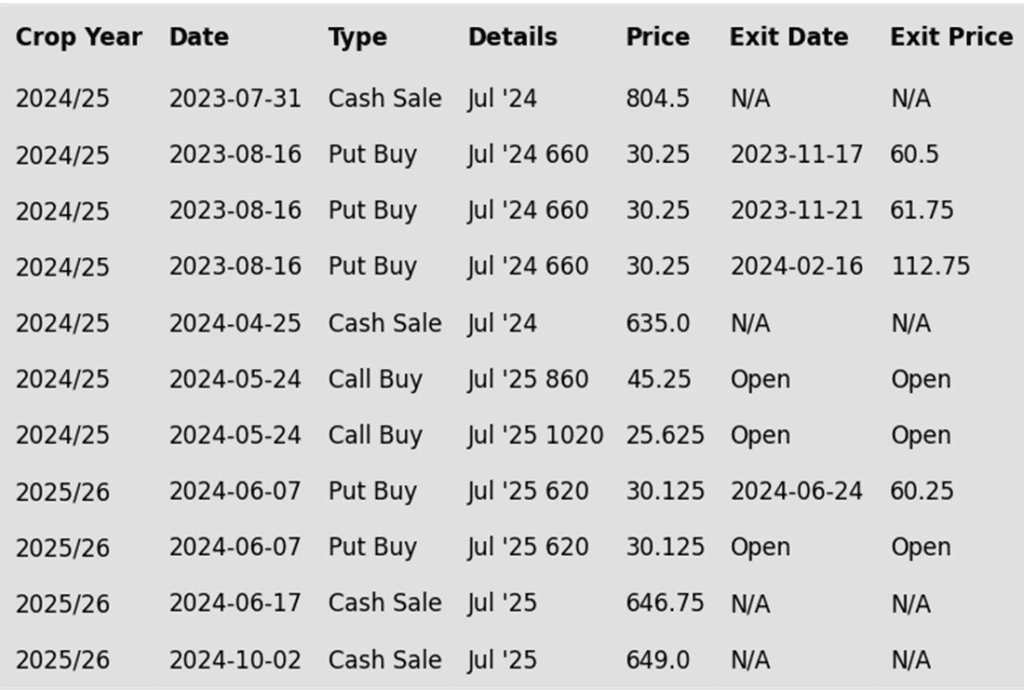

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

Above: March KC wheat remains rangebound between 536 and 577. A close below 536 could put the market at risk of testing the August low of 527 ¼. Conversely, a bullish trigger could lead to resistance near 567 before a retest of 577.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

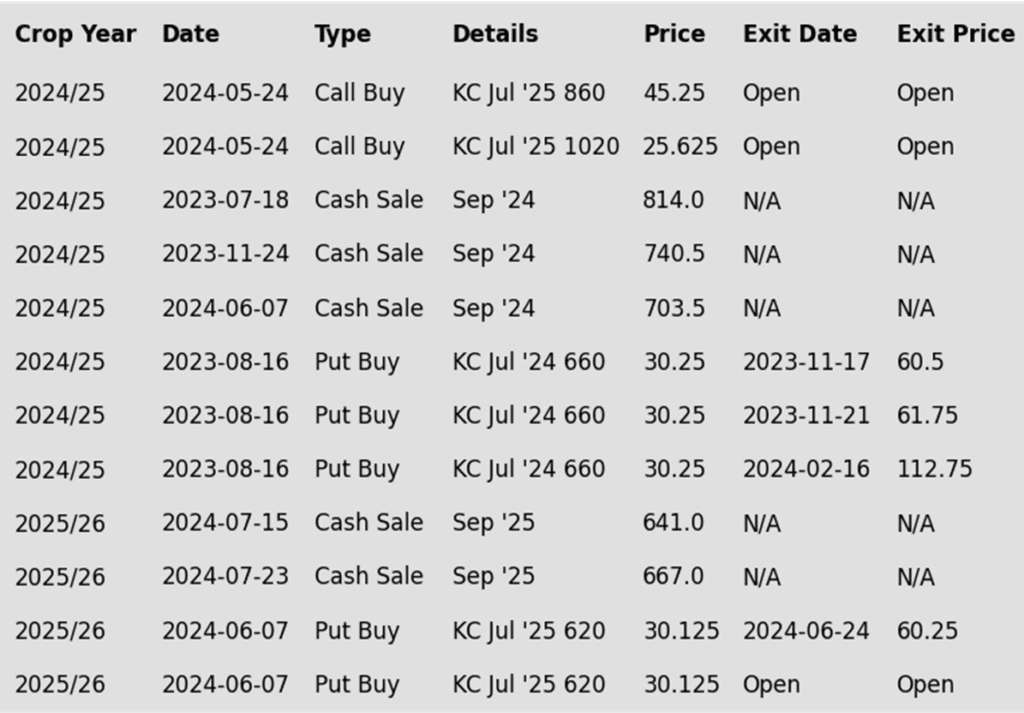

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Above: Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.