12-05 End of Day: Another SRW Sale to China Supports Wheat and Corn; Bean Complex Closes Mixed

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 490.5 | 5 |

| JUL ’24 | 510.25 | 4.5 |

| DEC ’24 | 515.75 | 2.5 |

| Soybeans | ||

| JAN ’24 | 1305.5 | -0.75 |

| MAR ’24 | 1326.5 | 0 |

| NOV ’24 | 1273.5 | 0.5 |

| Chicago Wheat | ||

| MAR ’24 | 631.25 | 10.75 |

| MAY ’24 | 644 | 10 |

| JUL ’24 | 651.5 | 8 |

| K.C. Wheat | ||

| MAR ’24 | 662.75 | 5 |

| MAY ’24 | 666.75 | 5 |

| JUL ’24 | 670 | 4.5 |

| Mpls Wheat | ||

| MAR ’24 | 739 | 2.75 |

| JUL ’24 | 759.75 | 3.25 |

| SEP ’24 | 768.25 | 2.75 |

| S&P 500 | ||

| MAR ’24 | 4624 | -2.5 |

| Crude Oil | ||

| FEB ’24 | 72.66 | -0.66 |

| Gold | ||

| FEB ’24 | 2037.2 | -5 |

Grain Market Highlights

- Strength from higher wheat likely triggered more short covering in the corn market, which led it to close just off its highs following two sided trade.

- Following firmer prices overnight and a strong opening of the day session, soybeans traded lower throughout much of the day on sharply lower soybean oil and expectations of more favorable Brazilian weather before turning back higher to close fractionally mixed on sharply higher soybean meal.

- Soybean oil likely came under pressure from a Bloomberg survey of plantation exec.’s, analysts, and traders that estimated Malaysian palm oil stocks at the highest level in 3 years. Meanwhile, soybean meal traded higher off extremely oversold conditions, supporting soybeans and Board crush margins.

- The report of another large private sale totaling 198k mt of SRW wheat to China ignited a gap higher in Chicago wheat as the markets reopened for the day session. Markets stayed mostly firm throughout the day in all three classes. Minneapolis and KC closed mid-range and well off session highs, with Chicago closing just 5 cents of its highs.

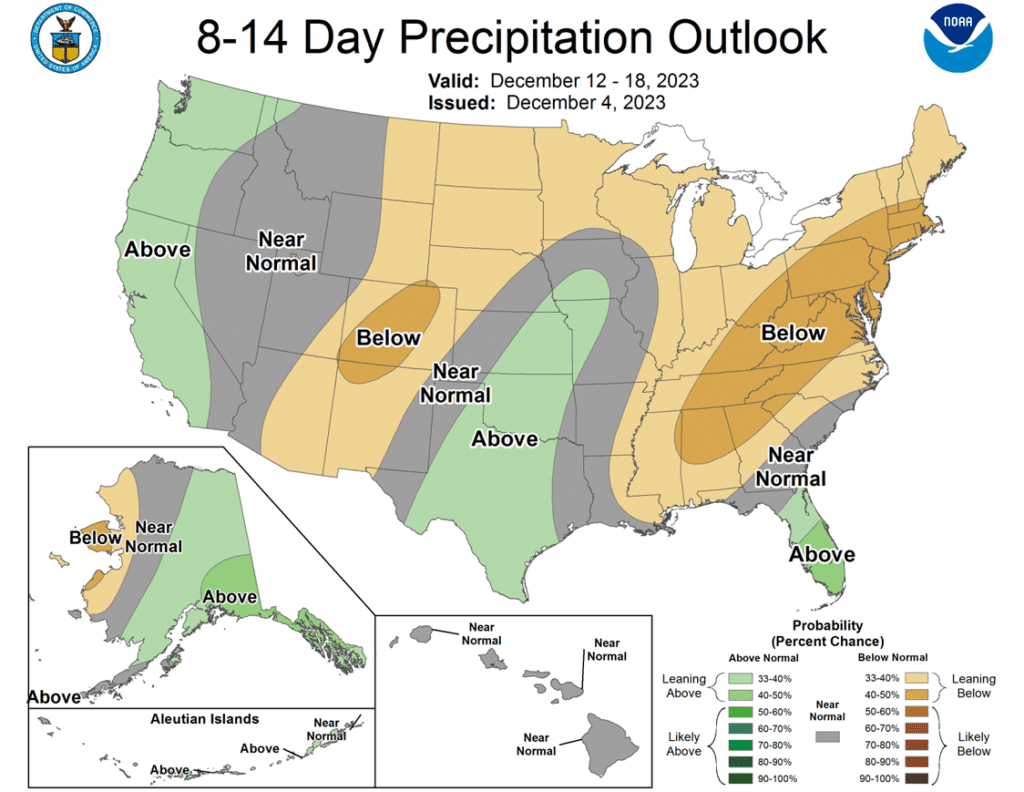

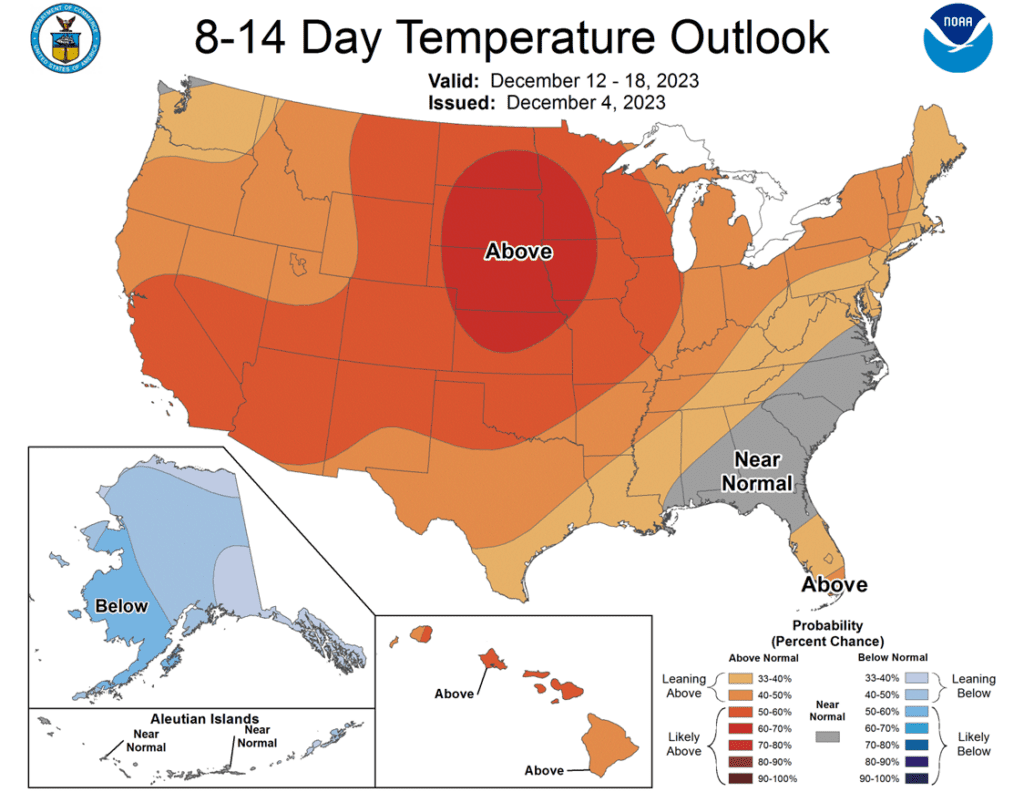

- To see the updated US 8 – 14 day temperature and precipitation outlooks, and Brazil and Argentina’s 2 week forecast precipitation as a percent of normal, courtesy of the National Weather Service, Climate Prediction Center, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

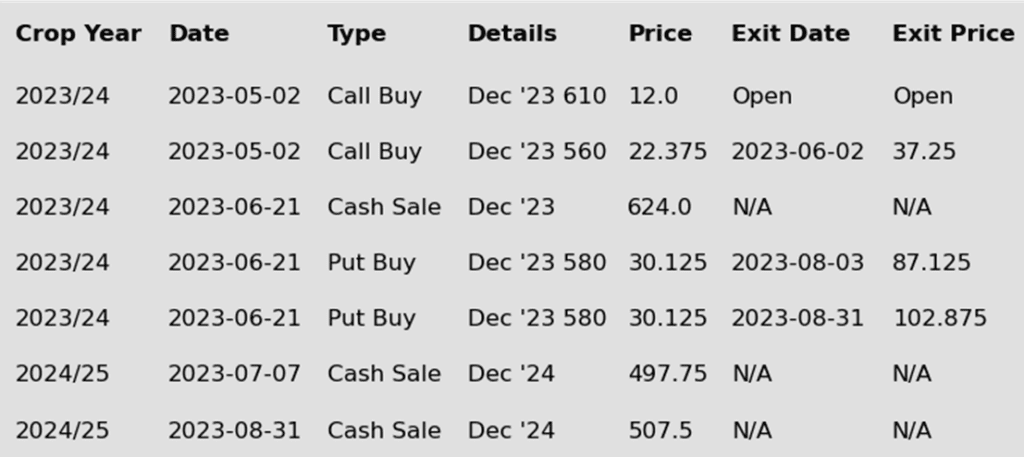

Corn Action Plan Summary

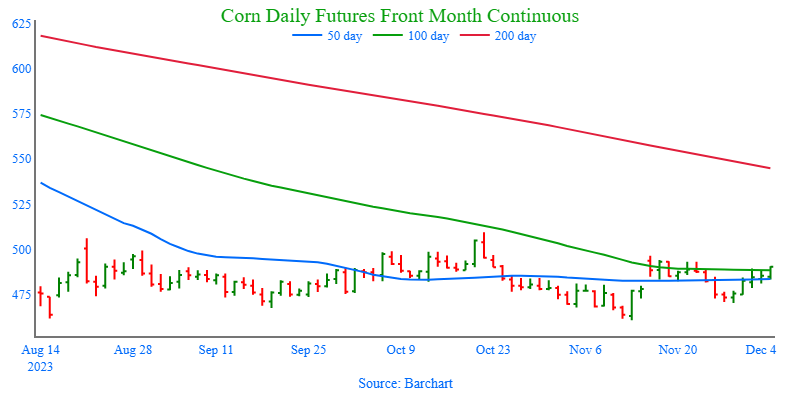

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of November’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. For now, Grain Market Insider will continue to hold tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 485 ¾ on the bottom and 602 on the top. After testing 491 to 547 last July, it has mostly traded between 500 and 525. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus crop prices as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without a bullish catalyst. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying Dec ‘23 560 and 610 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished with moderate gains on Tuesday, as late buying strength in the grain markets, and a strong wheat market helped push corn prices higher. March corn added 5 cents and posted its highest close in nearly two weeks.

- Funds have built a net short position of 206,478 contracts in last week’s Commitment of Trader’s report. The improved technical picture and the price strength in wheat is leading to an end-of-year short covering rally in corn. The upside may stay limited due to large supplies, but an improved demand picture could help sustain the rally into 2024.

- The USDA will release the next WASDE report on Friday, December 8. The grain market is likely going to square positions going into the report, and for corn, could see additional short covering and possible price support.

- The corn market is waiting for Chinese export demand, which is currently down 71% year-over-year at this point, but China has been active in the US wheat export market recently, and that has helped trigger some optimism in the extremely short corn market.

- Weak price action in the crude oil market could limit buying strength in corn, as well as other commodities. Ethanol margins are still positive, but could be squeezed with crude oil challenging the lower $70 a barrel price level.

Above: The corn market has so far held nearby support near 470, while knocking on the door of nearby overhead resistance at 496. Heavy resistance remains between 500 and 509 ½, and the market will need more bullish influence to push through and test the mid 500’s. Below the market, further support remains near 460, and 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

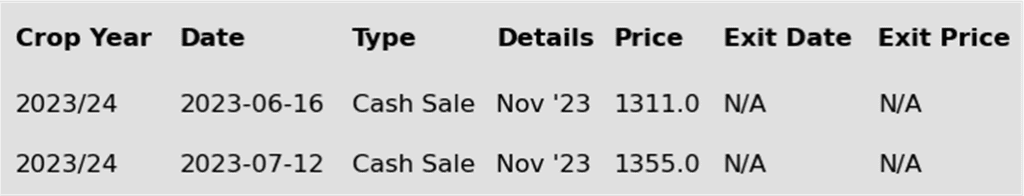

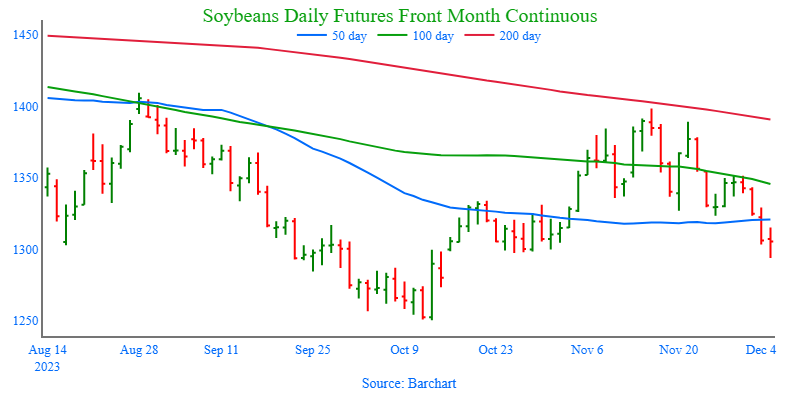

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. Since August, the 2023 soybean market has traded mostly between 1250 and 1400. After trading to 1251 last October, the Jan ’24 contract went on to test the Nov ’23 contract’s August high near 1400, but failed to break through the heavy resistance and has since retreated. Last summer, Grain Market Insider made two sales recommendations in the 1310 – 1360 price window versus Nov ’23, and while seasonally, we are at the time of year when prices tend to rally into the end of the year, due to the considerable overhead resistance in the market, Grain Market Insider may consider making additional old crop sales prior to year’s end.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. While the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last May. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the earliest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans traded both sides of unchanged throughout the day, but ultimately closed mixed, with the January contract slightly lower, March unchanged, and November slightly higher. Soybean meal was lower throughout the day, but rallied into the close, which supported soybeans.

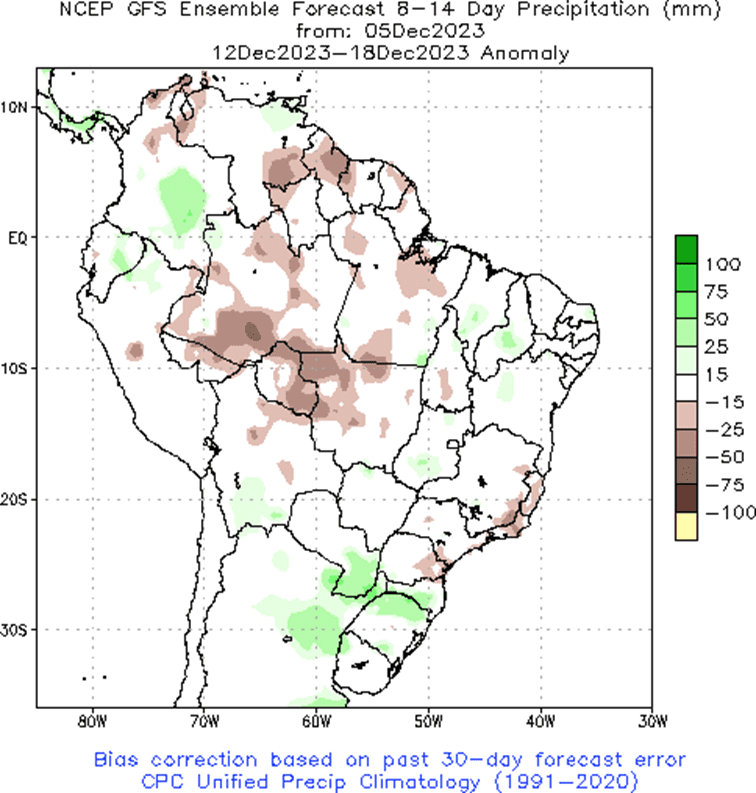

- Brazilian weather has improved significantly, with rain having fallen in some of the driest areas of the country with more expected. Despite this change, 4.2% of Mato Grosso, which is the largest soybean producing state, will need to be replanted, and many analysts are revising their estimates of total production lower. Many estimates are now closer to 150 mmt, compared to the 163 mmt estimated by the USDA.

- In Malaysia, palm oil reserves have reportedly risen to a 4-year high at 2.48 million tons. This is the seventh month in a row that palm oil stockpiles have risen there as production outpaces export demand. These large supplies could be a factor in pressuring US soybean oil.

- Yesterday’s soybean inspections were reported at 40.7 mb, which was on the low end, and although export demand has picked up recently, sales are still down by 17%. Yesterday, a sale of soybean cake and meal was reported to the Philippines totaling 183,000 mt. This Friday, the USDA will release their WASDE report, and it will be revealed if any changes are made to demand.

Above: On November 15, January soybeans posted a bearish reversal after coming within 11 cents of the August high. Since then, the market has retested the recent high and failed, creating a head-and-shoulders pattern, which suggests a potential to test October’s 1250 low unless bullish input enters the market. For now, heavy resistance remains between 1400 and 1410, with nearby resistance near 1350. Support below the market remains near 1297.

Wheat

Market Notes: Wheat

- Wheat was able to rally today in the face of a lower close for Paris milling wheat futures, and a US Dollar Index that is making another leg higher. Fund short covering appears to persist, as another announced sale of US wheat to China was confirmed today by the USDA. Today’s sale was for 198,000 mt of SRW wheat, in addition to yesterday’s 440,000 mt sale, their largest purchase in three years.

- Globally, there is still uncertainty about what wheat production will look like. Bearish figures were released by both Stats Canada and ABARE (Australia). The Canadian wheat production estimate was pegged at 31.954 mmt, higher than trade expectations and last month’s number of 29.835 mmt. Additionally, the estimate of Australian wheat production was raised to 25.5 mmt, which is 1 mmt above the current USDA projection.

- With a current wheat import duty at 40%, India is said to be considering lowering that to between 15% and 20% to import up to 1 mmt of Russian wheat. India’s internal wheat prices remain high, and this may be an effort to reduce food price inflation.

- The next WASDE report will be released this Friday. Pre-report estimates call for little to no change for US wheat ending stocks, with the same being true for corn and soybeans. The world ending stocks are projected to remain neutral as well, with no major changes expected.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

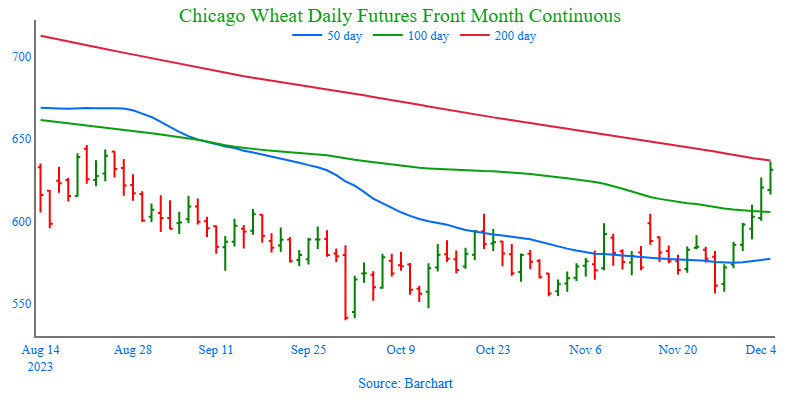

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, nearby Chicago wheat trended lower until finding support at 540. During that time, driven by weak US export demand and lower world wheat prices, funds established most of their short position that currently exceeds 100,000 contracts. While bearish obstacles remain, the large short fund position and a seasonal pattern that is currently supportive, could fuel an extended short-covering rally. Earlier this year, Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. Since July, new crop Chicago wheat has slowly worked its way lower with no significant opportunities to make additional sales. The lower market was driven mostly by managed fund selling from lower world wheat prices and weak US demand. As the market sold off, it became significantly oversold with managed funds building a short position in excess of 100,000 contracts. While bearish headwinds remain, the large fund short position and oversold condition of the market are two factors that could fuel a sizeable, short-covering rally. Additionally, price seasonals are supportive as prices tend to build in some risk premium going into the winter months. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

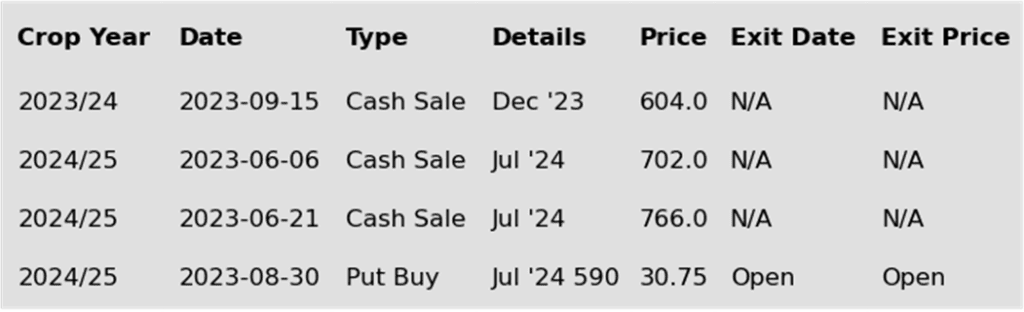

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Chicago wheat recently broke out of its trading range and approaching resistance between the 200-day moving average and the late August highs near 645, driven largely by short covering and the seasonal build up of weather premium. For now, support below the market comes in near the 50-day moving average, around 575, and again between 555 and 540.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

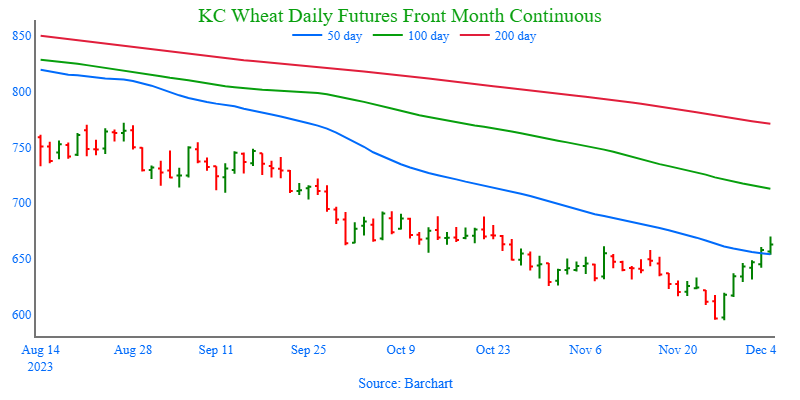

- No new action is recommended for 2023 KC wheat crop. Since late July old crop KC wheat has been in a downtrend that has largely been driven by managed fund selling on low world wheat prices and weak US export demand. As the selloff progressed, the market became oversold, and the funds established the largest short position in three years. Even though bullish headwinds remain, these two factors have fueled the recent short-covering rally, which could extend much further if a bullish catalyst enters the market. This would also line up with the historical tendency for price appreciation as the market builds risk premium going into wintertime. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover and may consider suggesting additional sales if prices become over extended.

- No new action is recommended for 2024 KC wheat. At the end of August, the Jul ’24 contract broke out of roughly a one-year trading range, between 740 and 860, to the downside. Since that breakout, the market has continued to slowly stair-step lower, largely driven by managed fund selling, weak US export demand, and lower world wheat prices. As the selloff progressed, the funds built up the largest net short position in three years. While bearish headwinds remain, the significant oversold condition of the market and the large fund net short position are two factors that could fuel a short-covering rally in the months ahead. Price seasonals are also supportive as prices tend to build in some risk premium going into the winter months. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. Though as the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

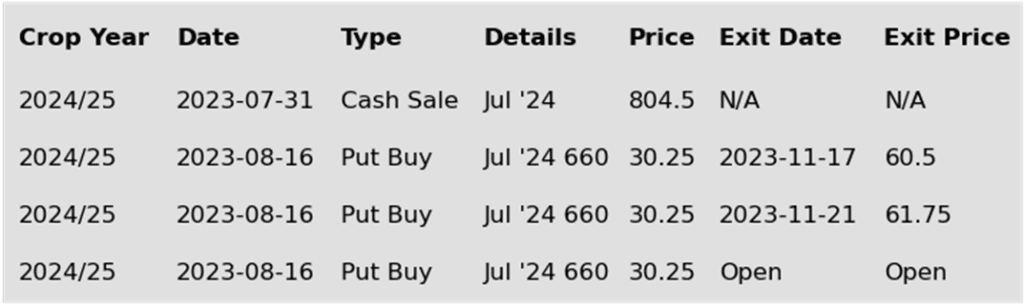

To date, Grain Market Insider has issued the following KC recommendations:

Above: Since the end of November, the wheat market has rallied largely on short covering activity from being extremely oversold. The market is now showing signs of being overbought, though its close above 661 and the 50-day moving average suggests that it may test the October highs around 692. If not, and prices retreat, support below the market will likely come in between 595 and 575.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

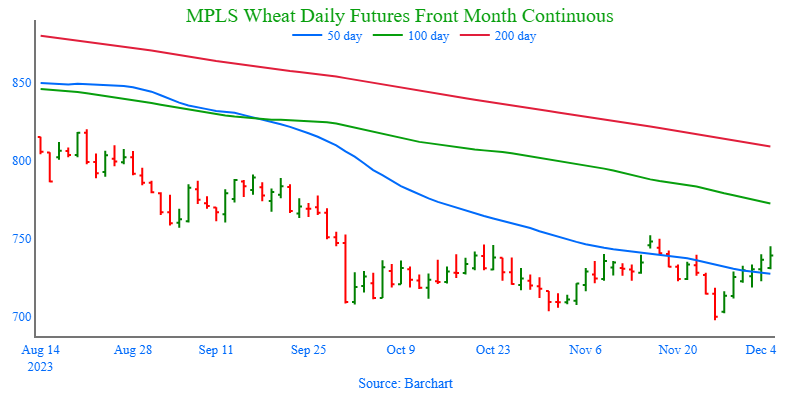

- No new action is currently recommended for the 2023 New Crop. Following last July’s rally, the market has slowly stair-stepped lower, primarily due to low world wheat prices, weak US export demand, and managed fund selling. With the funds building a record large short position as the market sold off. Since weak US export demand remains the main impediment to higher prices, the market continues to be at risk of further downside erosion. The record large fund short position could fuel a rally back higher if a bullish catalyst enters the scene, and if that happens, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation this winter with an eye on considering additional sales around 725 – 775, and again north of 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Minneapolis wheat. At the end of August, the Sept ’24 contract traded to a peak of 871 ¾ and has continued to slowly stair-step lower, largely driven by lower world wheat prices, weak US export demand, and managed fund selling, and as the selloff progressed, the funds built up a record large short position. While bearish headwinds remain, the significant oversold condition of the market and the large fund net short position are two factors that could fuel a short-covering rally in the months ahead. Price seasonals are also supportive as prices tend to build in some risk premium going into the winter months. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat. Though recently, as the KC market extended further into oversold territory and the July ‘24 KC wheat contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. For now, moving forward, Grain Market Insider is prepared to recommend exiting the last 25% of the open puts on any further supportive market developments.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After making a new contract low on November 27, the March contract found buying interest from its oversold status and record fund short. The market will need more bullish input to push prices above resistance at 740 and 750, at which point they could run toward 790. If prices retreat, support could be found near the recent low of 697 ½ before the May ’21 low of 669.

Other Charts / Weather

Brazil 2 week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.

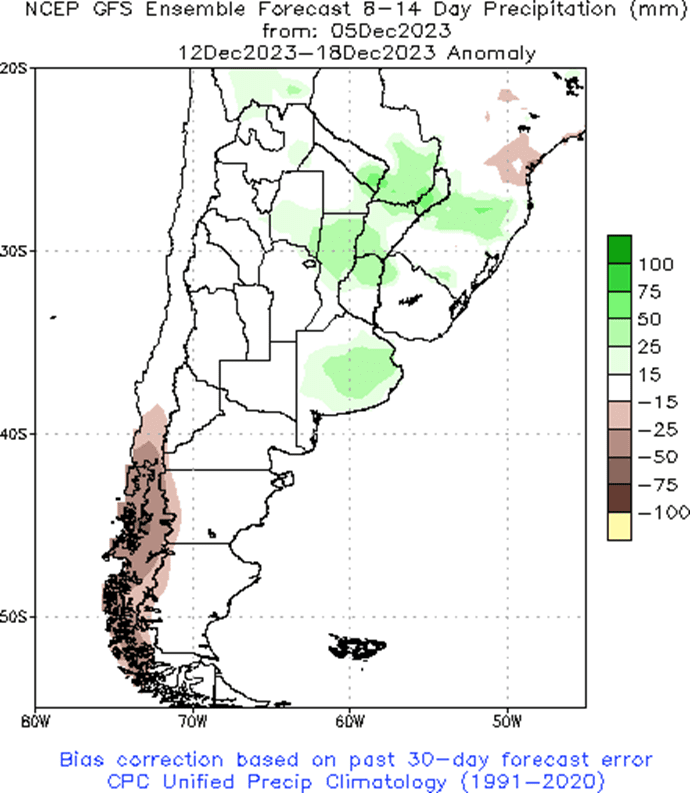

Argentina 2 week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.