12-01 End of Day: Short Covering Carries Grains Higher as Beans Retreat.

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 484.75 | 2 |

| JUL ’24 | 506 | 1.75 |

| DEC ’24 | 513.75 | 1.5 |

| Soybeans | ||

| JAN ’24 | 1325 | -17.75 |

| MAR ’24 | 1345.5 | -16.75 |

| NOV ’24 | 1282.25 | -11.75 |

| Chicago Wheat | ||

| MAR ’24 | 602.75 | 4.75 |

| MAY ’24 | 617 | 4.25 |

| JUL ’24 | 628.25 | 3.5 |

| K.C. Wheat | ||

| MAR ’24 | 646.75 | 3.75 |

| MAY ’24 | 651.5 | 4 |

| JUL ’24 | 656 | 3.5 |

| Mpls Wheat | ||

| MAR ’24 | 730.25 | 0.75 |

| JUL ’24 | 750.5 | 1.75 |

| SEP ’24 | 760.25 | 3 |

| S&P 500 | ||

| MAR ’24 | 4648.75 | 22 |

| Crude Oil | ||

| FEB ’24 | 74.65 | -1.4 |

| Gold | ||

| FEB ’24 | 2087.3 | 30.1 |

Grain Market Highlights

- The recent drop in open interest, along with the rising wheat market and sizable fund short position in corn, suggests traders have likely been covering short positions in the corn market and supporting prices, which have closed higher for the third day in a row.

- Profit taking and the prospect of a more normal South American weather pattern led the soybean market to a lower close with lower meal and soybean oil adding to the negativity.

- Friendly bio/renewable diesel data out of the EIA’s monthly report failed to support soybean oil which followed both palm and crude oil lower. While larger crop prospects out of Argentina continues to weigh on soybean meal.

- The wheat complex settled in the green again for the fourth day in a row. Open interest in all three classes has dropped over the same time frame suggesting that the rally has likely been driven short covering from the markets recently being oversold.

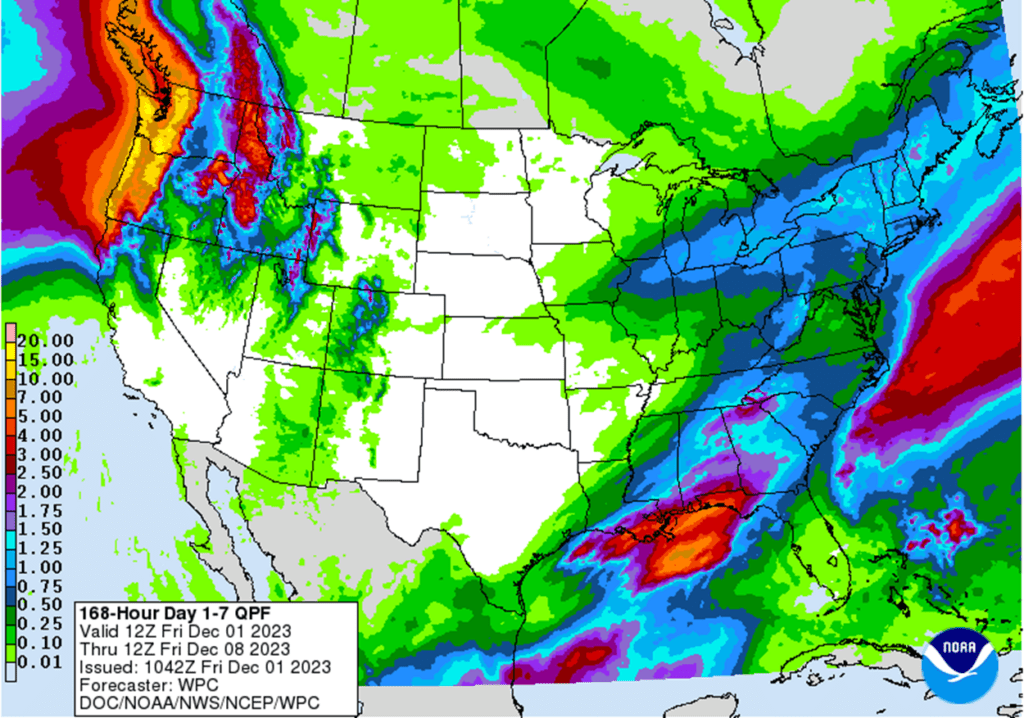

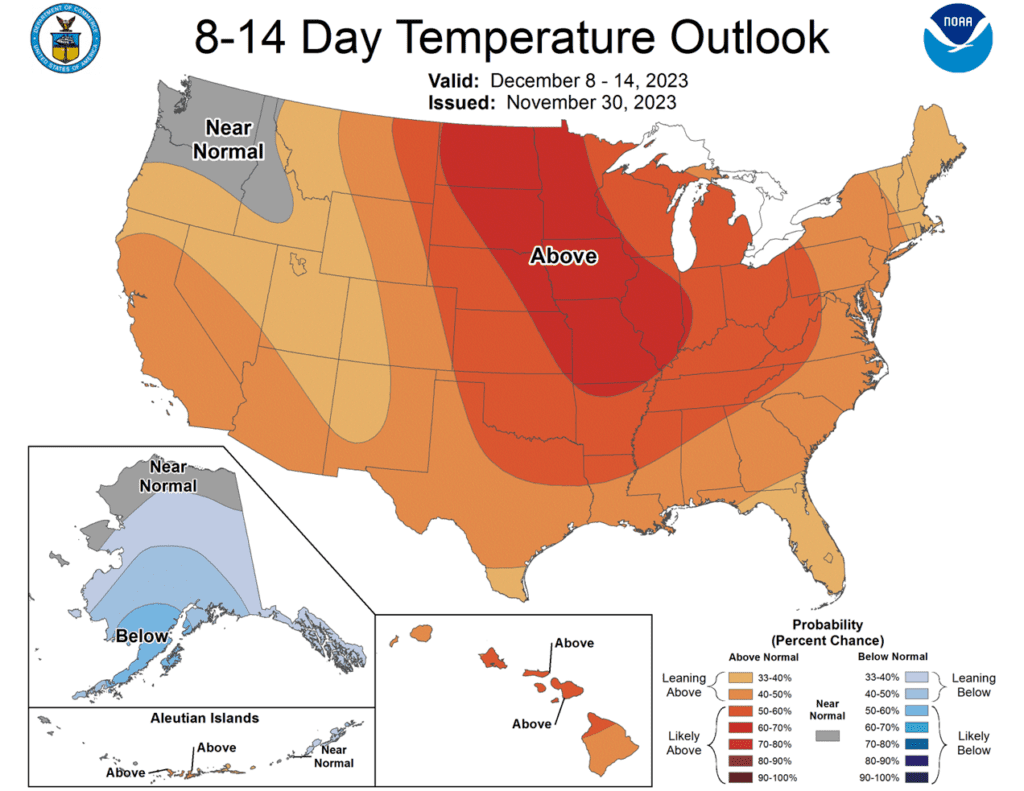

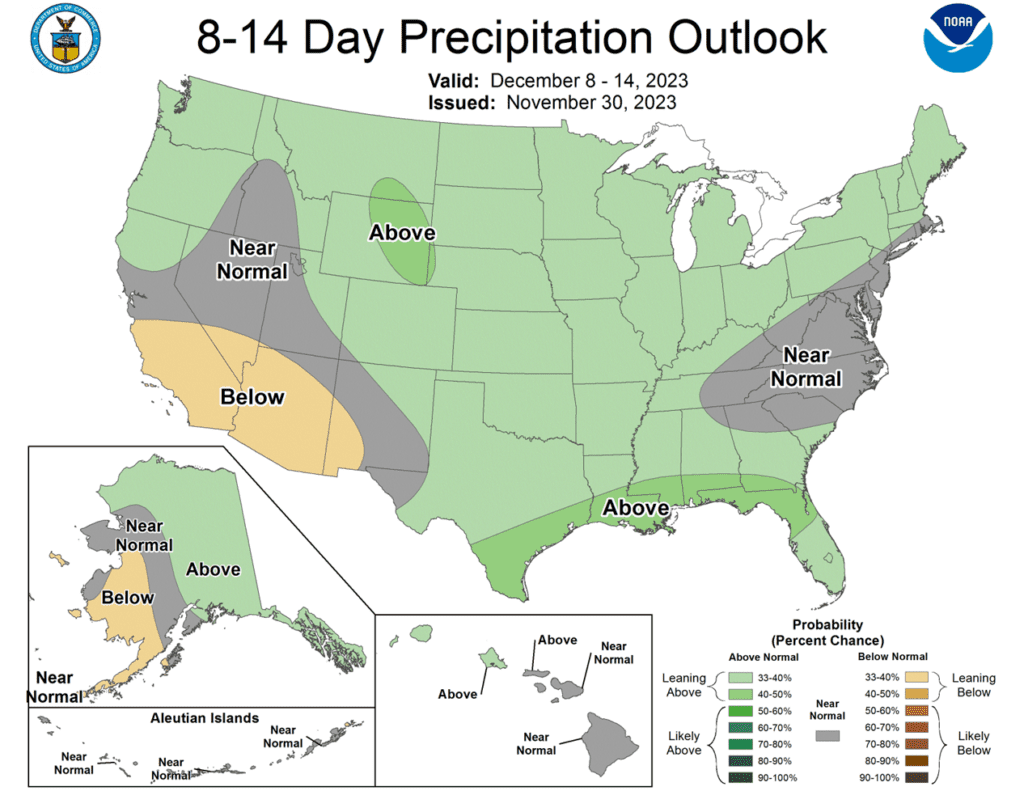

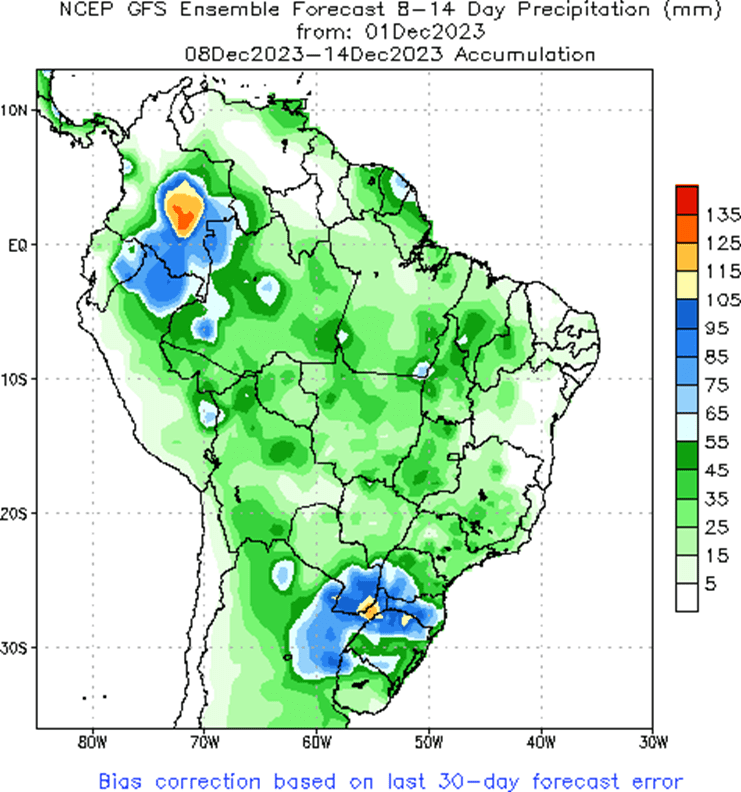

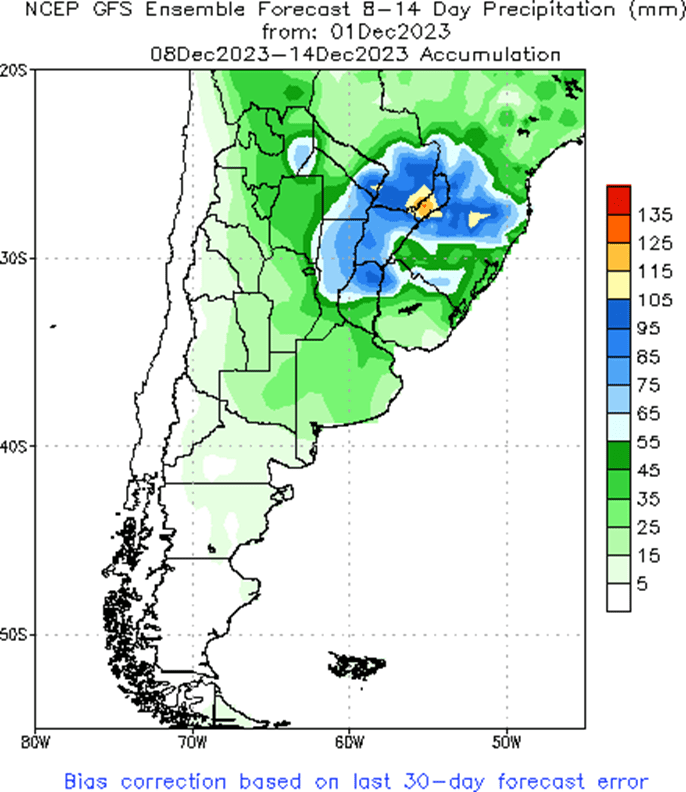

- To see the updated US 7-day precipitation forecast, the 8 – 14 day temperature and precipitation outlooks, and the Brazil and Argentina 2 week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of November’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. For now, Grain Market Insider will continue to hold tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 485 ¾ on the bottom and 602 on the top. After testing 491 to 547 last July, it has mostly traded between 500 and 525. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus crop prices as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without a bullish catalyst. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying Dec ‘23 560 and 610 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures rallied off session lows to finish with marginal gains on Friday. March corn gained 2 cents on the session. For the week, March corn settled 1 ½ cents over last week’s close and 13 ½ cents off the lows for this week.

- Weakness in the soybean market and crude oil market in the afternoon limited the corn rally. Soybeans are staying focused on South American weather, which has some rainfall potential for the weekend into next week. Argentina weather stays improved, the prospects of a “normal” corn and soybean crop next spring limits the corn market’s ability to rally.

- December corn is now in the delivery period. There were “zero” deliveries against the December futures on Thursday, but 221 contract on Friday. The delivered bushels and retendering of those bushels provided the weakness in the morning trade.

- Funds are still carrying a sizable bearish bet on corn futures with an estimated net short of 200,000 contracts. The improved technical picture with this week’s strength and jump in demand could have the funds squaring positions into the end of the year, supporting a limited price rally.

- South American weather will stay a focus of the grain markets going into December and the end of the year. The prospects of further soybean planting delays will push second-crop corn planting back even further. The current South American weather could potentially be a larger corn story in late spring and summer.

Above: The nearby corn contract has rejected the 100-day moving average on the daily continuous chart and has slipped below the 50-day moving average. Initial resistance now rests just above the market near 496 with further heavy resistance between 500 and 509 ½. Support below the market remains near 460, with the next major area of support near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. At the end of August, the soybean market turned lower and didn’t find any significant buying interest until it traded down to 1251 in early October. Since then, the nearby contract has traded through the 50-day moving average and tested the August high. Looking back, since last May, nearby soybeans have been in a range from 1435 up top to 1251 down below. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Seasonally, we are at the time of year when prices tend to rally into year’s end, and if the markets remain firm to higher in the next few weeks, Grain Market Insider may consider suggesting making additional old crop sales, while also continuing to be on the lookout for any call option buying opportunities to help protect current and future sales.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop, from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. And while the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last July. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

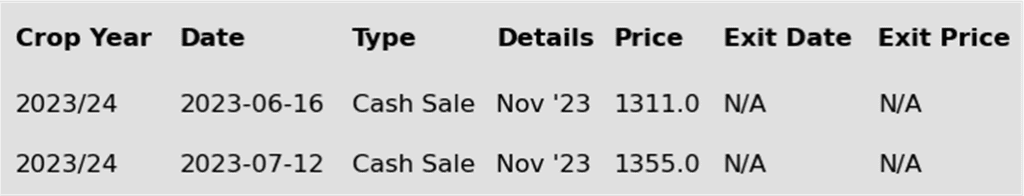

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower with pressure from sharply lower soybean meal as traders prepare for an influx of Argentinian meal now that their weather forecasts have turned more favorable. Soybean oil ended the day slightly lower but has held up relatively well compared to meal.

- This week held more positive news for export demand with the USDA reporting an increase of 69.6 mb of soybean export sales in 23/24 last week and big export shipments of 54.3 mb. In addition, two large private sales were reported this morning with one to China in the amount of 132,000 mt and one to unknown in the amount of 198,000 mt. Both were for the 23/24 marketing year.

- Tight US ending stocks and strong demand both domestically and for exports have been a key factor in keeping soybean futures elevated, but South American weather is looking like less of a problem now, and large combined production between Brazil and Argentina could pressure prices in the coming months.

- Thanks to strong cash markets, there have been no deliveries against the December contracts for either soybean meal or oil. Crush margins also remain firm despite some recent weakness in the soy products. Soybean oil has a good outlook with renewable fuel production in September reportedly record large and 43% higher than the previous year.

Above: On November 15, January soybeans posted a bearish reversal after coming within 11 cents of the August high. Since then, the market has retested the recent high and failed, creating a head-and-shoulders pattern which suggests a potential to test October’s 1250 low unless bullish input enters the market. For now, heavy resistance remains between 1400 and 1410, with support below the market near the 50-day moving average and again near 1297.

Wheat

Market Notes: Wheat

- The wheat market managed another positive close for all three US classes. Paris milling wheat also finished on a positive note. Support also stemming from possible short covering on oversold conditions, and a lower US Dollar Index.

- There are rumors that France has sold 2.5 mmt of wheat to China for December through March. For the week ending November 23, China was the top buyer of US wheat, purchasing 197,300 tons.

- It is possible that China may be buying wheat for their reserves since there is similar talk in the corn market, that China may purchase 30-40 mmt, whereas the USDA is looking for 23 mmt. These purchases may be due to political tension, but the reasoning remains unclear.

- Stats Canada will release their next update on December 4. Pre-report estimates peg wheat production at 0.7% higher for 2023 versus Stats Canada’s previous forecast. The average guess is for 30.03 mmt of production, with 29.30 mmt on the low end and 30.90 mmt on the high end.

- The Buenos Aires Grain Exchange kept their 23/24 wheat production estimate unchanged at 14.7 mmt, versus 12.2 mmt last year, and they stated that the harvest has advanced to 36.4% complete from 26.4%.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, nearby Chicago wheat trended lower until finding support at 540. During that time, driven by weak US export demand and lower world wheat prices, funds established most of their short position that currently exceeds 100,000 contracts. While bearish obstacles remain, the large short fund position and a seasonal pattern that is currently supportive, could fuel an extended short-covering rally. Earlier this year, Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. Since July, new crop Chicago wheat has slowly worked its way lower with no significant opportunities to make additional sales. The lower market was driven mostly by managed fund selling from lower world wheat prices and weak US demand. As the market sold off, it became significantly oversold with managed funds building a short position in excess of 100,000 contracts. While bearish headwinds remain, the large fund short position and oversold condition of the market are two factors that could fuel a sizeable, short-covering rally. Additionally, price seasonals are supportive as prices tend to build in some risk premium going into the winter months. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

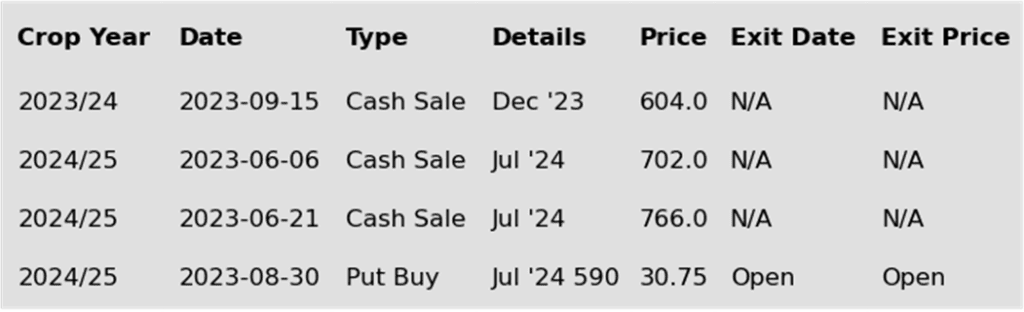

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Chicago wheat continues to trade in a broad range between 604 ½ up top, and 540 on the bottom, with most activity between 595 and 555. The market continues to need a significant bullish catalyst to drive prices higher above 604 ½. While short covering and profit taking continues to occur near the bottom end of the range, if the market breaches 540 support, it runs the risk of further erosion.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since late July old crop KC wheat has been in a downtrend that has largely been driven by managed fund selling on low world wheat prices and weak US export demand. As the selloff progressed, the market became oversold, and the funds established the largest short position in three years. Even though bullish headwinds remain, these two factors have fueled the recent short-covering rally, which could extend much further if a bullish catalyst enters the market. This would also line up with the historical tendency for price appreciation as the market builds risk premium going into wintertime. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover and may consider suggesting additional sales if prices become over extended.

- No new action is recommended for 2024 KC wheat. At the end of August, the Jul ’24 contract broke out of roughly a one-year trading range, between 740 and 860, to the downside. Since that breakout, the market has continued to slowly stair-step lower, largely driven by managed fund selling, weak US export demand, and lower world wheat prices. As the selloff progressed, the funds built up the largest net short position in three years. While bearish headwinds remain, the significant oversold condition of the market and the large fund net short position are two factors that could fuel a short-covering rally in the months ahead. Price seasonals are also supportive as prices tend to build in some risk premium going into the winter months. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. Though as the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

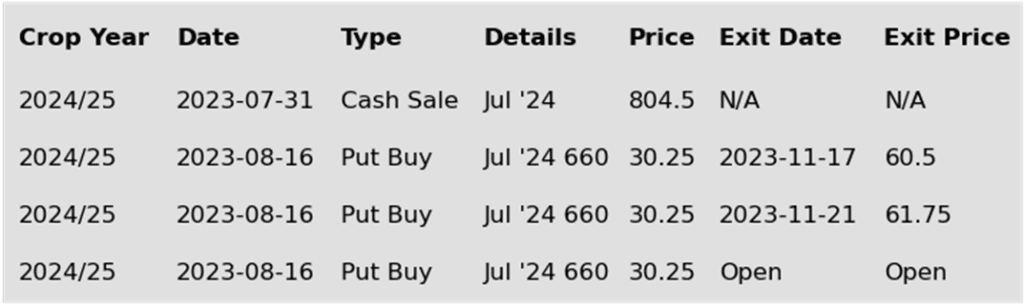

To date, Grain Market Insider has issued the following KC recommendations:

Above: The recent resumption of the downtrend has left the KC wheat market oversold with resistance now above the market between 633 and 661. The market’s oversold status can be supportive if a catalyst enters the market to turn prices back higher. Without a bullish catalyst, March ’24 runs the risk of retreating further and testing 575 support.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

Active

Sell SEP ’24 Cash

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. Following last July’s rally, the market has slowly stair-stepped lower, primarily due to low world wheat prices, weak US export demand, and managed fund selling. With the funds building a record large short position as the market sold off. Since weak US export demand remains the main impediment to higher prices, the market continues to be at risk of further downside erosion. The record large fund short position could fuel a rally back higher if a bullish catalyst enters the scene, and if that happens, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation this winter with an eye on considering additional sales around 725 – 775, and again north of 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 Spring wheat crop. Since late July, Sept ’24 Mpls wheat has been slowly stair-stepping lower, providing no rallies of substance to sell into. While we see improving conditions in the market that could provide fuel for a bottom and future upside sales opportunities, we also know historically, that if the market breaks support this time of year, it poses the risk that prices could continue to trend overall lower into spring of next year. All that said, a close below 743 support would signal that a trend lower into next year is a risk. Although Grain Market Insider still looks for higher prices, we know from our historical research the importance of having a “plan b” this time of year. With a daily close below 743, Grain Market Insider will recommend selling a portion of your 2024 crop while prices are still relatively elevated and historically good in case they erode further. While the mid-700s may not be the 1000 or higher that we’ve seen in the last two years, it remains much better than the possible 500 – 600 that the market saw back in 2020 and early 2021.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After making a new contract low on November 27, the March contract found buying interest from its oversold status and record fund short. The market will need more bullish input to push prices above resistance at 740 and 750, at which point they could run toward 790. If prices retreat, support could be found near the recent low of 697 ½ before the May ’21 low of 669.

Other Charts / Weather

Brazil 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Argentina 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.