11-28 End of Day: Beans and Wheat Close Higher in Typical Turnaround Tuesday Fashion.

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 451.5 | -4 |

| MAR ’24 | 473.5 | -1.75 |

| DEC ’24 | 505.75 | 1.5 |

| Soybeans | ||

| JAN ’24 | 1346.5 | 16.75 |

| MAR ’24 | 1364.75 | 16.5 |

| NOV ’24 | 1293 | 12.75 |

| Chicago Wheat | ||

| DEC ’23 | 543.75 | 9.5 |

| MAR ’24 | 572 | 11 |

| JUL ’24 | 601.75 | 12.75 |

| K.C. Wheat | ||

| DEC ’23 | 613 | 23 |

| MAR ’24 | 617.75 | 21.25 |

| JUL ’24 | 629.25 | 19 |

| Mpls Wheat | ||

| DEC ’23 | 694.5 | 10 |

| MAR ’24 | 713.25 | 13.5 |

| SEP ’24 | 741.5 | 12.25 |

| S&P 500 | ||

| DEC ’23 | 4561 | 0 |

| Crude Oil | ||

| JAN ’24 | 76.51 | 1.65 |

| Gold | ||

| JAN ’24 | 2053.8 | 30.7 |

Grain Market Highlights

- Position squaring and December ’23 liquidation ahead of Thursday’s first notice day likely led to bear spreading in the corn market, as traders sold the December contract versus the deferred contracts.

- Soybeans followed through to the upside and closed higher on the day with the aid of a 123k mt sale to unknown destinations and support from sharply higher soybean oil.

- Buying in January soybean oil carried over from Monday’s firmer trade and closed 1.88 cents higher with support coming from sharply higher crude oil. Meanwhile, soybean meal likely succumbed to some long liquidation ahead of first notice day and a fund position that is the largest since last March.

- While all three wheat classes shed some of the recent weakness and closed higher on the day, KC led the rally which posted a bullish key reversal.

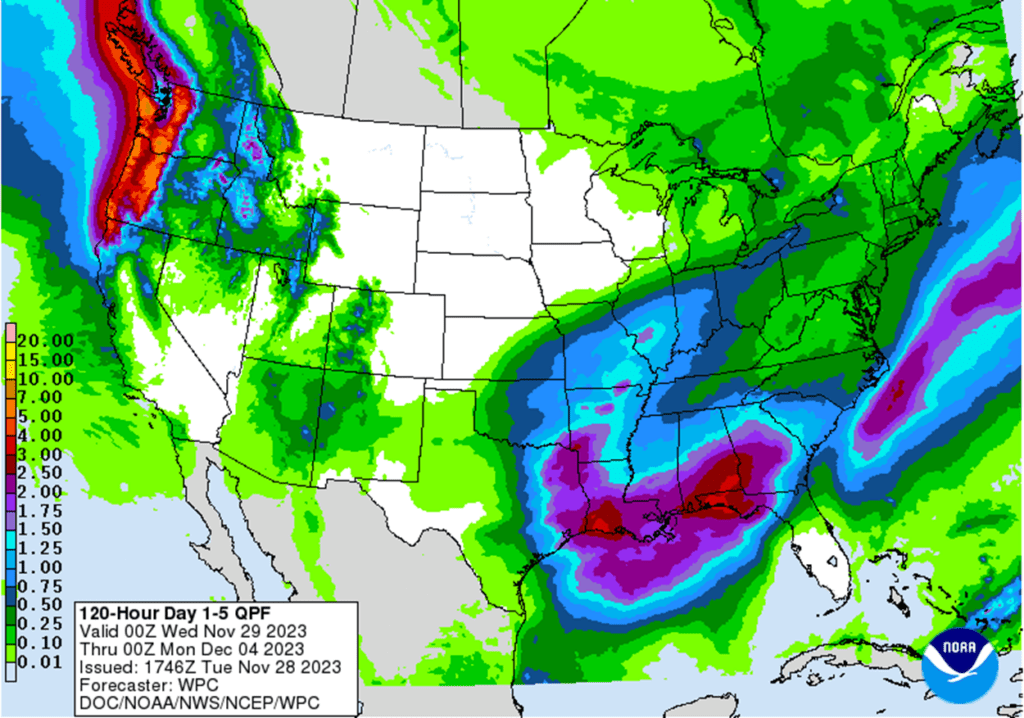

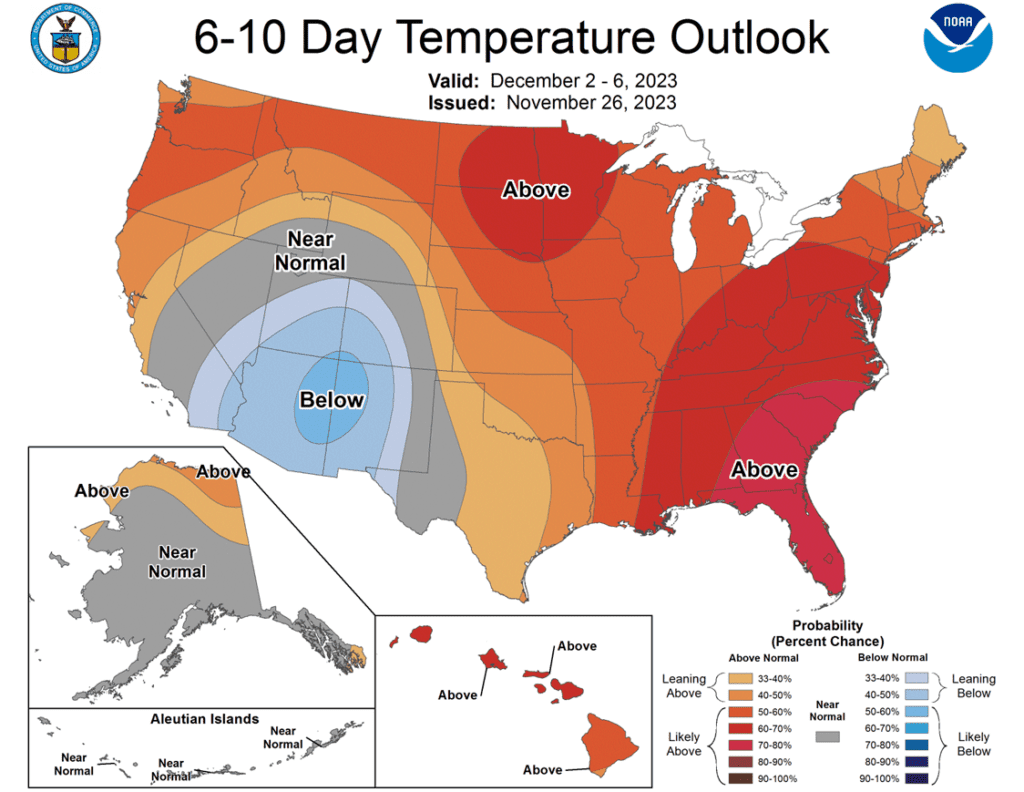

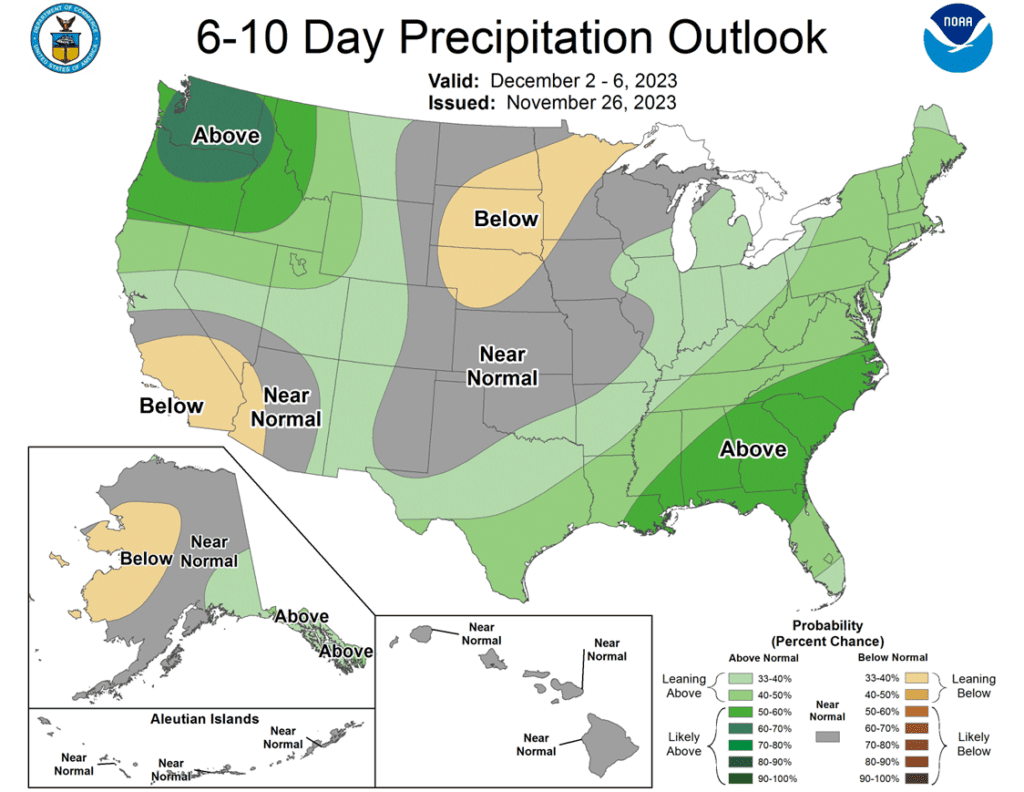

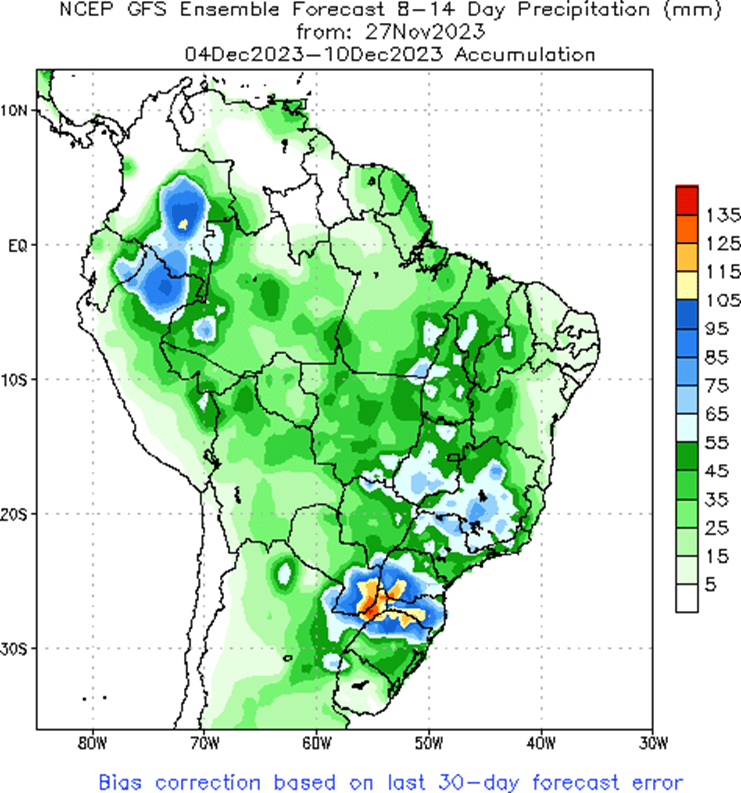

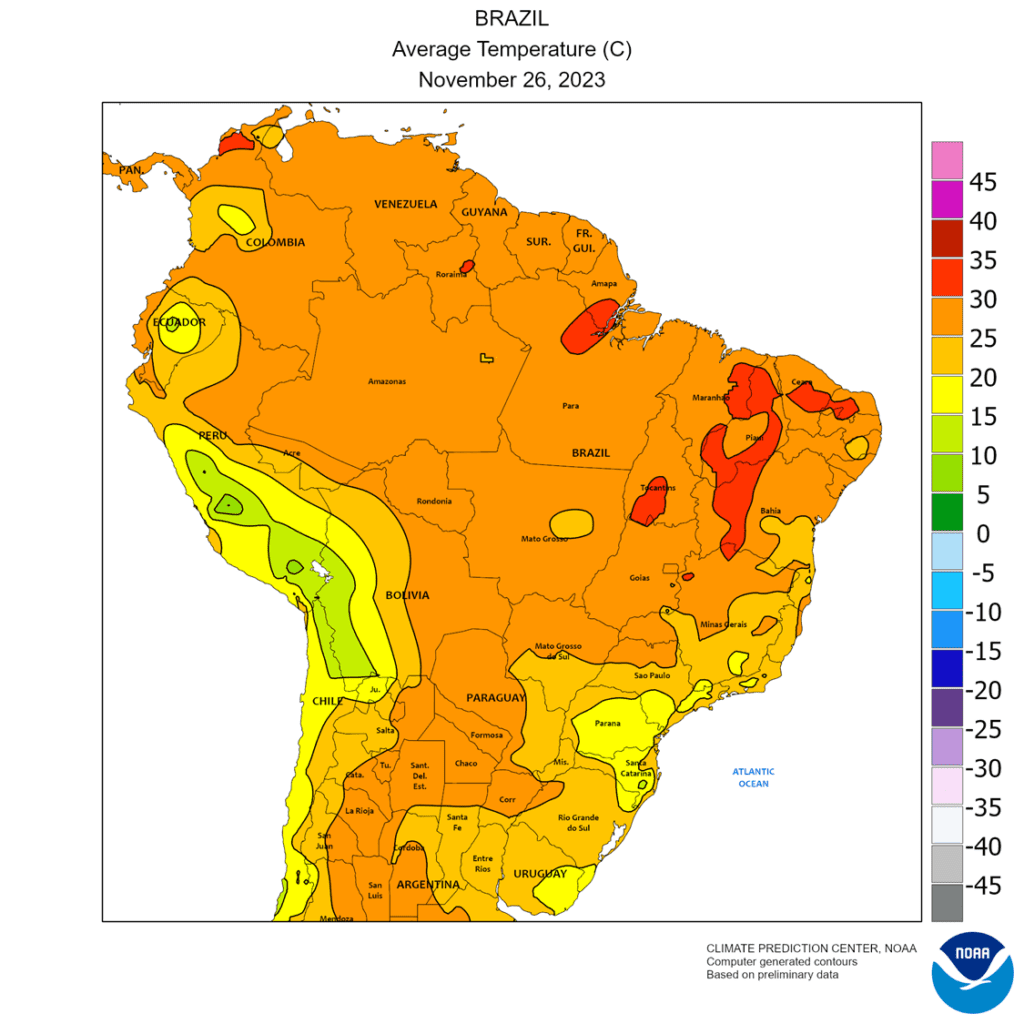

- To see the updated US 5 day precipitation forecast and 6 – 10 day Temperature and Precipitation Outlooks, and the Brazil 2-week forecast precipitation and average temperatures, courtesy of the National Weather Service, Climate Prediction Center, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of November’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 489 ¾ on the bottom and 600 on the top. After testing 491 to 547 last July, it has mostly traded between 500 and 525. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus Dec ’23 as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

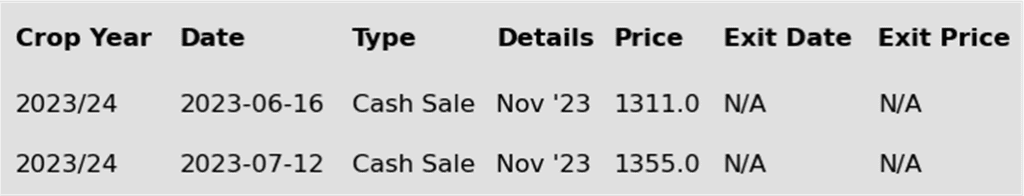

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Despite strong buying in other grain markets and the commodity sector in general, corn futures closed mixed on the session. With selling pressure in the front-end contracts, December corn lost 4 cents for the day.

- The upcoming first notice day for December corn is Thursday, 11/30, and that may have added to the selling pressure since the holder of long corn contracts needs to exit those positions or risk the prospects of delivery.

- Strong buying in the wheat market and soybean market helped limit the downside in corn futures. Wheat futures shook off earlier session pressure to post positive closes. December corn did test key support at a new low of 450, and that level could be a key psychological price point which could trigger additional support if prices can hold above it.

- Buying in the crude oil market likely helped support corn prices. Ethanol margins will likely remain supportive based on improved gasoline demand and driving over the past holiday weekend.

- Corn harvest is basically complete as the USDA reported corn harvest at 96% complete on this week’s Crop Progress report. Hedge pressure should start being minimized as extra supplies that were pushed on to the market are being worked through, and producers are storing bushels to encourage a more supportive cash market.

Above: The nearby corn contract has rejected the 100-day moving average on the daily continuous chart and has slipped below the 50-day moving average. Initial resistance now rests just above the market near 496 with further heavy resistance between 500 and 509 ½. Support below the market remains near 460, with the next major area of support near 415.

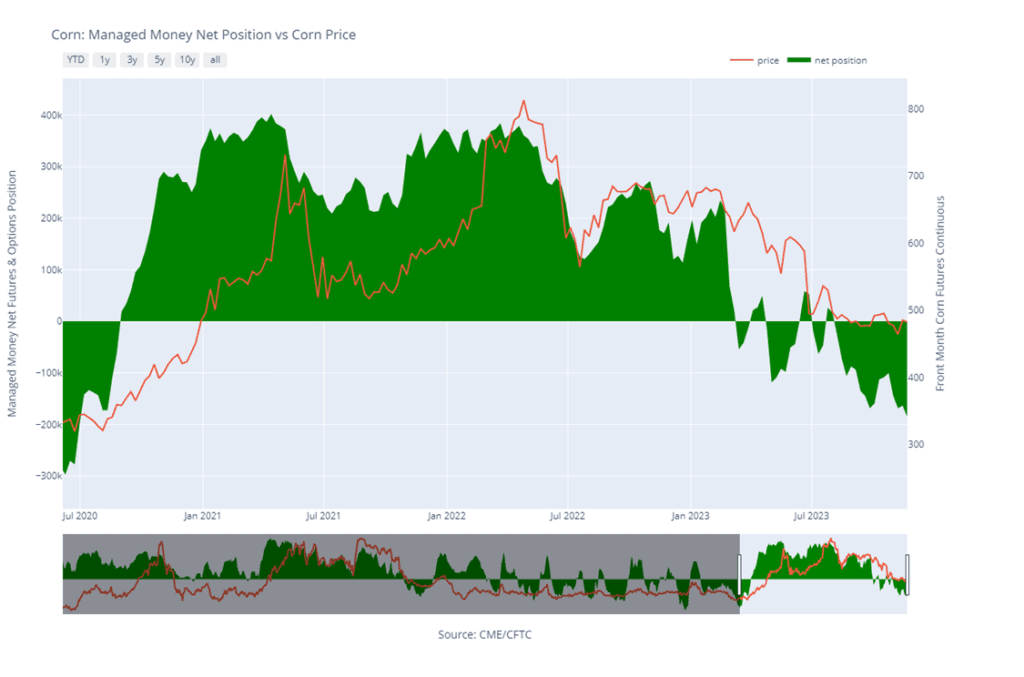

Corn Managed Money Funds net position as of Tuesday, November 21. Net position in Green versus price in Red. Managers net sold 22,016 contracts between November 15 – 21, bringing their total position to a net short 185,502 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

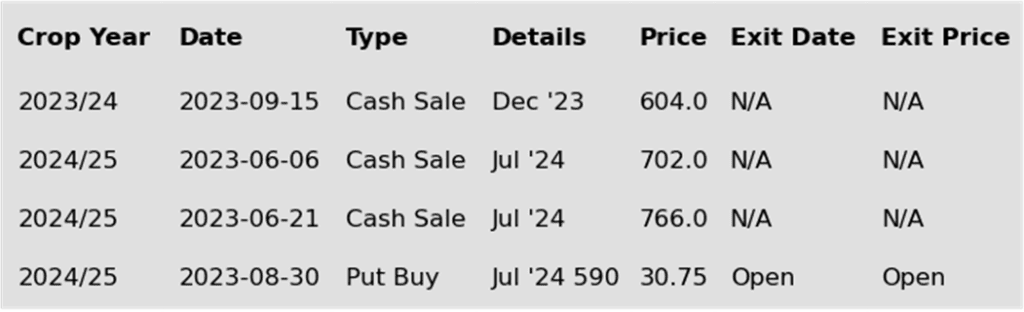

- No new action is recommended for 2023 soybeans. At the end of August, the soybean market turned lower and didn’t find any significant buying interest until it traded down to 1251 in early October. Since then, the nearby contract has traded through the 50-day moving average and tested the August high. Looking back, since last May, nearby soybeans have been in a range from 1435 up top to 1251 down below. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Seasonally, we are at the time of year when prices tend to rally into year’s end, and if the markets remain firm to higher in the next few weeks, Grain Market Insider may consider suggesting making additional old crop sales, while also continuing to be on the lookout for any call option buying opportunities to help protect current and future sales.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop, from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. And while the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last July. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher today as prices rebounded from three previous consecutive lower closes. Soybeans remain in a wide trading range over the past month, with swings a result of changes in Brazilian weather forecasts. Soybean meal ended lower while soybean oil was higher.

- The prospect of tight US ending stocks in 2024 along with good demand recently, has helped support soybean prices while corn and wheat have slipped to new lows. This morning, a flash sale was reported totaling 123,300 metric tons of soybeans to unknown destinations for 23/24.

- While Brazilian weather may be forecast to improve over the next seven days, the hot and dry conditions in the central and northern regions that soybeans were planted may impact final yields. Several private analysts have reduced their estimates for Brazilian production and MB Agro is saying this could lead to a decrease in export potential to 96 mmt from 100 mmt.

- As of November 21, funds were shown to be long 81,587 contracts of soybeans, a reduction of 6,326 contracts from the previous week. Funds also have a large net long position in soybean meal which is over 137,000 contracts and has helped prices remain elevated.

Above: On November 15, January soybeans posted a bearish reversal after coming within 11 cents of the August high. Since then, the market has retested the recent high and failed, creating a head-and-shoulders pattern which suggests a potential to test October’s 1250 low unless bullish input enters the market. For now, heavy resistance remains between 1400 and 1410, with support below the market near the 50-day moving average and again near 1297.

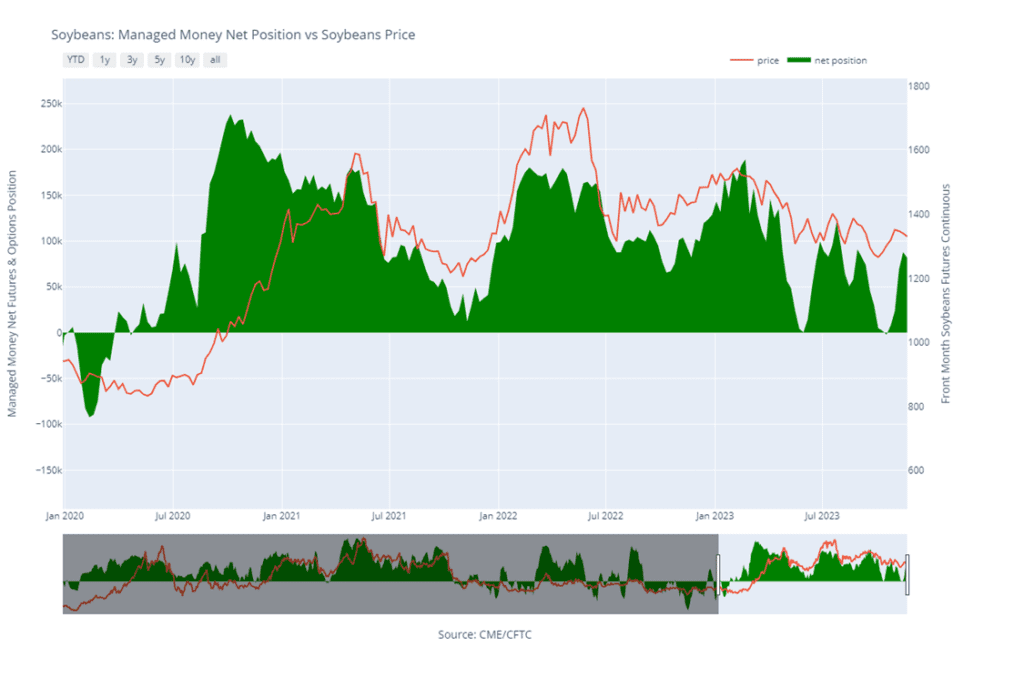

Soybean Managed Money Funds net position as of Tuesday, November 21. Net position in Green versus price in Red. Money Managers net sold 6,326 contracts between November 15 – 21, bringing their total position to a net long 81,587 contracts.

Wheat

Market Notes: Wheat

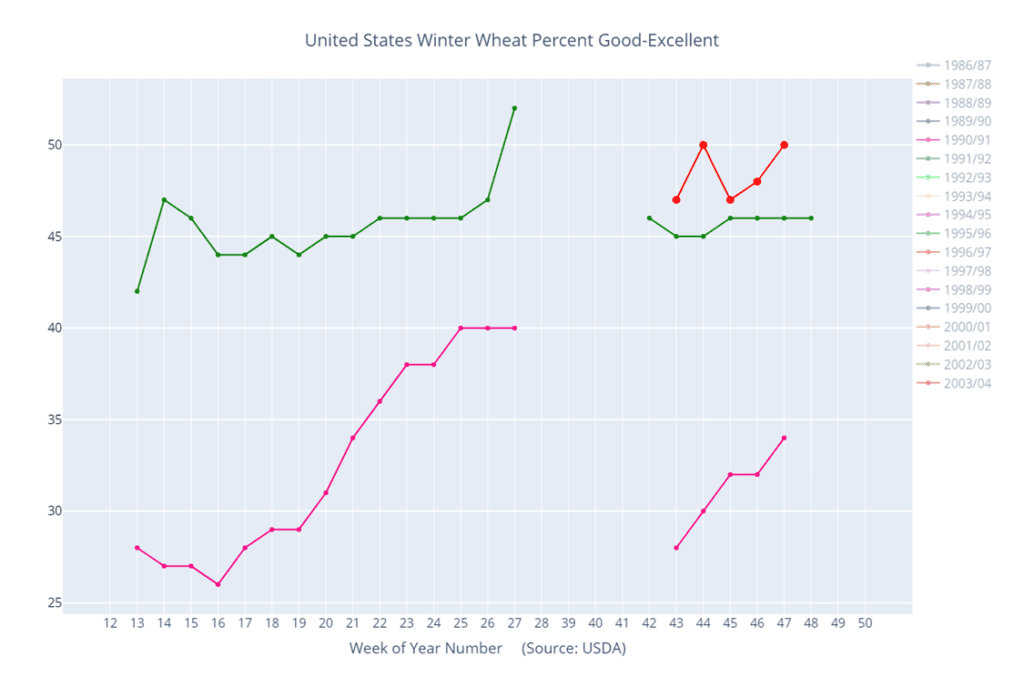

- Yesterday afternoon’s Crop Progress report showed winter wheat is 91% emerged versus 89% on average. Additionally, the crop rating improved 2% to 50% good to excellent. This was better than expected and well above last year’s 34% GTE. Nevertheless, wheat rallied today, reversing off yesterday’s lows. Technically, all three US futures classes could be considered oversold, and this may be the start of a correction to the upside.

- On a bearish note, Russia has said that their grain harvest is now 98% complete with 151 mmt collected. Of that total, 99 mmt is said to be wheat, which is well above the USDA estimate of 90 mmt. If true, given the fact that they are already dominating exports, this would continue to pressure US exports and the futures market.

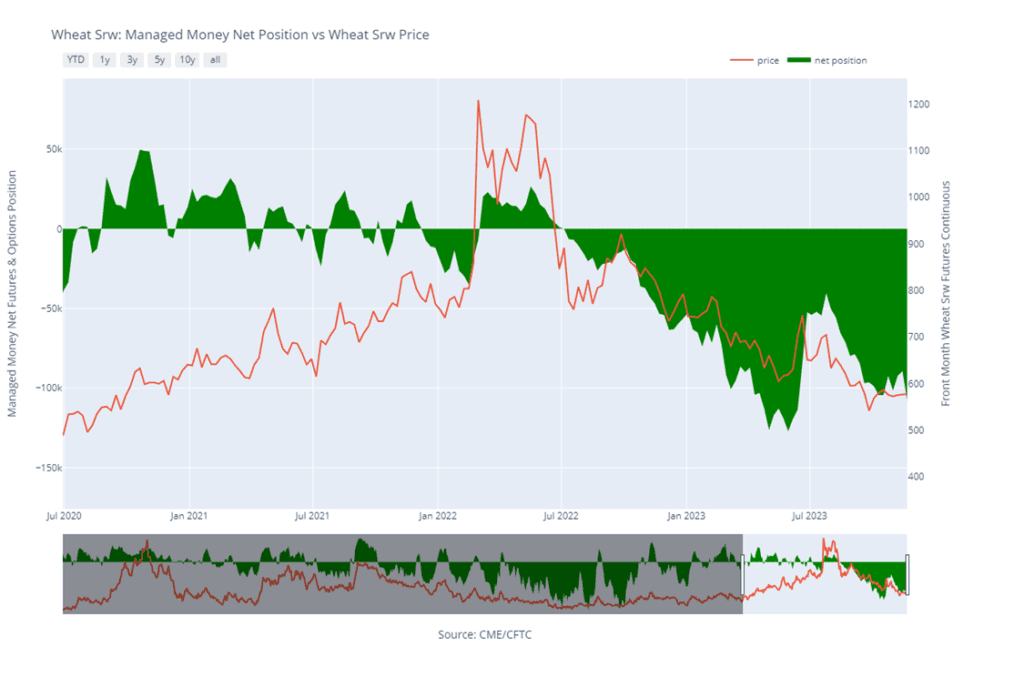

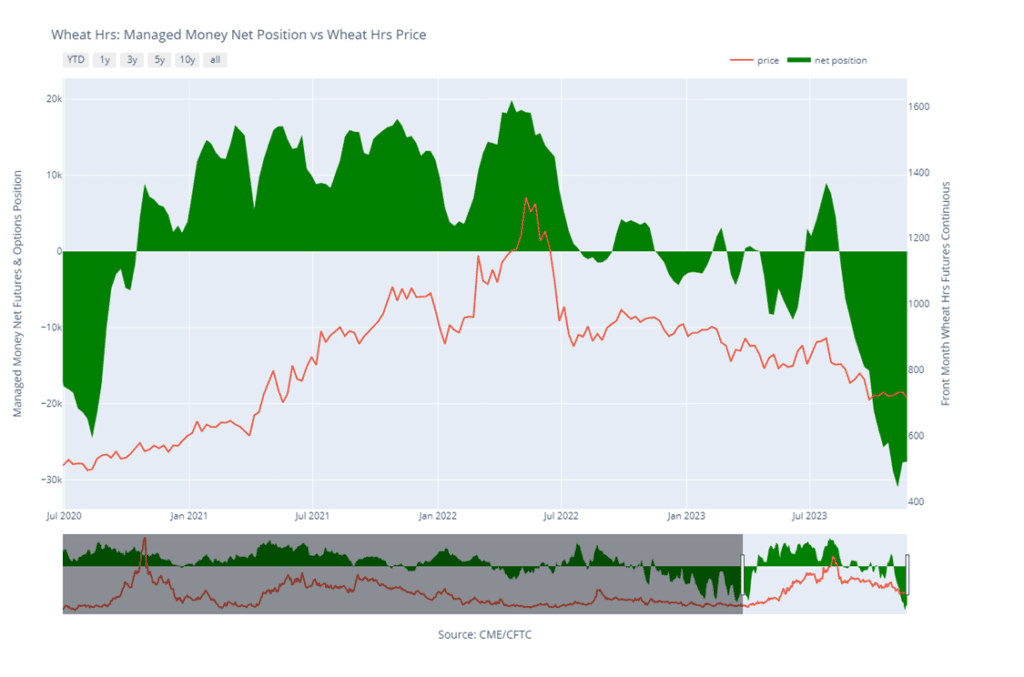

- According to the CFTC, between November 14 and November 21, managed funds added nearly 19,000 contracts to their short Chicago wheat position, leaving them net short about 108,000 contracts. This could lead to a significant short covering rally if there is enough new bullish news to act as a catalyst.

- Severe storms in the Black Sea have resulted in a pause on the loading of grain in both Ukrainian and Russian ports. Additionally, over one million people are said to be without power. The storm is forecasted to last for most of the week with winds up to 90 miles per hour.

- Wheat harvest in Brazil is nearly complete – CONAB said that as of November 18, 94.2% of the crop has been collected. But in the southern regions, quality is lacking due to the heavy amounts of rain they have received. This is keeping their internal wheat prices on the rise.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, nearby Chicago wheat trended lower until finding support at 540 on September 29, from which it rallied back, briefly piercing 600 and the 50-day moving average. The market now appears to be finding value in the 540 – 616 range established since early September, as weak US export demand, driven by cheap Russian exports, remains the dominant headwind to higher prices. Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. After retesting the 800 level back in July, new crop Chicago wheat retreated steadily until hitting the late September low of 610 ¼. Since then, prices have been mostly rangebound between 620 and 650. Just as fund positioning and weak fundamentals have driven old crop prices down closer to the mid to upper 500 range and new crop prices to the low to mid 600s. The risk of further new crop price erosion remains without fresh bullish input to move prices higher. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels, and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

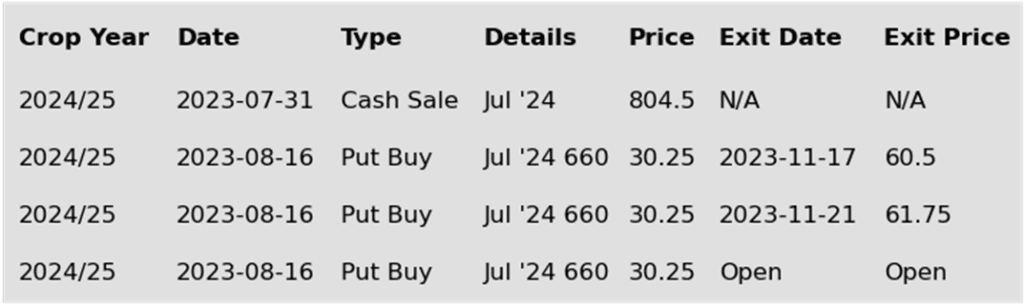

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: On November 15 nearby Chicago wheat rolled from the December contract to the March. While it appears that prices made a significant move, it is in fact the premium in March that is being represented on the chart. Upside resistance remains between 604 ½ and 618, while support below the market, remains between 564 and 554.

Chicago Wheat Managed Money Funds net position as of Tuesday, November 21. Net position in Green versus price in Red. Money Managers net sold 18,905 contracts between November 15 – 21, bringing their total position to a net short 108,176 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

Active

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

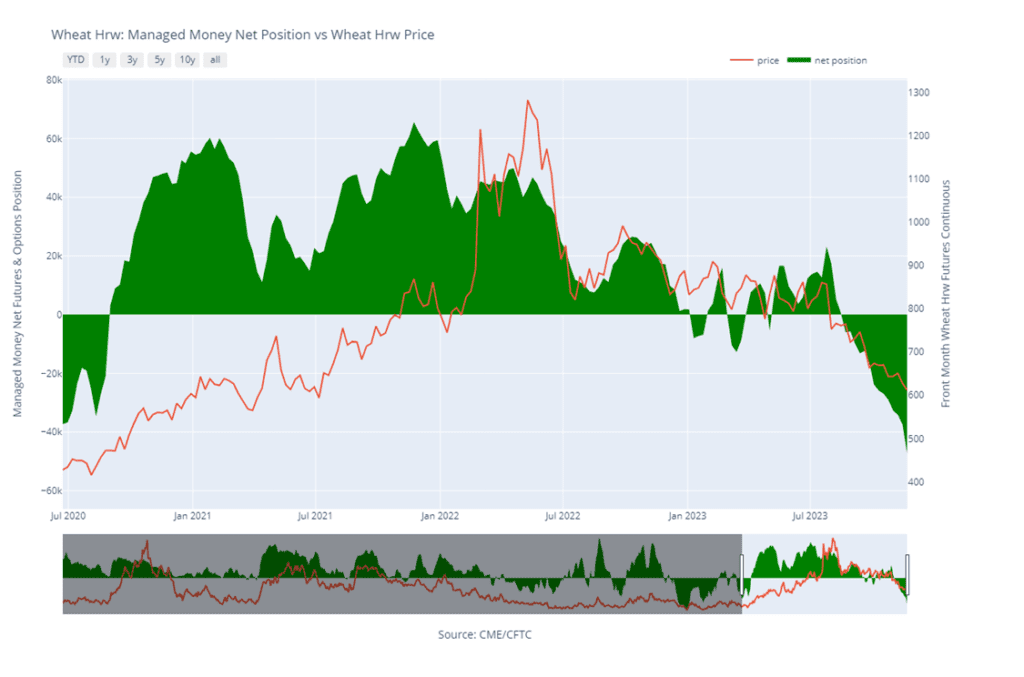

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since late July the nearby KC wheat has been in a downtrend that has had periods of relative stability, but not any significant reversals higher. The market once again found nearby support as it traded to, and held, its recent low of 625 ½. Currently, weak US export demand, driven by cheap Russian exports, remains the dominant headwind, and the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst enters the market to push prices above 700, it may signal that a fall low is in place and would line up with the historical tendency for prices to appreciate into winter and early spring. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover with an eye on considering additional sales near 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to cover half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium minus fees, and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The recent resumption of the downtrend has left the KC wheat market oversold with resistance now above the market between 633 and 661. The market’s oversold status can be supportive if a catalyst enters the market to turn prices back higher. Without a bullish catalyst, March ’24 runs the risk of retreating further and testing 575 support.

KC Wheat Managed Money Funds net position as of Tuesday, November 21. Net position in Green versus price in Red. Money Managers net sold 10,064 contracts between November 15 – 21, bringing their total position to a net short 47,513 contracts.

Winter wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

Active

Sell SEP ’24 Cash

2025

No Action

Puts

2023

No Action

2024

Active

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. Following last July’s rally, the market has slowly stair-stepped lower, primarily due to low world wheat prices, weak US export demand, and managed fund selling. With the funds building a record large short position as the market sold off. Since weak US export demand remains the main impediment to higher prices, the market continues to be at risk of further downside erosion. The record large fund short position could fuel a rally back higher if a bullish catalyst enters the scene, and if that happens, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation this winter with an eye on considering additional sales around 725 – 775, and again north of 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 Spring wheat crop. Since late July, Sept ’24 Mpls wheat has been slowly stair-stepping lower, providing no rallies of substance to sell into. While we see improving conditions in the market that could provide fuel for a bottom and future upside sales opportunities, we also know historically, that if the market breaks support this time of year, it poses the risk that prices could continue to trend overall lower into spring of next year. All that said, a close below 743 support would signal that a trend lower into next year is a risk. Although Grain Market Insider still looks for higher prices, we know from our historical research the importance of having a “plan b” this time of year. With a daily close below 743, Grain Market Insider will recommend selling a portion of your 2024 crop while prices are still relatively elevated and historically good in case they erode further. While the mid-700s may not be the 1000 or higher that we’ve seen in the last two years, it remains much better than the possible 500 – 600 that the market saw back in 2020 and early 2021.

- Grain Market Insider sees a continued opportunity to cover half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium, minus fees and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since the nearby contract rolled from the December to the March, prices have steadily declined through the October low of 703 ¼ and may be on track to test major support near the May ’21 low of 669. If prices turn back higher, resistance now stands between 721 and 740 with heavy resistance near 750.

Minneapolis Wheat Managed Money Funds net position as of Tuesday, November 21. Net position in Green versus price in Red. Money Managers net bought 118 contracts between November 15 – 21, bringing their total position to a net short 27,608 contracts.

Other Charts / Weather

Brazil 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Brazil average temperature courtesy of the National Weather Service, Climate Prediction Center.