11-27 End of Day: Soybeans Higher, Corn and Wheat Lower into Thanksgiving

HAPPY THANKSGIVING FROM ALL OF US AT TOTAL FARM MARKETING!

THURSDAY, NOVEMBER 28: The CME and Total Farm Marketing offices are closed.

FRIDAY, NOVEMBER 29: The CME closes at noon, and Total Farm Marketing closes at 1:00 p.m. (CST).

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 415.75 | -4.25 |

| MAR ’25 | 428 | 0 |

| DEC ’25 | 429.75 | -0.5 |

| Soybeans | ||

| JAN ’25 | 988.75 | 5.25 |

| MAR ’25 | 997 | 3 |

| NOV ’25 | 1014 | 1.25 |

| Chicago Wheat | ||

| DEC ’24 | 537.75 | -1.75 |

| MAR ’25 | 548.5 | -9.5 |

| JUL ’25 | 565.75 | -9.25 |

| K.C. Wheat | ||

| DEC ’24 | 526.25 | -24.25 |

| MAR ’25 | 544.5 | -14.25 |

| JUL ’25 | 559.5 | -13.5 |

| Mpls Wheat | ||

| DEC ’24 | 564.5 | -13 |

| MAR ’25 | 591.25 | -10.25 |

| SEP ’25 | 617 | -9 |

| S&P 500 | ||

| DEC ’24 | 6014.25 | -24 |

| Crude Oil | ||

| JAN ’25 | 68.72 | -0.05 |

| Gold | ||

| JAN ’25 | 2648.4 | 14 |

Grain Market Highlights

- A fifth consecutive day of liquidation hit December corn futures on Wednesday ahead of First Notice Day on Friday. Continued weakness in wheat futures added pressure to corn.

- Despite lower corn, wheat, and soybean oil futures, soybeans closed higher, with soybean meal futures also rebounding from recent lows.

- Wheat futures fell across the board ahead of the Thanksgiving holiday, retreating toward contract lows. Prices remained unaffected by the US dollar’s drop to its lowest level since early November.

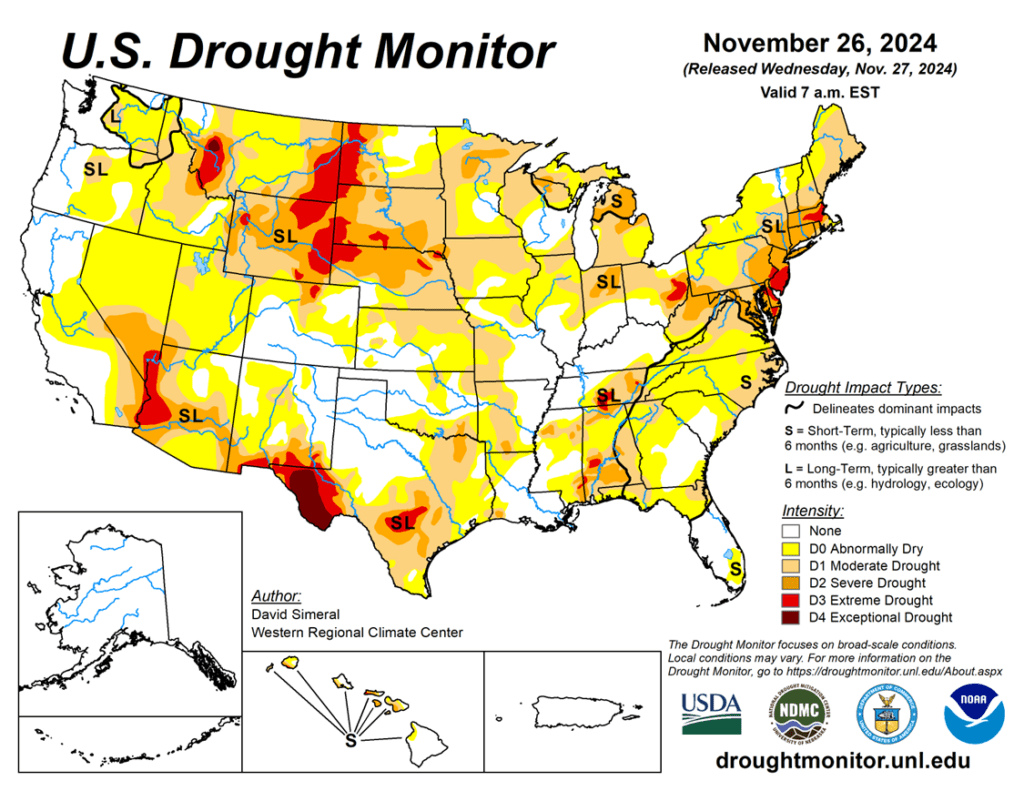

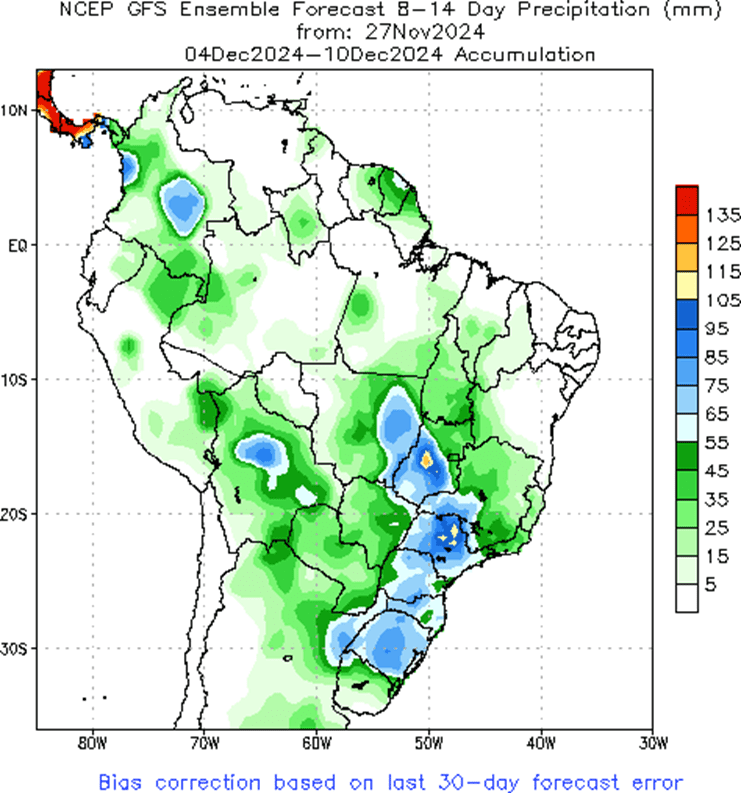

- To see the updated US Drought Monitor and the Week 2 South American Precipitation Forecast, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- Considering seasonal weakness, no new sales recommendations will be issued until opportunities improve, which could be as soon as late fall or as late as early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

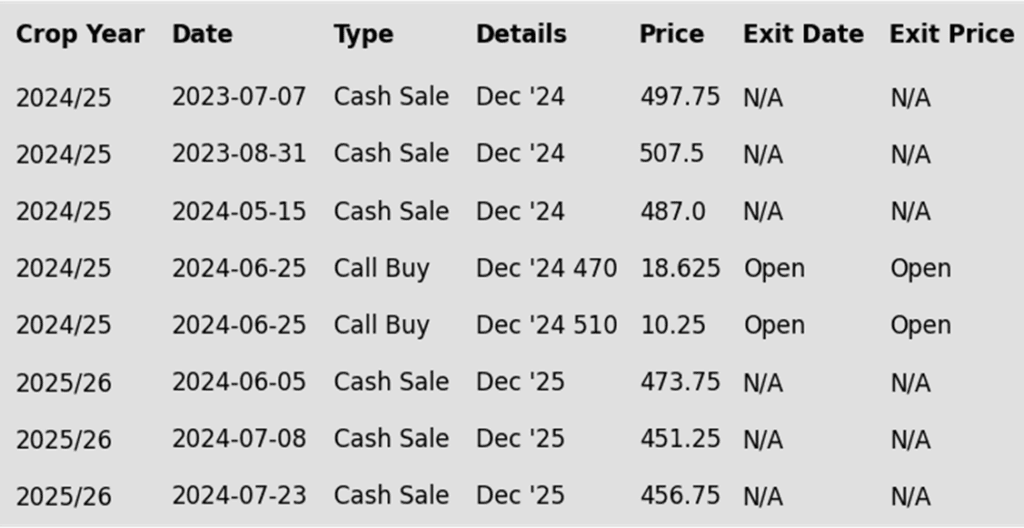

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The December corn market finished lower for the fifth straight session. First Notice Day on Friday and basis contract pricing likely pressured the market, leading to the lowest close since November 4. Open interest in the December contract has dropped by over 200,000 contracts since the start of the week as traders are moving aside long positions.

- The US dollar made a strong correction lower on Thursday as the prospect of the Bank of Japan raising interest rates sent profit taking in the Japanese yen versus US dollar trade. Expectations are for the dollar to remain firm, but the setback could help support commodity prices.

- With President Trump looking to impose a 25% tariff on Mexico imports as part of his Day 1 initiative, Mexico’s President Sheinbaum warned of retaliatory tariffs to counter. Mexico is the largest export buyer of US corn this marketing year.

- The USDA will release weekly export sales on Friday morning, delayed due to the Thanksgiving Day holiday. Corn sales have been strong to start the marketing year, but slowing as higher prices and strong dollar has hurt competitiveness. The market will be watching to see if this trend will continue.

Above: The corn market became overbought and drifted back to the 425 area, if prices break through and close below the 50-day moving average (ma) they run the risk falling further and testing more major support near the 410 area and 100-day ma. If this 425 – 420 area holds prices could retest the 442 area with the potential of trading towards 465.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- New sales recommendations will be issued as seasonal opportunities improve, which could be anytime between late fall and early spring.

2025 Crop:

- Sales targets have not been announced for next year’s crop. Patience is recommended, the earliest they will be set will be late fall or early winter, and early spring at the latest.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

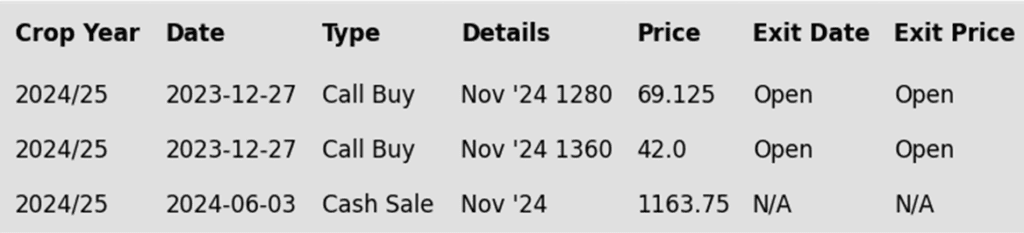

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher ahead of Thanksgiving, diverging from weaker corn and wheat markets. Gains in soybean meal offset a sharp 4.19% drop in soybean oil, which followed palm oil lower. This contrasted with yesterday’s soybean oil rally sparked by potential import tariffs on China’s used cooking oil.

- This morning, private exporters reported to the USDA export sales of 132,000 metric tons of soybeans for delivery to China during the 24/25 marketing year. Export sales have tapered off slightly over the past few weeks but remain firm.

- Brazilian Crop analyst, Dr. Michael Cordonnier, raised his 24/25 Brazilian soybean production forecast by 2.0 mmt to 168.0 mmt, citing a strong start and ideal weather in key growing regions. The 10-15 day forecast for central Brazil has turned slightly drier which could add some weather premium if it continued.

- Rain is expected over the next couple of weeks in the dry areas of Paraguay, Argentina, and southern Brazil, which could result in 2-4 inches of rain. This has some analysts projecting between 700-750 mb of increased soybean production for South America when compared to last year.

Above: January soybeans continue to drift and test the 975 support area. A close below there could put the market at risk of receding to the 940 support area around the August low. Should the 975 area hold turning prices back higher, they may find resistance between the 50-day moving average and 1014, before retesting the 1045 area.

Wheat

Market Notes: Wheat

- Despite the US Dollar Index plunging to a two-week low today, US wheat could not find any footing. Pressure stemmed from a lower trade for Matif wheat futures as well as the fact that First Notice Day for December grain contracts is Friday. With markets closed for Thanksgiving tomorrow, this may have added some selling pressure, as anyone long at the close today is at risk of delivery on Friday.

- Weakness in wheat was also tied to improved US winter wheat conditions. Monday’s Crop Progress report rated 55% good-to-excellent—the highest in four years—bolstered by recent Southern Plains rainfall.

- Ongoing harvest in the Southern Hemisphere may have also pressured wheat today. Both Australia and Argentina are harvesting, but Argentina’s peso has also reached a record low level, resulting in falling wheat export values.

- According to their agricultural ministry, the export duty on Russian wheat has risen to 3,020.3 rubles per ton from 2,689.7 rubles previously, a 12.3% increase. The duty on corn also increased, while it fell for barley. These rates are said to be valid until December 3.

- The European Commission has said that EU soft wheat exports as of November 24 have reached 9.2 mmt since the season began on July 1. This represents a 30% decrease from last year’s 13.1 mmt total. Top destinations for the wheat exports include Nigeria, the UK, and Egypt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

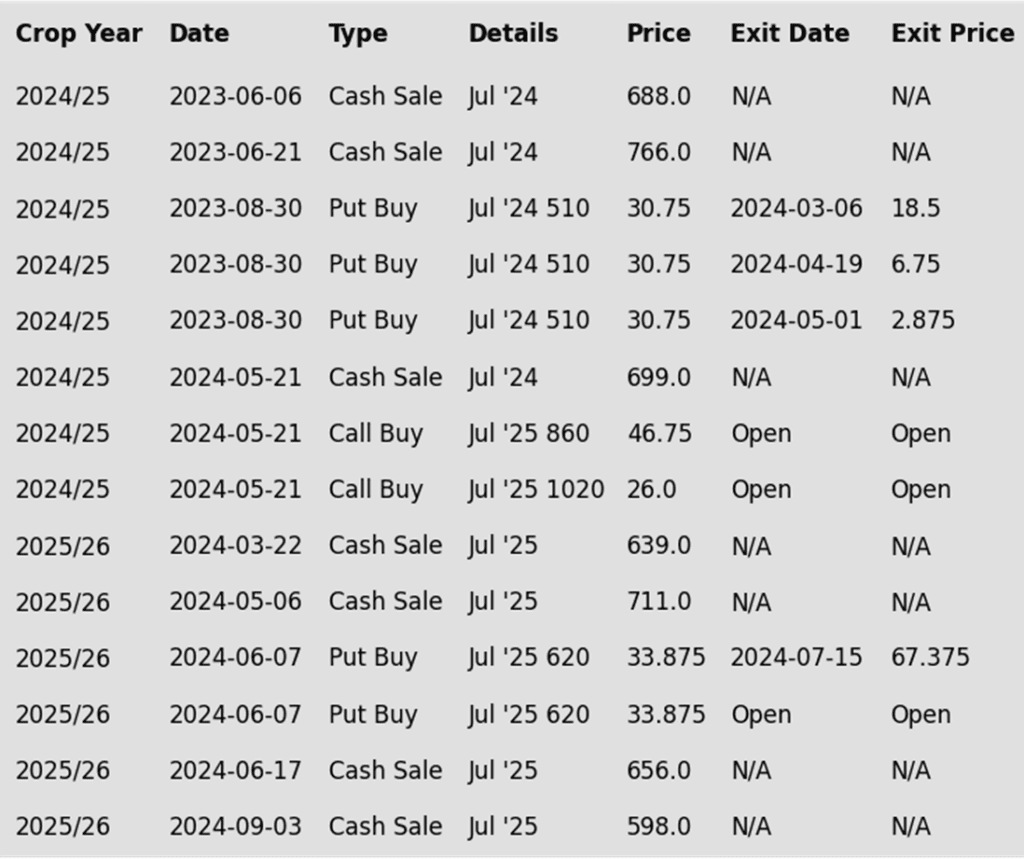

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front month Chicago wheat remains in a broad trading range between 536 down below and 586 up top. If the market can trade through the 50 and 200-day moving averages and close above 586 it could be poised to retest the 617 area. Whereas a close below 536 could put the market at risk of trading to the 521 – 514 support area.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

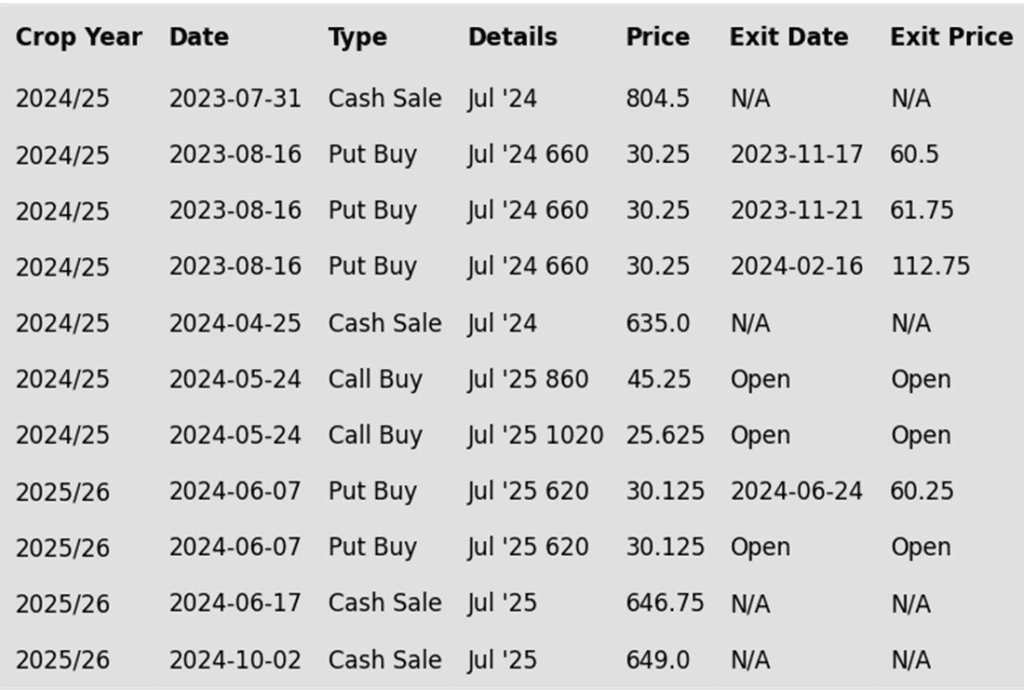

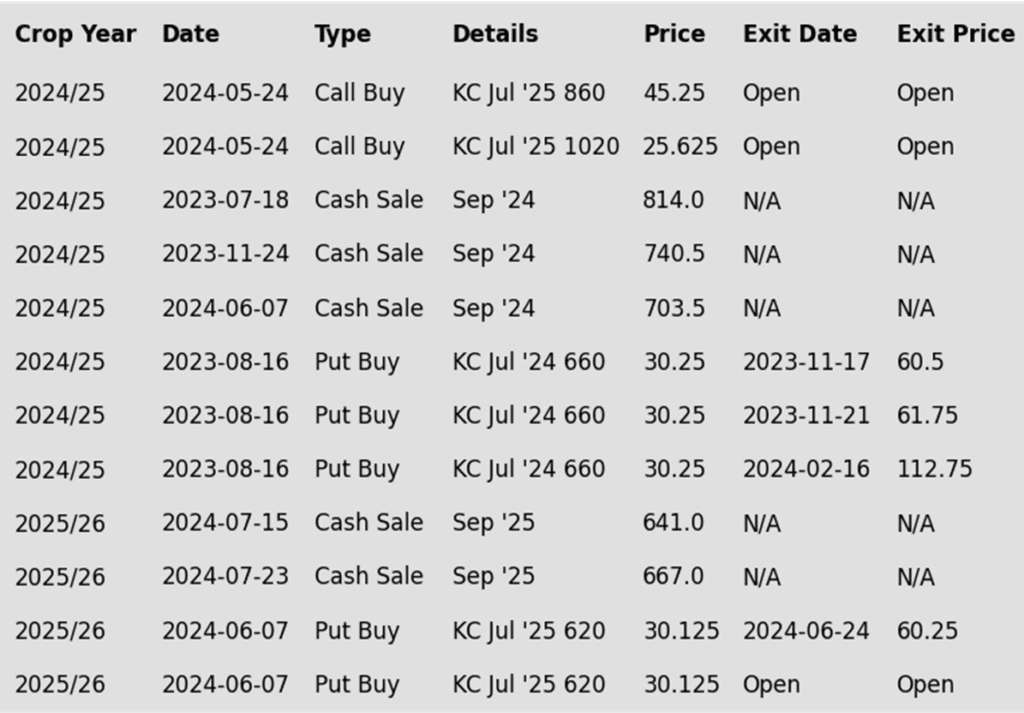

To date, Grain Market Insider has issued the following KC recommendations:

Above: March KC wheat found resistance just below the 50-day moving average, near 577. Should the market trade through this area and close above 583, it could be set to run towards the 593 – 603 area. Otherwise, close below 535 could press prices towards the August low of 527 ¼.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Target a rally back to the 710 – 735 range versus Sept. ’25 to make additional early sales on your 2025 crop. While this target area may seem far off, it aligns with the market’s potential based on our research. conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since rolling to the March contract, front month Minneapolis wheat has been capped by resistance near the 50-day moving average around 613. A close above this point could put the market on track to test the October highs near 655, with potential resistance around the 200-day moving average. Should prices slide below 584 they could then be at risk of retesting the 563 area.

Other Charts / Weather

Above: Brazil and N. Argentina two-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.