11-27 A Lack of Bullish News Presses Corn and Wheat to Fresh Lows.

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 455.5 | -7.75 |

| MAR ’24 | 475.25 | -7.25 |

| DEC ’24 | 504.25 | -6.5 |

| Soybeans | ||

| JAN ’24 | 1329.75 | -1 |

| MAR ’24 | 1348.25 | -0.5 |

| NOV ’24 | 1280.25 | 0 |

| Chicago Wheat | ||

| DEC ’23 | 534.25 | -14.5 |

| MAR ’24 | 561 | -16.25 |

| JUL ’24 | 589 | -15 |

| K.C. Wheat | ||

| DEC ’23 | 590 | -12 |

| MAR ’24 | 596.5 | -15 |

| JUL ’24 | 610.25 | -15.25 |

| Mpls Wheat | ||

| DEC ’23 | 684.5 | -12.25 |

| MAR ’24 | 699.75 | -14.75 |

| SEP ’24 | 729.25 | -11.25 |

| S&P 500 | ||

| DEC ’23 | 4558.5 | -9.75 |

| Crude Oil | ||

| JAN ’24 | 74.91 | -0.63 |

| Gold | ||

| JAN ’24 | 2024.4 | 10.7 |

Grain Market Highlights

- Despite trading firmer in the overnight session, corn futures were pressed to their lowest close in over two years on a lack of fresh news and weak export inspections that came in at a marketing year low.

- Disappointing export inspections and decent rainfall in some of Brazil’s driest areas weighed heavily on the soybean market which closed mixed and near unchanged following two-sided trade and firmer markets in both products.

- Both soybean meal and oil closed the day higher with gains lending support to a weak soybean market and raising Board crush margins in the January contracts 15 cents to 192 ½.

- After trading higher overnight, all three wheat classes followed through on last week’s weakness and traded to fresh contract lows. A lack of bullish news, lower Matif wheat, and year to date export inspections, at 77% of last year’s pace, continue to weigh on prices.

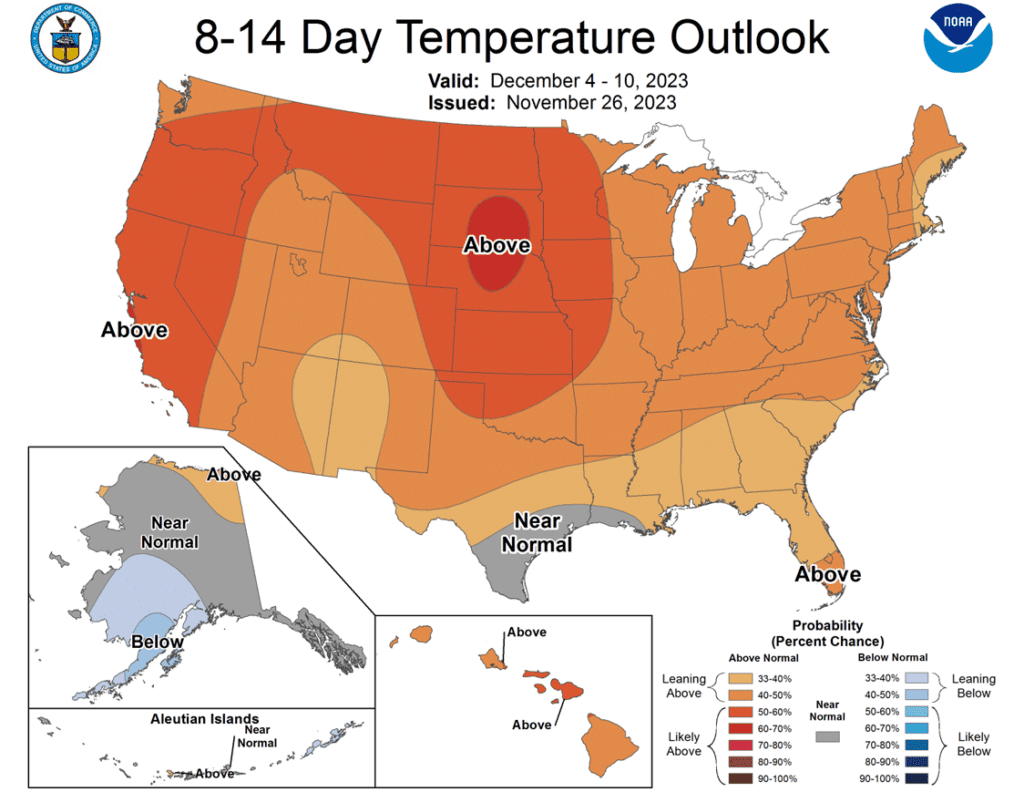

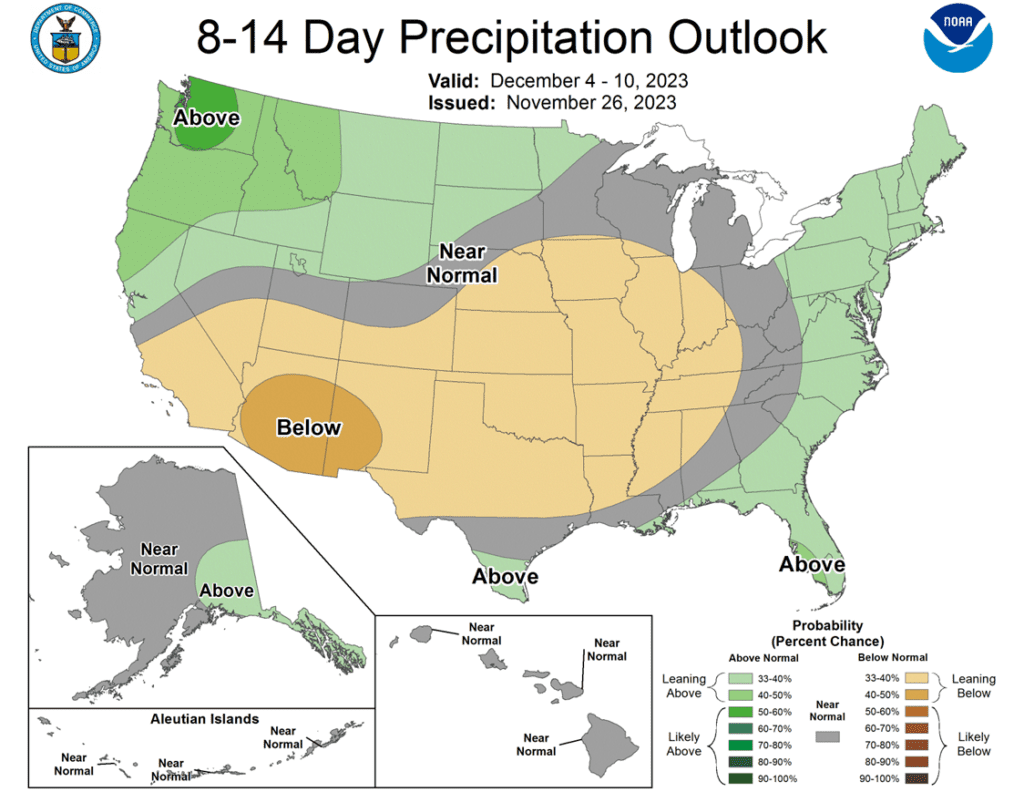

- To see the updated US 8 – 14 day Temperature and Precipitation Outlooks and the Brazil and Argentina 2-week forecast precipitation percent of normal, courtesy of the National Weather Service, Climate Prediction Center, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

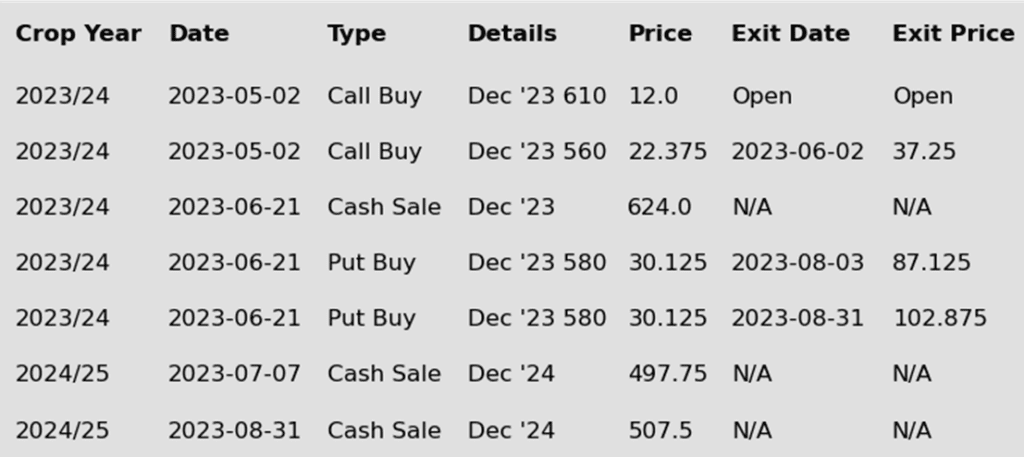

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of November’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 489 ¾ on the bottom and 600 on the top. After testing 491 to 547 last July, it has mostly traded between 500 and 525. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus Dec ’23 as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures pushed to new nearby lows on the trading session to start the week, pressured by strong selling in the wheat market and on-going demand concerns. December corn lost 7 ¾ cents and posted its lowest daily close since July 2021.

- The weak price action and the overall negative trend keeps pressure on the corn market as bullish news is still limited in a market that is working through the final pieces of this year’s corn harvest.

- Weekly corn export inspections were below analyst expectations at 407,000 mt (16 mb). Year-over-year, total inspections are up 25% for the marketing year. Last week’s shipping pace was impacted by the Thanksgiving Day Holiday, and water level concerns reoccurring for the Mississippi River.

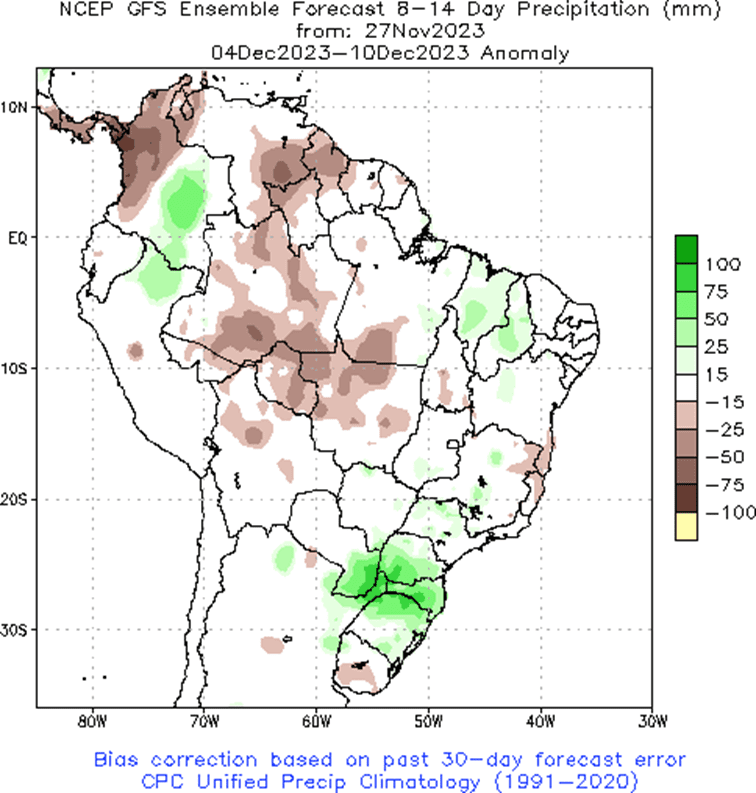

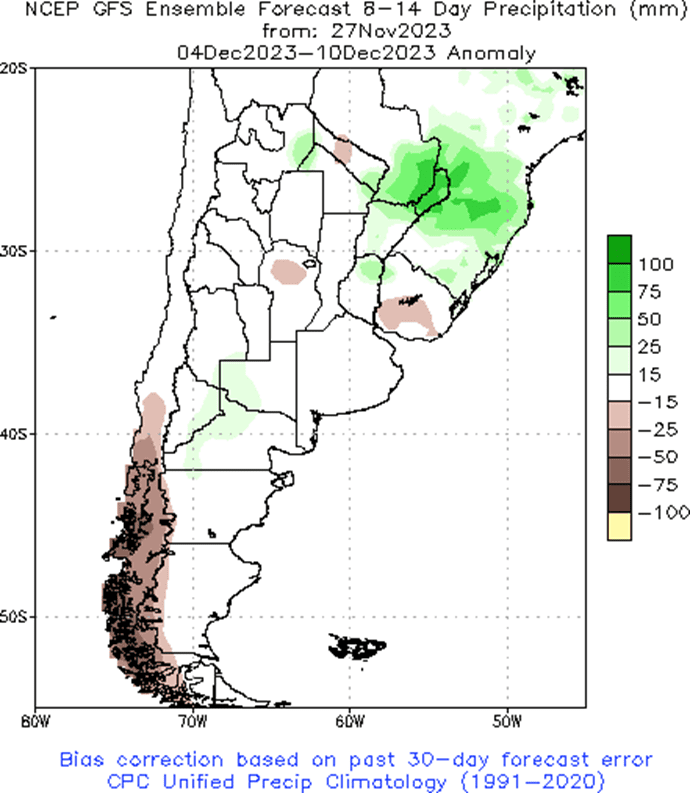

- Brazil weather is still a focal point in the markets. Some weather seems to be stabilizing, which has pressured soybean futures. Corn is more likely a longer-term story as delayed soybean planting will push corn planting back on Brazil’s key second corn crop. Argentina weather is improving, and corn and soybean production could return to more “normal” levels than the last two years influenced by drought.

Above: The nearby corn contract has rejected the 100-day moving average on the daily continuous chart and has slipped below the 50-day moving average. Initial resistance now rests just above the market near 496 with further heavy resistance between 500 and 509 ½. Support below the market remains near 460, with the next major area of support near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

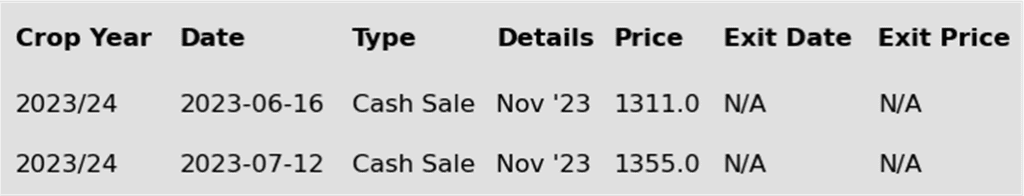

- No new action is recommended for 2023 soybeans. At the end of August, the soybean market turned lower and didn’t find any significant buying interest until it traded down to 1251 in early October. Since then, the nearby contract has traded through the 50-day moving average and tested the August high. Looking back, since last May, nearby soybeans have been in a range from 1435 up top to 1251 down below. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Seasonally, we are at the time of year when prices tend to rally into year’s end, and if the markets remain firm to higher in the next few weeks, Grain Market Insider may consider suggesting making additional old crop sales, while also continuing to be on the lookout for any call option buying opportunities to help protect current and future sales.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop, from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. And while the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last July. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day slightly lower in the front months but higher to unchanged in deferred months in a day of mixed trade that saw prices anywhere from 7 cents lower to 7 cents higher. Soybean meal and oil ended the day higher, further improving crush margins.

- Soybean inspections totaled 53 mb for the week ending Thursday, November 13, which was within the trade range but down slightly from last week. Total inspections for 23/24 are now at 641 mb, which is down 11% from the previous year.

- In Brazil, showers were reported in the central region of the country over the weekend and temperatures fell slightly, but there still has not been a major soaking rain that is needed, and crop failure is expected to occur in Mato Grosso and other northern states. Southern Brazil has been getting flooded with rain which will likely affect their production as well.

- While more favorable South American weather has caused soybeans to fall to the low end of their recent trading range, exports have picked up with 16.6 mb of new sales to China and unknown on Friday, and domestic demand has been strong with profitable crush margins.

Above: On November 15, January soybeans posted a bearish reversal after coming within 11 cents of the August high. Since then, the market has retested the recent high and failed, creating a head-and-shoulders pattern which suggests a potential to test October’s 1250 low unless bullish input enters the market. For now, heavy resistance remains between 1400 and 1410, with support below the market near the 50-day moving average and again near 1297.

Wheat

Market Notes: Wheat

- Another risk off session and lack of fresh news contributed to pressure in the wheat market. All three US futures classes closed with double digit losses, alongside lower Matif futures. March Matif wheat has been lower for eight of the past ten sessions. Today’s lower price action is also despite the US Dollar being in a downtrend.

- Weekly wheat inspections totaled 10.2 mb, bringing the 23/24 inspection totals to 299 mb. This is down 23% from last year and inspections are running behind the USDA’s estimated pace.

- Ukraine is doubling down on their export corridor. News outlets are reporting that they are planning to have convoy vessels in place for protection in the Black Sea. With the war raging on, Ukraine has shipped only 12.7 mmt of grain so far this season, versus 17.6 mmt at the same time last year.

- Argentina’s wheat harvest is reported to be 27% complete. But early drought there, and also in Australia, could mean a combined reduction of 9-12 mmt of exports of wheat globally.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

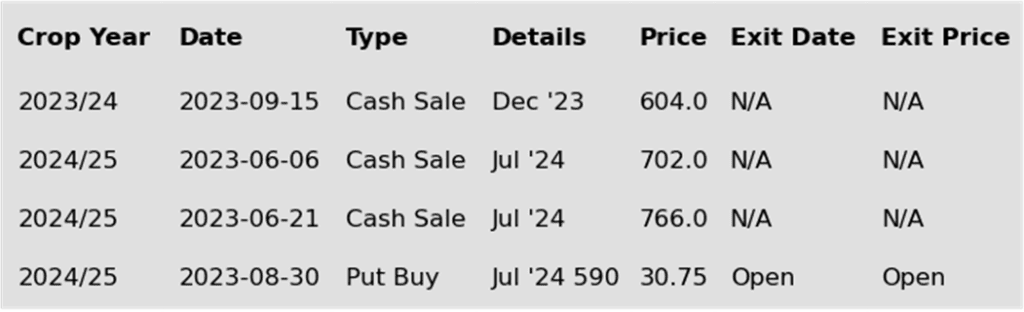

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, nearby Chicago wheat trended lower until finding support at 540 on September 29, from which it rallied back, briefly piercing 600 and the 50-day moving average. The market now appears to be finding value in the 540 – 616 range established since early September, as weak US export demand, driven by cheap Russian exports, remains the dominant headwind to higher prices. Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. After retesting the 800 level back in July, new crop Chicago wheat retreated steadily until hitting the late September low of 610 ¼. Since then, prices have been mostly rangebound between 620 and 650. Just as fund positioning and weak fundamentals have driven old crop prices down closer to the mid to upper 500 range and new crop prices to the low to mid 600s. The risk of further new crop price erosion remains without fresh bullish input to move prices higher. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels, and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: On November 15 nearby Chicago wheat rolled from the December contract to the March. While it appears that prices made a significant move, it is in fact the premium in March that is being represented on the chart. Upside resistance remains between 604 ½ and 618, while support below the market, remains between 564 and 554.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

Active

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since late July the nearby KC wheat has been in a downtrend that has had periods of relative stability, but not any significant reversals higher. The market once again found nearby support as it traded to, and held, its recent low of 625 ½. Currently, weak US export demand, driven by cheap Russian exports, remains the dominant headwind, and the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst enters the market to push prices above 700, it may signal that a fall low is in place and would line up with the historical tendency for prices to appreciate into winter and early spring. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover with an eye on considering additional sales near 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

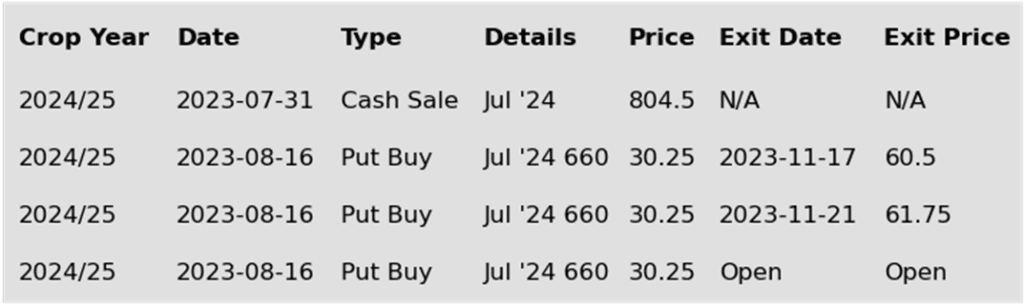

- Grain Market Insider sees a continued opportunity to cover half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium minus fees, and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The recent resumption of the downtrend has left the KC wheat market oversold with resistance now above the market between 633 and 661. The market’s oversold status can be supportive if a catalyst enters the market to turn prices back higher. Without a bullish catalyst, March ’24 runs the risk of retreating further and testing 575 support.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

Active

Sell SEP ’24 Cash

2025

No Action

Puts

2023

No Action

2024

Active

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. After making highs in July, and the subsequent downtrend to the October 2 low of 707 ½, nearby Minneapolis wheat has traded mostly sideways with no significant reversal higher. With weak US export demand still the primary impediment to higher prices, the market remains at risk of trending lower if September’s low close of 709 is violated to the downside unless another bullish impetus enters the scene. If that happens and prices begin to push back toward 775, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices. Even though the primary strategy is to look for higher prices, Grain Market Insider may also consider a “plan b” in the next couple of weeks if prices grind sideways to lower.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 Spring wheat crop. Since late July, Sept ’24 Mpls wheat has been slowly stair-stepping lower, providing no rallies of substance to sell into. While we see improving conditions in the market that could provide fuel for a bottom and future upside sales opportunities, we also know historically, that if the market breaks support this time of year, it poses the risk that prices could continue to trend overall lower into spring of next year. All that said, a close below 743 support would signal that a trend lower into next year is a risk. Although Grain Market Insider still looks for higher prices, we know from our historical research the importance of having a “plan b” this time of year. With a daily close below 743, Grain Market Insider will recommend selling a portion of your 2024 crop while prices are still relatively elevated and historically good in case they erode further. While the mid-700s may not be the 1000 or higher that we’ve seen in the last two years, it remains much better than the possible 500 – 600 that the market saw back in 2020 and early 2021.

- Grain Market Insider sees a continued opportunity to cover half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium, minus fees and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since the nearby contract rolled from the December to the March, prices have steadily declined through the October low of 703 ¼ and may be on track to test major support near the May ’21 low of 669. If prices turn back higher, resistance now stands between 721 and 740 with heavy resistance near 750.

Other Charts / Weather

Brazil 2-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.

Argentina 2-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.