11-21 End of Day: SA Weather Supports Beans & Corn; Short Covering Supports Wheat

Happy Thanksgiving from all of us at Total Farm Marketing!

Thursday, November 23, 2023: The CME and Total Farm Marketing offices are closed.

Friday, November 24, 2023: The CME closes at noon, and Total Farm Marketing closes at 1:00.

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 470 | 0.5 |

| MAR ’24 | 489 | 1.5 |

| DEC ’24 | 515 | 2.5 |

| Soybeans | ||

| JAN ’24 | 1377.25 | 10 |

| MAR ’24 | 1393 | 9.75 |

| NOV ’24 | 1313.25 | 8.5 |

| Chicago Wheat | ||

| DEC ’23 | 555 | 11.5 |

| MAR ’24 | 582.75 | 12.25 |

| JUL ’24 | 610.5 | 10.5 |

| K.C. Wheat | ||

| DEC ’23 | 615.75 | 5.25 |

| MAR ’24 | 625.5 | 5.25 |

| JUL ’24 | 638.5 | 5.75 |

| Mpls Wheat | ||

| DEC ’23 | 717.5 | 10.25 |

| MAR ’24 | 733.25 | 9.25 |

| SEP ’24 | 756.75 | 9 |

| S&P 500 | ||

| DEC ’23 | 4548.25 | -14 |

| Crude Oil | ||

| JAN ’24 | 77.85 | 0.02 |

| Gold | ||

| JAN ’24 | 2012.2 | 21.5 |

Grain Market Highlights

- For the second day in a row, corn settled higher on the day, as Brazilian weather concerns and support from soybeans continued to ripple through to the corn market.

- The soybean market closed higher on the day following two-sided trade that briefly dipped below unchanged at midday before bouncing back with support from continued weather concerns in Brazil, slow farmer selling in Argentina, and strength in the soybean oil market.

- After trading on both sides of unchanged, the wheat complex found support in all three classes near Monday’s lows and ended the day higher.

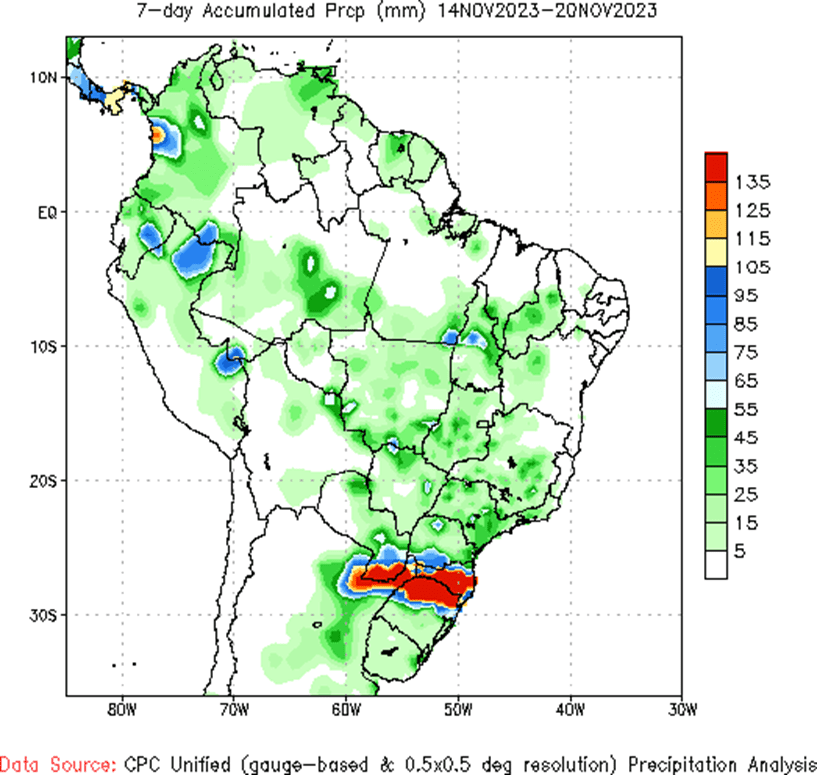

- To see the updated Brazil 1-week total accumulated precipitation, courtesy of the National Weather Service, Climate Prediction Center, scroll down to Other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

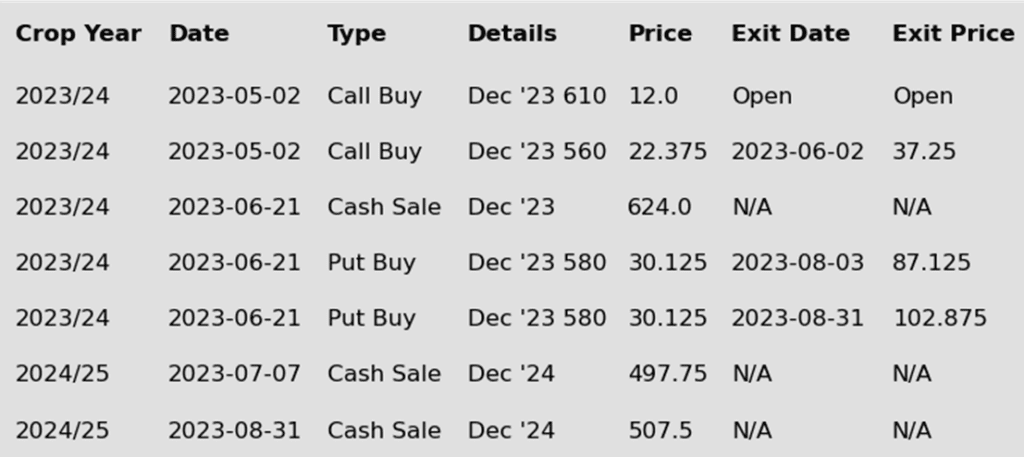

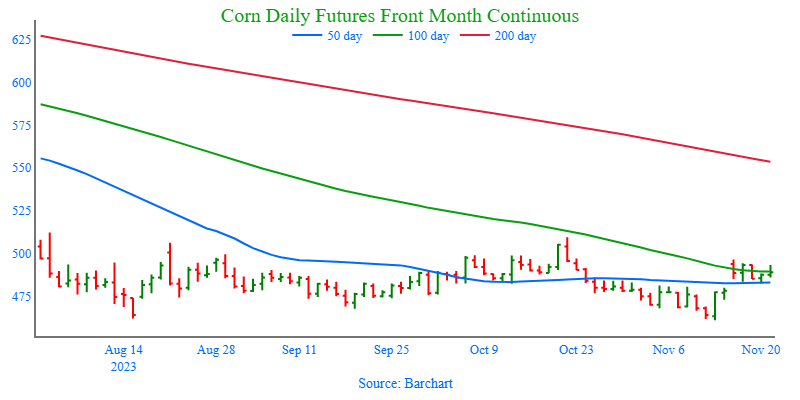

- No new action is recommended for 2023 corn. Since the beginning of August, the corn market has traded sideways largely between 470 and 500. October’s brief breakout to 509 ½ and the subsequent failure to stay above the 50-day moving average indicates there is significant resistance in that price range. The failure of November’s USDA report to provide a bullish influence on the market puts the market at risk of drifting sideways to lower without a bullish catalyst. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Since late February ’22, Dec ’24 has been bound by 489 ¾ on the bottom and 600 on the top. After testing 491 to 547 last July, it has mostly traded between 500 and 525. During this time, Dec ’24 has held up better as bear spreading has allowed Dec ’24 to maintain more of its value versus Dec ’23 as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Moving forward, the risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn ended the day slightly higher for the second consecutively higher close with support from higher soybeans and expectations for dry Brazilian weather. Corn futures remain rangebound, and trade has been relatively quiet ahead of the Thanksgiving holiday.

- Corn futures have been essentially gridlocked over the past few months as the expectation of large US production in the ballpark of 15.23 billion bushels weighs on prices, but the good domestic and export demand levels have simultaneously kept prices supported.

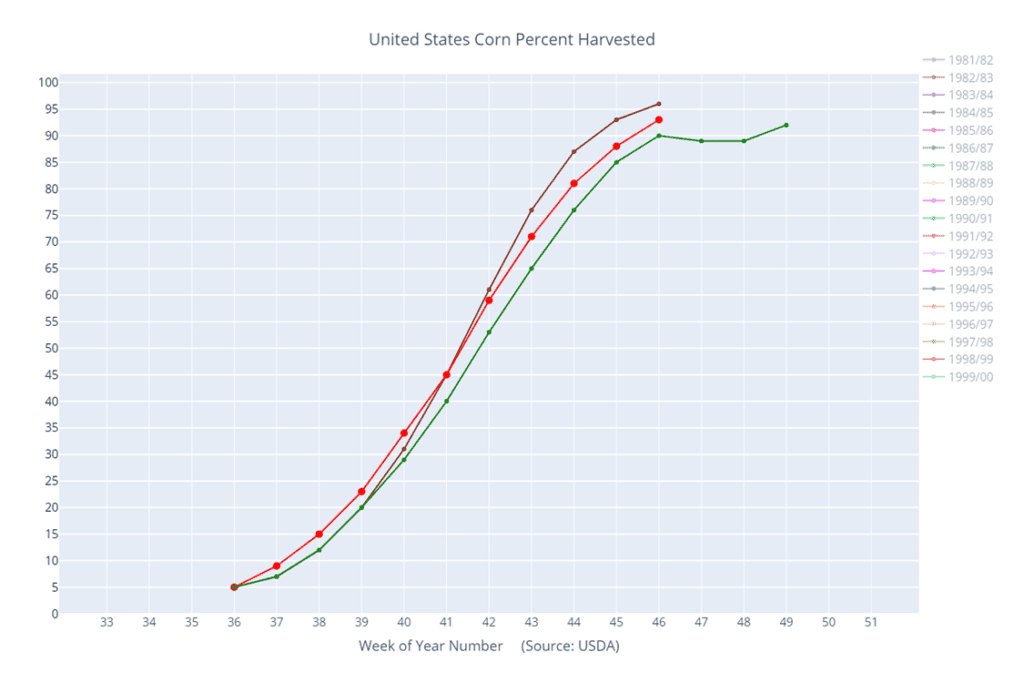

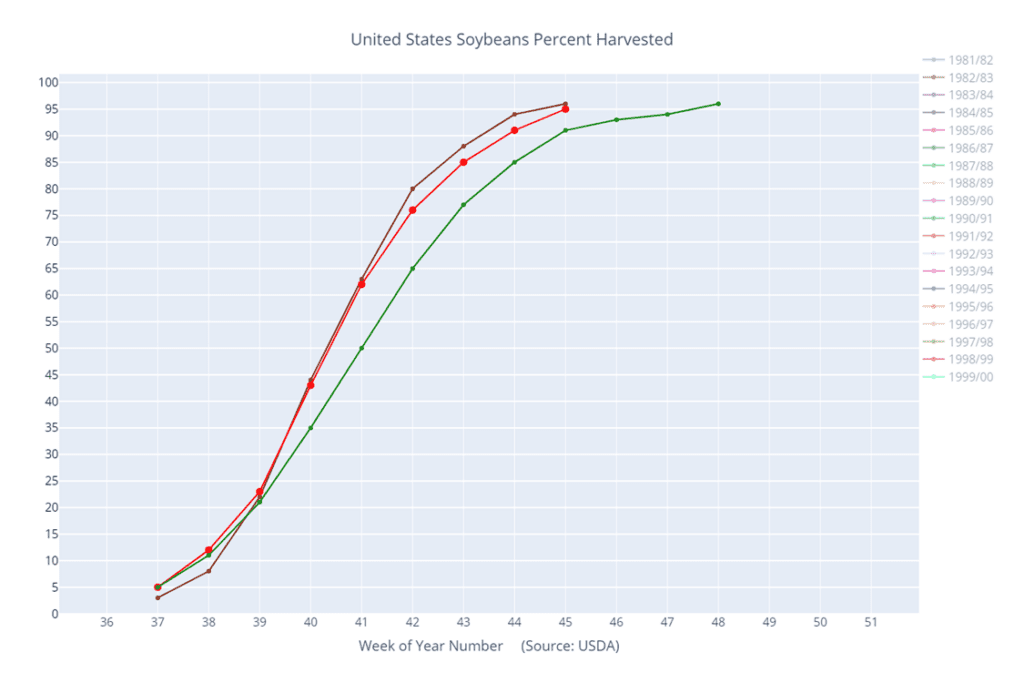

- Yesterday afternoon, the USDA released the Crop Progress report which showed the corn harvest at 93% complete which was below the 5-year average by a few points and below the average trade guess. Michigan and Pennsylvania are behind schedule due to late rains with 30% of the crop left to harvest.

- While no export sales were reported today, a sale of 4.1 mb was reported yesterday to Mexico for the 23/24 year, and yesterday’s export inspections brought total inspections 24% above the previous year. Corn export sales overall are now 33% higher than a year ago.

Above: The nearby contract in corn has rolled from the December contract to the March, and while the chart looks like prices made a significant jump, it is in fact the premium in the March that is being represented on the chart. Upside resistance remains between 500 and 509 ½, while support below the market remains near 460, with the next major area of support near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

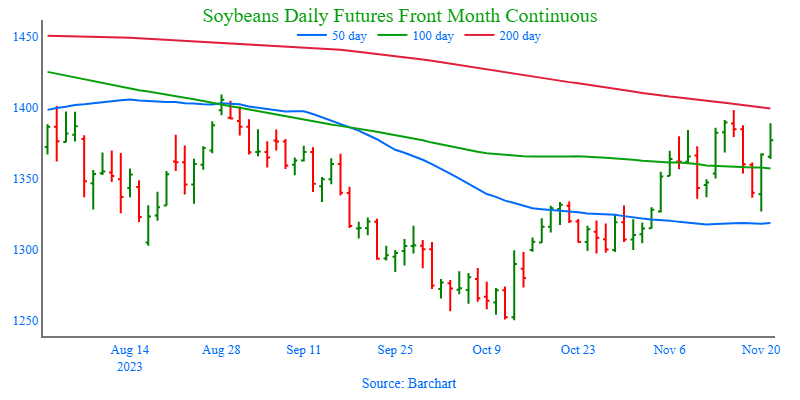

- No new action is recommended for 2023 soybeans. At the end of August, the soybean market turned lower and didn’t find any significant buying interest until it traded down to 1251 in early October. Since then, the nearby contract has traded through the 50-day moving average and tested the August high. Looking back, since last May, nearby soybeans have been in a range from 1435 up top to 1251 down below. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Seasonally, we are at the time of year when prices tend to rally into year’s end, and if the markets remain firm to higher in the next few weeks, Grain Market Insider may consider suggesting making additional old crop sales, while also continuing to be on the lookout for any call option buying opportunities to help protect current and future sales.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop, from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. And while the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last July. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

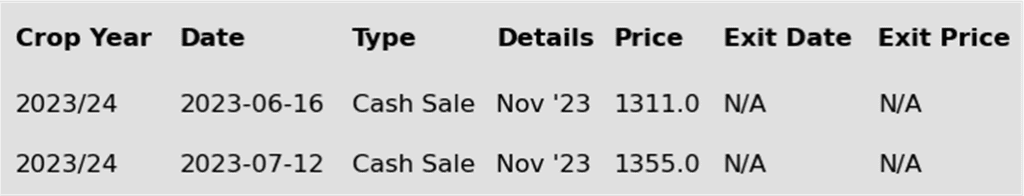

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher after a day of up and down trade that took prices from as much as 21 cents higher, down to only a penny higher, only to rally again into the close. Drier forecasts for Brazilian weather has been supportive. Soybean meal ended the day lower in the front months, while soybean oil was higher.

- Last Friday, forecasts were calling for significant rains throughout the driest areas of Brazil, but updated forecasts are now only calling for some scattered showers, not the soaking rains that had been expected. In addition, temperatures are expected to remain very hot which would further stress the soy crop.

- In the US, domestic demand has been strong for soybean crush, and the USDA is estimating that the processing value of soybeans in Illinois is $17.77 a bushel which is high enough to keep processors incentivized to buy soybeans.

- Brazilian soybean planting for 23/24 is now estimated at 68% complete as of November 16 and has advanced just 7 points from the previous week, way below the pace of 80% from last year. These planting delays are causing some producers to plant cotton instead, and the delays will impact corn planting as well.

Above: On November 15, January soybeans posted a bearish reversal after coming within 11 cents of the August high. Since then, prices have traded lower and filled the gap left from 1349 ¾. For now, heavy resistance remains between 1400 and 1410, with support below the market between 1336 and the 50-day moving average near 1318.

Wheat

Market Notes: Wheat

- All three wheat classes ended the day higher after finding support down near Monday’s lows. Additional support came early in the day from stronger soybeans and corn, which later gave up much of their gains.

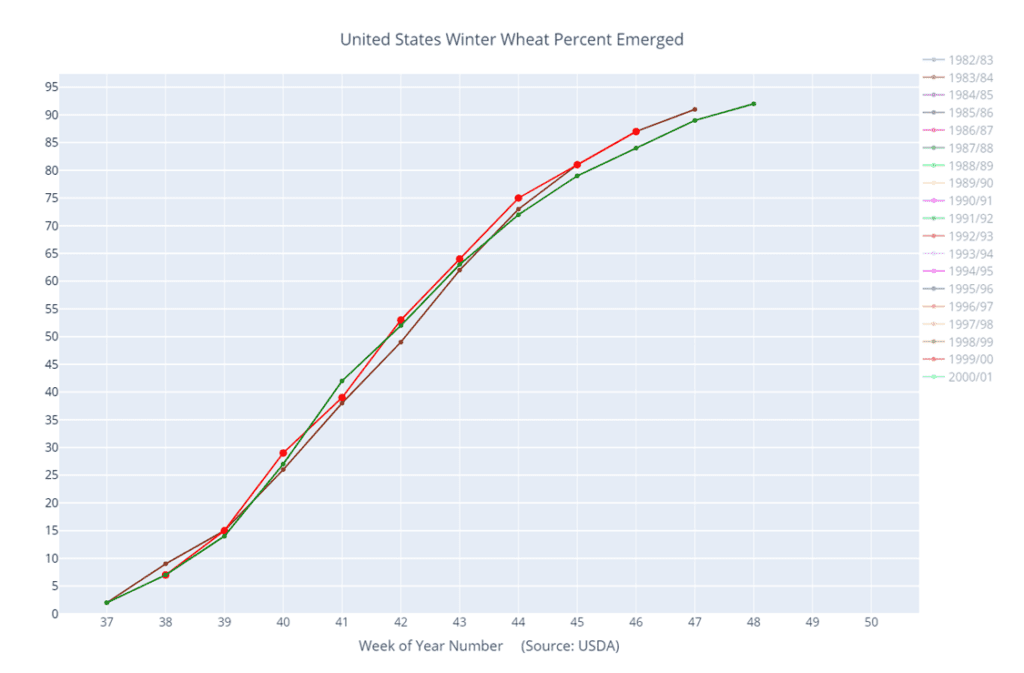

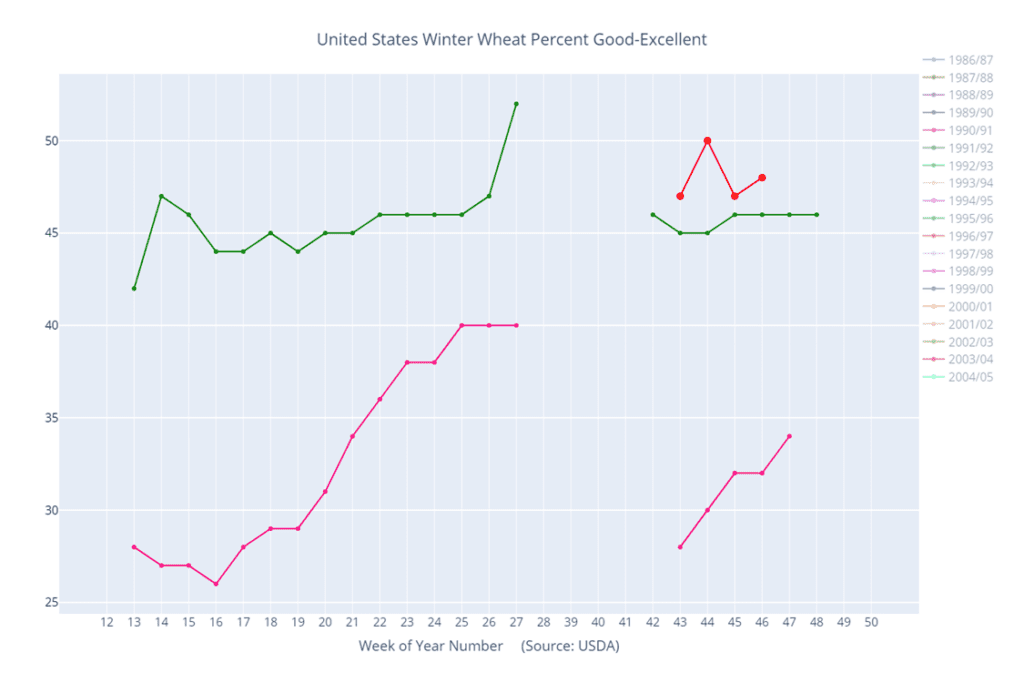

- The USDA issued its weekly Crop Progress report Monday afternoon, which showed that 95% of the winter wheat crop has been planted versus 98% last year. Emergence came in at 87% versus last year’s 86% and 85% on average. 48% of the crop is in good to excellent condition, up one point from last week and 16% ahead of last year.

- Ukraine’s Ag Ministry said that the country’s winter wheat crop is 92% planted, and AK-Inform, a crop analyst, raised their forecast for Ukraine’s wheat exports to 13 mmt, which is just above the USDA’s estimate of 12 mmt.

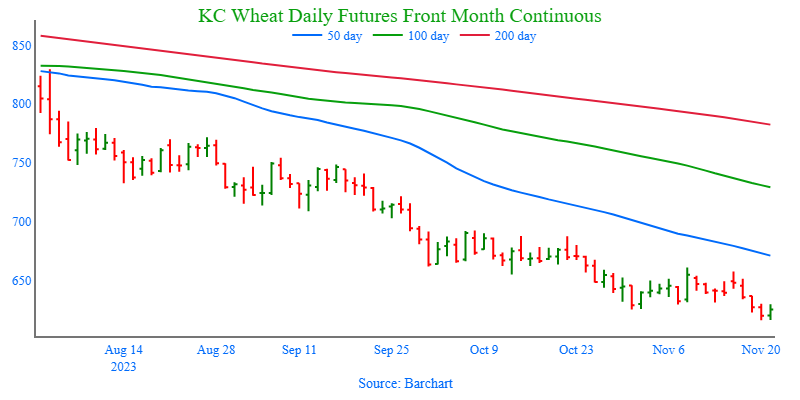

- US wheat export demand and prices have been greatly affected by low export prices out of Russia and the Black Sea. Russia continues to be cheapest among world exporters, and the pressure has affected Matif futures as well which are near a five month low.

- While many US winter wheat areas have seen some moisture, HRW areas remain dry and could use more to recover from the deficit. This continued lack of moisture and low prices may be leading to some short covering of the fund’s large short positions, supporting in prices.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, nearby Chicago wheat trended lower until finding support at 540 on September 29, from which it rallied back, briefly piercing 600 and the 50-day moving average. The market now appears to be finding value in the 540 – 616 range established since early September, as weak US export demand, driven by cheap Russian exports, remains the dominant headwind to higher prices. Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

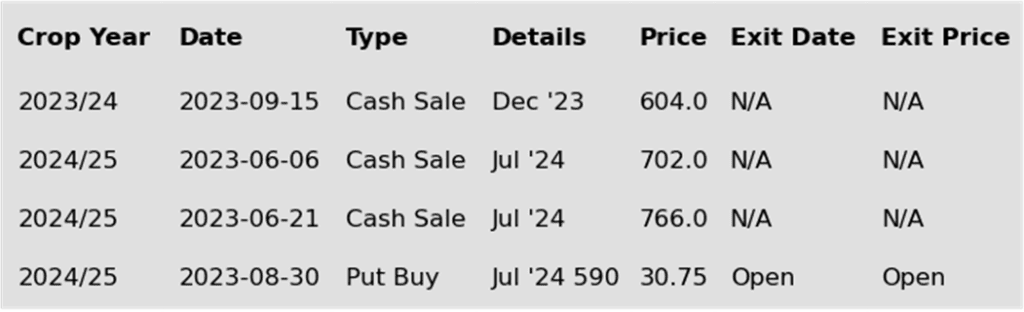

- No new action is recommended for 2024 Chicago wheat. After retesting the 800 level back in July, new crop Chicago wheat retreated steadily until hitting the late September low of 610 ¼. Since then, prices have been mostly rangebound between 620 and 650. Just as fund positioning and weak fundamentals have driven old crop prices down closer to the mid to upper 500 range and new crop prices to the low to mid 600s. The risk of further new crop price erosion remains without fresh bullish input to move prices higher. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels, and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: On November 15 nearby Chicago wheat rolled from the December contract to the March. While it appears that prices made a significant move, it is in fact the premium in March that is being represented on the chart. Upside resistance remains between 604 ½ and 618, while support below the market, remains between 564 and 554.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

New Alert

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

KC Wheat Action Plan Summary

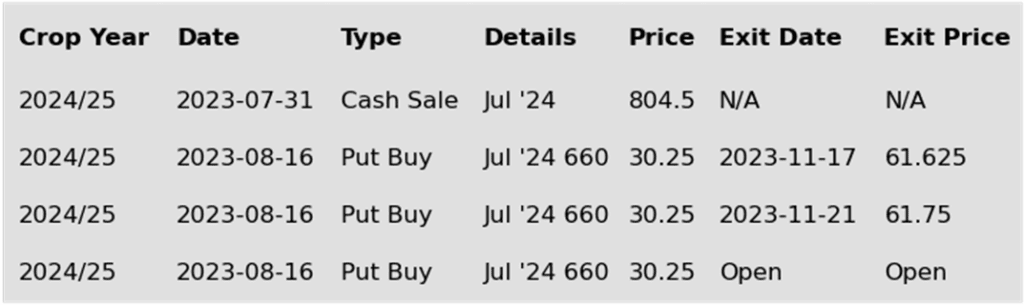

- No new action is recommended for 2023 KC wheat crop. Since late July the nearby KC wheat has been in a downtrend that has had periods of relative stability, but not any significant reversals higher. The market once again found nearby support as it traded to, and held, its recent low of 625 ½. Currently, weak US export demand, driven by cheap Russian exports, remains the dominant headwind, and the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst enters the market to push prices above 700, it may signal that a fall low is in place and would line up with the historical tendency for prices to appreciate into winter and early spring. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover with an eye on considering additional sales near 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- Grain Market Insider recommends covering half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees, and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium minus fees, and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: After testing resistance at the upper end of the recent range near 660, the market has retreated and broken through 625 support. Without fresh bullish input, March ’24 runs the risk of retreating further and testing 575 support.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

New Alert

Exit Half JUL ’24 KC 660 Puts ~ 61c

2025

No Action

Mpls Wheat Action Plan Summary

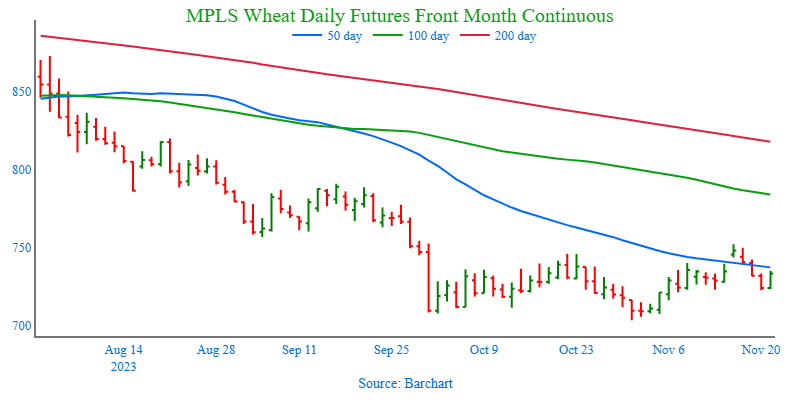

- No new action is currently recommended for the 2023 New Crop. After making highs in July, and the subsequent downtrend to the October 2 low of 707 ½, nearby Minneapolis wheat has traded mostly sideways with no significant reversal higher. With weak US export demand still the primary impediment to higher prices, the market remains at risk of trending lower if September’s low close of 709 is violated to the downside unless another bullish impetus enters the scene. If that happens and prices begin to push back toward 775, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices. Even though the primary strategy is to look for higher prices, Grain Market Insider may also consider a “plan b” in the next couple of weeks if prices grind sideways to lower.

- Grain Market Insider recommends covering half of the remaining July ’24 KC wheat 660 puts at current market prices, minus fees and commission. Last week Grain Market Insider suggested covering half of the originally recommended July ’24 KC wheat 660 puts at approximately 61 cents in premium, minus fees and commission. At 61 cents, the puts were about double their original cost. In yesterday’s and today’s trading sessions, the July ’24 contract may have found support at about the 630 level. Given the extreme oversold condition of the market, Grain Market Insider recommends covering another half of the remaining position to protect some of the current gains. This recommendation means that 75% of the original position should be closed out, leaving 25% of the original position to continue to provide downside protection in the event the market fails to rally off this 630 area.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: On November 15, nearby Minneapolis wheat rolled from the December contract to the March. While it appears that prices made a significant move, it is in fact the premium in March that is being represented on the chart. Nearby resistance remains near 755 with heavy resistance above the market near the September high of 791. Below the market initial support lies near 721 with major support down near 669, the May ’21 low.

Other Charts / Weather