11-20 End of Day: Corn and Wheat Recover to the Upside, While Beans Slide

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 430.25 | 3 |

| MAR ’25 | 440 | 2.25 |

| DEC ’25 | 441 | 1.5 |

| Soybeans | ||

| JAN ’25 | 990.5 | -8 |

| MAR ’25 | 999.25 | -9.25 |

| NOV ’25 | 1015.25 | -5.75 |

| Chicago Wheat | ||

| DEC ’24 | 552.5 | 2.75 |

| MAR ’25 | 572.25 | 4.5 |

| JUL ’25 | 589.25 | 5 |

| K.C. Wheat | ||

| DEC ’24 | 561.75 | 3.5 |

| MAR ’25 | 572.75 | 3.25 |

| JUL ’25 | 588 | 2.5 |

| Mpls Wheat | ||

| DEC ’24 | 586.75 | 1.75 |

| MAR ’25 | 605.25 | 1 |

| SEP ’25 | 636.5 | 1 |

| S&P 500 | ||

| DEC ’24 | 5902.5 | -36.25 |

| Crude Oil | ||

| JAN ’25 | 68.86 | -0.38 |

| Gold | ||

| JAN ’25 | 2665.5 | 22.5 |

Grain Market Highlights

- With support from the neighboring wheat market and a solid ethanol production report, corn futures managed their highest close in nearly two weeks, a difficult task as sellers have stepped in at these levels.

- Sharply lower soybean oil and the prospect of a large Brazilian soybean crop continue to weigh on the soybean market, which closed in the bottom third of the day’s 15-cent range despite new export sales.

- Soybean oil closed with a 3.47% loss after breaking support in the January contract as traders move to take profits and liquidate long positions triggered by weak world veg oil prices.

- Despite a stronger US dollar and Southern Hemisphere harvests, wheat closed higher across the board, rebounding from earlier declines as traders continue to add war premium to prices.

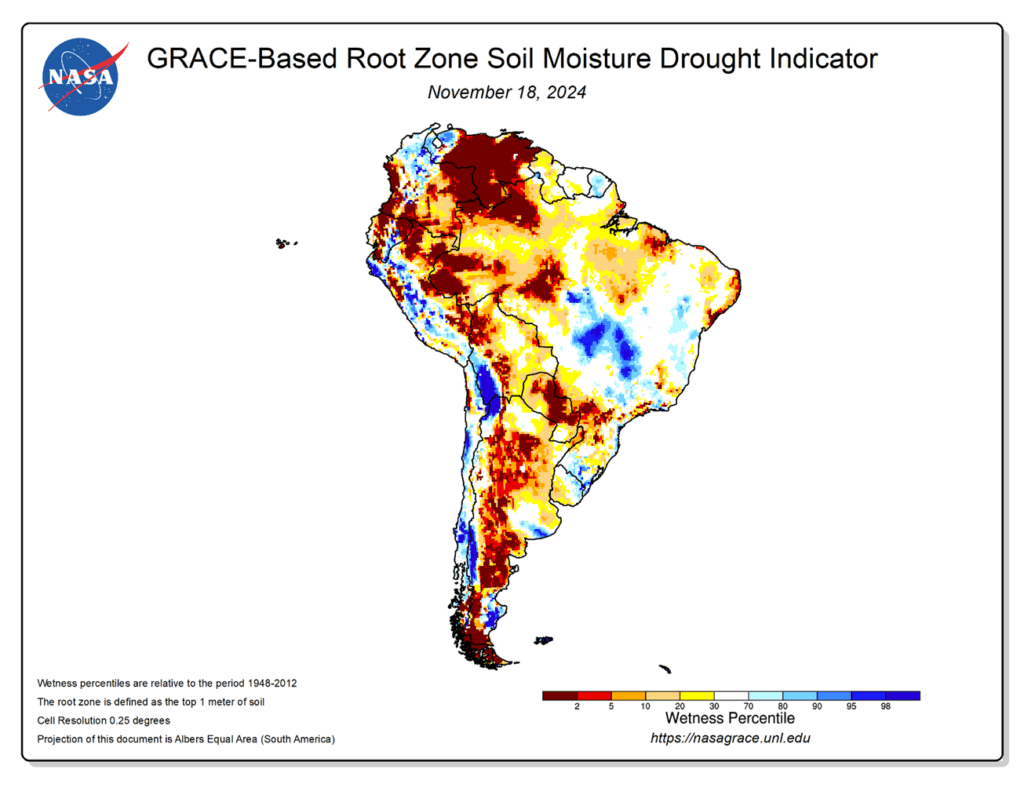

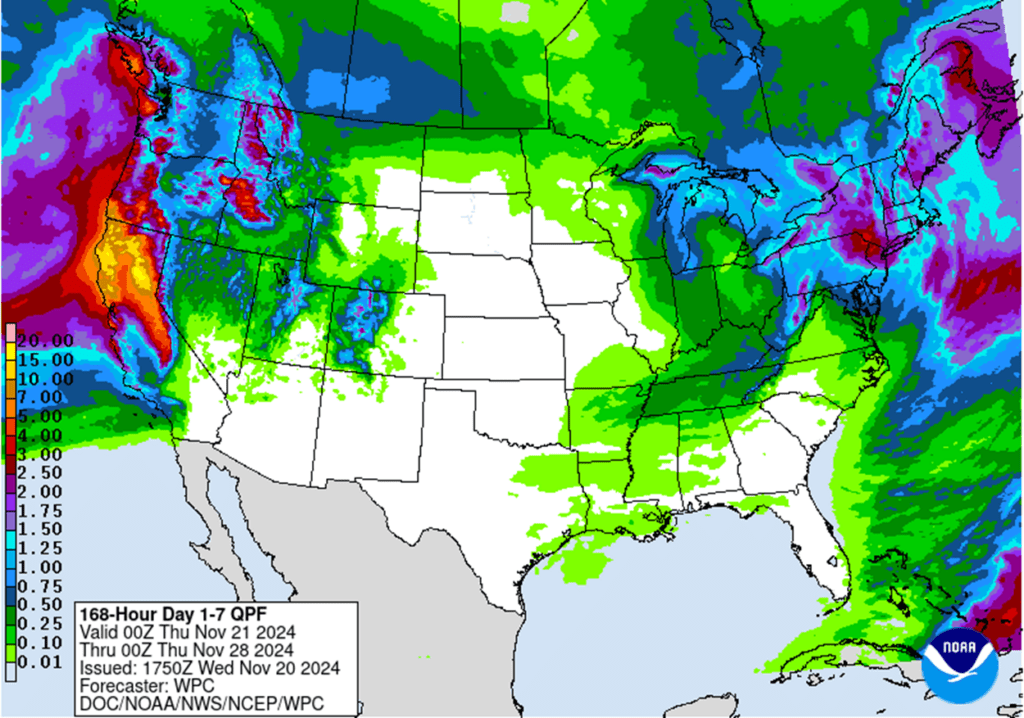

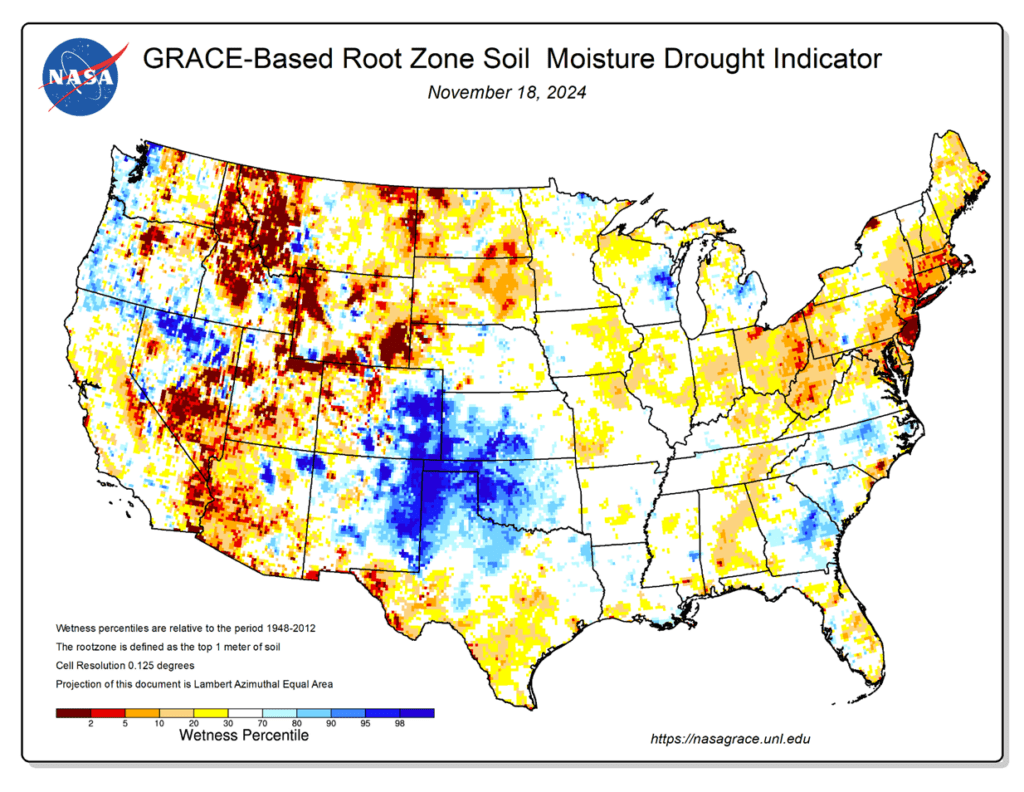

- To see updated US and South American precipitation forecasts and GRACE-based Drought Indicators, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- New sales recommendations will be issued when seasonal opportunities improve. This could be as early as late fall or as late as early spring.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- Considering seasonal weakness, no new sales recommendations will be issued until opportunities improve, which could be as soon as late fall or as late as early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

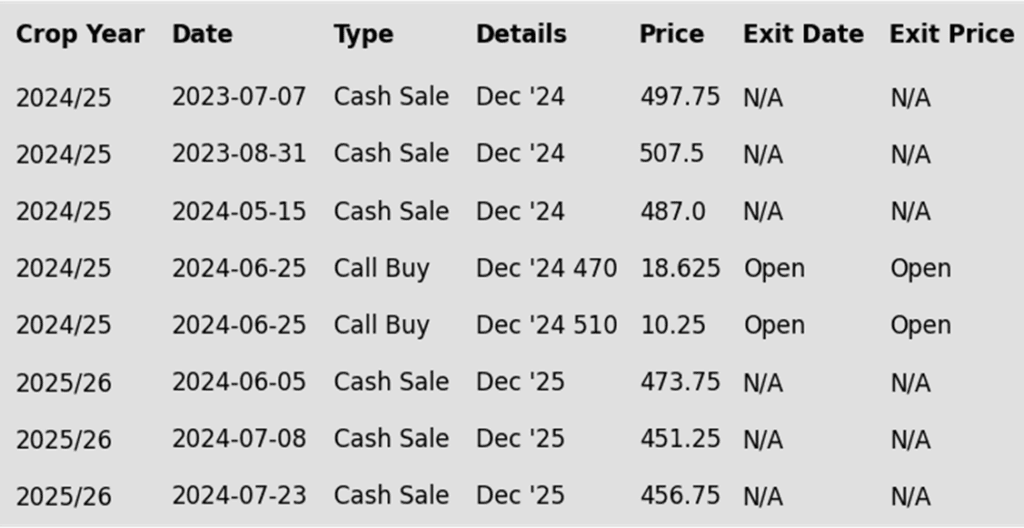

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures edged higher on Wednesday, marking their highest close since November 8. The 430-price level December continues to cap gains as sellers step in near this point.

- Weekly ethanol production dropped to 1.110 million barrels/day for the week ending November 15, down 3.27 million from the prior week but 8.5% higher than last year. Corn use totaled 111.6 mb, approximately 15.9 mb/day, above the pace needed to meet the USDA’s yearly ethanol grind target.

- The USDA will release weekly corn export sales Thursday, with expectations between 1.0 and 2.2 mmt. Last week’s 1.35 mmt sales were a bit disappointing, possibly due to a stronger US dollar reducing competitiveness.

- The cereal grain markets, corn and wheat, will be keeping a close eye on geo-political tensions between Ukraine and Russia. A possible escalation of the ongoing war between the two would likely be supportive for both cereal grain markets.

- The corn market may see an increase in volatility this week as December options expire Friday and First Notice Day nears next week, which could bring an increase in activity and money flow.

Above: Overhead resistance for the March contract comes in between 440 and 445. A close above this area could trigger a test of the 465 resistance area. Below the market, support may come in between 425 and 420.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- New sales recommendations will be issued as seasonal opportunities improve, which could be anytime between late fall and early spring.

2025 Crop:

- Sales targets have not been announced for next year’s crop. Patience is recommended, the earliest they will be set will be late fall or early winter, and early spring at the latest.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

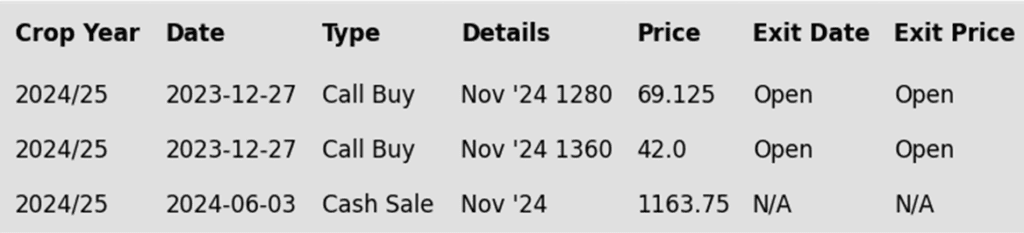

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower for the second day, with January contracts near session lows and 17 cents above the August contract low. Pressure came from weaker soybean oil, dragged down by lower palm oil, while soybean meal ended slightly higher.

- The USDA reported private export sales totaling 202,000 mt of soybeans to China and 226,200 mt to unknown destinations, both for 24/25 delivery.

- Abiove raised its 24/25 Brazil soybean production estimate to 167.7 mmt, surpassing CONAB’s 166.14 mmt projection. If realized, this record crop could boost exports to 104.1 mmt according to the firm.

- China’s October US soybean imports surged to 541,434 mt, nearly doubling last year, as buyers accelerated purchases amid trade tension concerns. Imports from Brazil totaled 8.09 mmt, maintaining its position as China’s top supplier.

Above: Soybeans appear to have found nearby support around 986. A close above 1014 could lead to another test of the 1044 -1050 area. Otherwise, should the market trade through 986 and close below 975 support, prices could drift towards 940.

Wheat

Market Notes: Wheat

- US wheat posted modest gains despite a strong day and positive reversal for Matif wheat futures, with a higher US Dollar Index likely keeping wheat prices in check.

- Wheat harvests in Australia and Argentina continue to pressure US markets, with Argentina’s wheat export values dropping $6 to $216/mt, making US wheat less competitive globally.

- EU soft wheat exports reached 8.79 mmt for the season as of November 17, down 31% from 12.7 mmt during the same period last year, according to the European Commission.

- Houthi rebels launched two separate unsuccessful missile attacks on a grain vessel en route from Ukraine to Pakistan on November 17 and 18, escalating regional tensions.

- Russia’s wheat export duty increased 4.7%, from 2,569.2 to 2,689.7 Rubels per mt starting November 20. In 2021 Russia initiated floating duties on exports of corn, barley, and wheat, with the funds going to subsidize agriculture producers.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

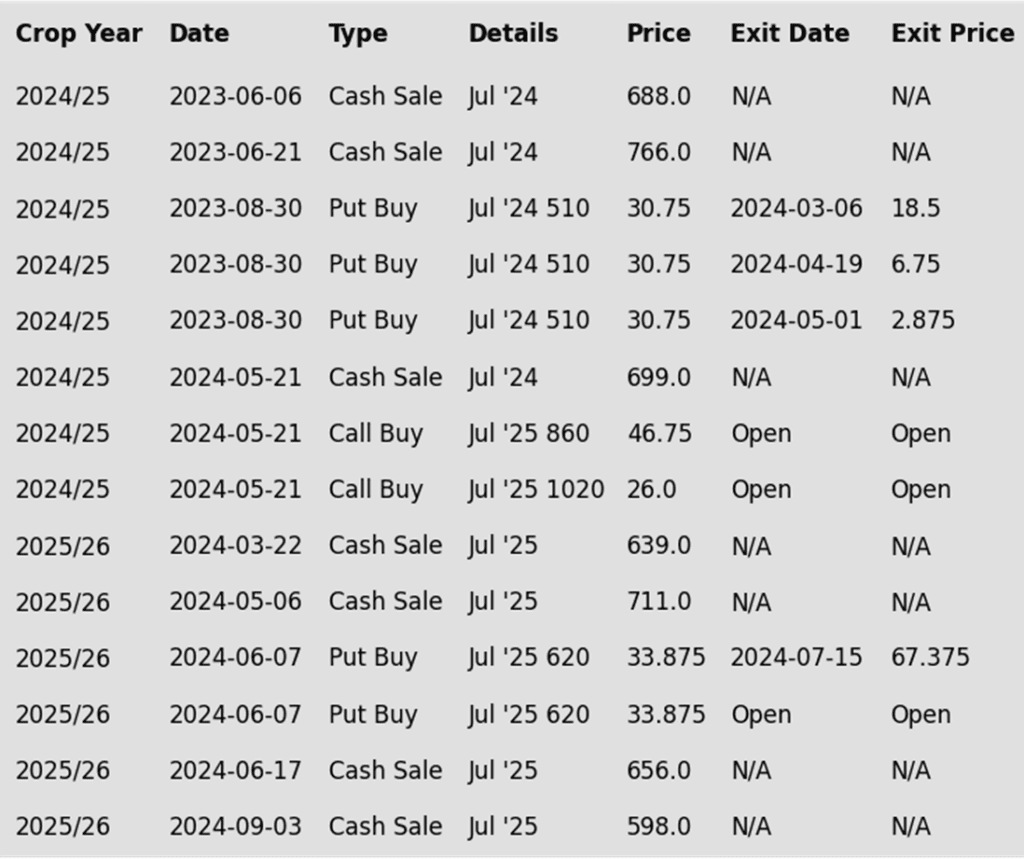

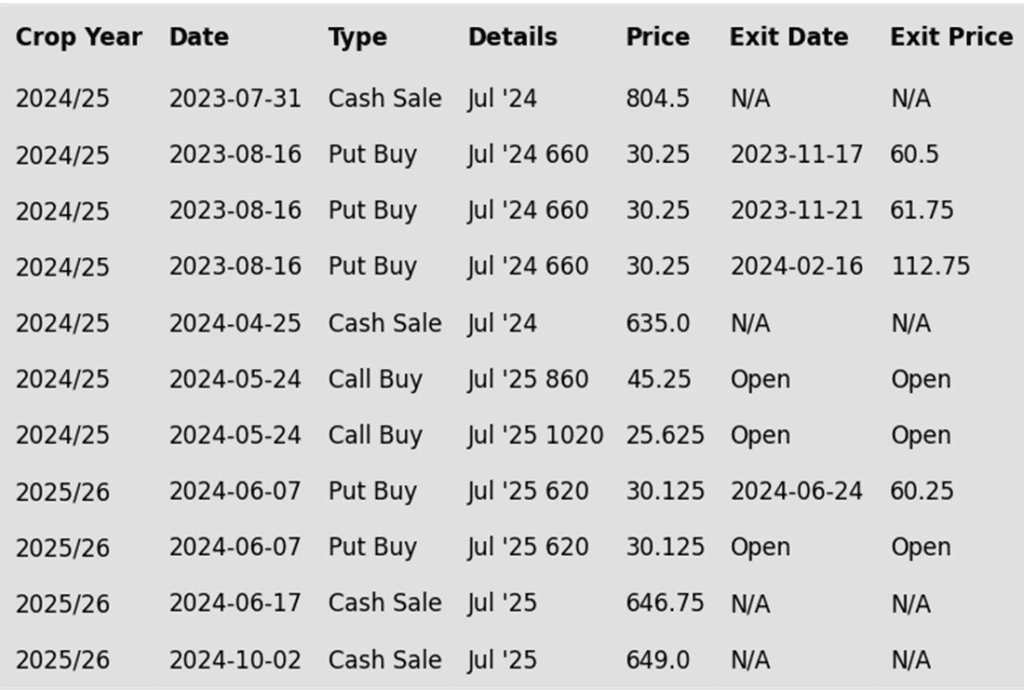

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Overhead resistance for March wheat lies near key moving averages around 578–586, with a close above potentially targeting 617. Support is seen between 546–536, with major support near 521–514.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

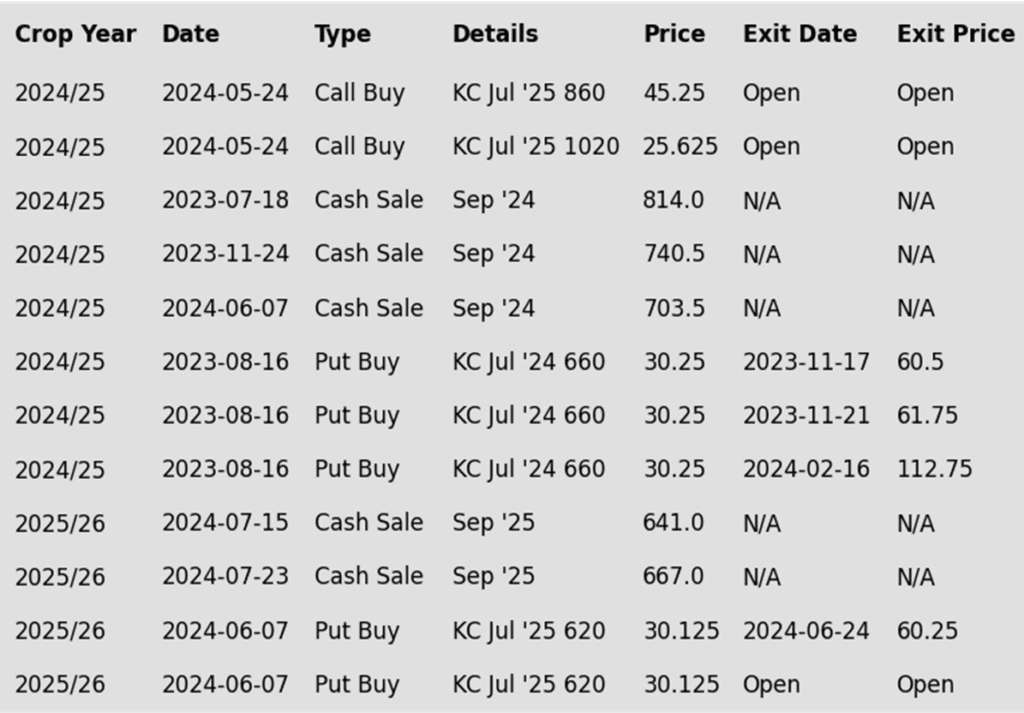

To date, Grain Market Insider has issued the following KC recommendations:

Above: With initial support below the market remaining in the 545 – 535 area, prices remain poised to test the heavy resistance area around 580 – 583. A close above that level could allow for a test of 593 – 603. Otherwise, close below 535 could press prices towards the August low of 527 ¼.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- New sales targets will be issued in the coming weeks, as timing and conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The front month chart rolled to March, leaving a gap between 580 ½ and 584 ½ from the contract roll. Resistance remains near 615–624, with initial support around 584 and major support near 563.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

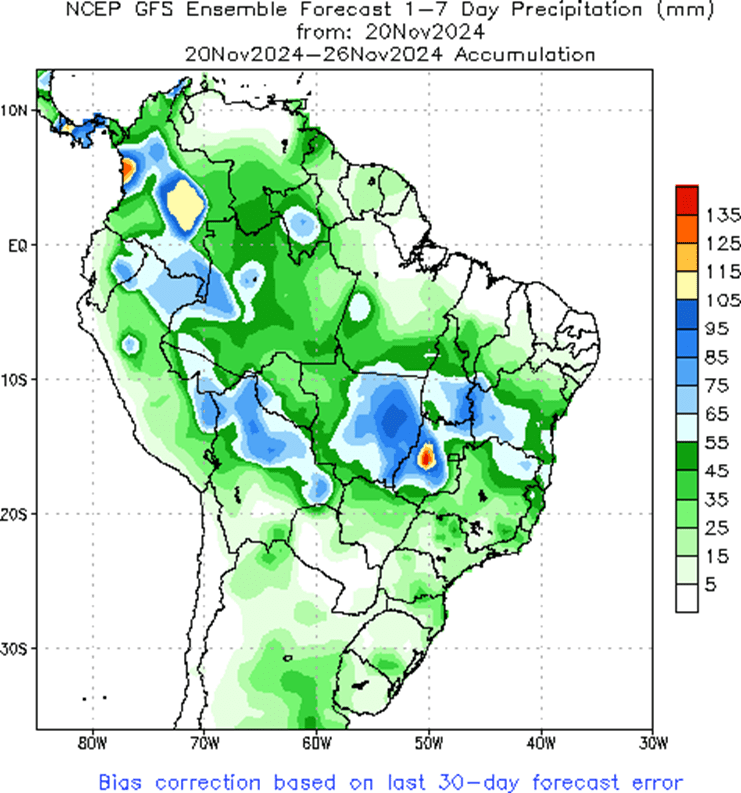

Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

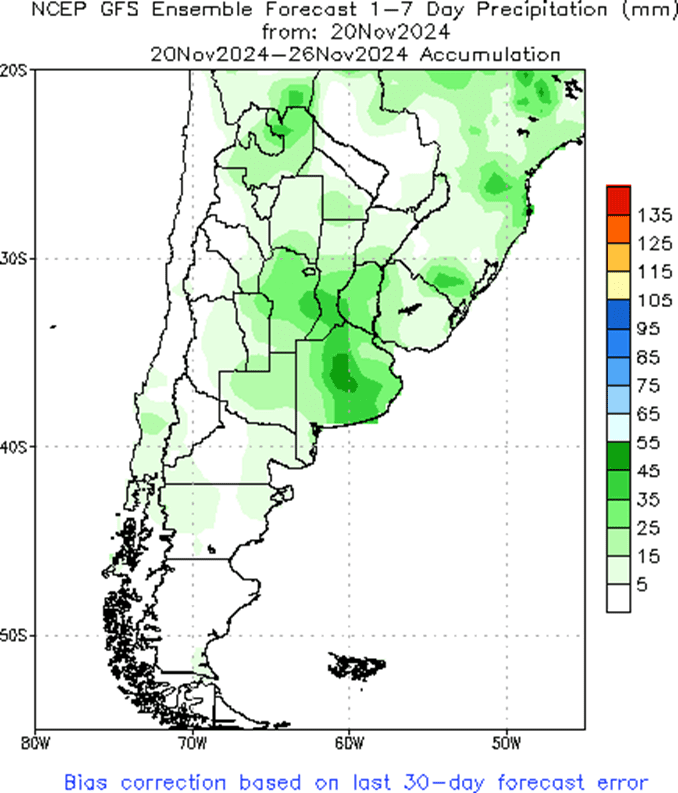

Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.