11-18 End of Day: Grain Markets Close Strong to Start the Week.

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 429.25 | 5.25 |

| MAR ’25 | 439.75 | 4.5 |

| DEC ’25 | 441 | 0.75 |

| Soybeans | ||

| JAN ’25 | 1009.75 | 11.25 |

| MAR ’25 | 1019 | 10.25 |

| NOV ’25 | 1026.75 | 6.5 |

| Chicago Wheat | ||

| DEC ’24 | 547.25 | 10.75 |

| MAR ’25 | 565.75 | 11.75 |

| JUL ’25 | 581.5 | 11.5 |

| K.C. Wheat | ||

| DEC ’24 | 555.25 | 15.25 |

| MAR ’25 | 567 | 14.75 |

| JUL ’25 | 582.5 | 13.5 |

| Mpls Wheat | ||

| DEC ’24 | 572.25 | 5.75 |

| MAR ’25 | 591.25 | 5.5 |

| SEP ’25 | 622.5 | 4.75 |

| S&P 500 | ||

| DEC ’24 | 5908.75 | 12.25 |

| Crude Oil | ||

| JAN ’25 | 69.21 | 2.29 |

| Gold | ||

| JAN ’25 | 2627.2 | 45.1 |

Grain Market Highlights

- Carryover strength from neighboring wheat and a drop in the US dollar from recent highs lent support to the corn market, which followed through on Friday’s gains to close just off today’s highs.

- Fresh export sales and solid weekly export inspections helped drive the soybean market from its overnight lows to close at the top end of its range, as it followed through on Friday’s strength.

- Following a day of choppy two-sided trade, soybean meal and oil both traded off Friday’s support to shed overnight lows and close higher on the day.

- All three wheat classes settled near the tops of their ranges, supported by escalating Russia-Ukraine tensions and a weaker US dollar.

- To see updated US and South American weather outlooks, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- If you missed our previous sales recommendations, consider targeting the 460 area in March ‘25 for any catch-up sales. Additionally, selling additional bushels into market strength may be beneficial if you have capital needs.

- We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- New sales recommendations will be issued when seasonal opportunities improve. This could be as early as late fall or as late as early spring.

2025 Crop:

- If you missed previous sales recommendations for next year’s crop, consider targeting 455 – 475 versus Dec’25 to take advantage of any post-harvest strength.

- Considering seasonal weakness, no new sales recommendations will be issued until opportunities improve, which could be as soon as late fall or as late as early spring.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

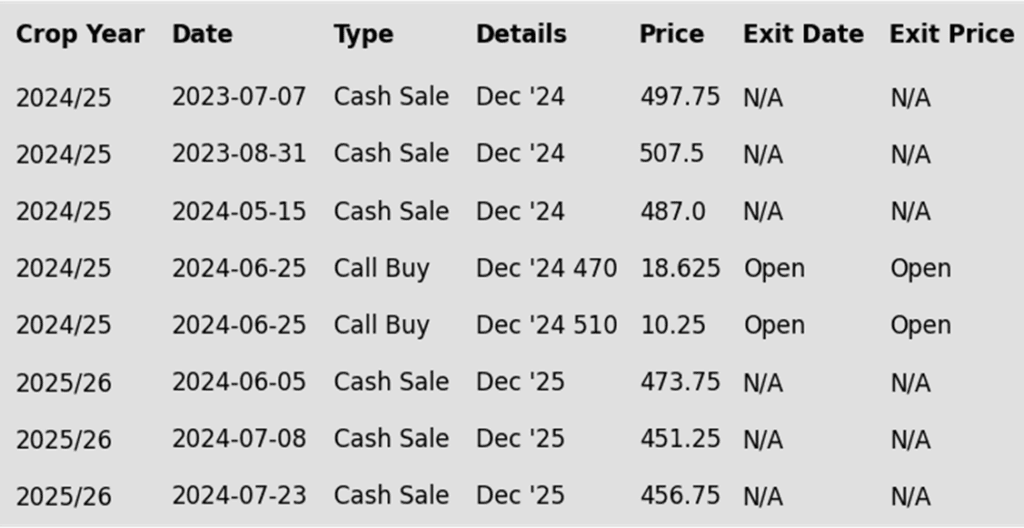

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- A strong move higher in wheat futures and a drop from the near-term peak in the US dollar supported corn futures with some follow through buying after Fridays positive close.

- This morning’s USDA Export Inspections report showed 821,000 mt (32.3 mb) of corn shipped last week, near the top of expectations. Year-to-date shipments are 9.021 mmt, up 32% from last year.

- The US Dollar Index eased off its highs today, signaling a potential near-term top. A potential correction could be friendly for commodity markets.

- The corn market may face additional volatility ahead of Thanksgiving as December options expire this Friday, followed by First Notice Day next week, which could drive increased money flow and trade activity.

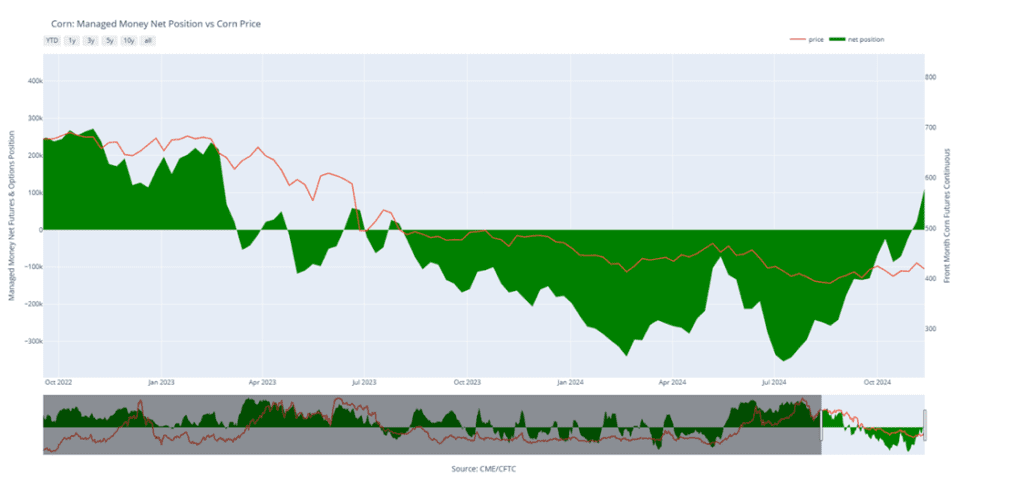

Above: Soybeans appear to have found nearby support around 986. A close above 1014 could lead to another test of the 1044 -1050 area. Otherwise, should the market trade through there and close below 975 support, prices could drift towards 940.

Corn Managed Money Funds net position as of Tuesday, Nov. 12. Net position in Green versus price in Red. Managers net bought 87,946 contracts between Nov. 6 – 12, bringing their total position to a net long 109,989 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- If you missed prior sales recommendations, a rally back to the 1050 – 1070 area versus Jan’25 could provide a good opportunity to make catch-up sales. For those with capital needs, consider making these sales into price strength.

- Additional sales could also be considered in the 1090 – 1125 range versus Jan’25 if prices rally beyond the 1070 area.

- New sales recommendations will be issued as seasonal opportunities improve, which could be anytime between late fall and early spring.

2025 Crop:

- Sales targets have not been announced for next year’s crop. Patience is recommended, the earliest they will be set will be late fall or early winter, and early spring at the latest.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

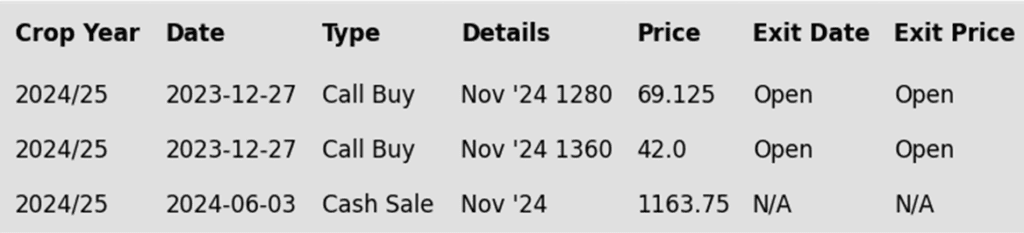

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher, led by front months on strong demand. Flash sales were reported this morning, and the USDA noted a large NOPA crush number Friday. Seasonal trends between Thanksgiving and New Year may also be driving fund activity. Both meal and oil finished higher.

- The USDA announced fresh export sales of soybeans, soybean meal, and soybean oil for the 24/25 marketing year. Reported sales include 261,264 mt of soybeans to Mexico, 135,000 mt of meal to the Philippines, and 30,000 mt of oil to India.

- Weekly USDA Export Inspections showed 79.6 mb of soybeans inspected for export last week, as expected. Year-to-date inspections are 9% ahead of last year.

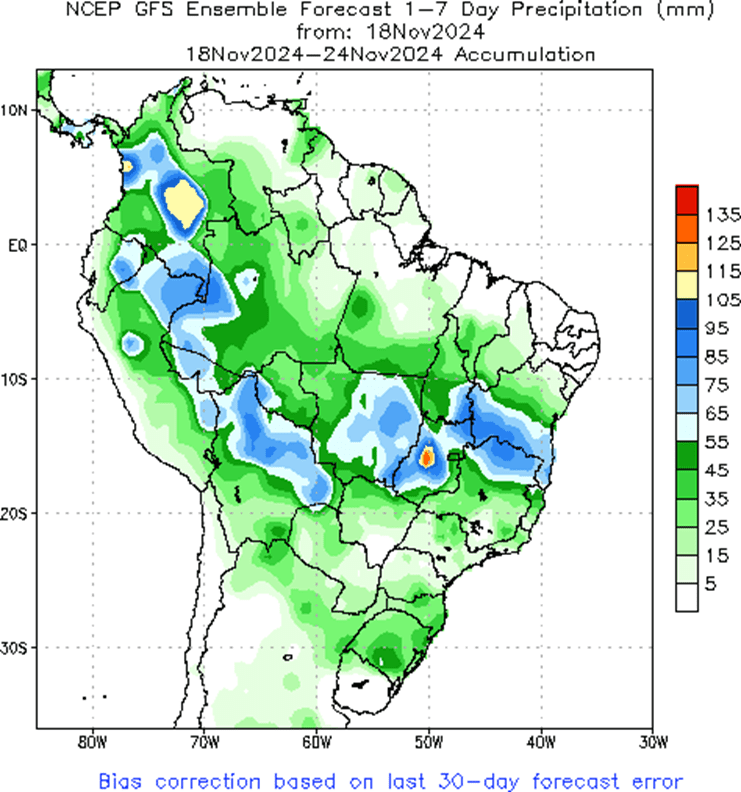

- According to AgRural, 80% of Brazil’s 24/25 soybean crop was planted as of last Thursday, significantly ahead of the 67% pace the previous year and the five-year average of 68%, which is impressive given the slow start to year.

- Reports suggest China plans to reduce its export tax rebate on used cooking oil, a move that could limit US imports of the product for biofuel production.

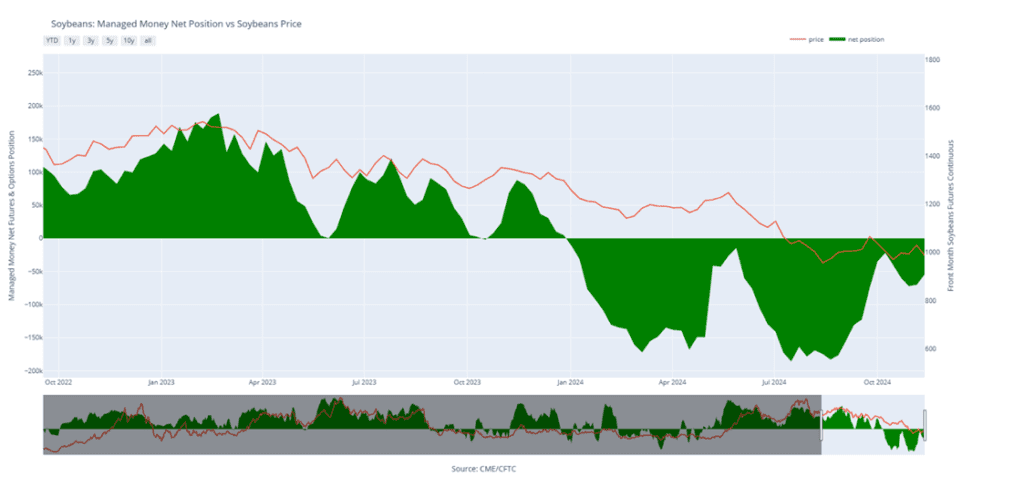

Above: Resistance in the 1044-1050 area held with the market reversal to the downside, suggesting a potential retreat toward the October lows, where support may be found near 975. If prices regain their strength, a close above 1014 could lead to another test of the 1044 -1050 area.

Soybean Managed Money Funds net position as of Tuesday, Nov. 12. Net position in Green versus price in Red. Money Managers net bought 15,576 contracts between Nov. 6 – 12, bringing their total position to a net short 54,536 contracts.

Wheat

Market Notes: Wheat

- Wheat posted double-digit gains across all classes, fueled by escalating Russia-Ukraine tensions and a weaker US Dollar Index. Russia launched attacks on Ukraine’s electrical grid, while reports suggest the US has approved Ukraine’s use of longer-range missiles against Russia.

- Weekly wheat inspections reached 7.2 mb, bringing 24/25 totals to 379 mb, up 31% year-over-year and ahead of the USDA’s pace to reach its projected 825 mb in annual exports, a 17% increase over last year.

- Chinese customs data shows October wheat imports at 220,000 mt, down 66.2% year-over-year, but year-to-date imports are up 1.2% to 10.96 mmt.

- Friday’s Commitment of Traders report indicated managed funds sold 14,500 Chicago, 11,000 Kansas City, and 5,000 Minneapolis wheat contracts, pushing their combined short position to 93,000 contracts — the largest in two months.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Target the 740 – 760 range versus March ‘25 to make additional sales. While this range may seem far away, it aligns with the market’s potential based on our research as we approach winter dormancy.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Continue holding open July ’25 620 puts to maintain coverage for unsold bushels. Back in July Grain Market Insider recommended selling the first half to offset the cost of the now remaining puts.

- Target the 650 – 680 range versus July ’25 to make additional sales.

- Look to protect current sales by buying upside calls in the 745 – 775 range if signs of an extended rally appear. This will give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

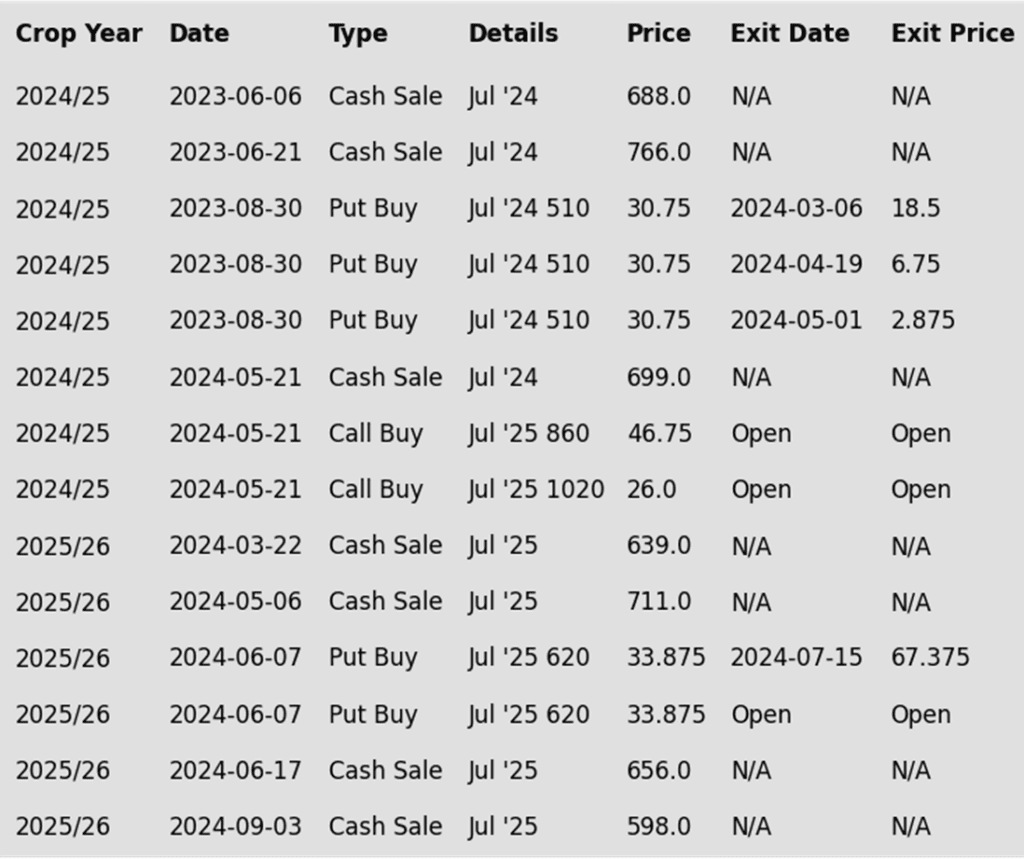

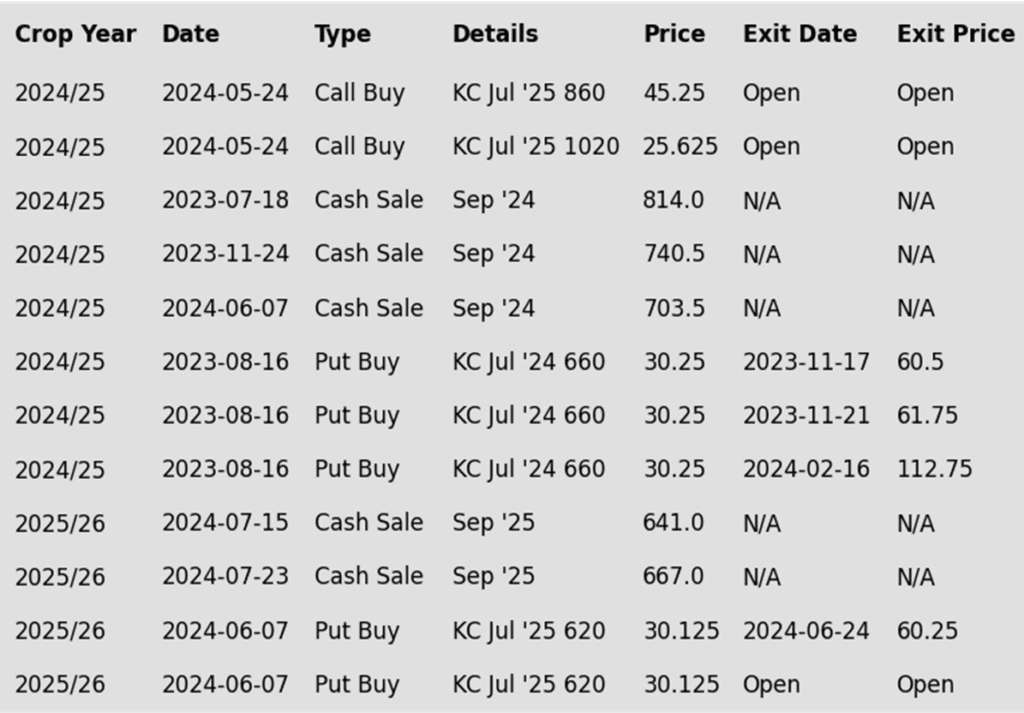

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The front month chart rolled to the March contract. Major support below the market remains between 521 and 514, though intermediate support may be found 535. Overhead, heavy resistance remains between 580 and 586.

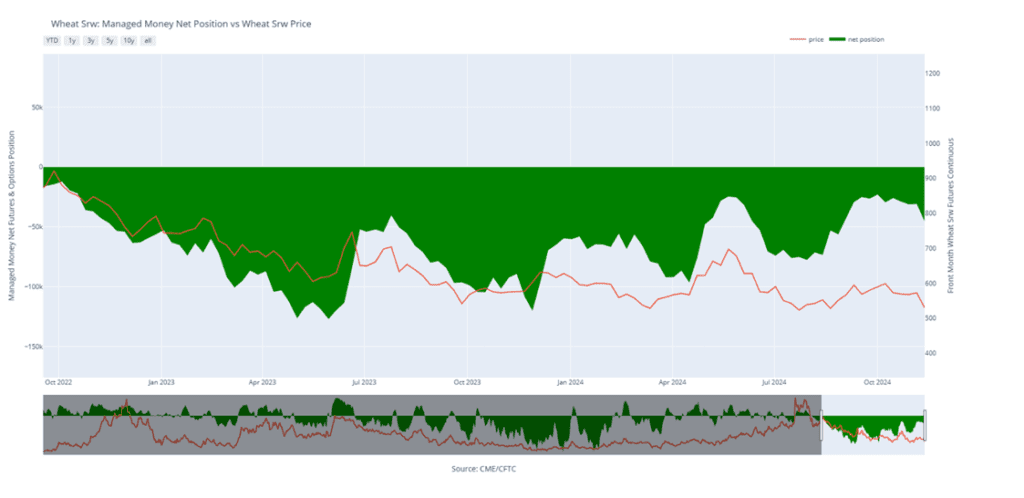

Chicago Wheat Managed Money Funds’ net position as of Tuesday, Nov. 12. Net position in Green versus price in Red. Money Managers net sold 14,526 contracts between Nov. 6 – 12, bringing their total position to a net short 45,307 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

- Continue to hold the remaining half of the previously recommended July ’25 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

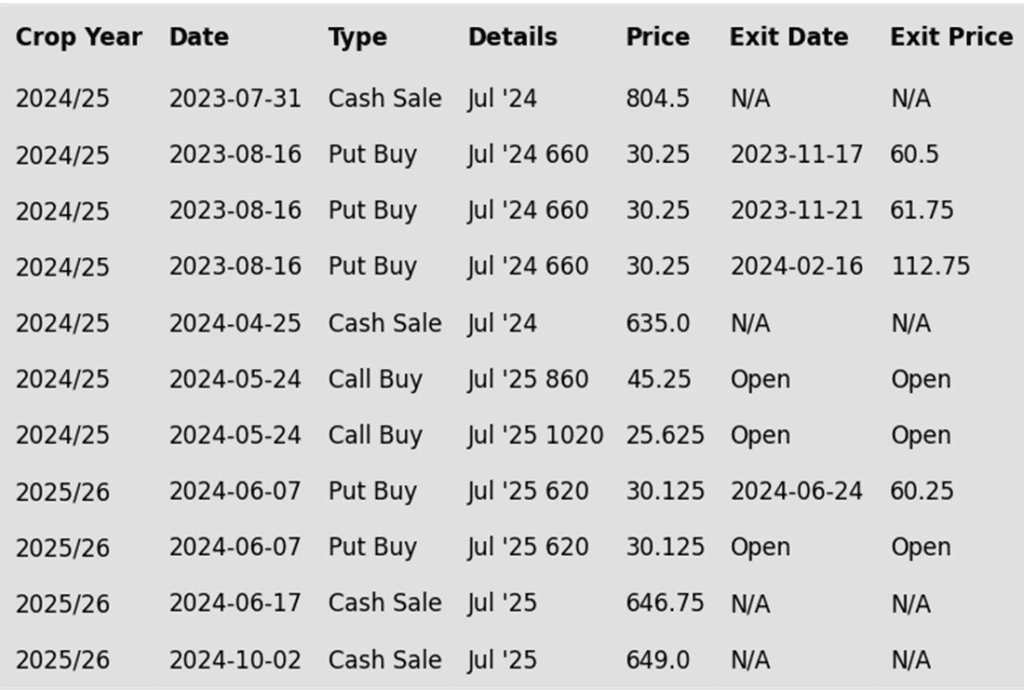

To date, Grain Market Insider has issued the following KC recommendations:

Above: The front month chart rolled to the March contract. A reversal back higher may still encounter heavy resistance near 580 – 583 before testing the 593 – 603 area. Below the market, initial support may come in between 545 and 535, while major support remains near the 527 ¼ August low.

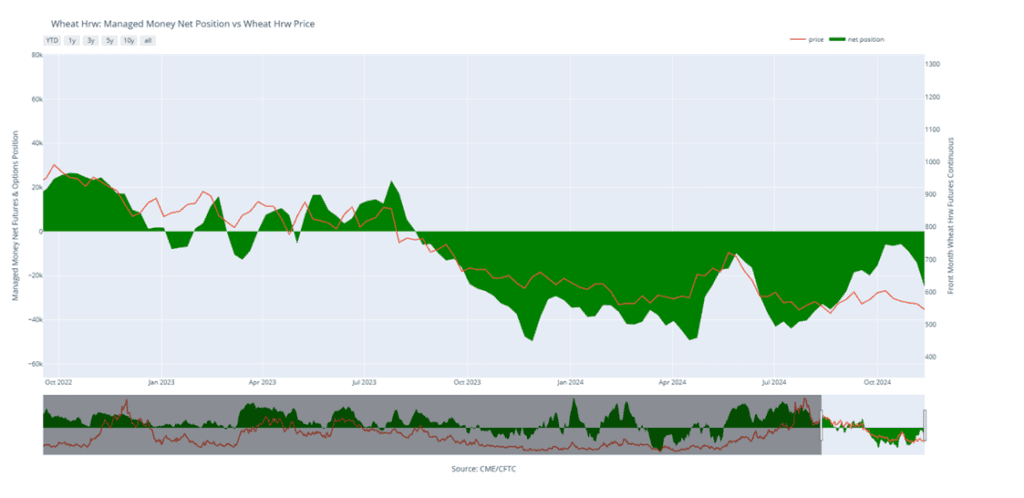

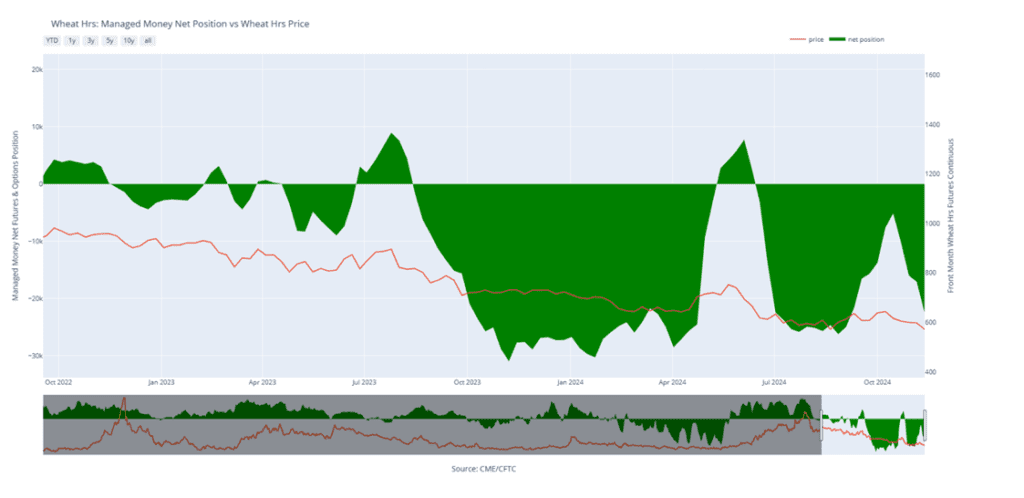

KC Wheat Managed Money Funds’ net position as of Tuesday, Nov. 12. Net position in Green versus price in Red. Money Managers net sold 11,018 contracts between Nov. 6 – 12, bringing their total position to a net short 25,098 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- New sales targets will be issued in the coming weeks, as timing and conditions improve seasonally. This could be as early as late November or December.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The front month chart rolled to the March contract and the chart gap left between 580 ½ and 584 ½ represents the price difference between the two contract months. Overhead resistance remains between 615 and 624, and while major underlying support lies near 563, initial support may come in near 584.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, Nov. 12. Net position in Green versus price in Red. Money Managers net sold 5,316 contracts between Nov. 6 – 12, bringing their total position to a net short 22,424 contracts.

Other Charts / Weather

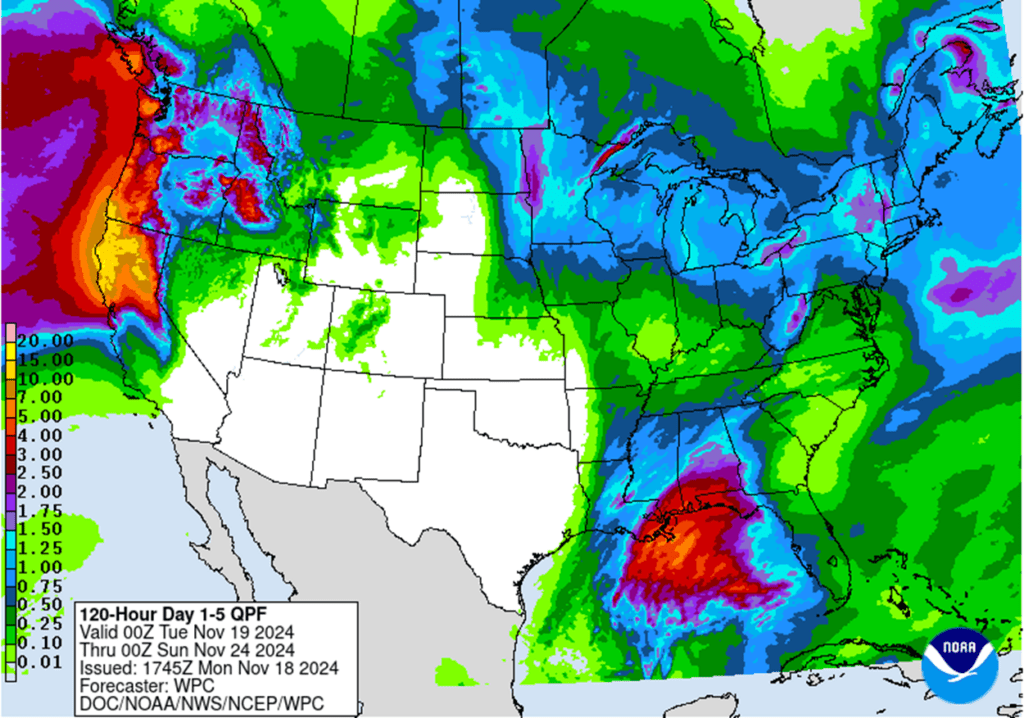

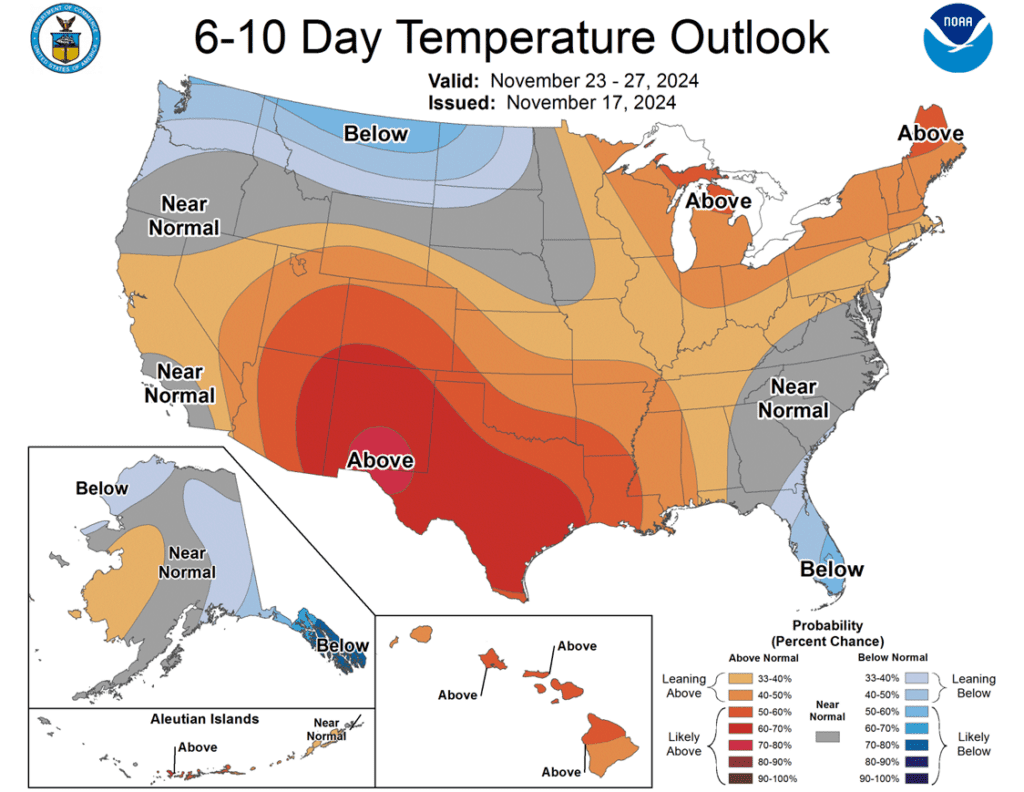

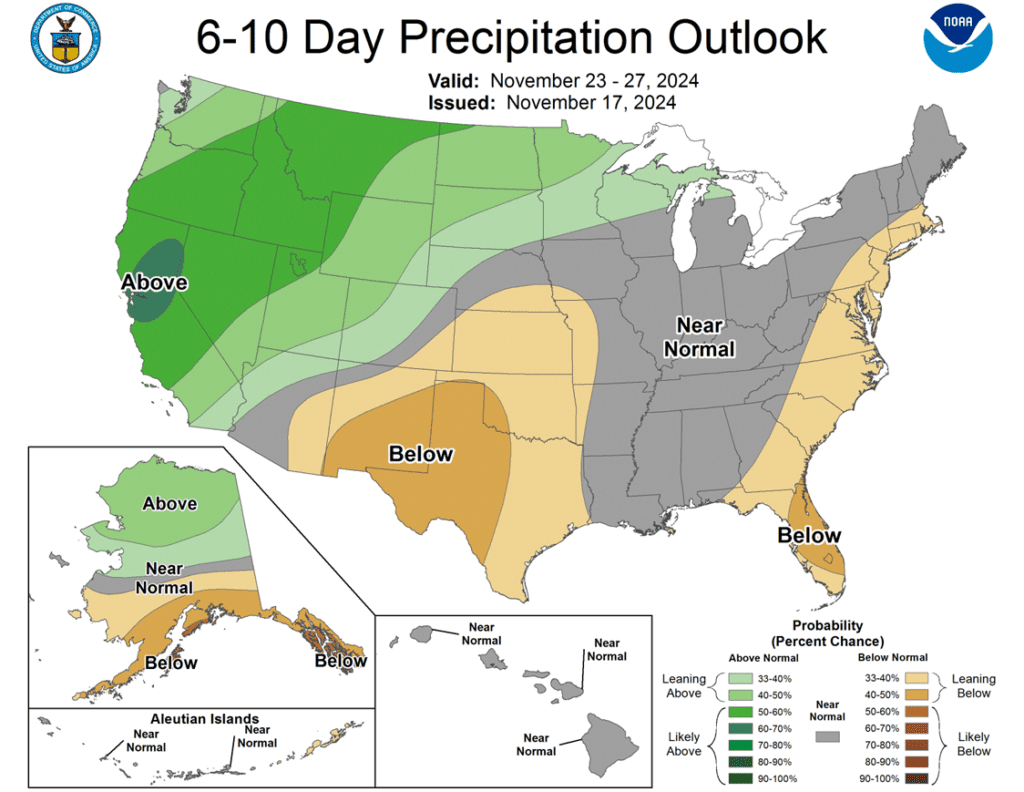

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.