11-13 End of Day: Grain Markets Drift Lower Again

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 426.5 | -2 |

| MAR ’25 | 437.5 | -2.75 |

| DEC ’25 | 440.25 | -2.5 |

| Soybeans | ||

| JAN ’25 | 1007.75 | -2.75 |

| MAR ’25 | 1018.5 | -4 |

| NOV ’25 | 1028.5 | -3.25 |

| Chicago Wheat | ||

| DEC ’24 | 541 | -11.25 |

| MAR ’25 | 556.5 | -10.5 |

| JUL ’25 | 574.25 | -10.5 |

| K.C. Wheat | ||

| DEC ’24 | 540.75 | -5.75 |

| MAR ’25 | 554.75 | -6 |

| JUL ’25 | 573 | -6.25 |

| Mpls Wheat | ||

| DEC ’24 | 577.75 | -14.25 |

| MAR ’25 | 600.5 | -11.75 |

| SEP ’25 | 632.25 | -11 |

| S&P 500 | ||

| DEC ’24 | 6020.25 | 7.25 |

| Crude Oil | ||

| JAN ’25 | 68.26 | 0.29 |

| Gold | ||

| JAN ’25 | 2600.9 | -17.7 |

Grain Market Highlights

- The corn market slid lower for the third day in a row, pressured by weakness in the wheat market and seasonal weakness despite the report of solid flash sales.

- With a lack of fresh export sales and pressure from lower soybean meal and oil, the soybean market closed with small losses after finding support near its 20-day moving average.

- Chicago wheat led the wheat complex lower as the USDA reported improved conditions for the winter wheat crop. Expectations for more rain, combined with lower Matif wheat futures and a stronger US dollar, added to the weakness.

- To see updated US and South American weather forecasts, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

- Grain Market Insider sees an opportunity for catch-up sales on a portion of your 2024 corn crop. The corn market has traded back towards the top of the 397 – 434 range that it has been in since September. If you missed any of our three previous sales recommendations from earlier in the season, this rally represents a good opportunity to begin to catch up.

- Catch-up sales opportunity for the 2025 crop. If you happened to miss our previous sales recommendations and are looking to make additional early sales for next year, you could consider targeting the 455 – 475 area versus Dec ’25 to take advantage of any post-harvest strength. For now, considering the seasonal weakness of the market around harvest time, we will not be posting any targeted areas for new sales until late fall or early winter. Although we are targeting the 470 – 490 area to buy upside calls to protect current sales in case the market experiences an extended rally beyond that point.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

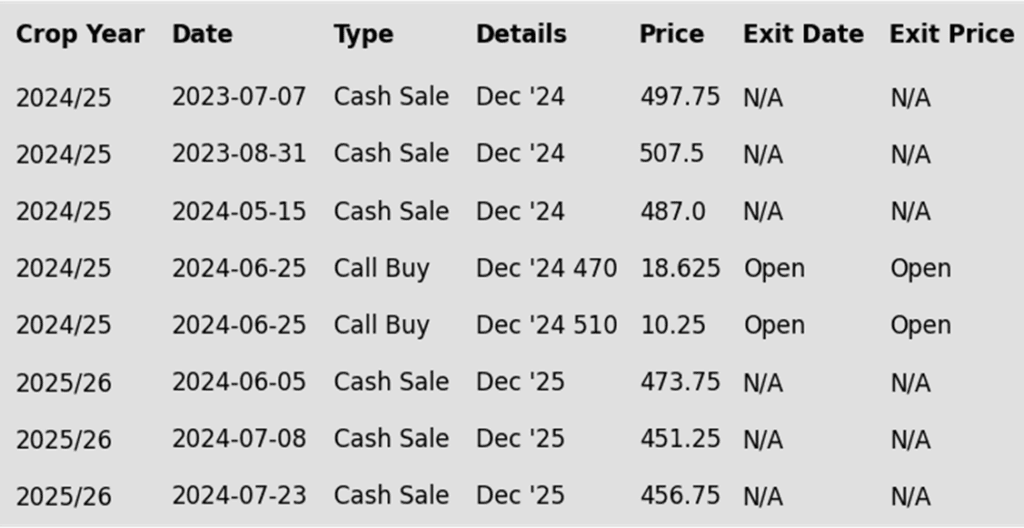

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures traded lower for the third consecutive day as weakness in the wheat market and seasonal selling pressure outweighed a friendly daily export sale announcement.

- The USDA announced a pair of corn export sales this morning. Mexico purchased 401,357 mt (15.8 mb) of corn, and unknown destinations added 290,820 mt (11.5 mb), with both sales for the current marketing year.

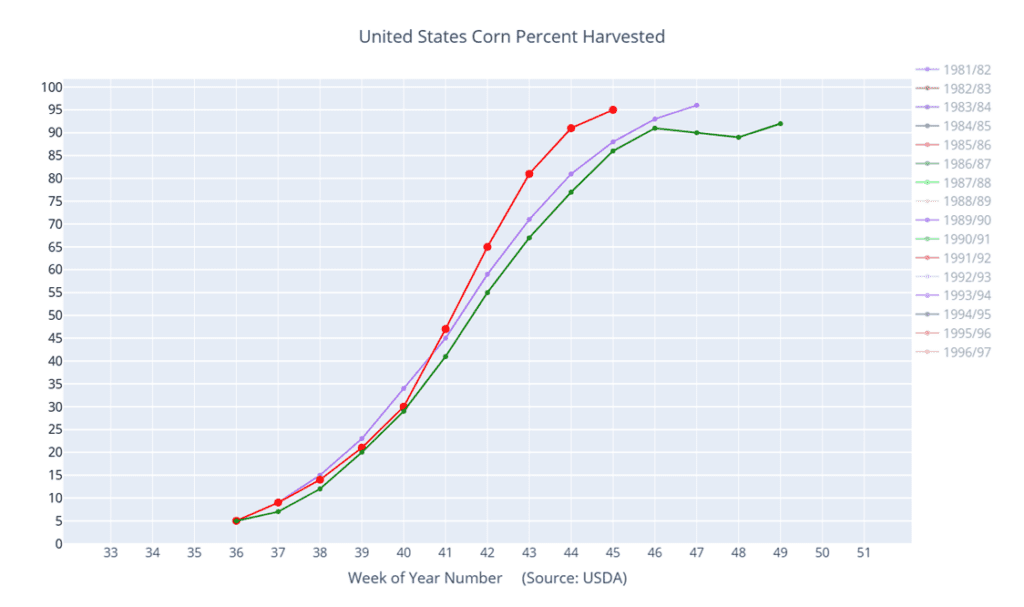

- On the weekly crop progress numbers released on Tuesday, the current corn harvest is estimated to be 95% complete, versus 86% a year ago and 84% for the 5-year average.

- Grain markets have been under pressure reacting to the potential appointees to positions in the Trump administration. It was announced on Tuesday the Former congressmen Lee Zeldon was tabbed to the head of the EPA. As a congressman, Rep. Zeldin has a history of supporting legislation that could limit the impact of biofuels.

- The corn market could have limited upside as the month of November brings December options expiration, and the pricing window for basis or price later contracts. As producers make decisions on these positions, it could lead to selling pressure and volatility in the corn market.

- U.S. dollar continues to climb, trading at its highest levels since May. The strong dollar limited U.S. export competitiveness and can trigger producer selling in Brazil and Argentina with the weak relationship of foreign currency versus the dollar.

Above: December corn continues to see resistance in the 435 area. A close above this level could put the market in position to rally toward 475, with potential resistance between 450 and 455. If prices retreat, support below the market may lie between 415 and 409.

Corn percent harvested (red) versus the 5-year average (green) and last year (purple).

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

- Catch-up sales opportunity for the 2024 crop. For those that missed any of our previous sales recommendations, there may still be an opportunity to make a catch-up sale. While we don’t expect the fall to offer the best pricing, a rally back to the 1050 – 1070 range versus Jan ‘25 could provide a good opportunity. If the market rallies further, additional sales can be considered in the 1090 – 1125 range versus Jan ‘25. If you happen to have capital needs, consider making additional sales into price strength. No further sales recommendations are anticipated until seasonal pricing opportunities improve, likely late fall to early spring.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

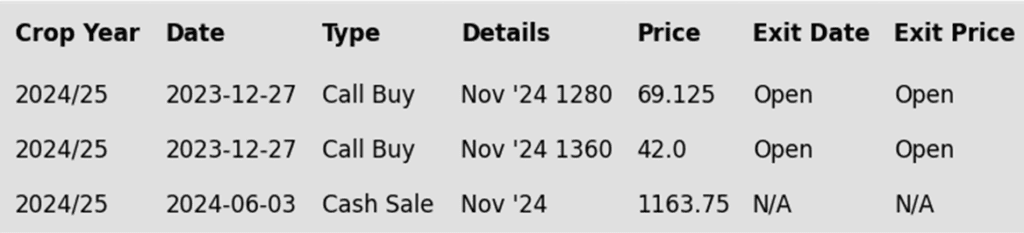

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower for the third consecutive day but found support near the 20-day moving average, bouncing off their lows to end with a small loss. The recent downtrend may stem from a lack of flash sales after several active weeks. Both soybean meal and oil also closed lower, with soybean oil posting the larger loss.

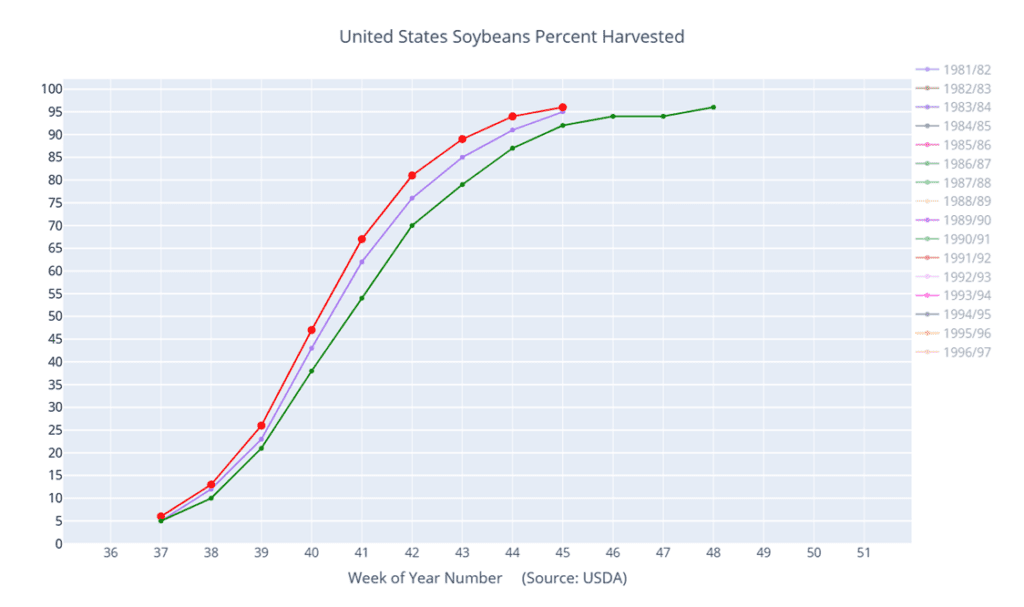

- Yesterday afternoon, the USDA released its Crop Progress report which showed the soybean crop at 96% harvested. This compares to 94% last week, the 5-year average of 91%, and was within the range of average trade guesses. With harvest virtually complete, trade will look for a potential post-harvest rally.

- In Brazil, the soybean crop is reportedly 67% planted as of Nov 7, according to AgRural. This compares to 54% a week ago and 61% the previous year. It has been impressive to see how quickly planting has rebounded after the weather delays. Production is expected to reach 168.3 mmt.

- China’s COFCO estimates that the country’s soybean imports may drop by 9.5% for the 24/25 marketing year. Officials also stated that Chinese buyers stockpiled soybeans ahead of the US elections out of concern for deteriorating relations with the US.

Above: The reversal in January soybeans suggests that the 1044–1050 resistance area remains intact, with prices potentially retreating toward the October lows, where support may be found near 975. Psychological support could emerge around the 1000 level before that. If prices regain their strength, a close above 1050 could lead to a test of the 1070 area.

Soybeans percent harvested (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat again posted double-digit losses in the Chicago futures, with smaller losses in Kansas City and Minneapolis. Sharply lower Matif wheat futures offered no support to the U.S. market, nor did another move higher in the US Dollar. Additionally, improvements in winter wheat crop conditions contributed to the weakness.

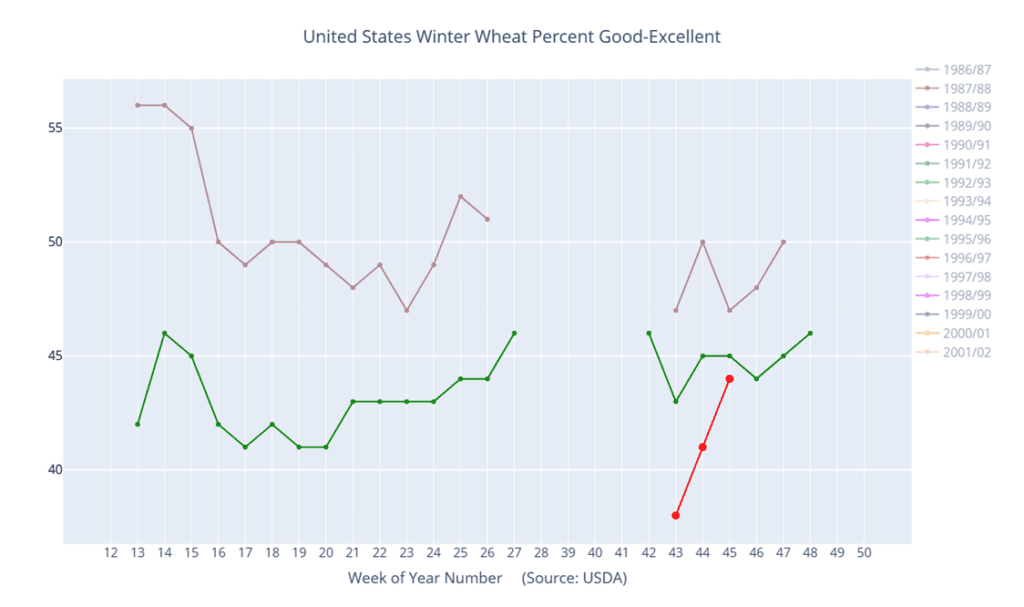

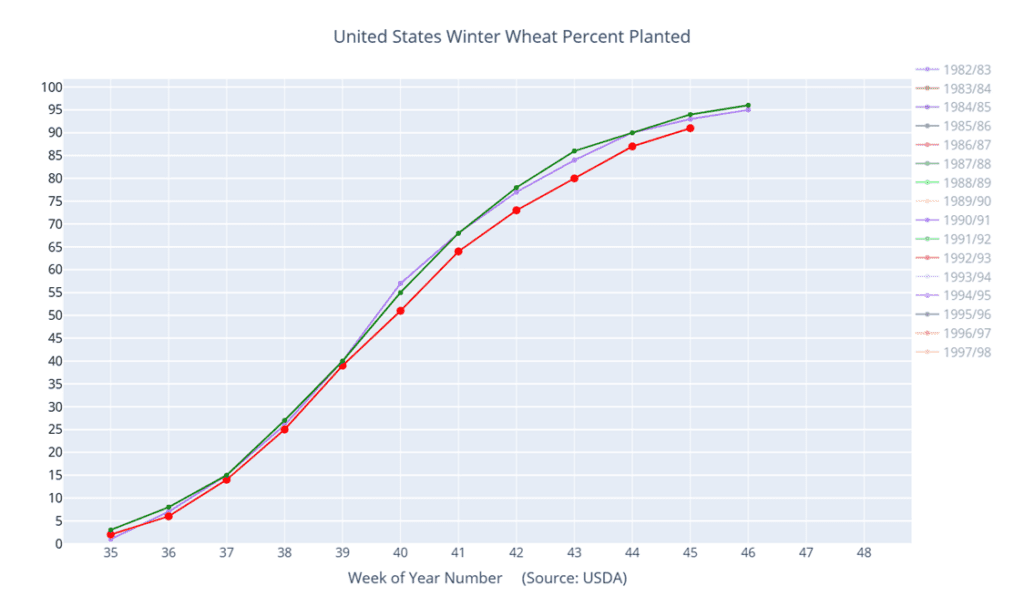

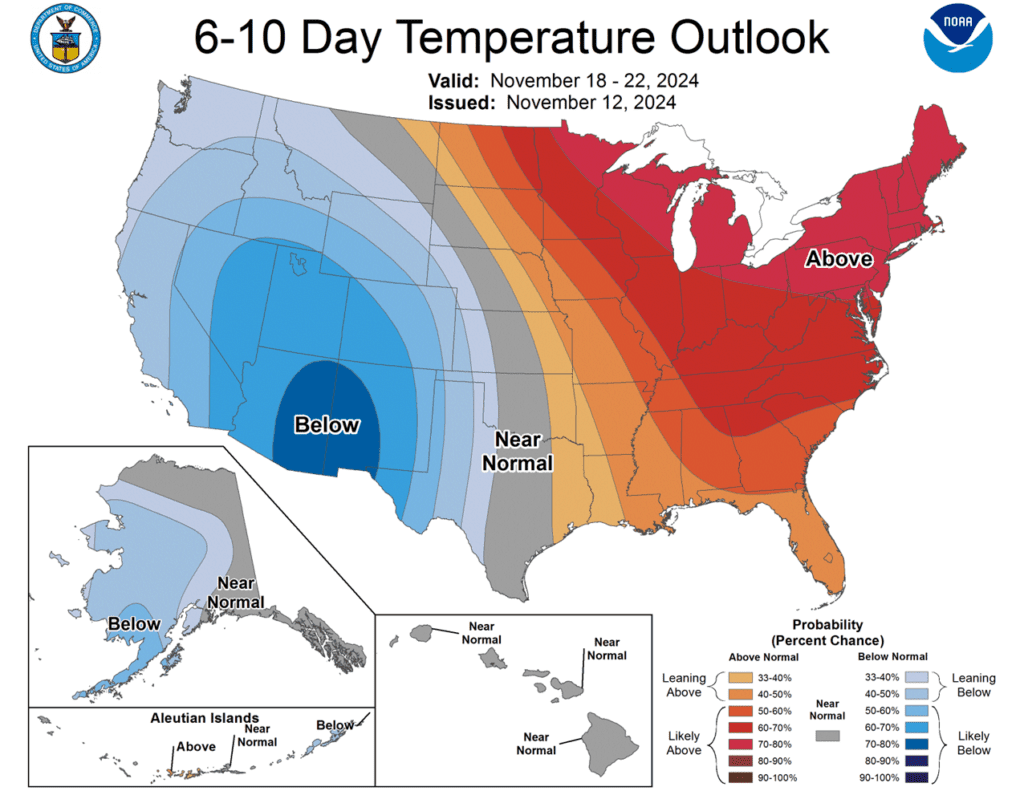

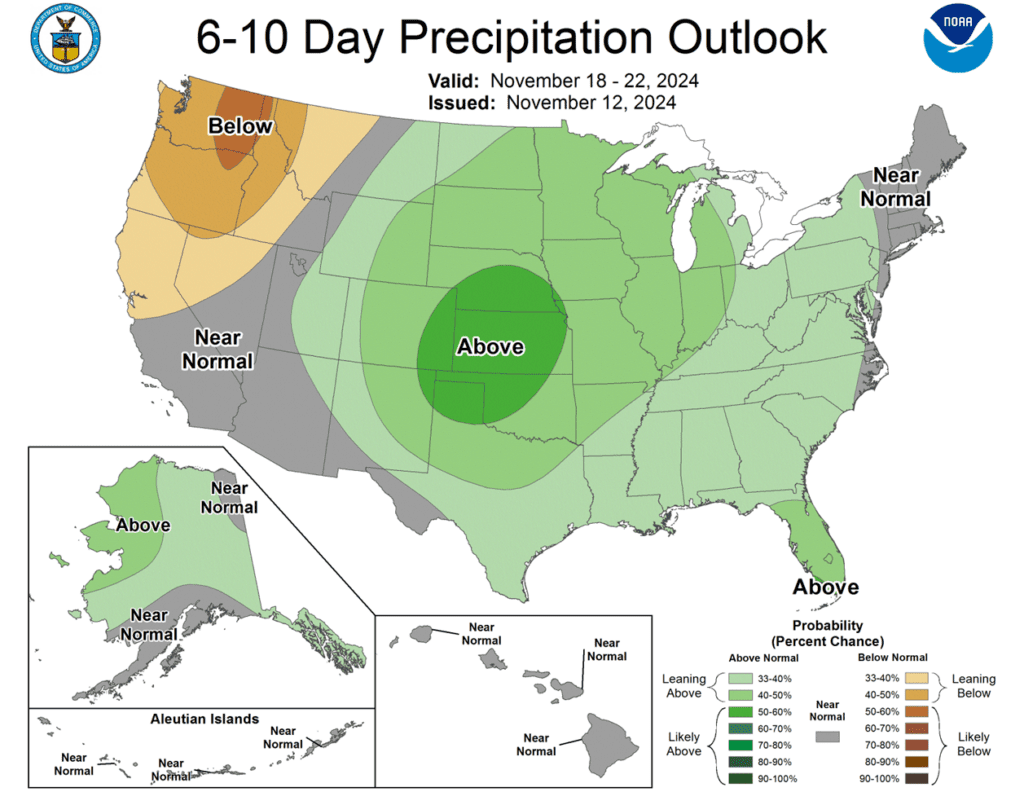

- According to the USDA, as of November 10, 91% of the US winter wheat crop has been planted, slightly behind last year’s 92% pace and the 93% average. Of the planted crop, 76% has emerged, also trailing last year and the average, both at 79%. Recent rains improved conditions, raising the good-to-excellent rating by 3% from last week to 44%. Additional moisture expected over the next week could further boost conditions.

- Russia’s wheat export values are reportedly at $226 per mt for December and $230 for January. These prices fall well below the government-suggested minimum, maintaining pressure on the export market. Additionally, EU and Argentina FOB values are now close to Russia’s, which is also bearish for the US market.

- On a bullish note, India’s domestic wheat prices have hit a record high due to strong demand and limited supply. In September, the Indian government reduced the amount of stocks that traders and millers could hold to curb prices. However, this measure appears to have been less effective than anticipated, and the government may need to release wheat from its reserves to control prices. This situation also reinforces the possibility that India may need to become a net wheat importer in the future.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

- No new action is recommended for 2024 Chicago wheat. Back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Currently, our strategy remains to target 740 – 760 versus Dec ’24 to recommend further sales. While this range may seem far off, based on our research, it represents the potential opportunity that this crop year can present as we move into the planting and winter dormancy windows of the next crop cycle. Considering this potential, we also continue to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. In September, we recommended taking advantage of the rally in wheat to make additional sales on your anticipated 2025 SRW production. While we continue to recommend holding July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, our Plan A strategy is targeting the 650–680 area in July ’25 to suggest making additional sales. Should the market show signs of a potentially extended rally, our Plan B strategy is to protect current sales and target the 745 – 775 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

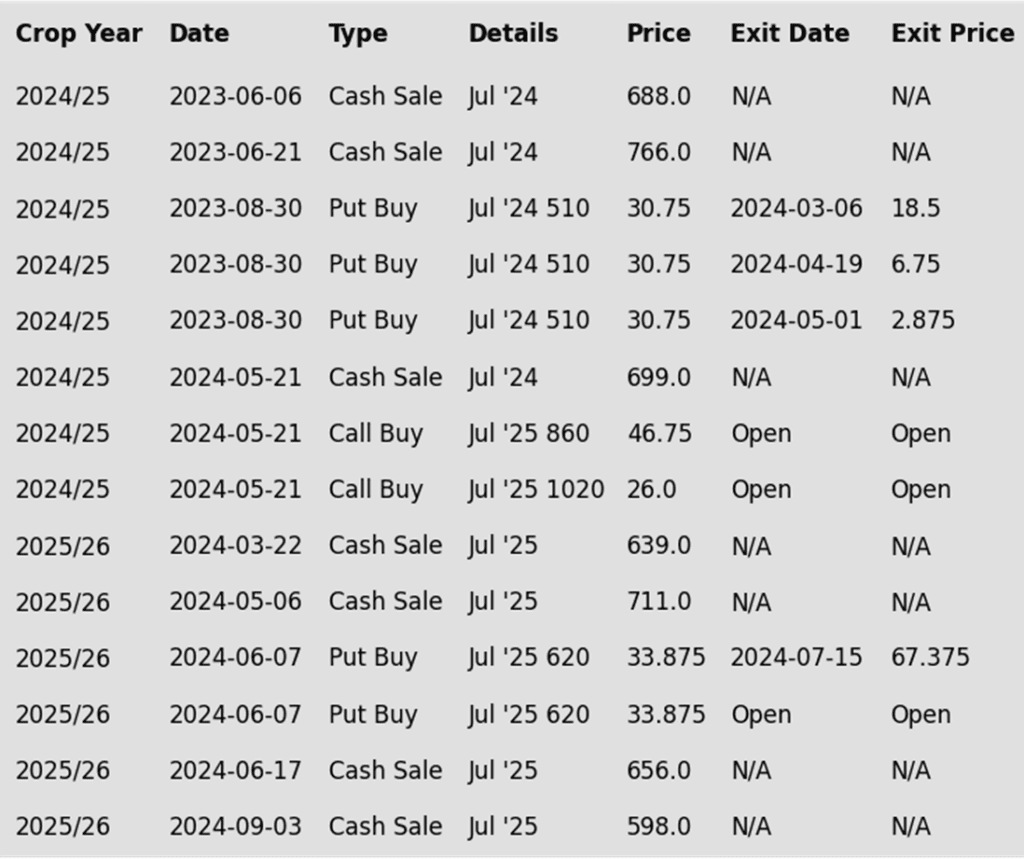

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The market’s decline since breaking through support suggests that prices may be poised to test the 521 – 514 support area near the August low. Should prices turn around, heavy overhead resistance remains between 580 and 586.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. While we still recommend holding the remaining half of the previously suggested July ’25 620 puts for downside protection on unsold bushels, considering the early October rally, we advised selling another portion of your anticipated 2025 HRW wheat production. Looking ahead, our current Plan A strategy is to target the 640 – 665 range for additional sales, while our Plan B strategies involve targeting the upper 400 range to exit half of the remaining 620 puts if the market turns toward new lows and targeting the 745–770 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

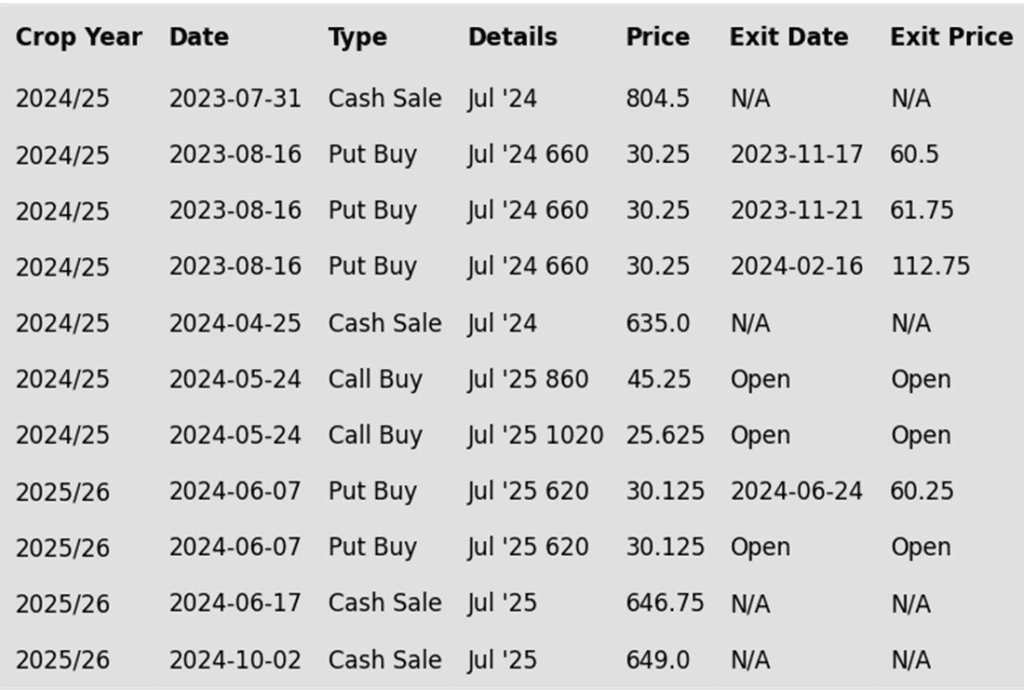

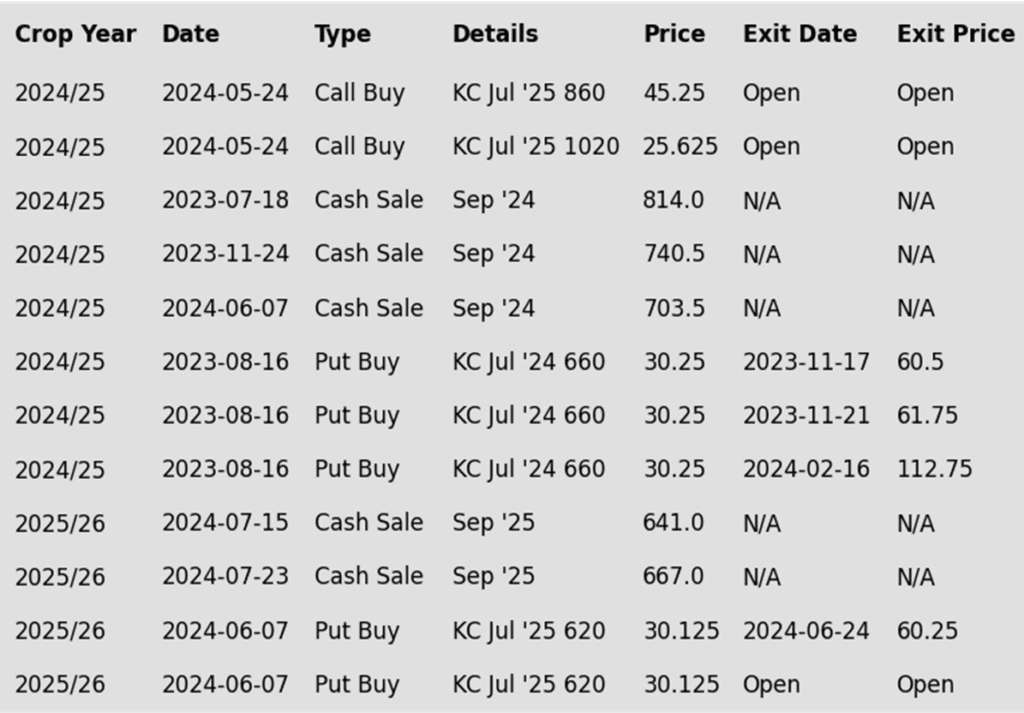

To date, Grain Market Insider has issued the following KC recommendations:

Above: The market’s close below 547 support suggests prices may be at risk of testing major support near the 527 ¼ August low. A reversal back higher may still encounter heavy resistance near 580 – 583 before testing the 593 – 603 resistance area.

Winter wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (purple).

Winter wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

- No new action is recommended for 2024 Minneapolis wheat. Now that we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 630 – 655 range to recommend making additional sales. Additionally, given the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not target any specific areas for additional sales until November or December, we continue to hold the remaining July ’25 KC 620 puts that were recommended in June for downside protection. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts. Additionally, should the wheat market show signs of an extended rally, we are targeting the 745–770 area in July ’25 KC to buy July ’25 KC upside calls in case the market rallies significantly beyond that point.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The close below 583 in the December contract puts the market at risk of trading down towards major support near the August low of 563. If a bullish catalyst enters the scene to turn prices higher, heavy resistance remains between 615 and 624.

Other Charts / Weather

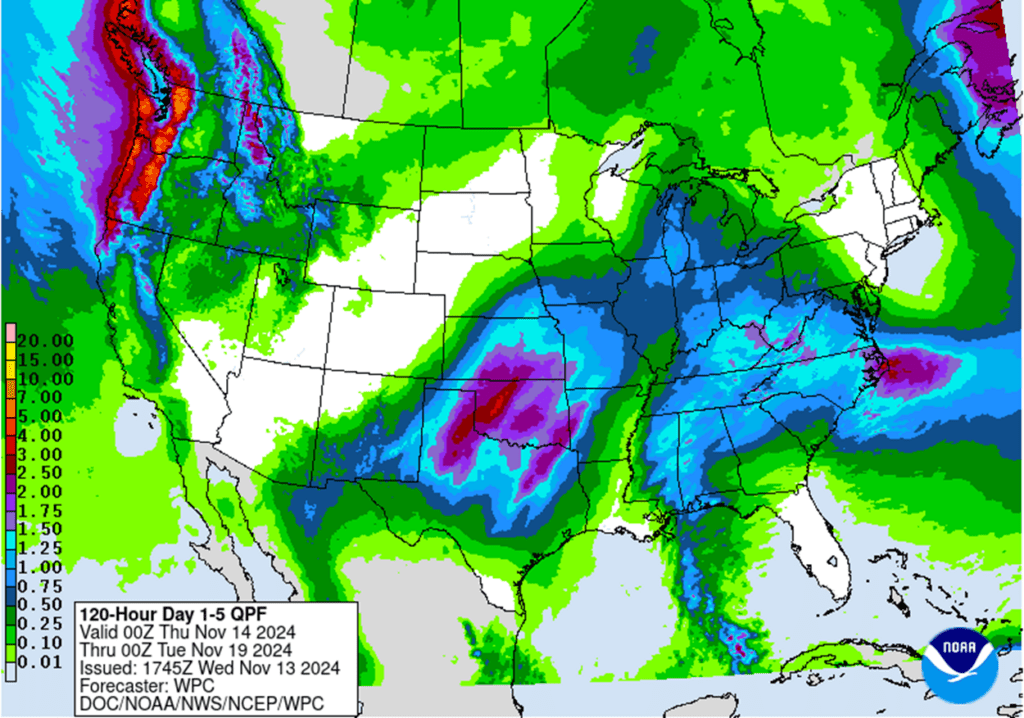

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

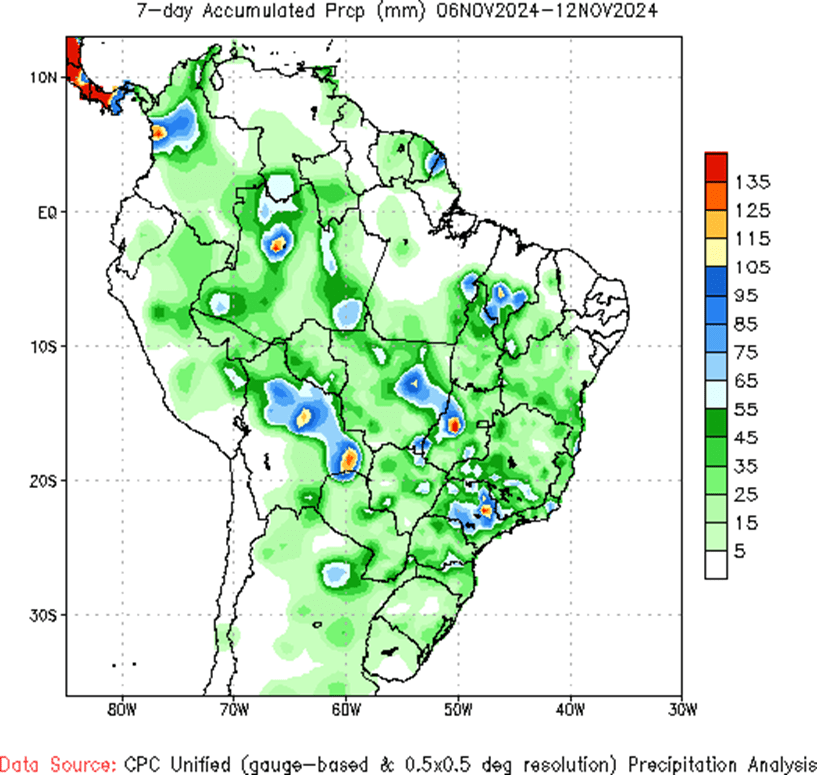

Brazil and N. Argentina 7-day total accumulated precipitation courtesy of the National Weather Service, Climate Prediction Center.