11-06 End of Day: South American weather rallies soybeans.

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’23 | 477.25 | 0 |

| MAR ’24 | 492.5 | 0.25 |

| DEC ’24 | 517.25 | -0.25 |

| Soybeans | ||

| JAN ’24 | 1364 | 12.25 |

| MAR ’24 | 1378.5 | 12 |

| NOV ’24 | 1304.5 | 7.5 |

| Chicago Wheat | ||

| DEC ’23 | 575.75 | 3.25 |

| MAR ’24 | 602.5 | 3.25 |

| JUL ’24 | 635.75 | 3.75 |

| K.C. Wheat | ||

| DEC ’23 | 645.75 | 2.25 |

| MAR ’24 | 656.75 | 2 |

| JUL ’24 | 671.5 | 1.75 |

| Mpls Wheat | ||

| DEC ’23 | 728.75 | 7.75 |

| MAR ’24 | 745.5 | 6 |

| SEP ’24 | 774 | 3.5 |

| S&P 500 | ||

| DEC ’23 | 4377.5 | 1.5 |

| Crude Oil | ||

| JAN ’24 | 80.94 | 0.71 |

| Gold | ||

| JAN ’23 | 1928.6 | -0.5 |

Grain Market Highlights

- After trading a tight 4-cent range and failing to hold the day’s highs despite strength in both wheat and soybeans, the corn market closed nearly unchanged following choppy trade with the quick harvest pace and hedge pressure limiting any gains.

- South American weather concerns and sharply higher soybean oil aided the soybean market to double-digit gains and the fifth higher close in a row.

- Soybean meal was the weak leg of the complex today as traders likely lifted some long positions to take profits from the rally that began in early October. Soybean oil, on the other hand, likely saw some short covering that was sparked by higher energy prices.

- Despite weak export inspections that were the lowest in 54 weeks and lower Matif wheat futures, all three classes closed the day on the positive side of unchanged, led by Minneapolis. Additionally, after posting large managed fund positions in Friday’s Commitment of Traders report and record large in Minneapolis wheat, a level of short covering may have been at play today and added to the markets’ strength.

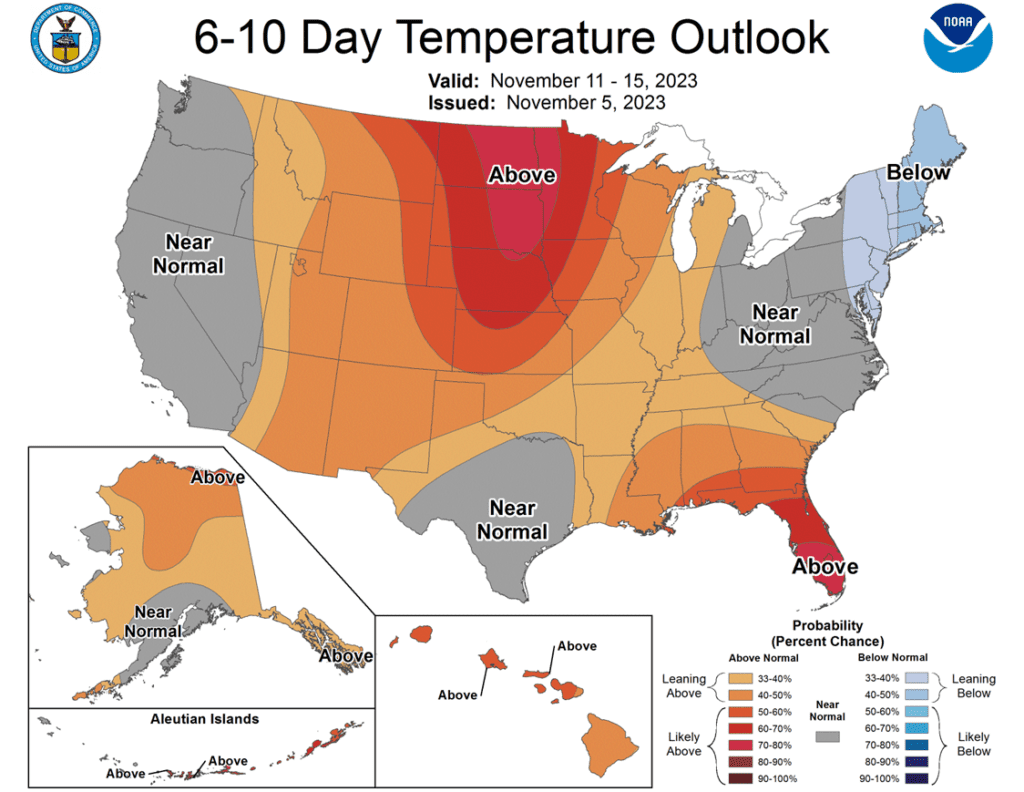

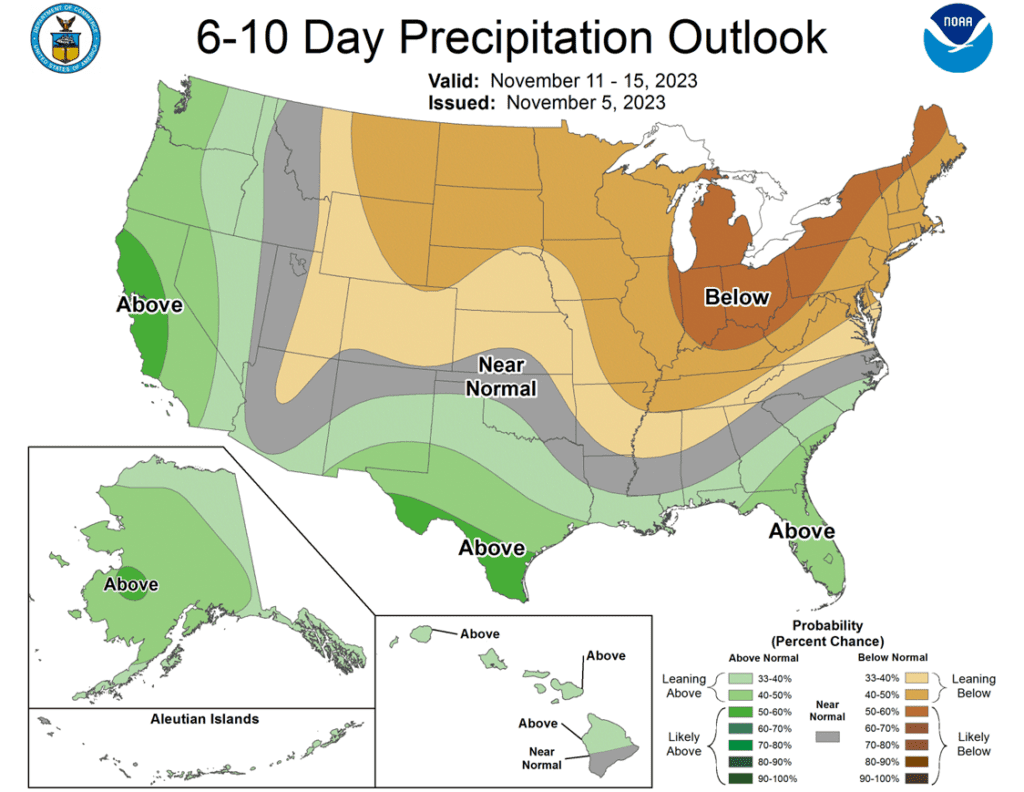

- To see the US 6 – 10 day Temperature and Precipitation Outlooks, and the South American 1-week forecast precipitation maps as a percent of normal, courtesy of the NWS, and CPC, scroll down to other Charts/Weather Section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. The Dec ’23 contract’s quick move above 500 on October 19, and then below the 50-day moving average of 485 just three sessions later, on October 24, signals that there is heavy resistance above the market near the 100-day moving average, and prices continue to be at risk of drifting sideways to lower. The next major level of support remains near the August low of 462 for front month corn. During last summer’s June rally, Grain Market Insider recommended making sales when Dec ’23 was around 624. So, for now, the thought process is to hold tight on any further sales recommendations until later this fall or early winter, with the objective of seeking out better pricing opportunities. If the market has not turned around by early winter, then Grain Market Insider may sit tight on the next sales recommendations until spring. If you end up harvesting more bushels than you can store this fall and must move them, consider protecting those sold bushels with either July or September ’24 call options.

- No new action is recommended for 2024 corn. The Dec ’24 contract has held up better than Dec ’23 as bear spreading over the last several months has brought increased buying interest into Dec ’24 and other further out contract months. Back in late July, the Dec ’23 contract traded up to a 25-cent premium over Dec ’24. Now, Dec ’24 holds about a 30-cent premium over Dec ’23. This bear spreading has held the Dec ’24 price up about 28 cents from its year-to-date low. The risk for 2024 prices is the same as for 2023 prices, which is a continuation of a lower trend without further bullish input. Grain Market Insider is watching for signs of a change in the current trend to look at recommending buying Dec ’24 call options. This past spring, Grain Market Insider recommended buying 560 and 610 Dec ’23 call options ahead of the summer rally and having those in place helped provide confidence to pull the trigger on recommending 2023 sales into that sharp rally, knowing that if corn kept rallying and went to 700 or 800 that the call options would protect those sold bushels.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

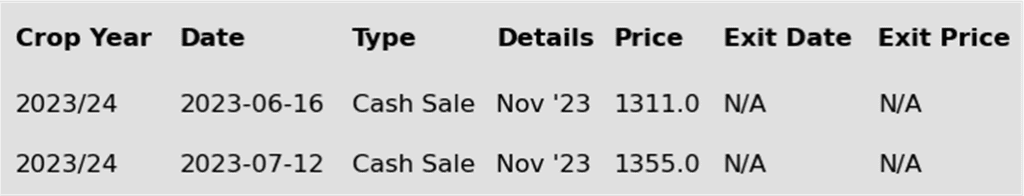

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- It was a choppy session in the corn market as prices failed to follow through Friday’s strong technical close. December corn finished the day unchanged with disappointing price action, failing to hold the highs of the session. Hedge pressure still limits the corn market, despite strength seen in both the soybean and wheat market.

- Corn export demand is still a concern for the market. The USDA did announce a flash sale of corn to Mexico; Mexico bought 289,575 mt (11.4 mb) for the current marketing year. Mexican demand has been good, but these sales are routine and fail to move the market overall.

- Weekly export inspections for corn were within expectations. Last week, the US inspected 535,000 MT (21.1 mb) for shipment. Total inspections are at 216 mb for the current marketing year, up 23% from last year, and slightly ahead of expected USDA export pace.

- USDA will release the harvest pace on Monday afternoon with the USDA crop progress report. Last week, 71% of the corn crop was harvested, and expectation should have moved into the last 20% remaining for this week. The harvest pace and selling pressure has limited the corn market.

- On November 9, the USDA will release the next Crop Production report. The market could be choppy this week with position squaring going into the report. Early expectations are for the USDA to slightly increase corn yield and production, which could add bushels back to an already heavy supply picture.

Above: On November 3, the December contract posted a bullish key reversal with a low of 468. The 50-day moving average is just above the market at 484, and the market is oversold. If prices can push over 484, they may move higher to test 500 – 509 ½. If not, support below the market rests between 468 and 460.

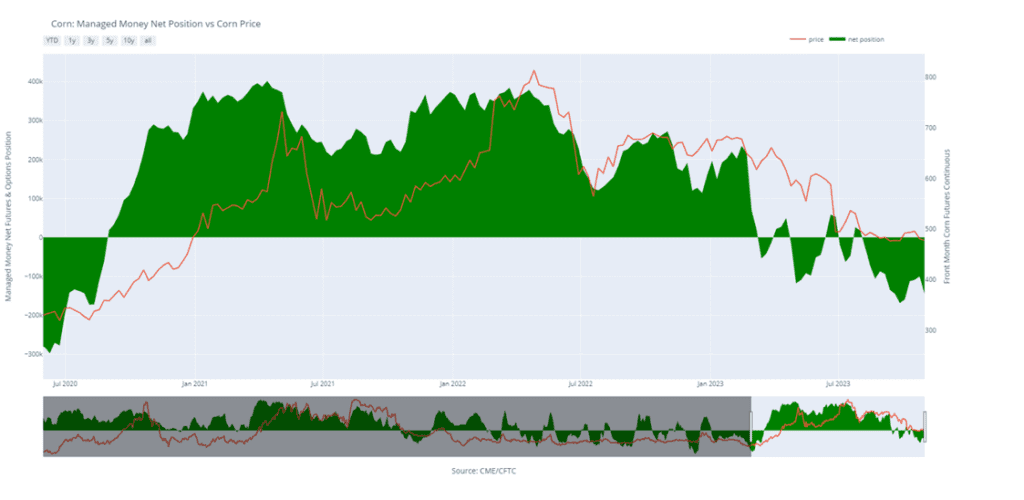

Corn Managed Money Funds net position as of Tuesday, Oct. 31. Net position in Green versus price in Red. Managers net sold 44,002 contracts between Oct. 25 – 31, bringing their total position to a net short 144,432 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. At the end of August, the soybean market turned lower and didn’t find any significant buying interest until it traded down to 1251 in early October. Since then, the nearby contract has traded through nearby resistance and the 50-day moving average and may be poised to test the August high. Looking back, since last May, nearby soybeans have been in a range from 1435 up top to 1251 down below. Last summer, Grain Market Insider did make two sales recommendations in the 1310 – 1360 price window versus Nov ’23. Given that those sales recommendations were made and given that now is not the time of year to be making many sales, if any, Grain Market Insider is content to hold tight on any further sales recommendations until later this fall or early winter. The focus for strategy right now is to be on the lookout for any call option buying opportunities. If you end up harvesting more bushels than you can store this fall, consider protecting any sold bushels with July or Aug ’24 call options.

- No action is recommended for the 2024 crop. Since the inception of the Nov ’24 contract, it has traded at a discount to the 2023 crop, from as much as 142 back in July, to as little as 17 ¾ in early October during harvest. And while the spread difference between the two crops has seen a good amount of volatility, Nov ’24 has been largely rangebound between 1250 and 1320 since it rallied off its 1116 ¼ low last July. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be early winter at the soonest. Currently, Grain Market Insider’s focus is also on watching for any opportunities to recommend buying call options.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

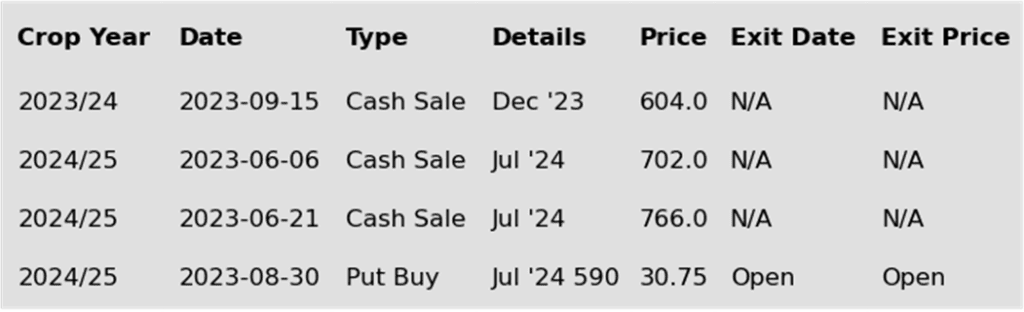

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day firmly higher for the fifth consecutively higher close. Support has mainly come from higher soybean meal, tight US ending stocks, and a concerning forecast for South American weather. Soybean oil was higher today but overall has trended lower since August.

- Export sales have picked up in this period that Brazil is running low on soybeans to ship as they are planting, and another sale was reported today of 126,000 metric tons for delivery to China during the 23/24 marketing year. The increase in export demand has been complemented by the uptick in domestic crush demand.

- Export inspections today were also strong with 2,085k tons reported for soybeans which was near the upper range of analyst expectations. Thursday’s WASDE report may, however, show a decrease in exports as they are still behind last year. Analysts are expecting that the USDA might decrease the national soybean yield but also decrease exports which would leave the carryout potentially unchanged at 220 mb.

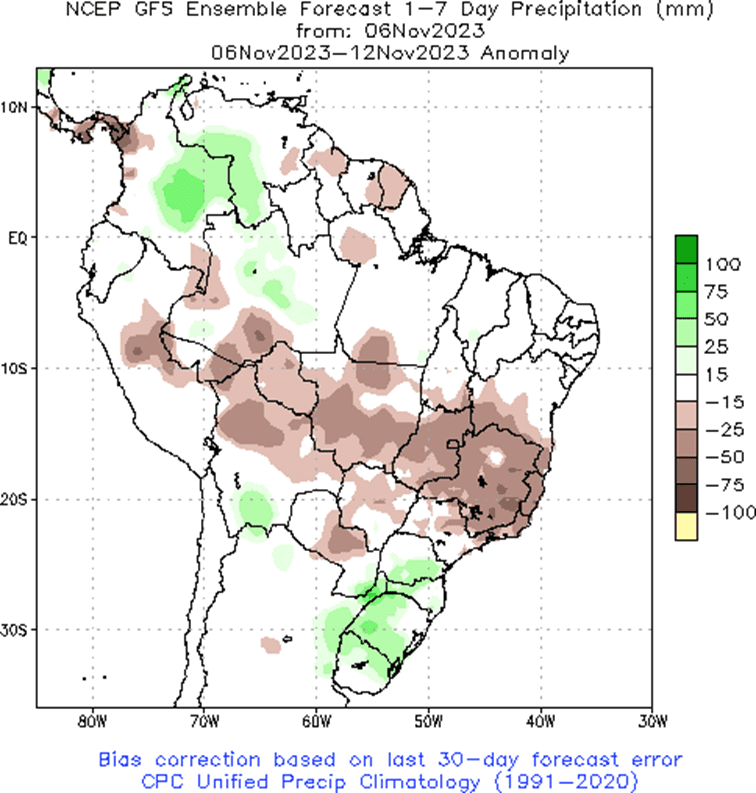

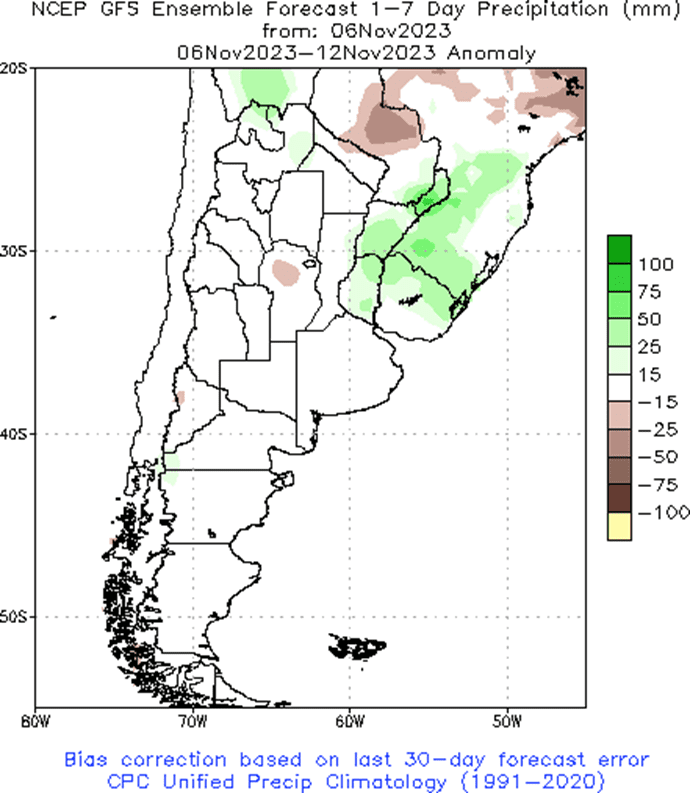

- A large part of this recent rally can likely be attributed to poor weather conditions in South America with Argentina and northern Brazil still dry, but southern Brazil receiving too much rain and flooding. So far, weather models are forecasting more of the same with hotter temperatures to come. Some Brazilian producers are either replanting their soybeans or opting to rip them up in favor of planting cotton.

Above: On November 3, January soybeans maintained strength above the 50-day moving average and closed above 1334 resistance, which now has become support. With the strong close, the market is poised to test 1370 – 1385. Below the market support is now between 1334 and the 50-day moving average, and again down near 1300.

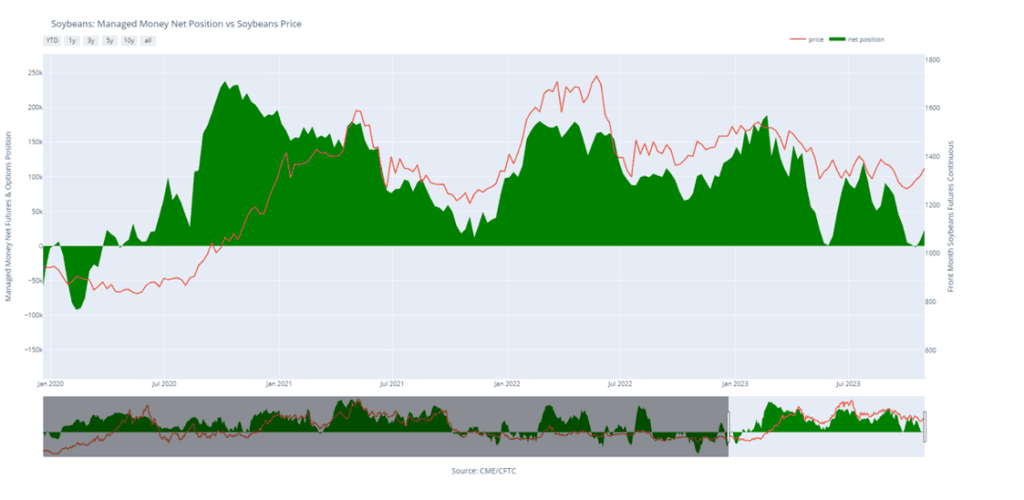

Soybean Managed Money Funds net position as of Tuesday, Oct. 31. Net position in Green versus price in Red. Money Managers net bought 15,400 contracts between Oct. 25 – 31, bringing their total position to a net long 23,153 contracts.

Wheat

Market Notes: Wheat

- After trading both sides of unchanged, wheat managed a positive close despite a slightly higher US Dollar, poor export inspections (71,068 mt), and lower Matif futures. This may signal that wheat is trying to find a bottom and support at these lower levels.

- Traders are anticipating this week’s USDA report. With Russia estimating their own wheat crop at 93 mmt as of last week, it is possible that the USDA could make an upward revision from their 85 mmt crop estimate.

- Brazil is said to have 2.5 mmt of feed wheat on hand that is very competitive on the export market. Reportedly, it is around $212 per mt on a FOB basis for December shipment.

- According to the UN Food and Agricultural Organization, winter wheat growing areas in the northern hemisphere are expected to shrink in 2024 as a reflection of lower crop prices.

- Odesa was again attacked by Russia with missiles and drones. This damaged the port and wounded eight people, but the market seemed to brush it off as old news.

Action Plan: Chicago Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. After making a high in late July, the Dec ’23 contract trended lower until finding support at 540 on September 29, from which it rallied back, briefly piercing 600 and the 50-day moving average. The market now appears to be finding value in the 540 – 616 range established since early September, as weak US export demand, driven by cheap Russian exports, remains the dominant headwind to higher prices. Grain Market Insider made sales recommendations in the late June rally around 720 and again earlier this fall near 604. With those two sales, Grain Market Insider’s strategy is to look for price appreciation going into this winter as weather becomes a more prominent market mover, with an eye on considering additional sales in the 625 – 650 range. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

- No new action is recommended for 2024 Chicago wheat. The July ’24 contract has been trading at a premium to the Dec ’23 contract since late April, which has steadily increased to about 55 cents, September 29, it traded as far out as 71 ¾ cents. Fund positioning and weak fundamentals have driven Dec ’23 closer to the mid to upper 500 range, and July ’24 to the low to mid 600’s. The market risk for July ’24 remains the same as for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for this possibility, and back in June, Grain Market Insider recommended two separate sales that averaged about 720 to take advantage of the brief upswing. If the market receives the needed stimulus to move prices back toward June’s highs, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: On October 20, the December contract posted a bearish reversal after making a new recent high of 604 ½. The market has retreated and solidified resistance above the market that now stands between 604 ½ and 618. Without bullish input, the market is likely to trend sideways to lower with the next major support level between 547 and 540.

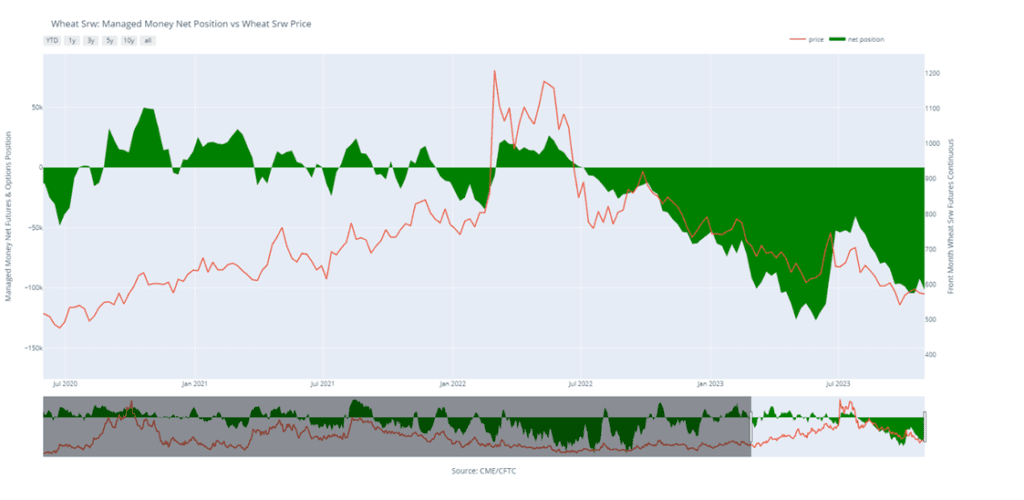

Chicago Wheat Managed Money Funds net position as of Tuesday, Oct. 31. Net position in Green versus price in Red. Money Managers net sold 9,321 contracts between Oct. 25 – 31, bringing their total position to a net short 101,575 contracts.

Action Plan: KC Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since late July the Dec ’23 contract has been in a downtrend that has had periods of relative stability, but not any significant reversals higher. The market once again found nearby support as it traded to, and held, its recent low of 625 ½. Currently, weak US export demand, driven by cheap Russian exports, remains the dominant headwind, and the market is in need of bullish input to stabilize and rally prices back higher. If a bullish catalyst enters the market to push prices above 700, it may signal that a fall low is in place and would line up with the historical tendency for prices to appreciate into winter and early spring. Grain Market Insider’s strategy is to look for price appreciation going into this winter, as weather becomes a more prominent market mover with an eye on considering additional sales near 750 – 800. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices.

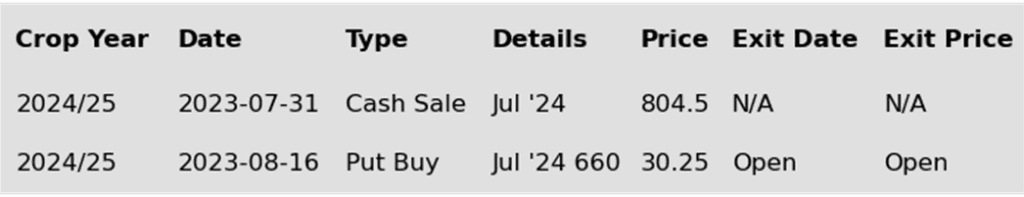

- No new action is recommended for 2024 KC wheat. The July ’24 contract is currently trading near a 25-cent premium to July ’23, which is up significantly from last July’s 60-cent discount. Weak fundamentals have driven spread activity to push July ’23 toward its contract lows, while July ’24 has been able to maintain more of its value. The risk for the July ’24 contract is much like that for Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July 660 puts to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 800 to take advantage of elevated prices before they eroded further. If the market receives the needed impetus to move prices back toward 750 – 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted a year from now. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Since breaking through the bottom of the consolidation range at 655, the market has drifted lower and tested minor support, which has held so far with the low at 625 ½. The next level of major support below that remains near 575. Major resistance above the market remains around 690 – 700, with minor resistance near 655.

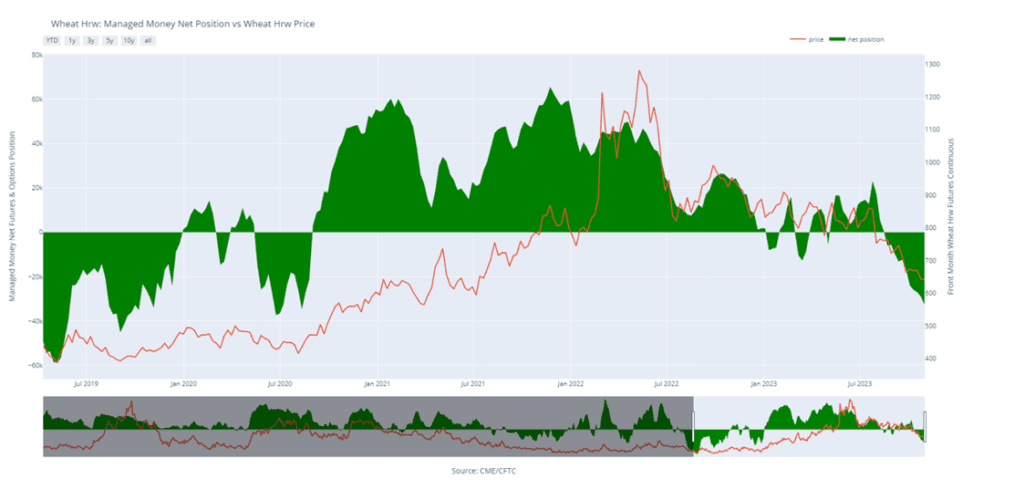

KC Wheat Managed Money Funds net position as of Tuesday, Oct. 31. Net position in Green versus price in Red. Money Managers net sold 3,628 contracts between Oct. 25 – 31, bringing their total position to a net short 32,622 contracts.

Action Plan: Mpls Wheat

Calls

2023

No Action

2024

No Action

2025

No Action

Cash

2023

No Action

2024

No Action

2025

No Action

Puts

2023

No Action

2024

No Action

2025

No Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. After making highs in July, and the subsequent downtrend to the October 2 low of 707 ½, the Dec ‘23 contract has traded mostly sideways with no significant reversal higher. With weak US export demand still the primary impediment to higher prices, the market remains at risk of trending lower if September’s low close of 709 is violated to the downside unless another bullish impetus enters the scene. If that happens and prices begin to push back toward 775, it may signal that a near-term low is in place. Earlier this year, Grain Market Insider made a sales recommendation during the July rally near 820, and with that sale in place, Grain Market Insider’s strategy is to look for price appreciation going into this winter with an eye on considering additional sales around 750 – 800, and again north of 825. If at that point the market remains strong and continues to rally, Grain Market Insider will consider potential re-ownership strategies to protect current sales and add confidence to make additional sales at higher prices. Even though the primary strategy is to look for higher prices, Grain Market Insider may also consider a “plan b” in the next couple of weeks if prices grind sideways to lower.

- No new action is currently recommended for 2024 Minneapolis wheat. In the last three months, the Sep ’24 contract has gone from a 60 – 80 discount to Dec ’23, to a 50-cent premium. Weak fundamentals led bear spreading to drive Dec ’23 in search of new contract lows, while Sep ’24 remains off its low from last May. The risk for the Sep ’24 contract is much like that of Dec ’23. The market needs bullish input to move prices higher, and without it, prices may continue to erode. In mid-August, Grain Market Insider recommended purchasing July KC 660 puts (for their greater liquidity, and correlation to Minneapolis pricing) to prepare for this possibility, and back in July, Grain Market Insider recommended a sale near 815 to take advantage of elevated prices. If the market receives the needed stimulus to move prices back toward 800, Grain Market Insider is prepared to recommend adding to current sales levels. Otherwise, the current recommended put position will add a layer of protection if prices erode further. Grain Market Insider will then be prepared to recommend covering some of those puts to offset some of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted two springs from now. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since the last week of October, the December contract has resumed the downward trend that has been in place since the end of July and found nearby support near 703. If fresh bullish news doesn’t enter the market, prices could slide to the next level of support near 669, the May ’21 low. If prices turn higher, initial resistance remains between 745 – 760.

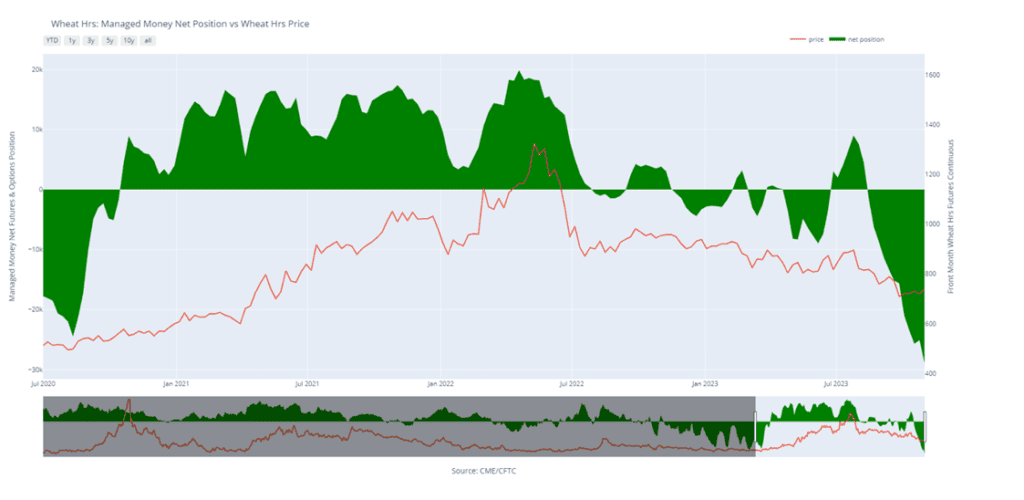

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Oct. 31. Net position in Green versus price in Red. Money Managers net sold 3,801 contracts between Oct. 25 – 31, bringing their total position to a net short 28,882 contracts.

Other Charts / Weather

Brazil 1-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.

Argentina 1-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.