10-9 End of Day: Grain Complex Slides as Prices Weaken Across the Board

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Ongoing harvest pressure on corn triggered broad weakness across the markets, with prices ending the session lower across the board.

- 🌱 Soybeans: Growing skepticism surrounding next month’s U.S.-China trade talks between President Trump and President Xi weighed on the soybean market, which pulled back and closed lower on the day.

- 🌾 Wheat: Wheat markets surrendered early gains to close lower, pressured by strength in the U.S. dollar.

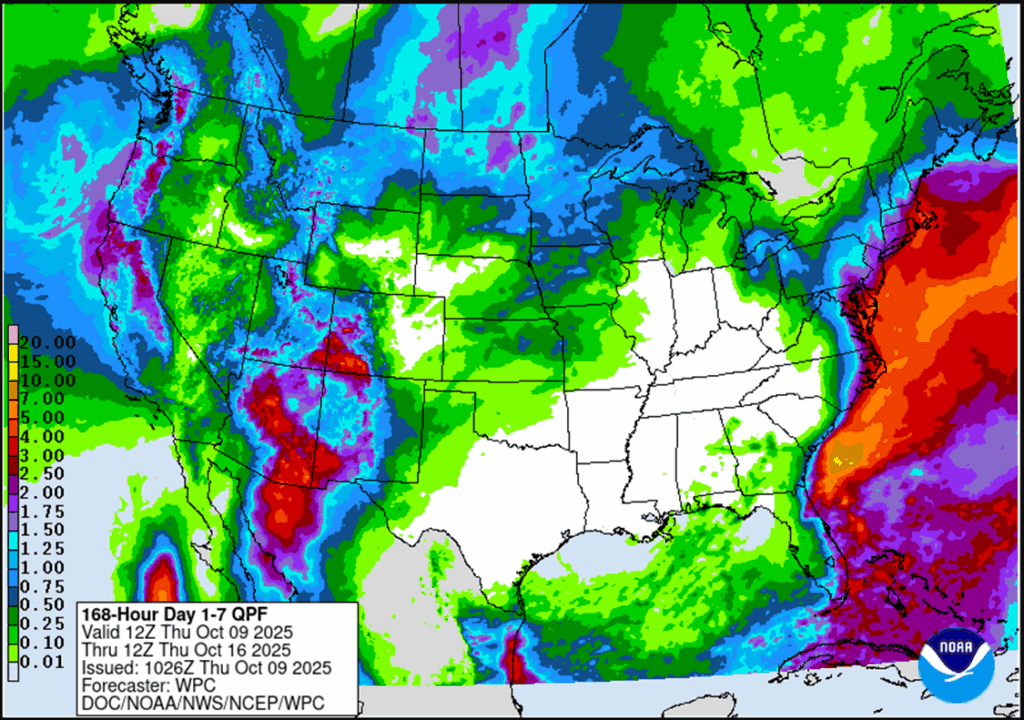

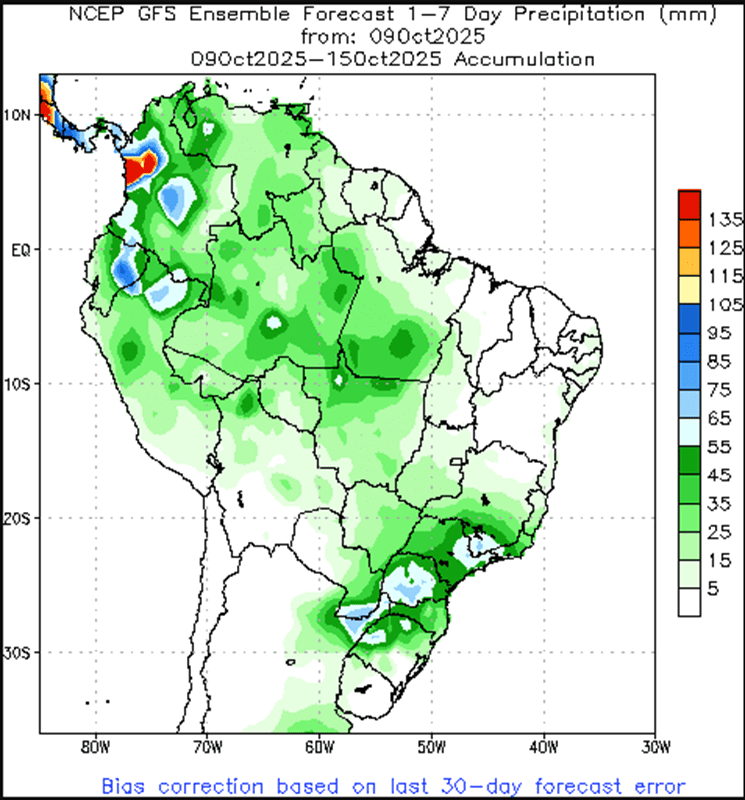

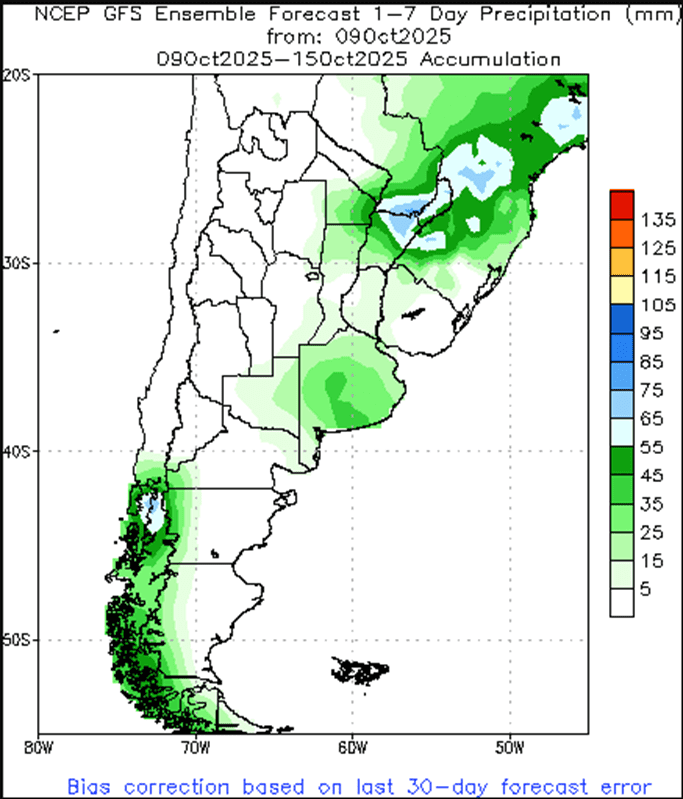

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

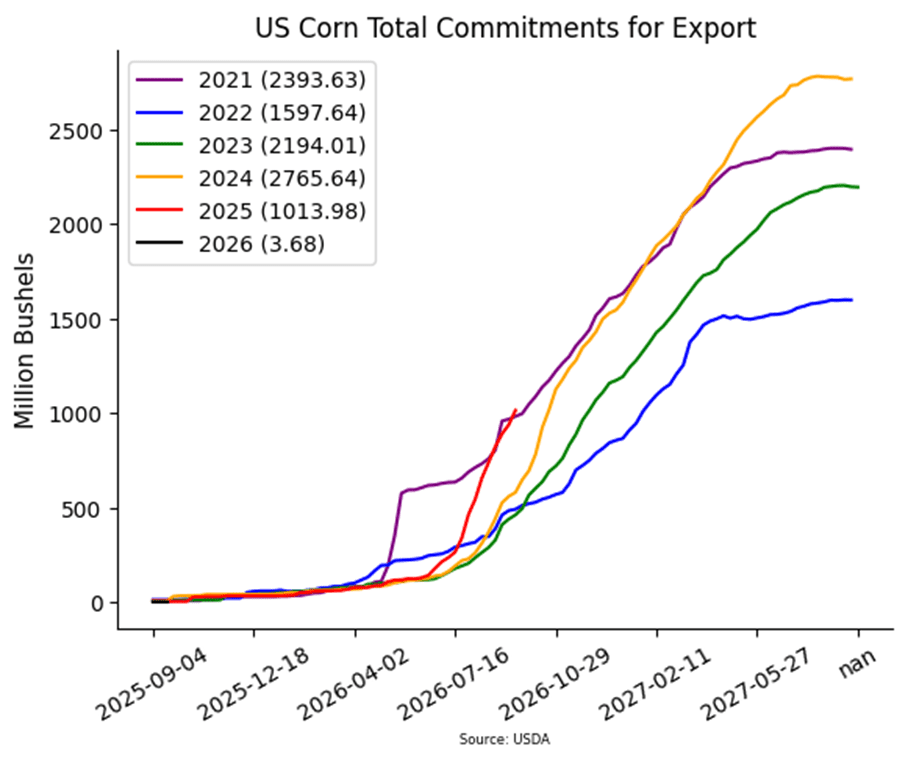

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fell under selling pressure amid ongoing harvest activity and a broader “risk-off” sentiment, as most equity and commodity markets trended lower. December corn slipped 3 ¾ cents to 418 ¼, and March fell 3 3/4 cents to 434.

- The U.S. Dollar Index continues to strengthen, reaching its highest level since July, and challenge the 100-basis point level. A firmer dollar may act as a headwind for U.S. export competitiveness.

- Rosario Grain Exchange released their projections for the 2025-26 Argentina corn crop. Current planting is 28% complete. The crop is expected to be planted on 9.7 million Hectare (23.9 acres). Total production is forecast to be near 61 MMT or 2.401 billion bushels. If achieved, it would be a new record.

- With producers moving off soybean harvest, hedge pressure from a ramping up corn harvest will likely limit the market.

- Due to large supplies of old crop and new crop, commercial storage for this fall’s corn harvest may be tight and at a premium. The overrun of bushels not finding storage will likely get pushed onto the cash corn market.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

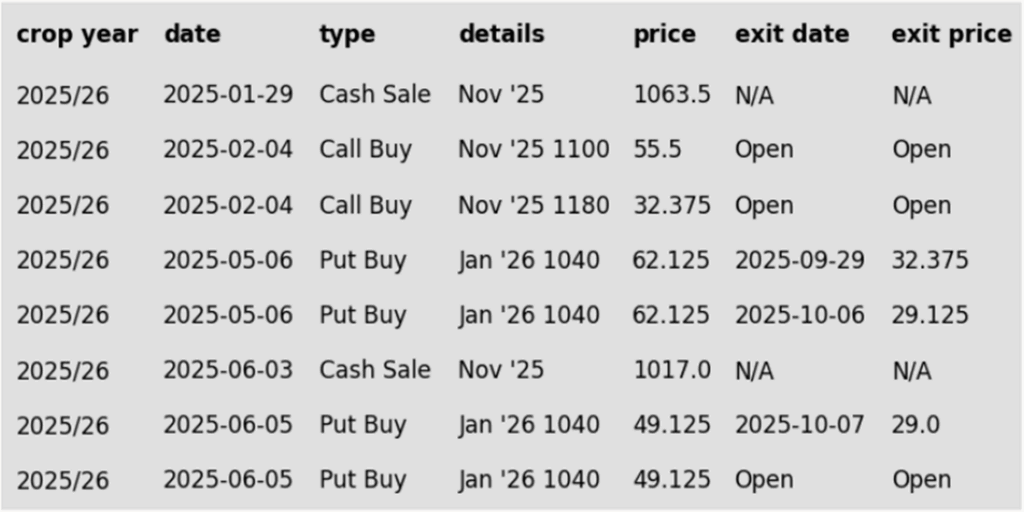

To date, Grain Market Insider has issued the following soybean recommendations:

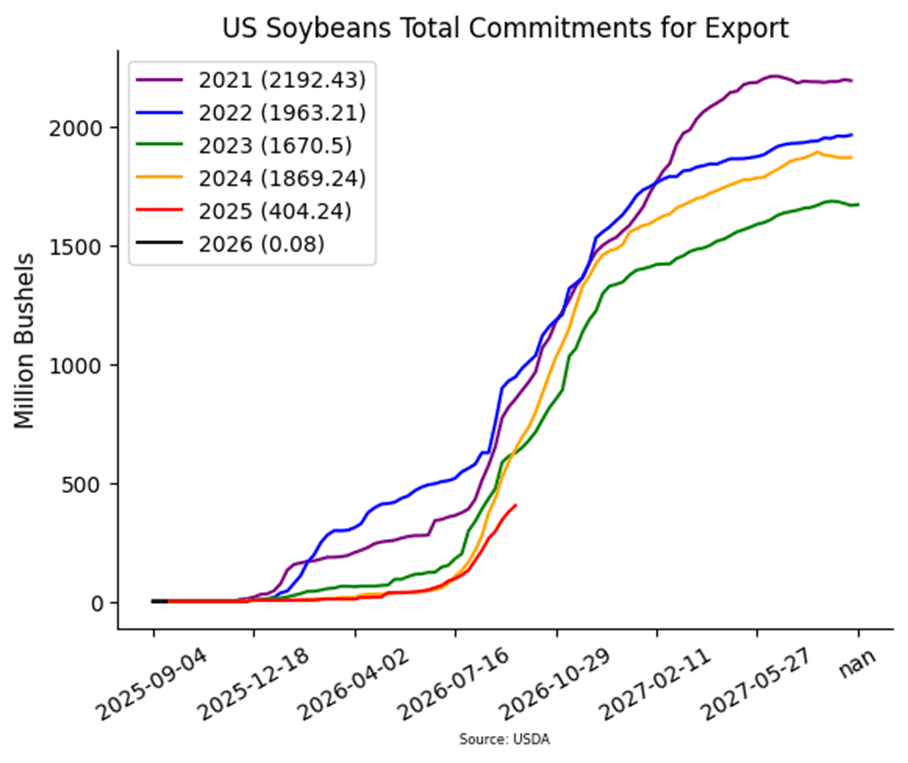

Market Notes: Soybeans

- Soybeans pulled back today after seeing gains yesterday. There appears to be some skepticism now regarding talks next month between President Trump and China’s President Xi. November soybean futures closed 7-1/4 cents lower to $10.22-1/4.

- U.S. Agriculture Secretary Brooke Rollins stated in a cabinet meeting today that once the government shutdown ends, a new program for farmers can be implemented.

- Weekly export sales data was delayed due to the government shutdown but many analysts are still expecting soybean sales between 0.6 and 1.6 mmt for the week of October 2.

- StoneX reported on Wednesday that they see Brazil’s biodiesel demand increasing more than 6% in 2026 to 10.5 billion litres. The group also said they see an increase in soybean oil usuage as well.

- The 8-14 day weather outlook shows above normal temperatures and above normal precipitation for much of the Western soybean belt.

Wheat

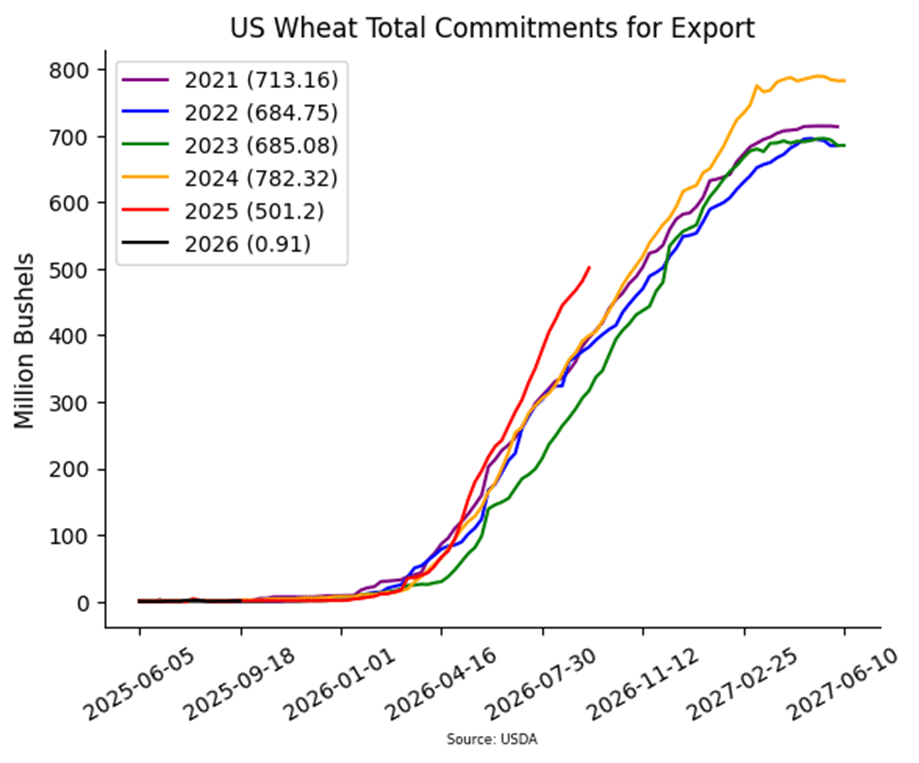

Market Notes: Wheat

- Wheat struggled to hold onto early gains and closed lower in both Chicago and Kansas City futures. MIAX Minneapolis futures, in contrast, did make small gains this session. Dec Chi closed 3/4 cent lower at 506-1/2, KC down 3-1/2 to 489-3/4, and MIAX was up 1-1/2 to 557. From a technical perspective, all three classes are at or very close to oversold levels – this may provide longer term support under the market.

- Wheat futures were initially higher following reports of a major Russian strike on the Odessa port overnight. Additional support came from comments by Russia’s agriculture minister, who noted that the country’s farmers are expected to plant about 6% fewer winter and spring wheat acres, shifting more acreage toward oilseeds. However, by the end of the session, another strong move higher in the U.S. dollar and renewed talk of increasing South American supply kept U.S. wheat markets under pressure.

- In an update from the Rosario Grain Exchange, Argentina’s wheat production estimate was increased by 3 mmt to 23 mmt. If reached, that would be a new record; the increase is the result of high yield potential and adequate soil moisture after above-average rainfall. For reference, the USDA is projecting a 19.5 mmt crop.

- According to Expana, a market intelligence company, their European Union soft wheat production estimate was raised by 0.3 mmt to 136.4 mmt, which still falls below the USDA forecast at 140 mmt. However, if realized, this would still be a record high and also be up 22.8 mmt from last year’s crop.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 599.72 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 599.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center