10-8 End of Day: Wheat Closes Firm as Corn and Soybeans Slide

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 420.75 | -5.25 |

| MAR ’25 | 438.25 | -4.5 |

| DEC ’25 | 454 | -1.5 |

| Soybeans | ||

| NOV ’24 | 1016.25 | -17.75 |

| JAN ’25 | 1034.5 | -18 |

| NOV ’25 | 1065.75 | -15 |

| Chicago Wheat | ||

| DEC ’24 | 594.75 | 2.25 |

| MAR ’25 | 618.25 | 1.75 |

| JUL ’25 | 638.5 | 1.25 |

| K.C. Wheat | ||

| DEC ’24 | 603.75 | 0.5 |

| MAR ’25 | 620.25 | 0.25 |

| JUL ’25 | 637.5 | 0.5 |

| Mpls Wheat | ||

| DEC ’24 | 645 | 0.75 |

| MAR ’25 | 666.25 | 0.75 |

| SEP ’25 | 685.5 | 1.25 |

| S&P 500 | ||

| DEC ’24 | 5790 | 45.25 |

| Crude Oil | ||

| DEC ’24 | 73.2 | -3.27 |

| Gold | ||

| DEC ’24 | 2634.9 | -31.1 |

Grain Market Highlights

- Carryover weakness from the soybean market and sharply lower crude oil kept sellers active in the corn market, which closed at its lowest level in six sessions and toward the bottom of its nearly 9-cent range in the December contract.

- A quick harvest pace, anticipated rain in Brazil, and sharply lower soybean oil weighed heavily on the soybean market, which closed at the low end of its 28-cent trading range (November). Soybean oil prices closed sharply lower in sympathy with crude oil, which dropped nearly 4.5% on talk of a potential ceasefire in the Middle East. Meanwhile, meal closed with a minor $1 loss

- The wheat complex closed mid-range and on the positive side of unchanged across all three classes despite losses in corn, soybeans and crude oil. Continued tensions in the Black Sea, a firm close in Matif wheat, and another day of consolidation in the US dollar, all offered support.

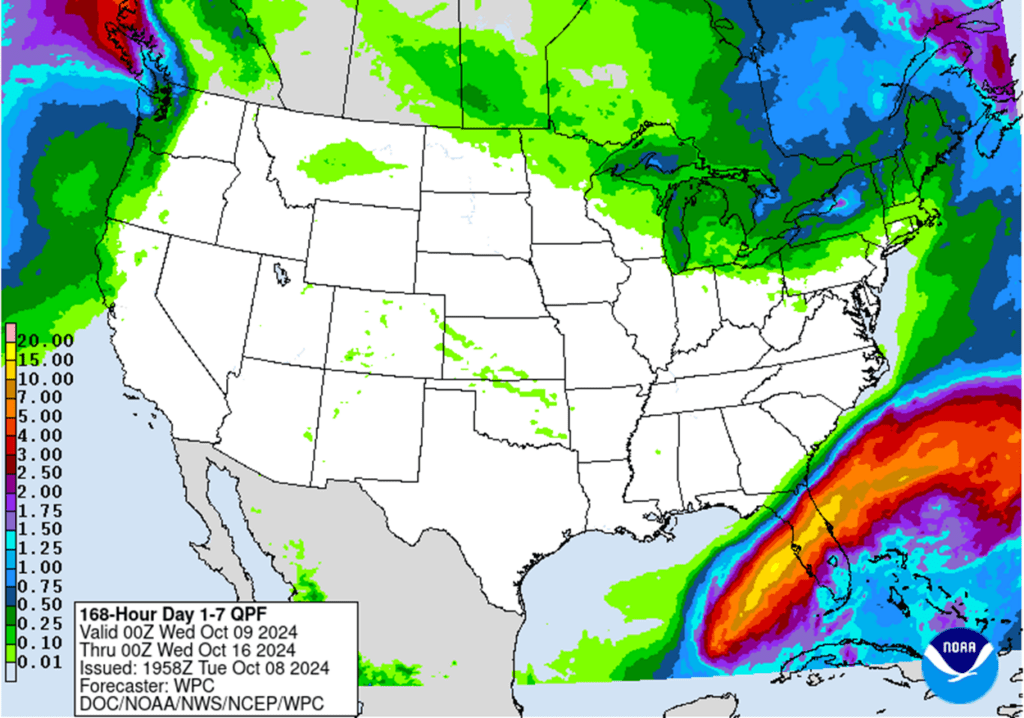

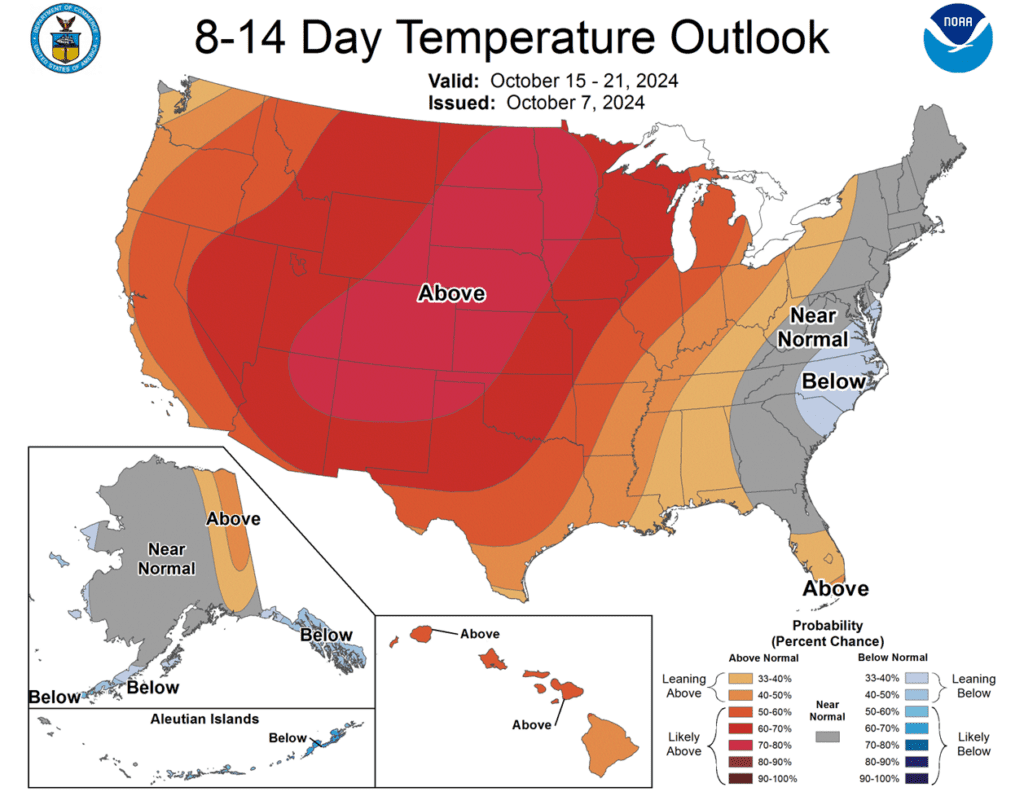

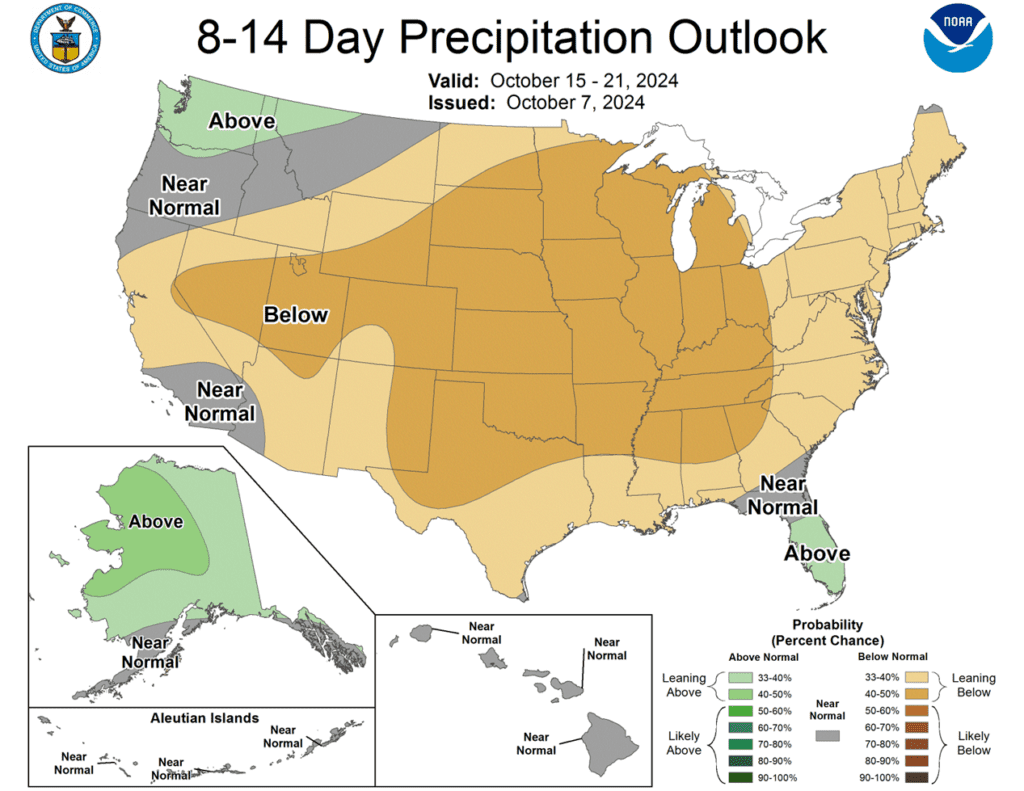

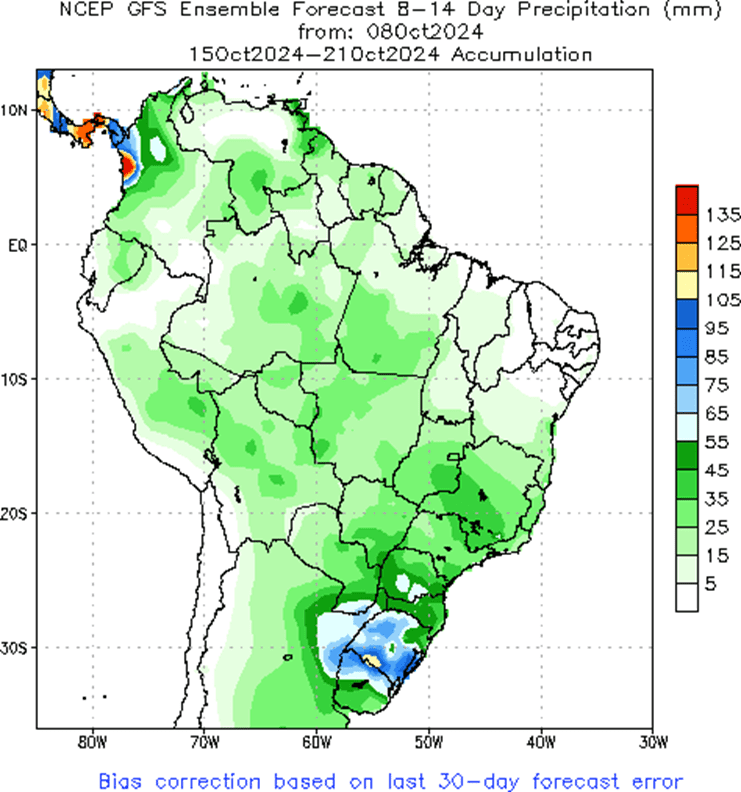

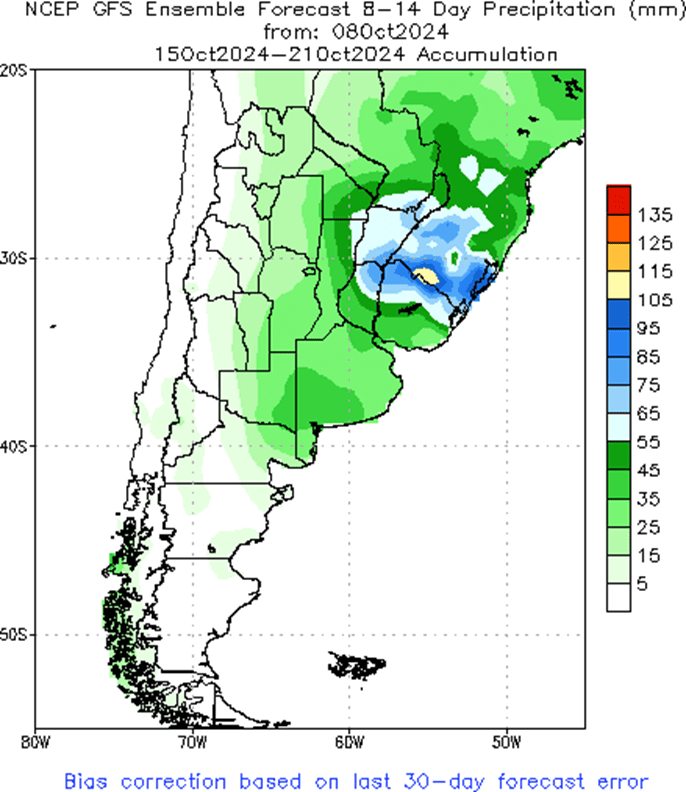

- To see the updated US 7-day precipitation forecast, 8 – 14 day Temperature and Precipitation Outlooks, and the 2-week precipitation forecast for South America, courtesy of NOAA and the Climate Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since printing a market low in late August, the corn market has rallied largely on fund short covering as the rush of old crop bushels into the market has slowed, US demand has picked up, and South American weather has been dry. While the harvest of an expectedly large crop could limit upside potential, it is a good sign that corn buyers have found value at these multi-year low price levels. Now that managed funds have covered a significant portion of their record short positions, they have flexibility to establish net long or net short positions. Any unexpected downward shift in anticipated US supply or continued South American dryness could trigger managed funds to continue buying and rally prices further. However, if harvest yields are strong and South American weather turns more seasonal, prices could be at risk of retreating from recent highs.

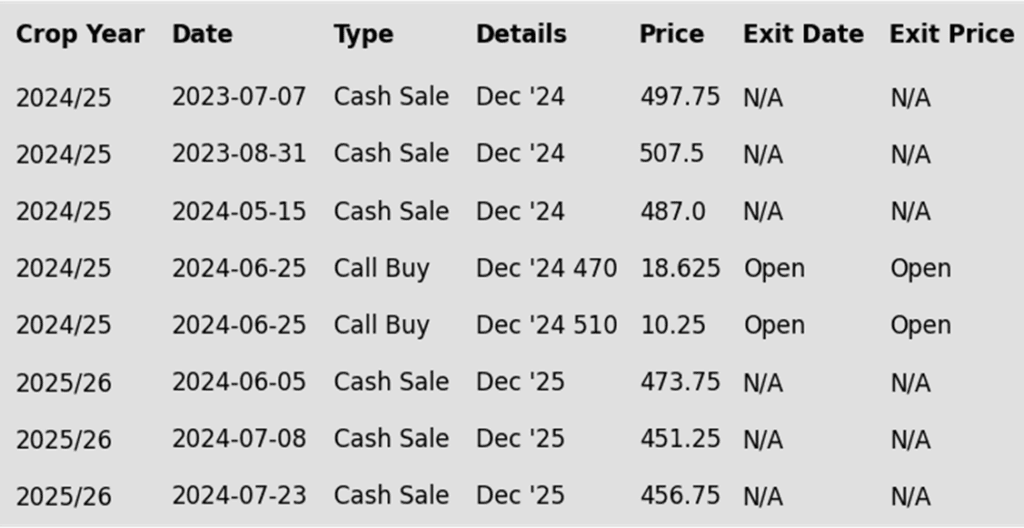

- No new action is recommended for 2024 corn. In June, we recommended purchasing Dec ’24 470 and 510 calls after Dec ’24 closed below 451, due to their relative value and the typically high market volatility during that time of year, and we continue to target a value of 29 cents to exit the Dec ’24 470 calls. Exiting at this level will allow you to lock in gains that offset much of the original position’s cost, while holding the remaining 510 calls at or near a net-neutral cost. This strategy should continue to protect existing sales and provide confidence for further sales during an extended rally. Considering harvest time doesn’t typically offer the most advantageous sales prices, we don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when opportunities tend to improve. For those who need to sell bushels due to space constraints or to raise capital, consider targeting a rally back to the 429 – 460 range versus Dec ’24 to make any necessary sales.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Strong selling in the crude oil market and the soybeans triggered some long liquidation in the corn market on Tuesday. December corn futures posted its lowest close in the past 6 days, and the chart looks challenged technically, which could bring additional negative money flow.

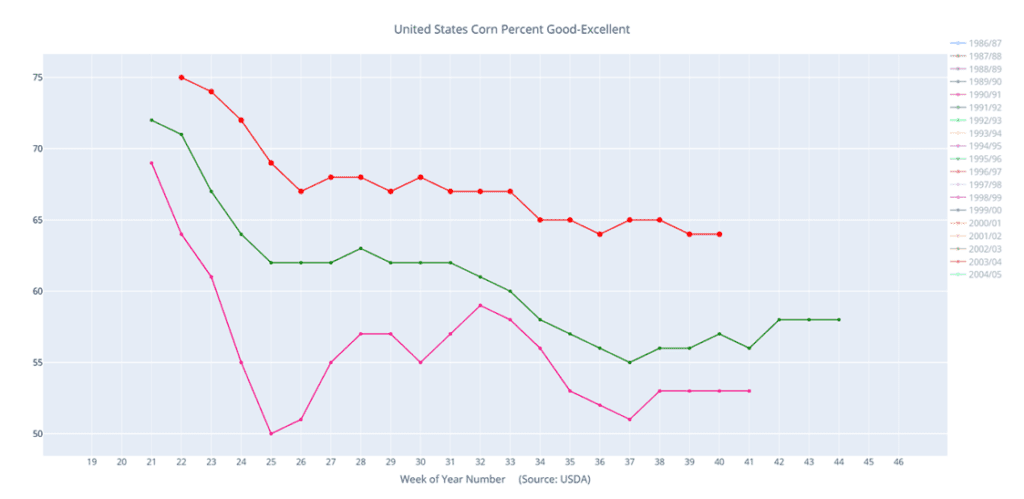

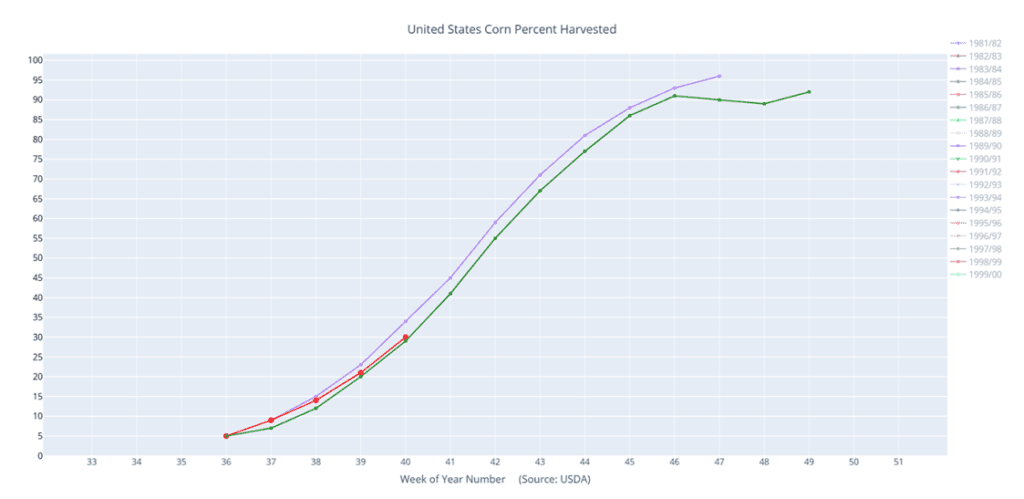

- The favorable midwestern weather has pushed corn harvest over the past week. On Monday’s Crop Progress report, corn harvest gained 9% to 30% complete. This was 3% above the 5-year average and below analysts’ expectations. The pace of corn harvest has been limited as producers focus on the soybean harvest.

- Talk of potential ceasefire negotiations between Hezbollah and Israel triggered strong selling in the crude oil market. November crude oil pushed 5% lower during the session, which pressured the overall commodity complex on Tuesday.

- The USDA will release the next Crop Production and Supply/Demand report on Friday morning. Expectations are for corn yield to decrease slightly to 183.5 bushels per acre, down 0.1 bushels from last month. With improved demand, and slightly lower potential production, corn carryout for the marketing year is looking to be lowered for the fourth consecutive month to just below the key psychological level of 2.000 billion bushels.

Above: The recent close above the 200-day moving average was met with resistance near 434 and prices retreated. Support below the market could come in between 420 and 416, near the 100-day ma. Below there, further support could be found between 410 and 400.

Above: Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Above: Corn percent harvested (red) versus the 5-year average (green) and last year (brown).

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

After posting what appears to be a seasonal low in mid-August, the soybean market has gradually moved higher as growing conditions in the US became drier during the later stages of crop development and have remained dry in key soybean-growing areas of South America. During this time, managed funds have covered large portions of their sizable, short positions, setting the stage for potential volatility in either direction. Higher prices might occur if conditions deteriorate further, prompting more fund buying, or a downside break in prices could happen if conditions improve, leading funds to potentially reestablish short positions. Seasonally, once harvest is complete, prices tend to firm as hedge pressure subsides and a South American weather premium tends to build.

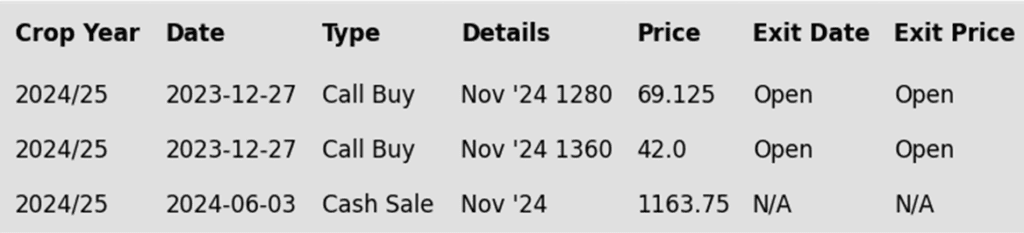

- No new action is recommended for the 2024 crop. In early June, when our Plan B strategy was triggered by the market’s close below 1180, we recommended making sales at that time due to the potential change in trend signaled by that weak close. Because harvest time typically does not present the most advantageous pricing opportunities, we don’t anticipate making any sales recommendations until seasonal opportunities improve, potentially as early as late fall or as late as early spring. For those who need to sell bushels due to space constraints or to raise capital, consider selling into price strength and targeting a rally back to the 1050 – 1070 range versus Nov ’24 to make any necessary sales. Should the market rally beyond there, consider additional sales in the 1090 – 1125 area versus Nov ’24.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

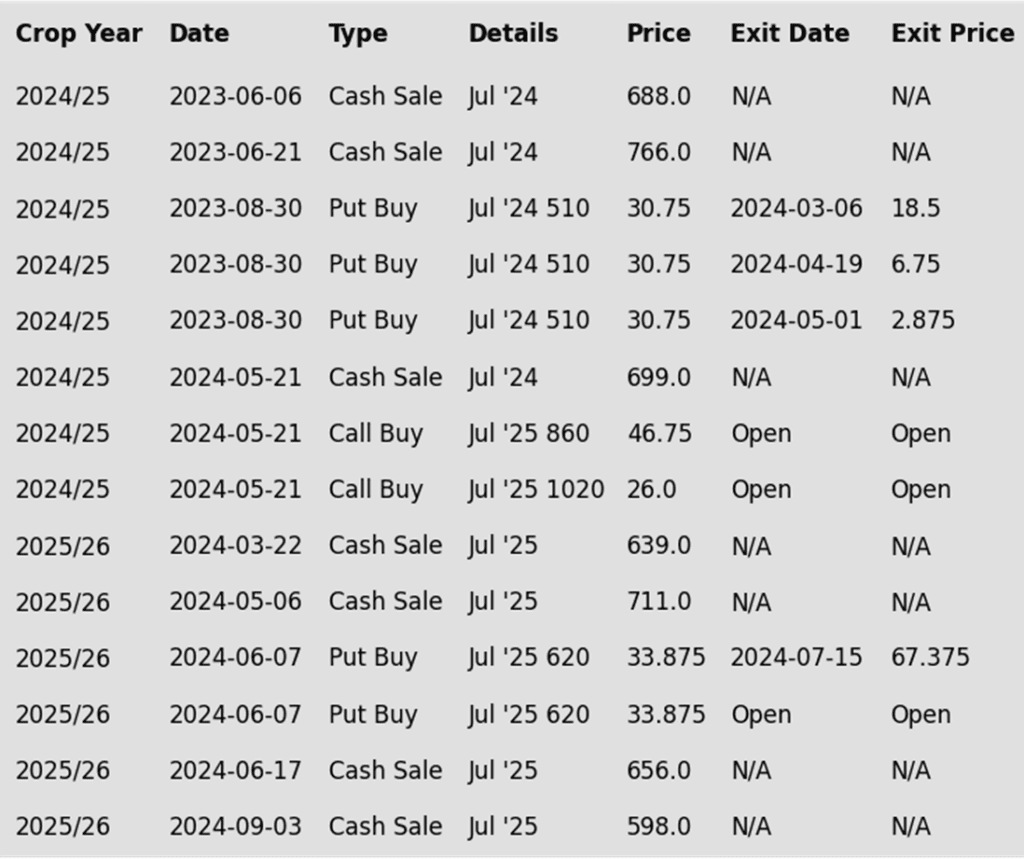

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly lower for the fifth consecutive day as pressure from rains in Brazil bring funds back to the market as sellers. US harvest pressure has been a bearish factor as well, but trade is likely more focused on Brazilian production. November futures traded down to the 50-day moving average but recovered slightly.

- Both soybean meal and oil ended the day lower, but soybean oil was down sharply as it followed crude oil which is currently down $3.25 per barrel. The decline in crude oil came after Hezbollah allegedly said that it would consider a ceasefire in Israel following months of intense fighting.

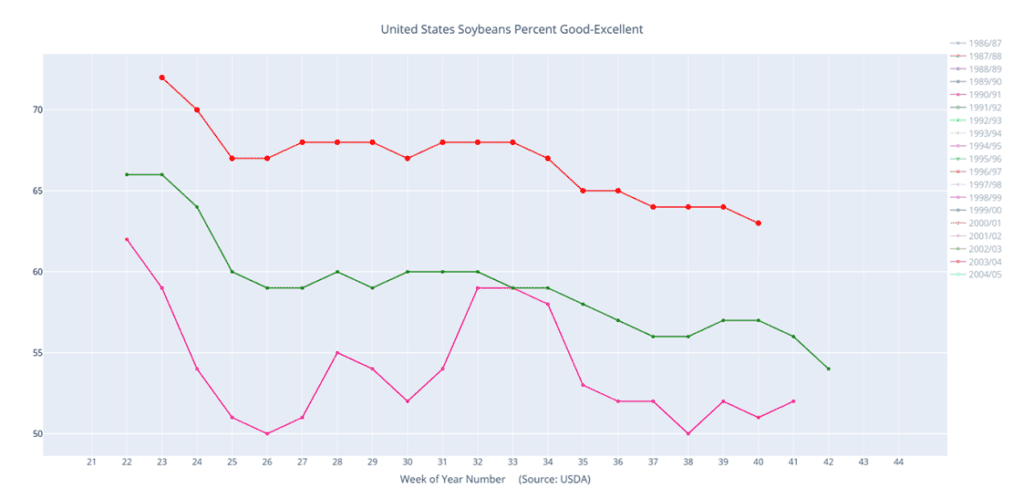

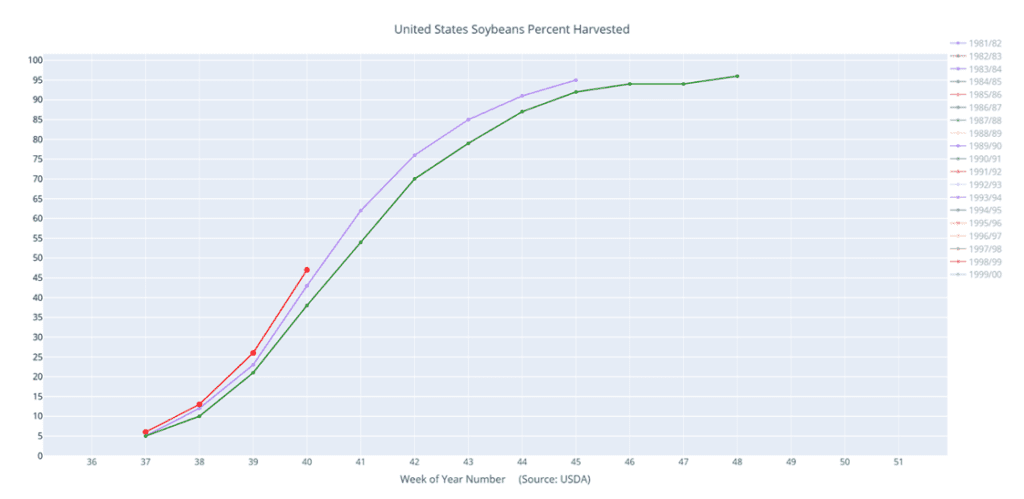

- Yesterday’s Crop Progress report showed that the good to excellent rating in soybeans fell 1 point from last week to 63% but was in line with the trade estimate. 90% of the crop is dropping leaves, compared to 91% a year ago, and 47% of the crop is now harvested.

- This morning, the USDA reported private export sales totaling 166,000 metric tons of soybeans for delivery to China during the 24/25 marketing year. This followed a sale yesterday to unknown destinations of 172,500 mt for the 24/25 marketing year.

Above: The break below 1030 support puts the market at risk of trading lower and testing support between the 50-day moving average and 995. Should this area hold, and prices turn back higher, overhead resistance remains near 1070 and the 100-day moving average.

Above: Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Above: Soybeans percent harvested (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat managed to just squeeze out a positive close, rejecting pressure from sharply lower soybeans and energy prices. Another day of consolidation for the US Dollar Index, as well as a higher close for Matif wheat futures lent support to the US market. Tensions in the Black Sea do remain elevated, which could also account for today’s relative strength in wheat as there are reports of a second grain vessel that was targeted by Russian missiles yesterday.

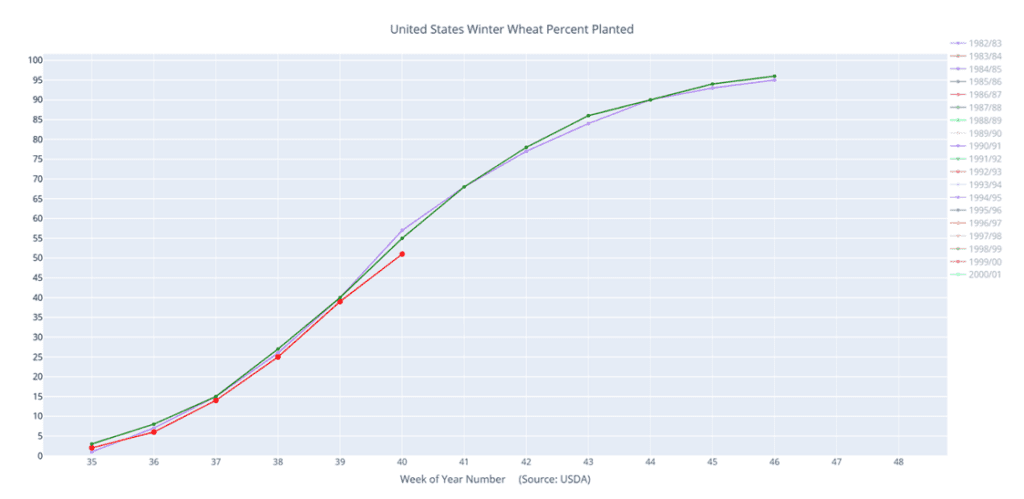

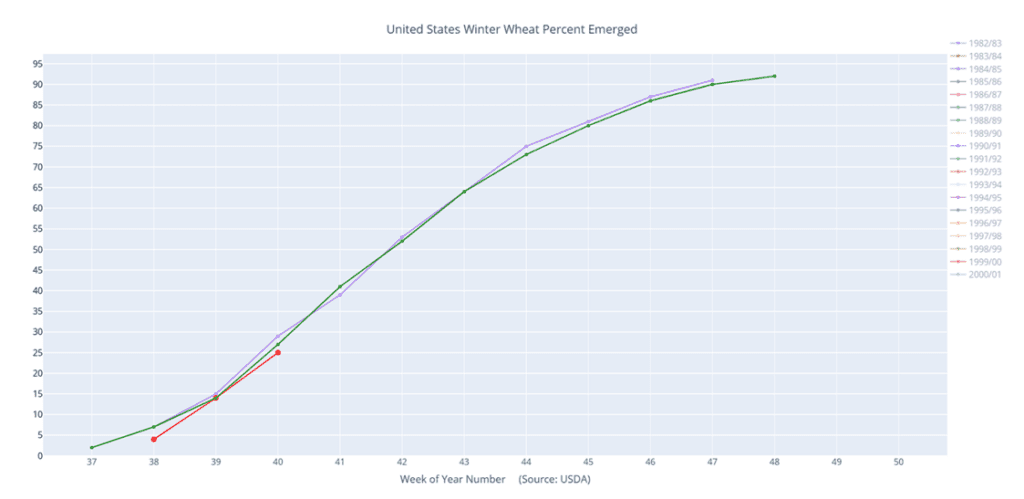

- According to the USDA’s Crop Progress report, as of October 6, the US winter wheat crop was 51% planted. Both last year’s pace and the 5-year average come in just above that at 52%. Additionally, 25% of the crop is reported to be emerged, which is in line with both last year and the average as well.

- The EU’s Monitoring Agricultural Resources unit is estimating the 2024 Kazakhstan spring wheat crop at 16.7 mmt compared with 11.3 mmt a year ago. Mild temperatures and good rains led to excellent growing conditions. Additionally, Kazakhstan’s ag ministry is expecting a 25 mmt total grain harvest this marketing year, with exports estimated to hit 12 mmt.

- Ukraine’s grain exports have totaled 11.2 mmt since the export season began on July 1, up 56% year over year compared to 7.2 mmt during the same period last year. Of that total, 6.5 mmt is wheat, marking an 80% year over year increase. Additionally, Ukraine has reportedly planted 2.88 million hectares of winter grain, with 2.62 million hectares being wheat.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

After posting a seasonal low in late July, the wheat market staged a rally that began in late August triggered by crop concerns due to wet conditions in the EU, and smaller crops out of Russia and Ukraine. The nearly 80-cent rally from the August low to September high also saw Managed funds cover about two-thirds of their net short positions. While low Russian export prices continue to be a limiting factor for higher US prices, a new season is upon us with many uncertainties ahead that could keep volatility in the market. Additionally, US export sales remain ahead of the pace set last year and in 2022, and any increase in demand from lower World supplies could rally prices further.

- No new action is recommended for 2024 Chicago wheat. Considering the rally in wheat back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. Recently, we recommended taking advantage of the wheat rally to sell more of your anticipated 2025 SRW production. While we continue to recommend holding the remaining July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, we are targeting a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

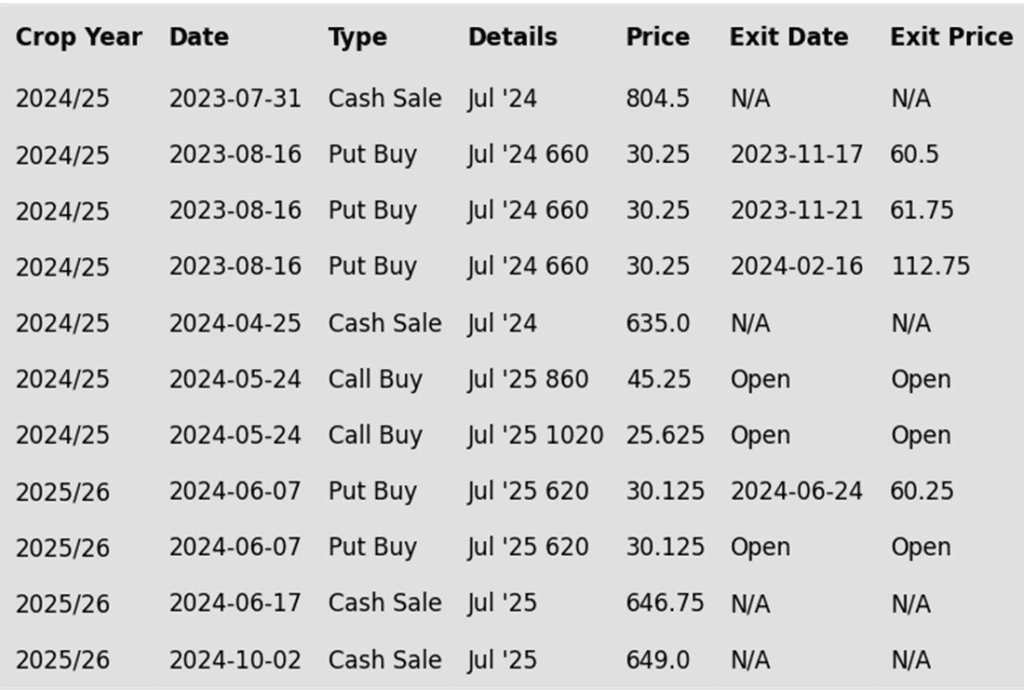

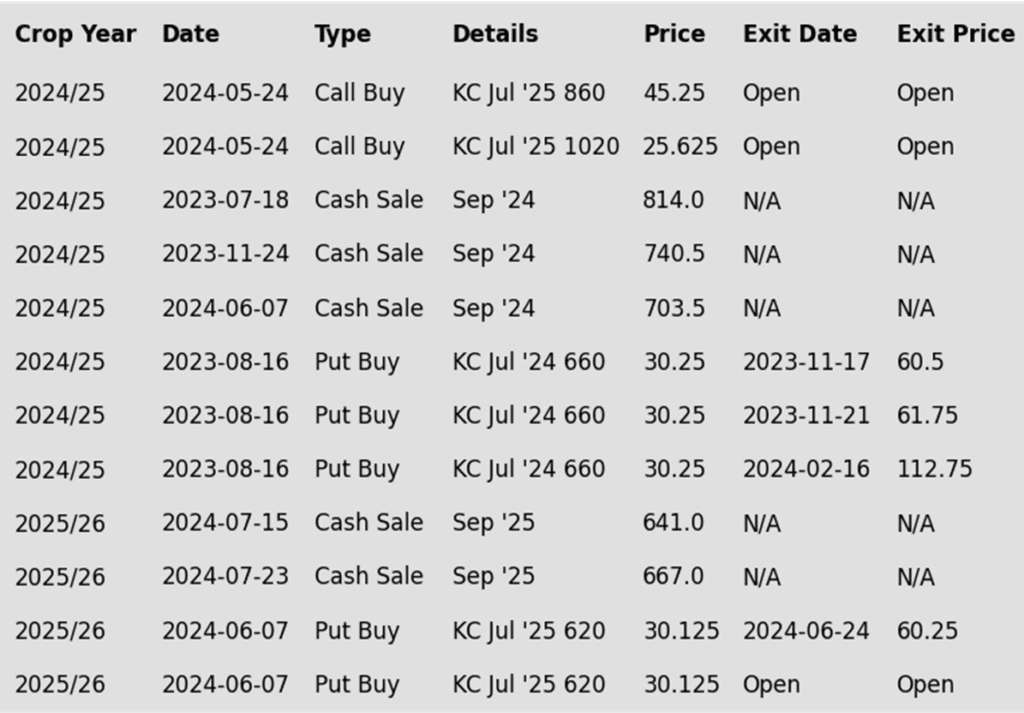

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The upside breakout in Chicago wheat was met with resistance near 617. Should prices turn back higher and close above 617, they could make a run towards the 645 resistance area. Otherwise, if prices drift lower, they could find support between 575 and 560.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

After hitting a market low in late August, the wheat market has rallied driven by crop concerns in the EU and reduced production from Russia and Ukraine. The rise in prices from late August through September also prompted Managed funds to cover a significant portion of their net short positions. Although low Russian export prices continue to cap potential gains for US wheat, the onset of a new season introduces a range of uncertainties that could fuel market volatility. Moreover, US export sales are currently outpacing last year’s figures and those from 2022, meaning that any uptick in demand due to tighter global supplies could further lift prices.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2025 HRW wheat production. July ’25 KC wheat is now about 100 cents off the August low, which represents nearly a 50% retracement back towards last spring’s highs. Considering the extent of this rally and that there may be considerable resistance overhead, we suggest taking advantage of this rally to make an additional sale on a portion of your anticipated 2025 hard red winter wheat crop, using either July ’25 KC wheat futures, or a July ’25 HTA contract, so basis can be set at a more advantageous time later on.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The recent rally was capped by resistance around 623. A close back above that level could put the market on track to test the 50% retracement level of 637 back toward the May high. Down below, the market may find trendline support near 581, with further support between 571 and 561.

Above: Winter wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Above: Winter wheat percentage emerged (red) versus the 5-year average (green) and versus last year (brown).

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since posting a seasonal low in late August, Minneapolis wheat has traded at the upper end of the range that was established in early July. During this period, managed funds have covered about 40% of their short positions in Minneapolis wheat. While low export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. Now that the spring wheat harvest is behind us, and we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 675 – 700 range to recommend making additional sales.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The recent breakout was met with resistance just below the 200-day moving average, a close above which could put the market on track to run towards 685. Below the market, initial support remains near the 100-day ma, with trendline support near 610.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Above: Argentina 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.