10-8 End of Day: Soybean Rally Continues, Corn and Wheat Futures Follow Higher Wednesday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended slightly higher Wednesday, continuing to consolidate around the $4.20 level. Ethanol production rebounded to 315 million bushels per day last week, up from 293 mb/day previously and above expectations.

- 🌱 Soybeans: Soybean futures closed higher across the entire soy complex Wednesday, supported by optimism surrounding the potential meeting between President Trump and China’s President Xi.

- 🌾 Wheat: Despite early weakness and a stronger U.S. dollar—now at its highest level since early August—wheat futures managed to close higher across all three classes.

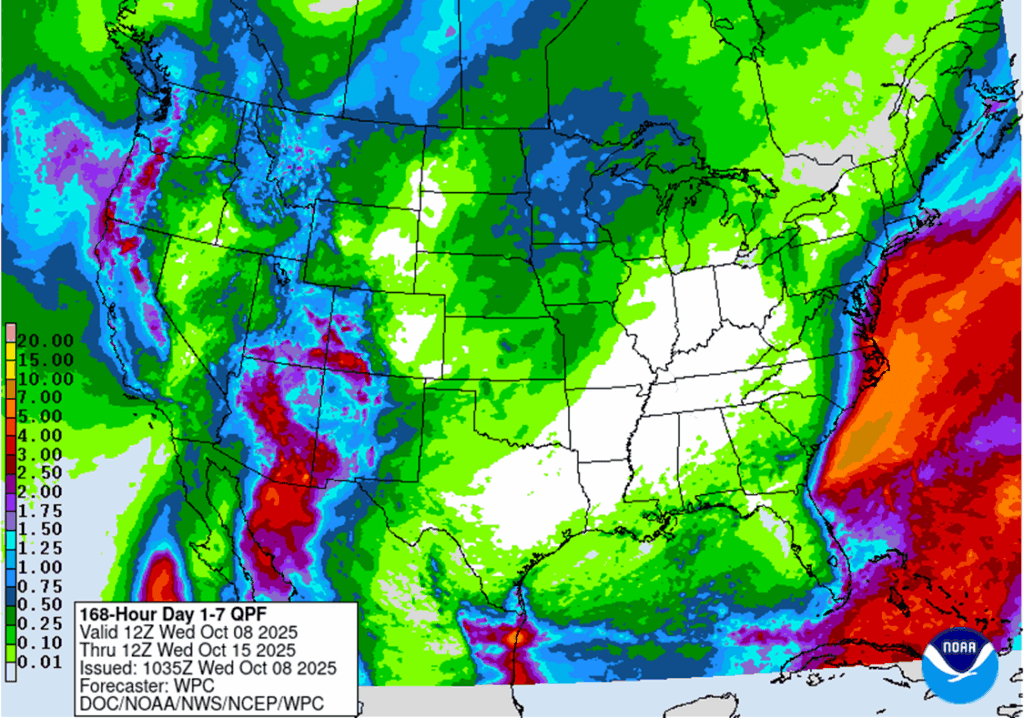

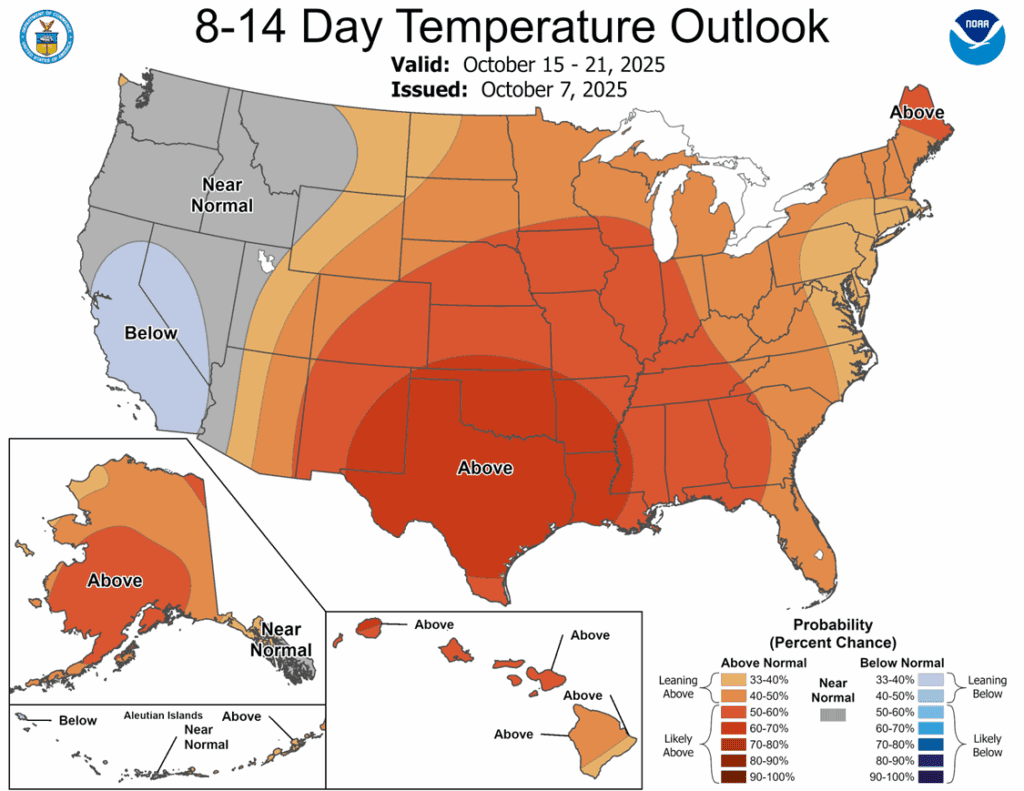

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn prices continue to grind around the 420-price area, being held in check by the 100-day moving average over the December contract, as prices finished with small gains on Wednesday. December futures gained 2 ¼ cents to 422. March added 1 ½ cents to 437 ¾.

- Corn spreads are showing some buying strength is the front end of the market as the Dec-Mar corn spread has been eliminating some carry and trading at its tightest level since July. This could be a reflection of the strong demand, producers holding bushels, or a tighter supply causing strength in the front months.

- Ethanol production recovered last week to 315 mb/day, up from 293 mb/day last week. This production total was above expectations. A total of 106.7 mb was used for ethanol grind last week, which is behind the pace needed to hit USDA targets for the marketing year.

- The Trump administration has delayed announcing a producer aid package as the ongoing government shutdown has limited administrative capacity to finalize details.

- The U.S. Dollar Index continues to strengthen, reaching its highest level since early August. A firmer dollar may act as a headwind for U.S. export competitiveness.

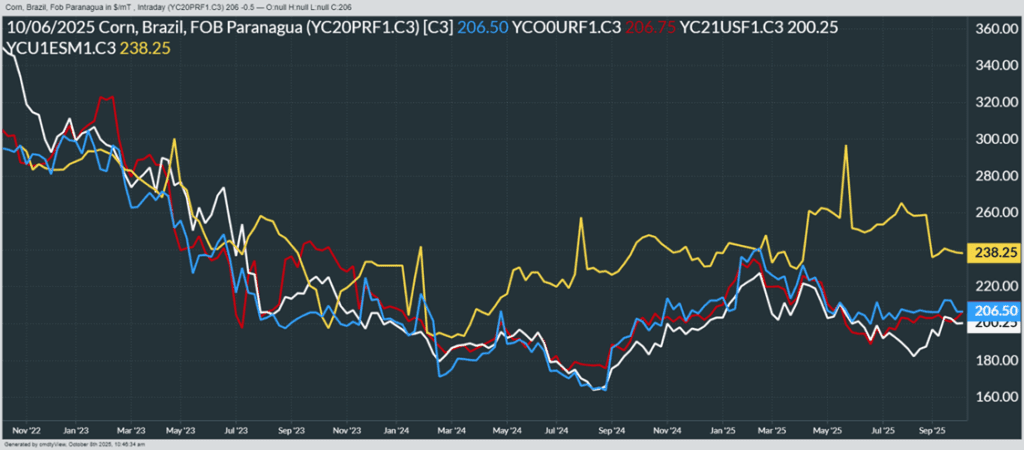

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

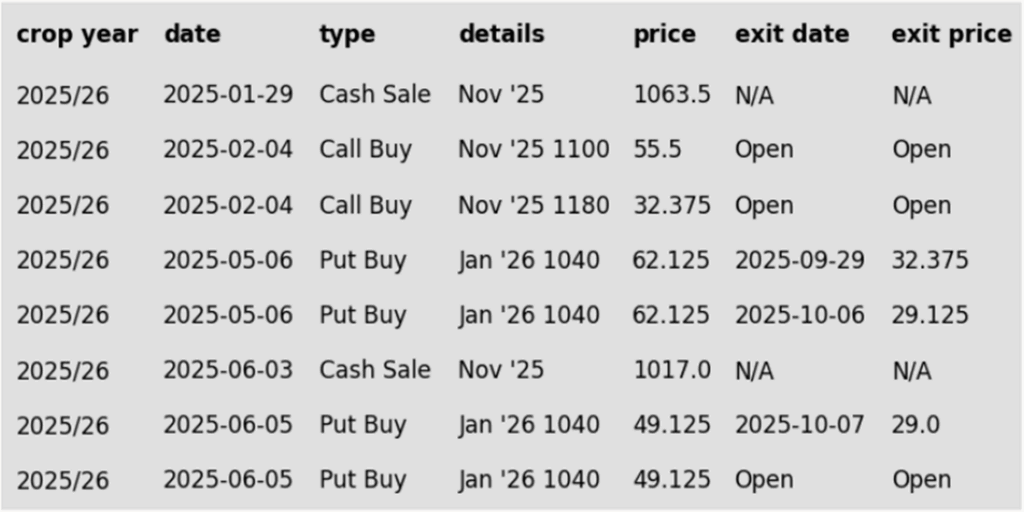

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- The soybean market wrapped up the midweek trading session with gains across the entire soy complex. Markets remain encouraged by optimism surrounding the potential upcoming meeting between President Trump and China’s President Xi, which could have implications for trade and tariffs. November soybean futures are trading up at $10.29 ¾.

- A major obstacle for U.S. soybean markets and a potential trade deal with China is the upcoming implementation of port fees on Chinese vessels entering U.S. ports, scheduled to begin October 14. Some analysts fear these fees could derail any progress on trade negotiations between the U.S. and China.

- With the government shutdown delaying USDA reports, trade estimates are being used as a proxy. Today’s trade estimates put the average U.S. soybean yield at 53.2 BPA, with ending stocks at 317 million bushels, up from 300 million in September. Global ending stocks are expected to decline slightly. While U.S. soybean yields showed a modest drop, the decline was less pronounced than that seen in corn.

- Argentina’s oilseed workers had planned a strike today over wages and benefits, but the government intervened and initiated a mandatory 15-day conciliation period to negotiate a deal. Historically, such strikes have tended to support U.S. soybean meal and oil prices.

- Brazil’s soybean exports are projected to reach 102.2 million tons through the end of October, surpassing the previous record of 101.3 million tons for this period set in 2023, according to Anec figures. The surge is driven by strong Chinese demand and the absence of U.S. soybean shipments to China, which has redirected purchases to Brazil.

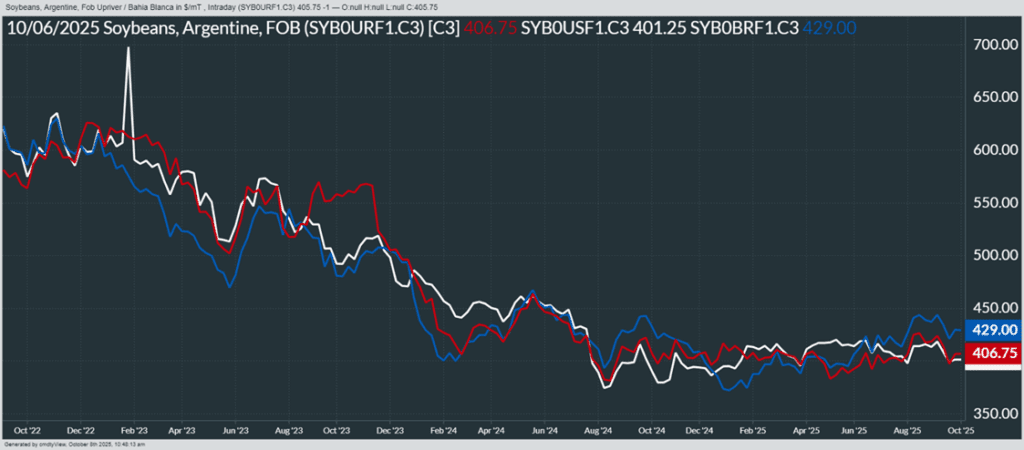

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Despite early weakness and a stronger U.S. dollar—now at its highest level since early August—wheat futures managed to close higher across all three classes. The December Chicago contract gained 1/2 cent to close at 507-1/4, while Kansas City was up 1-1/4 at 493-1/4, and MIAX moved 3-1/2 higher to 555-1/2.

- Russian cash wheat values are said to have weakened yesterday for the first time in several weeks. Additionally, FOB values between large global exporters are close together, keeping competition stiff. According to the International Grains Council, U.S. Gulf HRW offers are $229/mt, compared with $226 for French wheat, and $231 for Russian wheat.

- Ukrainian wheat exports July through September totaled 4.7 mmt. This is down 23% year over year; however, shipments out of the Black Sea area are expected to increase, which may limit upside for U.S. futures. For example, according to Rusagrotrans, Russian October wheat shipments could reach 5.1 mmt, which would be up from 4.6 mmt shipped in September.

- Tomorrow, traders will not receive the previously scheduled monthly WASDE report due to the government shutdown. However, private analysts are still being polled. According to a Bloomberg survey, the average estimate of 25/26 wheat ending stocks comes in at 880 mb, up from 844 in September. Global wheat carryout is estimated at 265.9 mmt, versus 264.1 on the September USDA report.

- SovEcon has increased their projection of Ukraine’s 2025 wheat crop, reportedly due to higher yields. The wheat production forecast was upped 1.5 mmt to 22.9 mm. Additionally, the 25/26 wheat export estimate was raised to 16.8 mmt.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 599.72 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 599.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

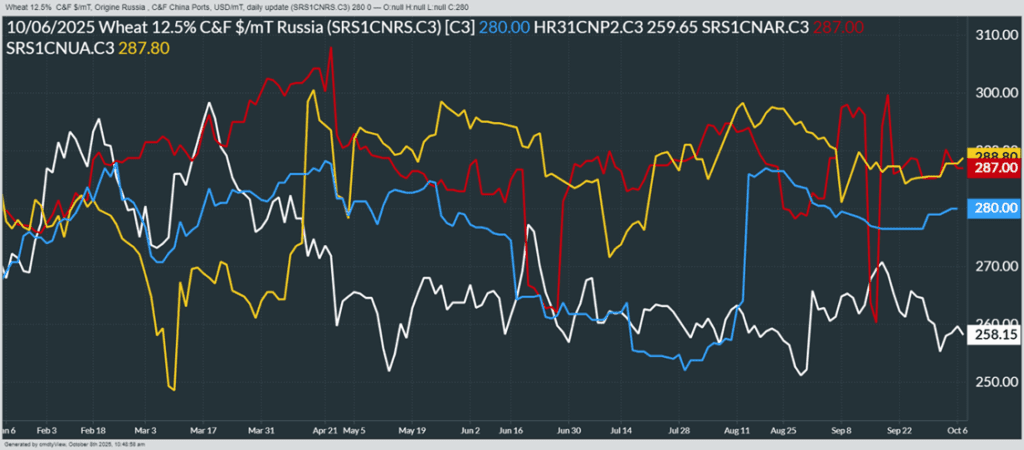

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

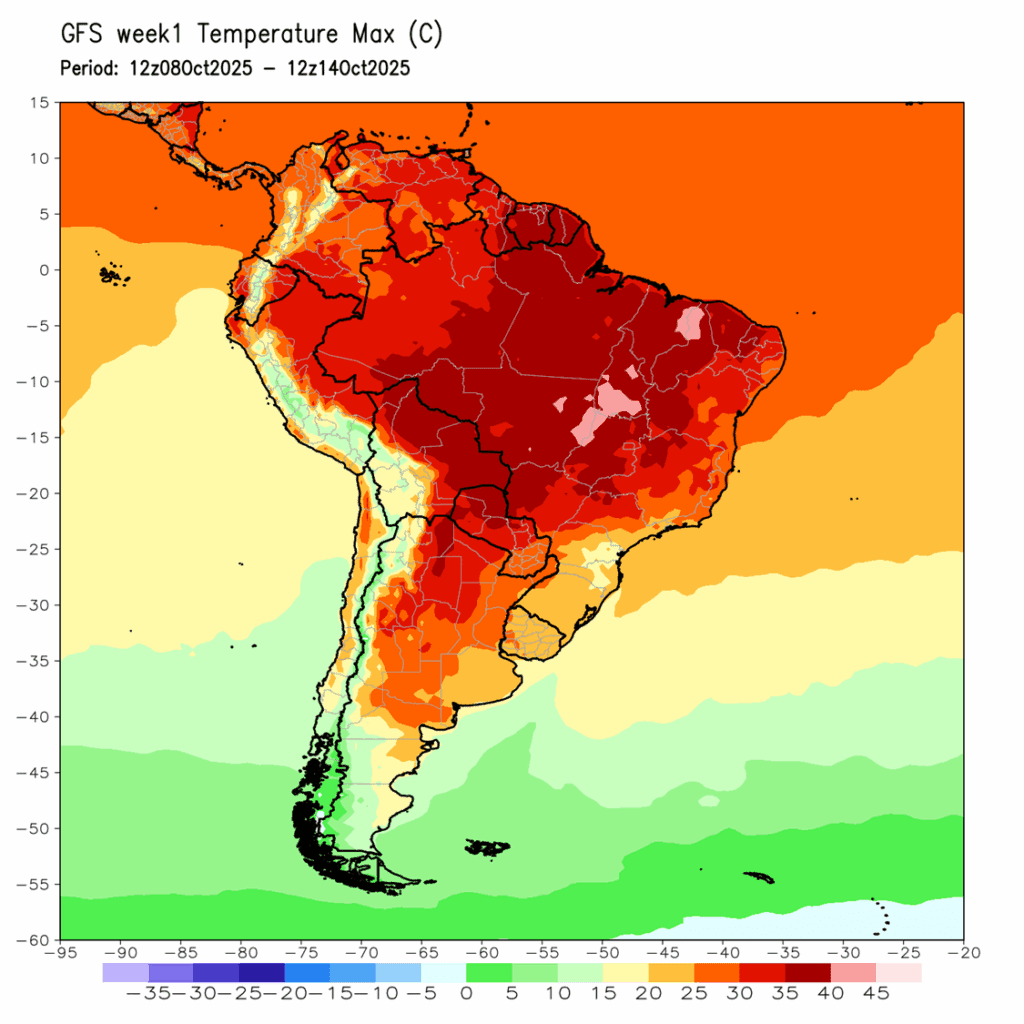

Above: South America 7-day temperature forecast courtesy of National Weather Service, Climate Prediction Center.