10-7 End of Day: Grains Finish Mixed as Harvest Progresses

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished slightly lower as private analysts release estimates maintaining the expectation for a record crop.

- 🌱 Soybeans: Soybeans futures closed higher as the market adopts an optimistic view of upcoming U.S. – China trade discussions.

- 🌾 Wheat: Wheat futures slid lower today as the U.S. dollar’s recent strength weighs on the market.

- Crop Progress data has not been released due to the government shutdown. Updated figures will be provided when the shutdown ends.

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures failed to push through overhead resistance and finished with marginal losses on the session. On going harvest and the prospects of large corn supplies weighed on prices. December futures lost 2 cents to 419 ¾, and March futures fell 2 cents to 436 ½.

- Corn harvest will likely be picking up after the current wet weather moves through as producers have been focused on harvesting a rapidly drying soybean crop. The prospects of a record crop and farmer selling will limit market gains.

- Even though the USDA October WASDE report is cancelled, many analyst groups released estimates for that potential report. Expectations were for corn yield to slip to 185 bu/a, and total production to remain a record crop at 16.645 BB produced. Corn carry out was still forecasted to remain burdensome at 2.231 BB.

- Brazilian Ag Agency report that corn exports in the month of September reached 7.65 MMT, up from 6.42 MMT last year as record production provide ample corn supplies to meet the global market.

- Brazilian consultancy, AgRural, estimated 2025/26 first-crop corn planting hit 40% done, up from 37% a year ago and the fastest since the 2012/13 season.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- NEW ALERT – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

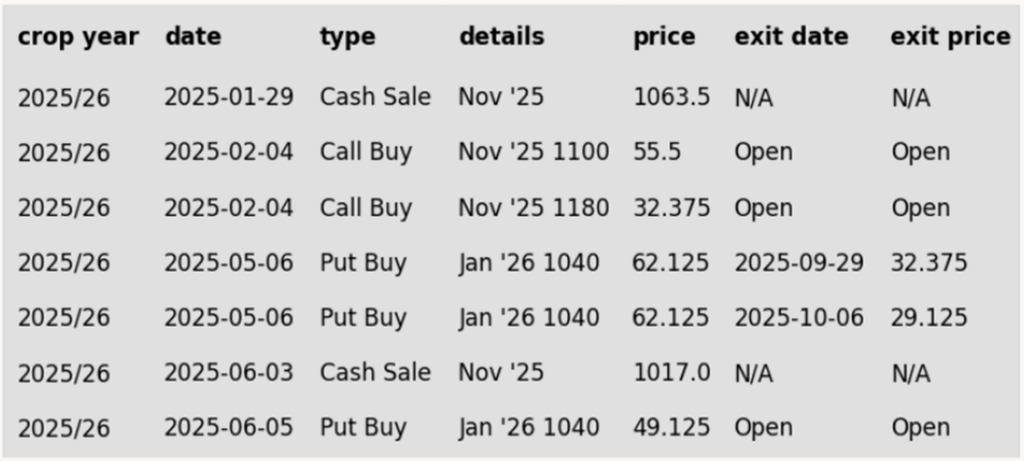

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended Tuesday’s session with modest gains, holding onto trade optimism that a potential meeting between President Trump and Chinese President Xi in early November could lead to renewed Chinese purchases of U.S. soybeans. In today’s trade, soybeans and soybean oil are posting slight gains, while soybean meal trended lower. November soybean futures closed at $10.22.

- Harvest activity continues to advance rapidly across the U.S. with progress nearing 40% completion, slightly behind the 47% reported at this time last year. These figures are based on private analyst estimates, as official government data were not released yesterday due to the government shutdown.

- Harvest pressure remains a significant obstacle for soybean markets, as weather across most of the Midwest looks ideal for harvesting over the next five days, before the 6–10 day forecast shifts to above-normal precipitation.

- Planting in Brazil is 9% complete, progressing toward the second-fastest pace on record. In Mato Grosso, planting has reached 15%, well ahead of the 6.1% average for this time of year. Soil moisture conditions are expected to improve next week, with increased precipitation in the forecast. President Trump and Brazilian President Lula held a phone meeting yesterday, which both sides described as constructive, with additional calls scheduled. Brazil continues to benefit from the U.S.–China trade tensions, as September soybean exports rose 20.2% year over year, while soybean meal exports increased 19.1%.

- The U.S. dollar is trading higher again today; however, U.S. soybean prices remain well below South American levels, and it would take a significantly larger dollar rally to narrow that gap.

Wheat

Market Notes: Wheat

- Wheat closed lower led by the Chicago class – December Chi lost 6 cents to close at 506-3/4. Meanwhile Dec KC was down 3-1/2 to 492 and MIAX finished 4-1/2 lower at 552. A combination of the rising US Dollar Index and a lack of fresh news kept the wheat complex under pressure.

- Though the crop progress report was not released this week due to the government shutdown, the US winter wheat crop is believed to be about 50% planted, up from 34% last week. Elsewhere, Ukraine’s winter wheat crop is also half planted, with 2.35 million hectares sown so far.

- Bangladesh has committed to purchasing 220,000 mt of US wheat, paying $308/mt on a DNF basis. This is part of a governmental trade deal between the two nations made earlier this year.

- Key rains were missed by southeastern areas of Australia during the month of September. This region produces about a fourth of the country’s wheat crop annually – the states of South Australia and Victoria were forecasted to harvest about 8.2 mmt of wheat, but with warming temperatures and lower soil moisture levels, analysts believe there will soon be production estimate cuts; some speculate on losses of one half to one million tons.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 601.5 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 601.5.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

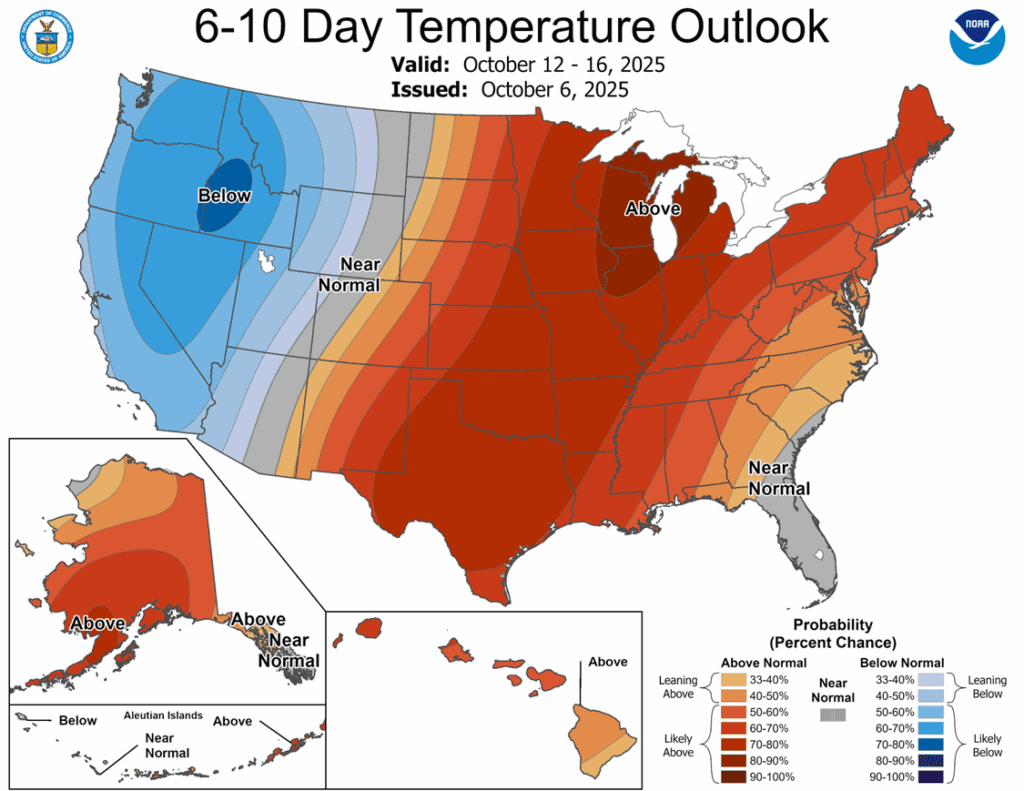

Above: U.S. 6-10 day temperature outlook courtesy of ag-wx.com

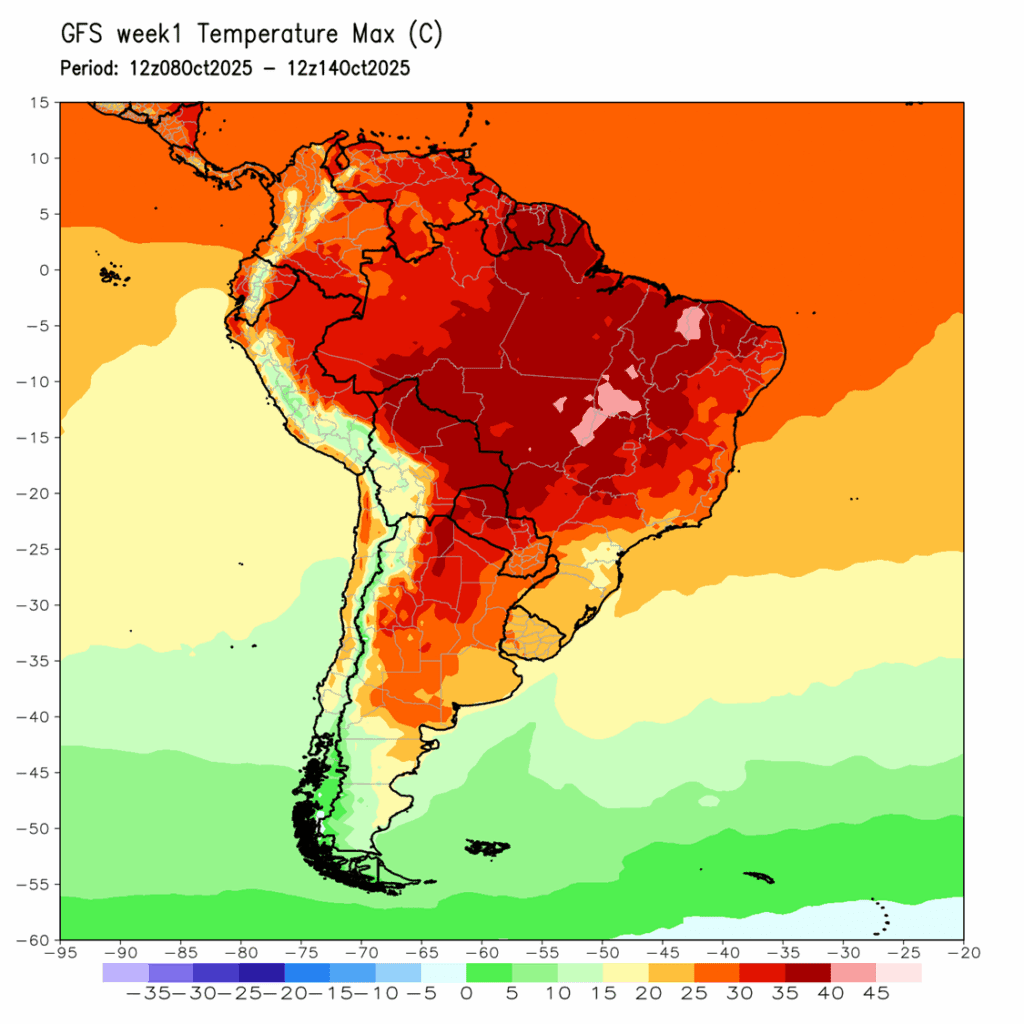

Above: South America 7-day temperature forecast courtesy of National Weather Service, Climate Prediction Center.