10-30 End of Day: China Trade Optimism Boosts Soybeans; Corn and Wheat Lag

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures closed lower, as spillover pressure from a weak wheat market outweighed optimism surrounding ongoing trade talks with China.

- 🌱 Soybeans: The soybean market ended the day higher on positive trade optimism with China, following an extremely volatile session.

- 🌾 Wheat: Wheat closed lower across all three classes, continuing to struggle amid a lack of news to drive a rally, while a stronger U.S. dollar added further pressure.

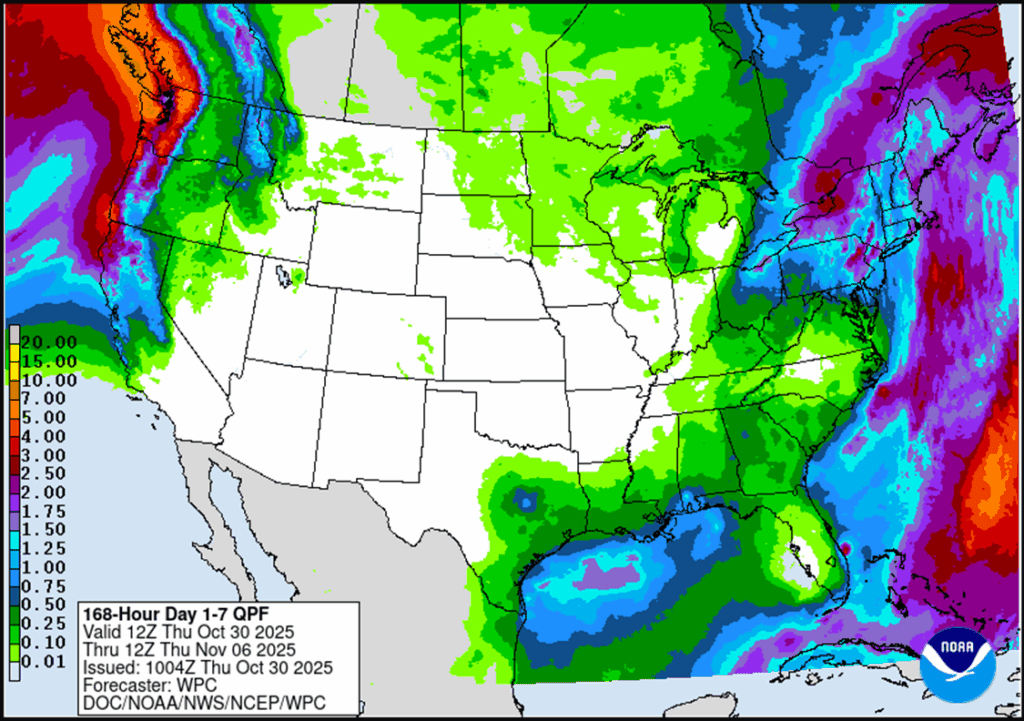

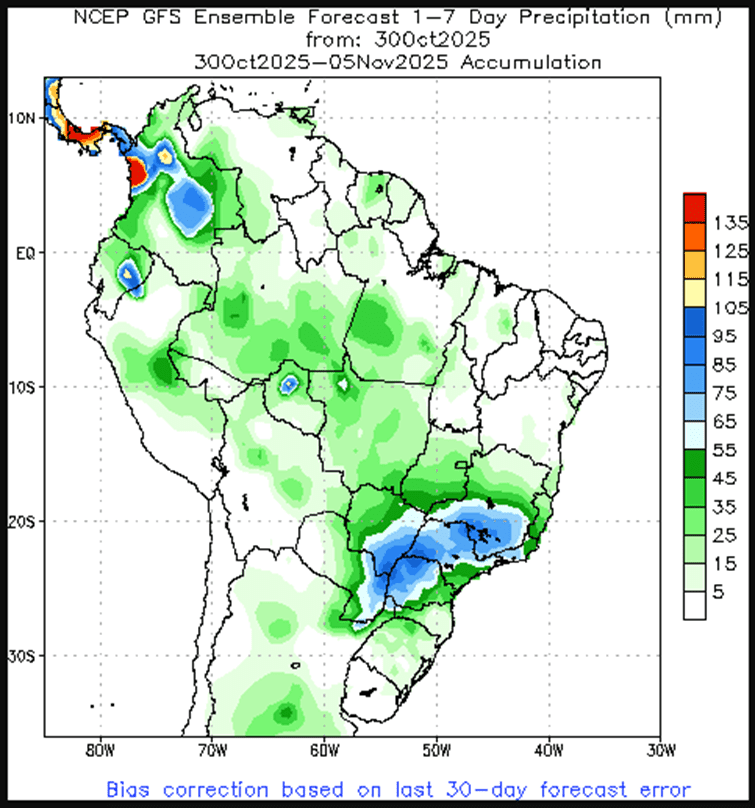

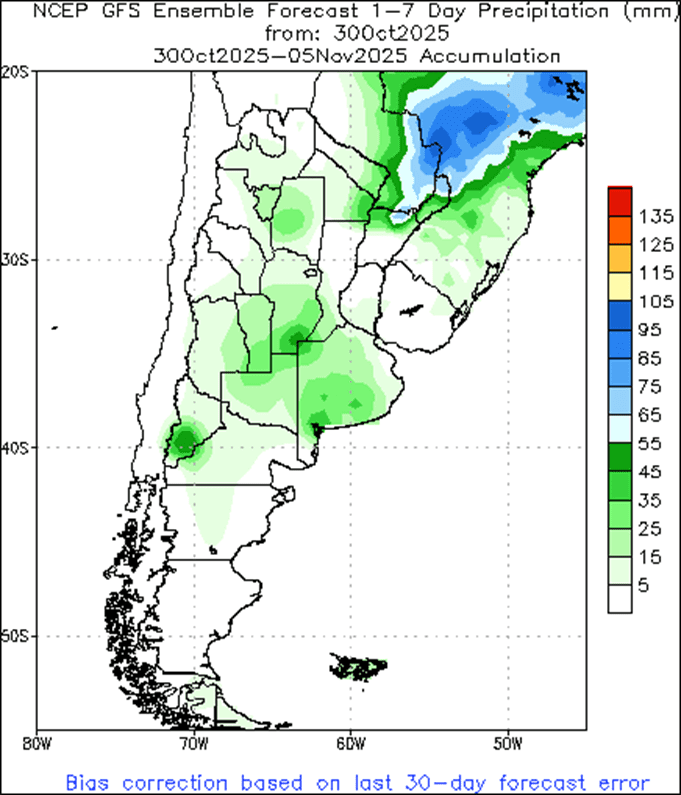

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA, scroll down to the other Charts/Weather section.

- The release of new export data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if December 2026 futures close above 483 macro resistance.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The Plan B call option target has been raised from 482 to 483.

- Notes:

- Resistance for the macro trend sits at 483 vs December 2026. A close above 483 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Despite the friendly trade negotiations with China, corn futures failed to push through resistance, and a weak wheat market limited the corn market on Thursday. December corn slipped 3 3/4 cents to 430 1/4, while March lost 3 cents to 443 3/4.

- December corn futures tested the 200-day moving average at 437 and failed to push through, triggering selling and some long liquidation. Bearish technical action on Thursday may lead to additional selling pressure into Friday’s session.

- The U.S. and China appear close to reaching a trade agreement, and the prospect of improved Chinese demand supported the soybean market. Strength in soybeans may have helped limit selling pressure in corn during the session.

- With the USDA still closed due to the government shutdown, the weekly Corn Export Sales report was not released. Analysts expected new sales to range from 600,000MT to 1.6 MMT. The 5-year average for the week is 1.376 MMT.

- Corn harvest is moving into its final stages, which may be prompting some cash sales of remaining bushels. Corn spreads were actively bearish during the session, with December futures giving ground to the deferred months.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if January 2026 futures close above 1175 macro resistance.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 1175 vs January 2026. A close above 1175 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Sell the first portion of your crop if November 2026 futures break below 1045.

- Buy call options if November 2026 futures close above 1161 macro resistance.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A Plan A stop sale target has been added.

- Notes:

- Key support for November 2026 futures is at 1045 – a break below this level would indicate the potential for a trend change. A stop is used to allow the current market trend to continue developing and will only trigger a sale recommendation if prices close below this level.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

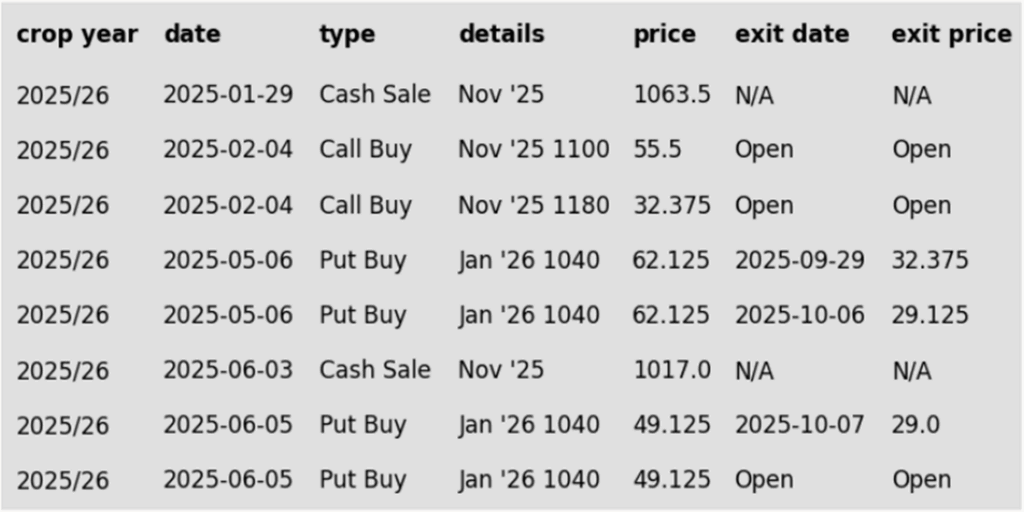

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher after an extremely volatile day that saw the trading range for November at 44 cents, with the low at $10.57 and high at $11.01. President Trump met with Chinese President Xi last night and achieved a breakthrough, with China committing to resume large soybean purchases.

- November soybeans have gained 71-3/4 cents between this week and last, and today gained 11 cents to $10.91-1/4 while March gained 10-1/2 cents to $11.15-3/4. December soybean meal gained $6.90 to $315.60, and December soybean oil lost 0.51 cents to 49.65 cents

- President Trump and Xi came to some good agreements regarding trade last night, with China agreeing to buy 12 mmt of soybeans this season and a minimum of 12 mmt per year for the next 3 years. Each country has lowered tariffs on the other, and the trade truce has been extended for a year.

- In Brazil, soybean crushing is expected to hit a record high of 177 mmt for 25/26 according to Rabobank, which would be up 3% year to year. Brazilian planted soybean area is estimated at 48.8 million hectares, which would be up 2% from the previous year.

Wheat

Market Notes: Wheat

- Wheat closed lower across all three classes. December Chi lost 8 cents to 524-1/4, KC was down 9-3/4 at 513, and MIAX closed 10 lower at 505-1/2. It was a volatile session for the grain markets, particularly soybeans, following last night’s meeting between President Trump and President Xi. Wheat appears to have little upside for now, as short covering may be mostly complete and there’s a lack of fresh bullish news. Adding to the pressure, Fed Chairman Powell indicated that interest rates may not be cut in December, boosting the U.S. dollar and weighing further on wheat prices.

- Ukraine’s winter wheat exports for the 25/26 season have reached 6.15 mmt as of October 29, but that is down 20% year over year. Furthermore, their winter wheat planting is said to be 82% complete with 3.86 million hectares sown so far. This falls below last year’s 4.1 million hectares planted at this time.

- A Bloomberg analyst survey suggests that U.S. wheat export sales may have reached 613,000 mt, which would be up from the 411,000 figure a year ago. The estimates, however, ranged between 350-900 thousand mt.

- A dry period is expected across the Pampas region of Argentina – this should be beneficial to the late developing wheat crop, given that there has been recent widespread rain and perhaps a surplus of moisture. In related news, LSEG weather research suggests that a weak La Niña weather pattern is developing. This could bring warm and dry conditions to the Pampas in the December-February timeframe.

- Russian wheat FOB export values are said to be around $231/mt. This is around the equivalent of 20 cents/bu below U.S. HRW wheat at the Gulf. Argentina wheat offers are also said to be cheaper than those of the U.S.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- Buy call options if July 2026 futures close above 669 macro resistance.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 669 vs July 2026. A close above 669 would signal a potential shift to a macro uptrend, triggering a call option purchase.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 590.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 590.50.

- Notes:

- Resistance for the macro trend sits at 590.50 vs December ‘25. A close above 590.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 590.50 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 590.50.

- Notes:

- Resistance for the macro trend sits at 590.50 vs December ‘25. A close above 590.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center