10-3 End of Day: Markets Drift Lower to Close Down on the Day

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 428.25 | -4.25 |

| MAR ’25 | 446 | -4 |

| DEC ’25 | 456.75 | -1.5 |

| Soybeans | ||

| NOV ’24 | 1046 | -10 |

| JAN ’25 | 1064.5 | -9.75 |

| NOV ’25 | 1088 | -8.25 |

| Chicago Wheat | ||

| DEC ’24 | 603.5 | -11.75 |

| MAR ’25 | 626.5 | -10.75 |

| JUL ’25 | 645.25 | -9.5 |

| K.C. Wheat | ||

| DEC ’24 | 611.5 | -7.75 |

| MAR ’25 | 628 | -6.25 |

| JUL ’25 | 644.5 | -5.5 |

| Mpls Wheat | ||

| DEC ’24 | 646.25 | -2.75 |

| MAR ’25 | 667.25 | -2.75 |

| SEP ’25 | 685.75 | -2.5 |

| S&P 500 | ||

| DEC ’24 | 5741 | -19.25 |

| Crude Oil | ||

| DEC ’24 | 73.33 | 3.64 |

| Gold | ||

| DEC ’24 | 2679.8 | 10.1 |

Grain Market Highlights

- Even though corn export sales exceeded trade expectations, the corn market closed lower for the first time since last week, driven by weakness in the wheat market, a strong US dollar, and ongoing hedge pressure.

- Despite another day of sharply higher bean oil, soybeans closed lower on the day influenced largely by another day of sharply lower soybean meal, which was weighed down by increased rain chances in Argentina and the ongoing dockworkers strike.

- Profit-taking, combined with a lack of fresh bullish news, a strong US dollar, and three consecutive days of gains, weighed on all three classes of the wheat complex, pushing them lower alongside corn and soybeans.

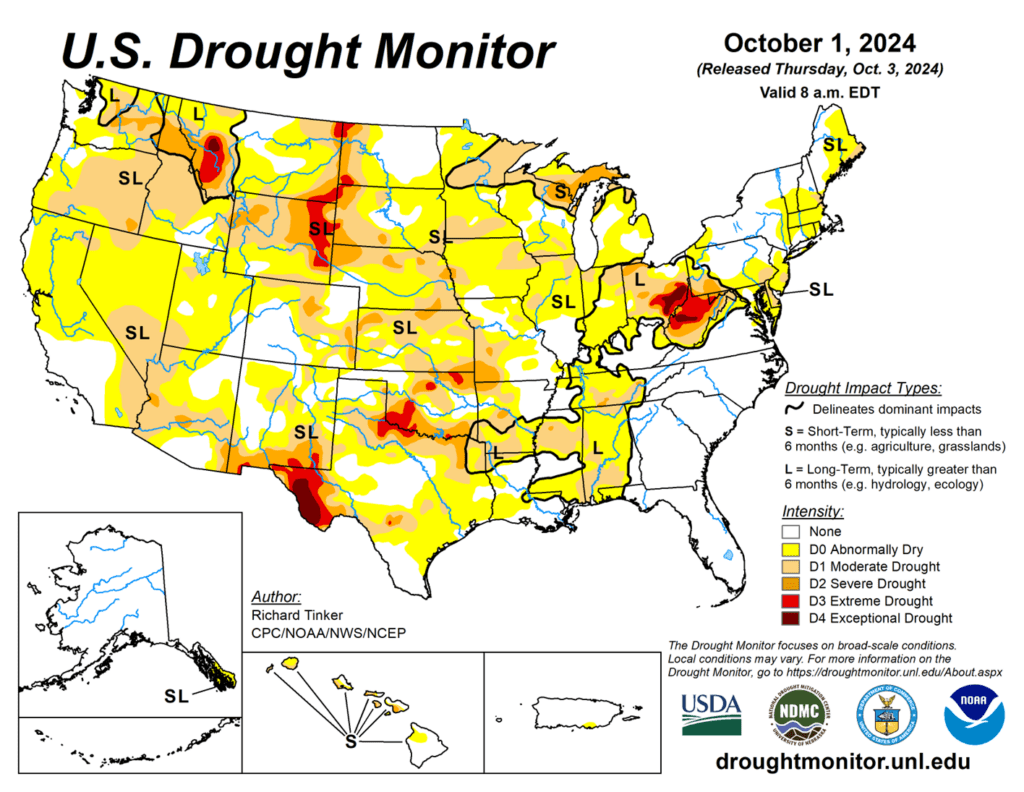

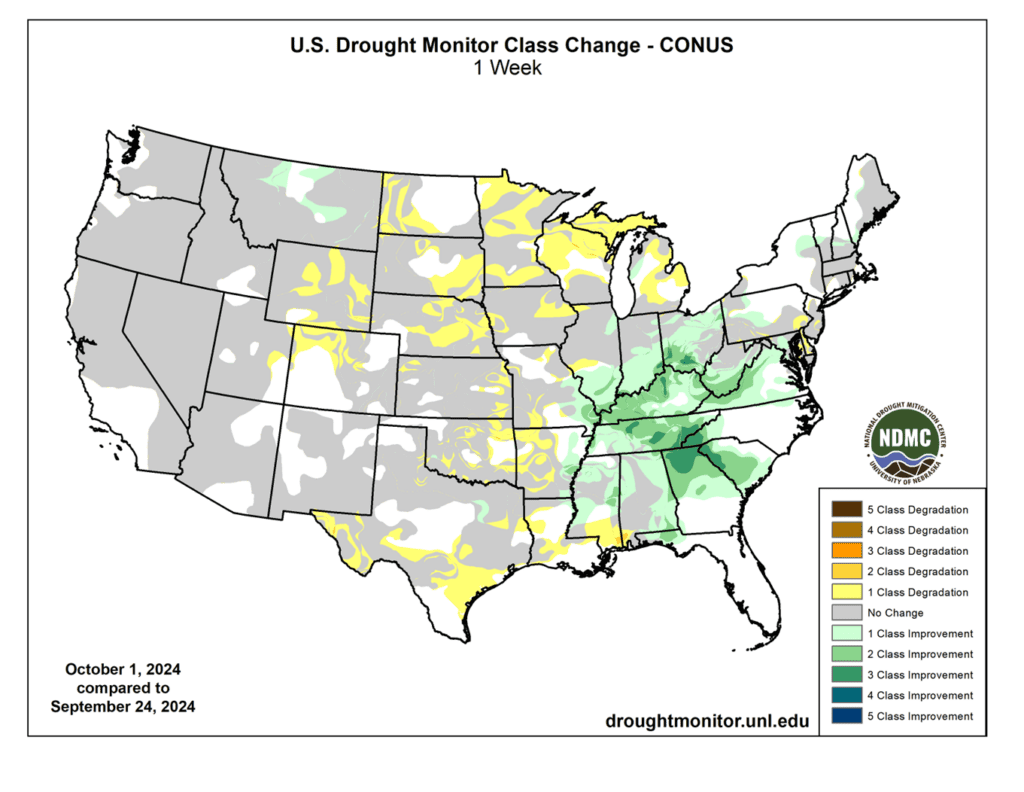

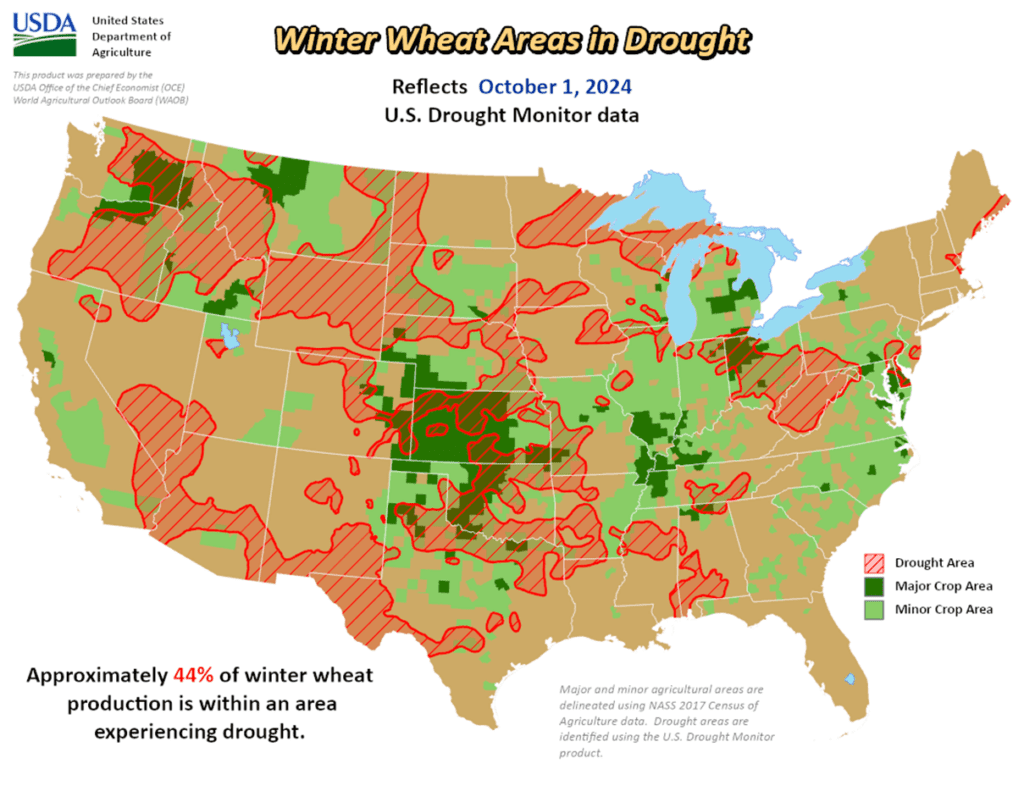

- To see the updated US Drought Monitor, One Week Classification Change, and Winter Wheat in Drought maps, courtesy of the National Drought Mitigation Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since printing a market low in late August, the corn market has rallied largely on fund short covering as the rush of old crop bushels into the market has slowed, US demand has picked up, and South American weather has been dry. While the harvest of an expectedly large crop could limit upside potential, it is a good sign that corn buyers have found value at these multi-year low price levels. Now that managed funds have covered a significant portion of their record short positions, they have flexibility to establish net long or net short positions. Any unexpected downward shift in anticipated US supply or continued South American dryness could trigger managed funds to continue buying and rally prices further. However, if harvest yields are strong and South American weather turns more seasonal, prices could be at risk of retreating from recent highs.

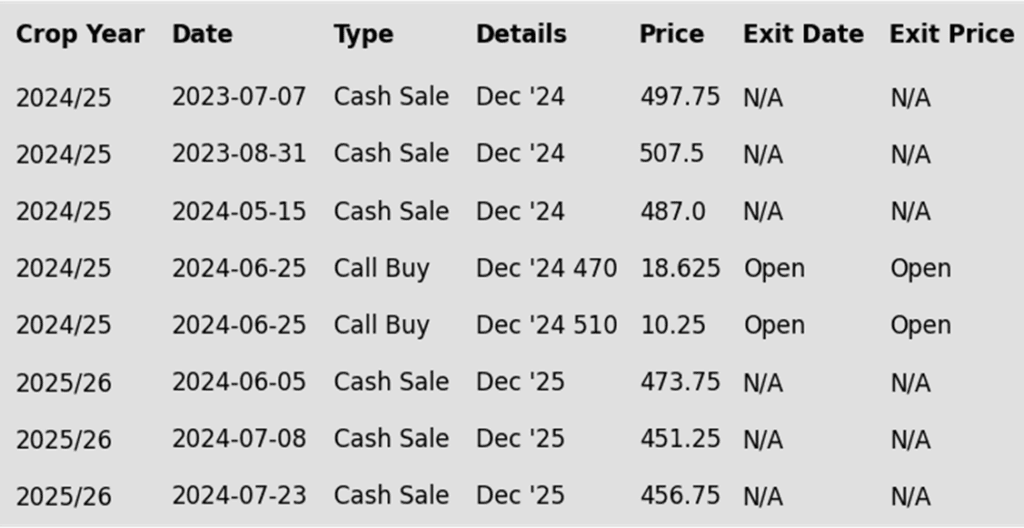

- No new action is recommended for 2024 corn. In June, we recommended purchasing Dec ’24 470 and 510 calls after Dec ’24 closed below 451, due to their relative value and the typically high market volatility during that time of year. Although we no longer have an upside objective for additional sales for now, we continue to target a value of 29 cents to exit the Dec ’24 470 calls. Exiting at this level will allow you to lock in gains that offset much of the original position’s cost, while holding the remaining 510 calls at or near a net-neutral cost. This strategy should continue to protect existing sales and provide confidence for further sales during an extended rally. Since harvest time is not an advantageous sales window, we will begin evaluating market conditions once it concludes and target areas for additional sales recommendations in late fall or early winter.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

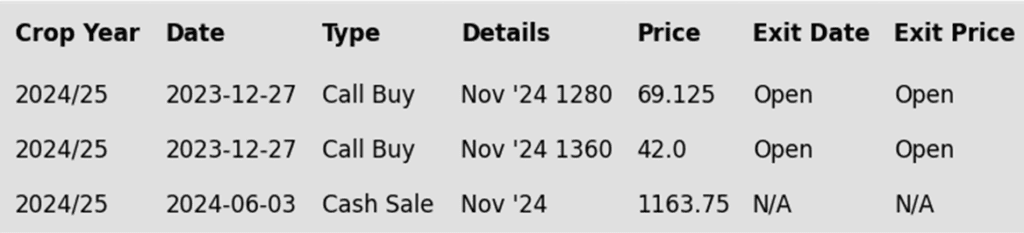

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market finished lower for the first time in four sessions as prices dropped back to test support. Selling in the wheat market, hedge pressure, and the stronger US Dollar likely limited the corn market on Thursday.

- The US Dollar Index has traded higher for the past four sessions and is at its highest level since early August. A stronger dollar plus the rally in corn prices could price US bushels out of the export market versus cheaper global competition.

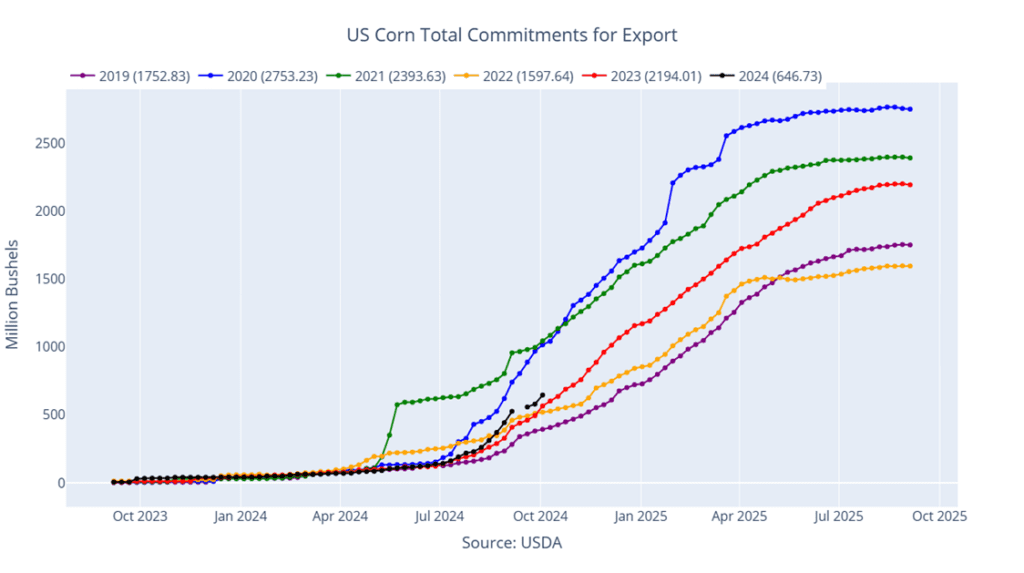

- Weekly export sales for corn rebounded after last week’s disappointing totals. US exporters reported new sales of 66.3 million bushels (1.684 mmt), which was well above market expectations. This was the strongest weekly volume since last November for corn sales.

- The weather forecast for the central US remains drier and warmer than normal, which should allow corn harvest to move along at a rapid pace. The selling pressure from freshly harvested bushels could limit rallies in the corn market in the short term.

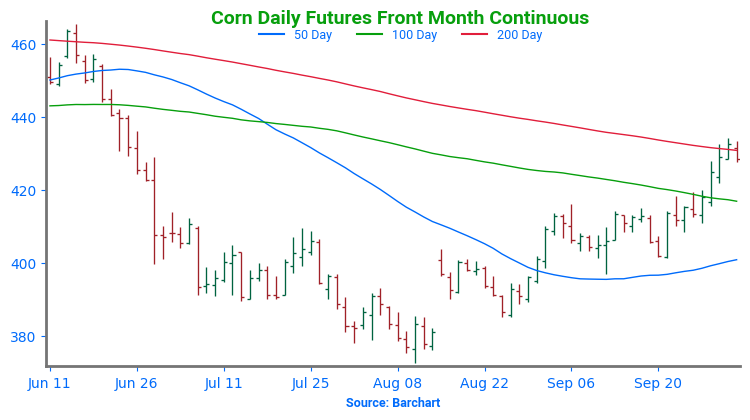

Above: With December corn showing upward momentum, the close above the 200-day moving average could set the market on course to test the June high around 465. Below the market initial support remains between 416 and 420 with further support near 401 – 397.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

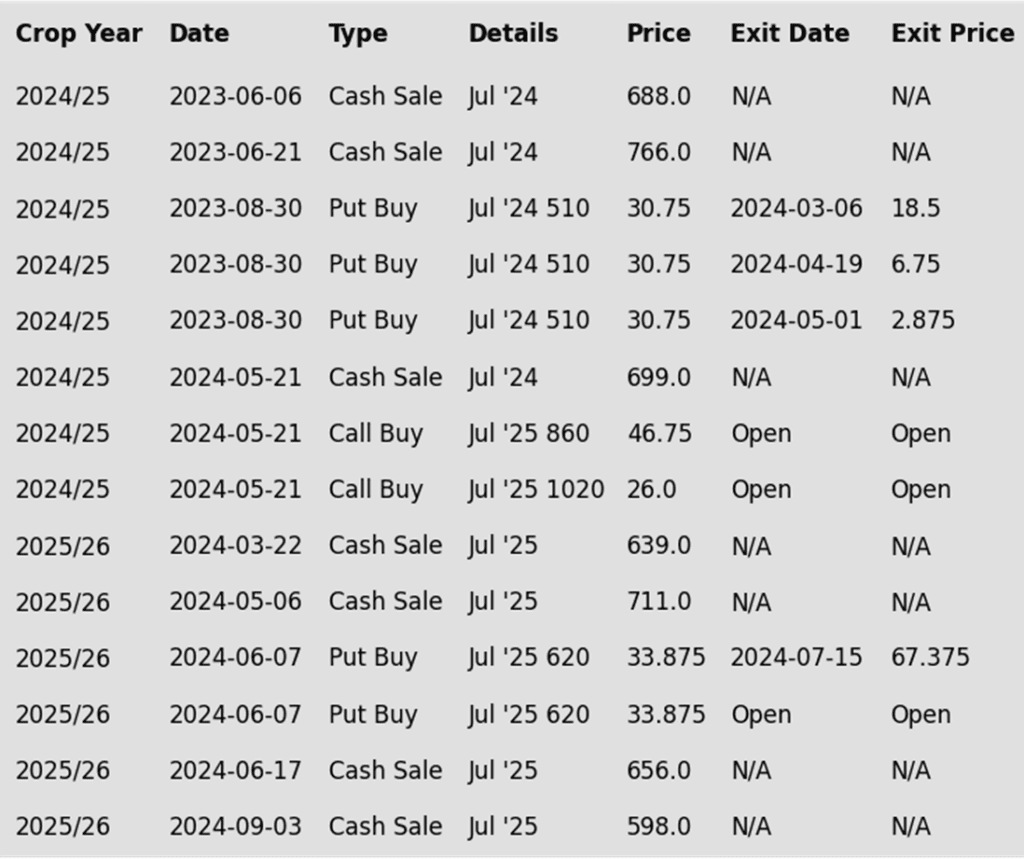

Soybeans Action Plan Summary

After posting what appears to be a seasonal low in mid-August, the soybean market has gradually moved higher as growing conditions in the US became drier during the later stages of crop development and have remained dry in key soybean-growing areas of South America. During this time, managed funds have covered large portions of their sizable, short positions, setting the stage for potential volatility in either direction. Higher prices might occur if conditions deteriorate further, prompting more fund buying, or a downside break in prices could happen if conditions improve, leading funds to potentially reestablish short positions. Seasonally, once harvest is complete, prices tend to firm as hedge pressure subsides and a South American weather premium tends to build.

- No new action is recommended for the 2024 crop. In early June, when our Plan B strategy was triggered by the market’s close below 1180, we recommended making sales at that time due to the potential change in trend signaled by that weak close. While we don’t currently have a target range for additional sales, because harvest time typically does not present the most advantageous prices, we will begin evaluating market conditions once it concludes and will target areas for additional sales recommendations in late fall or early winter.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

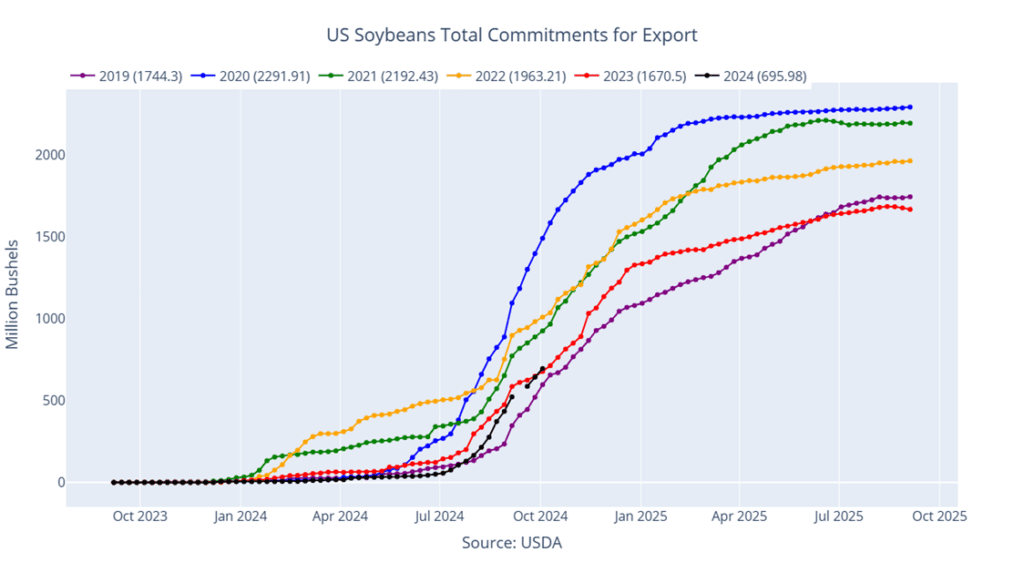

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, posting lower highs and lower lows for the past three trading days, as improved Brazilian weather forecasts have pressured the markets. While funds had been exiting their short positions over the past few weeks, they are likely now adding back to them. Soybean meal closed lower, while soybean oil finished higher.

- Today’s losses in soybean meal may be tied to the dockworker strike that has ports on the East Coast shut down for the past three days. The shutdown will likely impact exports of soybeans and soybean meal to China as they are shipped by container. Soybean oil was higher as it followed the sharp increase in crude oil.

- Today’s export sales report showed an increase of 53.0 million bushels in soybean export sales for 24/25 and an increase of just 37,000 bushels for 25/26. This was towards the higher end of trade estimates but slightly below last week’s export sales. Export shipments of 26.6 mb were below the 36.8 mb needed each week to meet the USDA’s estimates. Primary destinations were to China, Bangladesh, and the Netherlands.

- Forecasts for South America predict significant rainfall in both Brazil and Argentina over the next 15 days. While scattered showers have fallen intermittently, the extremely dry central region is expected to receive over an inch of rain, with southern regions likely to get even more.

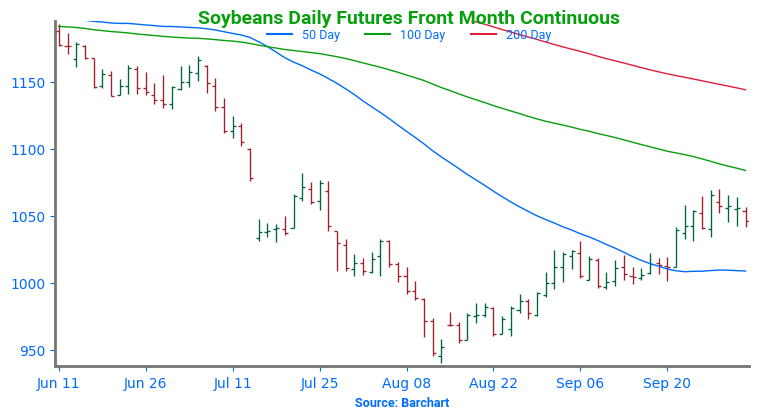

Above: November soybeans’ strong close above 1031 ¼ resistance suggests that prices could run toward the late July high between 1080 – 1085. Above there, further resistance could be met near the 100-day moving average. If prices retreat, initial support may be found near 1030, with further downside support between the 50-day moving average and 995.

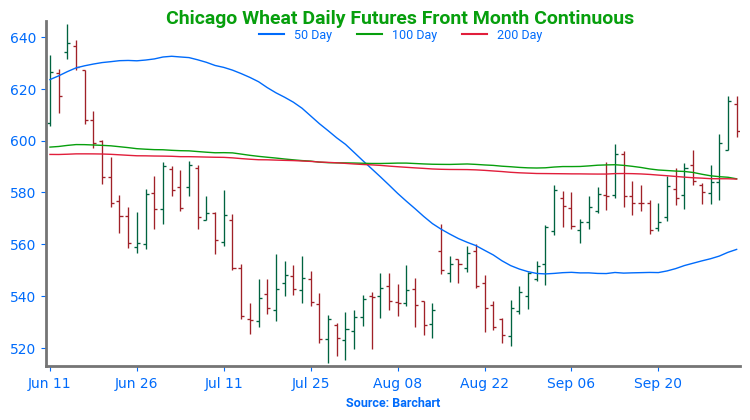

Wheat

Market Notes: Wheat

- Wheat closed lower across the board, alongside the rest of the grain complex. Profit-taking after the recent rally, along with a general lack of fresh news, may have contributed to today’s decline. Additionally, the US Dollar Index continues to rise, rallying back above the 102 level, reaching an area not seen since late August, which could pressure US commodity exports.

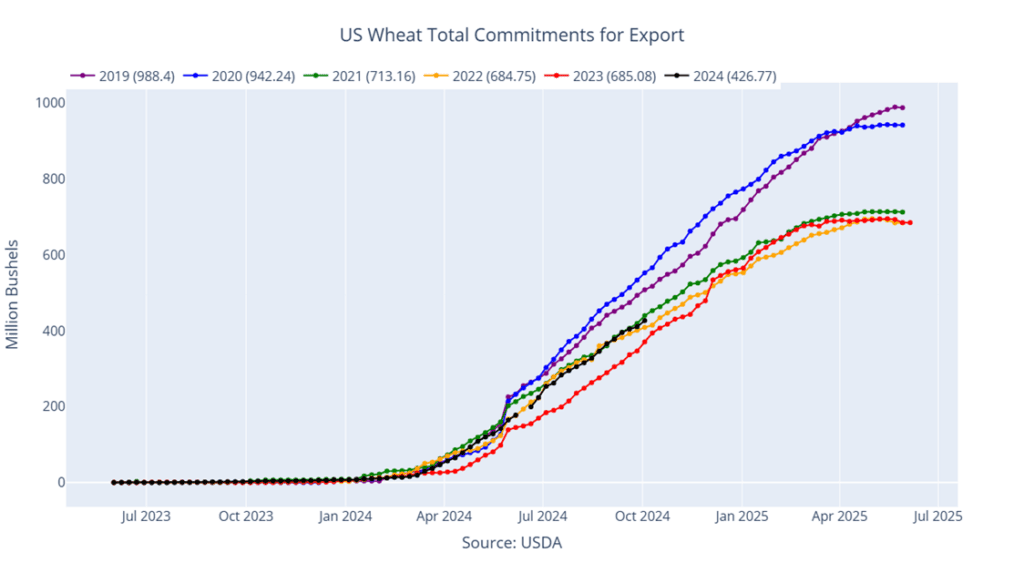

- The USDA reported an increase of 16.3 million bushels in wheat export sales for 24/25. Shipments last week at 19.5 mb exceeded the 15.3 mb pace needed per week to reach the USDA’s export goal of 825 mb. Sales commitments for wheat have reached 427 mb, which is up 23% from last year.

- Yesterday it was reported that Egypt purchased 3.1 mmt of wheat, likely from Russia. Since then, they have also announced that they plan to change their flour mix in order to reduce wheat consumption. Now 25% of their flour may be made from corn or sorghum, while the remaining 75% would be wheat. This is estimated to potentially decrease their annual wheat use by 1 mmt.

- Drought conditions in US winter wheat areas have improved. According to the USDA as of October 1, about 44% of US winter wheat acres are experiencing drought, compared with 50% a week prior. This should aid establishment of the crop currently being planted.

- The European Commission has proposed a one-year delay to a law aimed at reducing global deforestation. The law, if passed, would require commodity trading firms that sell food products in Europe to prove that the commodities did not originate on land cleared of forest after 2020. There was large pushback from many who claimed that this would result in inflation and increased costs in the world food supply chain.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

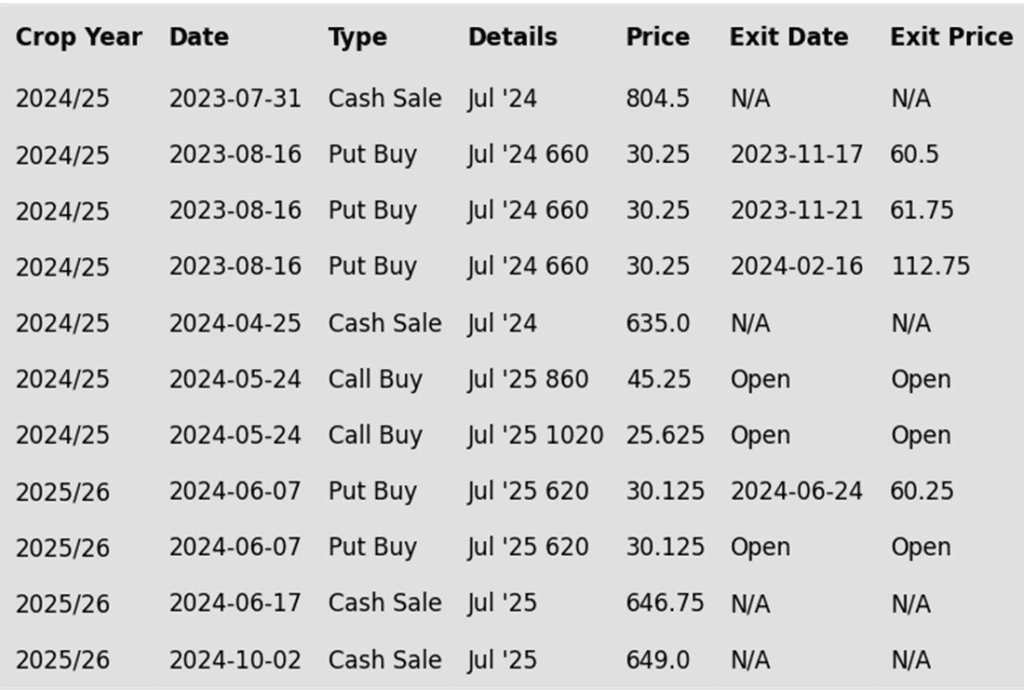

Chicago Wheat Action Plan Summary

After posting a seasonal low in late July, the wheat market staged a rally that began in late August triggered by crop concerns due to wet conditions in the EU, and smaller crops out of Russia and Ukraine. The nearly 80-cent rally from the August low to September high also saw Managed funds cover about two-thirds of their net short positions. While low Russian export prices continue to be a limiting factor for higher US prices, a new season is upon us with many uncertainties ahead that could keep volatility in the market. Additionally, US export sales remain ahead of the pace set last year and in 2022, and any increase in demand from lower World supplies could rally prices further.

- No new action is recommended for 2024 Chicago wheat. Considering the rally in wheat back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. Recently, we recommended taking advantage of the wheat rally to sell more of your anticipated 2025 SRW production. While we continue to recommend holding the remaining July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, we are targeting a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

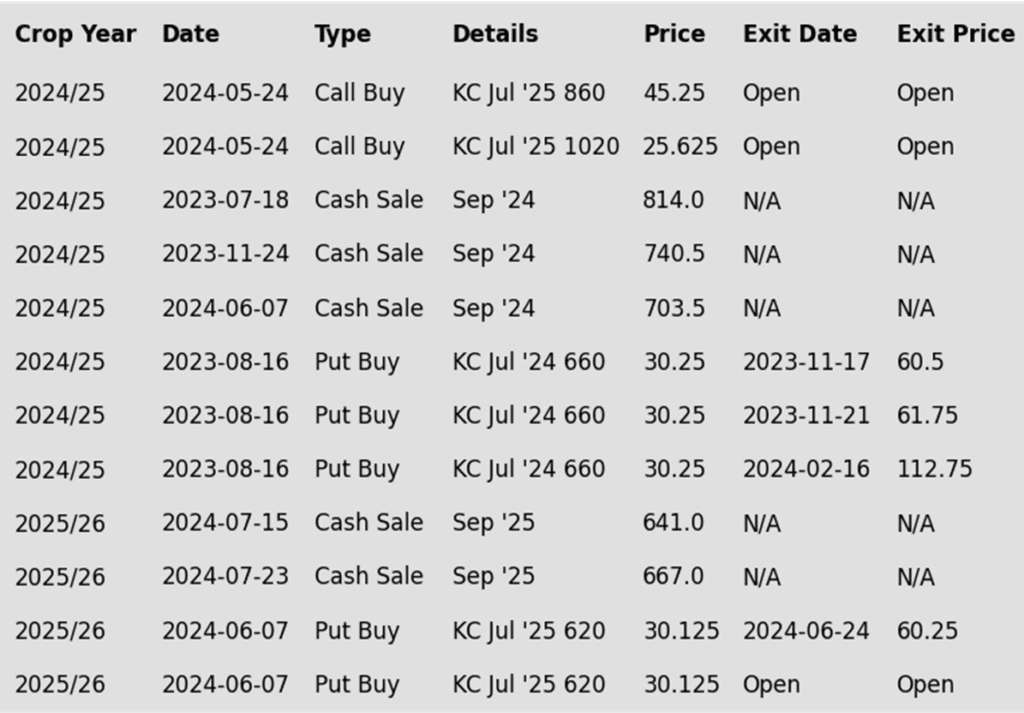

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: With the December wheat close above 600, the market is poised to test the 640 – 645 resistance area. Should prices turn back lower, support could be found near the 100 and 200-day moving averages, around 585. Below that, further support could be found near the 50-day moving average.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

After hitting a market low in late August, the wheat market has rallied driven by crop concerns in the EU and reduced production from Russia and Ukraine. The rise in prices from late August through September also prompted Managed funds to cover a significant portion of their net short positions. Although low Russian export prices continue to cap potential gains for US wheat, the onset of a new season introduces a range of uncertainties that could fuel market volatility. Moreover, US export sales are currently outpacing last year’s figures and those from 2022, meaning that any uptick in demand due to tighter global supplies could further lift prices.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2025 HRW wheat production. July ’25 KC wheat is now about 100 cents off the August low, which represents nearly a 50% retracement back towards last spring’s highs. Considering the extent of this rally and that there may be considerable resistance overhead, we suggest taking advantage of this rally to make an additional sale on a portion of your anticipated 2025 hard red winter wheat crop, using either July ’25 KC wheat futures, or a July ’25 HTA contract, so basis can be set at a more advantageous time later on.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: With the close above 604 ¼, and the 100 and 200-day moving averages, December KC wheat could be on track to run towards 637. Down below the market, if prices turn lower, initial support may be found near the 100 and 200-day moving averages, and again between the 50-day ma, and 561.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

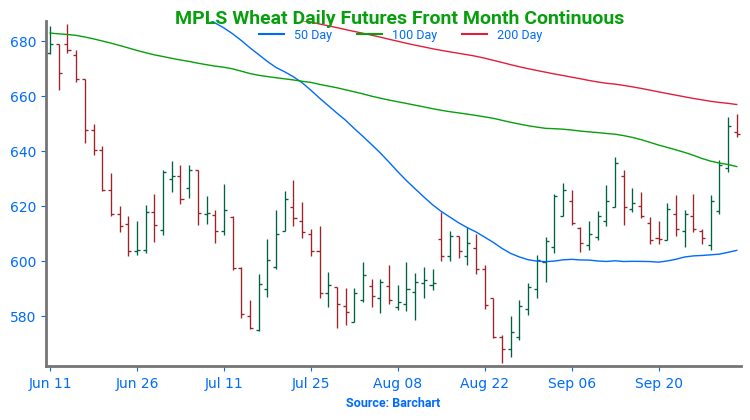

Mpls Wheat Action Plan Summary

Since posting a seasonal low in late August, Minneapolis wheat has traded at the upper end of the range that was established in early July. During this period, managed funds have covered about 40% of their short positions in Minneapolis wheat. While low export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. While we are at the time of year when market lows often occur, we will consider posting upside targets in late September or early October when market conditions often become more advantageous, and harvest is mostly behind us.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The recent breakout above 637 puts the market on track for a potential run towards 685, with initial resistance near the 200-day moving average. To the downside, a break below the 100-day ma could put the market at risk of trading to the 50-day ma, near 600.

Other Charts / Weather