10-28 End of Day: Sharply Lower Crude Weighs on Grains to Begin the Week

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 410.75 | -4.5 |

| MAR ’25 | 424.75 | -4.75 |

| DEC ’25 | 439.5 | -1.25 |

| Soybeans | ||

| NOV ’24 | 974 | -13.75 |

| JAN ’25 | 986 | -11.5 |

| NOV ’25 | 1021.75 | -11 |

| Chicago Wheat | ||

| DEC ’24 | 558.75 | -10.25 |

| MAR ’25 | 579.5 | -9.75 |

| JUL ’25 | 597.75 | -8 |

| K.C. Wheat | ||

| DEC ’24 | 561.5 | -10.5 |

| MAR ’25 | 575.5 | -10.75 |

| JUL ’25 | 593.5 | -10.5 |

| Mpls Wheat | ||

| DEC ’24 | 595.25 | -10 |

| MAR ’25 | 618 | -9.5 |

| SEP ’25 | 647.75 | -7.5 |

| S&P 500 | ||

| DEC ’24 | 5867 | 21 |

| Crude Oil | ||

| DEC ’24 | 67.4 | -4.38 |

| Gold | ||

| DEC ’24 | 2753.2 | -1.4 |

Grain Market Highlights

- Despite another round of flash sales, the corn market settled lower for a second consecutive day, pressured by sharply lower crude oil, ongoing harvest activity, and improved planting progress in Brazil.

- Sharply lower soybean oil, driven by steep losses in crude oil and an improved planting pace in Brazil, weighed on the soybean market, which settled just above the day’s lows. While closing lower along with soybeans and bean oil, soybean meal experienced relatively minor losses, settling mid-range.

- Losses in crude oil and falling Russian export prices weighed on the wheat complex, which settled just above its lows in all three classes following a second day of selling.

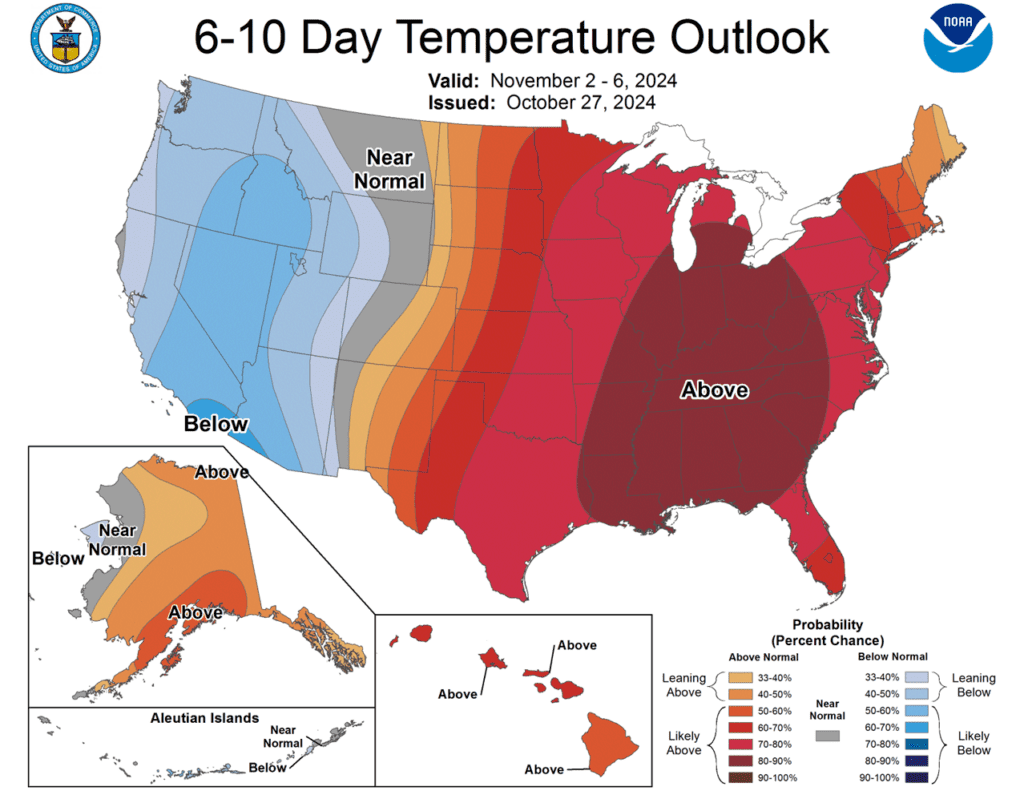

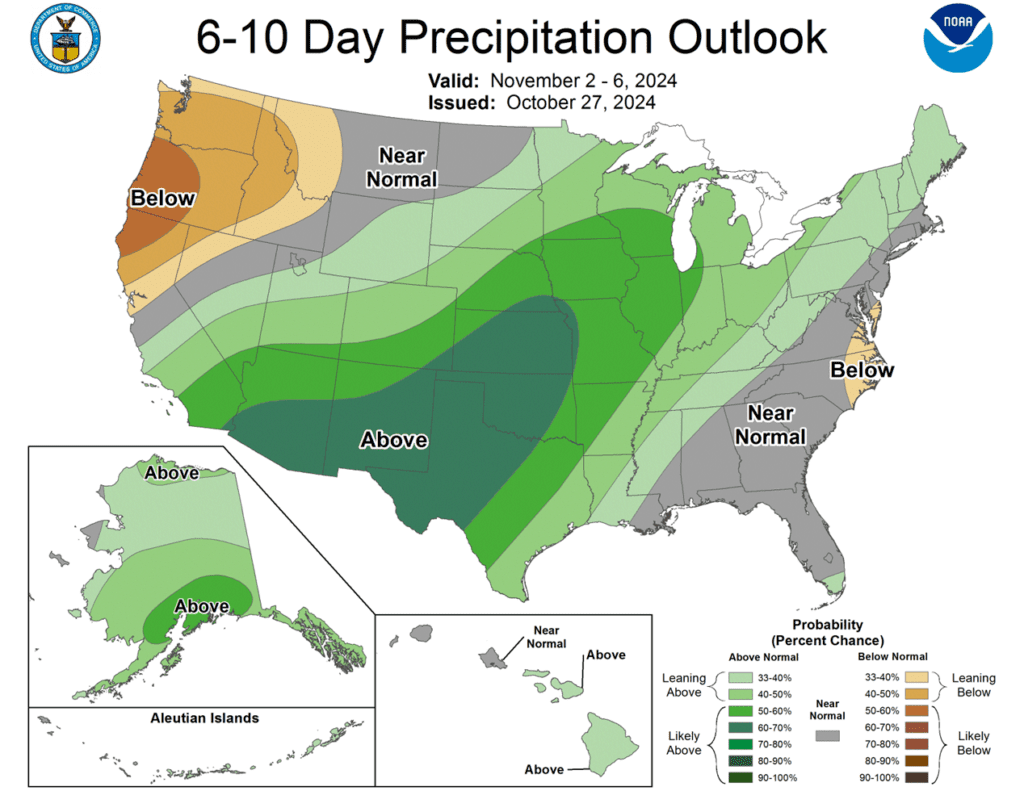

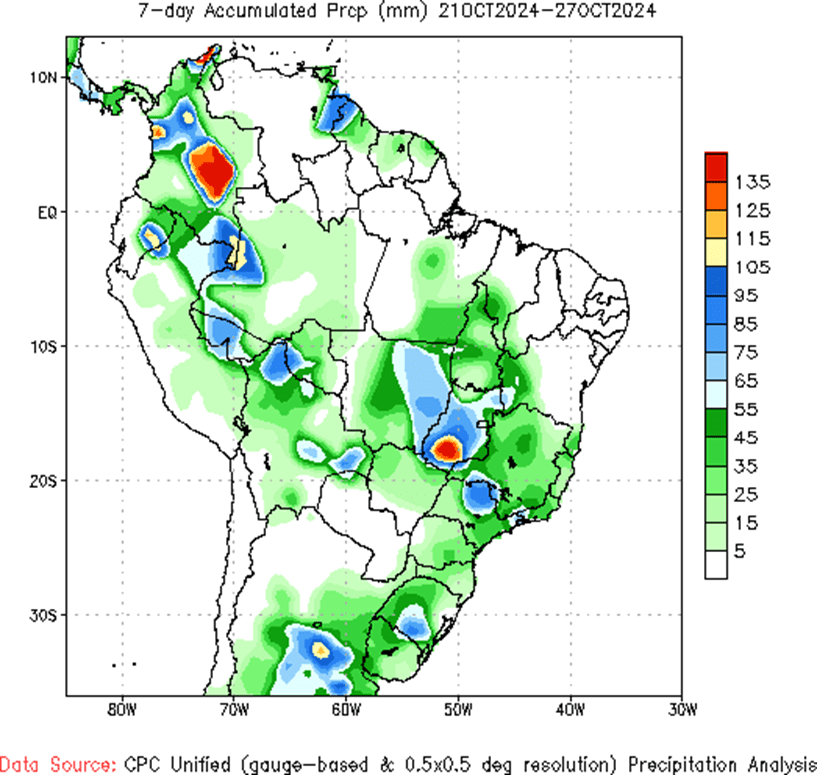

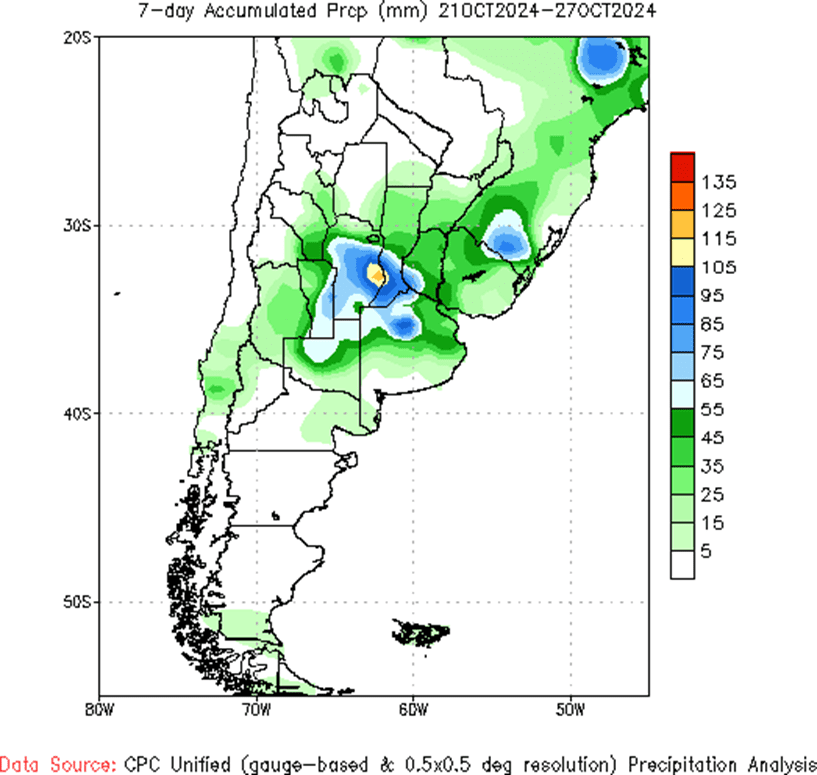

- To see the updated US 5-day precipitation forecast, 6-10 day Temperature and Precipitation Outlooks, and the South American 7-day accumulated precipitation, courtesy of the National Weather Service, Climate Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

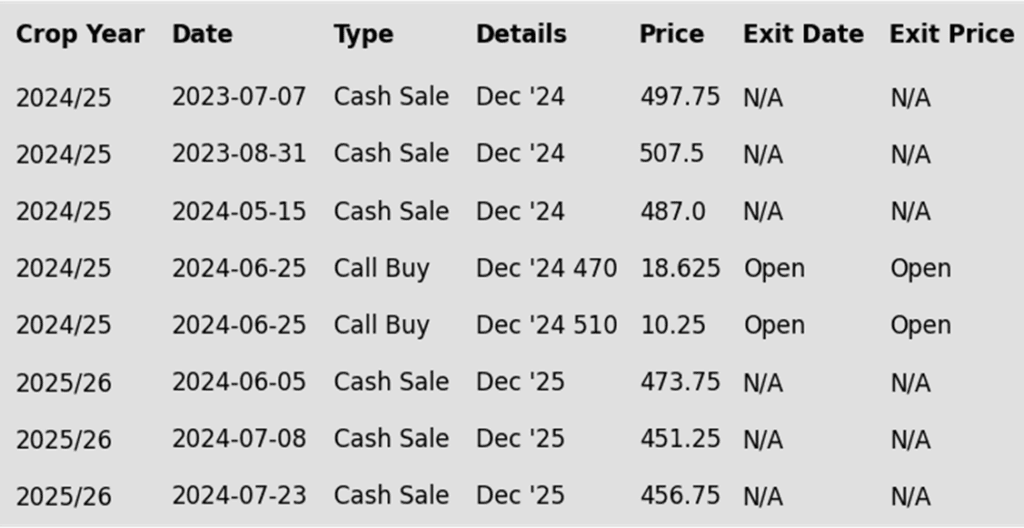

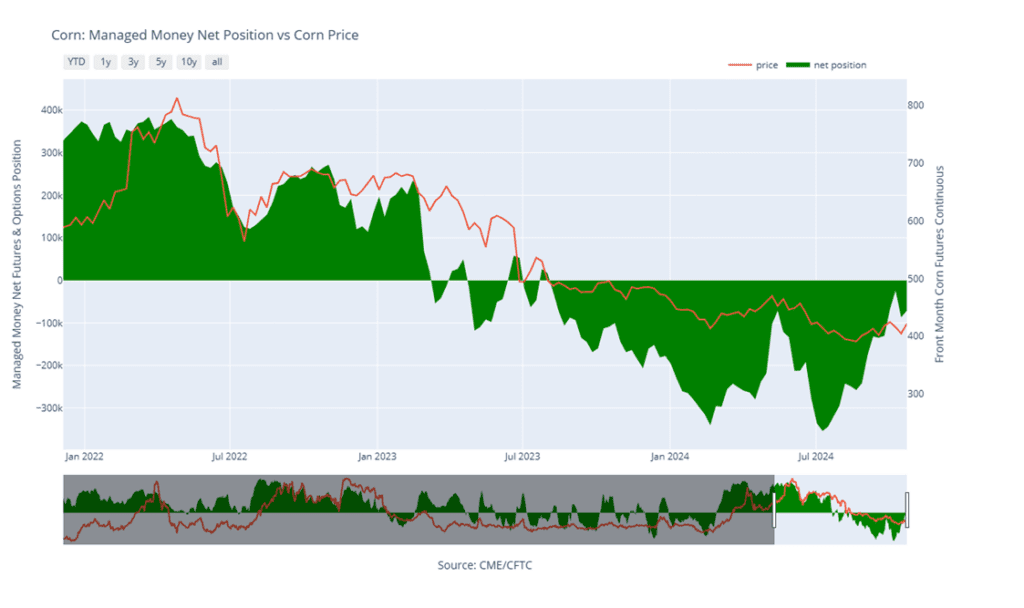

Since hitting a peak in early October, corn prices have fallen off as harvest continues at a rapid pace with record yields according to the USDA, and South American weather has turned more seasonal. Now that managed funds have covered most of their record short positions, they have flexibility to establish net long or net short positions. Any unexpected downward shift in anticipated US supply or deterioration in South American growing conditions could trigger managed funds to continue buying and rally prices further. However, if harvest yields remain strong and South American weather turns more favorable, prices could be at risk of retreating.

- Catch-up sales opportunity for the 2024 crop. If you missed any of our past sales recommendations, there may still be good opportunities to make additional sales for this crop. While this time of year doesn’t often provide the best pricing, a rally back toward the 429 – 460 area versus Dec ’24 could provide a solid opportunity to make any catch-up sales. Also, if storage or capital needs are a concern, you could consider selling additional bushels into market strength. We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- Catch-up sales opportunity for the 2025 crop. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. If you happened to miss those opportunities and are looking to make additional early sales for next year, you could consider targeting the 455 – 475 area versus Dec ’25 to take advantage of any post-harvest strength. For now, considering the seasonal weakness of the market around harvest time, we will not be posting any targeted areas for new sales until late fall or early winte. Although we are targeting the 470 – 490 area to buy upside calls to protect current sales in case the market experiences an extended rally beyond that point.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fell for a second day as broad selling pressure weighed on grain prices. Sharp declines in the crude oil market and ongoing harvest pressure limited any potential gains in corn to start the week.

- Weekly export inspections for corn shipments last week came in at 824,000 million metric tons. This was down from 1.001 mmt last week, but within trade expectations. Corn export demand has been good in recent weeks, but corn shipments may be pressured by exporters looking to ship soybeans in this time window, which is the typical pattern.

- For the ninth consecutive day, the USDA announced two flash exports sales of corn. Japan purchased 124,000 mt (4.9 mb) and Unknown Destinations purchased 120,000 mt (4.7 mb) of corn for the current marketing year.

- Brazil’s planting pace has picked up as weather conditions have turned more favorable. First crop Brazilian corn was 52% planted versus 53% last year, as reported by AgRural. That first corn crop corn is targeted more for domestic usage, but soybean planting jumped 18% week-over-week, which could mean the exported safrinha (second) corn crop may be back on schedule after soybean harvest this spring.

- The corn harvest was 65% complete last week, and the market is expecting a jump again on this week’s Crop Progress report. Fresh corn supplies are in the pipeline, and that has limited rally potential in corn futures.

Above: Since early September, the corn market has found support near the 400 area while posting a low of 397 on September 12, and a high of 434 ¼ on October 2. A close above this range could put the market on course for a larger move, potentially to the June high near 465, while a close below 397 could put it on track to test support near 385.

Above: Corn Managed Money Funds’ net position as of Tuesday, October 22. Net position in Green versus price in Red. Managers net bought 15,489 contracts between October 16 – 22, bringing their total position to a net short 71,499 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

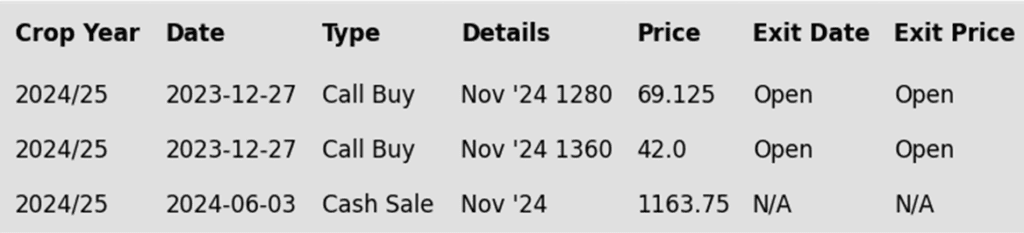

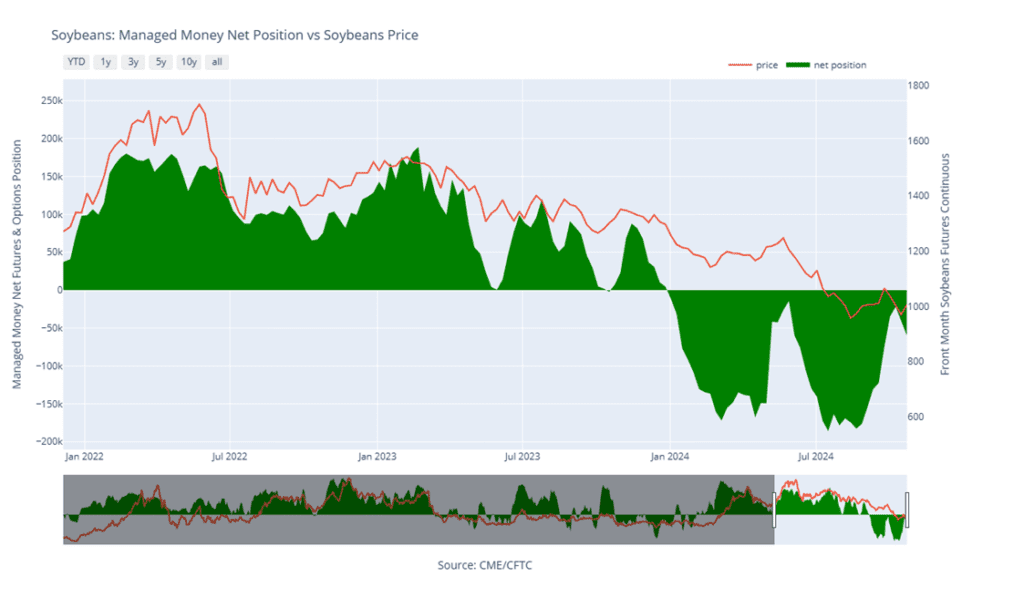

Soybeans Action Plan Summary

After peaking in early October, the soybean market declined as harvest activity and hedge pressure increased rapidly, driven by warm, dry conditions in the US and improving planting conditions in Brazil. With the harvest now in its final stages, we are entering a period when selling opportunities tend to improve as hedge pressure eases, and South American weather becomes a more dominant factor in their growing season. That said, managed funds hold a relatively small net short position, which creates the potential for volatility in either direction. Prices could rise if South American conditions decline or US demand improves, encouraging further fund buying, or decline if South American conditions improve and US demand remains stagnant, prompting funds to potentially rebuild short positions.

- Catch-up sales opportunity for the 2024 crop. If you missed the June sales recommendation triggered by the market’s close below 1180, there may still be an opportunity to make a catch-up sale. While we don’t expect the current harvest period to offer the best pricing, a rally back to the 1050 – 1070 range versus Nov ’24 could provide a good opportunity. For those with storage or capital needs, consider making these catch-up sales into price strength. If the market rallies further, additional sales can be considered in the 1090 – 1125 range versus Nov ’24. No further sales recommendations are anticipated until seasonal pricing opportunities improve, likely late fall to early spring.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, closing near the day’s lows. The biggest bearish factor today was the sharp selloff in crude oil as a result of Israeli retaliation on Iranian military bases instead of oil production facilities over the weekend, which brought December crude oil down over 4 dollars a barrel. Soybean meal only saw minor losses, while soybean oil posted a 146 point loss in the December contract as it followed crude oil.

- More pressure today has likely come from Brazil’s quickened planting pace which has now progressed to over 36%, up 18% from the previous week. While drought had previously delayed progress, planting is now only 4 points behind this time last year. The USDA estimates Brazilian production at 169 mmt, while CONAB’s estimate stands at 166 mmt.

- Today’s Export Inspections report was strong for soybeans as export demand remains firm. 2,394k tons of soybeans were inspected for export which was at the upper range of analyst estimates. This was slightly below last week’s inspections but put year-to-date inspections up 2% from last year.

- Friday’s CFTC report showed funds continue to sell soybeans aggressively. As of October 22, funds sold 19,233 contracts of soybeans which left them net short 59,574 contracts. Since that date, fund activity is estimated to have been quiet with 1,000 contracts being bought in the past three days.

Above: The market reversal on October 24, and subsequent follow through suggests that overhead resistance lies near 1018, and prices may retest support down near 980. A break below this level could find additional support near 955 and again around 940.

Above: Soybean Managed Money Funds’ net position as of Tuesday, October 22. Net position in Green versus price in Red. Money Managers net sold 39,233 contracts between October 16 – 22, bringing their total position to a net short 59,574 contracts.

Wheat

Market Notes: Wheat

- Wheat closed lower alongside the rest of the grain complex, pressured by a sharply lower crude oil market. At the time of writing, crude is down well over four dollars per barrel after having gapped lower at the open. This appears to be tied to news that while Israel did indeed retaliate against Iran, they chose to attack military targets as opposed to oil facilities.

- Weekly wheat export inspections of 9.1 mb brought total 24/25 inspections to 349 mb, up 34% from 262 mb at this time last year. Inspections are currently outpacing the USDA’s forecast, with wheat exports projected at 825 mb, 17% higher than last year.

- The US ag attaché in Argentina has their estimate of the country’s 24/25 wheat production at 18 mmt, in line with the current USDA forecast. However, their wheat export estimate is slightly higher than the USDA’s, at 12 mmt compared to 11.5 mmt.

- According to IKAR, Russia’s wheat export price ended last week at $232 per mt, which is down from $234 the week prior. This is also below their ag ministry’s suggested price floor of $240 per mt. Furthermore, SovEcon has reported that Russia shipped 1.02 mmt of grain last week, with wheat accounting for 1.0 mmt of that total.

- In a report from the Rosario Grains Exchange, Argentina’s wheat exports for the 24/25 season could reach 13.3 mmt, potentially the second highest total on record. They also anticipate a harvest of 19.5 mmt, exceeding both USDA and attaché estimates.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

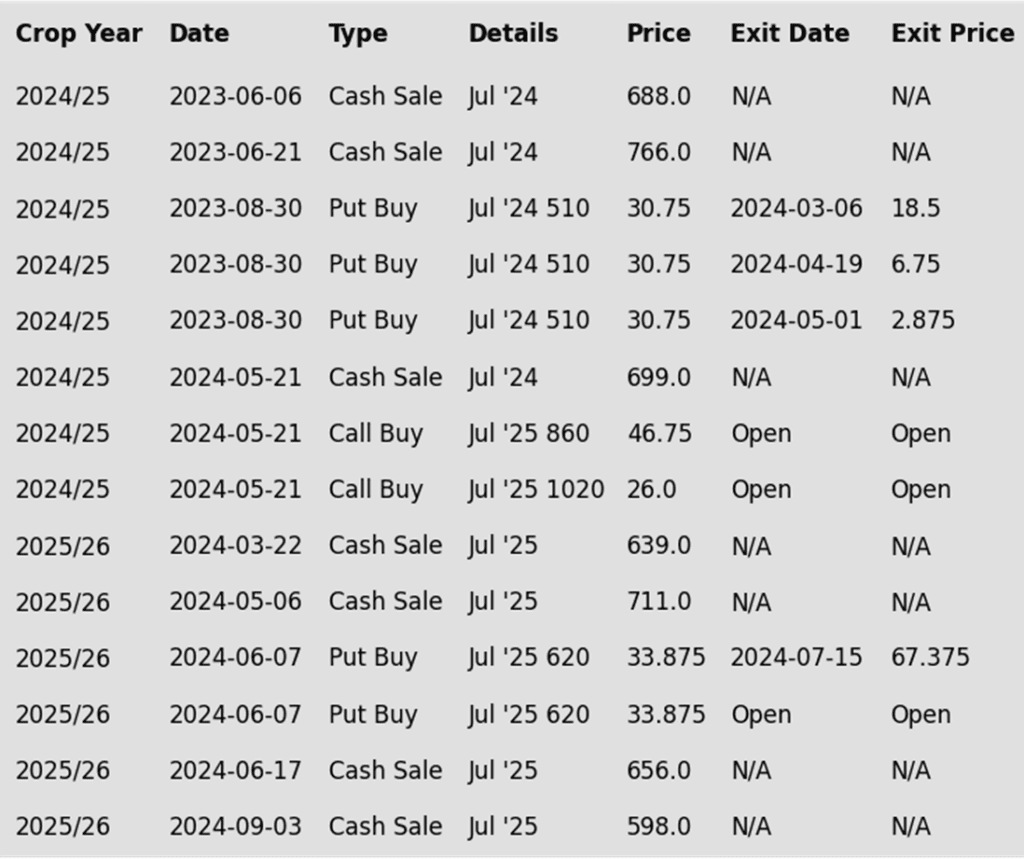

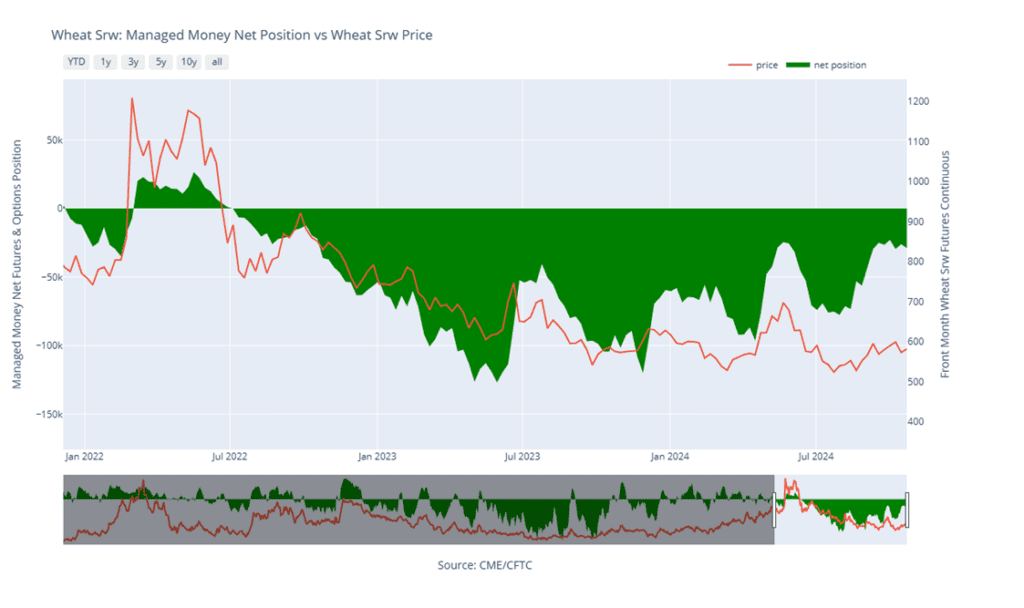

Chicago Wheat Action Plan Summary

Since reaching its recent high in early October, the Chicago wheat market has gradually moved lower as conditions in the Southern Hemisphere improved. While some production concerns in Australia appear to have eased, dryness remains an issue in the US Plains and the Black Sea region. Despite more competitive Russian and Black Sea wheat prices, US export demand remains firm, though these lower prices may still limit US prices. However, any US crop concerns or increased demand could support higher prices. Additionally, the managed funds’ net short position is much smaller than it was in late July, giving them the flexibility to either extend their shorts or go long, which could amplify market movements in either direction in the coming weeks.

- No new action is recommended for 2024 Chicago wheat. Back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Currently, our strategy remains to target 740 – 760 versus Dec ’24 to recommend further sales. While this range may seem far off, based on our research, it represents the potential opportunity that this crop year can present as we move into the planting and winter dormancy windows of the next crop cycle. Considering this potential, we also continue to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. In September, we recommended taking advantage of the rally in wheat to make additional sales on your anticipated 2025 SRW production. While we continue to recommend holding July ’25 620 puts—after advising to exit the first half back in July—to maintain downside coverage for any unsold bushels, our Plan A strategy continues to target a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales. Should the market show signs of a potentially extended rally, our Plan B strategy is to protect current sales and target the 745 – 775 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

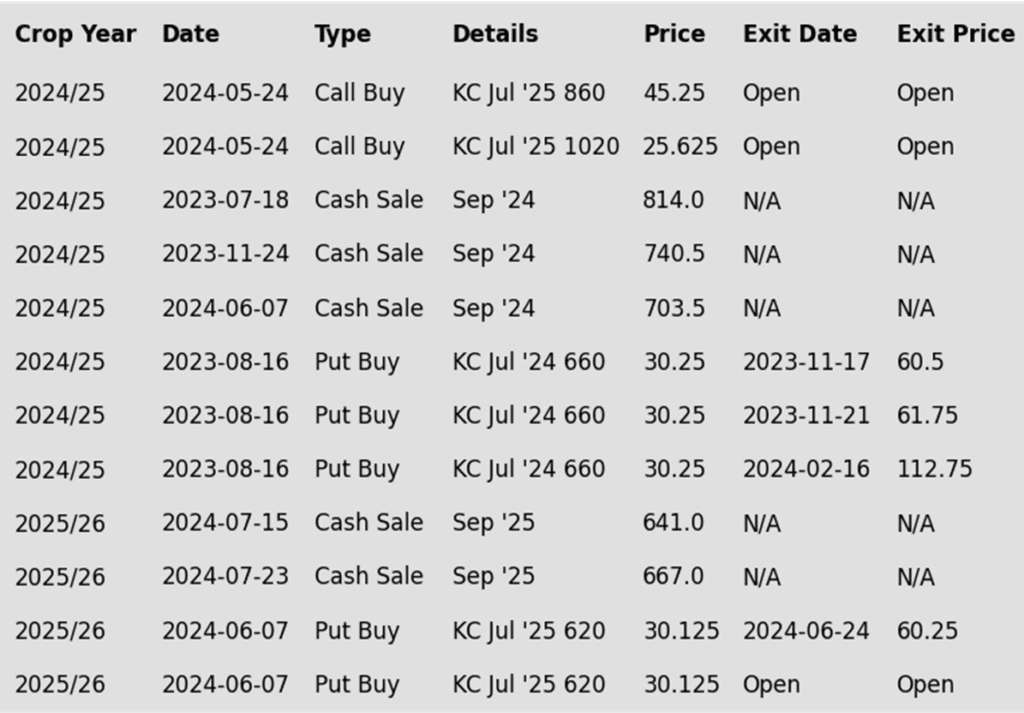

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Since hitting resistance near 617, December Chicago wheat has stair-stepped lower to the point of testing the 575 – 560 support area. A close below there could put the market at risk of sliding toward the major support area between 521 and 514. Though intermediate support may be found around 544. Meanwhile, initial overhead resistance may lie between 595 and 600.

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, October 22. Net position in Green versus price in Red. Money Managers net sold 2,902 contracts between October 16 – 22, bringing their total position to a net short 28,915 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

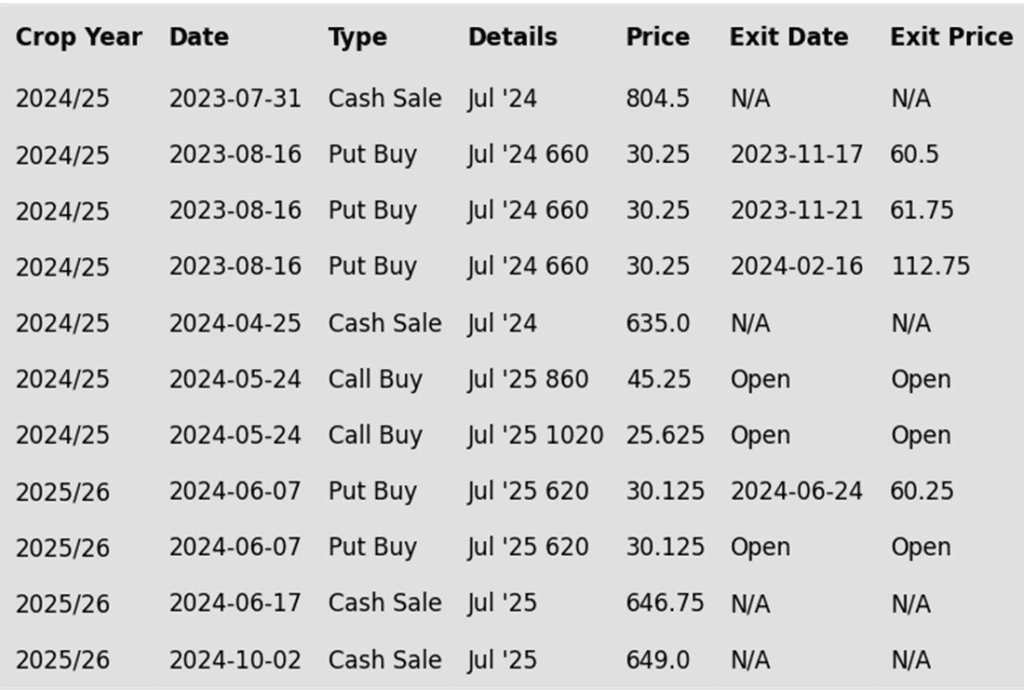

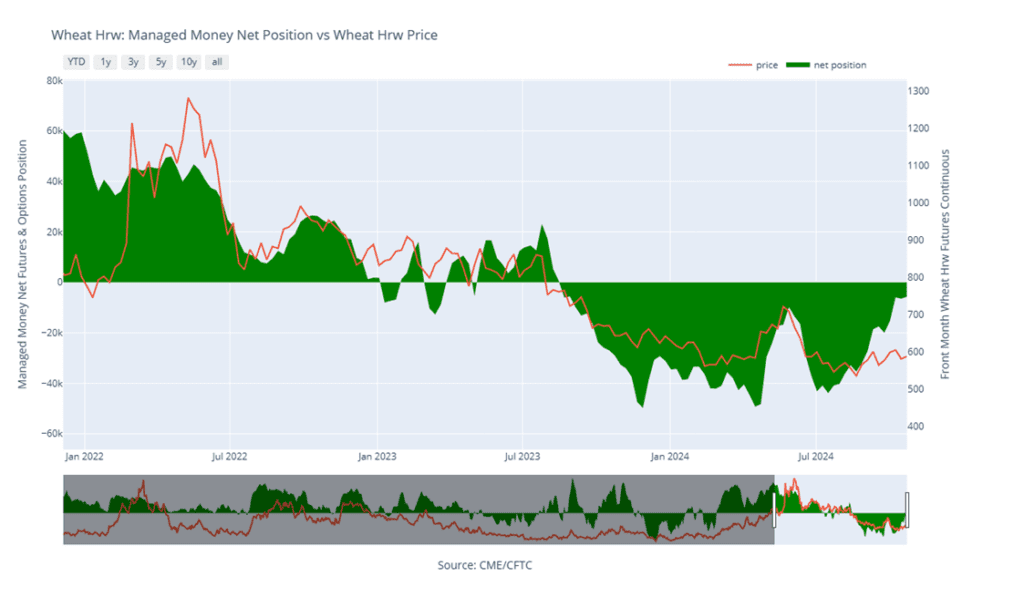

KC Wheat Action Plan Summary

After hitting a market low in late August, the wheat market has rallied driven by crop concerns in the EU and reduced production from Russia and Ukraine. The rise in prices from late August through early October also prompted Managed funds to cover a significant portion of their net short positions. Although more competitive Russian export prices continue to cap potential gains for US wheat, the onset of a new season introduces a range of uncertainties that could fuel market volatility. Moreover, US export sales are currently outpacing last year’s figures and those from 2022, meaning that any uptick in demand due to tighter global supplies could further lift prices.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. While we still recommend holding the remaining half of the previously suggested July ’25 620 puts for downside protection on unsold bushels, we recently advised selling another portion of your anticipated 2025 HRW wheat production in light of the early fall rally in the wheat market. Looking ahead, our current Plan A strategy is to target the 700–725 range for additional sales, while our Plan B strategies involve targeting the upper 400 range to exit half of the remaining 620 puts if the market turns toward new lows and targeting the 745–770 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The breach of the 580 – 575 support area puts the market at risk of trading lower towards the September low of 561 1/4, where it could find support. If prices reverse and trade higher, initial resistance might be found between 593 and 603.

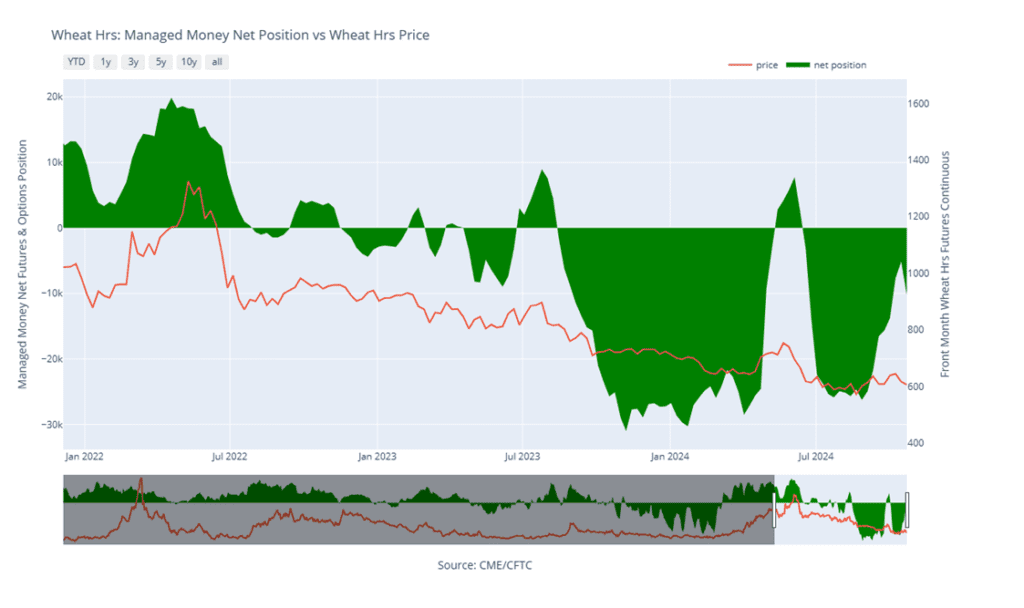

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, October 22. Net position in Green versus price in Red. Money Managers net bought 841 contracts between October 16 – 22, bringing their total position to a net short 5,647 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since posting a seasonal low in late August, Minneapolis wheat has traded up to its 200-day moving average and its highest level since mid-July. During this period, managed funds have covered about 75% of their short positions in Minneapolis wheat. While more competitive export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. Now that the spring wheat harvest is behind us, and we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 675 – 700 range to recommend making additional sales.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not target any specific areas for additional sales until November or December, when seasonal opportunities tend to improve, we continue to hold the remaining July ’25 KC 620 puts that were recommended in June for downside protection. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts. Additionally, should the wheat market show signs of an extended rally, we are targeting the 745–770 area in July ’25 KC to buy July ’25 KC upside calls in case the market rallies significantly beyond that point.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The breach of 604 support puts the market at risk of declining further and testing the August low of 563. Before reaching that point, prices could find support near 598 and again around 582. If prices turn higher, overhead resistance may be found near 615 – 624, with further resistance near 632.

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, October 22. Net position in Green versus price in Red. Money Managers net sold 5,070 contracts between October 16 – 22, bringing their total position to a net short 10,217 contracts.

Other Charts / Weather

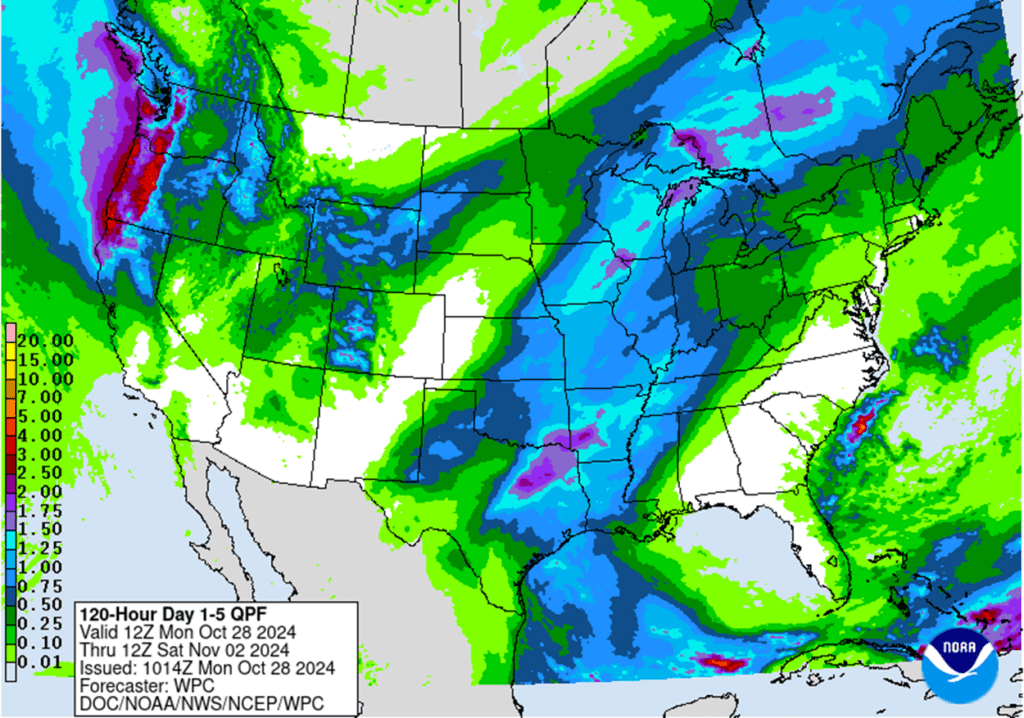

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil 7-day total accumulated precipitation courtesy of the National Weather Service, Climate Prediction Center.

Above: Argentina 7 day total accumulated precipitation courtesy of the National Weather Service, Climate Prediction Center.