10-28 End of Day: Grains Continue Higher as Trade Meeting Approaches

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures continued their upward momentum as trade optimism triggered technical buying and short covering.

- 🌱 Soybeans: Soybean futures led grains higher as the market awaits additional trade deal details from Thursday’s meeting.

- 🌾 Wheat: Wheat futures managed to close slightly higher, finding some spillover strength from soybeans and corn.

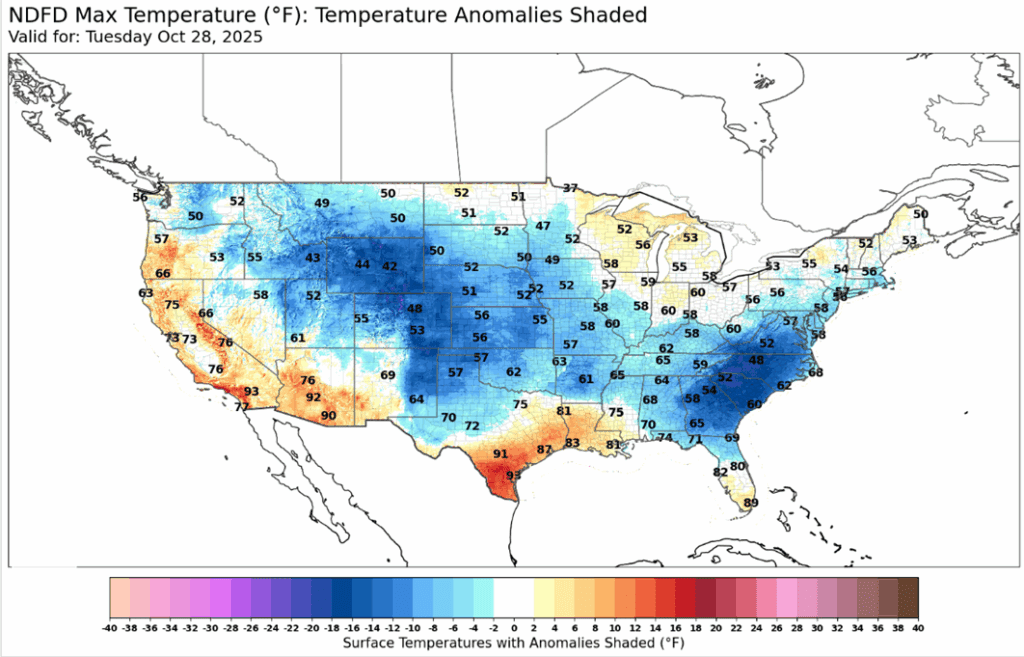

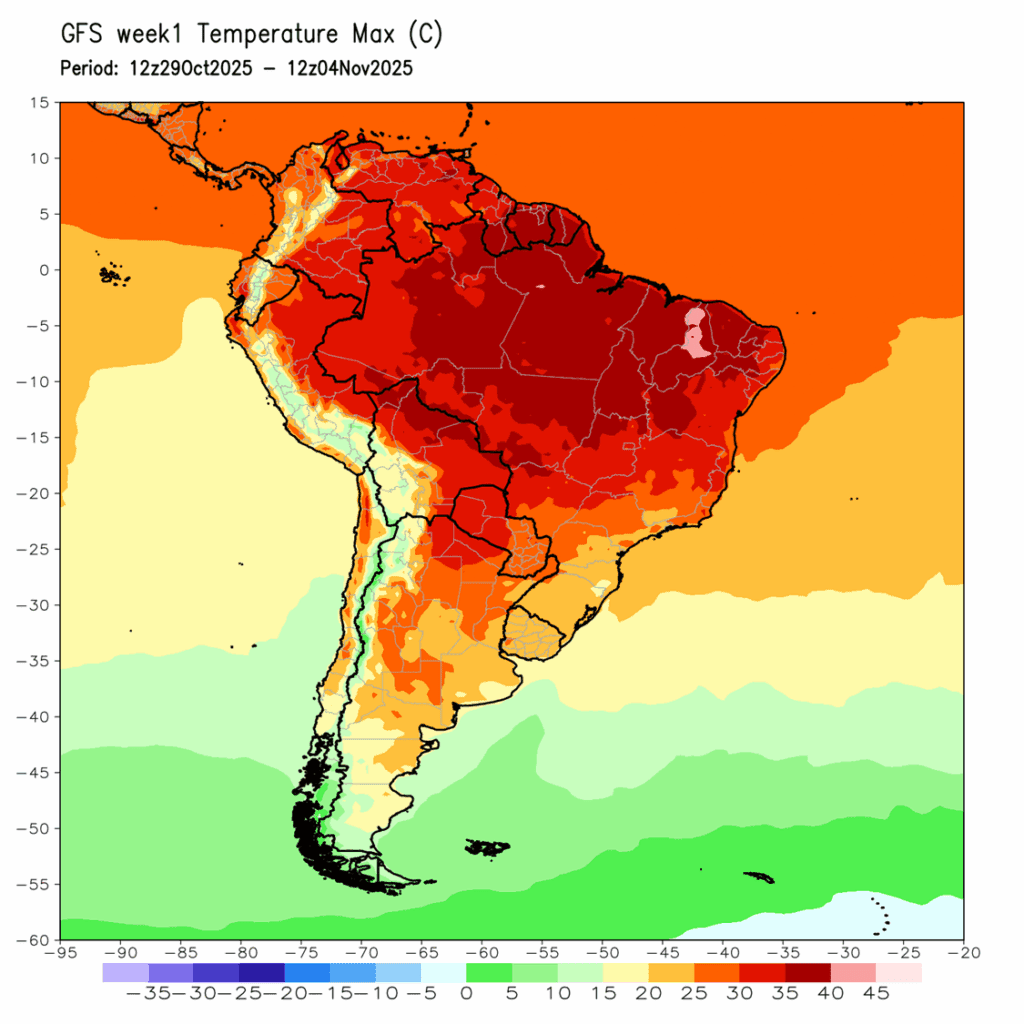

- To see the updated U.S. and South American weather maps, scroll down to the other charts/weather section.

- The release of new crop progress data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if December 2026 futures close above 483 macro resistance.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The Plan B call option target has been raised from 482 to 483.

- Notes:

- Resistance for the macro trend sits at 483 vs December 2026. A close above 483 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- December corn futures traded to their highest level since July 3 on Tuesday as short covering and technical buying triggered strength in the grain markets regarding trade optimism pushing prices higher. December corn traded as high as 436 ¼, before settling 3 ¼ cents higher to 432. March gained 1 ¾ cents to 446.

- December corn futures have rallied 27 cents since the October 14 low at 409. Resistance over the top of the December futures is the 200-day moving average at 437. December corn hasn’t closed over this point since May 23. Producer selling likely limited the upside potential in the December contract late in the session.

- Market analysts projected the corn harvest to be nearly 72% complete this past week as the harvest moves into its later stages. Corn harvest is likely moving past the “harvest pressure” stage with less than 30% remaining. Last year, the corn harvest was 81% complete for this date.

- The U.S. and Japan finalized and signed a trade deal on Tuesday. Over the last five years, Japan has averaged $14.3 billion in U.S. ag imports. An average of 18% of that total was Japanese corn imports from the U.S.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if January 2026 futures close above 1175 macro resistance.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 1175 vs January 2026. A close above 1175 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if November 2026 futures close above 1161 macro resistance.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

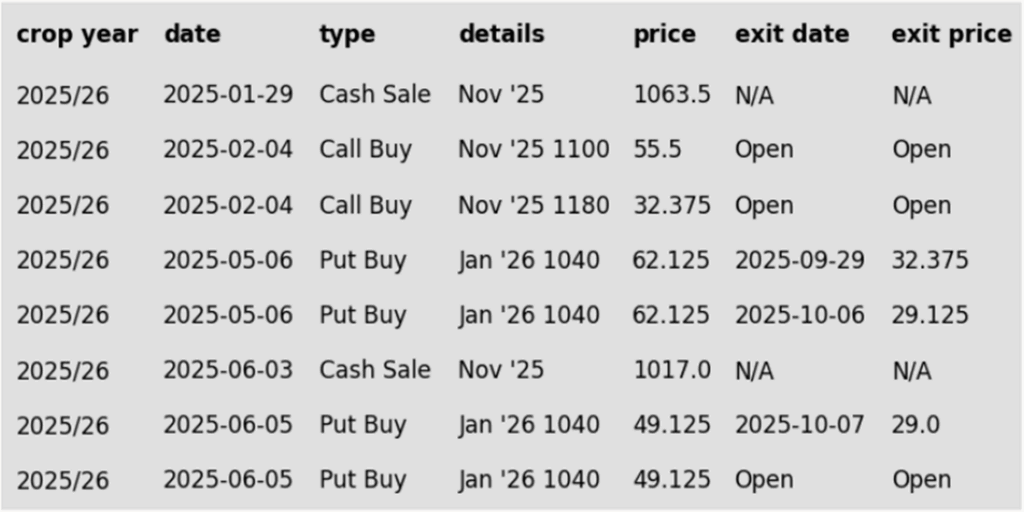

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher for the second consecutive day and have gained 36-1/2 cents on the week and 72 cents over the past 2 weeks. November gained 11 cents today to $10.78-1/4 while March gained 11-1/4 cents to $11.06-3/4. December soybean meal gained $8.30 to $306.50 and December soybean oil lost 0.51 cents to 50.26 cents.

- President Trump and China’s President Xi will meet this Thursday to discuss a trade deal, and Treasury Secretary Bessent indicated that China is expected to resume “substantial” purchases of U.S. soybeans, with the planned 100% tariff for November 1 reportedly withdrawn. Prices will likely react strongly on Thursday morning to whatever the trade deal results are.

- Surveys estimate that 84% of the soybean crop is now harvested with guesses ranging between 80 and 88%. This would compare to 74% at this time a week ago and 89% a year ago.

- Yesterday’s export inspections report saw 1,061k tons of soybeans inspected for export, which compared to 1,590k last week and 2,631k tons a year ago. Top destinations were to Mexico, Egypt, and Italy. Export demand has been decent, given China’s absence.

Wheat

Market Notes: Wheat

- Wheat posted gains today, albeit most contracts settled at least a nickel below session highs. Initial strength faded when soybeans lost upward momentum around 11 AM – corn and wheat followed. December Chicago gained 3 cents to 529, Kansas City was up 6 at 538, and MIAX closed 1-1/2 higher at 561-3/4.

- Southern areas of Argentina saw temperatures dip below freezing this morning. This may have caused some wheat crop damage and should be watched closely. Current FOB wheat offers out of Argentina are reportedly about $27/mt below U.S. HRW wheat at the gulf. This is the equivalent of roughly 73 cents per bushel.

- A Reuters analyst survey suggests that the U.S. winter wheat crop is 85% planted, which would be above last year’s pace of 80%. Additionally, 50% of the crop is believed to be in good to excellent condition, well above the 38% figure from a year ago.

- Speculative traders are estimated to have purchased about 5,500 contracts of Chicago wheat yesterday, bringing their net short position below 90,000 contracts. Open interest also dropped by about 6,000 contracts, which suggests that there was a healthy amount of short covering going on.

- Continued rainfall has disrupted and delayed wheat harvest in southern Brazil, especially in Parana. According to CONAB, about 38% of the nation’s wheat crop has been harvested so far. Domestic wheat prices in Brazil have fallen despite the slow harvest, largely due to high ending stocks and competitive imports.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- Buy call options if July 2026 futures close above 669 macro resistance.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 669 vs July 2026. A close above 669 would signal a potential shift to a macro uptrend, triggering a call option purchase.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 591.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 591.75.

- Notes:

- Resistance for the macro trend sits at 591.75 vs December ‘25. A close above 591.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 591.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 591.75.

- Notes:

- Resistance for the macro trend sits at 591.75 vs December ‘25. A close above 591.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day temperature outlook courtesy of ag-wx.com

Above: South America 7-day temperature outlook courtesy of National Weather Service, Climate Prediction Center.