10-24 End of Day: Grains Post Weekly Gains Ahead of Key U.S. – China Trade Talks

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended lower on Friday, pressured by profit-taking and November option expiration.

- 🌱 Soybeans: Soybean futures ended the week lower as traders took profits ahead of the weekend, with focus shifting to U.S.–China trade negotiations while harvest nears completion.

- 🌾 Wheat: Wheat futures ended mixed on Friday but held up better than corn and soybeans. Strength in the broader stock market may have provided some spillover support, as CPI data showed consumer prices rising slightly less than expected.

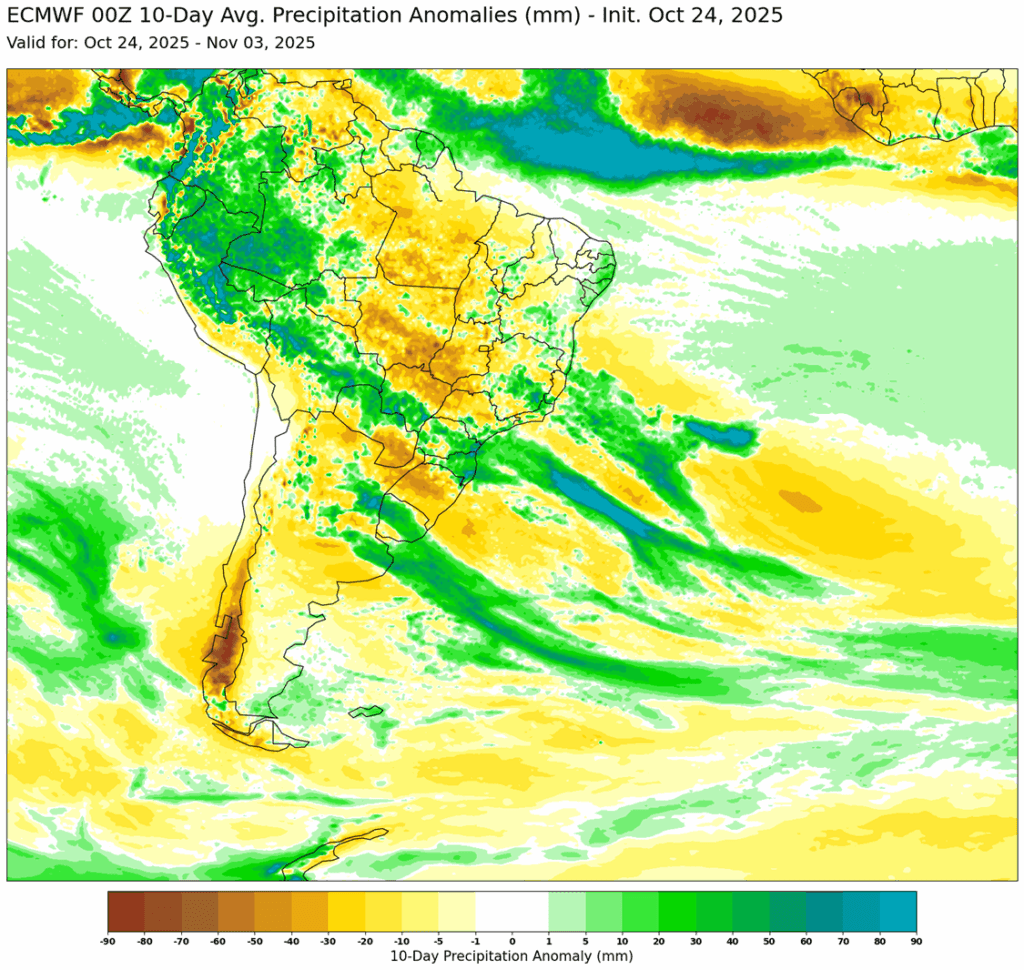

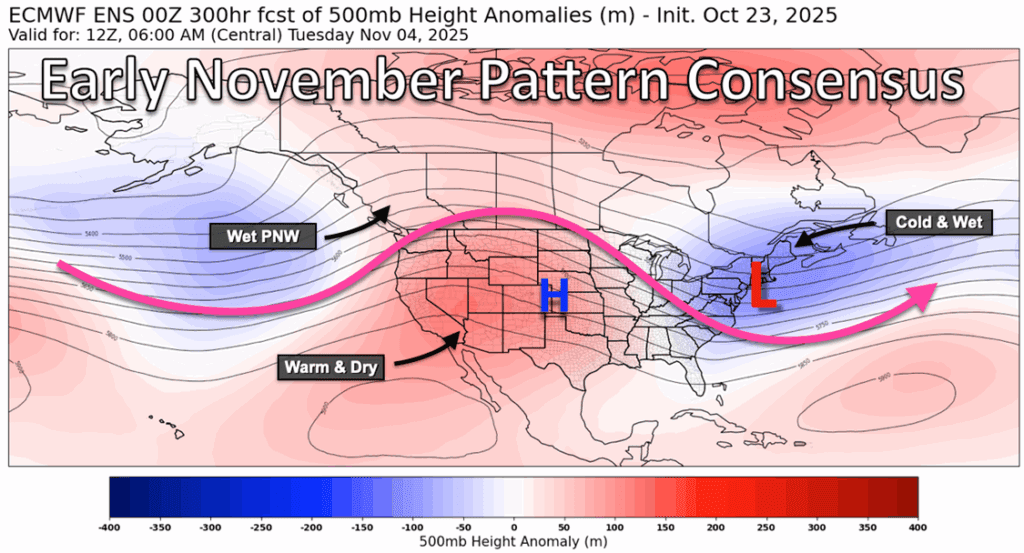

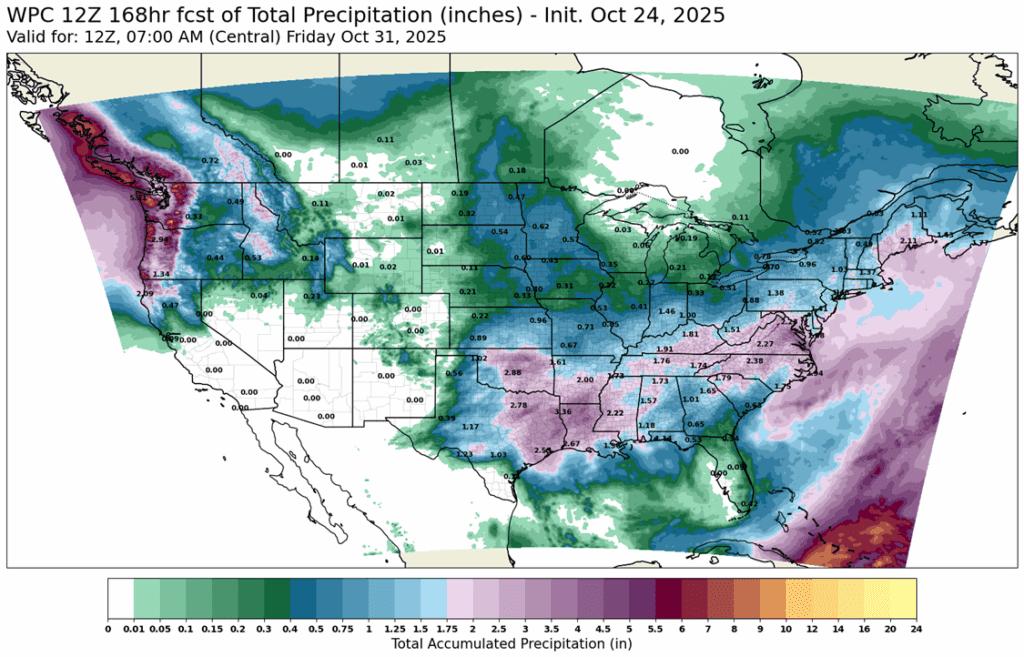

- To see the updated U.S. and South American weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw the end of the week profit taking and pressure from the November option expiration to close the week with light to moderate losses. December corn lost 4 ¾ cents to close at 423 ¼, while March corn fell 4 ¼ cents to 437. For the week, December corn traded ¾ cents higher.

- Planting pace for the 2025-26 Argentina corn crop is off to a good start. Corn planting is projected to be 30% complete vs. 26% last week, 24% last year. The 5-year average is 26% for this time period.

- The December corn spread sold were trading lower on the session. The spread has been helping the corn market work higher, but failing to push through resistance and possible increase in farmer selling likely triggered the pressure in the December contract.

- Weather outlooks remain favorable into November, supporting steady harvest progress as producers move into the final stages of corn and soybean harvest.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

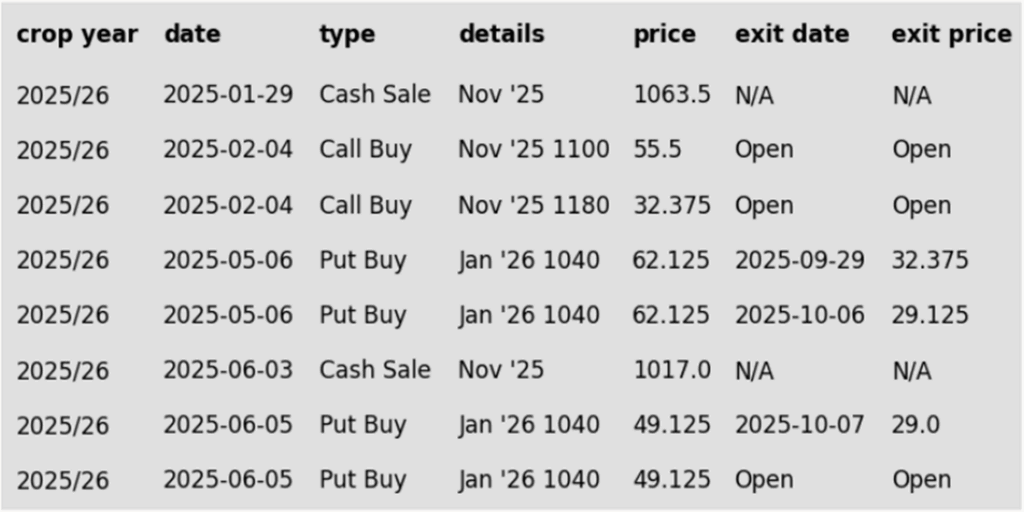

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures saw profit taking to end the week as the market is focused on trade negotiations between the US and China as US harvest is in the final stages. November soybeans lost 3 cents to 1041 ¾, while January soybeans sipped 1 ¾ cents to 1060 ¼. For the week, November soybeans gained 22 ¼ cents.

- The November soybean options expired on Friday, and option expirations tend to bring additional volatility as prices move toward the areas of largest open interest for puts and calls, and that strike was the 1040 level for November soybeans.

- Recent gains in U.S. soybean prices have narrowed the gap with Brazilian export offers, potentially erasing the competitive advantage U.S. beans had in global trade. This comes as traders await progress on trade discussions between the U.S. and China.

- Markets will closely watch the U.S.–China trade talks taking place in Malaysia this weekend, with Presidents Trump and Xi scheduled to meet on Tuesday.

- Brazil ag agency, CONAB, is forecasting another record harvest for Brazil production for the 2025-26 soybean crop. Soybean planting is in the early stages, but CONAB is expecting the planted area to grow 3.5% over last year to an equivalent of 121 million acres.

Wheat

Market Notes: Wheat

- Wheat futures ended mixed on Friday but held up better than corn and soybeans. Strength in the broader stock market may have provided some spillover support, as CPI data showed consumer prices rising slightly less than expected. The Dow was up more than 550 points at midday. December Chicago wheat slipped ½ cent to 512 ½, Kansas City gained 1 ½ cents to 501 ½, and Minneapolis lost 1 cent to 557.

- According to the Buenos Aires Grain Exchange, Argentina’s wheat crop has been 5.3% harvested so far. Early yield results are also said to be terrific. Nevertheless, the BAGE kept their estimate of the country’s crop unchanged at 22 mmt – this would still be 18% above last year. This compares with estimates from the Rosario Grain Exchange at 23 mmt and the USDA at 19.5 mmt.

- Managed funds were estimated to have purchased 4,000 contracts of Chicago wheat yesterday, which would reduce their net short position to an estimated 93,000 contracts. Furthermore, open interest declined by about 2,000 contracts which would suggest short covering played a role in yesterday’s trade.

- The Turkish wheat crop harvest for 2025 is expected to fall 13.9% year over year to 17.9 mmt. This estimate comes from TurkStat and is part of a broader trend of declining crop production for the nation.

- FranceAgriMer has reported that the French soft wheat crop has been 57% planted as of Monday. This is a big jump of 30% over the week before. The current pace is also well above the 20% planted at this time a year ago and the five-year average pace of 43%.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- Buy call options if July 2026 futures close above 669 macro resistance.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 669 vs July 2026. A close above 669 would signal a potential shift to a macro uptrend, triggering a call option purchase.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 610.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 610.50.

- Notes:

- Resistance for the macro trend sits at 610.50 vs December ‘25. A close above 612.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 612.50 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 612.50.

- Notes:

- Resistance for the macro trend sits at 612.50 vs December ‘25. A close above 612.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

From ag-wx.com

From ag-wx.com