10-23 End of Day: Markets Recover from Early Losses to Close Mostly in the Green

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 419 | 2.5 |

| MAR ’25 | 432 | 2.75 |

| DEC ’25 | 441.75 | 0 |

| Soybeans | ||

| NOV ’24 | 997.5 | 5.75 |

| JAN ’25 | 1005 | 4.5 |

| NOV ’25 | 1035.75 | 0 |

| Chicago Wheat | ||

| DEC ’24 | 578.5 | 2.5 |

| MAR ’25 | 598.25 | 2 |

| JUL ’25 | 614 | 1.25 |

| K.C. Wheat | ||

| DEC ’24 | 585.5 | -1 |

| MAR ’25 | 600.25 | -0.5 |

| JUL ’25 | 617.5 | 0 |

| Mpls Wheat | ||

| DEC ’24 | 615.5 | -1 |

| MAR ’25 | 637.5 | -0.5 |

| SEP ’25 | 661.75 | 1.25 |

| S&P 500 | ||

| DEC ’24 | 5826 | -66.5 |

| Crude Oil | ||

| DEC ’24 | 70.8 | -0.94 |

| Gold | ||

| DEC ’24 | 2728.3 | -31.5 |

Grain Market Highlights

- The corn market pressed higher for the third day in a row, driven by strong demand, an improving export basis, and this week’s options expiration, before hitting resistance at the 420 price level in the December contract.

- Flash export sales of soybeans totaling 389,000 metric tons reported this morning helped drive the soybean market to its third consecutively higher close, despite weakness in both soybean meal and oil.

- All three classes of wheat found support near yesterday’s lows before rallying back to close mixed. Chicago contracts showed the most strength, closing higher on the day, while KC contracts posted minor losses, and Minneapolis settled mixed, with nearby contracts losing ground to deferreds.

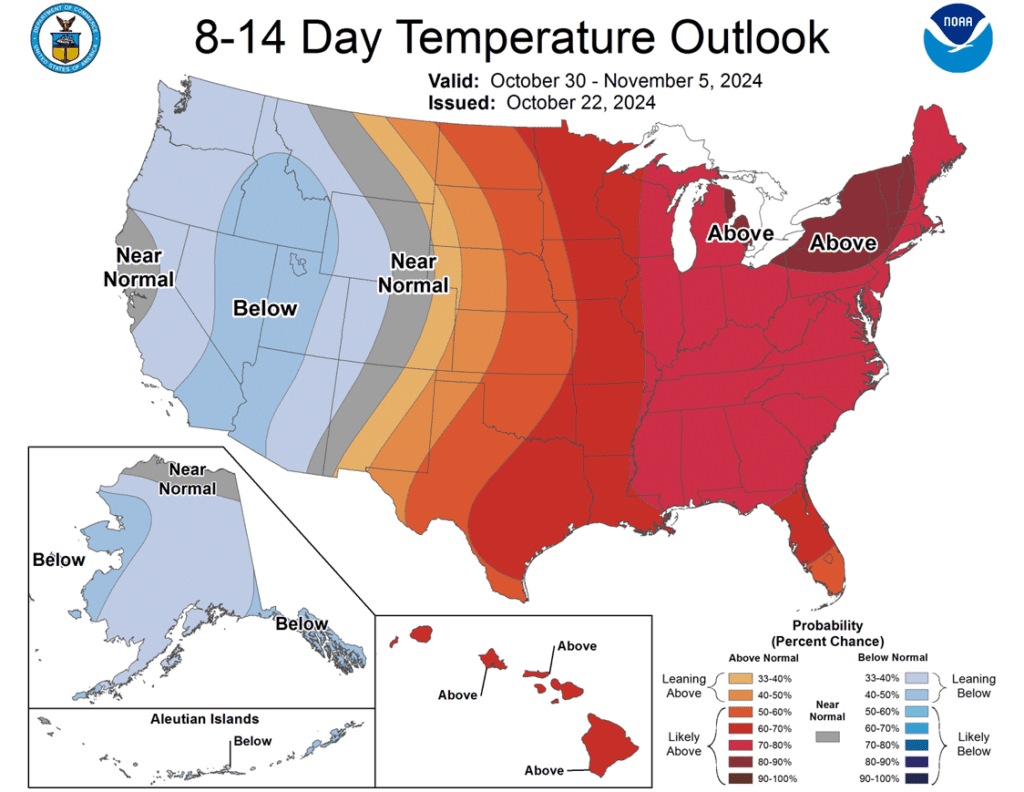

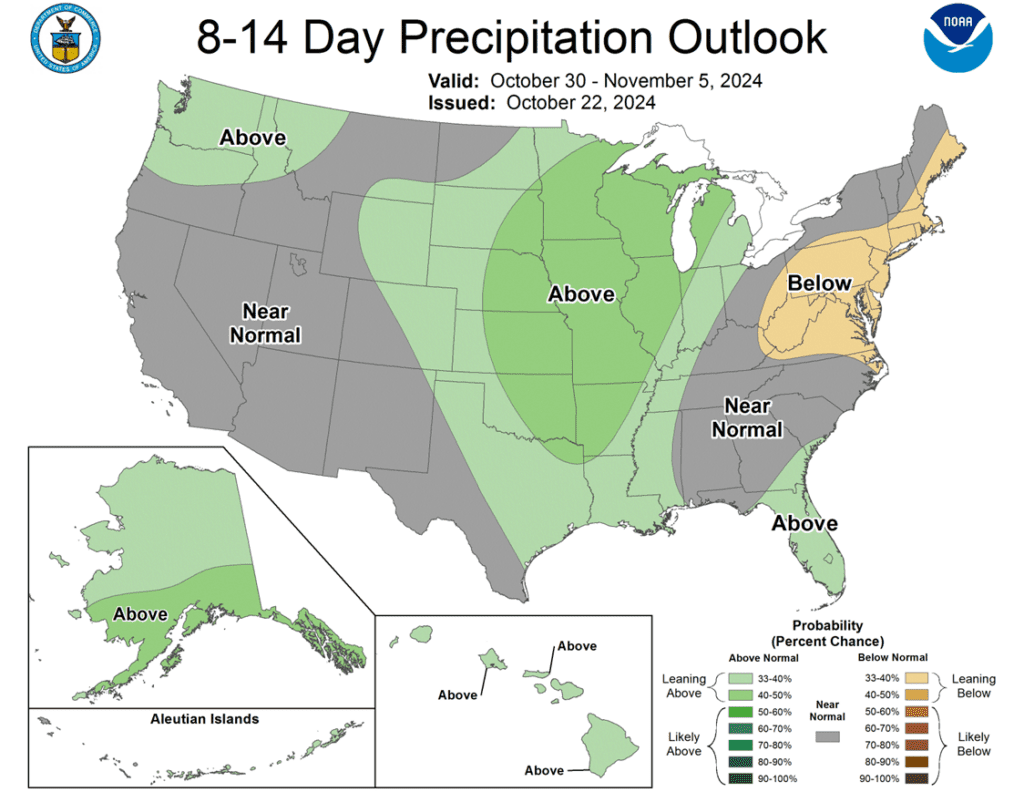

- To see the updated US 7-day precipitation forecast, 8-14 day Temperature and Precipitation Outlooks, and the South American 7-day total precipitation, courtesy of the National Weather Service, Climate Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since hitting a peak in early October, corn prices have fallen off as harvest continues at a rapid pace with record yields according to the USDA, and South American weather has turned more seasonal. Now that managed funds have covered most of their record short positions, they have flexibility to establish net long or net short positions. Any unexpected downward shift in anticipated US supply or deterioration in South American growing conditions could trigger managed funds to continue buying and rally prices further. However, if harvest yields remain strong and South American weather turns more favorable, prices could be at risk of retreating.

- Catch-up sales opportunity for the 2024 crop. If you missed any of our past sales recommendations, there may still be good opportunities to make additional sales for this crop. While this time of year doesn’t often provide the best pricing, a rally back toward the 429 – 460 area versus Dec ’24 could provide a solid opportunity to make any catch-up sales. Also, if storage or capital needs are a concern, you could consider selling additional bushels into market strength. We don’t anticipate making any sales recommendations until late fall at the earliest, or possibly as late as early spring when seasonal opportunities tend to improve.

- Catch-up sales opportunity for the 2025 crop. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. If you happened to miss those opportunities and are looking to make additional early sales for next year, you could consider targeting the 455 – 475 area versus Dec ’25 to take advantage of any post-harvest strength. For now, considering the seasonal weakness of the market around harvest time, we will not be posting any targeted areas for new sales until late fall or early winte. Although we are targeting the 470 – 490 area to buy upside calls to protect current sales in case the market experiences an extended rally beyond that point.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

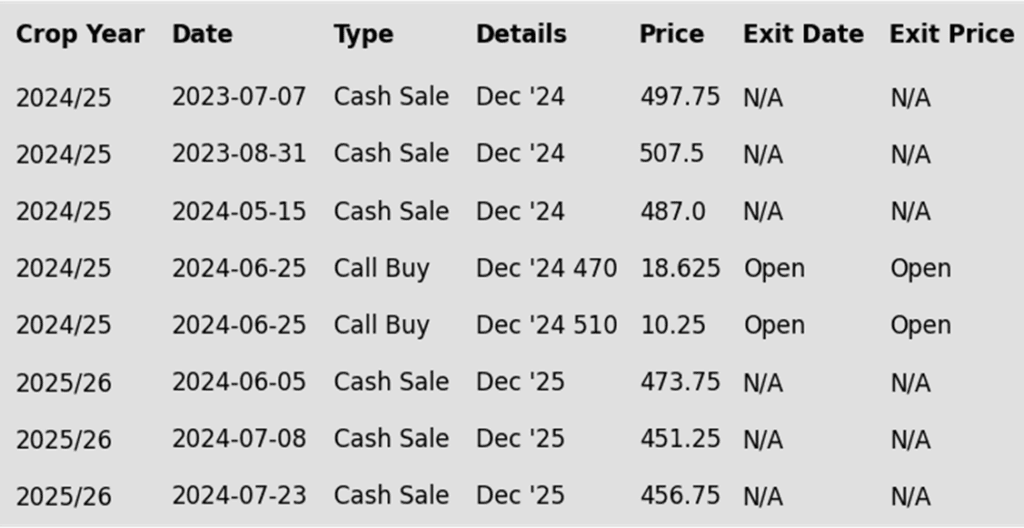

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished higher for the third consecutive day but ran into resistance at the 420 level in December corn. Options expiration, improved demand, and strong gulf basis bids helped support the corn market as we moved into the back half of harvest.

- On Friday, November grain options expire. Although there is no November futures contract for corn, the market does have short-term November options that expire on Friday. The largest area of open interest for November corn options is at the 420 level, and prices have moved into this range, which could introduce additional volatility as option expiration approaches.

- The USDA announced a flash export sale of corn this morning. Exporters sold 100,000 mt (3.9 mb) to unknow destinations for the current marketing year. This was the sixth consecutive day of an announced export sale for corn.

- The USDA will release weekly export sales on Thursday morning. The market is expecting a strong sales total for last week. Expectations are for 2.2 – 3.3 mmt of new sales. A large portion of these sales totals are known given the daily sales announcements by the USDA.

- Weekly ethanol production remains strong, pushing to 1.081 mb/day last week, up from the week prior and 4% above last year. A total of 108.7 mb of corn was used last week in ethanol production, with the current usage pace ahead of the USDA target for the marketing year.

Above: The rally from the 400 support level puts December corn on track towards a potential test of the 428 – 434 resistance area. If the turnaround fails and prices breach the 400 area and close below 397, prices could be at risk of retreating towards the 385 support level.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

After peaking in early October, the soybean market declined as harvest activity and hedge pressure increased rapidly, driven by warm, dry conditions in the US and improving planting conditions in Brazil. With the harvest now in its final stages, we are entering a period when selling opportunities tend to improve as hedge pressure eases, and South American weather becomes a more dominant factor in their growing season. That said, managed funds hold a relatively small net short position, which creates the potential for volatility in either direction. Prices could rise if South American conditions decline or US demand improves, encouraging further fund buying, or decline if South American conditions improve and US demand remains stagnant, prompting funds to potentially rebuild short positions.

- Catch-up sales opportunity for the 2024 crop. If you missed the June sales recommendation triggered by the market’s close below 1180, there may still be an opportunity to make a catch-up sale. While we don’t expect the current harvest period to offer the best pricing, a rally back to the 1050 – 1070 range versus Nov ’24 could provide a good opportunity. For those with storage or capital needs, consider making these catch-up sales into price strength. If the market rallies further, additional sales can be considered in the 1090 – 1125 range versus Nov ’24. No further sales recommendations are anticipated until seasonal pricing opportunities improve, likely late fall to early spring.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

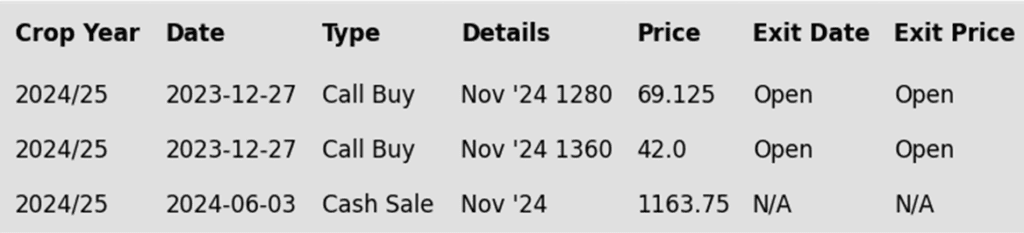

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher for the third straight session, with the November contract leading the way, while the deferred contracts trailed. As November options expiration approaches on Friday, there is substantial open interest at the $10 strike. However, the November contract has yet to rally above the $10.00 mark, since prices tend to gravitate toward strikes with large open interest.

- Trading in the soybean complex was interesting today, as both soybean meal and oil traded lower, while soybeans themselves closed higher. Yesterday, soybean oil gained over 3%, providing clear support for soybeans. Since the beginning of the month, soybean meal has moved inversely to soybeans, losing $27.10 so far.

- This morning, the USDA reported two flash sales by private exporters. The first sale was for 130,000 metric tons of soybeans to be delivered to China during the 24/25 marketing year, while the second was for 259,000 metric tons to unknown destinations, also for delivery during the 24/25 marketing year. Overall, export sales have been supportive over the past week.

- In Brazil, 18% of the soybean crop is now planted, compared to 8% last week and 30% at this time last year. Most of the country received rain last week, and the forecast for this week predicts 1 to 4 inches of rain in central Brazil. The season had a rocky start due to extremely dry conditions but has since shown signs of recovery.

Above: The recent downtrend appears to have found support near 980 on the front month chart, and with the market showing signs of being oversold, prices could rebound toward recent highs near 1070. Before that, prices may encounter resistance around 1025. If prices break the 980 support level in the January contract, they could find additional support near 955 and again around 940.

Wheat

Market Notes: Wheat

- Wheat closed in mixed fashion with small gains for Chicago, small losses for Kansas City, and was mixed for Minneapolis as the deferred months gained on the front. Matif wheat had a similar story with a 0.25 Euro rally in the December front month, but losses of 0.25 to 0.50 Euros in the deferred contracts. US wheat finished the session relatively strong, considering that the US Dollar Index scored a fresh near-term high above the 104.50 barrier.

- India’s cash wheat price is said to have hit the equivalent of $9.59 per bushel, which is a new season high. This continues to reinforce the idea that their nation may need to import wheat, which offers a bullish tone to the marketplace.

- At a BRICS summit, Vladimir Putin reportedly proposed once again the creation of a new grain exchange for these countries. The idea is based on the premise that it would allow for fair price discovery, become a predictable price indicator, and assist in ensuring global food security. Putin added that the exchange could later include other commodities, such as energy and metals.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

After posting a low in late July, the wheat market staged a rally triggered by crop concerns due to wet conditions in the EU, smaller crops out of Russia and Ukraine, and dryness in the US plains. The nearly 100-cent rally from the August low to October high also saw Managed funds cover about two-thirds of their net short positions. While cheaper Russian export prices continue to be a limiting factor for US prices, a new season is upon us with many uncertainties ahead that could keep volatility in the market. Additionally, US export sales remain ahead of the pace set last year and in 2022, and any increase in demand from lower World supplies could rally prices further.

- No new action is recommended for 2024 Chicago wheat. Back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Currently, our strategy remains to target 740 – 760 versus Dec ’24 to recommend further sales. While this range may seem far off, based on our research, it represents the potential opportunity that this crop year can present as we move toward the planting and winter dormancy windows of the next crop cycle. Considering this potential, we also continue to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. In September, we recommended taking advantage of the rally in wheat to make additional sales on your anticipated 2025 SRW production. While we continue to recommend holding July ’25 620 puts—after advising to exit the first half back in July—to maintain downside coverage for any unsold bushels, our Plan A strategy continues to target a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales. Should the market show signs of a potentially extended rally, our Plan B strategy is to protect current sales and target the 745 – 775 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

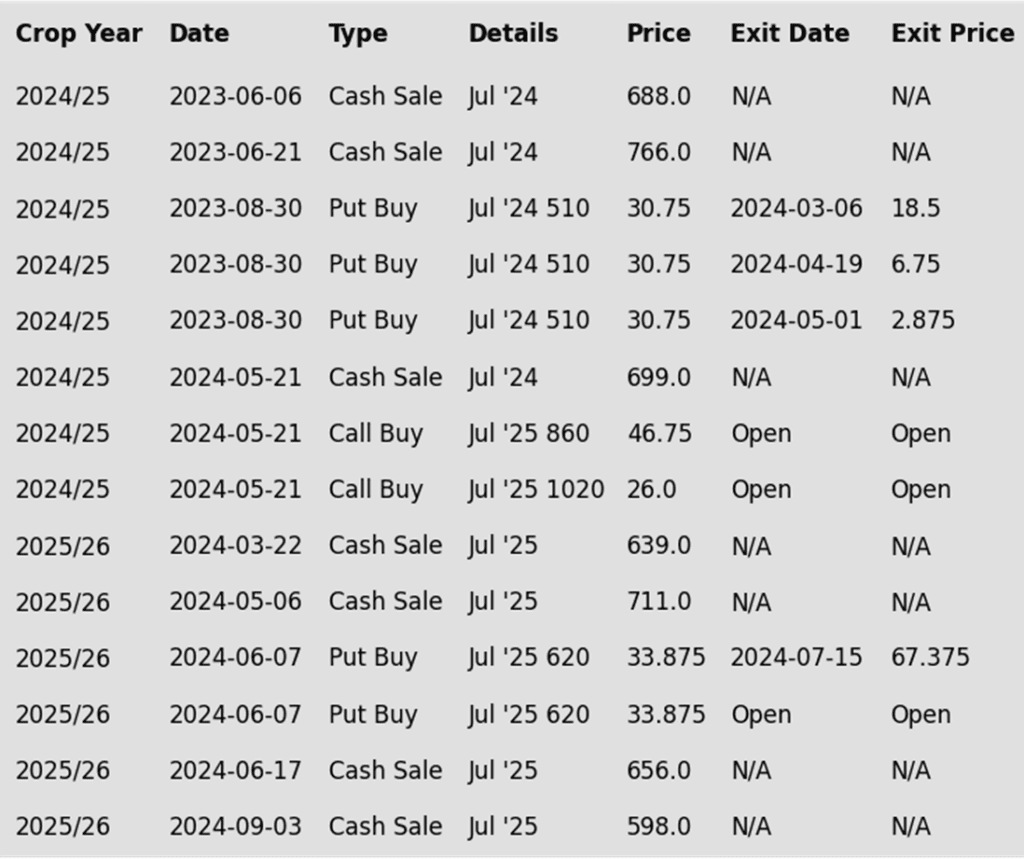

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Since hitting resistance near 617, December Chicago wheat has stair-stepped lower to the point of testing the 575 – 560 support area. A close below there could put the market at risk of sliding toward the major support area between 521 and 514. Though intermediate support may be found around 544. Meanwhile, initial overhead resistance may lie between 595 and 600.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

After hitting a market low in late August, the wheat market has rallied driven by crop concerns in the EU and reduced production from Russia and Ukraine. The rise in prices from late August through early October also prompted Managed funds to cover a significant portion of their net short positions. Although more competitive Russian export prices continue to cap potential gains for US wheat, the onset of a new season introduces a range of uncertainties that could fuel market volatility. Moreover, US export sales are currently outpacing last year’s figures and those from 2022, meaning that any uptick in demand due to tighter global supplies could further lift prices.

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 635 – 660 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. While we still recommend holding the remaining half of the previously suggested July ’25 620 puts for downside protection on unsold bushels, we recently advised selling another portion of your anticipated 2025 HRW wheat production in light of the early fall rally in the wheat market. Looking ahead, our current Plan A strategy is to target the 700–725 range for additional sales, while our Plan B strategies involve targeting the upper 400 range to exit half of the remaining 620 puts if the market turns toward new lows and targeting the 745–770 area to buy upside calls in case the market rallies significantly beyond that point.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

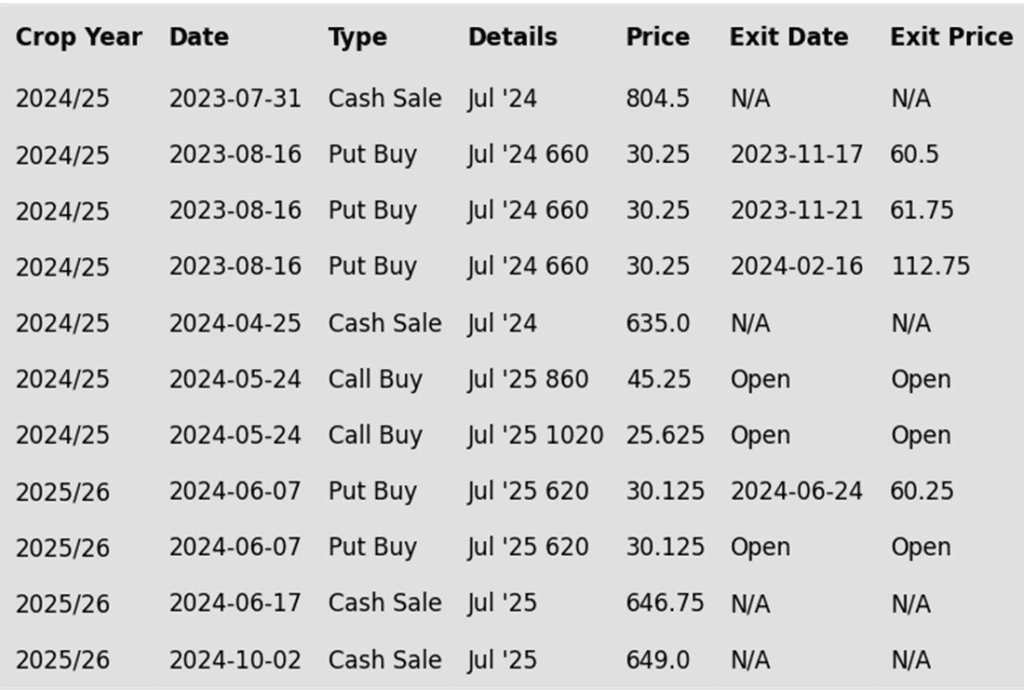

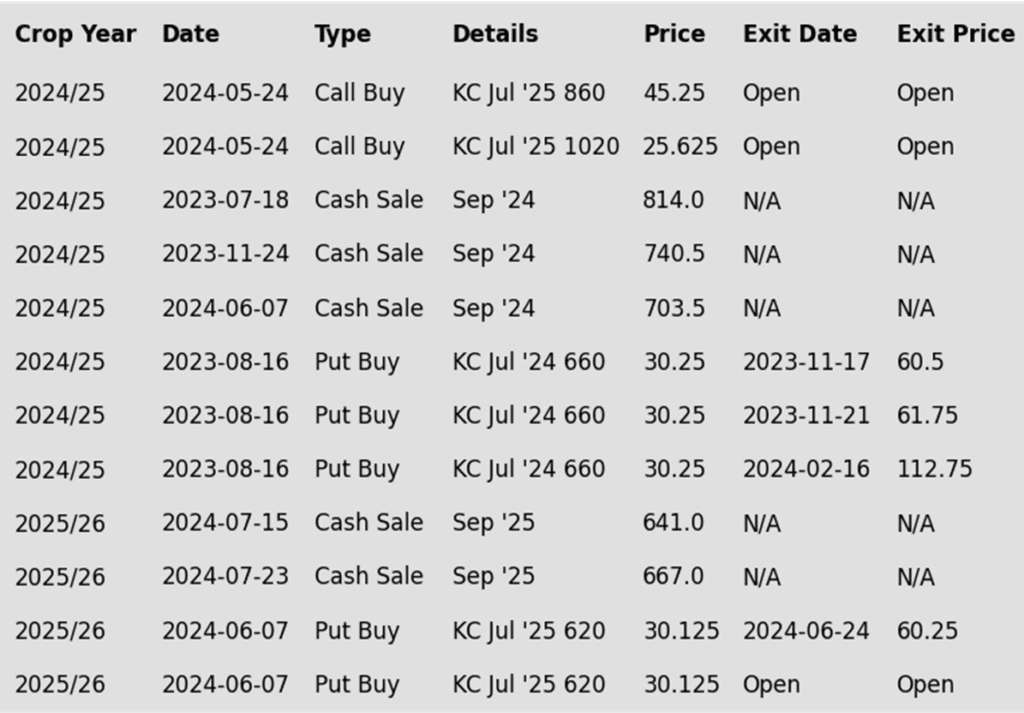

To date, Grain Market Insider has issued the following KC recommendations:

Above: The December KC wheat contract appears to have found support in the 580 – 575 area. A break below this level could put the market at risk of trading toward 561 support. Otherwise, should this area of support hold, prices could rebound toward recent highs and test resistance near 623, with initial resistance around 592.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since posting a seasonal low in late August, Minneapolis wheat has traded up to its 200-day moving average and its highest level since mid-July. During this period, managed funds have covered about 75% of their short positions in Minneapolis wheat. While more competitive export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. Now that the spring wheat harvest is behind us, and we are at the time of year when seasonal price trends tend to become more friendly, we are targeting the 675 – 700 range to recommend making additional sales.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not target any specific areas for additional sales until November or December, when seasonal opportunities tend to improve, we continue to hold the remaining July ’25 KC 620 puts that were recommended in June for downside protection. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts. Additionally, should the wheat market show signs of an extended rally, we are targeting the 745–770 area in July ’25 KC to buy July ’25 KC upside calls in case the market rallies significantly beyond that point.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The recent break below the 100-day moving average suggests that prices could drift further toward the 604 support area, with additional support near the 50-day moving average before reaching that level. If prices turn higher, overhead resistance may be around 632, with stronger resistance near 655.

Other Charts / Weather

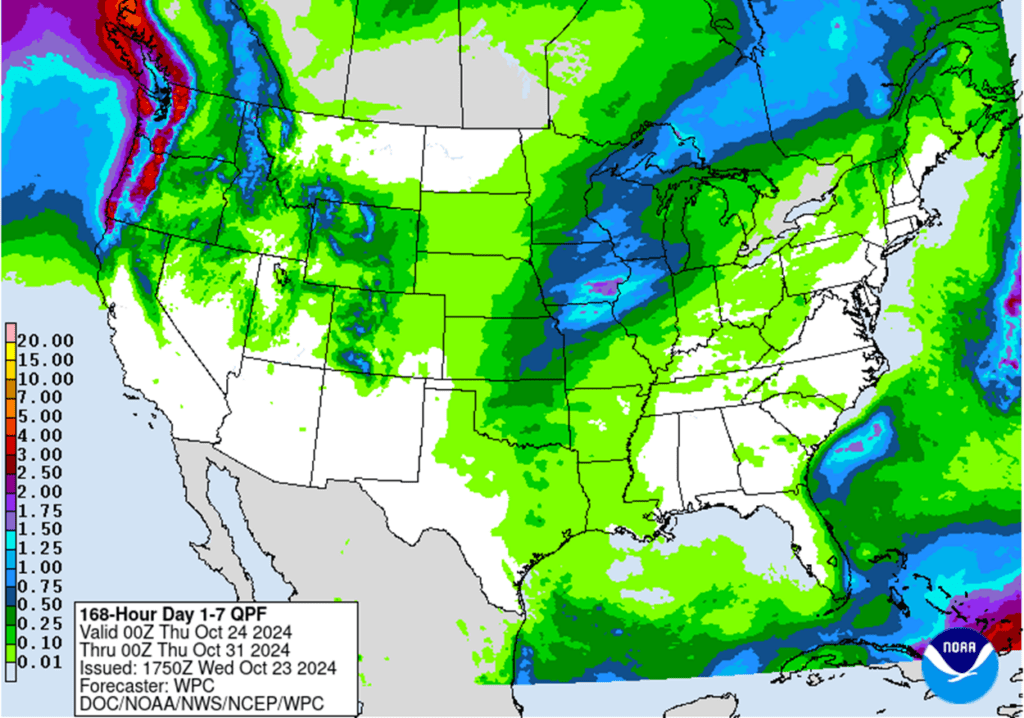

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

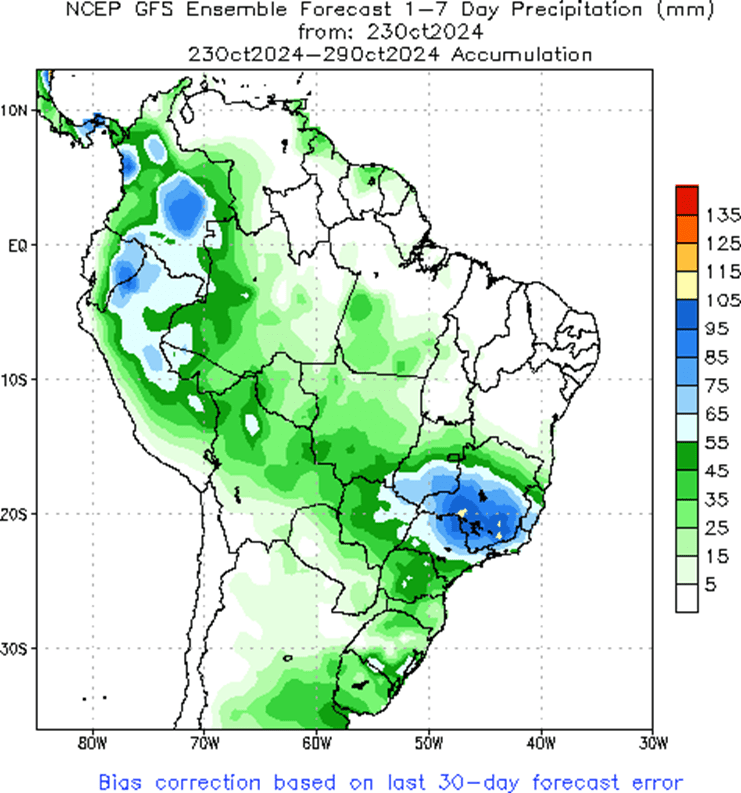

Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

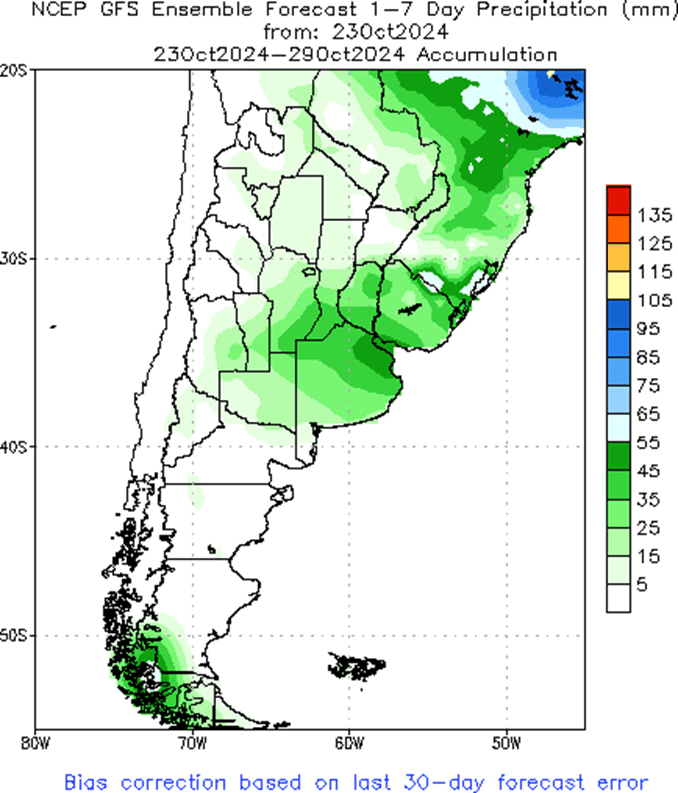

Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.