10-23 End of Day: Grain Futures End Higher Amid Signs of Trade Progress with China

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended the day modestly higher on continued strength from the weekly ethanol report and renewed trade optimism with China.

- 🌱 Soybeans: News that President Trump will meet with China’s President Xi Jinping next Thursday to discuss a deal pushed soybean futures sharply higher.

- 🌾 Wheat: The wheat markets showed strength today, fueled mostly by technical buying as traders continued to face a lack of fresh fundamental news. Prices ultimately closed higher on the day.

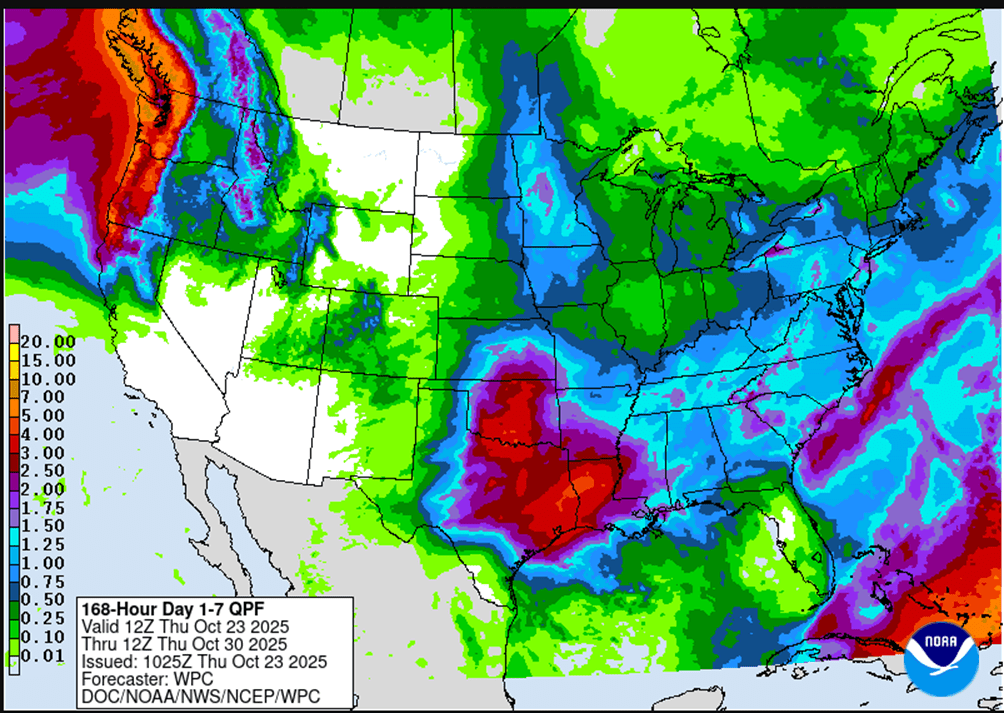

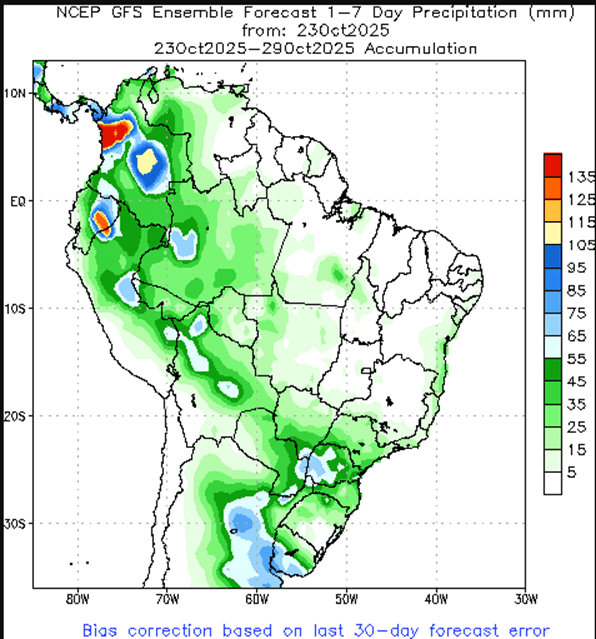

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

- The release of new export data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished Thursday with moderate gains, supported by trade optimism with China and a strong weekly ethanol report. December corn posted its highest daily close since September 15, gaining 5 cents to 428. March futures added 5 ½ cents to 441 ¼.

- Confirmation by the White House that President Trump will meet with Chinese President Xi next Thursday helped boost market optimism on Thursday.

- Wednesday’s ethanol production reported show strong ethanol production for the second straight week. For the week ending October 12, ethanol production reached 327 million gallons on the week, above expectation and marketing year high.

- Corn futures pushed through a key area of technical resistance, which triggered some short covering during the session on Thursday. A strong technical close leaves the corn market set up for additional upside support going into Friday.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

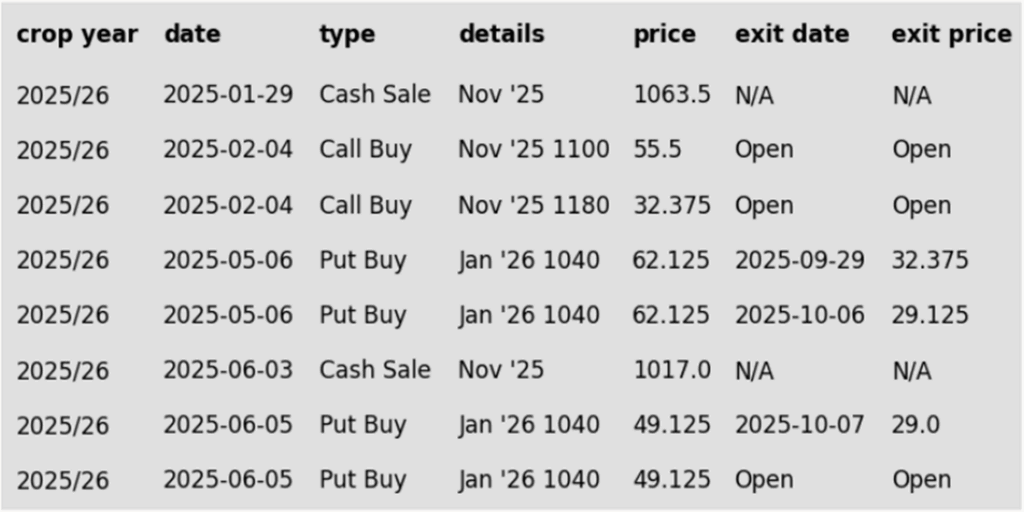

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher following news that President Trump will meet with China’s Xi next Thursday to discuss a trade deal. November soybeans were up 10 cents to $10.44-3/4 while March was up 12-1/4 to $10.75-1/4. December soybean meal was up $2.30 to $292.30 and December soybean oil gained 0.80 cents to 50.87 cents following gains in crude oil.

- President Trump is scheduled to meet with Chinese leader Xi Jinping next Thursday in a bilateral meeting that will be part of a multi-country trip to Asia, White House press secretary Karoline Leavitt said at a briefing today. On the Asian trip, Trump will also be meeting with leaders from Malaysia, Japan and Korea.

- Bloomberg estimates for the postponed export sales report for the week ending October 16 see soybean sales in a range between 700k and 2,000k tons with an average guess of 1,200k tons. This would compare to 2,088k last year. An unfounded rumor circulated today suggesting that China may have booked U.S. soybeans.

- In South America, weather has remained unusually dry throughout central Brazil this month which has led to a quickened planting pace for soybeans. The forecast for the next 7 days remains dry with potential showers expected in two weeks from now.

Wheat

Market Notes: Wheat

- Wheat closed with strength today, led by the Kansas City class. Dec Chi closed 9-1/4 cents higher at 513, KC was up 11-1/2 to 500, and MIAX gained 10-1/4 to 558. Today’s move appears to be largely technical in nature with speculative short covering. Wheat futures likely followed soybeans and crude oil higher after the U.S. announced new sanctions against two major Russian oil companies.

- The International Grains Council has increased their estimate of world 25/26 wheat production by 8 mmt to 827 mmt. If realized, this would be a record high, up 1.1% compared to the previous season, and compares with the USDA estimate of 816.2 mmt. This revision was primarily driven by higher projections for Russian, U.S., and Argentine crops.

- Algeria recently purchased milling wheat, however the amount may be far larger than the 50,000 mt tender. Reportedly, volumes could be as high as 500-600,000 mt, and the wheat was likely sourced from the Black Sea area. The purchase price is said to be around $259/mt on a CNF basis.

- As of October 21, an estimated 43% of U.S. winter wheat acres are experiencing drought conditions, down from 45% last week. Spring wheat areas in drought were unchanged from last week at 16%.

- Due to the government shutdown, there was no export sales report today. However, a Bloomberg analyst survey suggests an average estimate of 563,000 mt of wheat export sales. The estimates ranged from 350-750,000 mt and compared to 533,000 mt from a year ago.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- Buy call options if July 2026 futures close above 669 macro resistance.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

- A Plan B call option target has been added.

- Notes:

- Resistance for the macro trend sits at 669 vs July 2026. A close above 669 would signal a potential shift to a macro uptrend, triggering a call option purchase.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 612.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 612.50.

- Notes:

- Resistance for the macro trend sits at 612.50 vs December ‘25. A close above 612.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 612.50 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 612.50.

- Notes:

- Resistance for the macro trend sits at 612.50 vs December ‘25. A close above 612.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center