10-22 End of Day: Grain Markets Mixed as Corn Strengthens, Soybeans Steady, and Wheat Rebounds on Technical Buying

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished higher on Wednesday as buying strength lifted the front end of the market. Strong export demand and limited farmer selling continue to support the nearby contracts.

- 🌱 Soybeans: Soybeans ended mixed Wednesday, with strength in nearby contracts but weakness in deferred months.

- 🌾 Wheat: Wheat futures closed higher across all three U.S. classes Wednesday, largely on technical buying amid a lack of fresh news.

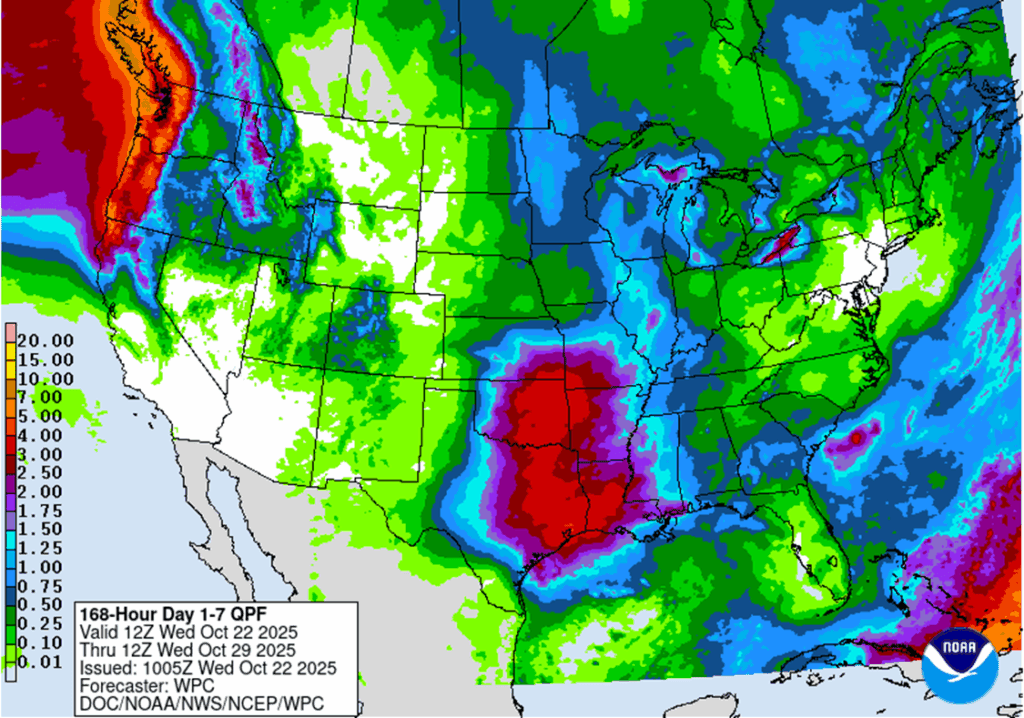

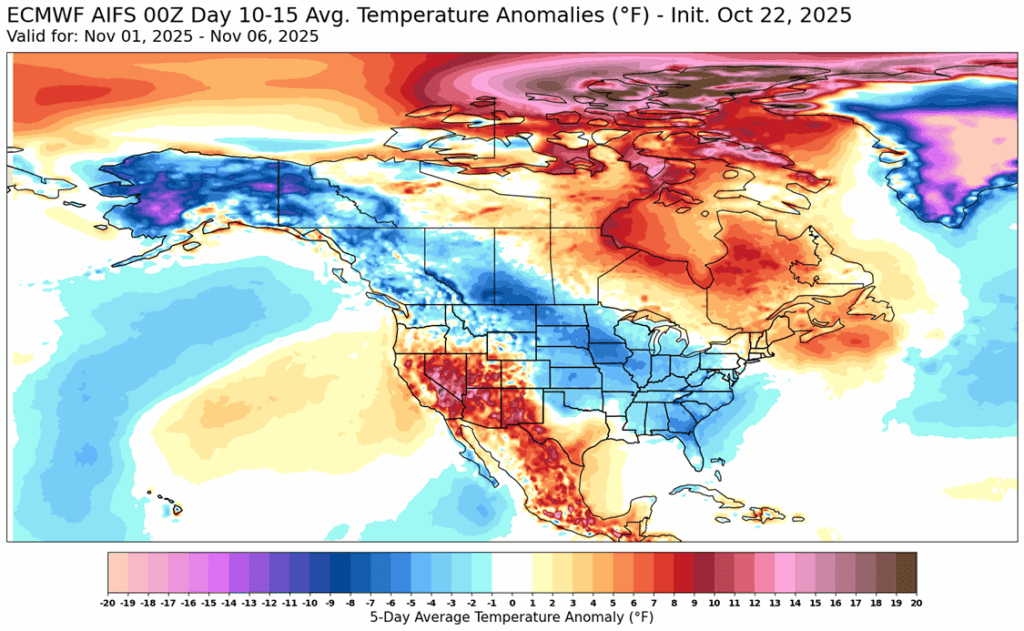

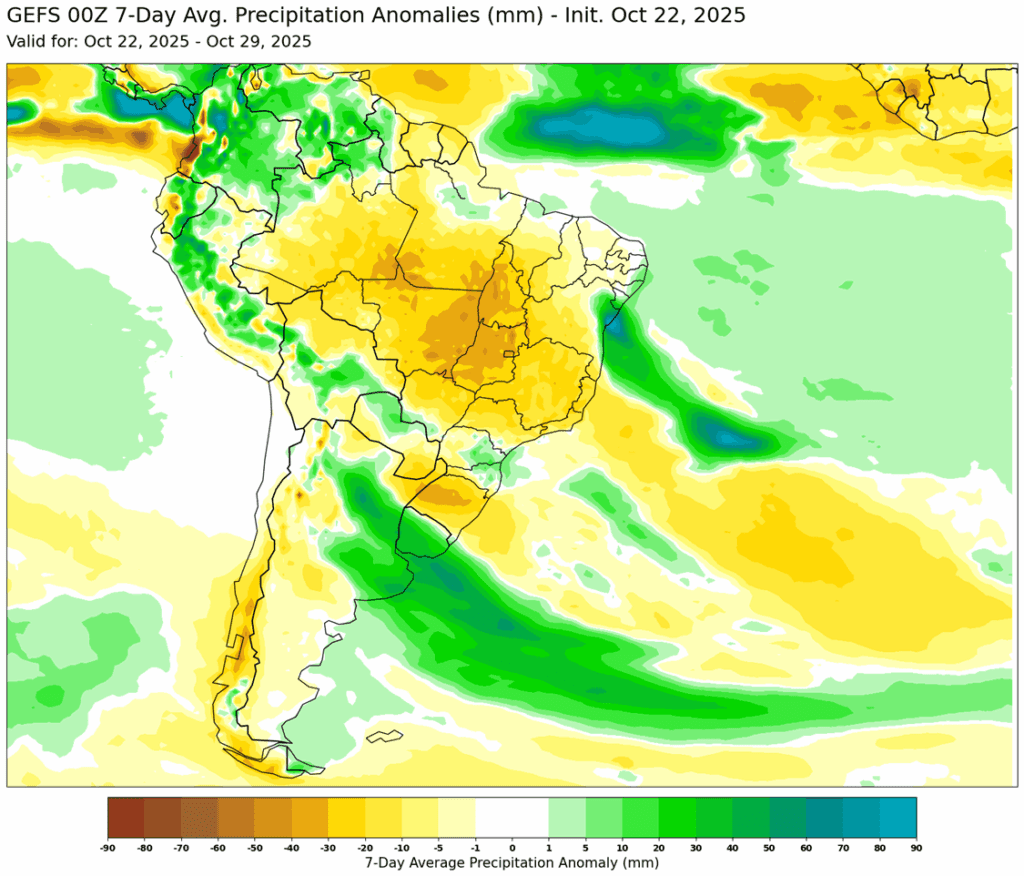

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

- The release of new crop progress data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished higher on Wednesday as buying strength helped pull the front end of the corn market higher. December corn finished 3 ¼ cents higher to 423, and March futures gained 2 cents to 435 ¾.

- Bull spreading remain a driver in the front end of the corn price as the Dec/March corn spread gained 1 ¼ cents to finish at –12 ½. This is the narrowest spread the has traded since April. The strong tone of demand in the export market and the lack of farmer selling is what is supporting the strength in the spread.

- Thursday morning typically has export sales report released, but with the government shut down, that report is still going unreported. Analysts have given projections for corn sales with a range of 800,000 mt-2.0 MMT. The market has expected corn export demand to remain strong.

- Restriction of barge flow on the Mississippi River due to low water levels can increase costs of transportation to the Gulf. Those increased costs will likely be reflected in basis levels along the river for cash prices.

- After three straight sessions of gains, the U.S. Dollar Index encountered technical resistance on Wednesday, potentially signaling a near-term shift in momentum.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

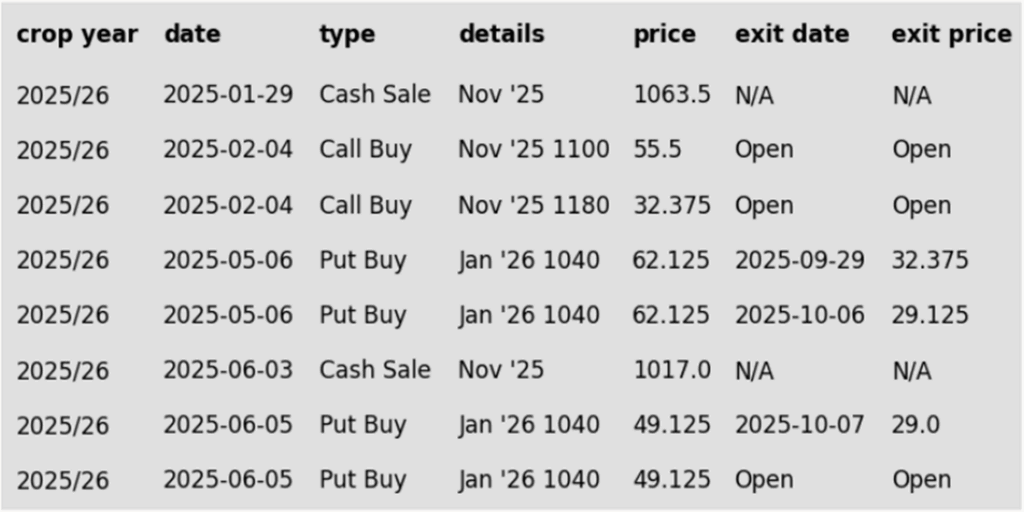

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were mixed today with gains in the front months but losses in deferred contracts. November soybeans gained 4 cents to $10.34-3/4 while March gained ¼ cent to $10.63 and November 2026 lost 2 cents to $10.70-3/4. December soybean meal gained $3.10 to $290 and December soybean oil lost 0.58 cents to 50.07 cents.

- Back-month pressure stemmed from President Trump’s comments that the U.S. may consider curbs on exports to China involving U.S.-made software — from jets to laptops — in retaliation for Beijing’s latest rare earth export restrictions. The escalation could complicate near-term trade negotiations.

- Early next week, Trump is set to meet with Japan’s new Prime Minister Takaichi where they will discuss potential U.S. investments. Takaichi will discuss purchases of US soybeans, pickups, and gasoline, and may invest as much as $550 billion in the US in exchange for lower auto tariffs.

- The U.S. soybean harvest is estimated by Bloomberg polls to be 74% complete with a range between 61-80%. This would compare to last week’s survey guess of 60% and would compare to 81% from the USDA at this time a year ago.

Wheat

Market Notes: Wheat

- Wheat closed with gains in all three U.S. futures classes today. Without much in the way of fresh news to drive the market, this was likely a technical move higher. Dec Chi was up 3-1/2 cents at 503-3/4, KC gained 3-1/2 cents to 488-1/2, and MIAX closed 3 cents higher at 547-3/4.

- Argentine wheat is reportedly at a significant discount to the US. Their FOB values are said to be near $208 to $210 per mt, which is about $16 to $18 below HRW offers at the US Gulf. This will likely limit upside for the US market. Furthermore, Argentina’s wheat harvest is set to begin in November, with a potential record 23 mmt crop anticipated.

- U.S. winter wheat planting is estimated to be more than 75% complete, though progress could slow as a storm system brings rain across the Southern Plains Thursday, with lighter showers expected in the Great Lakes region.

- Northern China has recently seen excess heavy rain. This is not only affecting harvest progress and quality of spring-sown crops but is also causing concern about winter wheat planting. Their winter wheat planting typically begins in October. According to China’s national climate center, the northern provinces of Henan and Shandong have had the rainiest season in 60 years.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 618 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 618.

- Notes:

- Resistance for the macro trend sits at 618 vs December ‘25. A close above 618 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- Buy call options if July 2026 closes at or above 648.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 618 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 618.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy call options if July 2026 KC wheat closes at or above 648.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- A Plan B call target has been added.

- Notes:

- Resistance for the macro trend sits at 648 vs July 2026. A close above 648 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather