10-20 End of Day: Grains Led Higher by Soybean Strength

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures inched higher as export inspections continue to be strong.

- 🌱 Soybeans: Soybeans led grains higher as optimism continues to grow that a trade deal with China can be reached.

- 🌾 Wheat: Wheat futures closed mixed, with pressure from strong foreign production continuing to weigh on the market.

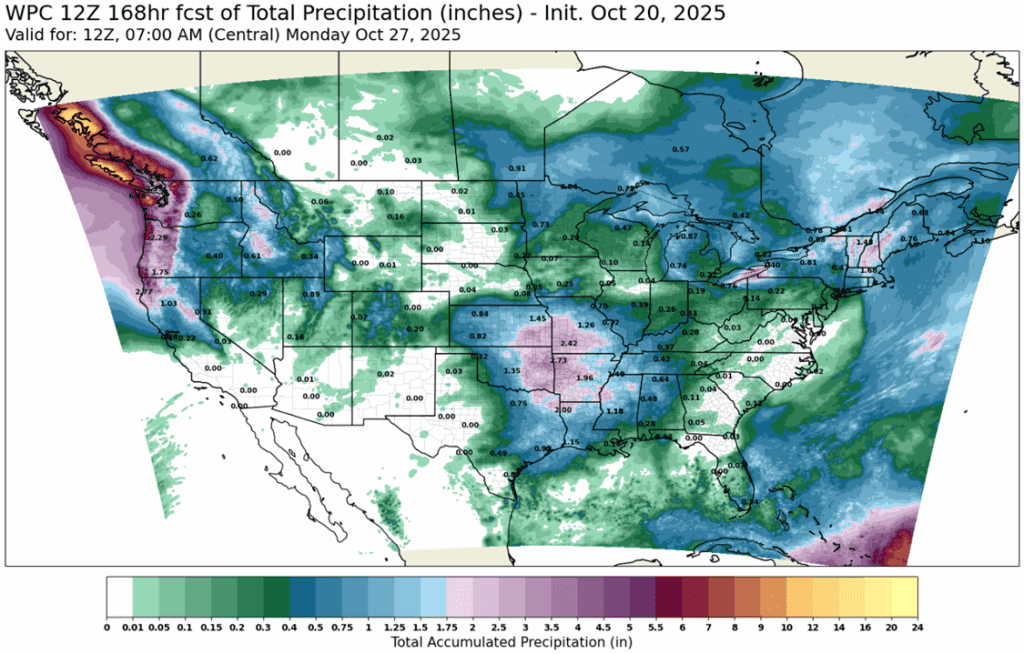

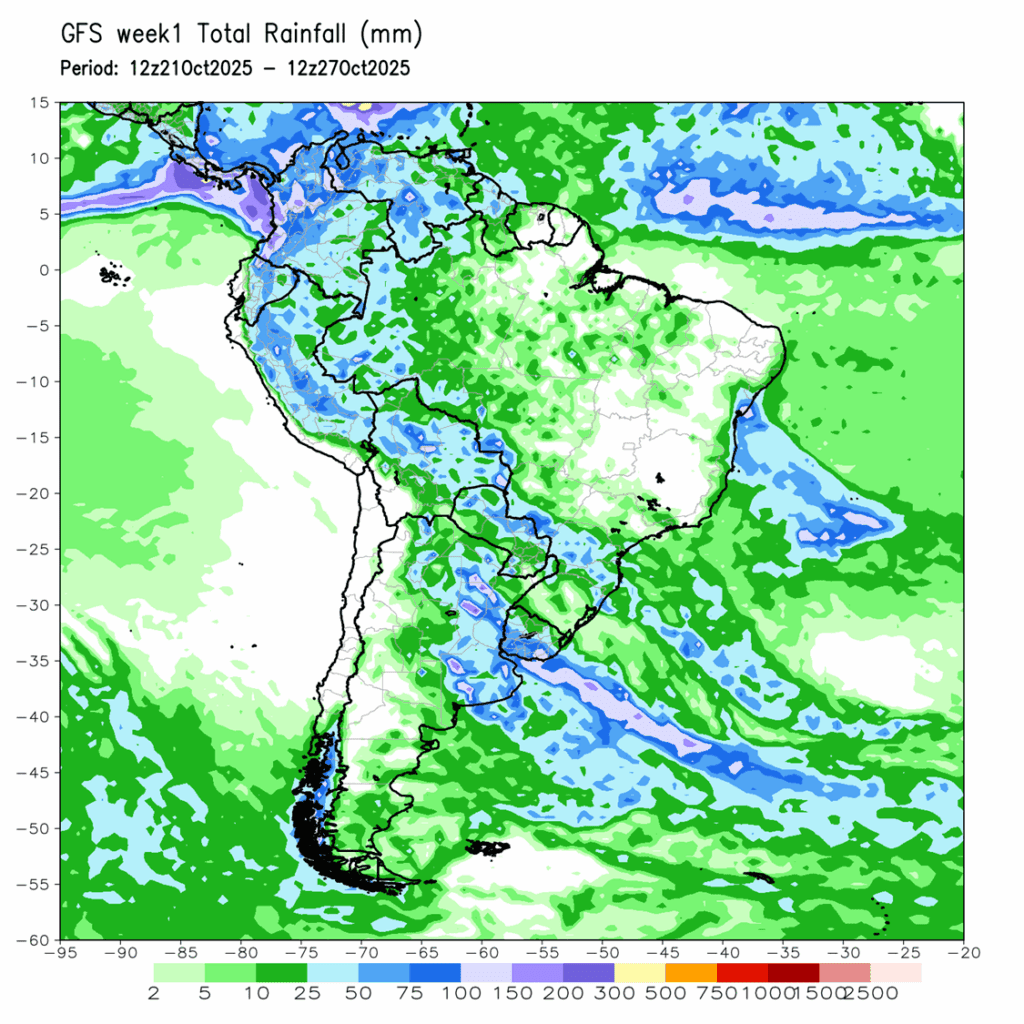

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

- The release of new commitment of traders data has been delayed as a result of the government shutdown. Updated figures will be issued following the resumption of government operations.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fought off early session weakness to finish with small gains to start the week. A quiet day overall with December corn trading a 4 ½ trading range. A strong week of export sales and strength in the soybean market provided support.

- Weekly export inspections remain strong for corn. For the week ending October 16, US exporters shipped 1.317 MMT (51.9 mb) of corn. For the marketing, total inspections have reached 368 mb, up 61% over last year.

- Corn harvest is projected to be past the halfway point. Analysts estimate the corn harvest is nearing 59% complete, up 15% over last week’s estimates. With the government shutdown, Crop Progress report is still in pause on Monday afternoons.

- Optimism for a possible trade deal with China is helped support the grain markets. President Trump made comments on Monday that he is hopeful a deal could come together by the end of the month.

- A lack of farmers selling or disappointing yields is supporting the cash market for corn. Areas have seen basis improvement, supporting cash.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

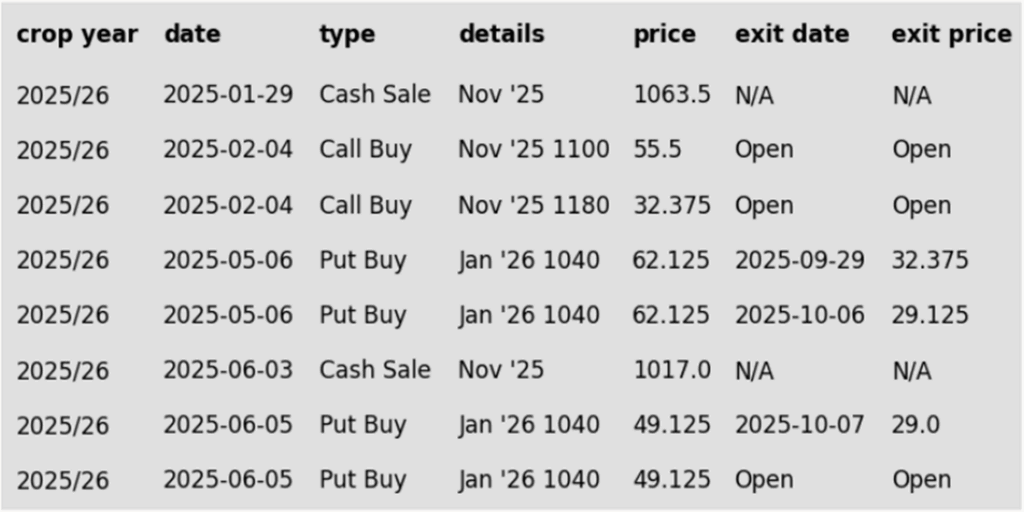

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly higher for the third consecutive day thanks to optimism that President Trump will strike a trade deal with China. November soybeans gained 12-1/4 cents to $10.31-3/4 while March was up 13-1/4 to $10.64. December soybean meal was up $4.00 to $285 while December bean oil was up 0.18 cents to 51.31 cents.

- Today, President Trump made comments on China saying that China could pay a 155% tariff on US goods if no deal is reached by November 1, that China has been “very respectful” to the US, and that he expects to work out a “fair deal” with President Xi. In addition, China said it would reimburse tariff costs for soybeans bought for state reserves from the US.

- Today’s export inspections report saw soybean inspections totaling 54.2 million bushels for the week ending October 16. Total inspections for 25/26 are now at 204 mb, which is down 31% from the previous year. Exports are expected to be down 10% this year from the previous year.

- Over the past 5 trading days funds are estimated to have bought back 17,500 contracts of soybeans which may have brought them back to a small net long position. They were likely buyers of both soybean meal and oil. Funds likely added to that long position today.

Wheat

Market Notes: Wheat

- Wheat had a mixed close after a two-sided trade. December Chi gained 1 cent to 504-3/4, KC lost 1-1/2 cents to 490, and MIAX was unchanged at 548-1/2. In general, the wheat market continues to trudge along near the lows without much reason to rally – large crops expected out of Argentina and Australia may further limit upside potential.

- Weekly wheat inspections were pegged at 17.7 mb, bringing total 25/26 inspections to 411.0 mb. This is up 20% from the year prior and inspections are running above the USDA’s estimated pace. Exports for 25/26 are forecasted at 900 mb, up 9% from last year.

- One unidentified grain analyst in Australia increased the estimate of their nation’s wheat production by 0.5 mmt to 35.7 mmt. If this new estimate is accurate, it would become the third largest crop on record. Compared to the USDA projection of 34.5 mmt.

- According to IKAR, Russian wheat export values ended last week at $231/mt, which is up $2 from the week before. Additionally, SovEcon has increased their estimate of Russian October wheat exports slightly to 5.1 mmt; this compares with 4.6 mmt in September.

- Chinese customs data indicates that their wheat and wheat flour imports for the month of September totaled 390,000 mt, which is up about 60% year over year. However, year to date total imports have reached only 2.99 mmt, which is down about 72% year over year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 565 to 563.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 617.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day precipitation forecast courtesy of ag-wx.com

Above: South America 7-day precipitation forecast courtesy of National Weather Service, Climate Prediction Center.