10-17 End of Day: Grains Close Week Higher on Market Strength Amid U.S.-China Optimism

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn closed the week modestly higher, marking its fourth consecutive day of gains on optimism surrounding U.S.-China trade talks.

- 🌱 Soybeans: Soybeans wrapped up the week with gains across the entire soy complex, fueled by hopes that upcoming U.S.-China talks could lead to a resolution in the ongoing trade dispute.

- 🌾 Wheat: Friday’s wheat trade ended positive, fueled by strength in other grains and potential weather concerns in Argentina.

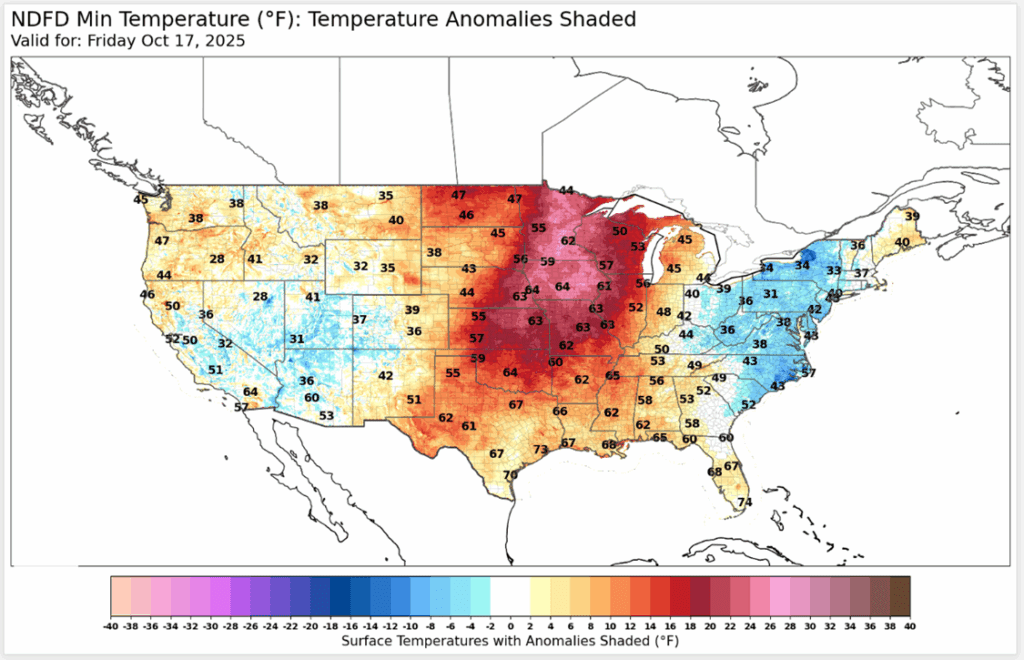

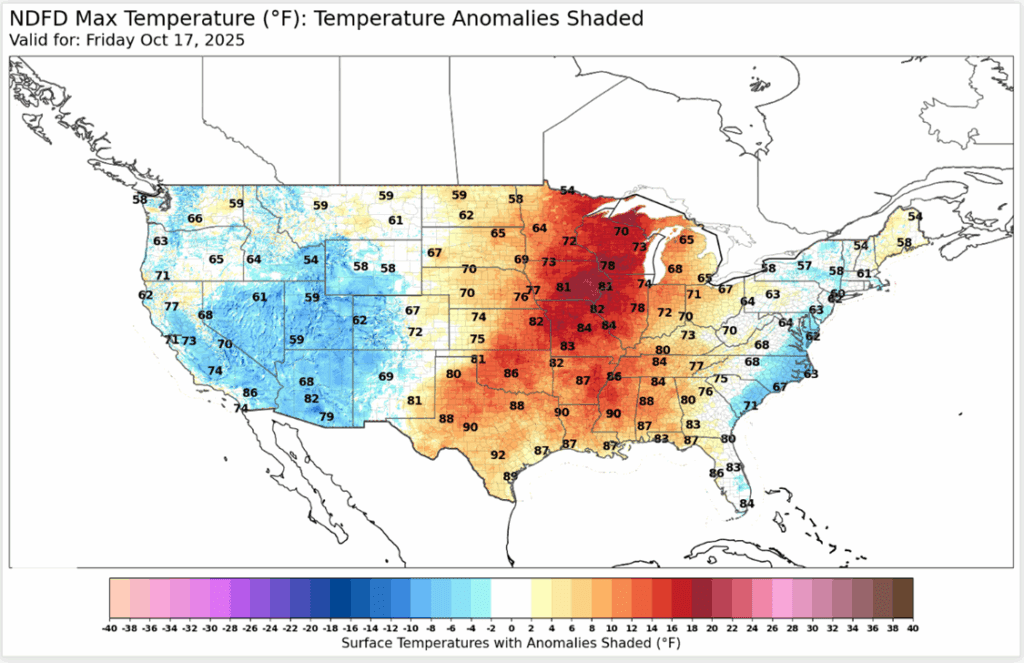

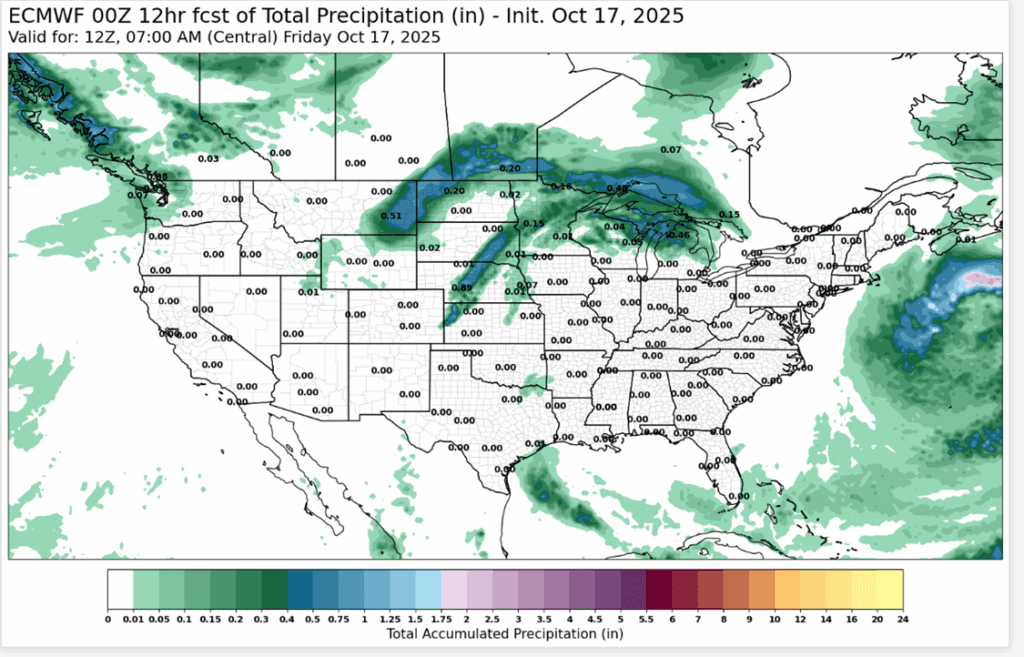

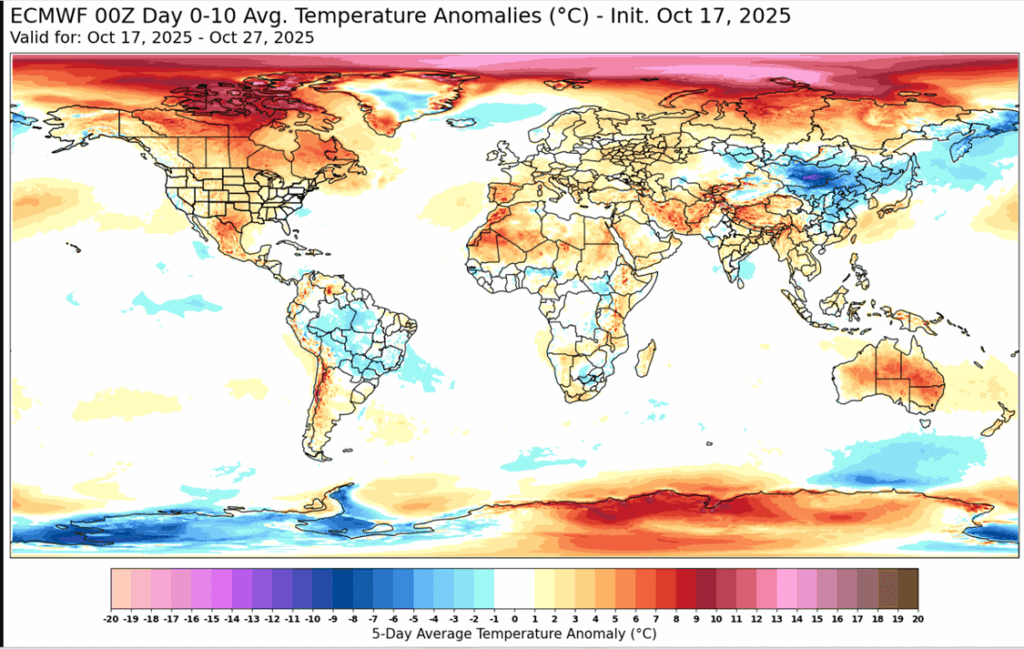

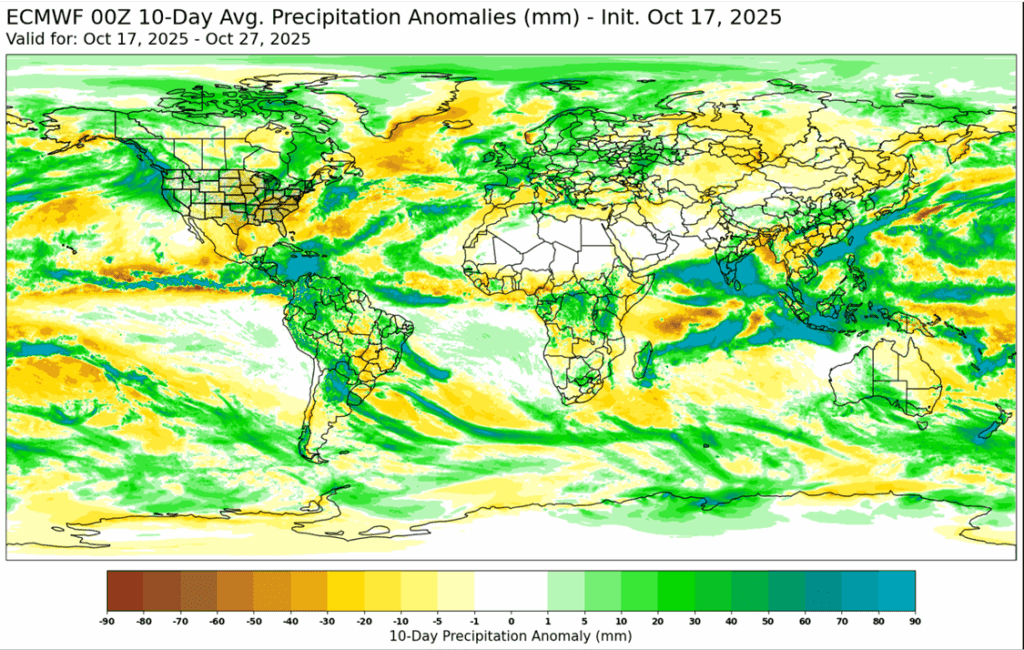

- To see the updated U.S. and global weather maps, scroll to the bottom.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished higher for the fourth consecutive session, closing with moderate gains. December contracts drew support from strength in other grains and tested resistance levels, but end-of-week profit-taking limited further upside. December corn gained ¾ cent to 422 ½, and March added 1 cent to 436 ½. For the week, December corn finished 9 ½ cents higher.

- A more positive tone on U.S.-China trade provided support to the soybean market on Friday, while spillover strength offered some optimism for corn.

- With harvest pushing the 50% level nationally, the lack of producers selling has helped support the market. Corn spreads between the front of the market versus deferred futures have been tightening as end users are trying to encourage movement of corn.

- The market will be shifting focus to South American weather as Brazil and Argentina are starting corn planting. Rain has fallen in key areas of the two countries, which should help promote a good start to their next year’s corn crops.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

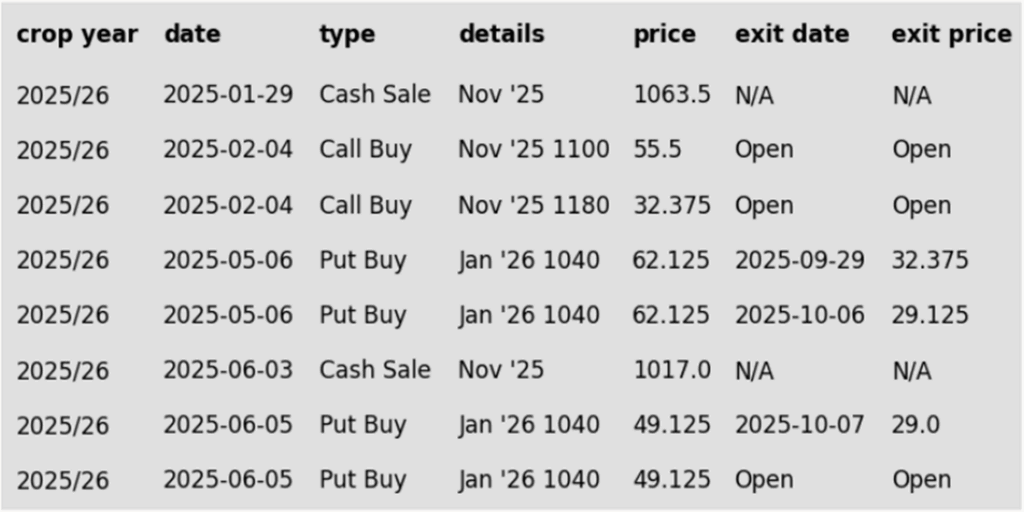

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher for the second consecutive day after President Trump said that 100% tariffs on China were not sustainable and said he would in fact meet with China’s President Xi. November soybeans gained 8-3/4 cents to $10.19-1/2 and March gained 7 cents to $10.50-3/4. December soybean meal gained $4.10 to $281 and December bean oil gained 0.26 cents to 51.13 cents.

- USDA export sales reports are paused indefinitely but estimates for the export sales report ending the week of October 9 see soybean sales in a range between 400k and 1,400k tons with an average estimate of 975k tons. This would compare to 1,703k a year ago.

- Market talk indicates that China may auction 3.5 million tons of soybeans from state reserves, opting to rely on domestic stocks instead of buying Brazil’s higher-priced supplies. However, with President Trump expected to meet with President Xi in the upcoming weeks and a phone call planned soon, renewed trade discussions could set the stage for potential progress toward a deal.

- For the week, November soybeans gained 12-3/4 cents taking back all over last week’s losses and then some while March gained 13-1/4 cents. December soybean meal gained $6.00 for the week while December bean oil gained 1.16 cents.

Wheat

Market Notes: Wheat

- Wheat closed with small gains in Chicago and Kansas City futures, but small losses for Minneapolis. December Chi was up 1-1/4 cents at 503-3/4, KC gained 2-3/4 to 491-1/2, and MIAX lost 1 cent to 548-1/2. Wheat remains a follower, trading near contract lows. Despite being oversold, a lack of fresh news has limited any short-covering rally.

- According to the Buenos Aires Grain Exchange, a cold front coming in next week could threaten Argentina’s wheat crop, which is currently rated 90% good to excellent. Harvest is expected to start next month; the BAGE has kept their production forecast unchanged at 22 mmt. This compares with the USDA estimate at 19.5 mmt and the Rosario Grain Exchange at 23 mmt.

- The Grain Industry Association of Western Australia has raised its estimate for the region’s wheat production by 8.6% to 12.6 mmt, which would set a record if realized. Total grain production in Western Australia could reach 25.5 mmt, just shy of the 2022 record of 26 mmt.

- Ukrainian grain exports so far this season are down 37% year over year at 7.9 mmt, according to their agriculture ministry. Of that total, wheat accounts for 5.6 mmt, which would be down 21% year over year.

- According to FranceAgriMer, the French soft wheat crop has been 27% planted as of Monday, an increase of 5% from the week prior. This is above last year’s pace by about 10% and compares with the five-year average of 22%.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 563 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 565 to 563.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 617 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 617.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather