10-14 End of Day: Grains Mixed – Wheat Leads Corn Higher, Soybeans Slip

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures closed higher, lifted by wheat and strong export inspections.

- 🌱 Soybeans: Soybean futures settled quietly lower as the market continues to look for news regarding U.S.-China trade discussions.

- 🌾 Wheat: Wheat rises following continued strength in the FGIS export inspections report.

- USDA’s Crop Progress report has not been released due to the government shutdown. Updated figures will be provided when the shutdown ends.

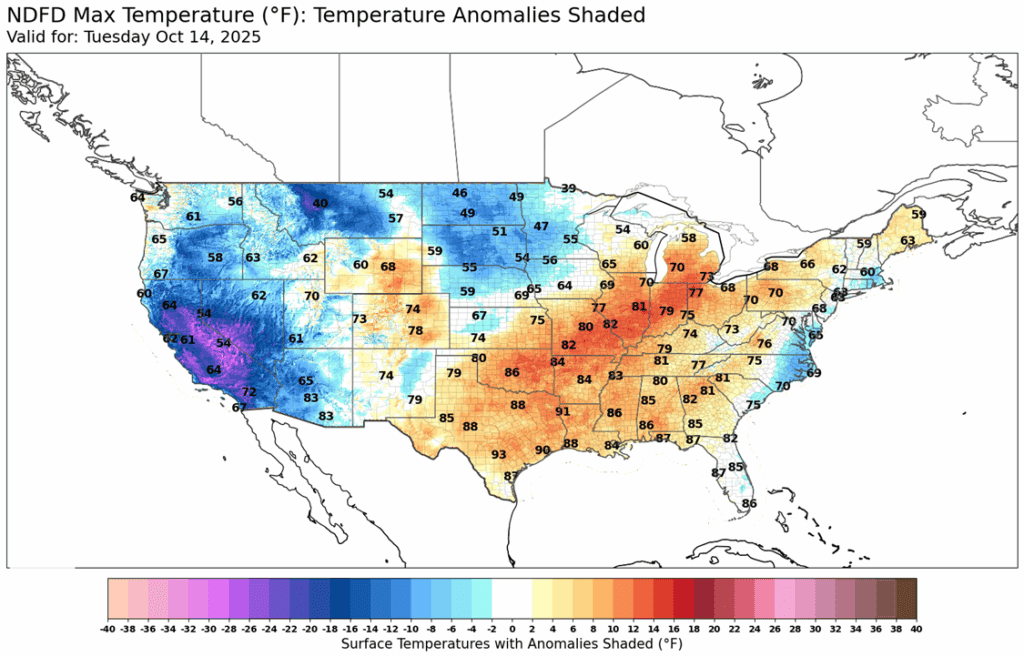

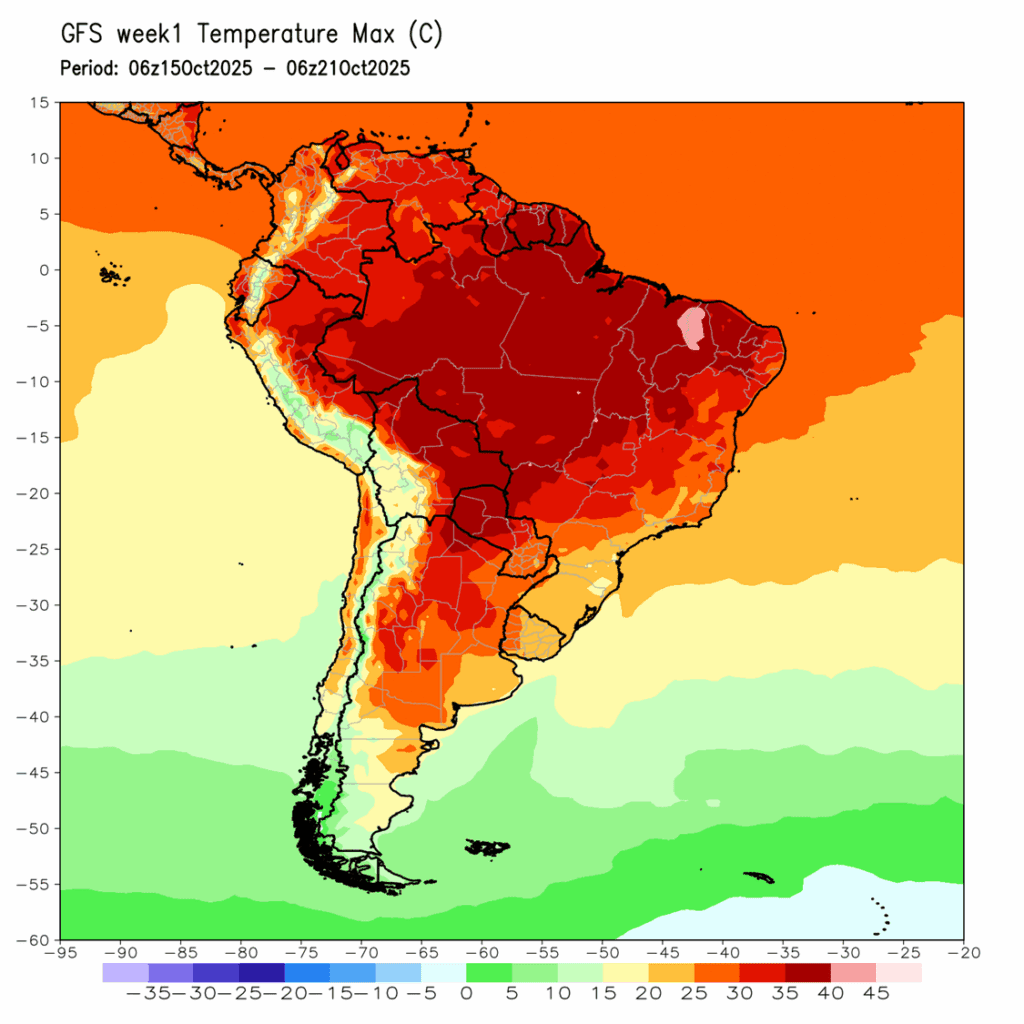

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended a three-day losing streak, finding some buying support from the wheat market, and export inspections to finish the day with positive December corn futures gained 2 ¼ cents to 413, and March added 2 cents to 426 ¼.

- The FGIS released weekly export inspections on Tuesday morning, delayed from yesterday’s holiday. For the week ending October 9, U.S. exporters shipped 1.129 MMT (44.5 MB) of corn. This was down 470,000 mt (18.5 MB) from last week, and below market expectations. Total inspections for the marketing year are 3.1 MMT (122 MB) more than last year’s pace.

- Corn harvest progress has been moving along at a nice pace. It was estimated that 44% of the crop was harvested by the end of last week. Increased precipitation in the forecast for the Corn Belt this week could slow harvest progress.

- The Brazil Ag Agency, CONAB, increased 2024/25 Brazilian corn output by 1.4 MMT to 141.1 MMT from 139.7 MMT forecast last month. A first look at 2025-26, Brazil is anticipated to raise 138.60 MMT of corn on increased planted acres.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

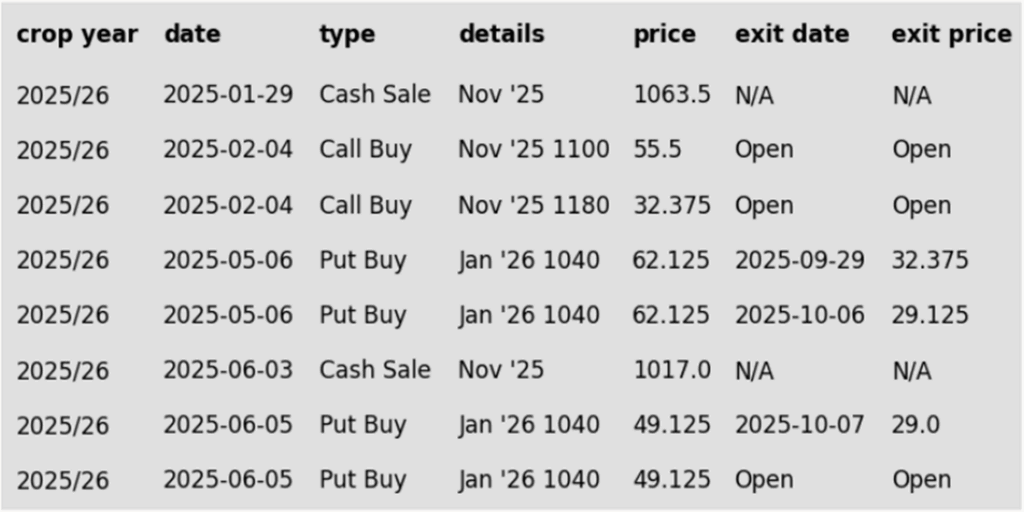

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day quietly lower but rebounded from earlier morning lows. November was down 1-1/4 cents to $10.06-1/2 and March was down ½ cent to $10.39-1/2. December bean meal was up $0.20 to $274.30 and December bean oil was down 0.03 cents to 50.57 cents.

- Futures are still well below all major moving averages following President Trump’s threat of additional Chinese tariffs on Friday. China imported a near record amount of soybeans in September, but none from the United States. Export sales have been decent despite this.

- With the government still shut down, no USDA reports are being released, but estimates for crop progress have been released. The soybean harvest is estimated to be 58% complete, which compares to a Reuters poll last week of 39%. Crop ratings are estimated to be unchanged from last week at 61%.

- In Brazil, soybean planting is reportedly 14% complete as of October 9, according to AgRural. This would compare to 9% last week and 8% at this time last year. This is the third fastest planting pace for the country on record for this time of year.

Wheat

Market Notes: Wheat

- Wheat ended the session higher, led by Kansas City futures. This was likely a technical bounce, as wheat remains oversold, and there is not much in the way of fresh news. However, the U.S. Dollar Index did fall slightly today, temporarily easing pressure on the market. Dec Chi gained 3-1/2 cents to 500-1/4, KC was up 7-1/4 cents at 488-1/2, and MIAX closed 2 cents higher to 553-1/2.

- Despite the government shutdown, traders did receive weekly export inspections data. Wheat inspections were pegged at 16.3 mb, bringing the 25/26 total inspections figure to 392 mb. This is up 18% vs last year. Inspections are running above the USDA’s estimated pace; total 25/26 exports are forecasted at 900 mb, up 9% from last year.

- Southern Brazil has seen a pattern of excess rainfall, making things too wet. This could impact the quality of their wheat crop; harvest is just getting started. With that said, CONAB has increased their estimate of Brazilian wheat production by 2% to 7.7 mmt, versus the USDA figure of 7.5 mmt.

- According to a Reuters poll of analysts, the average estimate of U.S. winter wheat planting progress is 66% complete. This would be up from last week’s guess of 50%. The official USDA data has not been released because of the government shutdown.

- The French agriculture ministry has reduced their estimate of France’s soft wheat production by 0.1 mmt to 33.2 mmt. Nevertheless, if realized, this total would still be nearly 30% above last year’s troubled crop and more than 4% above the five-year average.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 591.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 591.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 591.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 591.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 565 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 567 to 565.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 620 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 620.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day maximum temperature outlook courtesy of ag-wx.com

Above: South America 7-day temperature outlook courtesy of National Weather Service, Climate Prediction Center.