10-13 End of Day: Grains Mixed Following Renewed Optimism of U.S. – China Trade Relations

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures slipped lower as the market lacks the guidance typically offered USDA reports.

- 🌱 Soybeans: Soybean futures closed higher following the announcement of continued U.S. – China trade negotiations.

- 🌾 Wheat: Wheat pressed lower following spillover weakness from corn and strong global production estimates.

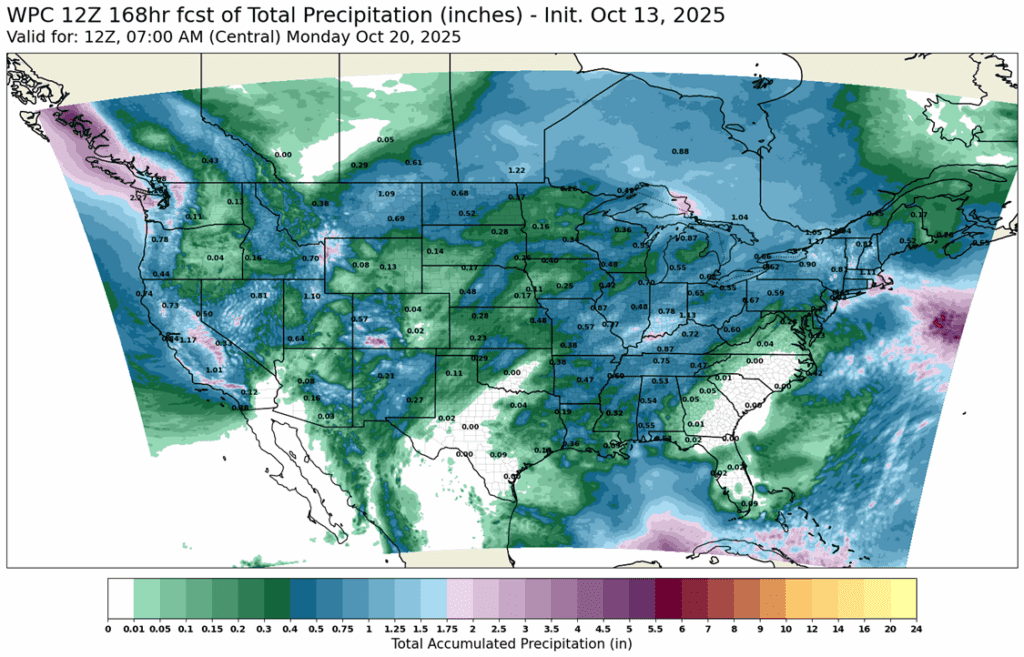

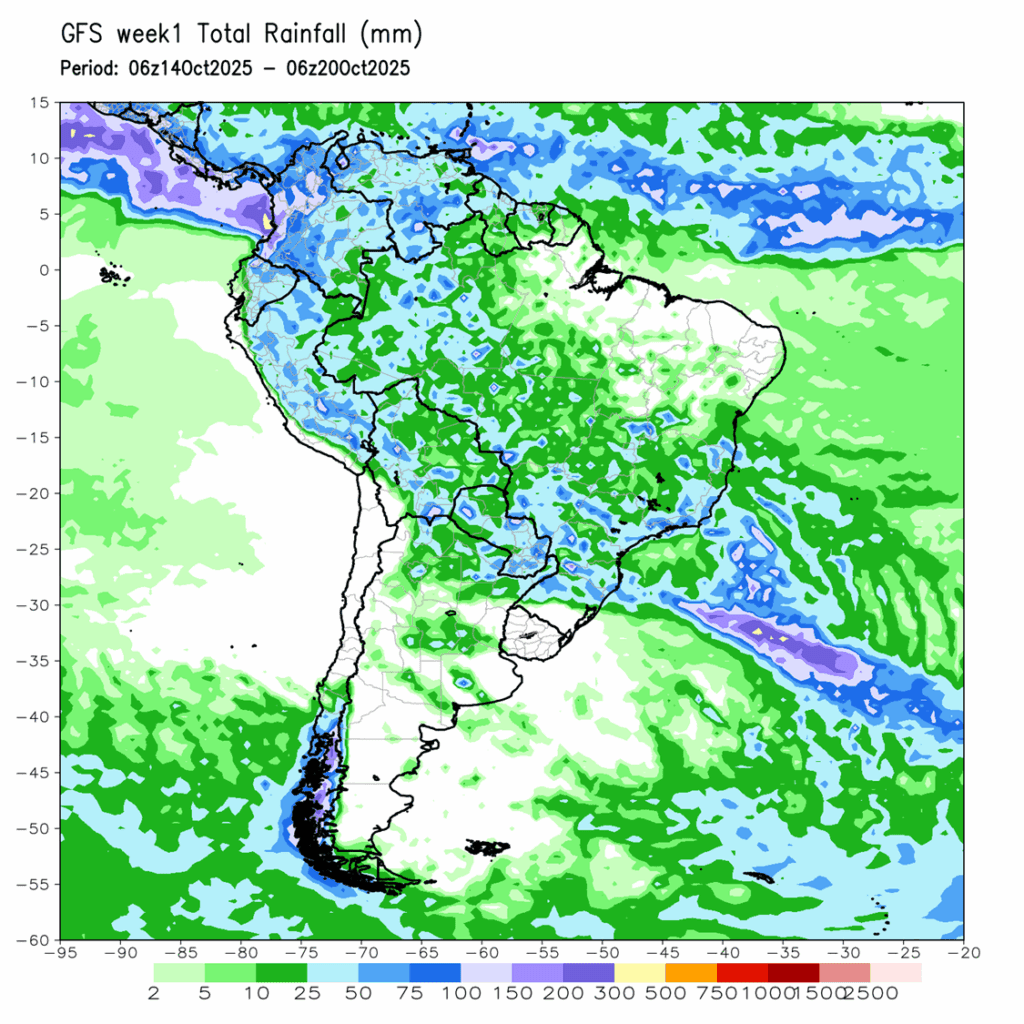

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures started the week with additional selling pressure as the lack of information and ongoing harvest limit market gains. December corn traded lower for the third consecutive session, losing 2 ¼ cents to 410 ¾ and March slipped 1 ¾ cents to 427 ½.

- The ongoing government shutdown limits the information to the market. The lack of USDA information has the market trading with uncertainty. Without information, the path of least resistance remains lower based off the supply picture and harvest pressure.

- The FGIS will release the weekly Export Inspections report on Tuesday morning, delayed because of the Columbus Day holiday. Export inspections are expected to remain strong given the strong start to export sales for the marketing year.

- The Brazil ag consulting group, Ag Rural, reported the first crop corn planting in Brazil has reached 45% complete as conditions remain overall favorable. This is a 4% jump from last year. Brazil’s first crop corn mainly goes to meet domestic demand for Brazil.

- With soybean harvest winding down in some regions, producers are shifting their focus to corn harvest. Logistics may become more difficult as the market handles fresh supplies of a record corn harvest.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

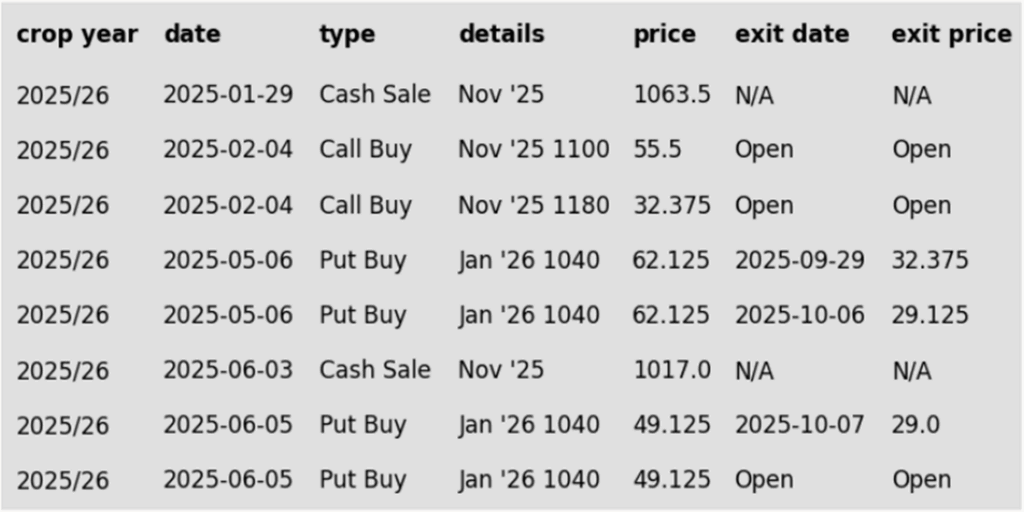

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended Monday’s session with gains following this morning’s announcement that the U.S.-China meeting is still on track. Traders remain optimistic that the meeting could lead to progress in resolving the trade war. Soybeans and soybean oil posted modest gains, while soybean meal experienced losses. November soybeans closed up 1-0 at 10.07-¾.

- China purchased 12.87 million tons of soybeans in September, according to the General Administration of Customs, up 13.2% from 11.37 million tons a year earlier. This made September’s soybean imports the second-highest on record, according to Reuters, driven by strong purchases from South America, as trade tensions prevented any significant purchases from the United States.

- As of Sunday, the U.S. soybean harvest is estimated at around 58% complete, slightly above the five-year average of 57%, but still behind last year’s pace of 64%.

- Brazilian soybean plantings have advanced 5%, reaching 14% complete, well above last year’s pace of 8%. Rain over the past weekend benefited the beans already planted, and monsoon rains are expected to continue across Brazil. Improving soil moisture should support additional planting. CONAB is expected to release updated production estimates tomorrow. Estimates put planted area up 47.4 million ha to 49.1 million ha this season and production is anticipated to hit 179 million tons up from 171.5 million last year.

Wheat

Market Notes: Wheat

- Wheat closed with small losses across all three classes. While a rise in the U.S. dollar today did not help, it did stay below Friday’s high, which may have limited the pressure on wheat. Without the support of the corn market and increasing global crop estimates, the U.S. wheat market remains under pressure. December Chicago lost 1-3/4 cents to 496-3/4, KC was down 1-3/4 to 481-1/4, and MIAX was down 1/4 at 551-1/2.

- According to IKAR, Russian wheat export values fell $3 last week (versus the week before) to $229/mt. Additionally, IKAR is forecasting that Russian wheat exports in the month of October will surpass 4.5 mmt.

- Analyst APK Inform has increased their estimate of Ukrainian 25/26 grain production to 59.1 mmt. Their wheat production estimate specifically was raised by 0.5 mmt to 22.4 mmt. This still falls just short of the USDA’s last projection at 23 mmt.

- According to the Buenos Aires Grain Exchange, the 2025 Argentine wheat crop is rated 96% normal to excellent, and 30% of the crop is flowering. This coincides with increasing production estimates for the country last week as high as 23 mmt.

- Globally, the wheat crop appears to be getting bigger. There is talk that Canada’s wheat production could reach a record high 40 mmt. Furthermore, recent good rains in Australia have boosted confidence in their wheat crop. Additionally, production figures were recently increased for the EU, Russia, and Ukraine.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 593.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan A sale target has been lowered to 593.25.

- The Plan B call option target has been lowered to 594.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 593.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 593.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 567 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 575 to 567.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 622 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 622.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day precipitation forecast courtesy of ag-wx.com

Above: South America 7-day precipitation forecast courtesy of National Weather Service, Climate Prediction Center.