10-10 End of Day: Grains Slide Friday on Harvest Pressure and Renewed China Concerns

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended the week under selling pressure as harvest activity and abundant supplies weighed on the market.

- 🌱 Soybeans: Soybeans ended the week sharply lower after President Trump indicated that the planned meeting with China’s President Xi later this month may no longer take place.

- 🌾 Wheat: Wheat futures closed lower in sympathy with corn and soybeans amid a broad “risk-off” session following reports of escalating U.S.–China tensions. All three U.S. wheat classes posted new contract lows.

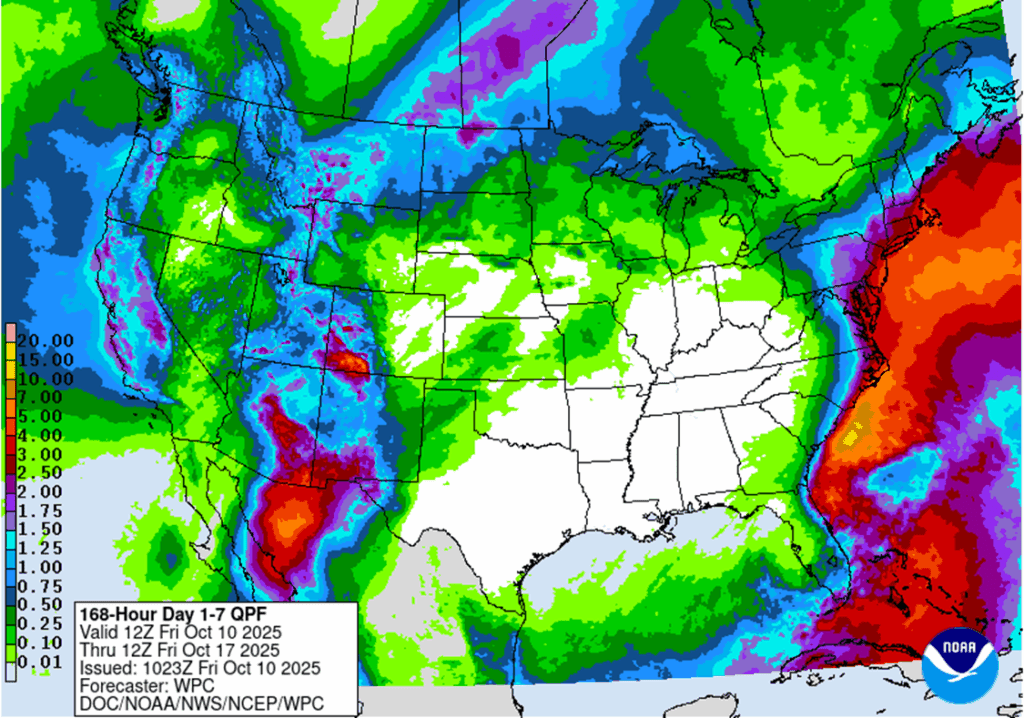

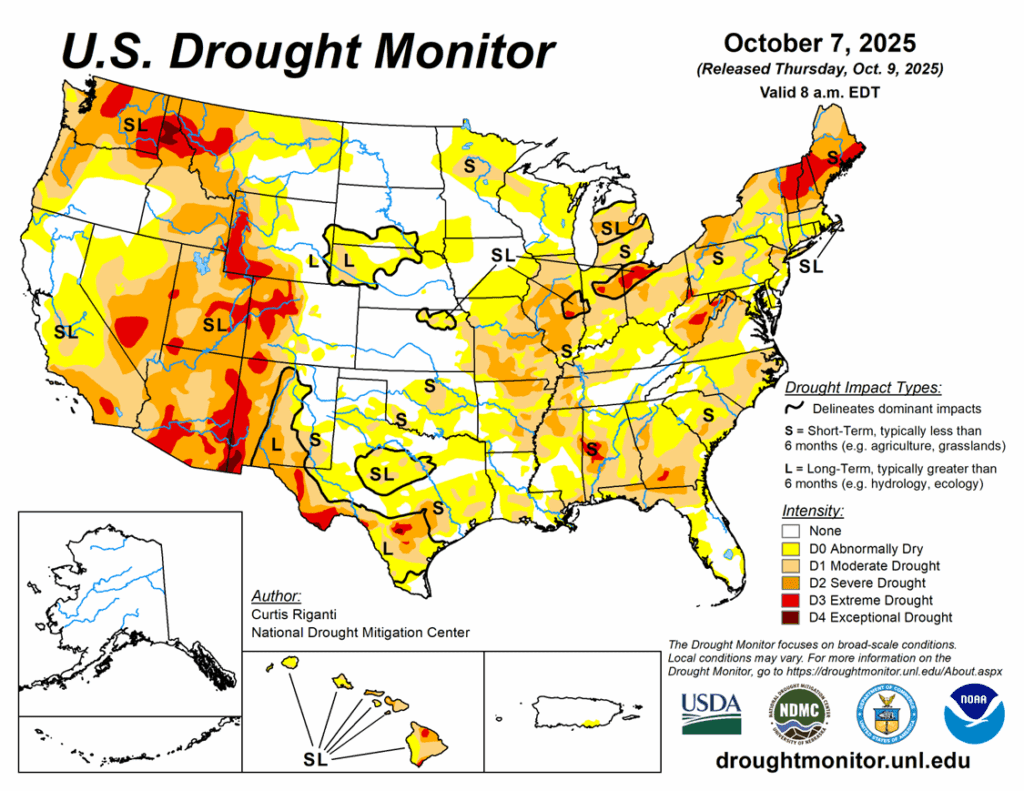

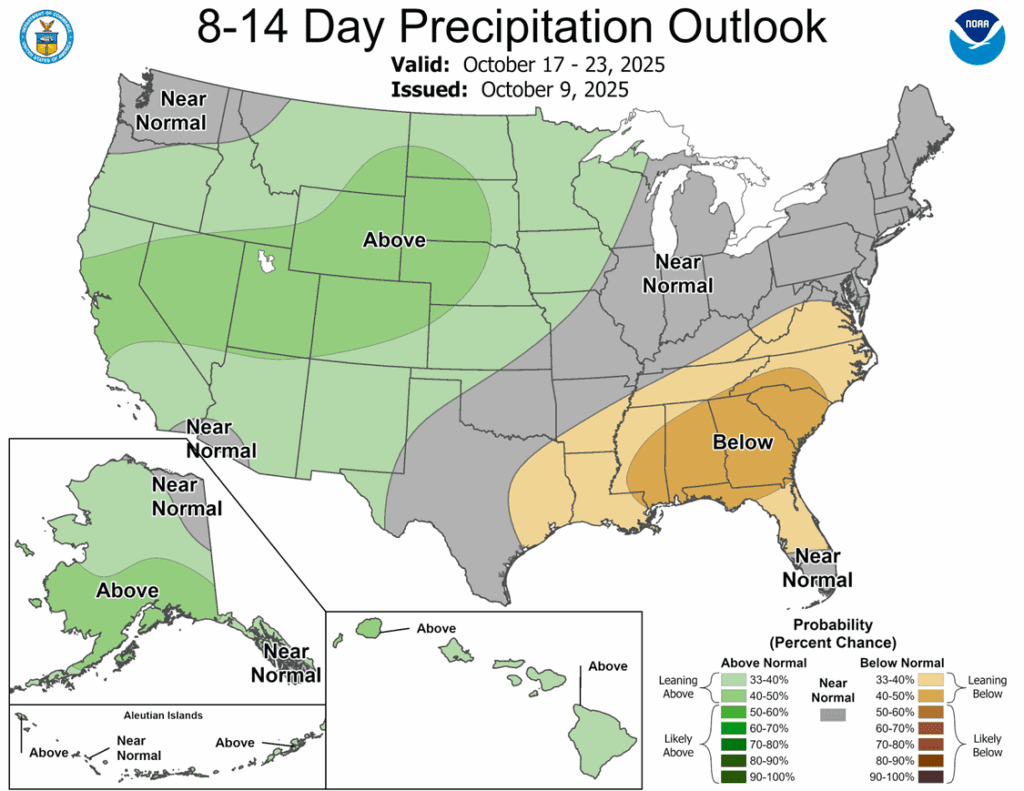

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week with selling pressure as harvest pressure and large supplies originally pressured the market. A late morning announcement by President Trump regarding China and trade only added to the selling pressure. December corn lost 5 ¼ cents to 413, and March fell 5 cents to 429. For the week, December corn lost 6 cents.

- The technical outlook for corn weakened, with the December contract posting its lowest close since August 28. The combination of a soft technical picture and large harvest-time supplies may keep pressure on the market into next week.

- President Trump announced that trade tension with China have increased, and the possible meeting between himself and President XI of China could not happen at the end of the month. In addition, the administration weigh ideas for “massive” new tariffs on Chinese imports.

- Broader markets reflected a “risk-off” tone for the second consecutive session, as rising trade tensions fueled volatility and prompted profit-taking.

- Temperatures through the middle of the month are expected to remain above normal, but precipitation will be more scattered from west to east. The forecast should allow harvest to move at a good pace.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

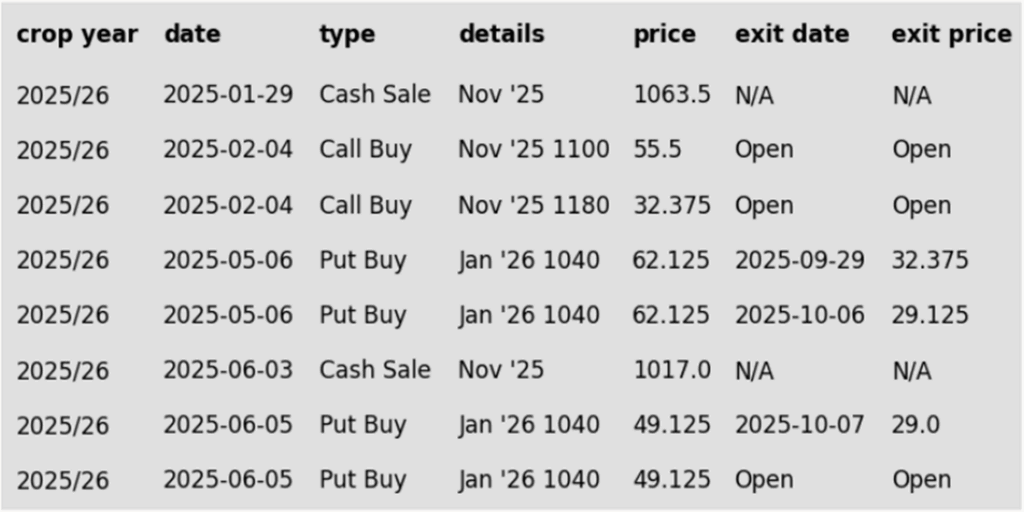

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-half of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 75% of the original position should be closed out, leaving 25% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed the week lower across the entire complex, on weakness in bean oil on an unexpected rise in September Malaysian palm oil stocks reaching a two-year high and ongoing uncertainty surrounding the outcomes of the upcoming U.S.-China meeting in early November. November soybeans are down 15-½ cents at 10.06-¾.

- China continues to show little interest in U.S. soybeans. After returning from their Golden Week holiday, Chinese crushers purchased roughly half a dozen cargoes of Brazilian soybeans for December shipment. This development is concerning for traders, as the window for U.S. soybeans to meet China’s import needs narrows ahead of the South American harvest in early 2026. Adding further uncertainty, President Trump indicated Friday that the planned meeting with China’s President Xi later this month may no longer take place.

- The U.S. soybean harvest is estimated to be 39% complete and is expected to reach 58% by the end of the upcoming weekend. These estimates come from private analysts, as the USDA is not releasing reports during the government shutdown.

- The area of U.S. soybeans affected by drought increased by 2%, reaching 39%, according to the U.S. Drought Monitor. The five-day outlook indicates continued dry conditions, followed by above-average precipitation during days 6 to 10.

- The continued absence of fundamental data — following a second week without export sales reports or commitments of trader positions — is keeping the market in a broad near-term range until the government reopens. In this environment, prices are increasingly sensitive to headlines and technical signals.

Wheat

Market Notes: Wheat

- Wheat closed lower in sympathy with corn and soybeans. A general risk off session was established after news outlets reported increasing tensions between the US and China. All three US wheat classes established new contract lows – December Chicago lost 8 cents at 498-1/2, Kansas City was down 6-3/4 to 483, and MIAX closed 5-1/4 lower at 551-3/4. Reports indicate China will begin imposing port fees on U.S. vessels next week, while President Trump may raise tariffs on Chinese imports. Uncertainty also surrounds the anticipated meeting between the two nations’ leaders later this month, which could delay progress on trade negotiations.

- Also bearish today was the fact that SovEcon once again increased their estimate of 2025 Russian wheat production, this time by 600,000 mt to 87.8 mmt. This compares to the most recent USDA forecast of 85 mmt. In related news, the Russian agriculture ministry reduced the wheat export tax by 35% to 318.6 Rubles/mt through October 21, with the goal of increasing export demand.

- As reported by Interfax, Russia might increase their grain export quota in 2026 to a level above this year’s. The 2025 wheat export quota in particular was 10.6 mmt. Their quotas are valid annually between February 15 through June 30. Additionally, Russia has reported collecting 130 mmt of grain so far, with wheat harvest having reached 91.5 mmt as of October 8; this is 6.5 mmt above last year.

- Since their export season began on July 1, Ukraine has shipped 7.2 mmt of grain through October 10. This is down 39% year over year. Of that total, wheat accounts for 5.12 mmt, which is down nearly 25% year over year.

- In Brazil, harvest is just beginning in the top-producing state of Rio Grande do Sul, estimated at 1% complete. About 58% of the crop is in the filling stage and 18% is mature. With 1.2 million hectares planted, production potential remains strong at this stage.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 597.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 597.50.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather