10-06 End of Day: Grains Finish Mixed as the Shutdown Saga Continues

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures begin the week by posting modest gains on continued export strength.

- 🌱 Soybeans: Soybeans finished lower, pressured by harvest selling and concerns regarding the ongoing government shutdown and lack of trade progress with China.

- 🌾 Wheat: Wheat futures traded lower following pressure created by the U.S. dollar trading higher.

- Commitment of Traders data has not been released due to the government shutdown. Updated figures will be provided when the shutdown ends.

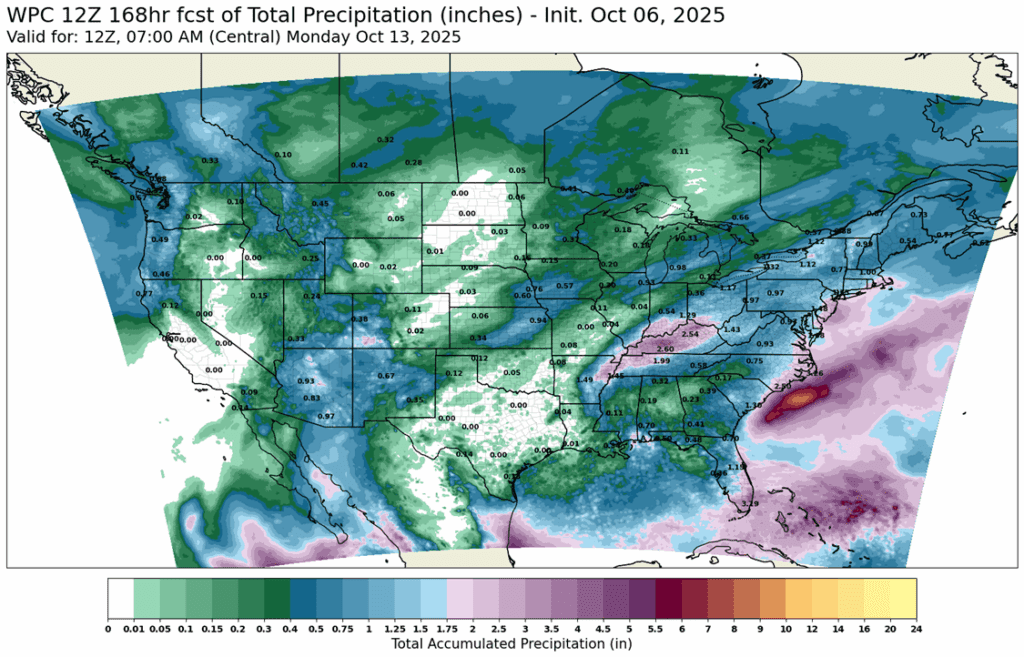

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The front end of the corn market pulled higher during the session, fighting off early selling pressure. The market was supported by good export demand, as prices held around the 420 December price level. December gained 2 ¾ cents to 421 ¾, March added 2 ½ cents to 438 ¼.

- Despite the government shutdown, the FGIS release weekly export inspections. For the week ending October 2, U.S. exporters shipped 1.599 MMT (62.9 mb) of corn. Total inspections for 2025-26 are now at 264.1 mb, up 56% from the previous year.

- Favorable weather over the weekend allowed for good harvest progress. Early session pressure is likely tied to harvest pressure to start the session.

- With fresh supplies of corn in the pipeline as producers have been moving stored old crop and freshly harvest new crop, barge freight rates on the Mississippi River have been on the decline, helping support cash basis in some areas.

- The Trump administration is expected to announce details of a producer aid package on Tuesday. The program will likely be directed towards the soybean crop, but aid for corn production, if included, could influence producer decisions with harvested bushels.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit 1/3rd JAN ’26 1040 Puts ~ 29c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- NEW ALERT – Sell one-third of the remaining January 1040 puts for approximately 29 cents, minus commission and fees.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-third of the remaining January ‘26 1040 puts has been added. This recommendation has been made to continue reducing the put position in a seasonally weak time period. This means that 50% of the original position should be closed out, leaving 50% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

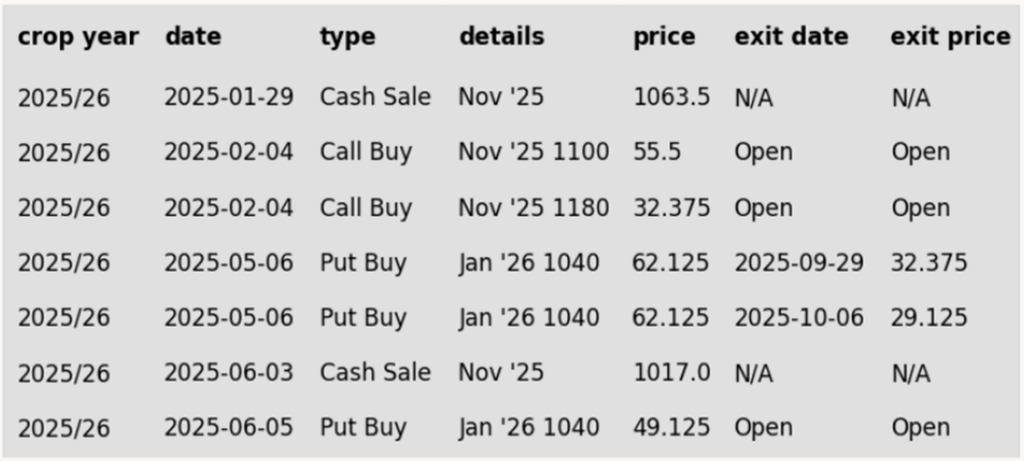

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans began the week on a weaker note, with Monday’s trading session ending lower amid concerns over the ongoing government shutdown. Traders faced the prospect of another week without key government data, including export inspections, the harvest progress report, Commitment of Traders data, and the WASDE report scheduled for later this week. Soybeans and soybean meal moved lower, while soybean oil posted modest gains. November soybeans closed down at $10.17 ¾.

- Export inspections totaled 28 million bushels, in line with expectations but below the 33 million bushels per week needed to meet the USDA’s export forecast. Year-to-date inspections stand at 111 million bushels, down 15% from last year, compared to the USDA’s projected 10% decline. The largest buyers this week were Mexico and Egypt, each taking 7–8 million bushels.

- Soybean planting in Brazil is progressing, with 9.15% of the crop planted and 15.03% completed in Mato Grosso, compared to the average pace of 6.10% for this time of year. Dry weather across much of Brazil this week has supported steady fieldwork, though wet season showers are expected to return next week, which could slow planting progress.

- Port fees on Chinese vessels entering U.S. ports are expected to take effect on October 14. Some reports suggest that China may be reconsidering participation in a meeting with President Trump at the APEC Summit in South Korea, pending resolution of the port fee dispute. Meanwhile, trade talks with India are progressing, with positive discussions continuing around India’s potential imports of U.S. soybeans for both oil production and animal feed.

- The U.S. soybean harvest is 39% complete, compared to 44% last year and the five-year average of 38%. Crop ratings are expected to hold steady at 62% good to excellent.

Wheat

Market Notes: Wheat

- Wheat finished the session with small losses in each of the three classes. A slight gap higher for the U.S. dollar put wheat on the defensive today, as well as continued talk of growing global production, and swift U.S. winter wheat planting progress. December contracts in Chicago closed 2-1/2 cents lower at 512-3/4, Kansas City was down 1-1/2 to 495-1/2, and MIAX lost 3-1/4 to 556-1/2.

- Despite the government shutdown, traders did receive export inspections data today. Weekly wheat inspections amounted to 18.6 mb, bringing the total 25/26 inspections to 374.0 mb, up 18% from last year. Inspections are running above the USDA’s estimated pace; total 25/26 exports are projected at 900 mb, up 9% from the year prior.

- In their tender, Saudi Arabia is believed to have purchased 455,000 mt of wheat for December and January shipment. The average price was reportedly $263/mt on a CNF basis. The Black Sea is believed to be the source of the grain, with it coming primarily from Russia.

- According to IKAR, Russian wheat export valued ended last week at $232/mt on a FOB basis – this would be an increase of $2 from the week before. SovEcon has reported that Russia shipped 4.6 mmt of wheat in September, and they are projecting October exports will increase to 5 mmt. Additionally, Russia will reportedly decrease their wheat export tax by 20% to 493.4 Rubles/mt between October 8-14.

- Argentina had a storm front move through over the weekend bringing widespread rainfall. However, the next 2-3 weeks are forecasted to be dry. This should help to reduce soil moisture levels making conditions more favorable for early wheat development.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 601.5 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 601.5.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day total precipitation forecast courtesy of ag-wx.com

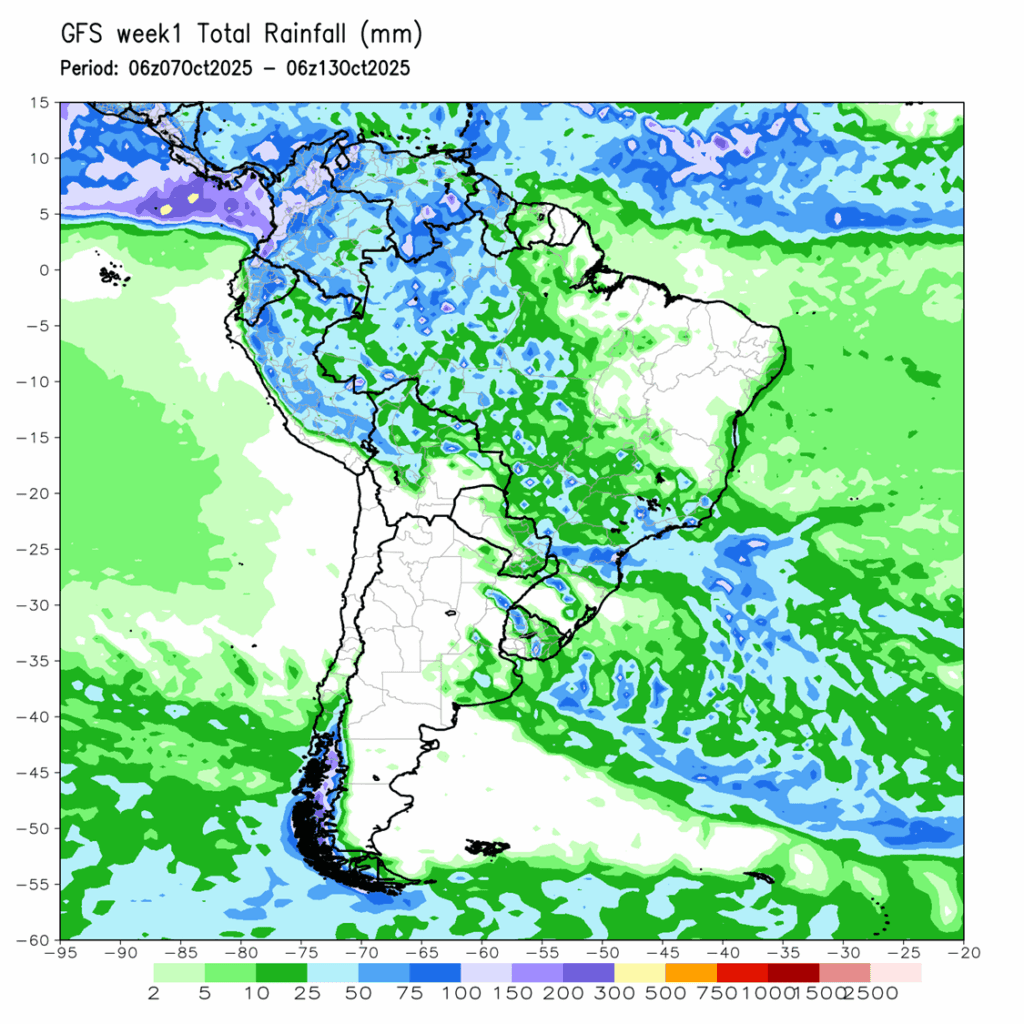

Above: South America 7-day total precipitation forecast courtesy of National Weather Service, Climate Prediction Center.