10-03 End of Day: Grains Fade Friday, Sliding Lower into the Weekend

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended the week with marginal losses under continued harvest pressure and technical selling.

- 🌱 Soybeans: Soybeans eased lower Friday, trimming gains after a midweek recovery, as traders kept focus on the upcoming meeting between President Trump and China’s President Xi.

- 🌾 Wheat: Wheat futures finished the week mixed, with pressure from weaker corn and soybean markets and a lack of fresh supportive news.

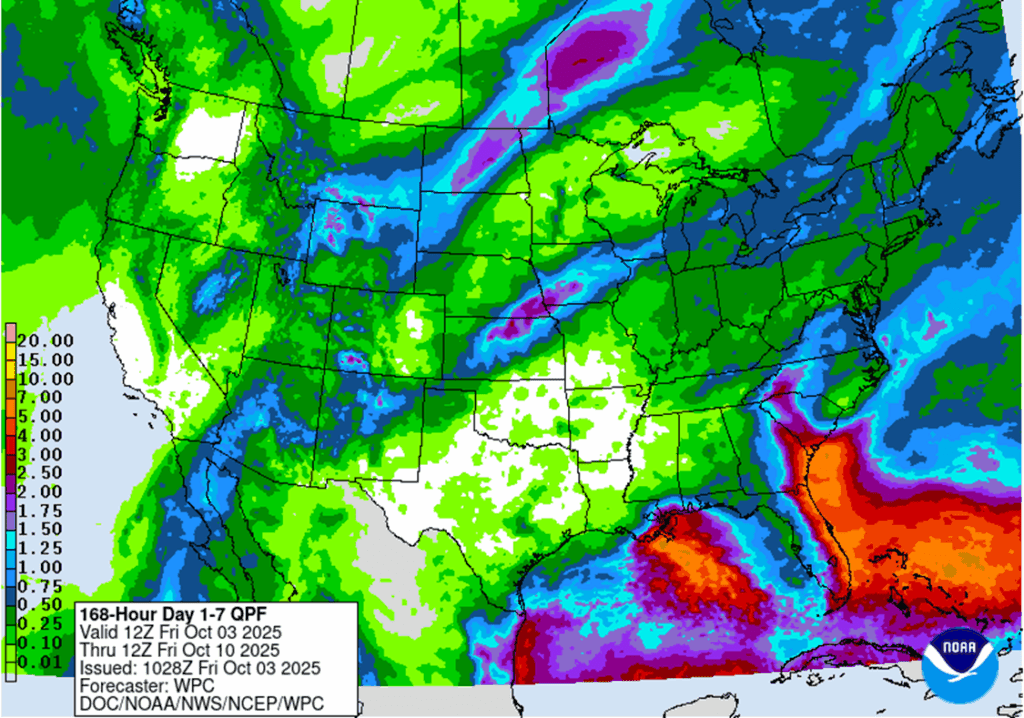

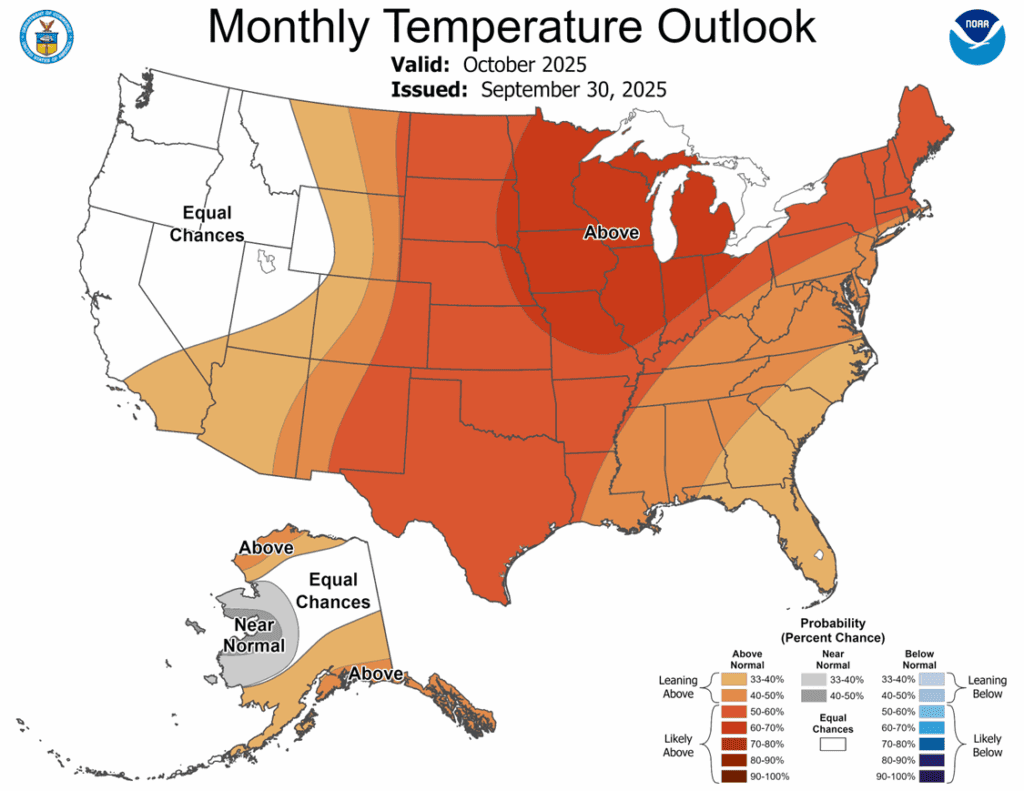

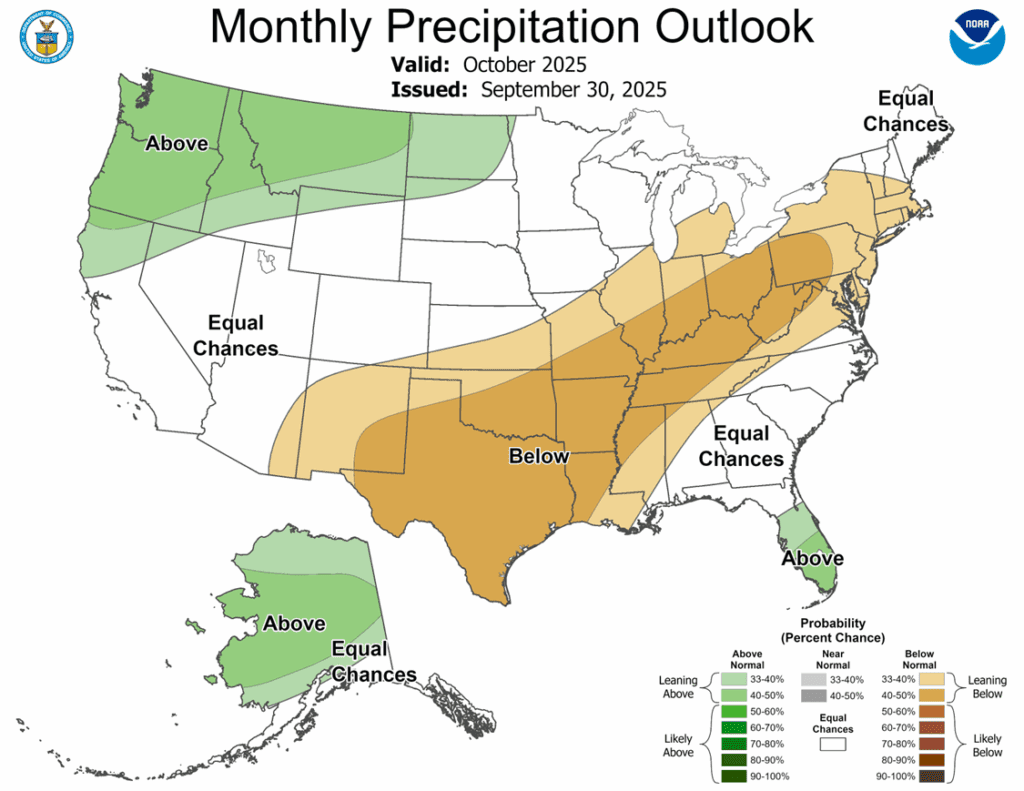

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Harvest pressure and technical selling pushed the corn market lower to end the week as the corn market saw marginal losses. December corn futures lost 2 ¾ cents to 419, and March slipped 2 ¼ cents to 435 ¾. For the week, December corn futures finished lower for the third consecutive week, losing 3 cents this week.

- December futures again met resistance just above 420, where selling pressure emerged and buyers stepped aside. The soft close and lower weekly trend could encourage additional selling into next week.

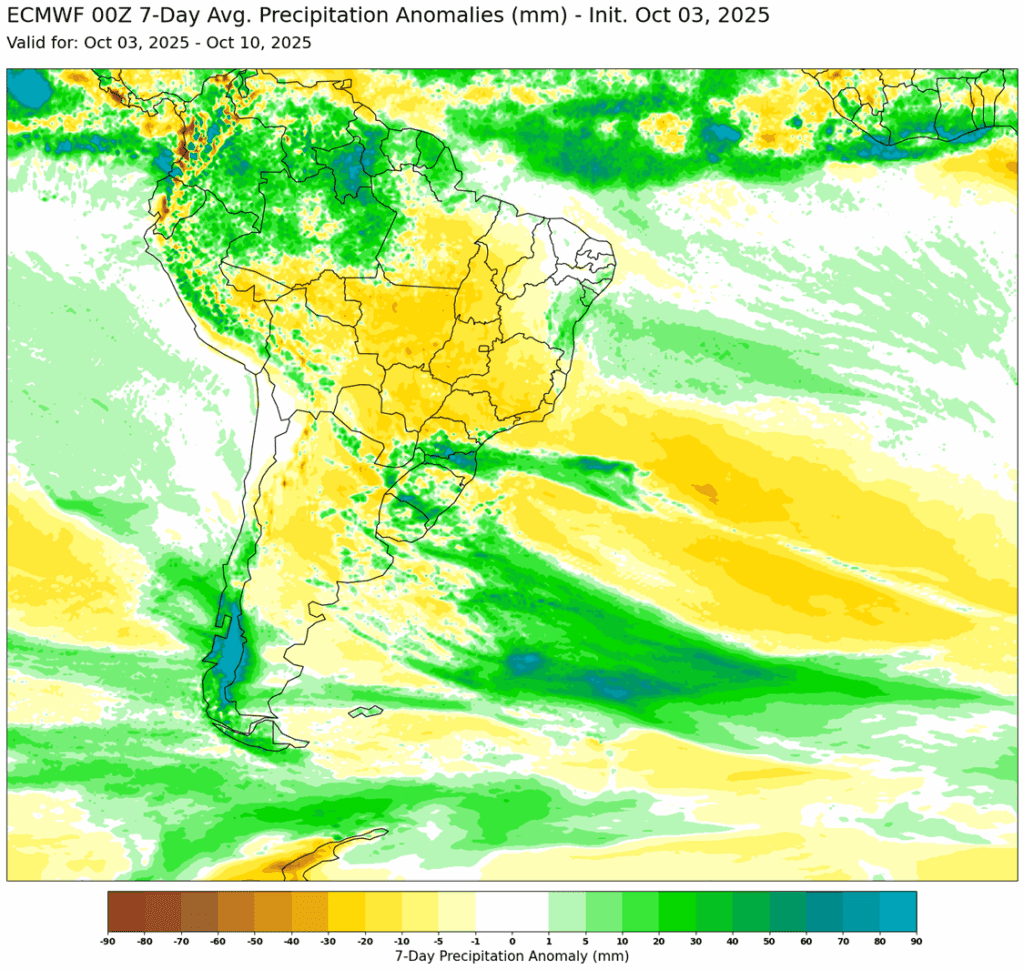

- Long-range forecasts are holding temperatures above normal and precipitation below average into the middle of the month. The favorable harvest conditions will likely keep harvest pressure limiting the market.

- The additional 200 mb of corn supply from Tuesday’s Grain Stocks report will remain burdensome in the corn market, despite the lower trend in yield. Harvest will still push a large amount of supply into the pipeline as end-users try and digest both old and new crop bushels.

- With the government shutdown curbing market data and reports, traders will look for outside support or fresh bullish news to spark rallies.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th JAN ’26 1040 Puts ~ 32c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of the January 1040 puts.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-quarter of the January ‘26 1040 puts has been added. This recommendation has been made to begin reducing the put position in a seasonally weak time period. This means that 25% of the original position should be closed out, leaving 75% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed in the red on the day after looking to have found some momentum at midday. November soybeans lost 5-3/4 cents to $10.18-00 while the March contract was down 4 cents to $10.51-1/4.

- The market will continue to monitor the upcoming meeting between President Trump and China’s Xi as the two leaders will likely discuss soy products.

- S&P Global has lowered their U.S. soybean yield projection by 0.8 bpa to 53 bpa. This compares to StoneX at 53.9 bpa and the USDA at 53.5 bpa.

- Rain is expected for parts of the Western Corn Belt next with some areas seeing up to 2 inches of moisture. This may risk harvest delays.

- Treasury Secretary Scott Bessent announced plans for a new farmer support program amid weak Chinese demand, though details remain uncertain given the government shutdown.

Wheat

Market Notes: Wheat

- Wheat closed mostly lower today, with the exception being December Chicago, which gained 1/2 cent to 515-1/4. Meanwhile, Dec Kansas City lost 2 cents to 497, and MIAX was down 3/4 cent at 559-3/4. A lack of fresh, friendly news, along with increasing global production estimates, kept pressure on the wheat complex today.

- Taiwan Flour Milling Group purchased 80,000 mt of U.S. HRW, soft white, and durum wheat for late-November to early-December shipment.

- Russia had exported 5.7 mmt of grain during the month of September, which was down 28% year over year. Of that total, wheat accounted for 5.1 mmt. Russia’s agriculture ministry has reduced their export tax to 493.4 rubles/mt, a drop of 20%, in an effort to stimulate more exports.

- According to the Buenos Aires Grain Exchange, 93% of Argentina’s wheat crop is rated good to excellent. This is up 4% from the week prior. Additionally, the BAGE increased their Argentine wheat production estimate earlier this week to 22 mmt – the USDA’s last forecast, for reference, was 19.5 mmt.

- The UN Food and Agriculture Organization (FAO) has increased their estimate of 25/26 world grain production by 10.1 mmt to 2.97 bmt. Total grain stocks are forecasted to rise 1.6 mmt to 900.2 mmt. Wheat stocks specifically are projected to increase 2.4 mmt to 320.3 mmt, in part due to good harvests in Russia and Canada.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 594.25.

- Notes:

- Resistance for the macro trend sits at 594 vs December ‘25. A close above 594 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 601.5 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A sale target has been lowered to 601.5.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather