10-02 End of Day: Grains Continue Higher Thursday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures moved moderately higher on Thursday, supported by gains in soybeans.

- 🌱 Soybeans: Soybeans rallied sharply for a second straight session, supported by President Trump’s comments that soybean trade will be a key topic in next month’s meeting with President Xi.

- 🌾 Wheat: Wheat futures ended higher Thursday following corn and soybeans higher.

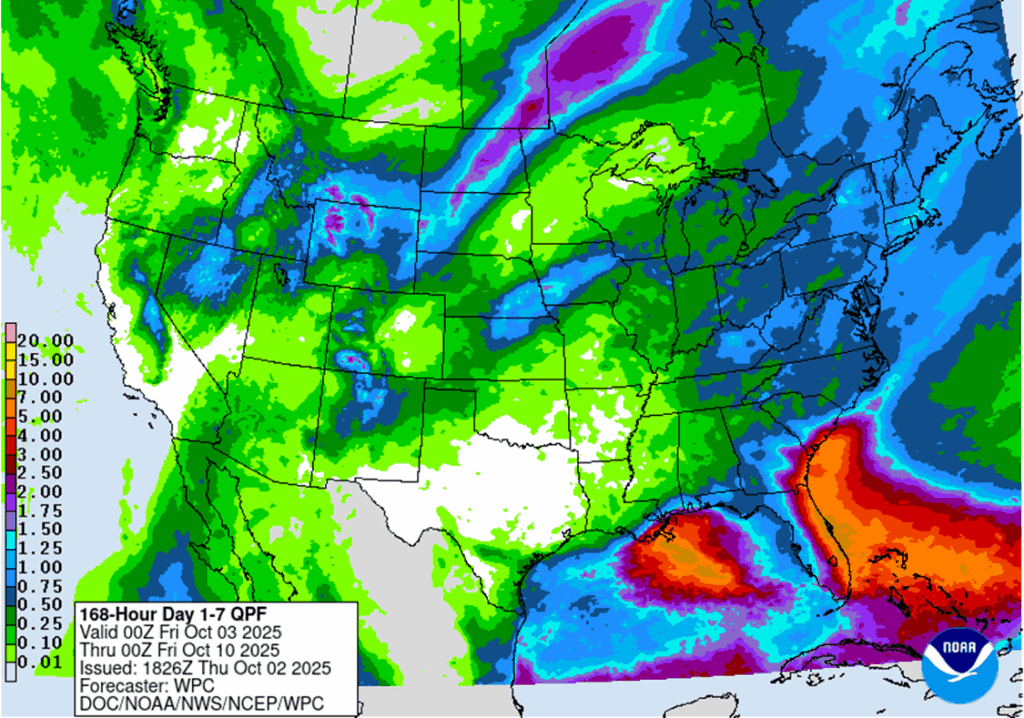

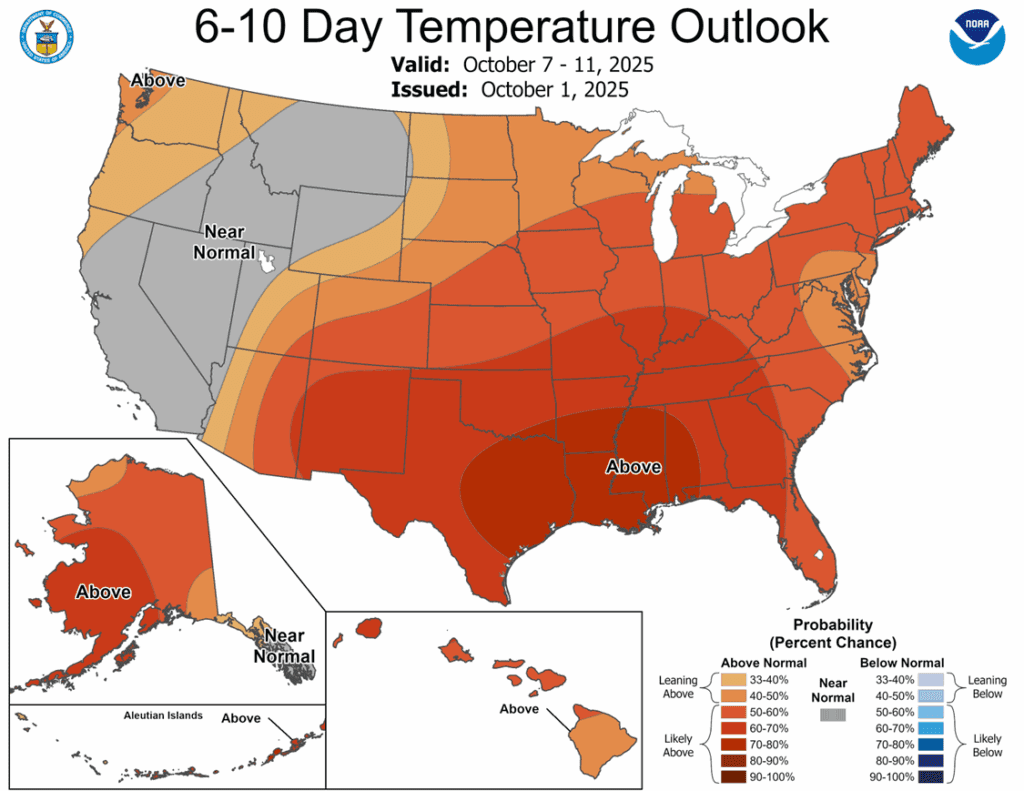

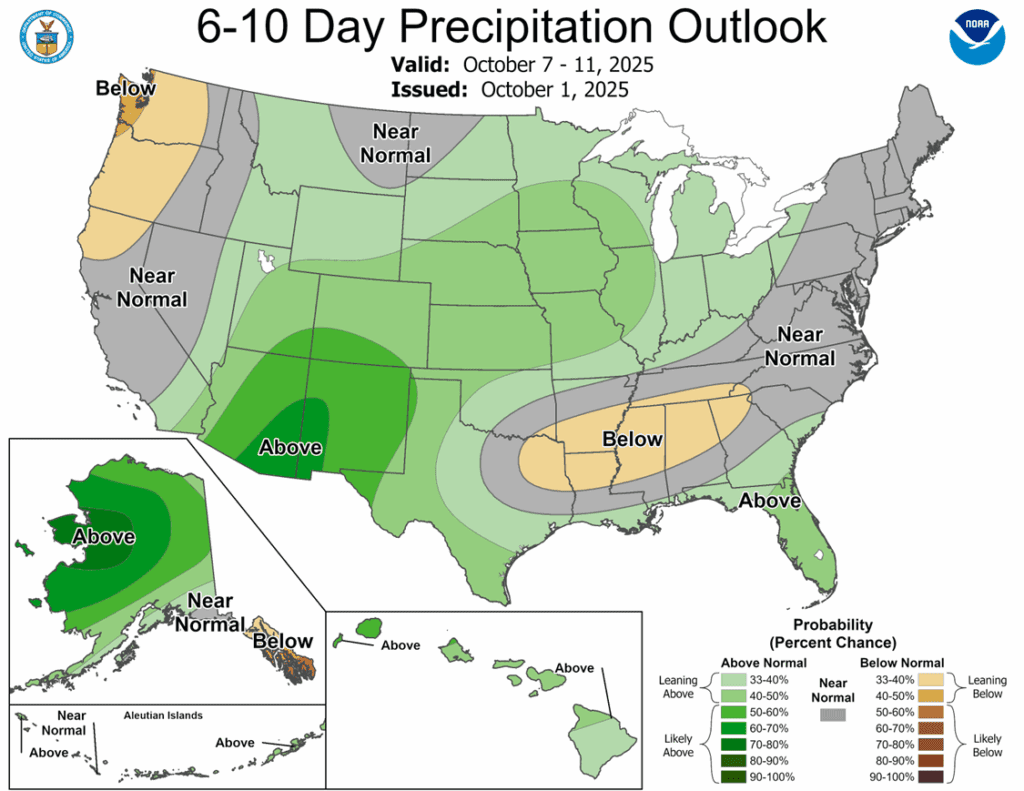

- To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit Half DEC ’25 420 Puts ~ 11c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- NEW ACTION – Sell half of the December 420 corn puts at approximately 11 cents in premium minus fees and commission.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Sell half of the remaining December 420 corn puts today. The December corn contract is about 15 cents off its September high, providing an opportunity to continue incrementally scaling out of the December 420 puts, as this is seasonally the time of year when downside price risk can become more limited. Exiting half of the remaining position leaves just 25% of the original position in place, continuing to provide downside price protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market saw follow-through buying led by strength in the soybean market as corn futures finished with moderate gains. December corn gained 5 ¼ cents to close at 421 ¾, while March Added 5 ¼ to 438.

- The government shutdown continues to limit market information, delaying weekly export sales, daily flash sales announcements, and likely next week’s WASDE report.

- Despite the lack of a WASDE report next week, private analyst groups have been releasing their expectations for corn yield. Two large analyst firms lowered their corn yield estimates below the September forecasts. This keeps the trend of a lower corn yield overall in the market’s mind, which would have been the expectations for next week’s WASDE report.

- Harvest is advancing quickly across the Corn Belt with warm weather aiding maturity, though harvest pressure is expected to cap rallies.

- The strong demand tone and export movement of corn should be reflected in the cash market, supporting cash prices as fresh bushels move into the pipeline. With the lack of government information, the cash market will be the driver of the corn futures prices.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th JAN ’26 1040 Puts ~ 32c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of the January 1040 puts.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-quarter of the January ‘26 1040 puts has been added. This recommendation has been made to begin reducing the put position in a seasonally weak time period. This means that 25% of the original position should be closed out, leaving 75% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher for the second consecutive day following President Trump’s bullish tweet yesterday, stating that some tariff income could go to farmers and that soybean exports would be a major point of conversation when he meets with President Xi in a month.

- November soybeans gained 10-3/4 cents to $10.23-3/4 and are just below the 50-day moving average, while March beans are up 10 cents to $10.56-1/4. October soybean meal gained $6.60 to $271.30 and were a major driver of the soy complex today, while October soybean oil 0.07 cents 49.82.

- Following the excitement of yesterday, speculative traders are believed to have purchased 30,000 contracts of soybeans, 6,500 of soybean oil, and 3,000 of soybean meal. Funds are estimated to remain short around 12,000 soybean contracts, however.

- StoneX has increased their soybean yield estimate by 0.7 bpa to 53.9 bpa and raised their production figure by 69 mb to 4.326 bb. This comes in about 25 mb higher than the USDA’s estimate on the September WASDE report.

Wheat

Market Notes: Wheat

- Wheat rallied today but was perhaps more of a follower of corn and beans than a leader. December Chicago gained 5-1/2 cents to 514-3/4, Kansas City up 3-1/2 at 499, and MIAX increased 3-1/2 to 560-1/2. While a higher close for Matif wheat was supportive to the U.S. market, the gains today were likely follow-through on yesterday’s bullish reversals.

- Export sales data was unavailable due to the ongoing U.S. government shutdown. The October 9 WASDE report is also in jeopardy if the shutdown continues.

- The Ukrainian agriculture ministry is estimating that the winter wheat planted area will increase 9% from their previous estimate (for the 2026 harvest) to 5.2 million hectares. Reportedly, farmers will switch away from corn and sunflower plantings due to drought over the past few months.

- Spec traders were estimated to have purchased around 3,000 contracts of Chicago wheat futures yesterday. That may have increased with today’s rally; however, their total net short position is still believed to be near 100,000 contracts.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 594.25 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 606.75 to 594.25.

- Notes:

- Resistance for the macro trend sits at 594.25 vs December ‘25. A close above 594.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 575 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A sales target has been lowered from 585 to 575.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 631 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 631.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather