1-30 End of Day: Wheat Extends Winning Streak, Defying Corn and Soybean Weakness

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 490.25 | -6.75 |

| JUL ’25 | 504.25 | -4.75 |

| DEC ’25 | 464.25 | -2.5 |

| Soybeans | ||

| MAR ’25 | 1044 | -16.5 |

| JUL ’25 | 1074.5 | -14.25 |

| NOV ’25 | 1053.5 | -10 |

| Chicago Wheat | ||

| MAR ’25 | 566.5 | 4 |

| JUL ’25 | 590.5 | 2.5 |

| JUL ’26 | 643.5 | 3 |

| K.C. Wheat | ||

| MAR ’25 | 588.25 | 8 |

| JUL ’25 | 607.5 | 7.75 |

| JUL ’26 | 647.25 | 6.75 |

| Mpls Wheat | ||

| MAR ’25 | 620.25 | 6.5 |

| JUL ’25 | 637.25 | 6.25 |

| SEP ’25 | 646.5 | 6.75 |

| S&P 500 | ||

| MAR ’25 | 6106.25 | 38.75 |

| Crude Oil | ||

| MAR ’25 | 72.85 | 0.23 |

| Gold | ||

| APR ’25 | 2844.3 | 50.8 |

Grain Market Highlights

- Corn: Prices fell on technical selling and month-end positioning as March futures failed to break the $5 mark.

- Soybeans: Dropped sharply after failing to push through resistance, pressured by weak export sales and a steep decline in soybean meal. Soybean oil remained steady.

- Wheat: Managed to close higher across all three classes, bucking the broader grain market trend, as U.S. and Russian weather concerns continued to support prices.

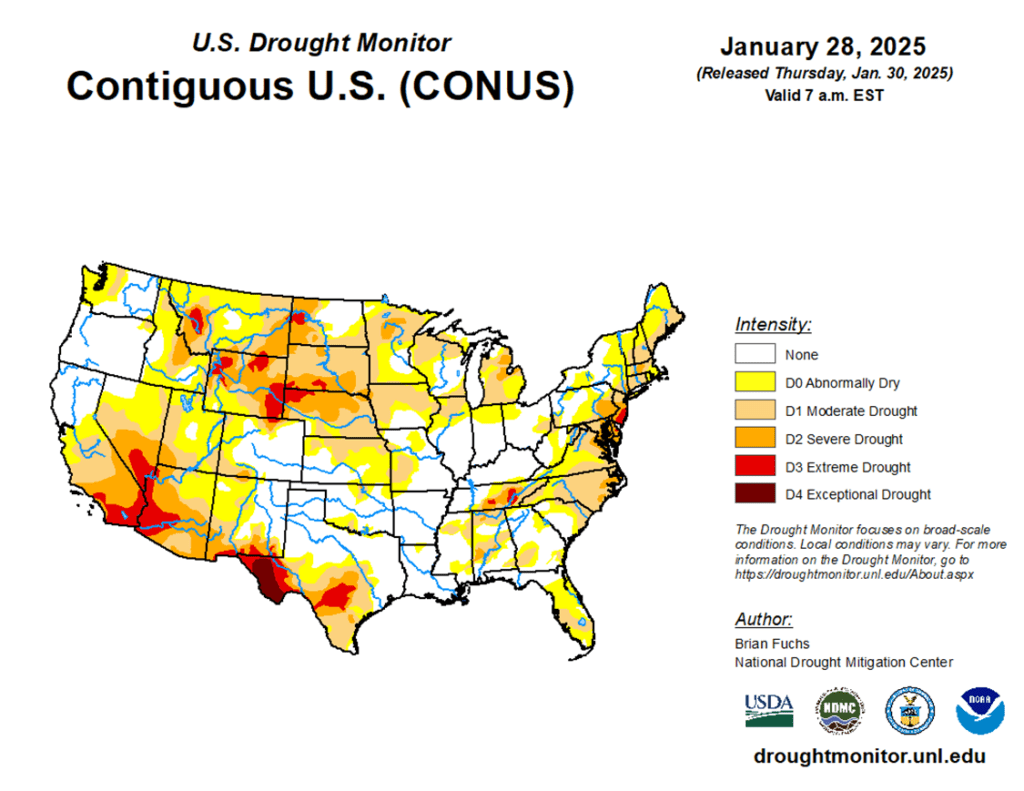

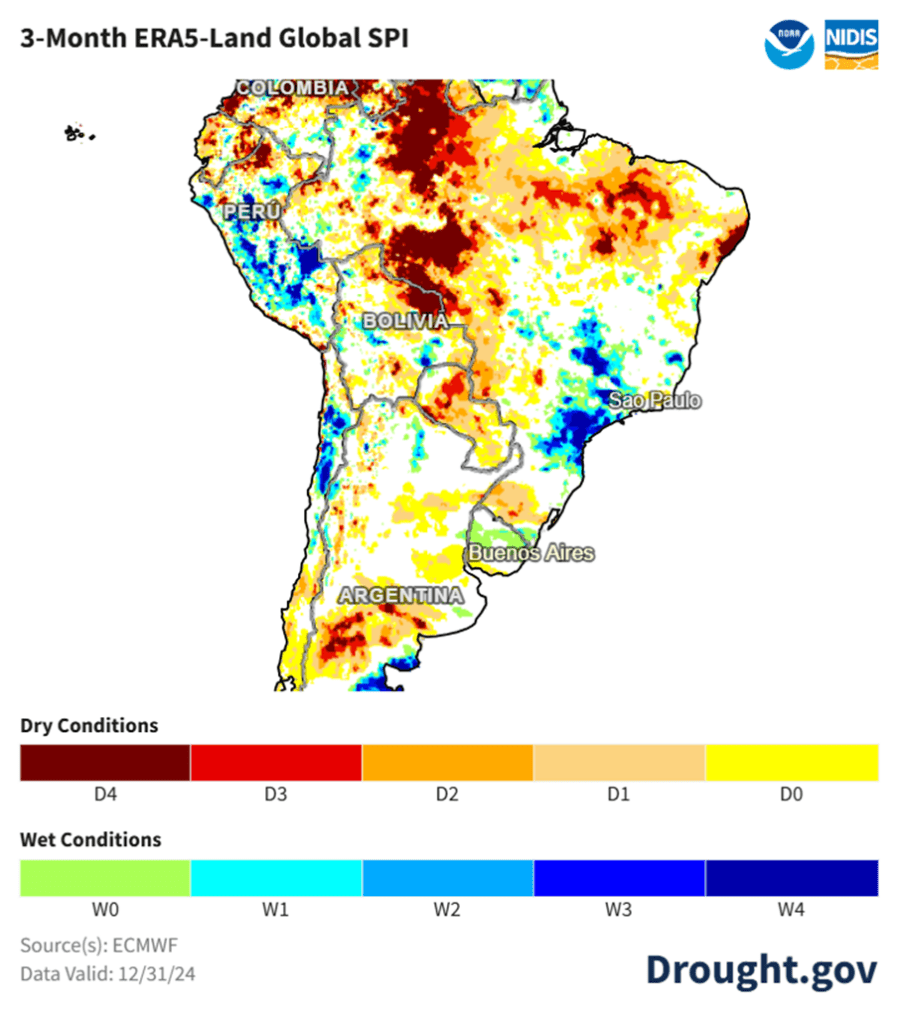

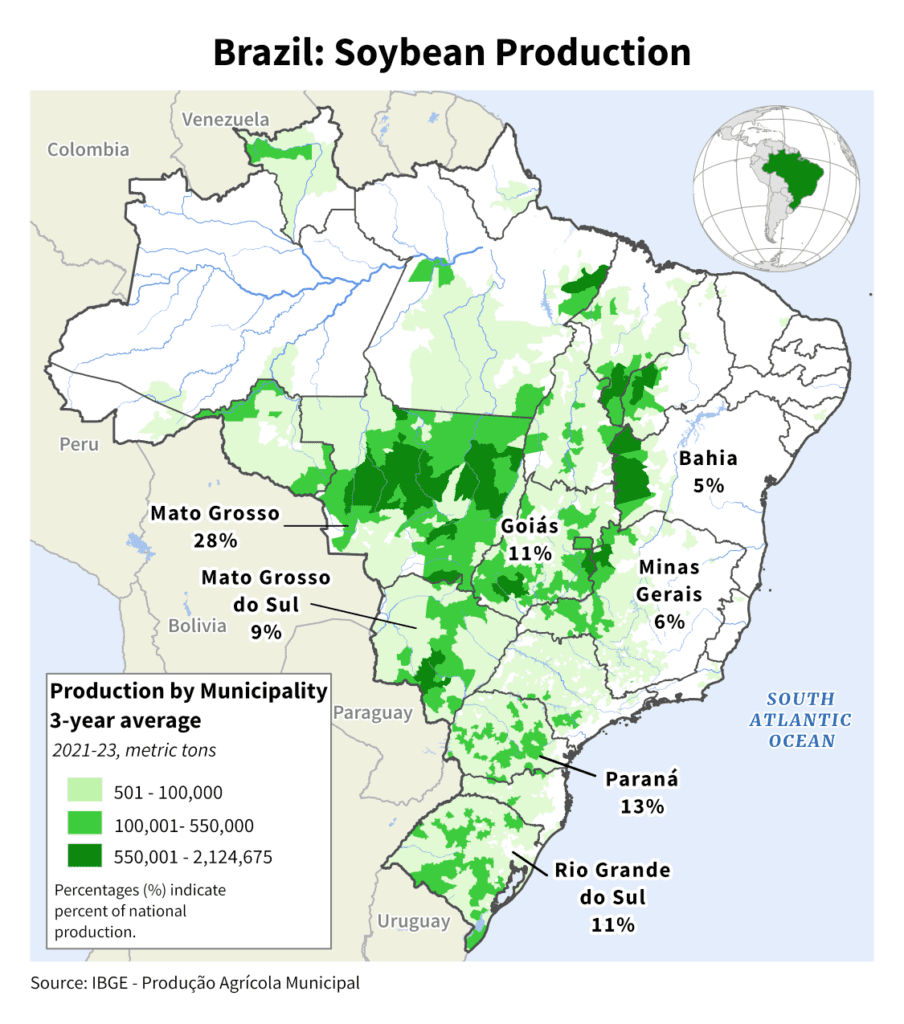

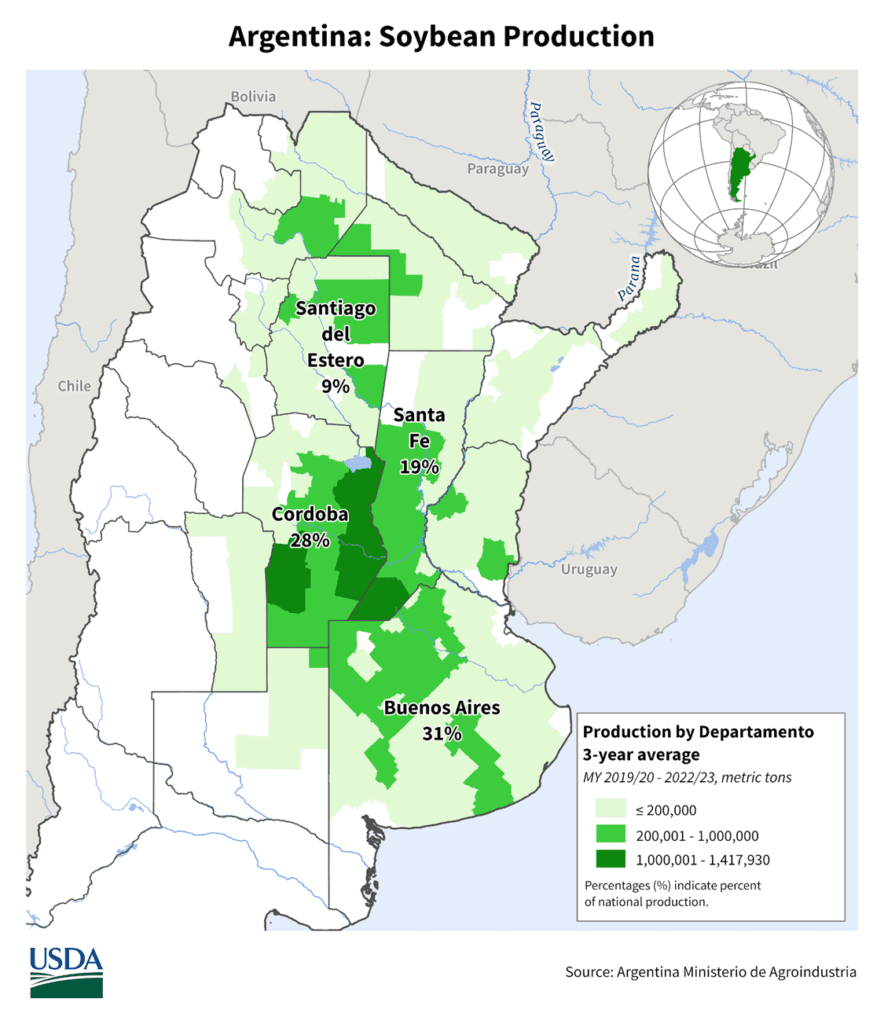

- To see the updated U.S. drought monitor as well as the 3-month drought monitor and soybean production maps for South America scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Next Sales Target Range: Yesterday the March ‘25 contract surged to new highs, closing just within the lower end of the 495 to 515 target range. Given that strong finish — just half a cent shy of the session high — Grain Market Insider is holding off on a sales recommendation for now, allowing for the chance at the upper end of the target range.

- Highest Close: Yesterday’s close marks the highest settlement for front-month corn since October 19, 2023, reinforcing the recent upward momentum.

- Resistance Levels: Key resistance on the front-month continuous chart stands between the September 2021 low of 497.50 and the May 1996 high of 513.50 — historical levels that could challenge further upside.

2025 Crop:

- Opportunity: Yesterday’s close above 465.50 resistance opens the door for the next upside target in the 470-480 range for the December ‘25 contract.

- Downside Support: Key support for December ‘25 sits at 453.75, a level to watch for the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A decisive close above this level could signal broader upside potential heading into the spring planting window.

- Buying Call Options: If prices break above the 479 resistance, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge for existing sales while keeping you positioned for any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 3–5 weeks.

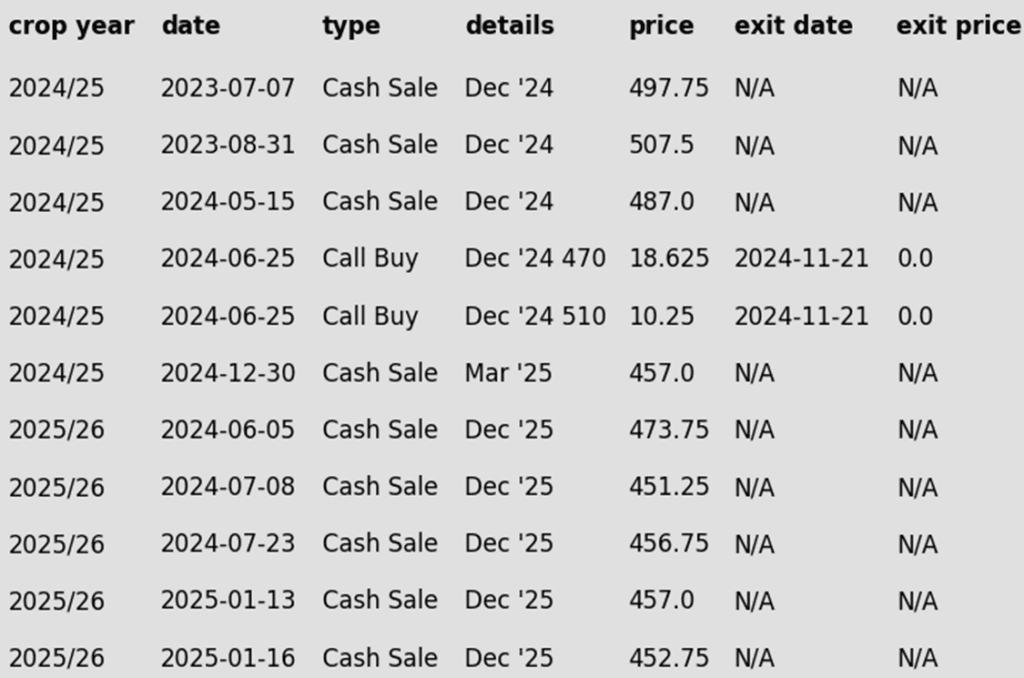

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Sellers stepped back into the corn market on Thursday as prices suffered moderate losses. Technical selling pressured the market with month-end positioning as March corn failed to push the $5 level.

- Going into the Thursday session, the corn market was in an overbought condition as hedge funds were holding a near record long position. With selling pressure in the soybean market, corn futures were pressured lower.

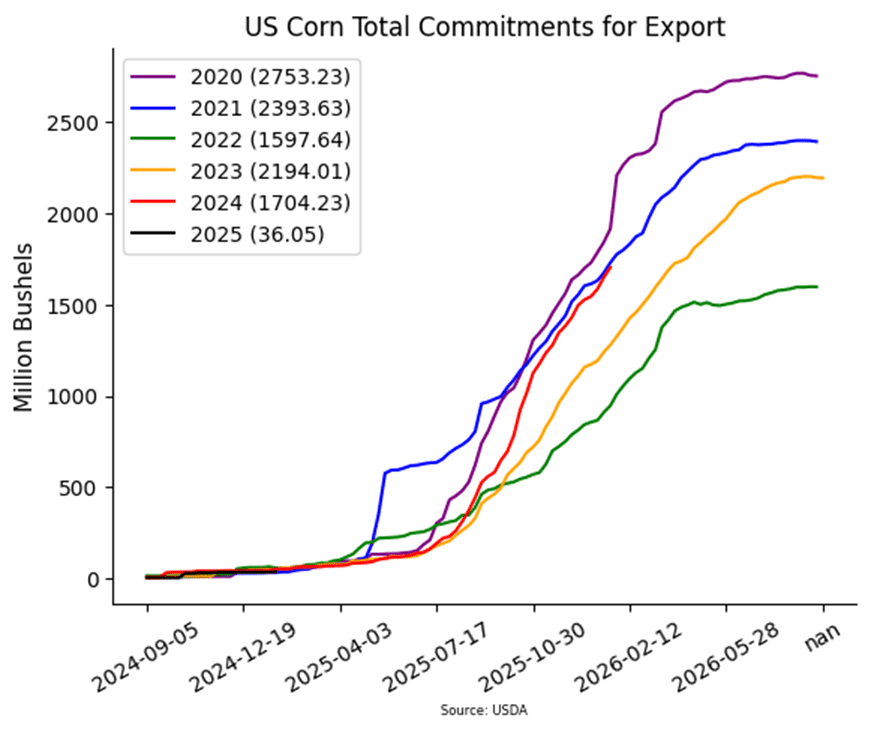

- USDA released weekly export sales on Thursday morning. For the week ending January 23, new corn sales totaled 1.359 MMT (53.5 mb). This total was toward the upper end of expectations but down 18% from last week. Total corn commitments remain strong, still trending 28% ahead of last year’s pace.

- Buenos Aires Grain Exchange rated 78% of the crop as good/normal, down 2% from last week, while poor ratings rose to 22% despite recent moisture improvements.

Corn Uptrend Well Supported

Fund buying and strong demand have sustained the corn market’s uptrend since harvest. Initial support is at 475, with additional support near the breakout area around 450. Overhead resistance is now just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Recent Sales Recommendation: Grain Market Insider recently made a recommendation to sell another portion of your 2024 soybean crop.

- Bulls vs. Bears – The Battle at 1060: Soybean bulls and bears continue to slug it out in the March ‘25 contract around the 1060 level. The 1060 – 1080 zone — a key resistance range Grain Market Insider has been watching — remains the battleground. The big question: Who will win? If the bulls manage to push prices above 1080, the next upside target would be 1150. But if the bears take control, the first downside risk is a retreat toward 1000.

- Fund Activity: Funds have aggressively covered short positions and shifted to a net-long stance on soybeans. This shift reinforces the idea that now remains an opportune time to capitalize on the rally.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling the first portion of your 2025 soybean crop.

- First Sale Recommendation: Grain Market Insider recommended initiating 2025 soybean sales yesterday, as the November ‘25 contract closed at a fresh high of 1063.50. Since last Wednesday, November ‘25 has gained approximately 16 cents, yet the March ‘25 / November ‘25 spread has flipped from an 18-cent inversion to a 3-cent carry. With this spread trending bearish and significant resistance looming near 1070, now looks like a strategic opportunity to start locking in new crop sales. Especially as Grain Market Insider is prepared to quickly recommend reowning this sale with call options if needed.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

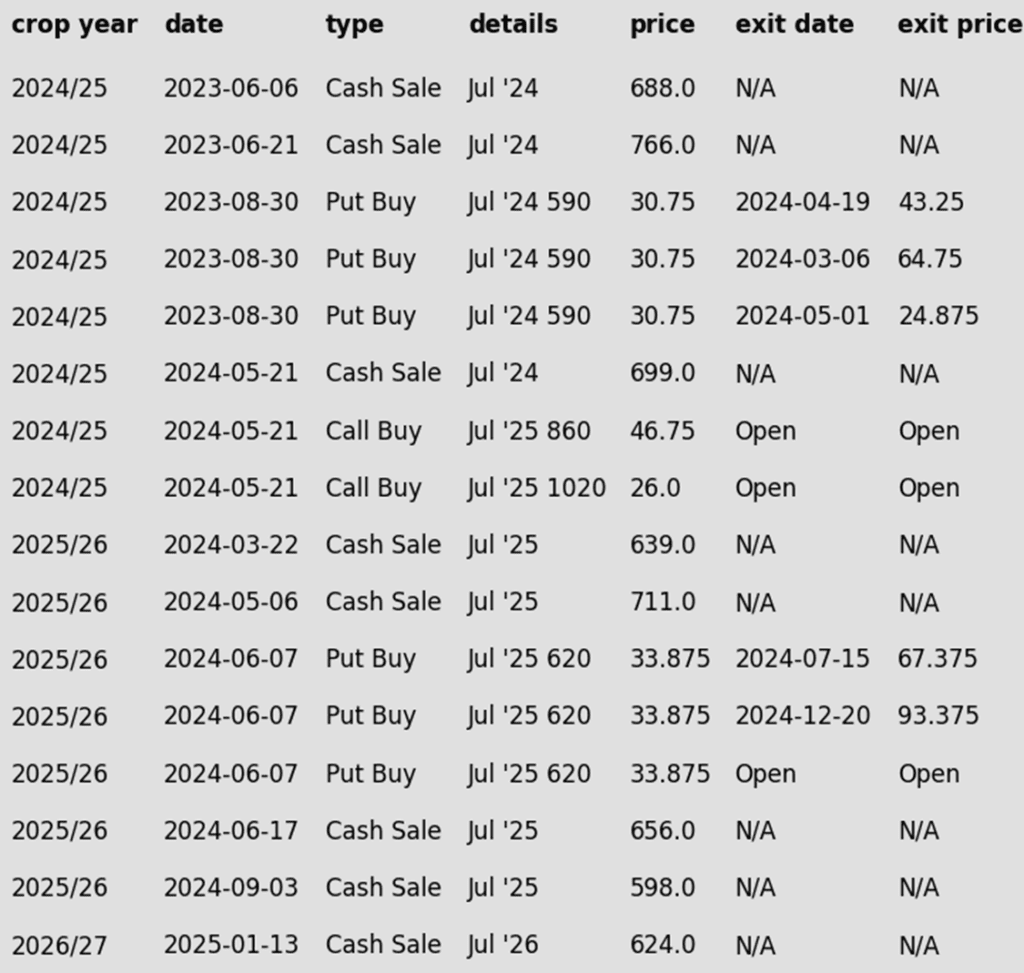

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly lower meeting resistance at $10.60 in March yesterday and were unable to break that level again today. Export sales were disappointing today, which pressured prices, and lower soybean meal added to that pressure losing $5.10 in March. Soybean oil was relatively unchanged to slightly higher.

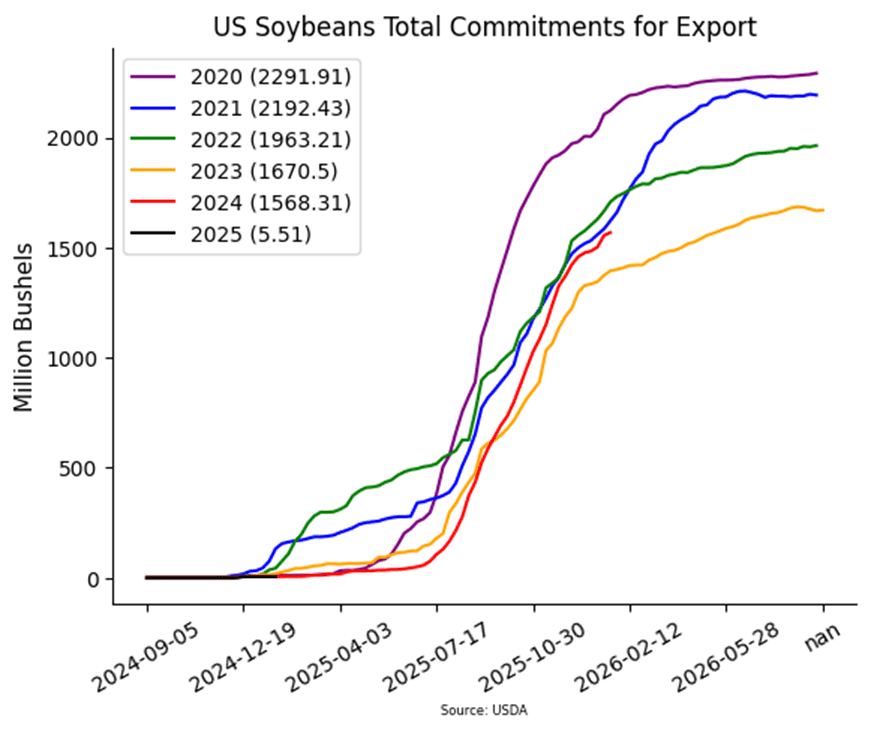

- The USDA announced weekly export sales on Thursday morning. For the week ending January 23, new soybean sales totaled 438,000 MT (16.1 mb). This was below market expectations and down 71% from last week’s totals.

- Despite seeing scattered rainfall last week, Argentina crop ratings did not improve. According to the Buenos Aires Grain Exchange, The Argentina soybean crop was 72% good/normal and 28% poor. The poor category was unchanged from last week.

- With U.S. tariffs on China, Mexico, and Canada set to take effect this weekend, concerns over potential trade retaliations threaten future soybean exports.

Soybeans Face Long-Term Resistance

Front-month soybeans hit resistance at the 200-day moving average in January, a level capping gains for over 18 months. Support is expected near 1000 on a pullback. Initial resistance lies at the 200-day and recent highs around 1060. A weekly close above 1060 could pave the way for a test of the 1100 level.

Wheat

Market Notes: Wheat

- Wheat closed with modest gains, as there is continued concern about winterkill in both the US and Russia. Also offering support today was a higher close for Matif wheat futures, a slight drop in the US Dollar, and reports that there were new Russian drone attacks on Ukrainian grain storage facilities.

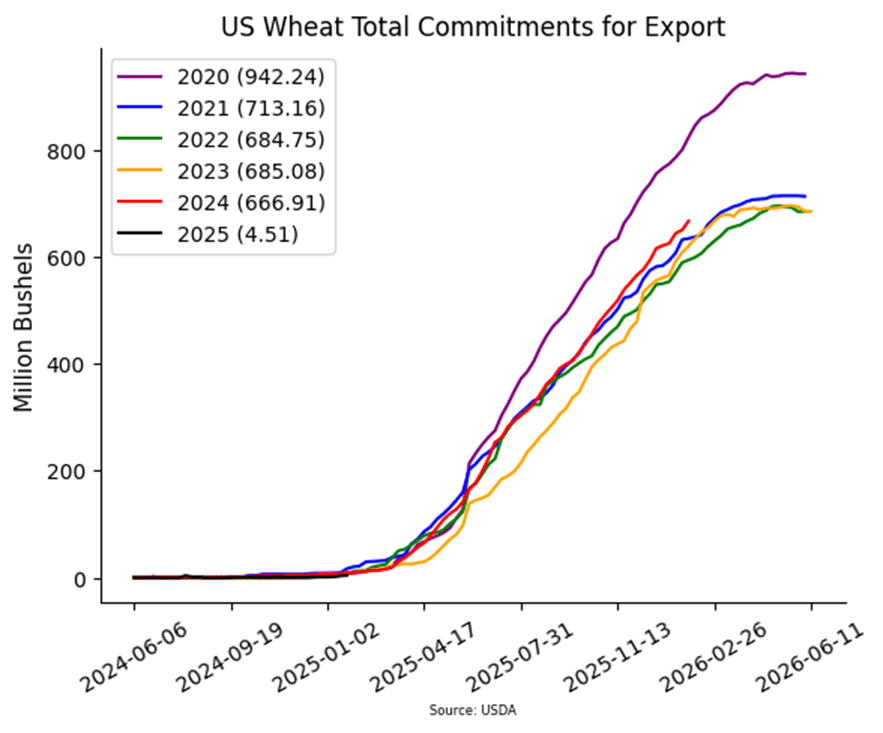

- Weekly wheat export sales totaled 16.8 mb for 24/25 and 0.9 mb for 25/26, while shipments of 21.6 mb exceeded the 19.5 mb/week pace needed to reach USDA’s 850 mb target. Total commitments for 24/25 are now at 667 mb, up 8% from last year.

- SovEcon lowered its Russian wheat export forecast from 43.7 mmt to 42.8 mmt, citing upcoming export quotas starting Feb. 15. Meanwhile, Russia’s ag ministry reports 82% of the winter wheat crop is in good to satisfactory condition, though weather remains a risk.

- February temperatures in India are expected to be above average, potentially reducing wheat yields. If production drops significantly, India — normally a self-sufficient wheat consumer — could become a net importer, a bullish factor for global wheat markets.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: Grain Market Insider maintains a target range of 680–705 for March ’25 for the next sale.

- Sales Recommendations to Date: So far, three sales recommendations have been issued for the 2024 Chicago wheat crop. The current target range aligns with two earlier recommendations. If you’re behind on sales, this range presents a solid opportunity for a heavier sale.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue holding. While actionable targets remain out of reach, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

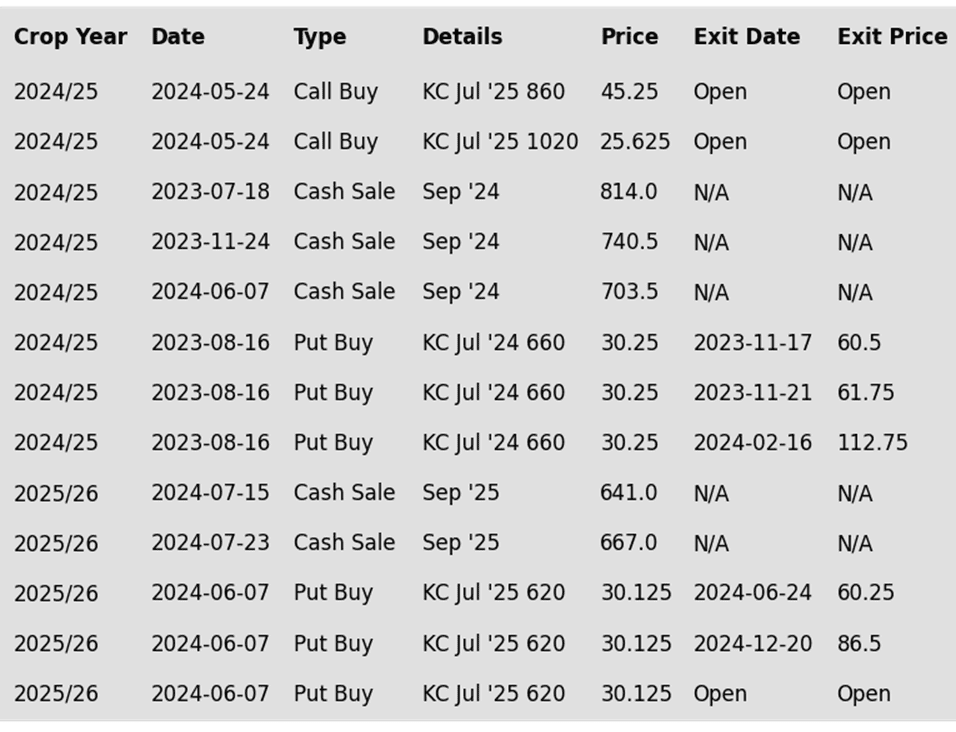

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stays Rangebound

Front-month Chicago wheat remains confined between 530 and 577. A breakout above the 577–586 resistance zone could prompt a retest of 617, while a close below 536 may lead to a decline toward the 521–514 support range.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range for selling more of your 2024 HRW wheat crop remains 650–700 vs. March ’25.

- Sales Recommendations to Date: Grain Market Insider has issued just two sales recommendations so far, reflecting last year’s significant yield uncertainty and limited post-harvest opportunities. These two recommendations, though widely spaced, averaged around 719 vs. July ’24 futures. A sale within the next target range will lower this average, but upside opportunity expectations remain modest for now.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue to hold. While actionable targets are still a way off, these options have about five months remaining until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Maintains Range

KC wheat has traded between 536 and 583 since November, with initial resistance near the 100-day moving average at 568. A close above 583 could pave the way for a move toward 600, while a close below 536 risks a decline to 525.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potential Sales Target Range: The initial target for another sale of your 2024 HRS wheat crop is a rally to the 610–635 range vs. March ’25. That said, keep in mind that the near-record short position held by the Funds could lead Grain Market Insider to adjust this target range higher as price action develops.

- Open Call Options: If you hold the previously recommended KC July ’25 860 and 1020 call options, continue holding them. While actionable targets remain distant, these options have about five months left until their expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Holds Range

Minneapolis wheat remains rangebound between 585 and 613. A breakout above 613 could spark a rally toward 655, with interim resistance at 624 and 637. Conversely, a close below 585 may trigger a decline toward November lows near 568.

Other Charts / Weather