1-30 End of Day: Corn, Beans, and Chicago Wheat Post Key Reversals on Turnaround Tuesday

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 447.75 | 7.5 |

| JUL ’24 | 467.25 | 8 |

| DEC ’24 | 480.25 | 5.75 |

| Soybeans | ||

| MAR ’24 | 1218.75 | 24.5 |

| JUL ’24 | 1236.25 | 21 |

| NOV ’24 | 1197.25 | 17 |

| Chicago Wheat | ||

| MAR ’24 | 605.5 | 12 |

| JUL ’24 | 620.25 | 10.75 |

| JUL ’25 | 657.25 | 8.5 |

| K.C. Wheat | ||

| MAR ’24 | 630.75 | 12.5 |

| JUL ’24 | 623.5 | 8 |

| JUL ’25 | 660 | 10.75 |

| Mpls Wheat | ||

| MAR ’24 | 699.75 | 6.5 |

| JUL ’24 | 711 | 6.25 |

| SEP ’24 | 719.5 | 6 |

| S&P 500 | ||

| MAR ’24 | 4953.5 | -1 |

| Crude Oil | ||

| MAR ’24 | 77.72 | 0.94 |

| Gold | ||

| APR ’24 | 2054.7 | 10.1 |

Grain Market Highlights

- Carryover strength from neighboring soybeans helped support the corn market which saw strong buying and possible short covering from early in the session. After printing a fresh contract low in the overnight, March corn closed just off its high of the day in a bullish key reversal.

- Buying activity in the soybean complex built up steam throughout the day as confidence waned in the forecasted rain amounts for Argentina. March soybeans posted a key bullish reversal and closed within 2 ½ cents of the day’s high.

- Soybean meal also likely saw additional support on tight supplies from the extreme cold earlier this month that reduced crushing capacity. Soybean oil posted a bullish reversal in concert with soybeans, though the market continues to see resistance from Chinese demand concerns and lower biodiesel RIN values.

- Chicago and KC led the wheat complex to a strong finish, with all three classes closing within 2 cents of their respective highs and Chicago posting a key bullish reversal.

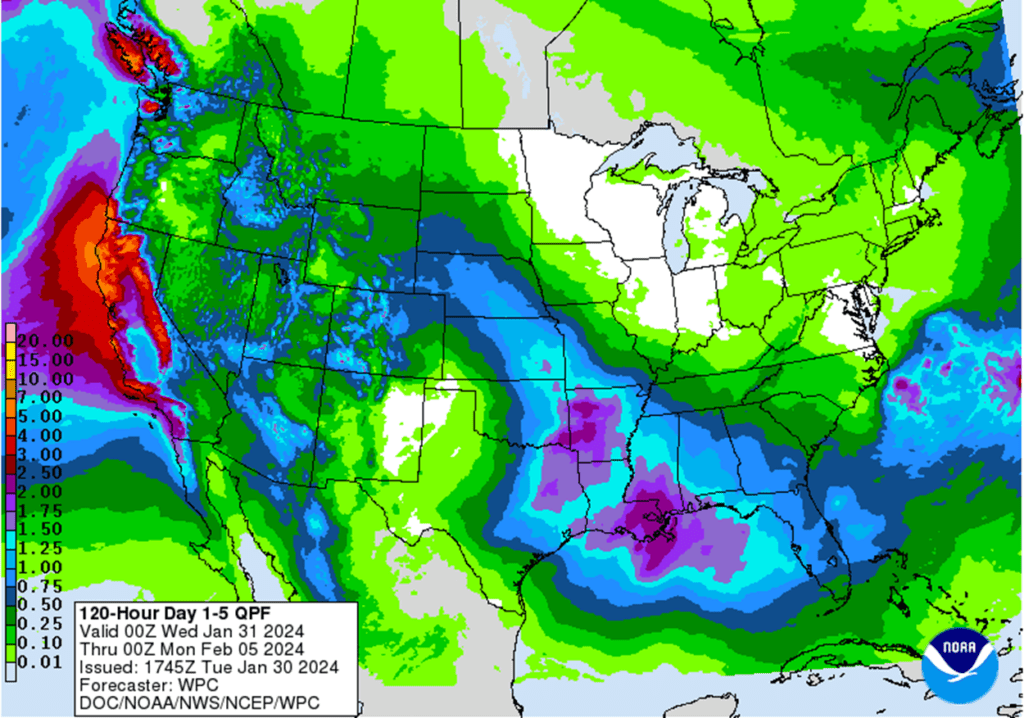

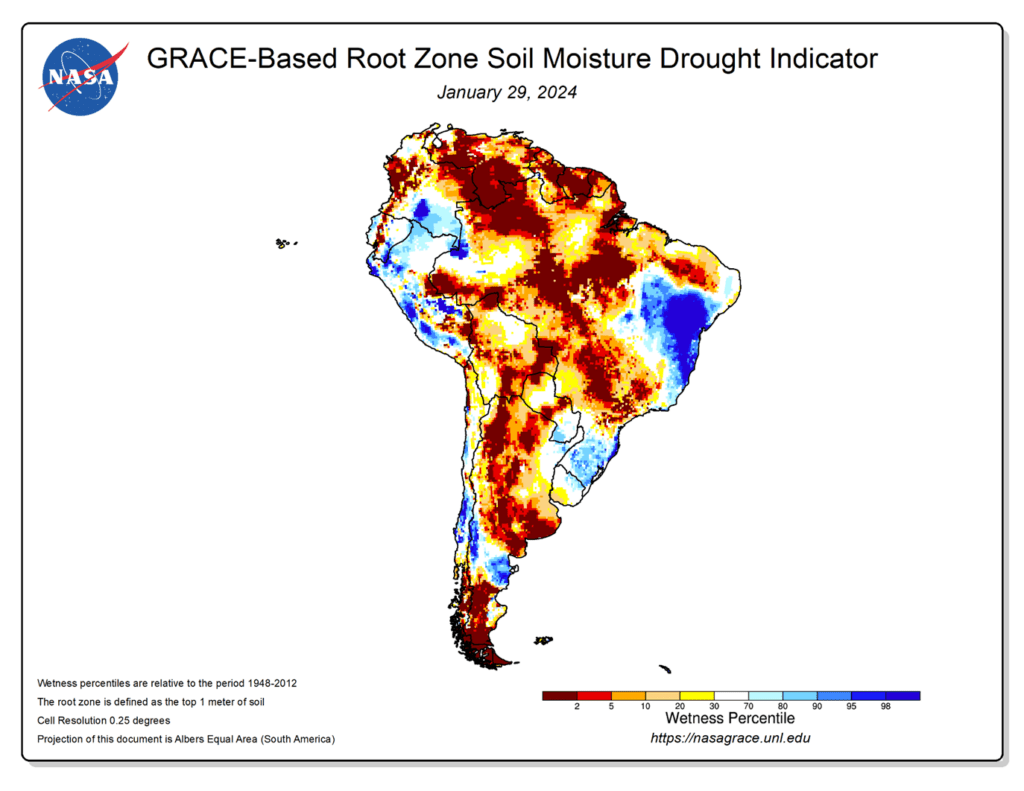

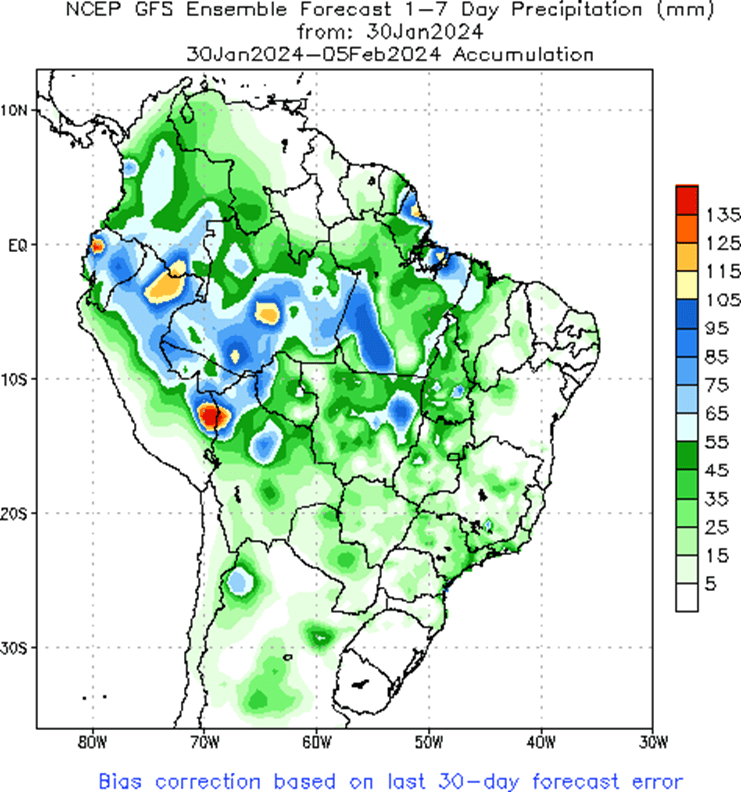

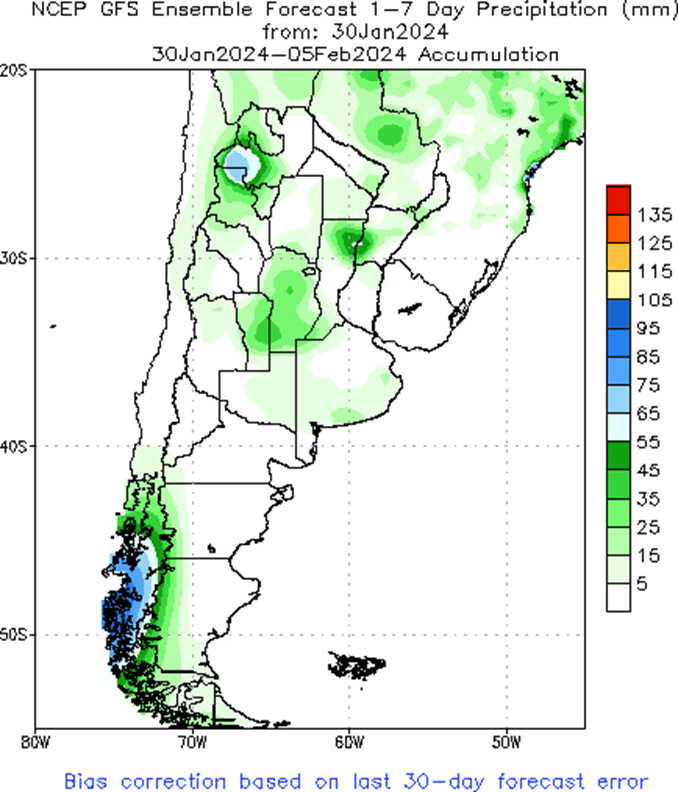

- To see the updated US 5-day precipitation forecast, the updated NASA-Grace based Drought Indicator for South America, and the 1-week GFS Precipitation Forecast for South America, courtesy of the National Weather Service, NOAA, the Climate Prediction Center, and NASA Grace with the NDMC, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. Front month corn has languished in a sideways to lower trend since printing a high in October, with a general lack of bullish news and an estimated US carryout over 2.1 billion bushels. The failure of the USDA’s January report to provide the bullish news necessary to turn prices higher was disappointing and the market remains at risk of remaining in the same pattern. With that being said, managed funds continue to hold a sizable net short position, which could trigger a short covering rally if a bullish catalyst enters the scene. For now, Grain Market Insider will continue to hold tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring.

- No new action is recommended for 2024 corn. Following the January USDA Supply and Demand update, Dec ’24 broke through the bottom end of the 485 ¾ to 602 range that had been in place since February ’22. While this is a disappointing development, bear spreading has allowed Dec ’24 to maintain more of its value versus old crop, as traders attempt to price in a larger 2023 carryout with more uncertainty remaining for the 2024 crop. Grain Market Insider continues to watch for signs of a change in the current trend to look at recommending making additional sales and buying Dec ’24 call options.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

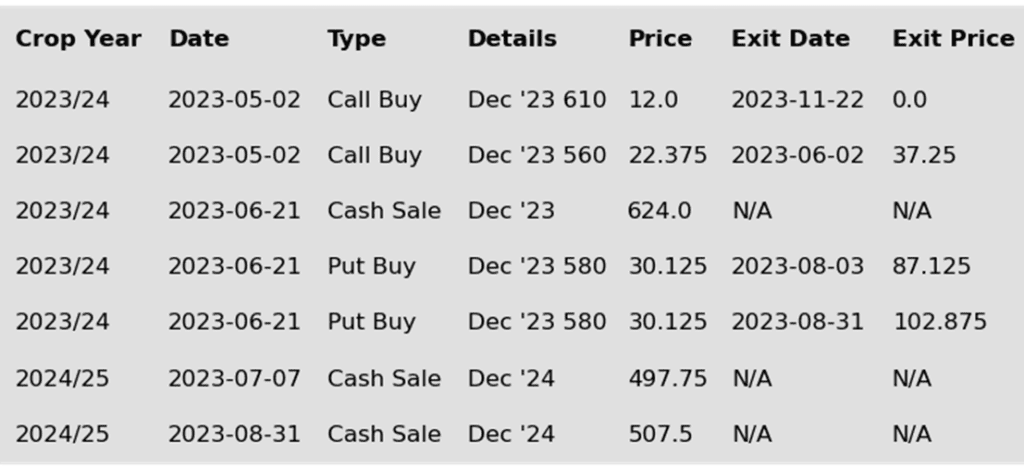

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- After posting a new contract low, March corn futures turned higher with moderate gains on the day. March corn gained 7 ½ cents and posted a bullish turn on the chart. Strong buying in the soybean and wheat markets helped support the corn market.

- With Managed Money holding an extremely large short position in the corn market, today’s price turn posted a key bullish reversal on the charts. The strong price action could lead to additional short covering going into tomorrow’s session.

- Argentina weather has been a focus. Weather forecasts are looking at decent rainfall potential going into February, but temperatures are above normal in the near-term. The excess heat could limit some grain production overall, which helped support the market.

- Despite today’s price move, demand remains a limiting factor in the market. US corn is in a key export window compared to more expensive sources. Corn export sales need to reflect improved business over the next few weeks.

Above: Front month corn posted a key bullish reversal on January 30. This indicates there is significant support below the market around 436, and that prices could retest the 460 resistance area. If the market were to reject the bullish reversal and turn lower, the next major level of support below 436 remains near 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. Front month soybeans recent downside breakout of the 1290 – 1400 range indicates that there is risk that prices may continue to retreat toward 1180, as forecasts for improved South American weather lessen the potential for the record large global carryout to be reduced. Given the potential of a downside breakout, Grain Market Insider recommended adding to sales as the current price level is still historically good. It’s been disappointing how the market has been unable to push higher despite the South American production concerns. Because of that, Grain Market Insider’s concern is that, if the weather pattern doesn’t remain adverse, the path of least resistance could be lower. Grain Market Insider will continue to look at additional sales opportunities, as well as potential re-ownership strategies.

- No new action is recommended for the 2024 crop. The Nov ’24 contract recently broke through the downside of the 1233 – 1320 range that has been in place since the end of July. Given this downside breakout and considering South American weather appears to be improving, Nov ’24 runs the risk of retreating towards 1150 unless another bullish catalyst enters the market. If prices find support and turn back higher, Grain Market Insider recently recommended buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated 2024 production and to protect any sales in an extended rally. Grain Market Insider will also continue to watch for any sales opportunities.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed sharply higher today taking back all of yesterday’s losses and then some. Yesterday, trade reacted strongly to news of potential weakness in China’s economy, but the selloff may have been an overreaction. Both soybean meal and oil closed higher with larger gains in meal.

- Lower soybean meal has put a significant amount of pressure on soybeans as it reached its lowest price since 2022 in the March contract yesterday. With freight costs falling, some cargoes of South American soybeans have been imported into the Southeast US for crushing. Crush margins have fallen recently but remain profitable.

- In Soybean oil, prices have been steadily falling as well. Both palm oil and soybean oil on the Dalian exchange sold off sharply on worries about Chinese demand, and some analysts are lowering estimates for Chinese imports of soybeans below 98 mmt.

- Argentinian weather is still mostly hot and dry but is expected to become more friendly in the coming days, though confidence may be waning. While the whole of Brazil is receiving scattered showers today. The northern region of Brazil has gotten too much rain while today’s showers are beneficial to the southern regions. Harvest is estimated at 11% complete which is above the average pace for this time of year.

Above: After printing a new low for the move and closing higher in a classic bullish key reversal, soybean may be on track to retest overhead resistance around 1250. If the market rejects the key reversal, initial support should be found near 1188 with further support near the November ’21 low of 1181.

Wheat

Market Notes: Wheat

- Wheat reversed off of the lows in all three US futures classes, with Chicago and KC both posting double digit gains at the close. There wasn’t much in the way of fundamental news to drive this rally, but the grain complex as a whole had a positive session. This may indicate that today was a technical bounce that resulted in short covering by the managed funds.

- Winter wheat conditions in the US are looking much better than a year ago. Select states released their crop condition data yesterday afternoon. Kansas, the biggest wheat producing state, rated their crop at 54% good to excellent versus 21% at this time last year. In fact, every reporting state except for North Carolina had better ratings than a year ago.

- US wheat exports have not been stellar, and with only 9.7 mb inspected last week, total inspections are down 17% from last year. One of the limiting factors is exports out of Russia, which continue to dominate the market. According to IKAR, Russian FOB values fell by three dollars to just $235 per mt. This may limit further upside movement in the market.

- Russia exported 4.26 mmt of wheat in January of last year. This year there is an estimated reduction of about 13% to 3.7 mmt; it is believed this is to help maintain reserves and also increase exports in the spring months. Additionally, as of January 26, Russia has purchased 473,000 mt of wheat for their state fund, with plans to buy up to two million metric tons of grain in total.

- The US Dollar Index continues to consolidate, but its direction will be critical for wheat pricing. It was down slightly during today’s session, which may have offered some support to wheat. Tomorrow afternoon, traders will receive the results of the FOMC meeting; the Fed is expected to keep rates steady, but any surprise could affect the direction of the Dollar.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The wheat market has continued to be dominated by lower world export prices that have stymied US export sales and depressed US prices. In early December, Grain Market Insider recommended taking advantage and making a sale on a short covering rally which was sparked by several Chinese purchases of US wheat. Since then, China has been silent in the US wheat export market, and prices remain somewhat elevated. Any remaining 2023 soft red winter wheat should be getting priced into market strength with the goal of having zero bushels unpriced by the end of January. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Since early December, the July ’24 contract has traded mostly sideways to slightly lower after its brief short covering runup on Chinese buying. Although China has since been absent from the US wheat export market, prices appear to have found support above 585, and managed funds continue to hold a sizeable, short position that could trigger another short covering rally if a bullish impetus enters the market. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion. Although, if the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Since early September, the July ’25 contract has been mostly rangebound with 632 at the low end and 685 at the top. Grain Market Insider’s strategy for the 2025 crop year up to this point has been to sit tight. Though if prices rally toward the upper end of this range, we will consider taking advantage of the rally’s historically good prices to make sales recommendations.

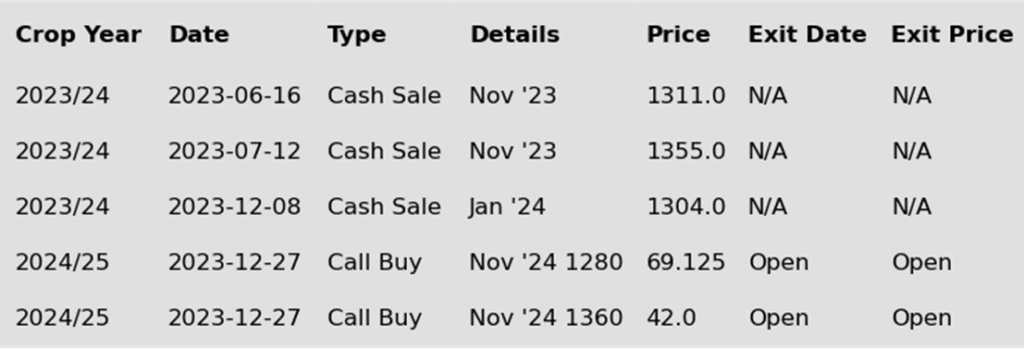

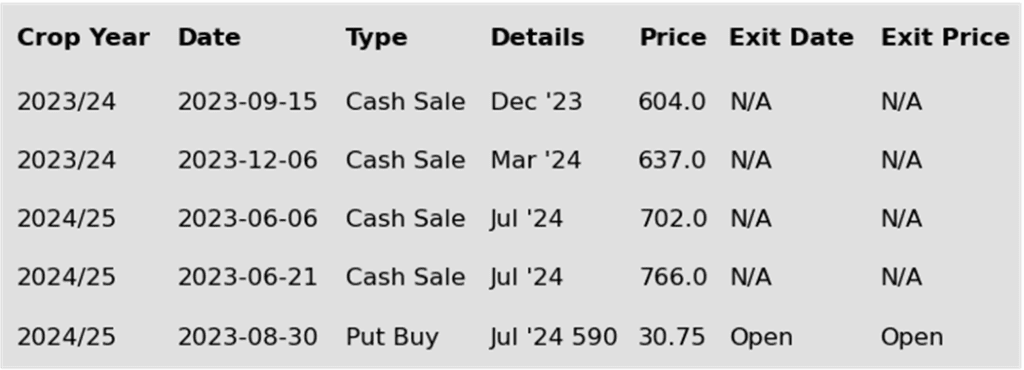

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The recent rally came within earshot of the 620 – 625 resistance area and was rejected. For now, minor nearby support may be found near the 100-day moving average. If that breaks, the market runs the risk of receding further with the next downside support near 573 and again around 556.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since last fall, front month KC wheat has been mostly rangebound between 678 up top and the 590 area down below. The latter has held as support for the past three months. Although fundamentals remain weak, considering support lies just below the market and managed funds continue to carry a sizable short position, these factors could trigger a return to higher prices if any unforeseen risks enter the market. Grain Market Insider’s strategy is to look for price appreciation as weather becomes a more prominent market mover and may consider suggesting additional sales if prices make a modest 20% retracement of the 2022 highs back toward 730.

- No new action is recommended for 2024 KC wheat. At the end of August, the July ’24 contract broke out of roughly a one-year trading range and stepped down to a 609 ¼ low in late November, largely driven by managed fund selling in the front month on weak US export demand and lower world wheat prices. Since then, the funds covered part of their large short position which also rallied prices in the July ’24 contract. While bearish headwinds remain, managed funds continue to hold a sizable, short position, and price seasonals remain positive for adding weather risk premium. These are two factors that could fuel additional short covering and rally prices in the months ahead. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. As the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It will probably be mid-winter before Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat appears to be consolidating around the 50-day moving average following its rally, and it continues to show signs of being overbought. Currently, upside resistance sits near the recent high of 641, with the next major support level remaining between 595 and 575.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for the 2023 New Crop. For the last six months, front month Minneapolis wheat has slowly stair-stepped lower with little bullish news to move markets higher. During this time, the 50-day moving average has acted as resistance, above which the market has not been able to hold for very long. Managed funds have also established and maintained a record (or near record) short position for much of the same time. Although bullish headwinds remain, support may be building in the 670 – 675 area, and the large fund net short position continues to leave the market susceptible to a short-covering rally at any time here. Grain Market Insider’s strategy is to look for a modest retracement of the July high and consider additional sales around 725 – 750.

- No new action is recommended for 2024 Minneapolis wheat. Much like the front month contracts, Sept ’24 has been in a downward trend since last summer. And just as Sept ’24 has been influenced to the downside by the front months, it could be similarly influenced to the upside by the front months if a bullish impetus enters the scene and triggers a short covering rally due to the fund’s large short position. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat, and in November recommended exiting 75% of the originally recommended position as July ’24 KC wheat showed signs of support around 630. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. Grain Market Insider remains prepared to recommend exiting the last 25% of the open puts on any further supportive market developments and consider recommending additional sales if prices make a modest retracement of the 2022 highs.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be mid-winter before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The recent rally in the March contract appears to be stalling, with the market consolidating between the upper 690s and low 700s. Initial resistance now sits just above the market between 710 and 720, with heavier resistance around 735. Below the market support remains near 669.

Other Charts / Weather

Brazil 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.