1-29 End of Day: Buying Interest on Weather Worries Drives Grains Higher Wednesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 497 | 11.75 |

| JUL ’25 | 509 | 10.75 |

| DEC ’25 | 466.75 | 5.75 |

| Soybeans | ||

| MAR ’25 | 1060.5 | 15.5 |

| JUL ’25 | 1088.75 | 16.5 |

| NOV ’25 | 1063.5 | 16 |

| Chicago Wheat | ||

| MAR ’25 | 562.5 | 17.25 |

| JUL ’25 | 588 | 17.75 |

| JUL ’26 | 640.5 | 15.5 |

| K.C. Wheat | ||

| MAR ’25 | 580.25 | 19.25 |

| JUL ’25 | 599.75 | 20 |

| JUL ’26 | 640.5 | 18.25 |

| Mpls Wheat | ||

| MAR ’25 | 613.75 | 16 |

| JUL ’25 | 631 | 13.5 |

| SEP ’25 | 639.75 | 11.75 |

| S&P 500 | ||

| MAR ’25 | 6055.75 | -41.25 |

| Crude Oil | ||

| MAR ’25 | 72.8 | -0.97 |

| Gold | ||

| APR ’25 | 2790 | -4.6 |

Grain Market Highlights

- Strong buying lifted corn futures on Wednesday, with the March contract posting its highest close since May 28 as money flowed into the grain markets.

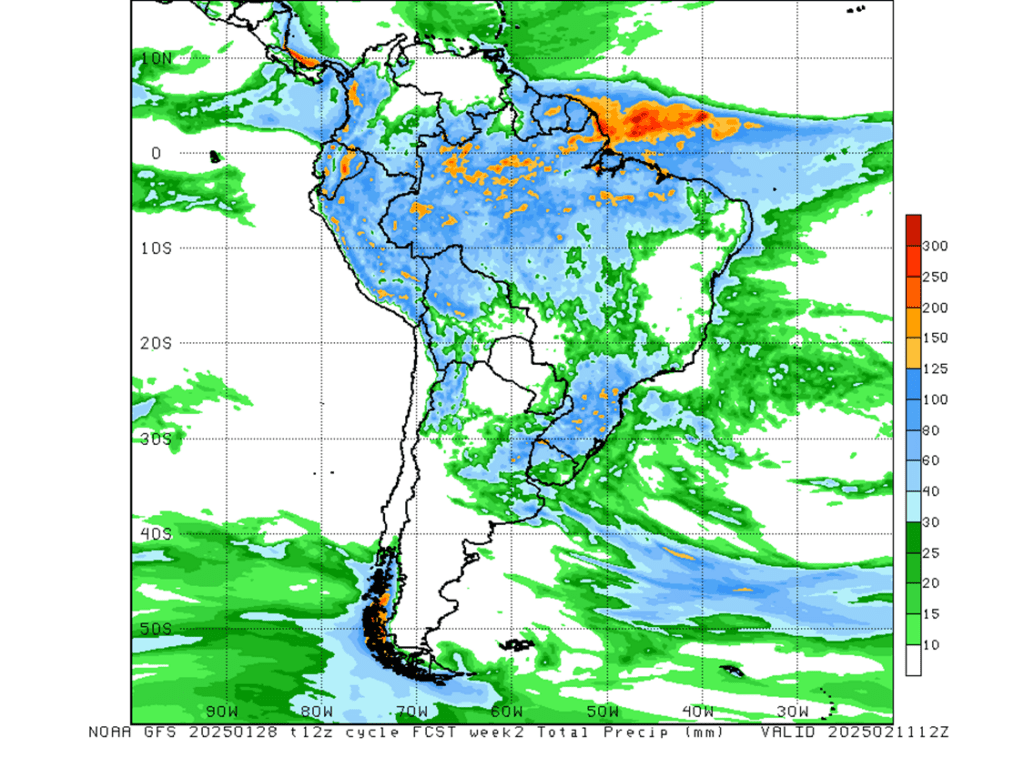

- Renewed concerns with South American weather drove soybean prices back near their recent highs. Soybean meal led the gains in soybeans today while soybean oil slipped slightly lower.

- Wheat futures surged with double-digit gains across all three classes, supported by strength in corn, soybeans, and Matif wheat.

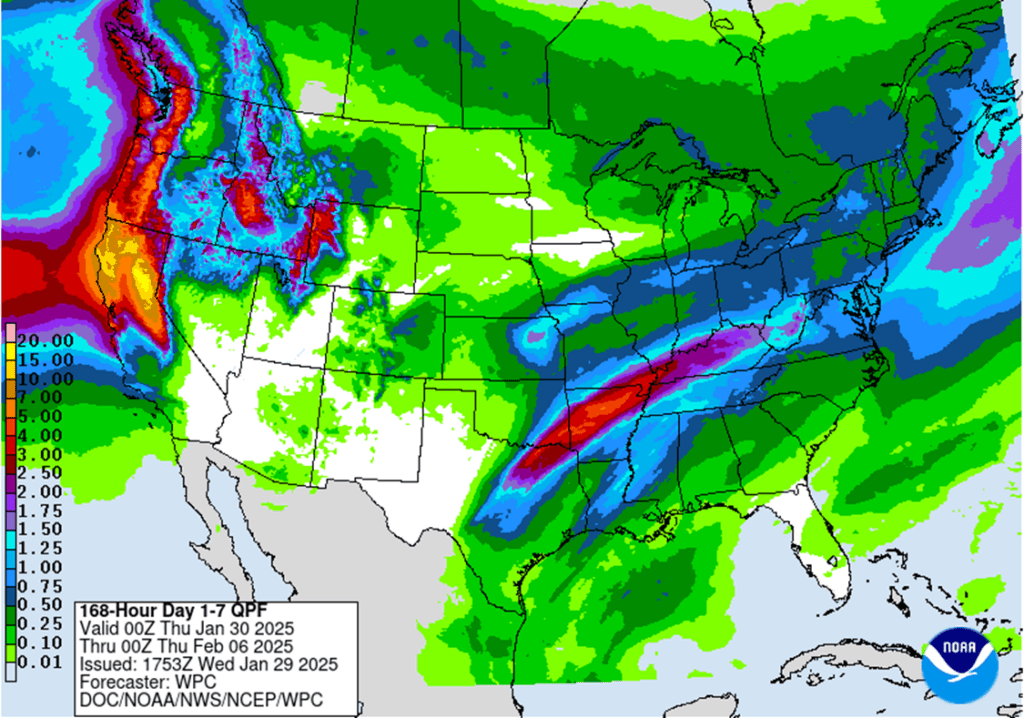

- To see the updated 7-day U.S. precipitation forecast as well as the week two South American precipitation forecast scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Next Sales Target Range: The March ‘25 contract surged to new highs, closing just within the lower end of the 495 to 515 target range. Given today’s strong finish — just half a cent shy of the session high — Grain Market Insider is holding off on a sales recommendation for now, allowing for the chance at the upper end of the target range.

- Highest Close: Today’s close marks the highest settlement for front-month corn since October 19, 2023, reinforcing the recent upward momentum.

- Resistance Levels: Key resistance on the front-month continuous chart stands between the September 2021 low of 497.50 and the May 1996 high of 513.50 — historical levels that could challenge further upside.

2025 Crop:

- Opportunity: Today’s close above 465.50 resistance opens the door for the next upside target in the 470-480 range for the December ‘25 contract.

- Downside Support: Key support for December ‘25 sits at 453.75, a level to watch for the current uptrend.

- Upside Resistance: Major resistance stands at 479 for December ‘25. A decisive close above this level could signal broader upside potential heading into the spring planting window.

- Buying Call Options: If prices break above the 479 resistance, stay tuned for a potential recommendation to purchase call options. This strategy would provide a hedge for existing sales while keeping you positioned for any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 3–5 weeks.

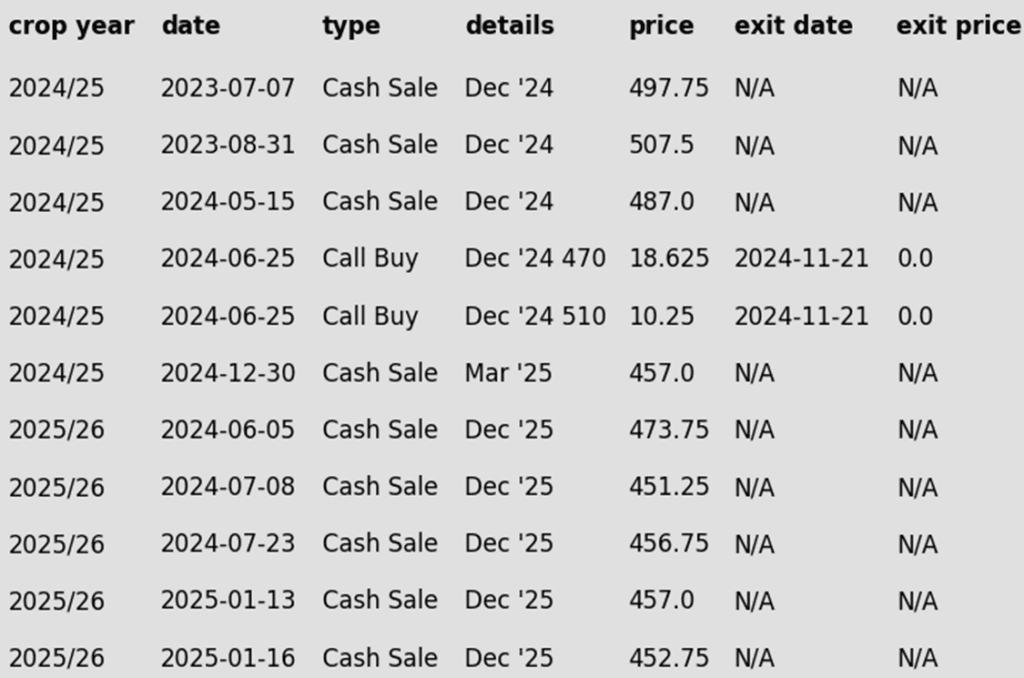

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Strong buying moved into the grain markets on Wednesday, and that supported corn futures’ strong gains on the session. Corn futures contract broke to new nearby highs as money flowed into the grain markets. The March corn contract posted its highest close since May 28.

- Weekly ethanol production fell 7.6% to 1.015 million barrels/day but remains 2.4% above year-ago levels. The weekly grind used 102.4 mb of corn, slightly below the pace needed for USDA targets.

- The USDA will release weekly export sales on Thursday morning. Expectations for new sales to range from 850,000 – 1.8 MMT. As U.S. corn is still very competitive in the global export market. Last week, sales were 1.660 MMT.

- Corn eased from session highs as President Trump reaffirmed a Feb. 1 deadline for potential tariffs on Mexico and Canada, raising concerns over retaliatory measures from Mexico, the top U.S. corn buyer.

- Weather forecast for central Brazil look to stay on the wetter side. Additional rainfall may limit soybean harvest pace, which would slow the planting pace of the key second crop Brazil corn. The second crop Brazil corn is the main crop that competes against U.S. bushels on the export market.

Corn Uptrend Well Supported

Fund buying and strong demand have sustained the corn market’s uptrend since harvest. Initial support is at 475, with additional support near the breakout area around 450. Overhead resistance is now just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

New Alert

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell another portion of your 2024 soybean crop.

- Bulls vs. Bears – The Battle at 1060: Soybean bulls and bears continue to slug it out in the March ‘25 contract around the 1060 level. The 1060 – 1080 zone — a key resistance range Grain Market Insider has been watching — remains the battleground. Today’s session ended in a stalemate, with March ‘25 settling at the lower edge of that range at 1060.50. The big question: Who will win? If the bulls manage to push prices above 1080, the next upside target would be 1150. But if the bears take control, the first downside risk is a retreat toward 1000.

- Fund Activity: Funds have aggressively covered short positions and shifted to a net-long stance on soybeans. This shift reinforces the idea that now remains an opportune time to capitalize on the rally.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends selling the first portion of your 2025 soybean crop.

- First Sale Recommendation: Grain Market Insider recommends initiating 2025 soybean sales today, as the November ‘25 contract closed at a fresh high of 1063.50. Since last Wednesday, November ‘25 has gained approximately 16 cents, yet the March ‘25 / November ‘25 spread has flipped from an 18-cent inversion to a 3-cent carry. With this spread trending bearish and significant resistance looming near 1070, now looks like a strategic opportunity to start locking in new crop sales. Especially as Grain Market Insider is prepared to quickly recommend reowning this sale with call options if needed.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

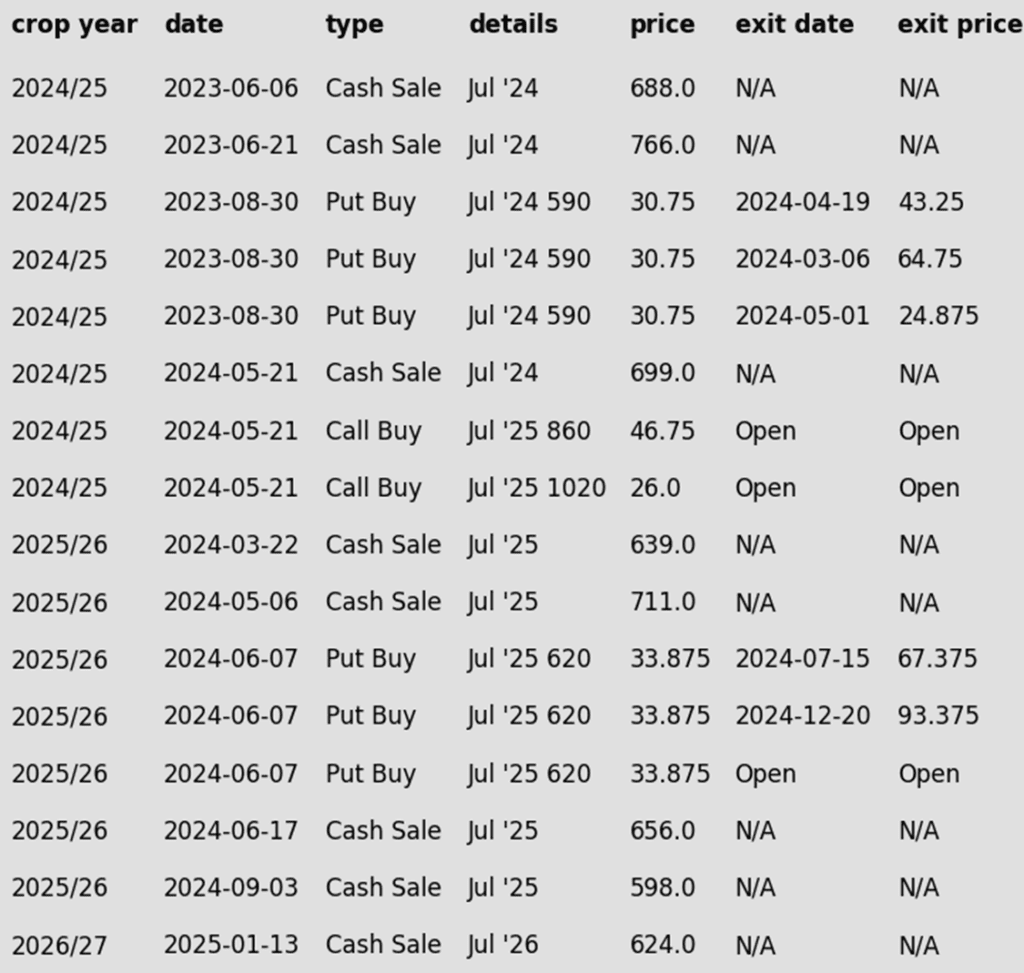

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher, with March futures targeting the 200-day moving average at $10.73. Strength came from a sharp rally in soybean meal due to Argentine crop concerns, while soybean oil ended lower.

- The U.S. export window to China is closing unless President Trump can convince China to agree to Phase 1 purchase obligations. China is on a holiday through most of next week which could cause some delays in negotiations.

- In Argentina, just 20% of the soybean crop is setting/filling pods, and adequate soil moisture levels have fallen from 81.1% to 54.8 since the beginning of the year. Recent rains are expected to improve conditions.

- A Brazilian port found 51 cargoes of soybean meal contaminated with sand during inspections. This follows China rejecting multiple soybean shipments over phytosanitary concerns.

Soybeans Face Long-Term Resistance

Front-month soybeans hit resistance at the 200-day moving average in January, a level capping gains for over 18 months. Support is expected near 1000 on a pullback. Initial resistance lies at the 200-day and recent highs around 1060. A weekly close above 1060 could pave the way for a test of the 1100 level.

Wheat

Market Notes: Wheat

- The wheat market closed sharply higher with double-digit gains across all three classes. Higher corn and soybeans, as well as higher Matif wheat futures both played a part in boosting US wheat. Funds likely covered short positions amid concerns over Russian winterkill.

- Following Argentina’s export tax cut, its FOB wheat prices are now $11/MT below Russia’s $225/MT offers. Increased Argentine exports could cap upside potential for U.S. wheat.

- This afternoon, the Federal Reserve announced no change to interest rates, as inflation remains elevated. This was largely in line with expectations, and at the time of writing the US Dollar Index is only slightly higher for the day.

- According to the European Commission, EU 24/25 soft wheat exports as of January 26 have reached 12.18 mmt since the season began in July. This falls well below the 19.35 mmt shipped for the same timeframe last year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: Grain Market Insider maintains a target range of 680–705 for March ’25 for the next sale.

- Sales Recommendations to Date: So far, three sales recommendations have been issued for the 2024 Chicago wheat crop. The current target range aligns with two earlier recommendations. If you’re behind on sales, this range presents a solid opportunity for a heavier sale.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue holding. While actionable targets remain out of reach, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

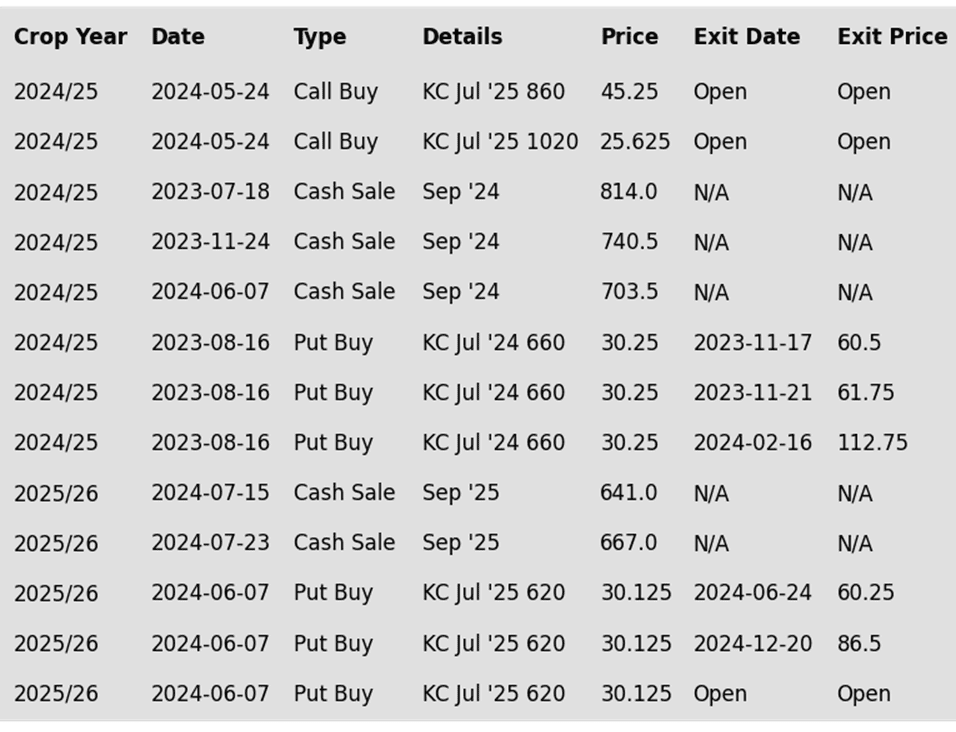

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stays Rangebound

Front-month Chicago wheat remains confined between 530 and 577. A breakout above the 577–586 resistance zone could prompt a retest of 617, while a close below 536 may lead to a decline toward the 521–514 support range.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range for selling more of your 2024 HRW wheat crop remains 650–700 vs. March ’25.

- Sales Recommendations to Date: Grain Market Insider has issued just two sales recommendations so far, reflecting last year’s significant yield uncertainty and limited post-harvest opportunities. These two recommendations, though widely spaced, averaged around 719 vs. July ’24 futures. A sale within the next target range will lower this average, but upside opportunity expectations remain modest for now.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue to hold. While actionable targets are still a way off, these options have about five months remaining until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Maintains Range

KC wheat has traded between 536 and 583 since November, with initial resistance near the 100-day moving average at 568. A close above 583 could pave the way for a move toward 600, while a close below 536 risks a decline to 525.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potential Sales Target Range: The initial target for another sale of your 2024 HRS wheat crop is a rally to the 610–635 range vs. March ’25. That said, keep in mind that the near-record short position held by the Funds could lead Grain Market Insider to adjust this target range higher as price action develops.

- Open Call Options: If you hold the previously recommended KC July ’25 860 and 1020 call options, continue holding them. While actionable targets remain distant, these options have about five months left until their expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Holds Range

Minneapolis wheat remains rangebound between 585 and 613. A breakout above 613 could spark a rally toward 655, with interim resistance at 624 and 637. Conversely, a close below 585 may trigger a decline toward November lows near 568.

Other Charts / Weather

Brazil and N. Argentina week two forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.