1-28 End of Day: Wheat Leads the Grain Complex Higher Tuesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 485.25 | 3.25 |

| JUL ’25 | 498.25 | 4.5 |

| DEC ’25 | 461 | 2.75 |

| Soybeans | ||

| MAR ’25 | 1045 | 0 |

| JUL ’25 | 1072.25 | 2 |

| NOV ’25 | 1047.5 | 4.25 |

| Chicago Wheat | ||

| MAR ’25 | 545.25 | 9.75 |

| JUL ’25 | 570.25 | 8.75 |

| JUL ’26 | 625 | 6.75 |

| K.C. Wheat | ||

| MAR ’25 | 561 | 7.75 |

| JUL ’25 | 579.75 | 7.5 |

| JUL ’26 | 622.25 | 5.75 |

| Mpls Wheat | ||

| MAR ’25 | 597.75 | 12 |

| JUL ’25 | 617.5 | 9.75 |

| SEP ’25 | 628 | 9 |

| S&P 500 | ||

| MAR ’25 | 6102.25 | 55.5 |

| Crude Oil | ||

| MAR ’25 | 73.85 | 0.68 |

| Gold | ||

| APR ’25 | 2799.9 | 33.7 |

Grain Market Highlights

- Continued strong demand for U.S. corn pushed prices higher Tuesday, erasing Monday’s losses.

- Soybeans finished mixed, with March futures unchanged and deferred contracts higher. The bean products corrected slightly after yesterday’s sell-off, with soybean meal and oil closing modestly higher.

- Wheat futures added double digits on Tuesday, backed by stronger European wheat futures and weather worries in the Black Sea region.

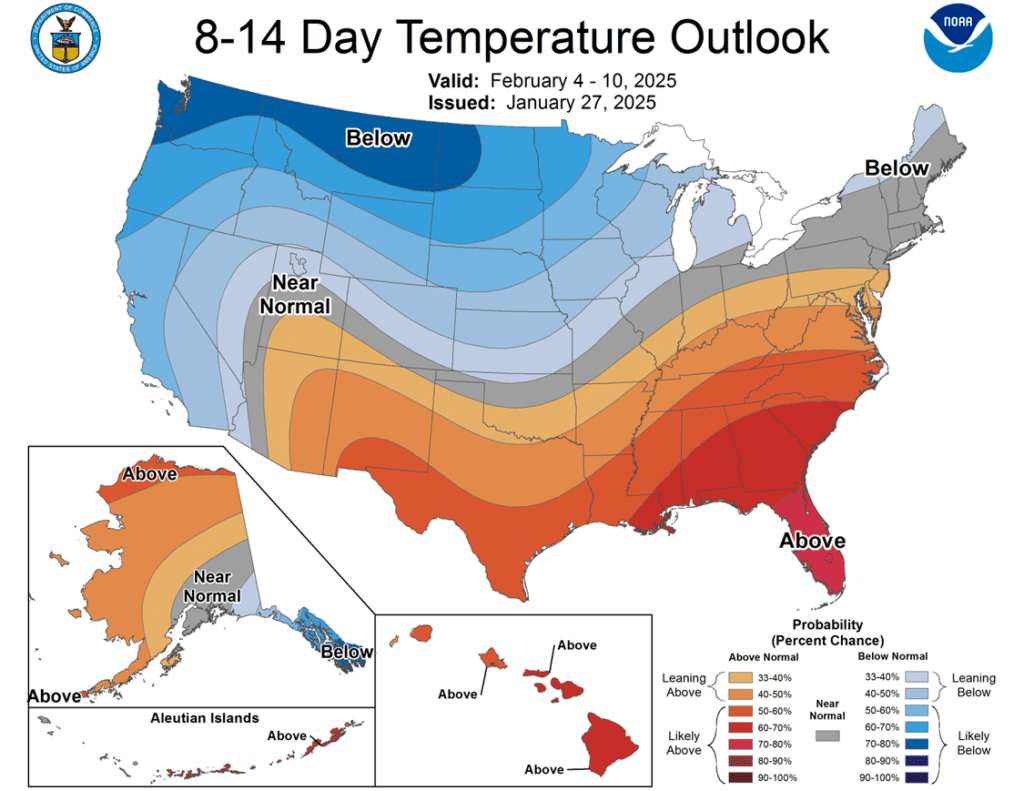

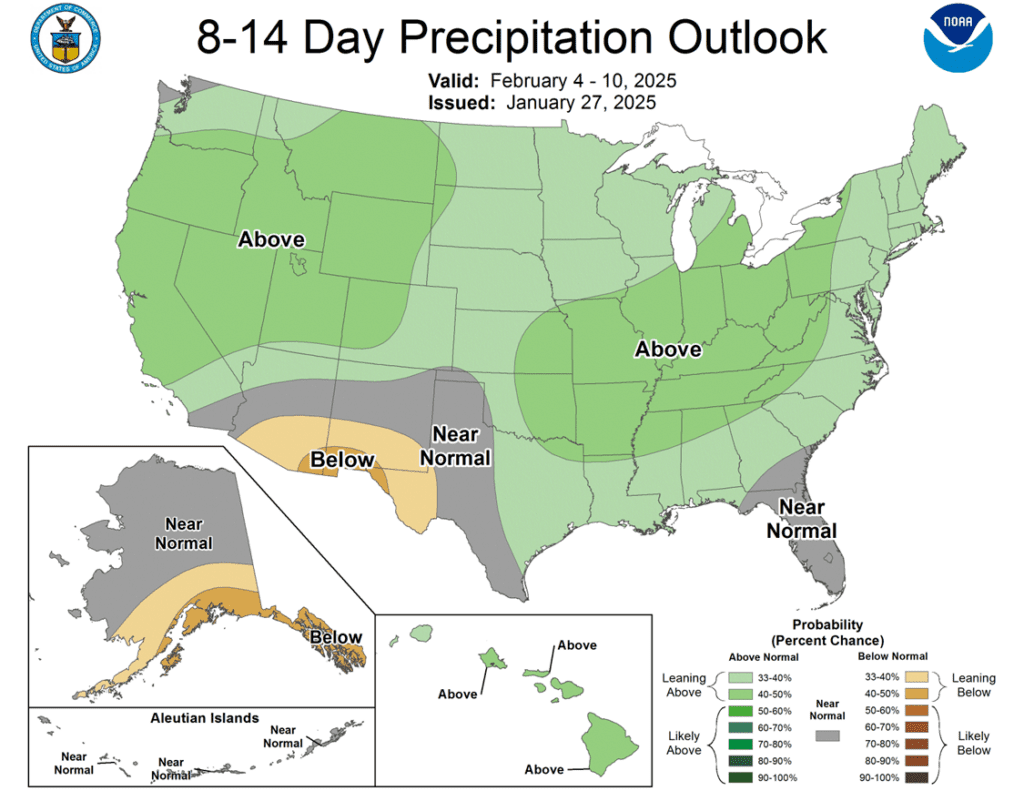

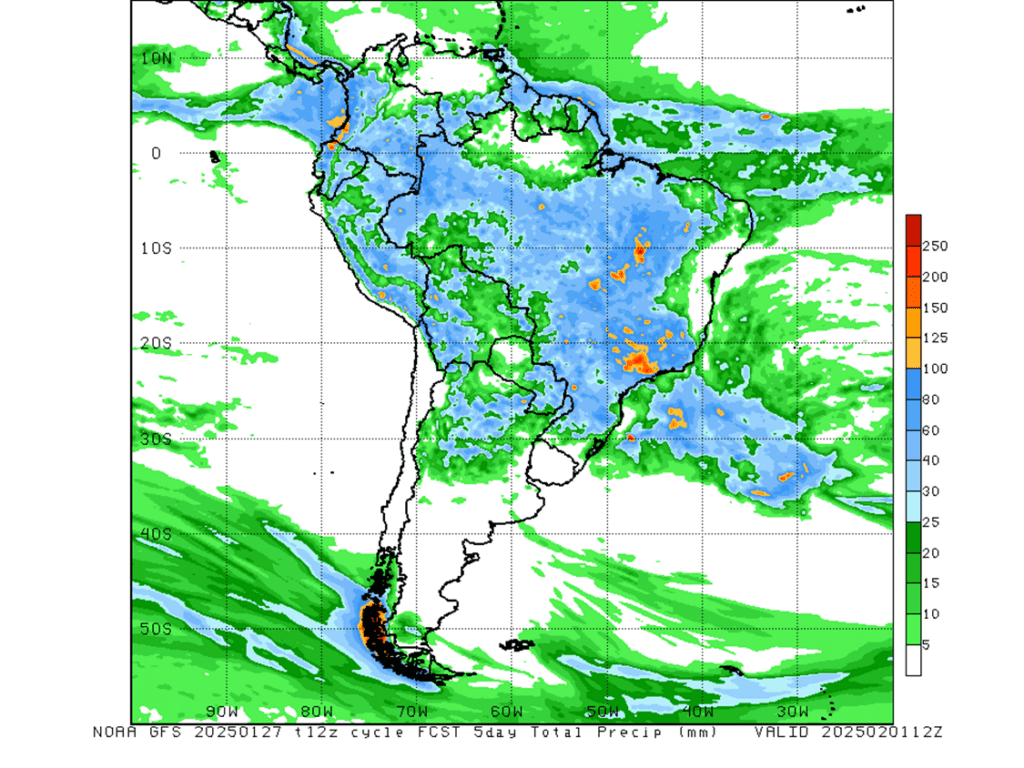

- To see the updated 5-day GFS precipitation forecast for South America as well as the 8–14-day US temperature and precipitation outlooks scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Next Sales Target Range: Eyeing the 495 to 515 range for the March ’25 contract.

- Modest Weekly Gain: Following two strong weekly gains totaling 33 cents, the March ’25 contract managed a modest two-cent uptick last week, closing slightly higher overall.

- Resistance Levels: On the front-month continuous chart, key resistance lies between the September 2021 low of 497.50 and the May 1996 high of 513.50.

- March ’25 Contract Levels: Last week, the March ’25 contract revisited the 487–508 range—where Grain Market Insider issued its first three sales recommendations for the 2024 corn crop during summer 2023 and spring 2024. So far, four sales recommendations have been made for the 2024 crop. If you haven’t acted on all four yet, now is a great time to catch up. Prices rebounded to a high last week of 494.50 vs March ‘25, and despite weakness in the last two trading days, the market remains over 100 cents higher than the August low on the front-month continuous chart.

2025 Crop:

- Grain Market Insider recently recommended selling another portion of your 2025 corn crop.

- First Resistance: Resistance is now pegged at last week’s high of 465.50. On Thursday, the December ’25 contract managed to break above the October 2024 high of 459.75, but the breakout proved short-lived, with prices closing back below 459.75 today.

- Downside Risk: A confirmed close above last week’s high of 465.50 would validate the breakout over 459.75. However, failure to sustain momentum above this level increases the likelihood of a false breakout. In that scenario, the market risks returning to range-bound trading, with support at the lower end of the range near 428.00.

- Opportunity: If the December ’25 contract succeeds in rallying above 465.50, a test of the next major resistance area of 480 should be an easy task. Selling near 480 would be the next target for a potential Grain Market Insider sales recommendation.

- Opposing Fundamentals: Strong demand for U.S. corn continues to underpin the market. However, higher prices could incentivize increased U.S. planted acreage for the 2025 crop, potentially adding headwinds.

- Buying Call Options: Keep an eye out for a recommendation to purchase call options if prices close above major resistance in the 480 area. This strategy would provide cover to current sales and allow you to benefit from any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 3–5 weeks.

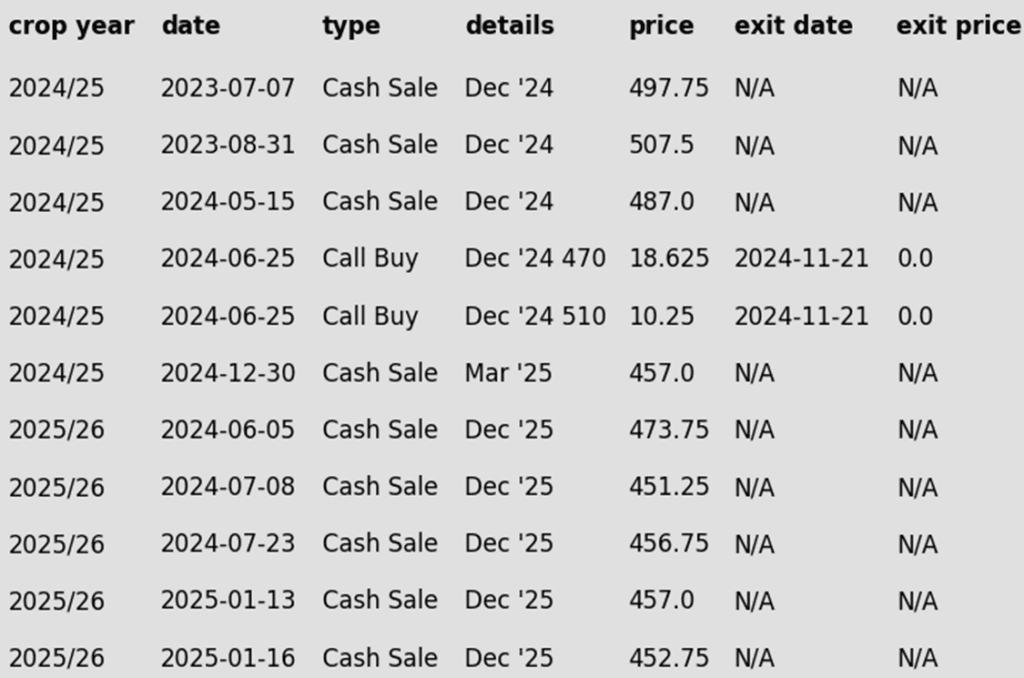

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Buyers returned to the corn market on Tuesday as buying strength across the grain markets helped push corn prices moderately higher. The strong demand tone continues to help support the old crop side of the market.

- The USDA reported a flash sale of 132,000 MT (5.2 mb) of U.S. corn to South Korea for the current marketing year, marking the fourth consecutive day of announced export sales.

- Corn prices eased from session highs after President Trump reiterated a February 1 deadline for potential tariffs on Mexico and Canada. Concerns over counter-tariffs linger as Mexico remains the largest buyer of U.S. corn.

- Afternoon forecasts show the potential for rain fall for central Brazil. Additional rainfall may limit soybean harvest pace, which would slow the planting pace of the key second crop Brazil corn. The second crop Brazil corn is the main crop that competes against U.S. bushels on the export market.

Corn Uptrend Well Supported

Fund buying and strong demand have sustained the corn market’s uptrend since harvest. Initial support is at 475, with additional support near the breakout area around 450. Overhead resistance is now just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell another portion of your 2024 soybean crop.

- Sales Target Range Reached: The March ’25 contract pushed further into the 1060–1080 target range last week, reaching an intraweek high of 1073.50. However, the gains proved short-lived, with the contract closing below the January 14th high of 1064. Out of three trading days spent in the 1060–1080 range, two ended with bearish reversals, closing below 1060. This highlights the strength of the 1060–1080 range as a key resistance area, which factored prominently into last week’s sales recommendation.

- From the Lows: Despite recent softening, the March ’25 contract is still up roughly one dollar from its December low of 947.00. This remains a solid rally and a valuable opportunity to act if you haven’t already.

- Fund Activity: Funds have aggressively covered short positions and shifted to a net-long stance on soybeans. This shift reinforces the idea that now remains an opportune time to capitalize on the rally.

2025 Crop:

- Target Range: The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day mixed with the front month March unchanged but the deferred contracts higher. Futures were likely correcting yesterday’s sell-off slightly as little has changed fundamentally. Both soybean meal and oil ended the day slightly higher.

- The Brazilian soybean harvest is reportedly the slowest since the 20/21 harvest. Parana has been leading the country in progress, but Mato Grosso and other states are still delayed although there have been reductions in rainfall projections.

- In Argentina, just 20% of the soybean crop is setting/filling pods, and adequate soil moisture levels have fallen from 81.1% to 54.8 since the beginning of the year. Recent rains are expected to improve conditions.

- Yesterday’s export inspections report saw soybean inspections at 729k tons which compared to 979k last week and 913k the previous year. The majority of the soybeans are headed to China followed by Turkey.

Soybeans Face Long-Term Resistance

Front-month soybeans hit resistance at the 200-day moving average in January, a level capping gains for over 18 months. Support is expected near 1000 on a pullback. Initial resistance lies at the 200-day and recent highs around 1060. A weekly close above 1060 could pave the way for a test of the 1100 level.

Wheat

Market Notes: Wheat

- Wheat made modest gains in all three classes today, despite the move higher for the US Dollar. Support came from a rebound in Paris milling wheat futures, as well as talk that warm weather in the Black Sea region could cause wheat to come out of dormancy too soon.

- The Russian Grain Union projects 2024/25 grain exports may fall below 50 MMT due to weather issues and reduced production, with wheat accounting for 41–42 MMT. SovEcon estimates January wheat exports at 2.1 MMT, the lowest since 2017.

- Secex data shows Brazil’s daily average wheat imports for January 2025 at 34.4K MT, up 23.3% year-over-year. Total imports through January 20 reached 412.8K MT, compared to 614K MT for all of January 2024.

- The US ag attaché to Argentina is estimating their wheat crop at 18.1 mmt, which is above the USDA’s guess of 17.5 mmt. Additionally, Argentina’s wheat export volume may increase, as their government’s recently announced export tax reduction began today.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: Grain Market Insider maintains a target range of 680–705 for March ’25 for the next sale.

- Sales Recommendations to Date: So far, three sales recommendations have been issued for the 2024 Chicago wheat crop. The current target range aligns with two earlier recommendations. If you’re behind on sales, this range presents a solid opportunity for a heavier sale.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue holding. While actionable targets remain out of reach, these options still have about five months until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The next target range for a sale remains 690–715 vs. July ’25.

- Sales Recommendations to Date: Grain Market Insider took a slightly more aggressive strategy for the 2025 crop, capitalizing on market carry during the broader downtrend since the October high. So far, four sales have been made vs. July ’25, averaging approximately 651. A sale within the current target range would boost that average.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

- Recent Sales Recommendation: Grain Market Insider recently recommended selling the first portion of the 2026 Chicago wheat crop on January 13th.

- Carry & Increased Volume: With growing daily trading volume and approximately 50 cents of additional carry in the July ’26 contract compared to July ’25, the July ’26 contract is shaping up as an early opportunity to watch closely.

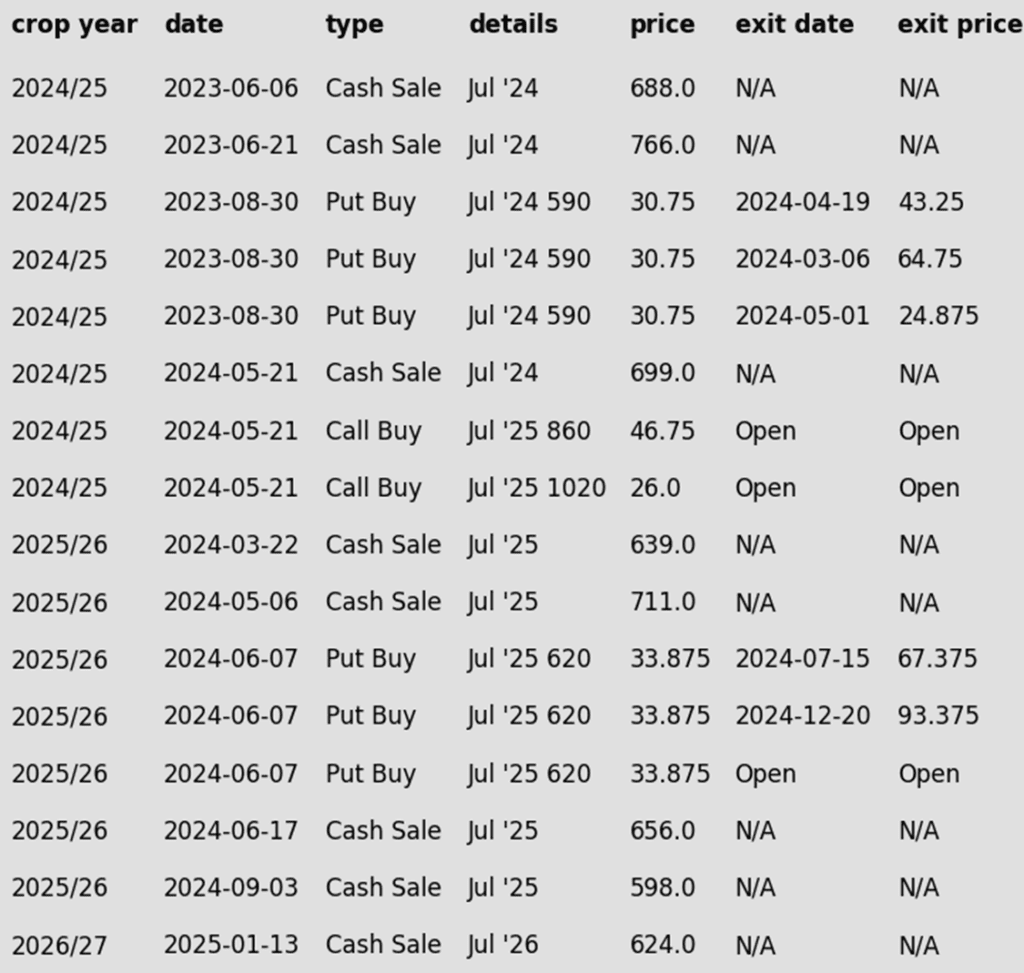

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Stays Rangebound

Front-month Chicago wheat remains confined between 530 and 577. A breakout above the 577–586 resistance zone could prompt a retest of 617, while a close below 536 may lead to a decline toward the 521–514 support range.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Sales Target Range: The target range for selling more of your 2024 HRW wheat crop remains 650–700 vs. March ’25.

- Sales Recommendations to Date: Grain Market Insider has issued just two sales recommendations so far, reflecting last year’s significant yield uncertainty and limited post-harvest opportunities. These two recommendations, though widely spaced, averaged around 719 vs. July ’24 futures. A sale within the next target range will lower this average, but upside opportunity expectations remain modest for now.

- Open Call Options: For those holding the previously recommended July ’25 860 and 1020 call options, continue to hold. While actionable targets are still a way off, these options have about five months remaining until expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range to make an additional sale for your 2025 HRW wheat crop is still 640–665 vs. July ’25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

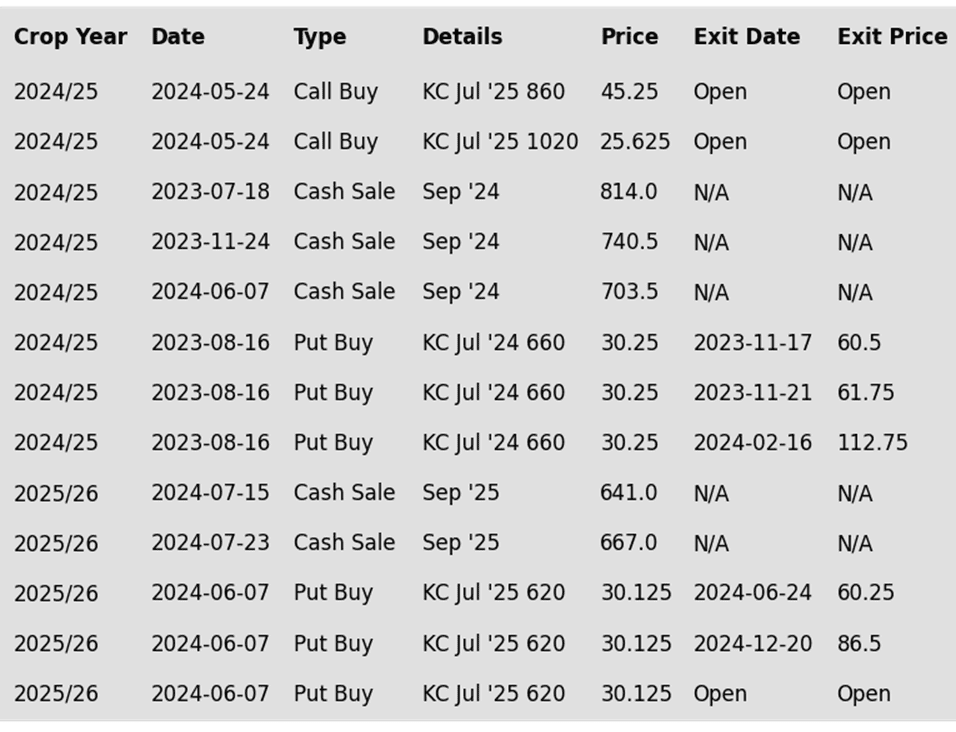

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Maintains Range

KC wheat has traded between 536 and 583 since November, with initial resistance near the 100-day moving average at 568. A close above 583 could pave the way for a move toward 600, while a close below 536 risks a decline to 525.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potential Sales Target Range: The initial target for another sale of your 2024 HRS wheat crop is a rally to the 610–635 range vs. March ’25. That said, keep in mind that the near-record short position held by the Funds could lead Grain Market Insider to adjust this target range higher as price action develops.

- Open Call Options: If you hold the previously recommended KC July ’25 860 and 1020 call options, continue holding them. While actionable targets remain distant, these options have about five months left until their expiration in the third week of June.

2025 Crop:

- Sales Target Range: The target range remains 700–750 vs. September ’25.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Holds Range

Minneapolis wheat remains rangebound between 585 and 613. A breakout above 613 could spark a rally toward 655, with interim resistance at 624 and 637. Conversely, a close below 585 may trigger a decline toward November lows near 568.

Other Charts / Weather

South America 5-day GFS Total Accumulated Precipitation forecast, in millimeters, courtesy of NOAA.