1-2 End of Day: Corn and Soybeans Green to Start 2025

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 459.5 | 1 |

| JUL ’25 | 470.25 | 1.5 |

| DEC ’25 | 446.5 | 2.75 |

| Soybeans | ||

| MAR ’25 | 1012 | 1.5 |

| JUL ’25 | 1037.75 | 3 |

| NOV ’25 | 1028 | 2.75 |

| Chicago Wheat | ||

| MAR ’25 | 545.75 | -5.75 |

| JUL ’25 | 564.5 | -5 |

| JUL ’26 | 617.25 | -3.75 |

| K.C. Wheat | ||

| MAR ’25 | 551.75 | -7.5 |

| JUL ’25 | 569.5 | -6.5 |

| JUL ’26 | 610 | -5 |

| Mpls Wheat | ||

| MAR ’25 | 589.5 | -6.25 |

| JUL ’25 | 606 | -5 |

| SEP ’25 | 615.75 | -4.75 |

| S&P 500 | ||

| MAR ’25 | 5898 | -37.75 |

| Crude Oil | ||

| MAR ’25 | 72.74 | 1.49 |

| Gold | ||

| APR ’25 | 2693.8 | 27.8 |

Grain Market Highlights

- Corn ended the day slightly higher as strong demand continues to provide underlying support to the market. March corn has closed higher in eight of the last nine trading days.

- Soybean futures held onto fractional gains to start the year; support today came from higher soybean meal futures while soybean oil was lower.

- Wheat futures began the year on a softer note as the US dollar index surged to a 26-month high today.

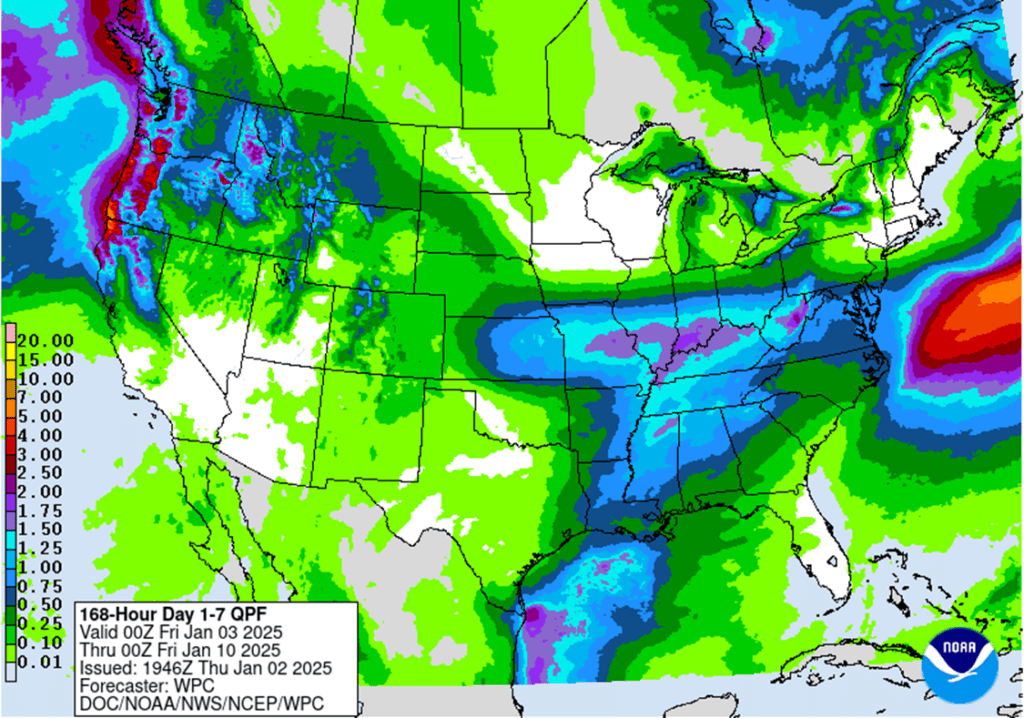

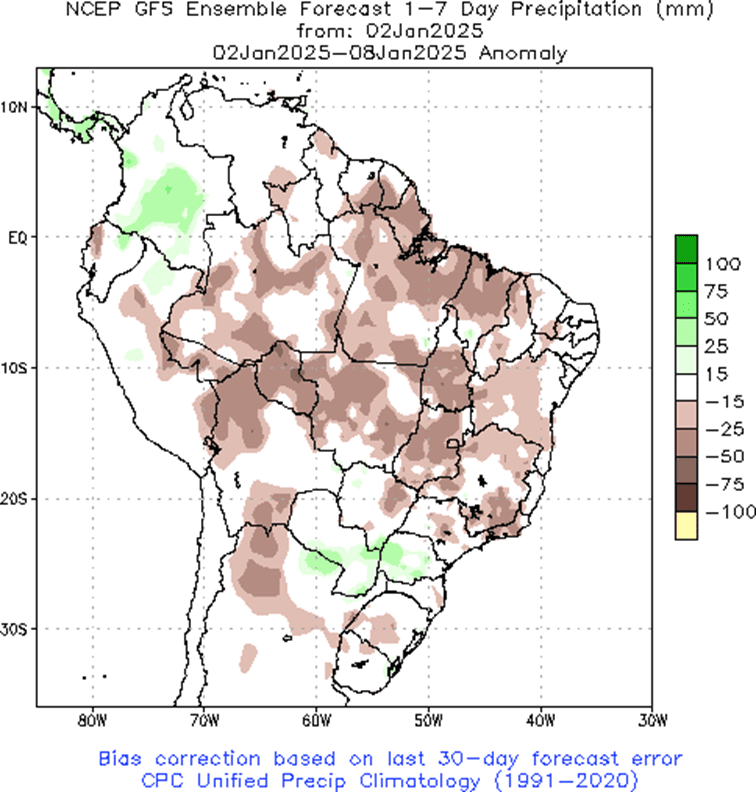

- To see the US 7-day precipitation forecast as well as the Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

2024 Crop:

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 corn crop.

- The March 2024 contract has rallied 30 cents from the Thanksgiving low and has recently traded to its highest level since late June. Looking back even farther, corn is roughly 23% higher than the August low when looking at the continuous corn chart. While strong demand has been a main driver of this rally, we are starting to see corn demand slowing at these higher prices. Therefore, Grain Market Insider sees this as an advantageous area to reward this rally by selling a portion of your 2024 corn crop.

2025 Crop:

- Target the 455 – 460 versus Dec. ‘25 area to make additional sales against your 2025 crop.

- The strong demand tone for US corn continues to provide support to the market, but this higher price will likely buy additional planted acres in the US for 2025.

- Major resistance for the December 2025 chart sits near the 480 futures level, a close above this area would be a potential breakout of the current range.

- Be on the lookout for a recommendation to buy call options in the 470–490 range versus Dec’25 to protect current sales against a potential extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

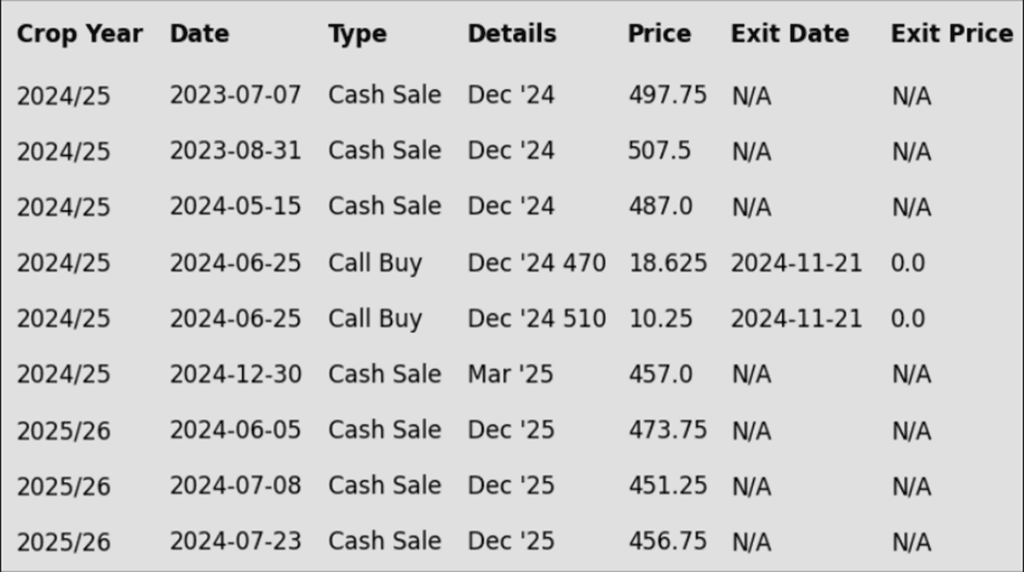

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures posted mild gains on the first trading day of 2025, supported by strong demand. Gains were capped by overhead resistance at $4.60 (March futures), a stronger U.S. dollar, and weakness in wheat.

- The U.S. dollar index broke out to new 26-month highs on Thursday, now trading at its highest point since May 2022. The strong dollar limits U.S. competitiveness in the global export market. In addition, the Brazilian Real currency dropped to its lowest point versus the dollar in history on Thursday.

- The USDA will release weekly export sales on Friday morning, delayed a day due to the New Year Holiday. Expectations are for new sales to range from 800,000 – 1.4 MMT for the week ending December 26. Last week’s reported sales exceeded expectations at 1.711 MMT.

- Weekly ethanol production rebounded to 327 million gallons per day last week, up slightly from the prior week. Corn used for production last week reached an estimated 112 mb, which is above the pace needed to reach the current USDA target. Ethanol stocks have climbed, however, hitting a 15-week high on this report.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 450, with additional support near 434. Initial overhead resistance comes in near 460 with additional resistance near 475.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

2024 Crop:

- We are in the time frame when seasonal opportunities typically improve due to the South American growing season.

- Any negative change in Brazil’s or Argentina’s growing conditions could send the soybean market higher, target the 1060-1080 versus March ‘25 area to make additional sales against your 2024 crop.

- For those with capital needs, consider making these sales into price strength.

2025 Crop:

- We are in the window when targets for additional sales on next year’s crop will start being posted. Though patience is still recommended since they could be set as late as early spring.

- Be on the lookout for a recommendation to buy call options. A rally to the upper 1100 range versus Nov ’25 could increase the likelihood of an extended rally, and we would recommend buying calls to prepare for that possibility.

2026 Crop:

- Patience is advised. No sales recommendations are currently planned as we monitor the market for more favorable conditions and timing.

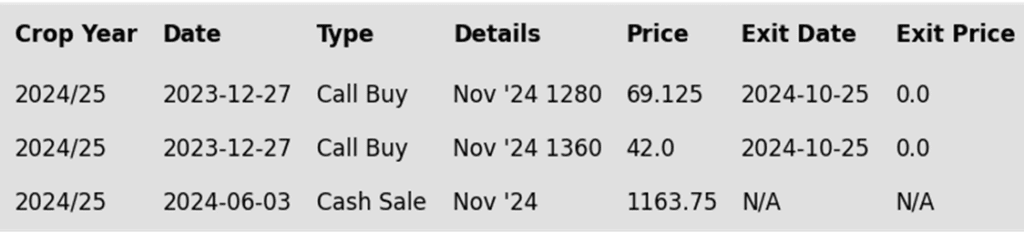

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day slightly higher to start the new year following a sharply higher move on Tuesday that brought March futures back above $10.00 and above recent resistance at the 50-day moving average. Support today came from soybean meal while soybean oil was lower.

- Soybean demand has been firm, and soybean crush has continued to increase over the past few months. Bloomberg analysts see soybean crush for November at 208.1 million bushels which would compare to 200.1 mb a year ago. Oil stocks are expected to come in at 1.496b lbs, which would be down from the previous year.

- Support in soybeans has also come from a drier Argentinian forecast that is expected to last for around 10 days. This has specifically been beneficial to soybean meal as Argentina exports a significant amount. Brazilian weather remains favorable, and production estimates continue to rise with an estimate today by StoneX at 171.4 mmt.

- On December 31 there were 380 deliveries against January soybeans for a total of 489 deliveries. There have been 1,764 deliveries against January bean meal and 617 deliveries against January soybean oil.

Above: The recent break in prices found initial support near 950. Initial overhead resistance lies just above the market near 1030 with additional resistance between 1060 and 1075.

Wheat

Market Notes: Wheat

- Wheat prices fell on Thursday, failing to break upside resistance. Traders are navigating a strong U.S. dollar, a poor Russian wheat crop, and firm demand, with the market in a consolidation phase.

- Pressure in the wheat market today was likely due to a sharp increase in the value of the US dollar combined with the falling value of the Russian ruble. Wheat exports have been slightly better than expected recently though, with cuts to Russian production estimates.

- The USDA’s Friday export report is expected to show wheat sales between 200,000–500,000 MT for the week ending Dec. 26, compared to last week’s 612,000 MT.

- Weather forecasts are showing an improved chance of precipitation over the winter wheat belt going into the end of the week. The U.S. storm track will likely push more southerly, allowing for moisture to help support the crop.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

2024 Crop:

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing. With harvest underway in the southern hemisphere and winter wheat into dormancy in the northern hemisphere, this can historically be a slow time of the year for the wheat market.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is advised, as we monitor the market for improved conditions and timing. It may be some time before target ranges are set for the 2026 crop.

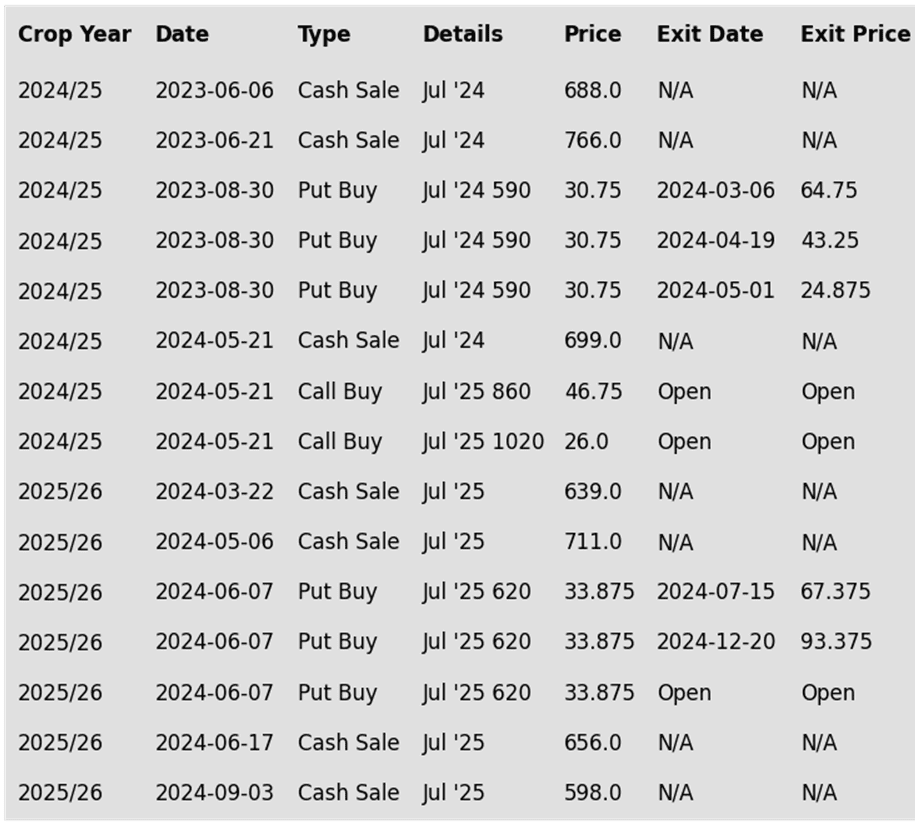

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

2024 Crop:

- Target the 635 – 660 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls,target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

Above: KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

2024 Crop:

- Target a rally to the 610 – 635 area versus March ‘25 to sell more of your 2024 crop. We are at that time of year when seasonal price trends become more favorable.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider sees a continued opportunity to liquidate half of the remaining open July ’25 620 KC wheat puts at approximately 86 cents in premium minus fees and commission. Back in July Grain Market Insider recommended selling half of the original position to offset the cost of the now remaining puts. Our research shows that, with the July ’25 futures contract down roughly 14% from its October high of 653.75, this is an attractive risk/reward point to exit half of the remaining July ’25 620 KC Wheat put options as we approach the winter dormancy period.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining half of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit half of these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

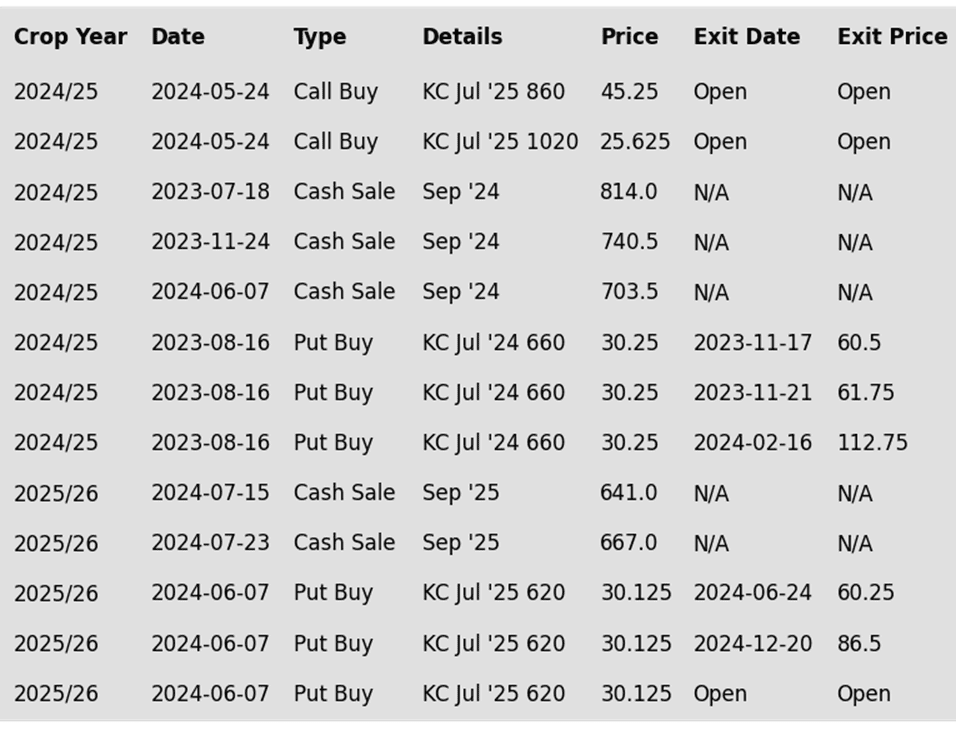

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and N. Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.