1-17 End of Day: Corn Market Leads Grains Higher

The CME and Total Farm Marketing offices will be closed Monday, January 20, in observance of Martin Luther King Jr Day.

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 484.25 | 9.75 |

| JUL ’25 | 494.25 | 8.25 |

| DEC ’25 | 456 | 3.25 |

| Soybeans | ||

| MAR ’25 | 1034 | 15 |

| JUL ’25 | 1055.25 | 12.5 |

| NOV ’25 | 1027.75 | 7 |

| Chicago Wheat | ||

| MAR ’25 | 538.75 | 1.25 |

| JUL ’25 | 560.5 | 1 |

| JUL ’26 | 619 | 1 |

| K.C. Wheat | ||

| MAR ’25 | 548.5 | 0.25 |

| JUL ’25 | 567.25 | -0.25 |

| JUL ’26 | 614.5 | -0.5 |

| Mpls Wheat | ||

| MAR ’25 | 583.5 | 2 |

| JUL ’25 | 603.5 | 1.25 |

| SEP ’25 | 614.5 | 1.25 |

| S&P 500 | ||

| MAR ’25 | 6036.25 | 60.75 |

| Crude Oil | ||

| MAR ’25 | 77.28 | -0.57 |

| Gold | ||

| APR ’25 | 2765.9 | -10.6 |

Grain Market Highlights

- Corn closed above the May 2024 high of 475.50 on the front-month continuous chart, reaching its highest level since early December 2023.

- Soybeans ended a three-day losing streak with a double-digit rebound, supported by easing trade war concerns following reports of positive phone discussions between President-elect Trump and Chinese President Xi.

- Wheat markets continue to struggle, managing only meager gains of one to two cents as bullish drivers remain nowhere to be found.

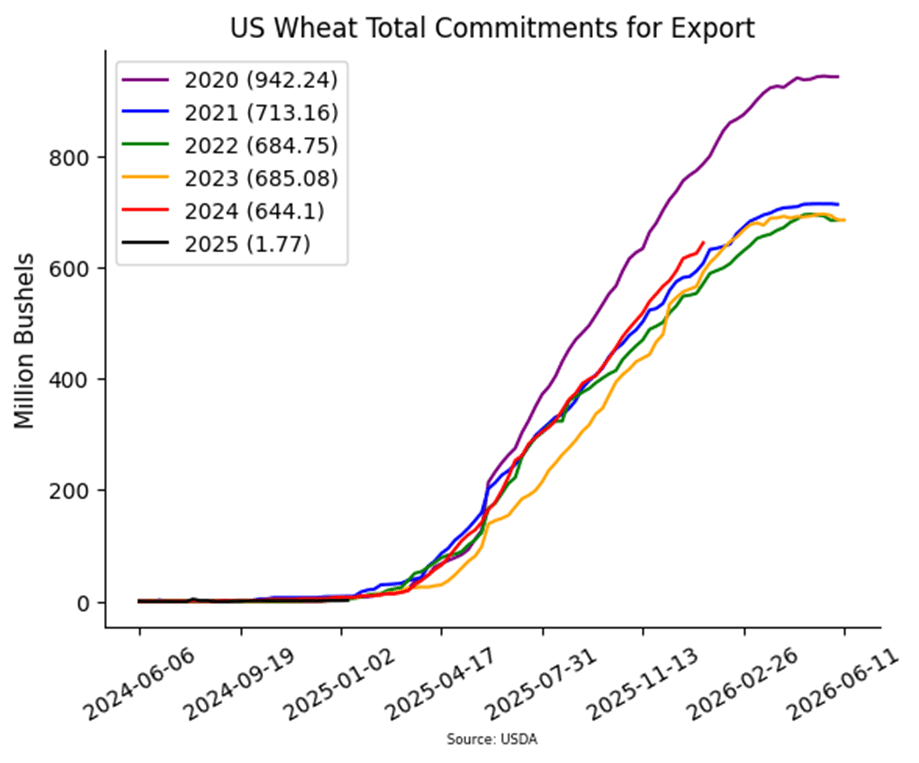

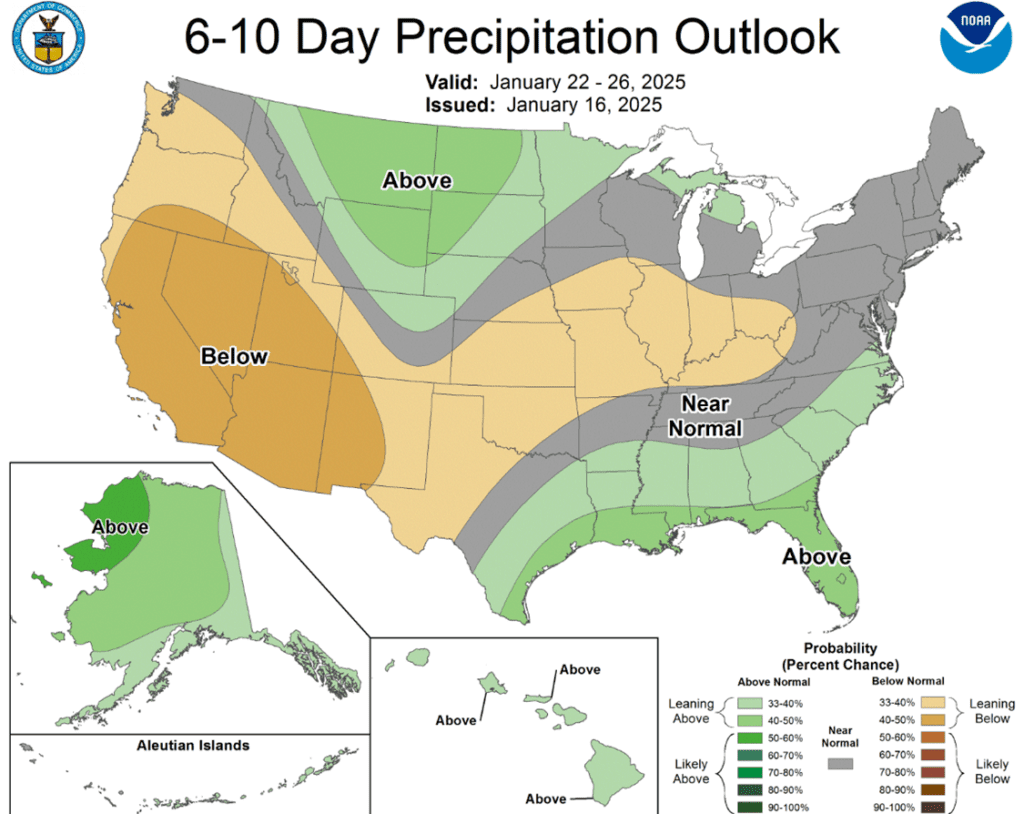

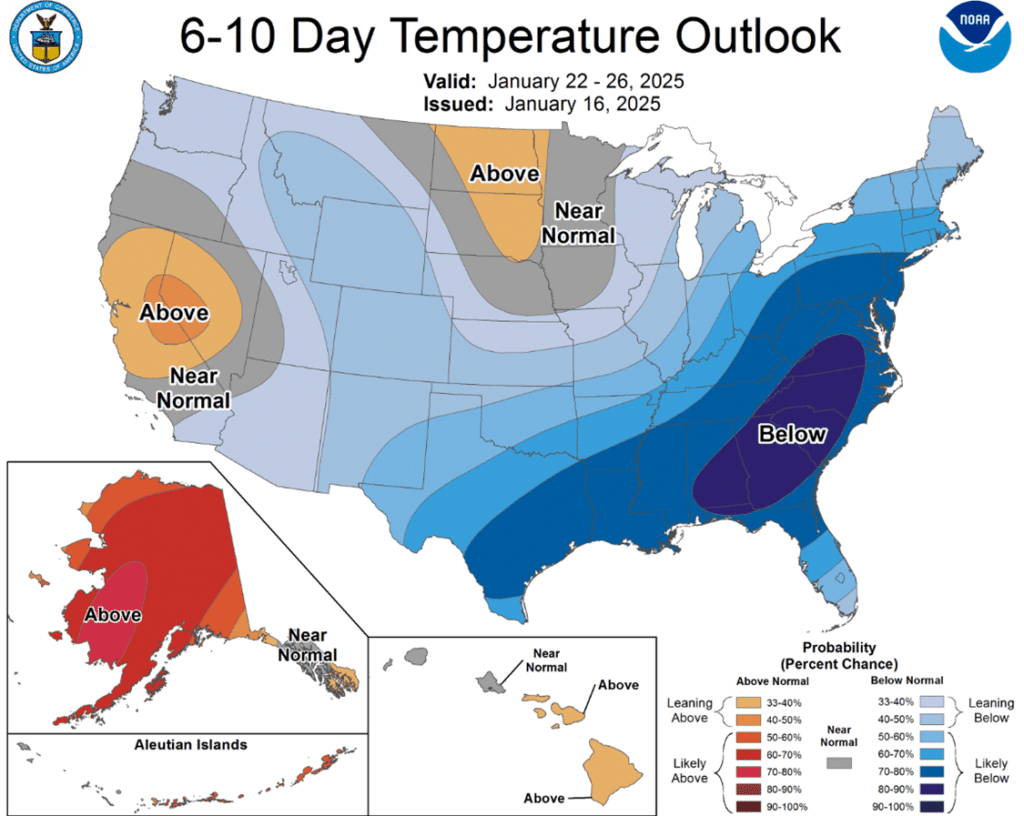

- To see the U.S. 6 to 10-day precipitation and temperature outlook courtesy of NOAA Weather Prediction Center, scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Next Target Range: 495 to 515 for the March ’25 contract.

- Weekly Close: The March ’25 contract posted a strong weekly close, finishing above the May 2024 high of 475.50. This marks the highest close since the week of December 4, 2023.

- Resistance Levels: On the front-month continuous chart, the next resistance range lies between the September 2021 low of 497.50 and the May 1996 high of 513.50.

- March ’25 Contract Levels: The March ’25 contract has nearly returned to the price range of 487 to 508 (vs. December ’24), where Grain Market Insider recommended the first 2024 corn crop sales during the summer of 2023 and spring of 2024.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell another portion of your 2025 corn crop.

- First Resistance: Resistanceremains at the October 2024 high of 459.75. Selling near this level is advisable in case this resistance halts further gains in the December ’25 contract.

- Downside Risk: Failure to rally over 459.75 poses the risk of range-bound trading, with the bottom end of the range at 428.00.

- Opportunity: If the December ’25 contract eventually succeeds in rallying above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential Grain Market Insider sales recommendation.

- Opposing Fundamentals: Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Buying Call Options: Keep an eye out for a recommendation to purchase call options if prices close above major resistance in the 480 area. This strategy would provide cover to current sales and allow you to benefit from any extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 4–6 weeks.

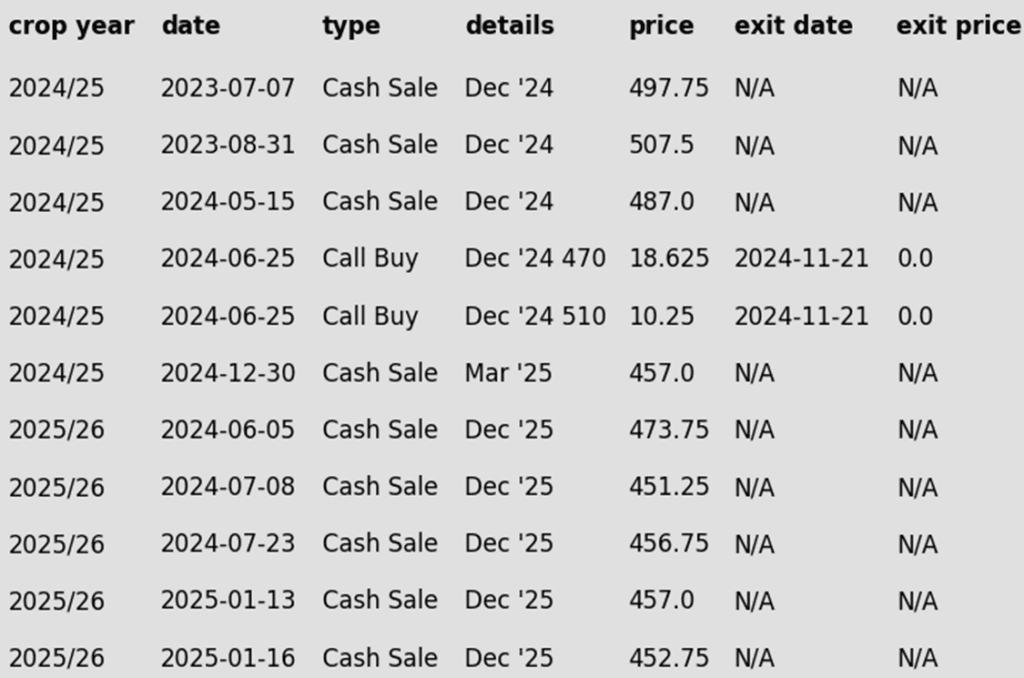

To date, Grain Market Insider has issued the following corn recommendations:

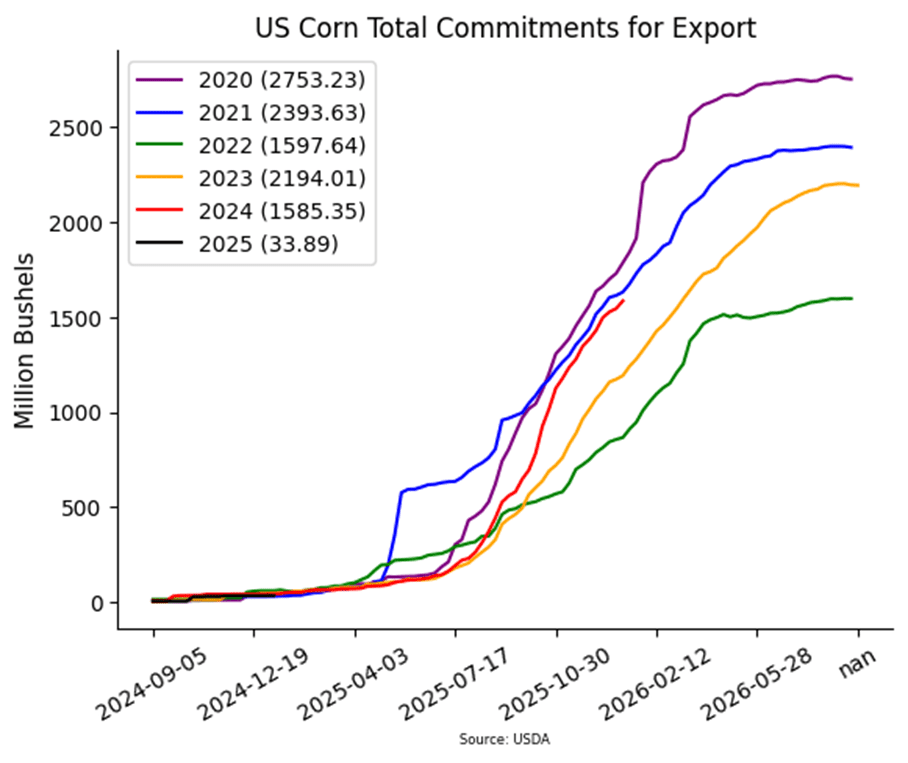

Market Notes: Corn

- The corn market closed the week with strong gains as buyers returned. Concerns over Argentina’s weather and a technical breakout helped drive money flow into the front-end of the market.

- Wet weather is expected to return to Argentina’s dry areas, but long-range forecasts turn drier by Friday. These concerns reintroduced weather premiums into the market.

- The Buenos Aires Grain Exchange rated the corn crop at 39% good-to-excellent, down from 42% last week, with 14% rated poor, up from 9%. Adverse weather continues to pressure crop conditions.

- Corn futures saw significant technical improvement, breaking through resistance from earlier price highs. This sets the stage for potential follow-through when trading resumes next week.

- Managed funds are steadily amassing a substantial long position in the corn market. As of January 7, hedge funds held a net long of 253,346 contracts, with expectations for further growth following last Friday’s bullish USDA report.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 470, with additional support near previous resistance at 450. Larger overhead resistance now comes in just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell a portion of your 2024 soybean crop.

- Target Range Reached: The March ’25 contract entered the 1060–1080 target range on Tuesday, reaching an intraday high of 1064.

- From the Lows: At Tuesday’s close of 1047.50, the contract stood one dollar above its December low of 947.00, marking a solid rally worth capitalizing on.

- Fund Activity: Funds have covered a significant number of short positions and are nearing a net-neutral stance, further supporting the idea that now is an ideal time to capitalize on the rally.

2025 Crop:

- Target Range: The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Call Buying: Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

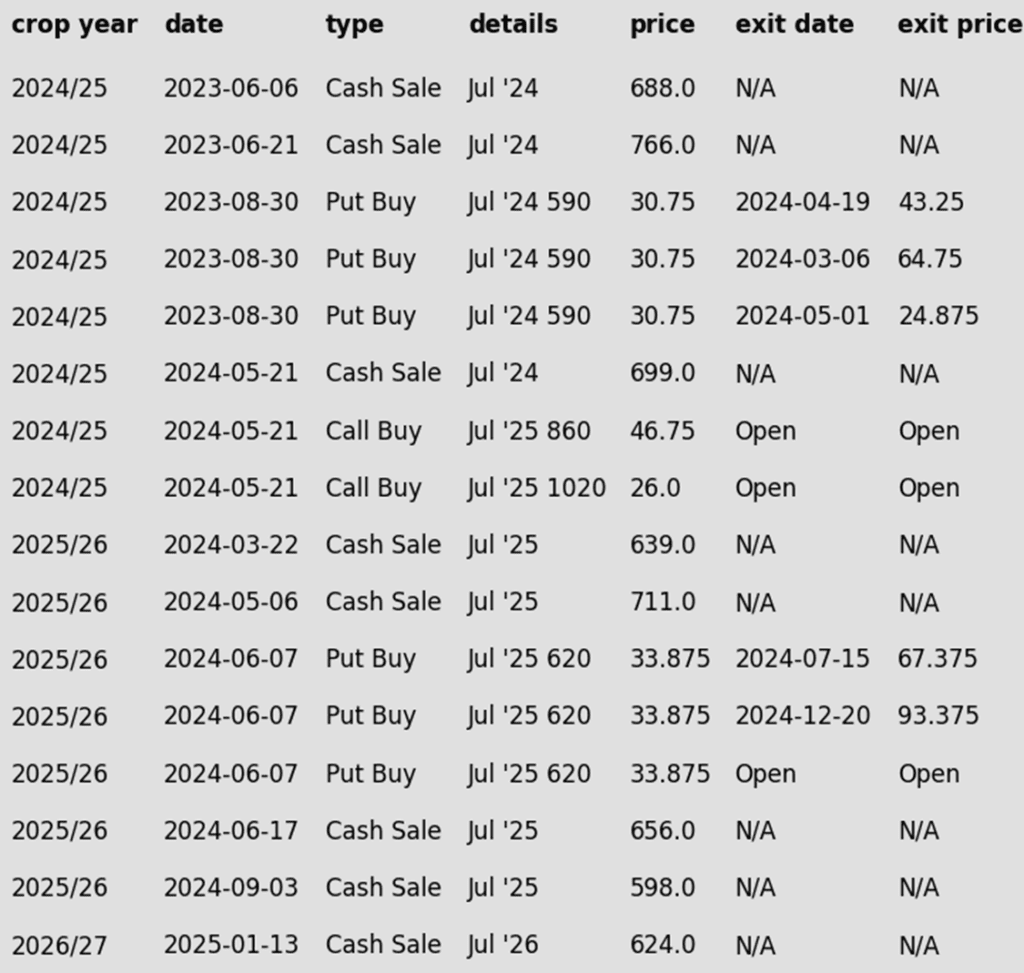

To date, Grain Market Insider has issued the following soybean recommendations:

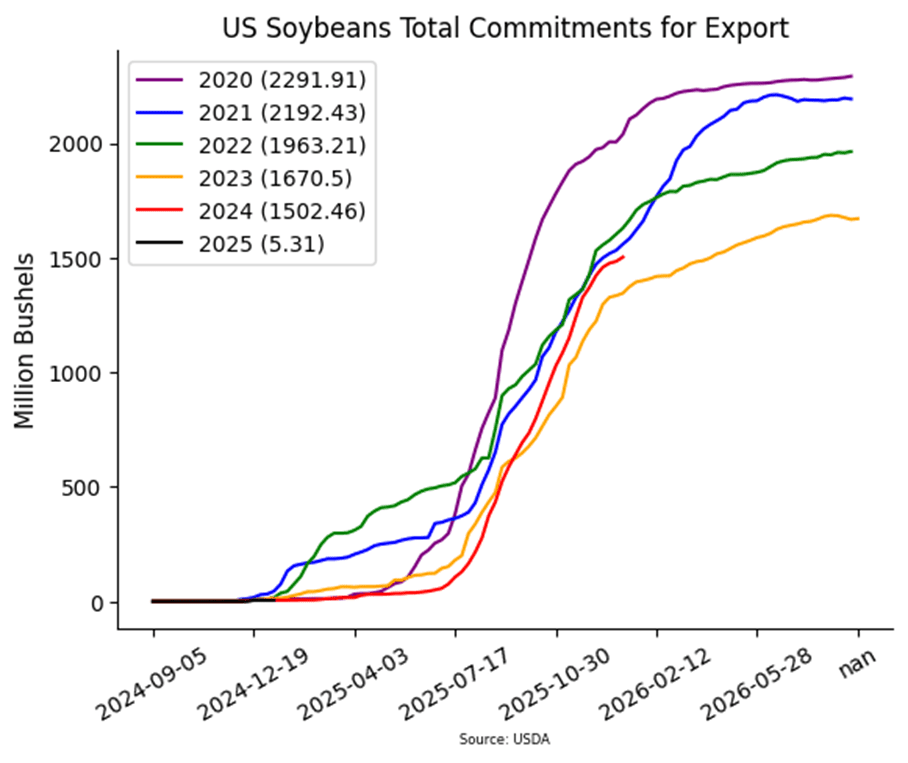

Market Notes: Soybeans

- Soybeans ended the day significantly higher, breaking three days of consecutively lower closes and gaining back nearly all of yesterday’s losses. New weather forecasts today saw a drier pattern in Argentina and southern Brazil which spurred fund buying. Both soybean meal and oil ended the day higher as well.

- Estimates for Brazilian soybean production has been increased by Agroconsult to 172.4 mmt which would be an 11% increase from last season. This compares with the USDA at 169 mmt and CONAB at 166 mmt.

- While yesterday’s export sales for soybeans were within the average trade guess, some Chinese buyers have reportedly switched to cheaper Brazilian soybeans ahead of President Trump’s inauguration on Monday. With the sharp increase in the value of the dollar over the past few months combined with the weakened real, Brazilian soy offers are much more competitive.

- While Argentina’s dry streak is expected to be broken within the next few days, some damage has already been to the crop with the Buenos Aires Grain Exchange lowering good to excellent ratings by 13 points. Only 8% of the crop is pod filling at this point.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Wheat

Market Notes: Wheat

- Despite the strength of corn and soybeans today, not much of it spilled over into wheat. Chicago contracts gained about a penny, while Kansas City was mixed to lower, and Minneapolis posted small gains. The US Dollar Index was on the rise again today, adding to pressure.

- Also offering weakness to the US wheat market are the new crop supplies coming out of Argentina and Australia, which are both said to be cheaper than US offers. Thailand reportedly purchased 195,000 mt of feed wheat with most of that coming from Australia and a little bit from the US. Furthermore, Russian FOB values are said to have declined as well.

- On a bullish note, Russia’s cap to wheat exports has led SovEcon to project Russian exports at 43.7 mmt, falling below the USDA’s estimate of 46 mmt. In related news, Russia’s ag ministry is said to have raised the wheat export tax by 10.7% to 4,699.60 Rubles per mt through January 27.

- According to the Buenos Aires Grain Exchange, Argentina’s wheat harvest is 100% complete as of January 16. Their production estimate remains steady at 18.6 mmt, compared with a 15.1 mmt crop last year.

- The International Grains Council has reduced their estimate of world grain stockpiles for the 24/25 season to 573 mmt. This compares to 576 mmt in the November estimate. However, this reduction is primarily for corn and barley. In fact, wheat stocks are expected to increase to 265 mmt vs 263 mmt previously.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell JUL ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target 680 – 705 vs March ‘25 to make the next sale.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Continue holding the remaining quarter of the previously recommended July ’25 Chi wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 Chi wheat to exit these remaining puts if the market makes new lows.

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing.

2026 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell the first portion of your 2026 Chicago wheat crop.

- With daily trading volume in the July ‘26 contract increasing to start the New Year, and nearly 90 cents of carry between the March ‘25 and July ‘26 contracts, we recommend making your first sale for the crop you’ll plant this fall.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target the 650 – 700 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

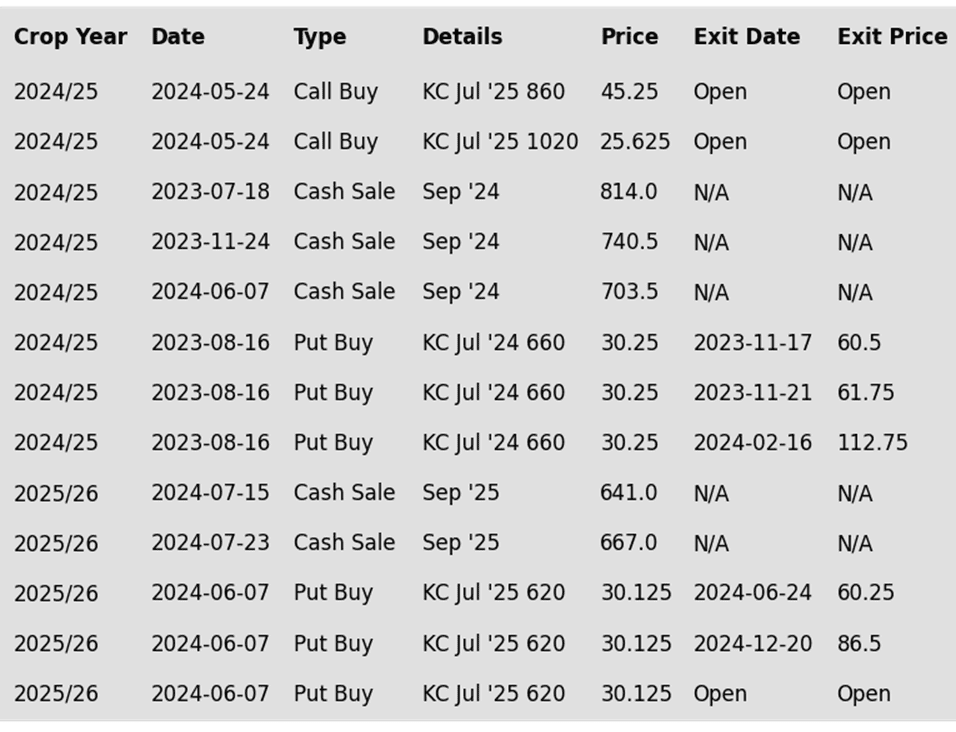

To date, Grain Market Insider has issued the following KC recommendations:

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potentially targeting a rally to the 610–635 range versus March ’25 for additional sales of your 2024 crop. While this is the initial area of interest, the near-record short position held by the Funds suggests that this target range could shift as future price action develops.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: US 6 to 10-day precipitation outlook courtesy of NOAA, Weather Prediction Center

Above: US 6 to 10-day temperature outlook courtesy of NOAA, Weather Prediction Center