1-16 End of Day: Grain Markets Close Red

The CME and Total Farm Marketing offices will be closed Monday, January 20, in observance of Martin Luther King Jr Day.

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 474.5 | -4.25 |

| JUL ’25 | 486 | -6 |

| DEC ’25 | 452.75 | -4.25 |

| Soybeans | ||

| MAR ’25 | 1019 | -23.75 |

| JUL ’25 | 1042.75 | -23.25 |

| NOV ’25 | 1020.75 | -18.5 |

| Chicago Wheat | ||

| MAR ’25 | 537.5 | -9.5 |

| JUL ’25 | 559.5 | -9 |

| JUL ’26 | 618 | -9.25 |

| K.C. Wheat | ||

| MAR ’25 | 548.25 | -9.25 |

| JUL ’25 | 567.5 | -9 |

| JUL ’26 | 615 | -8 |

| Mpls Wheat | ||

| MAR ’25 | 581.5 | -6 |

| JUL ’25 | 602.25 | -7 |

| SEP ’25 | 613.25 | -7.25 |

| S&P 500 | ||

| MAR ’25 | 5984 | -5 |

| Crude Oil | ||

| MAR ’25 | 77.91 | -0.8 |

| Gold | ||

| APR ’25 | 2774.1 | 30.2 |

Grain Market Highlights

- Corn futures finished lower as South American weather conditions improved, and Canada proposed a counter tariff.

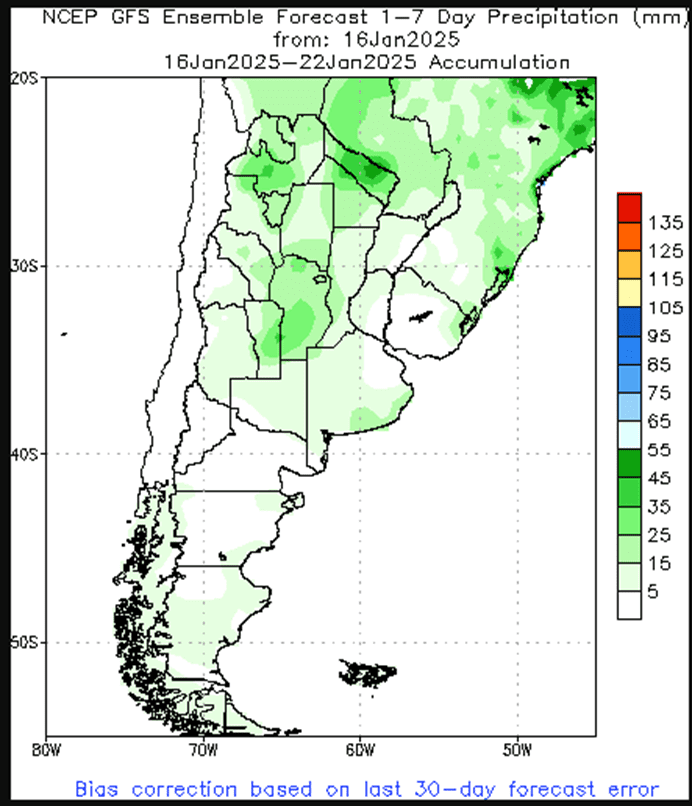

- Soybeans closed lower for the third consecutive day, pressured by overbought conditions and improving weather forecasts in South America.

- Wheat followed the trend of other grain markets today, closing lower across all three wheat classes.

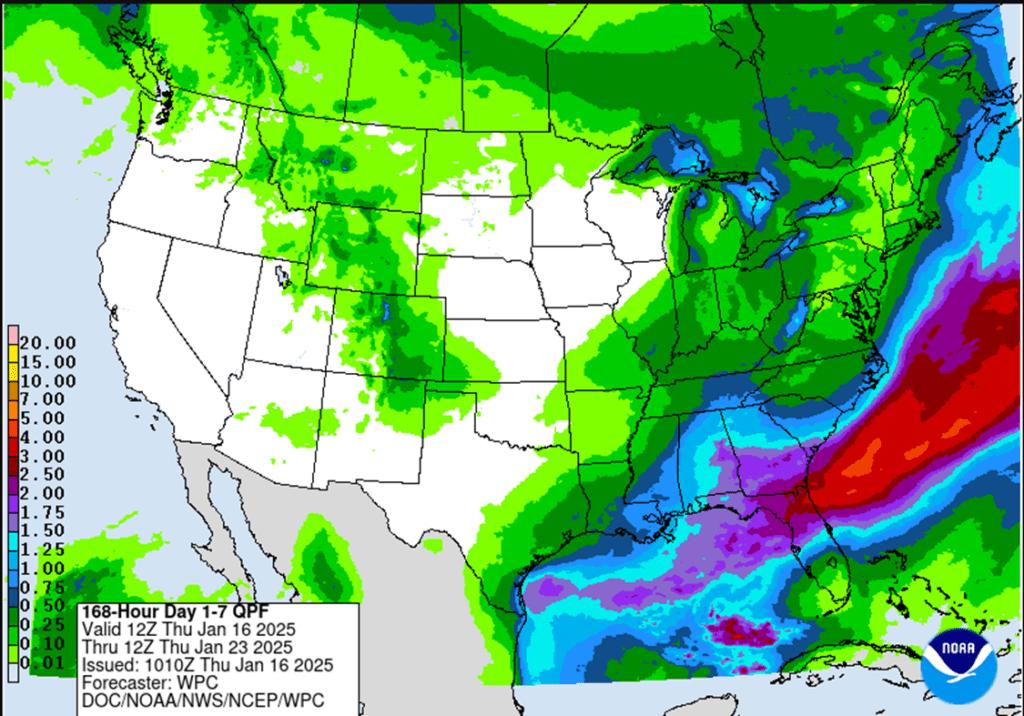

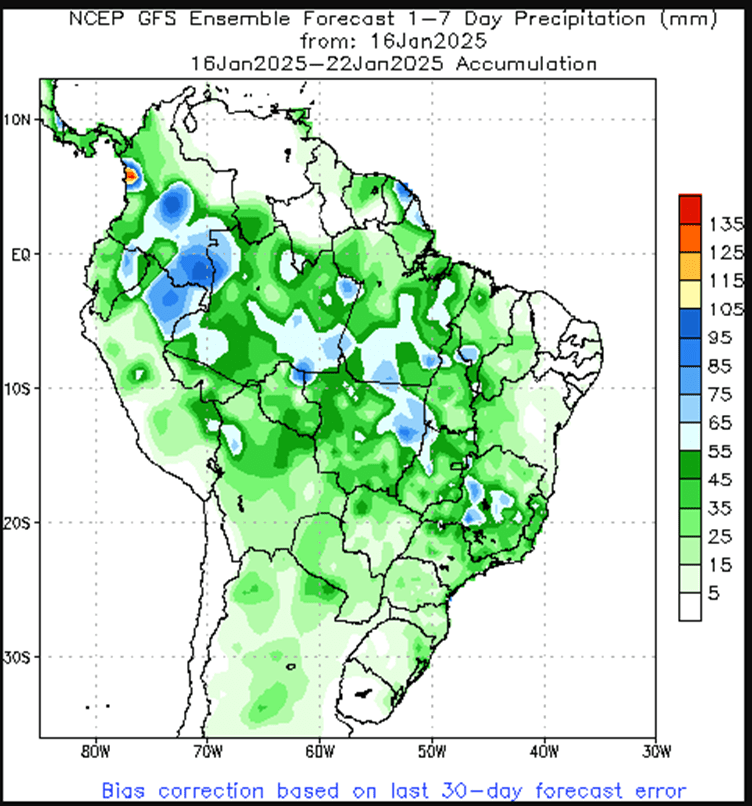

- To see the U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

New Alert

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 corn crop.

- With March futures knocking on the door of their highest level since May 2024 and continuous corn up roughly 25% from the pre-harvest low in August, it is time to reward this rally.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends selling another portion of your 2025 corn crop.

- The December ’25 corn contract attempted to re-enter the 455–475 target range, reaching a high of 456.75 today but was subsequently rejected.

- This marks the fourth consecutive day the contract has approached within three cents or less of the October high of 459.75 without breaking through. This area is proving to be a strong resistance level.

- First support remains at the November low of 428.00. If the contract fails to break above 459.75, range-bound trading is likely to continue, with a potential retest of the lower end of the range.

- If the December ’25 contract breaks above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential sales recommendation.

- Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Keep an eye out for a recommendation to purchase call options if prices close above major resistance. This strategy would protect current sales while allowing you to benefit from any extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

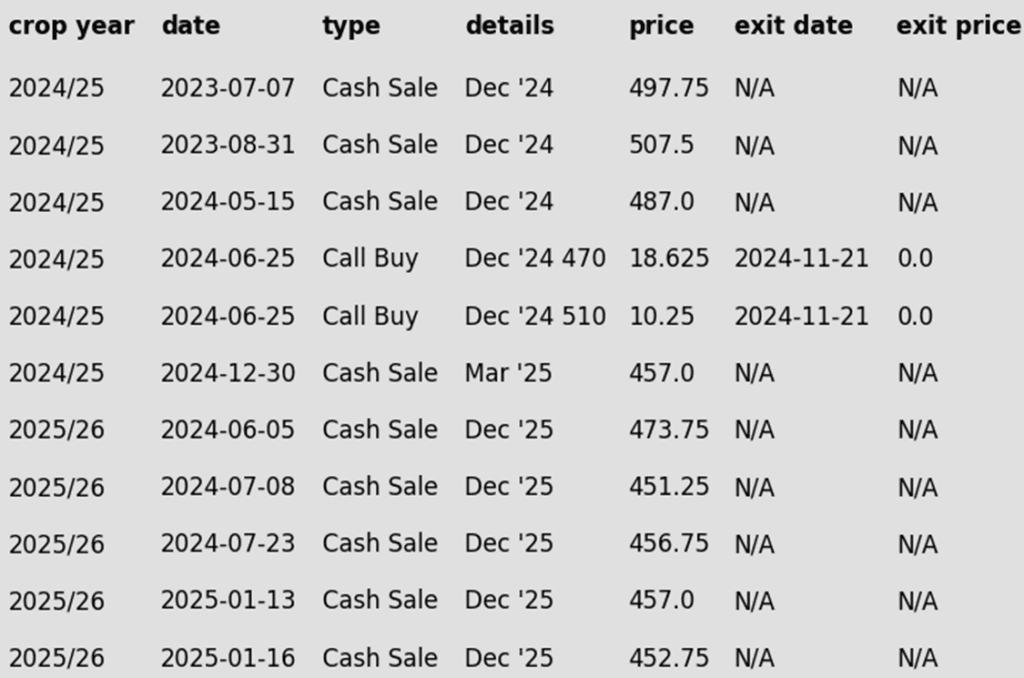

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market finished moderately lower on Thursday, with overall grain market weakness prompting some long liquidation. An improved weather forecast for South America, along with Canada’s proposal for a counter tariff, likely contributed to the selling pressure in corn. For the week, March corn futures are trading 4 cents higher heading into Friday’s session.

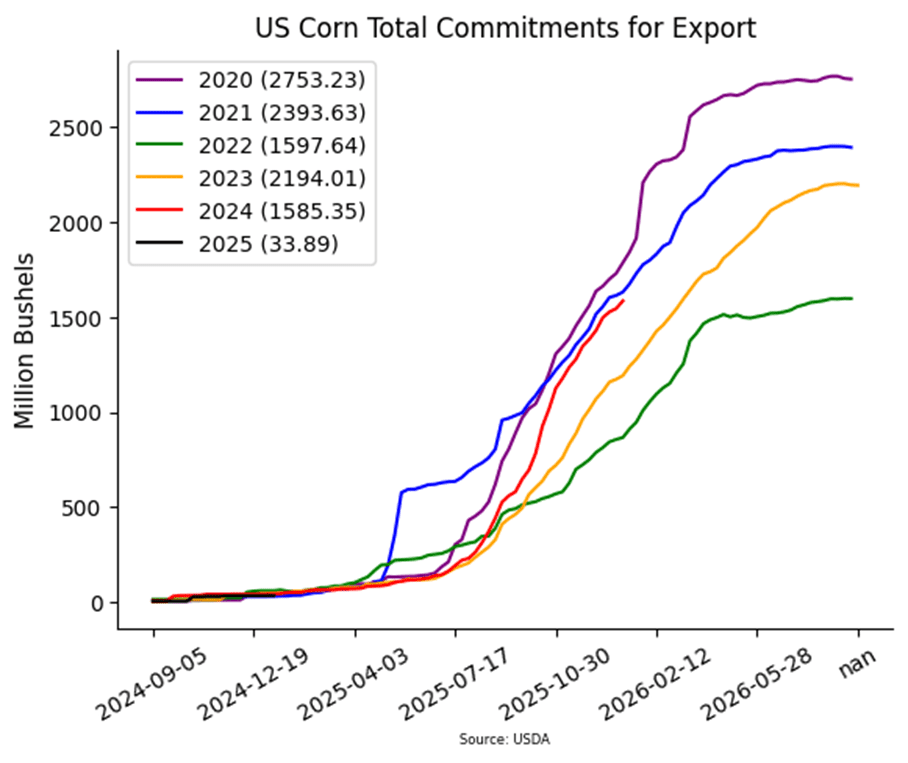

- The USDA released weekly exports sales on Thursday morning. For the week ending January 9, U.S. exporters posted new sales of 1.024 MMT (40.3 mb) for the current marketing year. Total sales commitments for the marketing year are at 1.585 bb, which is up 28% over last year and ahead of the pace needed to reach USDA exports target.

- Forecasts have shifted to a wetter outlook for the dry areas in Brazil and Argentina, helping to alleviate crop stress caused by hot and dry conditions. Additionally, the wetter regions in Brazil are expected to dry out, which will allow for the harvest and planting of the second crop of corn to gain momentum.

- The Canadian government proposed a counter tariff plan on U.S. imports totaling $105 billion dollars. One item that may be impacted could be U.S. ethanol imports, which approximately 35% of U.S. exported ethanol goes to Canada.

- Corn futures may face pressure from technical trading in the near term. The corn market is currently in an overbought condition, with managed hedge funds estimated to hold a near-record net long position. Additional selling pressure could weigh on the market heading into the 3-day weekend on Friday.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 460, with additional support near previous resistance at 450. Initial overhead resistance comes in near 480 with larger resistance just below 500.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell a portion of your 2024 soybean crop.

- The March ’25 contract reached the 1060–1080 target range Tuesday, with an intraday high of 1064.

- At Tuesday’s close of 1047.50, the contract stands one dollar above its December low of 947.00.

- With Funds covering a significant number of short positions and nearing a net-neutral stance, now is an opportune time to capitalize on the rally.

2025 Crop:

- The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Patience is recommended. No sales recommendations are planned until at least the peak of the U.S. growing season.

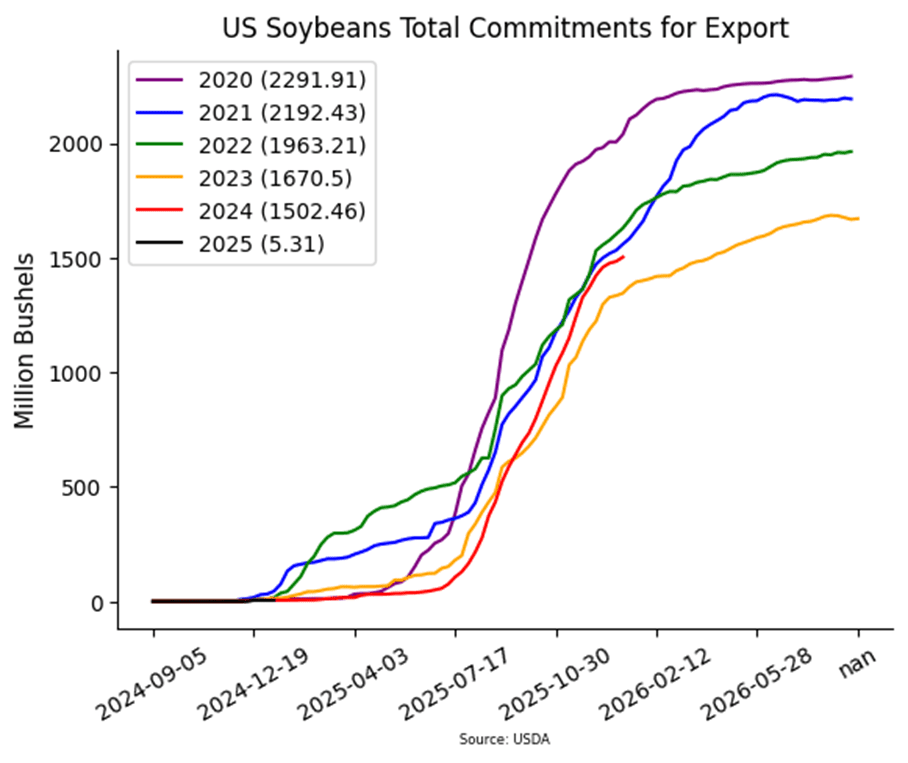

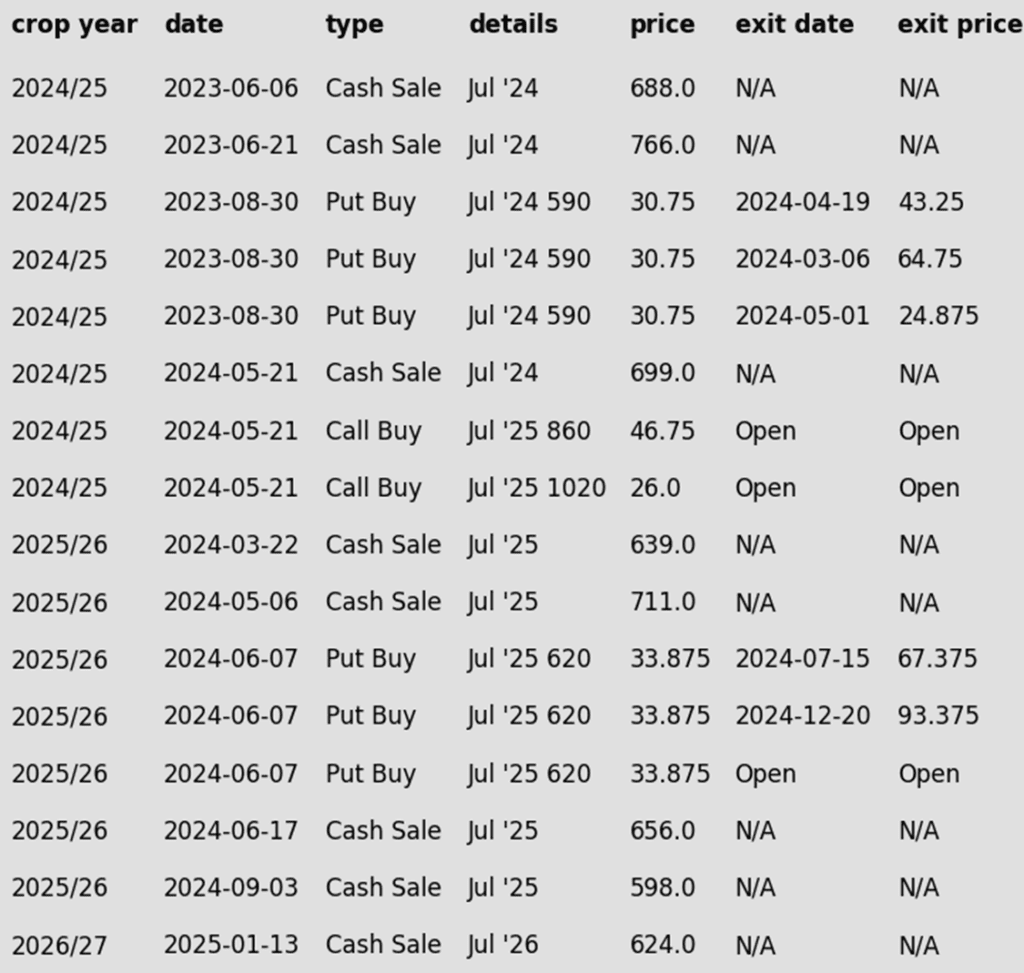

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply lower, marking a third consecutive decline and pushing the March contract back below the 100-day moving average. The selloff was likely driven by overbought conditions leading funds to take profit, as well as favorable weather conditions in South America. Both soybean meal and oil also saw lower prices.

- Today’s export sales report saw an increase of soybean sales of 20.9 million bushels for 24/25, which was in line with the average analyst estimate. Sales were down 27% from the prior 4-week average. Primary destinations were to China, Bangladesh, and Mexico. Last week’s export shipments of 54.2 mb were above the 21.5 mb needed each week to meet the USDA’s estimates.

- Yesterday’s NOPA crush report for December saw soybean crush at 206.60 million bushels, setting a record for the month as several new processing facilities have begun operations. This exceeded the average trade estimate of 203 million bushels.

- While Argentina’s dry streak is expected to be broken within the next few days, some damage has already been to the crop with the Buenos Aires Grain Exchange lowering good to excellent ratings by 13 points. Only 8% of the crop is pod filling at this point.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Wheat

Market Notes: Wheat

- All three classes of wheat experienced selling pressure on Thursday, following the trend of other grain markets and failing to hold recent gains. The weak price action and disappointing technical close may leave wheat prices susceptible to further selling pressure as the week comes to a close.

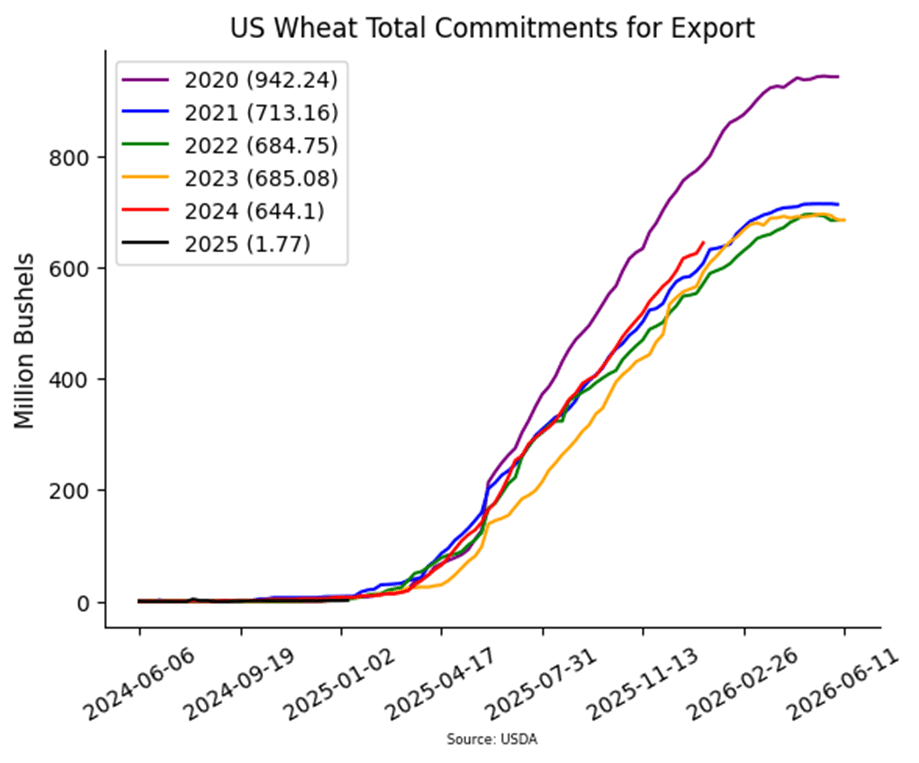

- USDA released weekly export sales on Thursday morning. For the week ending January 9, U.S. exporters posted new sales of 513,400 MT (18.9 mb) for the current marketing year. South Korea was the largest buyer of U.S. wheat for that time period. Total export commitments are at 644 mb, up 9% from last year, but behind the pace to reach USDA export targets.

- The International Grains Council (IGC) left its world wheat production forecast at 796 million tons. The IGC lowered their Russia crop forecast but balanced that total with a forecasted strong Australian crop. For 2025-26 growing season, the IGC sees wheat production rising to a possible record of 805 million tons, up 1% year-on-year.

- Consultancy Strategie Grains raised its 2025-26 soft wheat production forecast for the European Union, citing higher-than-expected plantings in Germany. The firm now projects the 2025 EU wheat crop at 127.2 MMT, up 600,000 MT from its initial forecast and 13 MMT above last year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell JUL ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target 680 – 705 vs March ‘25 to make the next sale.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Continue holding the remaining quarter of the previously recommended July ’25 Chi wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 Chi wheat to exit these remaining puts if the market makes new lows.

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing.

2026 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell the first portion of your 2026 Chicago wheat crop.

- With daily trading volume in the July ‘26 contract increasing to start the New Year, and nearly 90 cents of carry between the March ‘25 and July ‘26 contracts, we recommend making your first sale for the crop you’ll plant this fall.

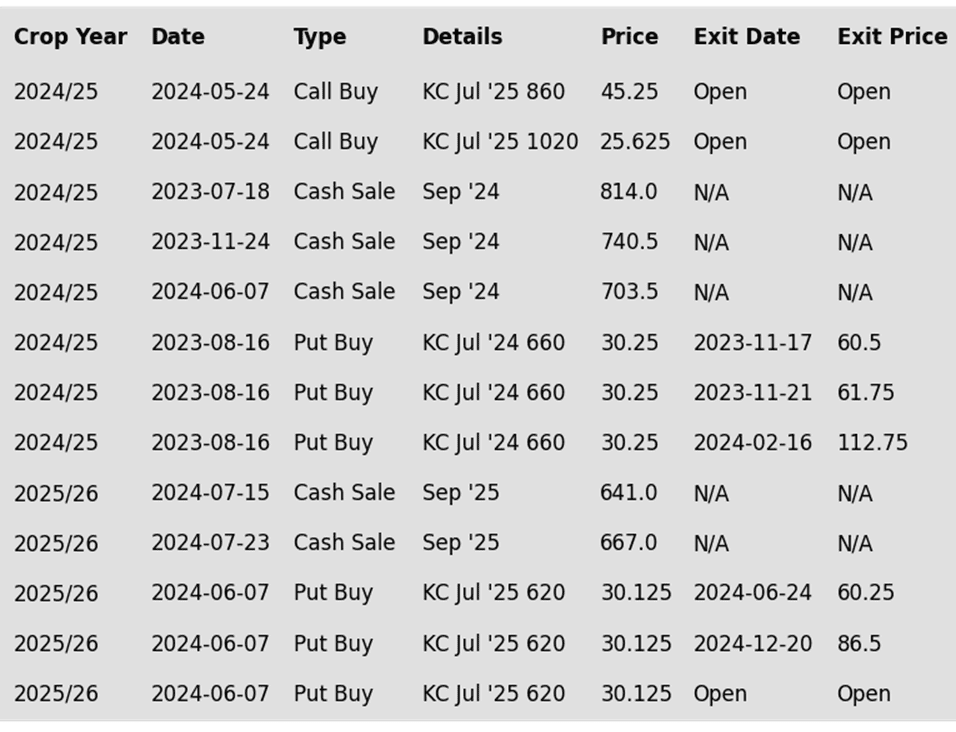

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target the 650 – 700 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following KC recommendations:

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potentially targeting a rally to the 610–635 range versus March ’25 for additional sales of your 2024 crop. While this is the initial area of interest, the near-record short position held by the Funds suggests that this target range could shift as future price action develops.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center

Above two: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.