1-14 End of Day: Corn and Soybeans Retreat from Recent Highs

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 474.5 | -2 |

| JUL ’25 | 489 | -1 |

| DEC ’25 | 456.75 | -0.5 |

| Soybeans | ||

| MAR ’25 | 1047.5 | -5.5 |

| JUL ’25 | 1072.5 | -5.5 |

| NOV ’25 | 1049.5 | -1.5 |

| Chicago Wheat | ||

| MAR ’25 | 546.25 | 1.25 |

| JUL ’25 | 568.5 | 1 |

| JUL ’26 | 627.25 | -1.5 |

| K.C. Wheat | ||

| MAR ’25 | 560.75 | -0.25 |

| JUL ’25 | 579.5 | 0 |

| JUL ’26 | 623 | 0 |

| Mpls Wheat | ||

| MAR ’25 | 589.5 | -4 |

| JUL ’25 | 607.75 | -2 |

| SEP ’25 | 619 | -1.75 |

| S&P 500 | ||

| MAR ’25 | 5858 | -16.5 |

| Crude Oil | ||

| MAR ’25 | 76.43 | -0.87 |

| Gold | ||

| APR ’25 | 2713.4 | 7.3 |

Grain Market Highlights

- Corn futures tested upside resistance during Tuesday’s session but ultimately closed lower as buying momentum eased.

- After a more than 50-cent higher move in just two sessions, soybean futures corrected lower on Tuesday.

- Wheat futures ended mixed, with Chicago wheat managing slight gains, while Kansas City and spring wheat futures dipped into negative territory.

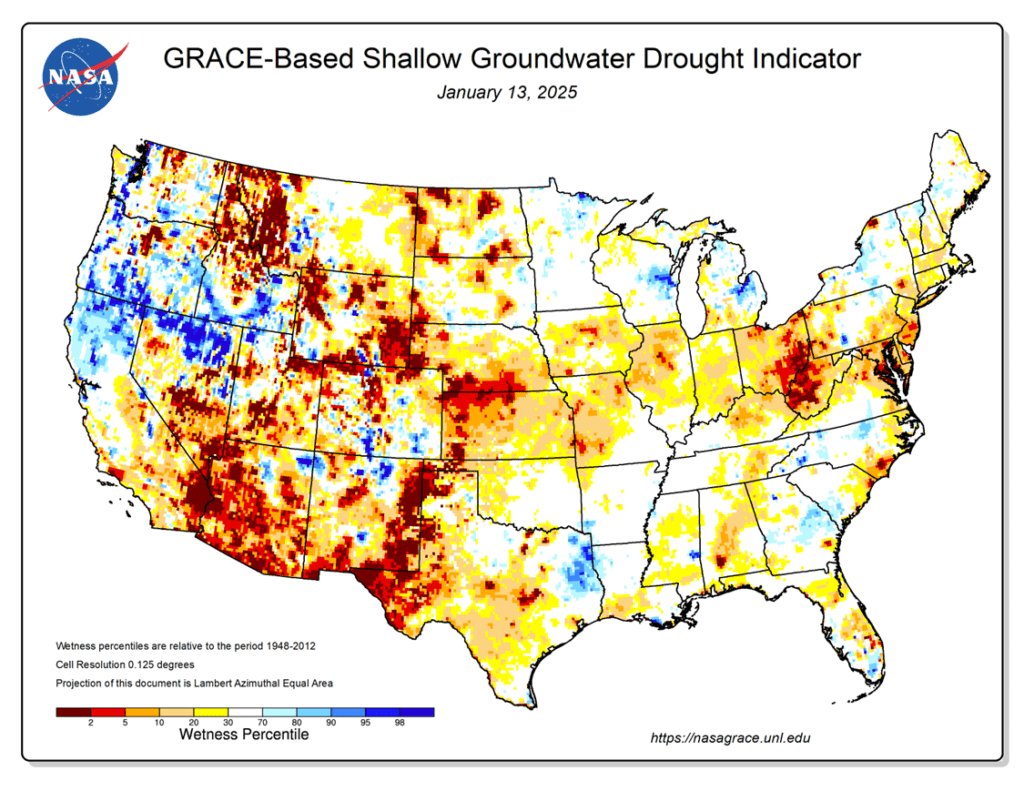

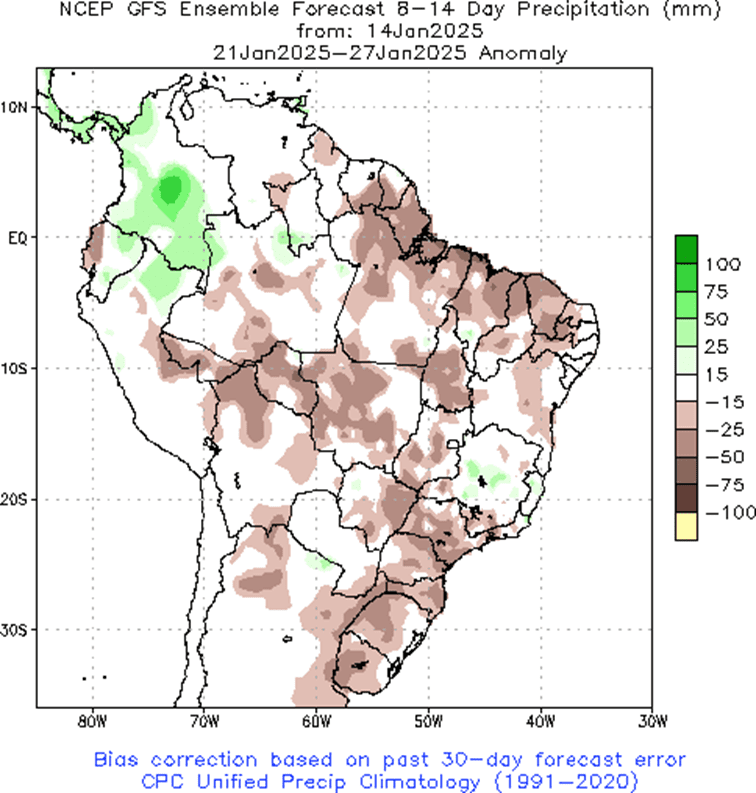

- See the updated GRACE-based shallow ground water drought indicator for the U.S. as well as the week two precipitation anomaly forecast for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

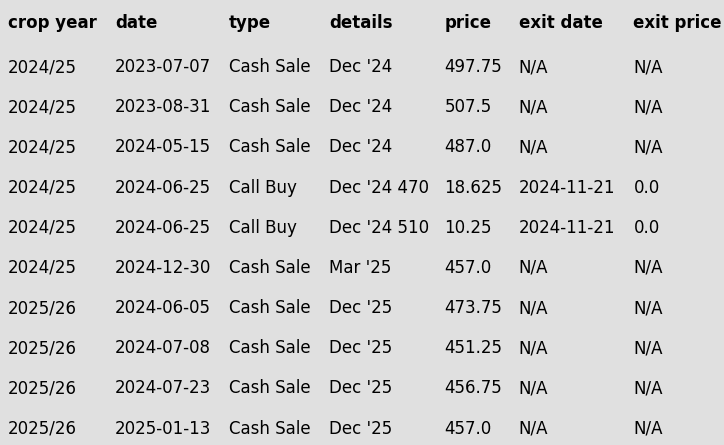

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 corn crop.

- With March futures knocking on the door of their highest level since May 2024 and continuous corn up roughly 25% from the pre-harvest low in August, it is time to reward this rally.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell a portion of your 2025 corn crop.

- The December ’25 corn contract has entered the target range of 455–475.

- First resistance is just under 3 cents away at the October 2024 high of 459.75. Selling near this level is advisable in case this resistance halts further gains in the December ’25 contract.

- If the December ’25 contract breaks above 459.75, the next major resistance level is around 480. Selling near 480 would be the next target for a potential sales recommendation.

- Strong demand for U.S. corn continues to support the market, but higher prices may incentivize additional planted acres in the U.S. for 2025.

- Keep an eye out for a recommendation to purchase call options if prices close above major resistance. This strategy would protect current sales while allowing you to benefit from any extended rally.

2026 Crop:

- Patience is advised. No sales recommendations are planned currently, as we continue to monitor the market for more favorable conditions.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures lost momentum on Tuesday, retreating from their highest levels since June 2024. Producer selling and weakness in other markets likely limited the upside. With the turn lower, the corn market posted a bearish hook reversal on the daily charts, which could lead to additional selling pressure of this weak technical signal.

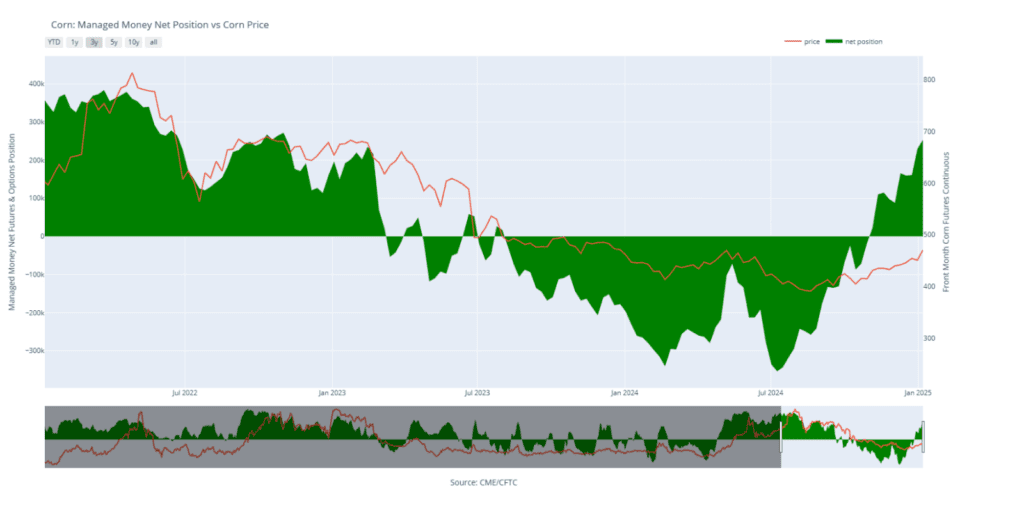

- Managed hedge funds added to their length in the corn market on last week’s Commitment of trader’s report. Funds were a net long approximately 253,000 contracts as of Jan 7. Estimates have the funds holding a net long of 280,000-300,000 contracts going into today’s trade. If realized, this would be the largest net long position since 2022 for this time frame.

- Crude oil prices faced selling pressure on Tuesday after reaching $79 per barrel early in the session — the highest price since July. This weakness likely weighed on the corn and soybean markets.

- In the cash market, basis levels have widened as producer selling has ramped up in response to recent price increases. While futures have rallied strongly since the USDA report, the cash market in some areas has not fully mirrored these gains.

Above: The uptrend in the corn market remains intact. Initial support below the market lies near 460, with additional support near previous resistance at 450. Initial overhead resistance comes in near 475 with larger resistance just below 500.

Corn Managed Money Funds net position as of Tuesday, Jan 7. Net position in Green versus price in Red. Managers net bought 24,540 contracts between Dec. 31– Jan 7, bringing their total position to a net long 253,346 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell MAR ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

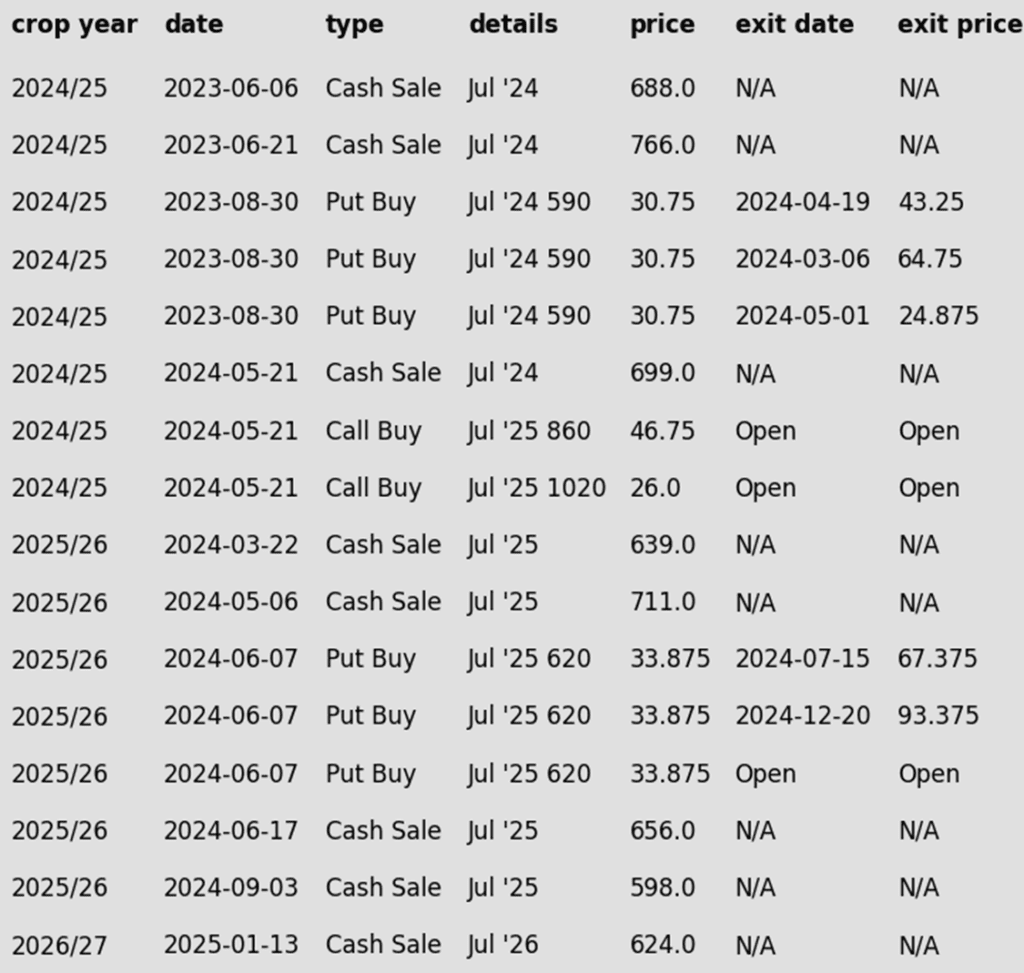

2024 Crop:

- NEW ACTION – Grain Market Insider recommends selling a portion of your 2024 soybean crop.

- The March ’25 contract reached the 1060–1080 target range today, with an intraday high of 1064.

- At today’s close of 1047.50, the contract stands one dollar above its December low of 947.00.

- With Funds covering a significant number of short positions and nearing a net-neutral stance, now is an opportune time to capitalize on the rally.

2025 Crop:

- The target range for issuing the first sales recommendation is 1070–1100 versus Nov ’25.

- Keep an eye out for a potential call option recommendation. Since major resistance lies within this range, it’s possible that both a sales recommendation and a call option recommendation could be issued around the same time.

2026 Crop:

- Patience is recommended. No sales recommendations are planned until at least the peak of the U.S. growing season.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ultimately ended the day with a lower close but briefly traded as much as 10 cents higher this morning before fading. The fundamentals are bullish overall with a dry Argentine forecast and a lower national US soybean yield, but fund profit taking and farmer selling may have added pressure today.

- Soybean meal finished higher, while soybean oil declined slightly. However, soybean oil has rallied sharply this year due to the potential removal of foreign-used cooking oil from renewable diesel production, which would boost demand. The Biden administration’s progress on the 45Z tax credit could further support soybean oil, though uncertainties remain regarding qualification criteria.

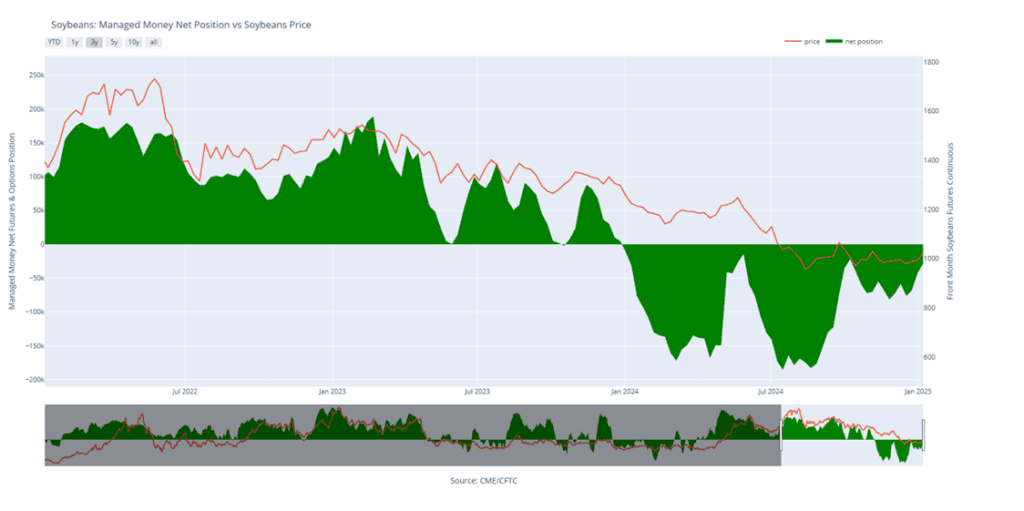

- Yesterday’s CFTC report showed funds as buyers of 13,835 contracts of soybeans as of January 7 which reduced their net short position to 28,612 contracts. Funds are estimated to have bought back over 27,000 contracts in just the last two days, which would likely establish them with a new net long position.

- The USDA initially announced a 198,000 MT soybean sale to China, which was later corrected to a corn sale. Near-term soybean demand concerns persist, as Brazilian export prices range $0.90 to $1.20 per bushel below U.S. soybeans.

- CONAB raised its soybean production forecast for the current crop year to 166.33 MMT, up slightly from last month. Most analyst have the Brazil soybean crop above 170 MMT for their estimates.

The 1000 level should act as support on a break lower. Initial overhead resistance lies near the last September highs between 1060 and 1075.

Soybean Managed Money Funds net position as of Tuesday, Jan 7. Net position in Green versus price in Red. Money Managers net bought 13,835 contracts between Dec. 31 – Jan 7, bringing their total position to a net short 28,612 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed mixed, with Chicago posting modest gains, while Kansas City and Minneapolis saw neutral to slight losses. Wheat’s resilience, despite weaker corn and soybean markets, can be attributed to a sharply lower US Dollar Index.

- According to CFTC data, managed funds were net sellers of around 1,900 Chicago and 2,200 Minneapolis wheat contracts. However, they were net buyers of around 2,000 Kansas City contracts. The combined net short position for all three classes sits at nearly 150,000 contracts, compared to the record short of over 198,000 contracts in December 2023.

- The Russian Grain Union reported total grain exports of 34.3 mmt from July to December 2024, a 5.4% decline from the same period a year earlier. However, wheat exports increased slightly by 0.7% to 30 mmt.

- According to Secex, Brazil imported 520.9 mmt of wheat in December, bringing 2024 total imports to 6.65 mmt, significantly surpassing 2023 imports of 4.18 mmt. December imports were the highest for any month since 2019, and 2024 marked the largest annual total since 2018.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell JUL ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target 680 – 705 vs March ‘25 to make the next sale.

- For those holding open July ’25 860 and 1020 call options that were recommended in May, target a selling price of about 73 cents for the 860 calls to offset the cost of the remaining 1020 calls. Holding the 1020 calls will provide protection for existing sales and give you confidence to make additional sales at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Continue holding the remaining quarter of the previously recommended July ’25 Chi wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 Chi wheat to exit these remaining puts if the market makes new lows.

- Patience is advised regarding sales, as we monitor the market for improved conditions and timing.

2026 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider sees a continued opportunity to sell the first portion of your 2026 Chicago wheat crop.

- With daily trading volume in the July ‘26 contract increasing to start the New Year, and nearly 90 cents of carry between the March ‘25 and July ‘26 contracts, we recommend making your first sale for the crop you’ll plant this fall.

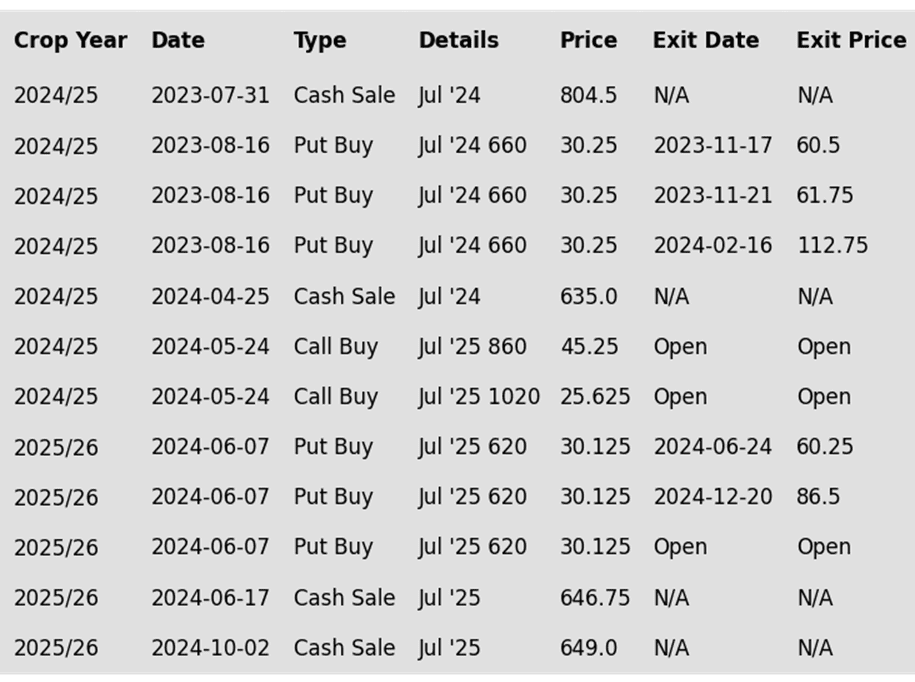

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Front-month Chicago wheat remains largely rangebound between 540 and 577. A close above the 577–586 resistance area could set up a retest of 617, while a close below 536 might lead to a slide toward the 521–514 support zone.

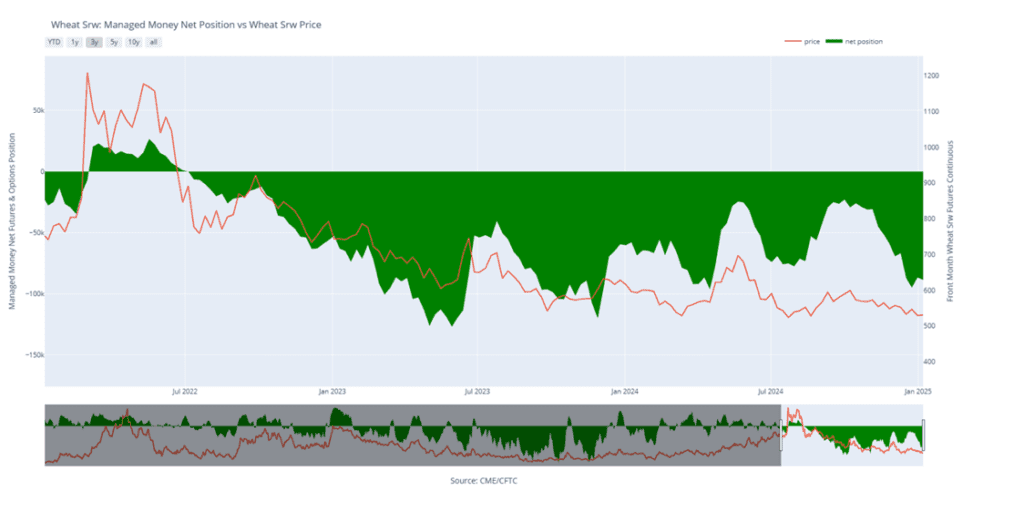

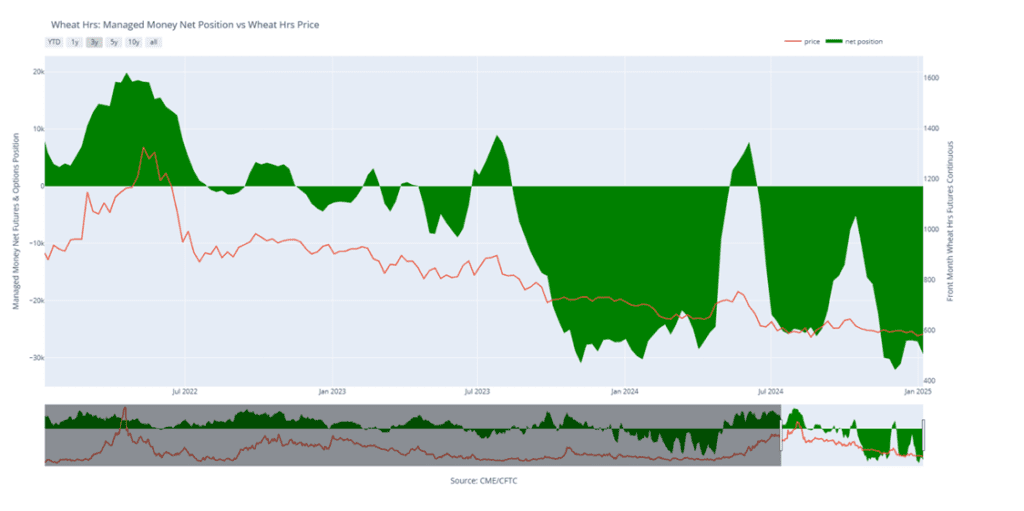

Chicago Wheat Managed Money Funds’ net position as of Tuesday, Jan 7. Net position in Green versus price in Red. Money Managers net sold 1,875 contracts between Dec 31 – Jan 7, bringing their total position to a net short 88,637 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Target the 650 – 700 versus March ‘25 area to sell more of your 2024 HRW wheat crop.

- For those holding the previously recommended July ’25 860 and 1020 calls, target a selling price of about 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls, and still give you confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Target the 640 – 665 range versus July ’25 to make additional 2025 HRW wheat sales.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

- If the market rallies considerably, look to protect sales by buying upside calls in the 745 – 770 range versus July ’25. This will also give you confidence to sell more bushels at higher prices.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

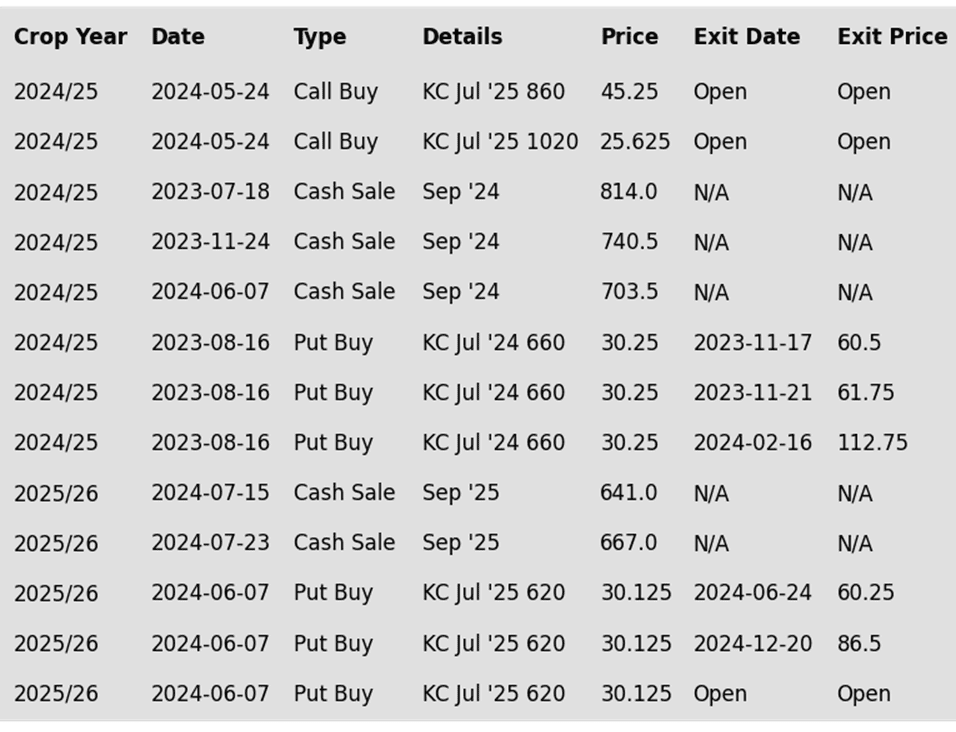

To date, Grain Market Insider has issued the following KC recommendations:

KC wheat remains largely rangebound between 536 and 583, with initial overhead resistance near the 100-day moving average around 568. A close above this level and beyond 583 could set the market up for a test of the 590–595 area, while a close below 536 could put prices at risk of falling to the 525 level.

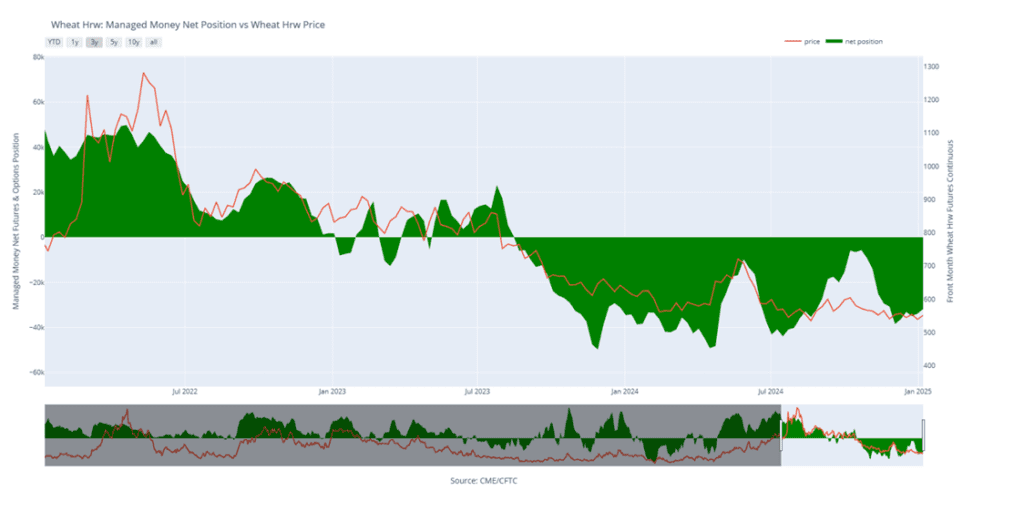

KC Wheat Managed Money Funds’ net position as of Tuesday, Jan 7. Net position in Green versus price in Red. Money Managers net bought 2,003 contracts between Dec. 31 – Jan 7, bringing their total position to a net short 31,858 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Potentially targeting a rally to the 610–635 range versus March ’25 for additional sales of your 2024 crop. While this is the initial area of interest, the near-record short position held by the Funds suggests that this target range could shift as future price action develops.

- For those holding the previously recommended July ’25 KC wheat 860 and 1020 calls, target a selling price of approximately 71 cents on the 860 calls. This would achieve a net-neutral cost on the remaining 1020 calls and provide confidence to sell more bushels at higher prices.

2025 Crop:

- Grain Market Insider recently recommended liquidating a portion of previously recommended put options.

- Look to protect existing sales by buying upside calls in the 745 – 770 range versus July ’25 KC wheat if the market turns higher and rallies considerably. This will also give you confidence to sell more bushels at higher prices.

- Continue holding the remaining quarter of the previously recommended July ’25 KC wheat 620 puts to provide downside protection for unsold bushels. Additionally, target the upper 400 range versus July ’25 KC wheat to exit these remaining puts if the market makes new lows.

2026 Crop:

- Patience is recommended. It may be some time before targets are set for the 2026 crop, as we continue to monitor the market for better conditions and timing.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

March Minneapolis wheat is rangebound between 585 and 613. A close above 613 could trigger a rally toward 655, with resistance at 624 and 637. A close below 585 may lead to a decline toward 568.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, Jan 7. Net position in Green versus price in Red. Money Managers net sold 2,242 contracts between Dec. 31 – Jan 7, bringing their total position to a net short 29,385 contracts.

Other Charts / Weather

Brazil week two-forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.